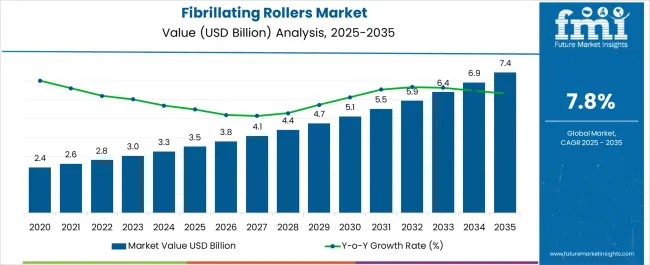

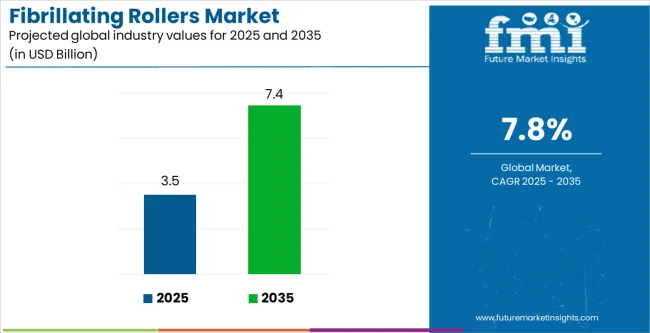

The Fibrillating Rollers Market is estimated to be valued at USD 3.5 billion in 2025 and is projected to reach USD 7.4 billion by 2035, registering a compound annual growth rate (CAGR) of 7.8% over the forecast period.

| Metric | Value |

|---|---|

| Fibrillating Rollers Market Estimated Value in (2025 E) | USD 3.5 billion |

| Fibrillating Rollers Market Forecast Value in (2035 F) | USD 7.4 billion |

| Forecast CAGR (2025 to 2035) | 7.8% |

The fibrillating rollers market is gaining traction as industries emphasize higher efficiency in fiber processing and advanced material handling solutions. Rising demand for improved yarn quality and consistency in textile applications has accelerated the adoption of fibrillating rollers.

Continuous technological enhancements in roller design and durability have enabled superior fiber separation, which is critical in producing lightweight, high-strength fabrics. Additionally, the market is supported by the increasing adoption of automation in textile manufacturing and the expansion of synthetic fiber applications across apparel, automotive, and industrial fabrics.

Regulatory focus on sustainable production practices and energy-efficient equipment has further promoted investments in advanced fibrillating rollers. The future outlook remains promising as manufacturers integrate precision engineering and materials innovation to cater to evolving textile industry requirements.

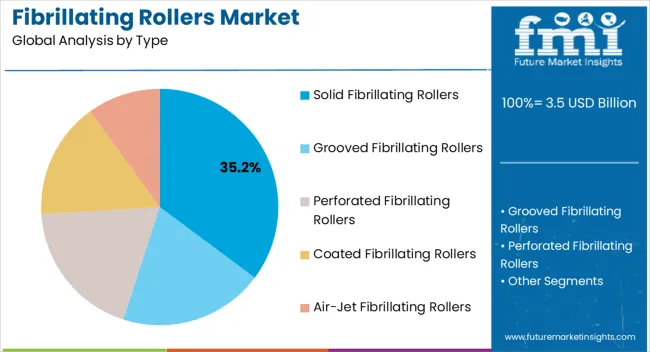

The solid fibrillating rollers type is projected to account for 35.20% of total market revenue by 2025, making it a leading category. This growth is attributed to their durability, operational stability, and ability to handle high-intensity fiber processing.

Solid rollers have been preferred for their lower maintenance requirements and long operational life, ensuring cost efficiency for manufacturers.

Their performance consistency in large-scale textile production has reinforced their dominance in the type segment, supported by increasing adoption in both synthetic and natural fiber processing units.

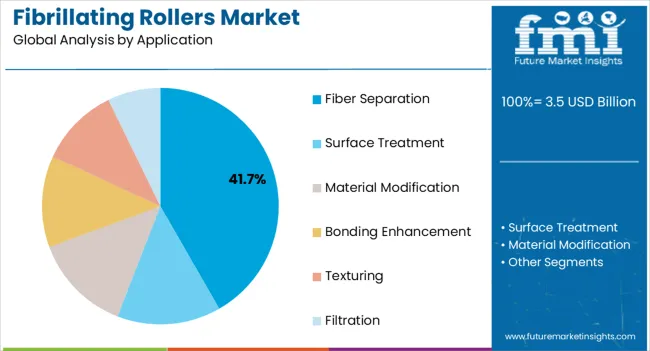

The fiber separation application is expected to contribute 41.70% of total market revenue by 2025, establishing it as the leading application. This dominance is being driven by the critical role fibrillating rollers play in enhancing fiber uniformity, improving texture, and enabling high-quality yarn output.

Growing demand for specialty fabrics with precise mechanical properties has further elevated the importance of advanced fiber separation techniques.

The segment has benefited from textile industry modernization, where efficient separation directly translates into improved end-product performance and reduced production waste.

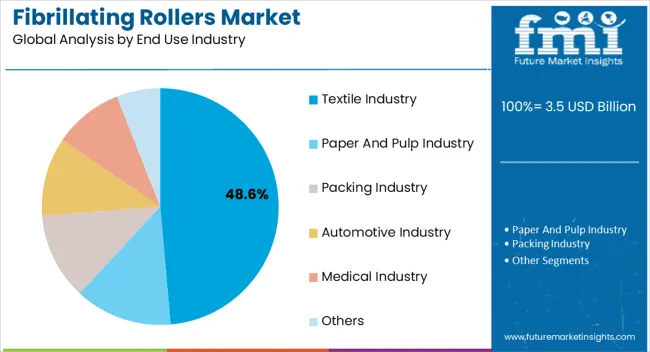

The textile industry segment is anticipated to represent 48.60% of market revenue by 2025, positioning it as the most prominent end-use sector. This leadership is a result of the sector’s extensive reliance on fibrillating rollers to improve yarn quality, optimize production efficiency, and meet the rising demand for diverse textile applications.

Expanding consumer markets, coupled with a shift toward performance fabrics, have intensified the use of fibrillating rollers.

Investments in high-speed textile machinery and sustainable production practices have further reinforced the segment’s dominance, making the textile industry the cornerstone of market growth.

From 2020 to 2025, the global Fibrillating Rollers market experienced a CAGR of 8.2%, reaching a market size of USD 3.5 billion in 2025.5.

From 2020 to 2025, the global Fibrillating Rollers industry witnessed steady growth due to the increased demand for high-quality goods, the demand for organic and natural foods, and advances in technology anticipated to contribute to the demand for fibrillating rollers.

As consumers become more health-conscious and seek higher-quality foods, the demand for fibrillating rollers is projected to grow. Additionally, the implementation of stringent regulations by governments across the globe further propelled market growth during this period.

Looking forward, the global Fibrillating Rollers industry is expected to rise at a CAGR of 8.2% from 2025 to 2035. During the forecast period, the market size is expected to surpass USD 5.3 billion.

The Fibrillating Rollers industry is expected to continue its growth trajectory from 2025 to 2035, driven by growth in demand for high-quality food products and increasing consumer awareness of the importance of organic and natural foods. Technological advancements are also expected to drive efficiency and productivity in food processing, further contributing to the growth of the industry.

The market is also likely to witness significant growth in the Asia Pacific region due to the presence of significantly growing economies such as China and India. However, market growth may be hindered by the emergence of alternative technologies and the high installation and maintenance costs associated with fibrillating rollers.

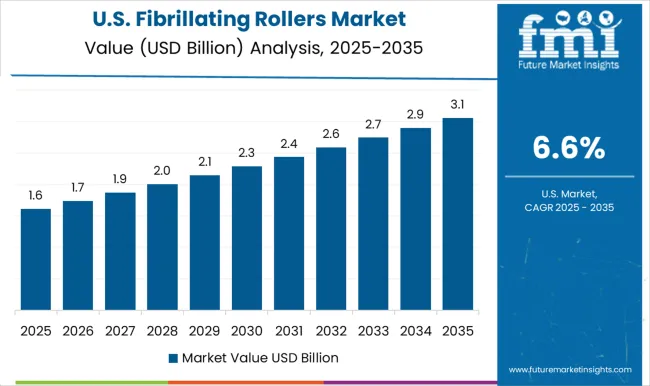

The Fibrillating Rollers industry in the United States is expected to reach a market share of USD 7.4 billion by 2035, expanding at a CAGR of 6.8%.

The Fibrillating Rollers industry in the United States is expected to witness growth due to the increasing demand for high-quality food products and the growing concerns over the food and beverage industry. Additionally, there are couple of other factors expected to drive the demand for fibrillating Rollers in the country:

| Country | France |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 0.72 billion |

| CAGR % 2025 to End of Forecast (2035) | 6.7.4% |

The Fibrillating roller industry in France is expected to reach a market share of USD 0.72 billion, expanding at a CAGR of 6.7.4% during the forecast period. The France market is projected to experience growth owing to the rising demand for fibrillating rollers in the Pharmaceutical and cosmetics industries.

The production of tablets and capsules in the pharmaceutical industry, and in the production of creams and lotions in the cosmetics industry, and the demand for other high-quality and consistent products in these industries are driving the demand for Fibrillating Rollers in France.

| Country | China |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 7.4.35 billion |

| CAGR % 2025 to End of Forecast (2035) | 7.3% |

The Fibrillating Rollers industry in China is anticipated to reach a market share of USD 7.4.35 billion, moving at a CAGR of 7.3 % during the forecast period.

The Fibrillating Rollers industry in China is expected to grow prominently due to the increase in high-quality and consistent products in these industries is driving the demand for Fibrillating Rollers, Additionally, the government's focus on industrial upgrading and the development of the chemical industry is also expected to contribute to the growth of the Fibrillating Rollers market in China.

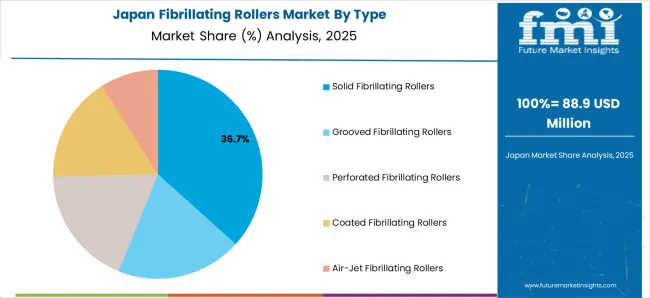

| Country | Japan |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 0.55 billion |

| CAGR % 2025 to End of Forecast (2035) | 7.5% |

The Fibrillating Rollers industry in Japan is estimated to reach a market share of USD 0.55 billion by 2035, thriving at a CAGR of 7.5%. The market in Japan is predicted to grow because of the increasing adoption of Fibrillating Rollers in various industries, such as food and beverage, pharmaceuticals, and chemicals, Additionally, the growing awareness of the importance of food safety and hygiene, are also expected to contribute to the growth of the fibrillating rollers market in Japan.

| Country | Brazil |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 0.88 billion |

| CAGR % 2025 to End of Forecast (2035) | 7.8% |

The Fibrillating Rollers industry in Brazil is expected to reach a market share of USD 0.88 billion, expanding at a CAGR of 7.8% during the forecast period. The Brazilian textile industry is one of the largest and most advanced in the South America Region, and the demand for high-quality and consistent textiles is driving the adoption of Fibrillating Rollers in the industry.

Additionally, the increasing awareness of the importance of sustainable and eco-friendly textiles, and the growing demand for organic and natural textiles, are also contributing to the growth of the Fibrillating Rollers market in Brazil.

The solid fibrillating roller segment is expected to dominate the Fibrillating Rollers industry with a CAGR of 8.2% from 2025 to 2035. This segment captures a significant market share in 2025 due to its cost-effectiveness, high efficiency, and low maintenance requirements.

Solid fibrillating rollers are highly used due to their ability to produce high-quality paper products with minimal waste. The increasing demand for mining, ceramics, and chemicals are the key factors driving the growth of the solid Fibrillating rollers segment in the Fibrillating Rollers industry.

The Food and Beverage Industry is expected to dominate the Fibrillating Rollers industry with a CAGR of 8.0% from 2025 to 2035. This segment captures a significant market share in 2025 due to the demand for high-quality and consistent products and the increasing focus on health awareness among consumers.

Fibrillating Rollers are highly effective in the production of various food and beverage products such as tablets, capsules, and other pharmaceuticals, and in the production of creams and lotions, cosmetics, and other personal care products.

The factors such as the growing population, rising disposable income, and increasing health awareness among consumers. Additionally, the growing demand for organic and natural food and beverage products is also driving the adoption of Fibrillating Rollers in the industry.

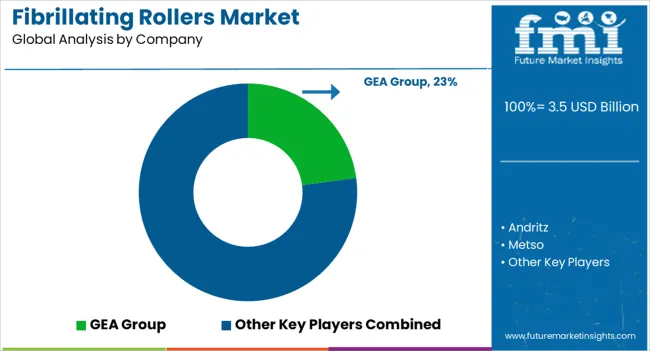

The Fibrillating Rollers industry is highly competitive, with numerous players vying for market share. In such a scenario, key players must adopt effective strategies to stay ahead of the competition.

Key Strategies Adopted by the Players

Product Innovation

Companies invest hugely in research and development to introduce innovative products that offer enhanced efficiency, reliability, and cost-effectiveness. Product innovation enables companies to differentiate themselves from their competitors and cater to the evolving needs of customers.

Strategic Partnerships and Collaborations

Key players in the industry often form strategic partnerships and collaborations with other companies to leverage their strengths and expand their reach in the market. Such collaborations also allow companies to gain access to new technologies and markets.

Expansion into Emerging Markets

The Fibrillating Rollers industry is witnessing significant growth in emerging markets such as China and India. Key players are expanding their presence in these markets by establishing local manufacturing facilities and strengthening their distribution networks.

Mergers and Acquisitions

Key players in the Fibrillating Rollers industry often merge to consolidate their market position, expand their product portfolio, and gain access to new markets.

Key Players in the Fibrillating Rollers Industry

Key Developments in the Fibrillating Rollers Market:

The global fibrillating rollers market is estimated to be valued at USD 3.5 billion in 2025.

The market size for the fibrillating rollers market is projected to reach USD 7.4 billion by 2035.

The fibrillating rollers market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in fibrillating rollers market are solid fibrillating rollers, grooved fibrillating rollers, perforated fibrillating rollers, coated fibrillating rollers and air-jet fibrillating rollers.

In terms of application, fiber separation segment to command 41.7% share in the fibrillating rollers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Paint Rollers Market Size and Share Forecast Outlook 2025 to 2035

Baby Strollers & Prams Market Size & Demand 2024-2034

Motion Controllers Market

Display Controllers Market by Type, Application, and Region-Forecast through 2035

Embedded Controllers Market Size and Share Forecast Outlook 2025 to 2035

SCR Power Controllers Market

Optical Microcontrollers Market

LED Lighting Controllers Market

SBCs – Securing IoT & VoIP Networks Globally

Textile Based pH Controllers Market Size and Share Forecast Outlook 2025 to 2035

WAN Optimization Controllers Market Analysis by Solution, Application, End User, and Region Through 2035

High Pressure Grinding Rollers Market Size and Share Forecast Outlook 2025 to 2035

Application Delivery Controllers Market Size and Share Forecast Outlook 2025 to 2035

Pulse Width Modulation Controllers Market Size and Share Forecast Outlook 2025 to 2035

Radiation Hardened Microcontrollers Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Controllers Market Size and Share Forecast Outlook 2025 to 2035

Dissolved Oxygen Meters and Controllers Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Water Sensors & Controllers Market Trends & Forecast 2025 to 2035

Non-Agriculture Smart Irrigation Controllers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA