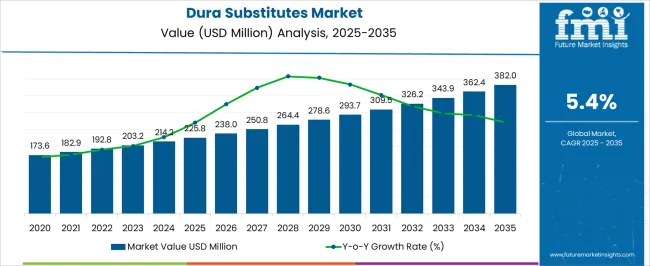

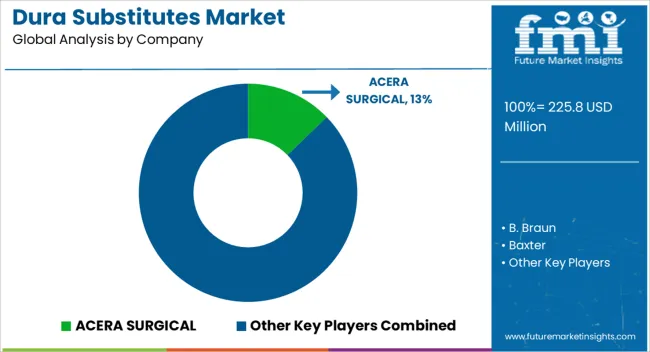

The dura substitutes market is projected to rise from USD 225.8 million in 2025 to USD 382 million by 2035 at a 5.4% CAGR.

| Metric | Value |

|---|---|

| Dura Substitutes Market Estimated Value in (2025 E) | USD 225.8 million |

| Dura Substitutes Market Forecast Value in (2035 F) | USD 382.0 million |

| Forecast CAGR (2025 to 2035) | 5.4% |

The dura substitutes segment is estimated to account for about 22% of the neurosurgical implants market, roughly 18% of the surgical biomaterials market, close to 16% of the cranial and spinal surgery devices market, nearly 21% of the surgical patches and mesh market, and around 9% of the hemostats and surgical sealants market. Taken together, these proportions aggregate to approximately 86% across the listed parent categories. This weight is considered significant because duraplasty products enable watertight dural closure and cerebrospinal fluid leak prevention in craniotomy, posterior fossa, and spine durotomy cases, which directly influences outcomes and reoperation risk. Adoption has been supported by collagen and xenograft sheets, allograft membranes, and synthetic polymer options that cover both onlay and suturable formats.

Procurement tends to be guided by suture retention, conformability over irregular anatomy, resorption profile, MRI compatibility, and packaging sterility, with hospitals favoring kits that pair patches with sealants for reliable hemostasis. Infection mitigation, adhesion control, and predictable handling in microsurgical fields are prioritized by surgeons and perioperative teams, anchoring durable specification in neuro and spine service lines. Distributors with reliable cold chain where required, lot traceability, and credentialed in theater support often gain preference during tenders. As training pathways reinforce standard duraplasty algorithms and as documentation against CSF leak rates improves, dura substitutes are expected to sustain a strong share within these parent markets, shaping formulary decisions, operating room preference cards, and quality metrics for cranial and spinal procedures.

The dura substitutes market is experiencing consistent growth, driven by advancements in neurosurgical techniques, increasing incidences of traumatic brain injuries, and a rising number of complex cranial procedures. Demand is being supported by the growing adoption of synthetic and biologically derived materials designed to repair or replace the dura mater following surgical intervention. Improvements in biomaterial engineering have enhanced biocompatibility, reduced infection risks, and promoted faster healing, which are influencing adoption rates across both developed and emerging healthcare markets.

Increased availability of minimally invasive surgical solutions and rising access to specialized neurosurgical care in developing regions are further expanding the market base. Regulatory approvals for innovative products and the introduction of customizable grafts tailored to patient-specific needs are also contributing to market expansion. As neurological disorders become more prevalent due to aging populations and lifestyle changes, the demand for effective dura substitutes is expected to grow steadily Continuous research into material performance and integration with regenerative medicine approaches will likely open new growth opportunities in the coming years.

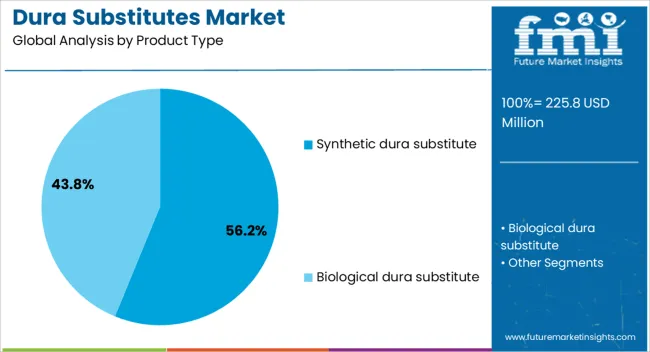

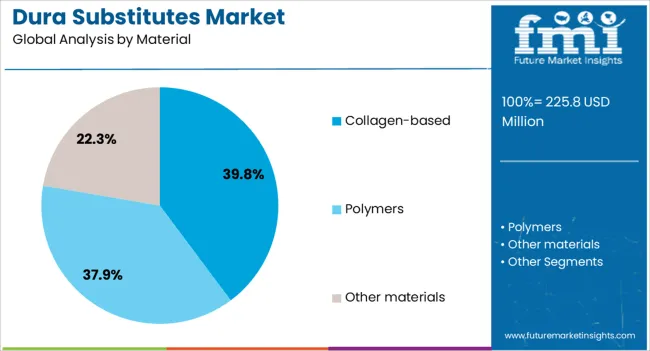

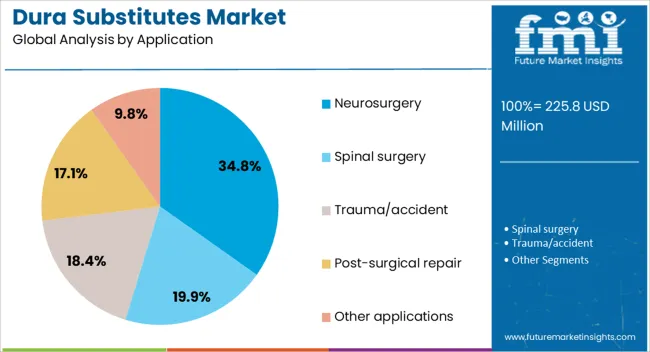

The dura substitutes market is segmented by product type, material, application, end use, and geographic regions. By product type, dura substitutes market is divided into Synthetic dura substitute and Biological dura substitute. In terms of material, dura substitutes market is classified into Collagen-based, Polymers, and Other materials. Based on application, dura substitutes market is segmented into Neurosurgery, Spinal surgery, Trauma/accident, Post-surgical repair, and Other applications. By end use, dura substitutes market is segmented into Hospitals, Ambulatory surgical centers, and Other end users. Regionally, the dura substitutes industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The synthetic dura substitute segment is projected to account for 56.2% of the dura substitutes market revenue share in 2025, making it the leading product type. This dominance is being supported by its consistent performance, ease of sterilization, and extended shelf life compared to traditional grafting materials. Synthetic variants are designed to provide reliable mechanical strength and watertight closure, reducing the risk of postoperative cerebrospinal fluid leakage.

The ability to manufacture these products at scale ensures availability in various sizes and thicknesses, meeting diverse surgical requirements. Furthermore, synthetic dura substitutes eliminate the risk of disease transmission associated with biological materials, making them preferable in certain clinical settings.

Advances in polymer chemistry and textile engineering have led to products that closely mimic the elasticity and durability of natural dura mater, enhancing surgical outcomes Hospitals and surgical centers are increasingly adopting synthetic options due to their predictable performance and compatibility with both traditional and minimally invasive neurosurgical techniques, reinforcing their leadership in the market.

The collagen-based material segment is anticipated to hold 39.8% of the dura substitutes market revenue share in 2025, establishing itself as the leading material category. This leadership is being driven by the material’s natural biocompatibility and ability to promote tissue regeneration, making it particularly effective for dura repair. Collagen-based products are designed to integrate with host tissue, gradually resorbing over time while supporting the body’s natural healing process.

Surgeons value these materials for their flexibility, ease of handling, and ability to conform to complex cranial anatomies. The segment’s growth is further supported by advancements in purification and cross-linking technologies, which have improved tensile strength and reduced the risk of immune reactions.

As the demand for biologically active grafts increases, collagen-based materials are being favored in procedures where regenerative outcomes are prioritized. Their established safety record, combined with increasing global access to advanced surgical care, positions this segment for continued prominence in the dura substitutes market.

The neurosurgery application segment is expected to account for 34.8% of the dura substitutes market revenue share in 2025, making it the dominant application area. This dominance is being reinforced by the rising global prevalence of neurological conditions requiring surgical intervention, including brain tumors, traumatic brain injuries, and congenital cranial defects. Neurosurgical procedures often necessitate precise and durable dura repair, making high-quality substitutes essential for successful outcomes.

Advancements in surgical techniques, including minimally invasive approaches and computer-assisted navigation, are expanding the range of patients eligible for these procedures, thereby increasing demand. The segment is also benefiting from investments in specialized neurosurgical centers and the training of surgeons in advanced grafting techniques.

As healthcare systems prioritize improved postoperative recovery and reduced complication rates, the use of premium dura substitutes in neurosurgery is becoming standard practice. With ongoing innovation in materials and surgical tools, this application area is expected to remain a key driver of market growth over the forecast period.

The dura substitutes market is projected to grow as neurosurgeons and spine surgeons prioritize watertight dural closure, lower cerebrospinal fluid leak rates, and predictable handling in cranial and spinal procedures. Demand is reinforced by volumes in skull base surgery, intradural tumor resection, Chiari decompression, and revision cases where autologous fascia is not preferred. Opportunities are opening in education-led selling, sealant bundled kits, and emerging neurosurgical centers. Trends favor collagen matrices, synthetic polymer patches, and onlay options paired with hemostatic agents. Challenges persist around cost evidence, procurement scrutiny, and regionally variable standards.

Demand has been supported by steady case volumes in cranial and spinal duraplasty where watertight closure and low pseudomeningocele rates are required. Dura substitutes, including collagen matrices, xenogeneic pericardium, and synthetic polymer patches, are being selected to avoid donor site morbidity and to standardize handling across teams. Neurological procedures such as skull base tumor resections, microvascular decompressions, and intradural spine surgery have driven adoption because reliable sealing against CSF egress is prioritized in high-risk fields. Patients with anticoagulation, diabetes, or prior radiation are viewed as poor candidates for autologous grafting, which bolsters preference for ready-to-use dural grafts. Operating room efficiency and consistent suture retention have been valued more than headline material claims. As hospitals pursue lower readmissions tied to CSF leaks and meningitis, engineered dural grafts and adjunct sealants are being positioned as critical components of neurosurgical closure protocols.

Opportunities have been identified in bundled offerings that pair suturable or onlay dural grafts with fibrin or PEG-based sealants, applicators, and dural tack-up accessories for a single purchase order. Training pathways for skull base and spine fellows, with wet lab programs and leak model demos, are being used to accelerate preference formation. Expansion is being observed in ambulatory spine centers and regional hospitals where neurosurgical capacity is growing, creating demand for pre-sized, sterile packs with clear indications. Distributors are capturing share through consignment, rapid replenishment, and loaner kits for complex cases. Strongest gains will be realized by suppliers who publish closure algorithms, MRI compatibility notes, and documented leak-rate outcomes. Co-development with surgeons on radiopaque markers, curved-edge geometries, and anti-adhesion surfaces offers product differentiation, while reimbursement-aligned coding guides and bilingual IFUs improve adoption in newer markets.

Trends have focused on collagen matrices optimized for pliability, low swell, and predictable resorption windows, alongside polymeric patches designed for strength and low permeability. Onlay techniques with adjunct sealants are being preferred in confined skull base corridors, while suturable sheets with reinforced borders are being chosen for larger dural defects in spine and posterior fossa. Radiopacity for intraoperative verification, antimicrobial or hemostatic surface treatments, and pre-attached suture tabs are gaining visibility. Hospitals are requesting dual sterile barrier packaging, extended shelf life, and lot traceability with UDI to simplify audits. Real-world registries tracking CSF leak rates, reoperation, and infection are being referenced during value analysis decisions. Consistent handling and verifiable leak protection should be treated as the decisive attributes, since faster closure and fewer drains translate into tangible recovery and bed management benefits for neurosurgical services.

Challenges have been noted in cost comparisons against autologous fascia lata or pericranium, where supply is considered free despite operative time and donor site risk. Evidence heterogeneity across materials, variable follow-up intervals, and differing leak definitions complicates head-to-head evaluations for procurement committees. Regional differences in regulatory pathways, tissue-source acceptability, and labeling restrict swift market entry. Cold-chain or humidity sensitivity for certain grafts can strain inventory practices, while the supply of bovine or porcine-derived components raises allergy and sourcing questions for select patients. Training gaps in onlay versus sutured techniques lead to performance variability that is sometimes misattributed to product choice. Transparent clinical data, standardized leak testing, and clear IFUs will be required to defend pricing. Without disciplined technique, sealant selection, and postoperative protocols, outcomes variance will continue to slow broader adoption despite strong surgeon interest.

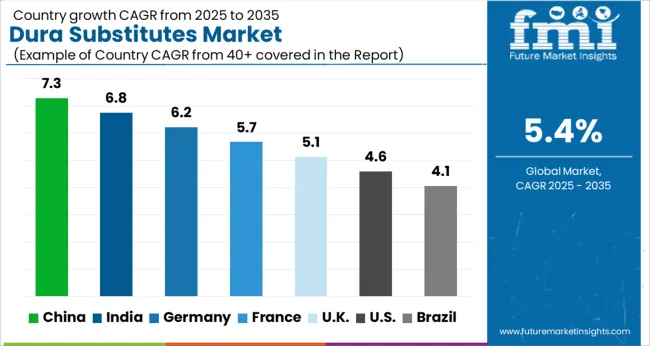

| Country | CAGR |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| France | 5.7% |

| UK | 5.1% |

| USA | 4.6% |

| Brazil | 4.1% |

The global dura substitutes market is projected to grow at 5.4% from 2025 to 2035. China leads at 7.3%, followed by India 6.8% and Germany 6.2%; the United Kingdom 5.1% and United States 4.6% follow. Demand is being pulled by cranial and spinal duraplasty volumes, wider use in skull-base and endoscopic procedures, and preference for infection-resistant, suture-friendly grafts. Collagen matrices, xenografts, allografts, and synthetic polymers are being evaluated on CSF-leak rates, handling, hemostasis, and adhesion control. Hospitals favor products with strong clinical evidence, ready availability, and predictable reimbursement. In our view, suppliers that pair onlay and suturable formats with sealant compatibility, clear IFUs, and robust post-market surveillance will capture share across high-acuity neurosurgical centers and growing tertiary networks. This report includes insights on 40+ countries; the top markets are shown here for reference.

The dura substitutes market in China is expected to expand at 7.3%. Growth is being shaped by higher cranial case volumes in tier-1 and tier-2 hospitals, broader adoption during skull-base and posterior fossa work, and procurement models that prefer bundled hemostats and sealants. Domestic manufacturers are scaling collagen and polymer grafts with consistent thickness and tear strength, while import brands retain share in complex tumors and combined ENT–neurosurgery cases. Decision makers weigh CSF-leak statistics, anti-adhesion behavior, and MRI compatibility, with provincial tenders emphasizing price discipline and stable supply. Training through key opinion leader centers is raising confidence in onlay placement and watertight suturing. In our view, China’s mix of local supply and evidence-led purchasing will keep momentum strong as hospitals standardize kits for endoscopic skull-base lines and high-risk trauma suites.

The dura substitutes market in India is projected to grow at 6.8%. Momentum is being created by expanding neurosurgical capacity in metro institutes and tier-2 cities, with rising use in traumatic brain injury, meningioma resections, and endoscopic transsphenoidal work. Hospitals value grafts that balance affordability with low CSF-leak incidence and straightforward handling over curved anatomy. Importers and local converters are offering collagen xenografts and synthetic sheets with suturability that tolerates limited exposure. Reimbursement pathways in private networks are aligning SKUs with package pricing for cranial and spine cases, while public tenders emphasize shelf-stable products and wide size options.

The dura substitutes market in Germany is anticipated to rise at 6.2%. Adoption is being guided by evidence-based protocols in university clinics and certified spine centers, where products are assessed on watertight closure, inflammatory profile, and adhesion control for re-entry safety. Buyers prioritize CE-marked grafts with clear IFUs, predictable suture retention, and compatibility with fibrin sealants. Neurosurgeons favor low-swelling matrices around cranial nerves and venous sinuses, with MRI behavior and artifact reduction scrutinized in post-op imaging. Procurement frameworks reward consistent documentation and field support in complex skull-base cases. In our view, Germany will sustain a premium profile as multidisciplinary teams standardize on portfolios that cover onlay, suturable, and patching approaches for cranial, spinal, and pediatric indications.

The dura substitutes market in the UK is forecast to expand at 5.1%. Growth is being supported by skull-base pathways in regional neuroscience centers and steady trauma volumes. Trusts evaluate grafts on handling under endoscopic visualization, suture pull-out strength, and leak performance when combined with fibrin or PEG sealants. Framework agreements emphasize batch traceability, IFU clarity, and training access for junior registrars. Preference has formed around low-profile onlay sheets for narrow corridors and suturable options for posterior fossa closure.

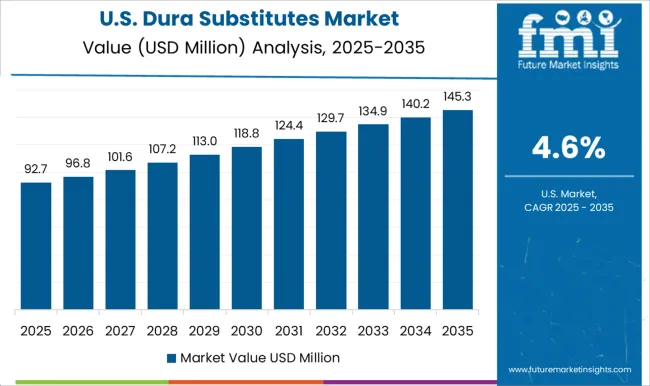

The dura substitutes market in the United States is projected to grow at 4.6%. Demand is being sustained by complex cranial work in academic centers, lumbar duraplasty during revision spine, and broad use in pituitary surgery. Value committees favor products with durable suturability, clear hydration steps, and proven leak statistics in peer-reviewed series. Compatibility with hemostats and sealants is weighed alongside ease of re-entry in staged oncology cases. Distributor support for in-service training and revision protocols influences brand stickiness.

The dura substitutes market is characterized by a highly competitive landscape, driven by both global and regional players focusing on product innovation, cost optimization, and supply chain efficiency. Leading manufacturers leverage advanced material science and proprietary formulations to develop durable, high-performance alternatives that meet diverse industrial and commercial applications. Competitive differentiation is often achieved through customization, faster delivery capabilities, and sustainable production practices, allowing players to cater to evolving end-user requirements.

Key players actively invest in research and development to enhance product functionality, improve thermal and mechanical properties, and reduce production costs. Strategic collaborations, mergers, and partnerships are commonly employed to expand market reach, enhance distribution networks, and strengthen technological capabilities. Price competitiveness, product quality, and technical support remain central factors influencing buyer preference. The market remains fragmented, with emerging regional manufacturers challenging established players by offering cost-effective, application-specific solutions, intensifying overall competition.

| Item | Value |

|---|---|

| Quantitative Units | USD 225.8 Million |

| Product Type | Synthetic dura substitute and Biological dura substitute |

| Material | Collagen-based, Polymers, and Other materials |

| Application | Neurosurgery, Spinal surgery, Trauma/accident, Post-surgical repair, and Other applications |

| End Use | Hospitals, Ambulatory surgical centers, and Other end users |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ACERA SURGICAL, B. Braun, Baxter, Bennett, Biosynth, Cook Medical, DePuy Synthes, GUNZE, INTEGRA, Medprin, Medtronic, Natus, Severn Healthcare Technologies, Stryker, and GORE |

| Additional Attributes | Dollar sales by product type (biologic xenografts, allograft dermis, synthetic resorbable, synthetic nonresorbable), Dollar sales by application (cranial, spinal dural repair, skull base ENT), Trends in endoscopic duraplasty and watertight patches, Role in CSF leak prevention, Growth from procedure volumes and reimbursements, Regional adoption in North America, Europe, Asia Pacific. |

The global dura substitutes market is estimated to be valued at USD 225.8 million in 2025.

The market size for the dura substitutes market is projected to reach USD 382.0 million by 2035.

The dura substitutes market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in dura substitutes market are synthetic dura substitute and biological dura substitute.

In terms of material, collagen-based segment to command 39.8% share in the dura substitutes market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Durability Testing Systems Market Size and Share Forecast Outlook 2025 to 2035

Durable Medical Equipment Rental Market Growth - Trends & Outlook 2025 to 2035

Durable Insulated Container Market Analysis – Size, Trends & Forecast 2024-2034

Epidural Guidance Systems Market Outlook - Share, Growth & Forecast 2025 to 2035

Meat Substitutes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Flour Substitutes Market Analysis by Baked Goods, Noodles, Pastry, Fried Food, Pasta, Bread, Crackers Applications Through 2035

Gelatin Substitutes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Bone Grafts and Substitutes Market Overview - Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA