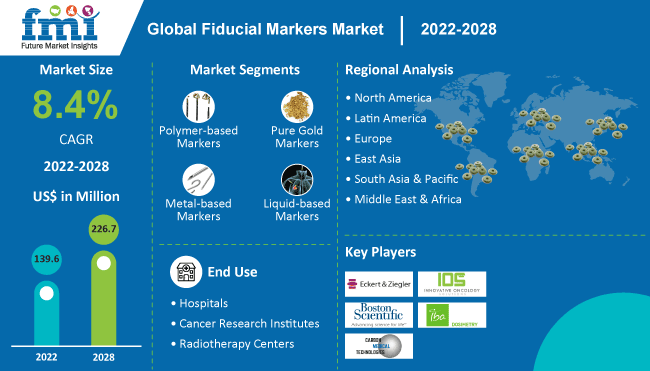

The global Fiducial Markers Market is estimated to be valued at USD 186.8 million in 2025 and is projected to reach USD 430.2 million by 2035, registering a compound annual growth rate (CAGR) of 8.7% over the forecast period. The growth of the market is anchored in expanding global cancer incidence and enhanced adoption of precision radiotherapy modalities like SBRT and IGRT, which require sub-millimeter localization accuracy.

Continued investments from public-private cancer research initiatives are further driving product innovation. Metal-based markers remain dominant due to their superior radiopaque visibility in CT/CBCT and MRI applications. Technological advances in polymer-based. and biodegradable variants cater to ultrasound-guided procedures and MR compatibility.

Additionally, outpatient clinics are increasingly providing marker implantation services ahead of radiotherapy sessions. Market expansion in emerging Asia Pacific nations is supported by rising healthcare infrastructure and oncological treatment capabilities. Adoption of minimally invasive placement techniques and real-time imaging validation protocols signals increasing integration of fiducial markers into complex tumor management pathways across radiation oncology and image-guided surgery.

Key players in the fiducial markers market include CIVCO Radiotherapy, IZI Medical Products, Medtronic, Naslund Medical (Gold Anchor), Nanovi, Boston Scientific, and IBA Dosimetry. Companies are enhancing marker visibility, biocompatibility and imaging compatibility through R&D. Companies are also focussed towards developing partnership agreement with healthcare organization to optimize supply chain and enhance patient outcome.

In 2024, Carbon Medical Technologies, Inc. has been awarded a group purchasing agreement with Premier, Inc for the for the BiomarC Fiducial Marker Product Line. “The collaboration with Premier is an incredible opportunity for Carbon Medical Technologies to promote increased use of fiducial markers for higher targeted radiation doses and better patient outcomes in the growing segment of Image Guided Radiotherapy and other Radiation Therapy techniques” said Stephanie Kent, CEO at CMT.

Besides introduction of new product, companies are also expanding distribution channels and forming partnerships with radiation oncology networks to support adoption. Incentives aligned with value-based oncology and higher reimbursement for IGRT procedures further promote marker uptake in key regional markets.

North America leads the market with approximately one-third of global revenue in 2025. This reflects high volumes of SBRT and proton therapy, presence of leading marker manufacturers, and strong insurance coverage for image-guided interventions. Hospitals are investing in hybrid operating rooms that combine imaging and surgical workflows.

Europe’s market growth has been supported by national cancer control initiatives and reimbursement for image-guided radiotherapy, especially in Germany and the UK. Apart from this, European oncology centers have rapidly adopted biocompatible markers that align with MRI-based planning protocols. Registries documenting fusion-gain and treatment precision have reinforced clinician confidence. Partnerships between national health systems and marker manufacturers have reduced clinic-level costs and improved implantation protocols.

In 2025, pure gold markers have been identified as the dominant product category in the fiducial markers market, accounting for 63.9% of the global revenue share. This leadership position has been attributed to the superior radiopacity, biocompatibility, and inert nature of pure gold, which ensures consistent visibility across CT, CBCT, and MRI modalities without causing significant image distortion or adverse reactions.

Their stability under high-dose radiation and compatibility with a broad range of tumor locations-particularly prostate, lung, and liver-has further reinforced their preference in clinical practice. Unlike hybrid or polymer markers, pure gold markers offer predictable artifact behavior, which has been favored in precision radiotherapy protocols.

Moreover, ongoing training programs and procedural standardization across oncology centers have enabled clinicians to consistently achieve optimal placement using pure gold markers. These combined advantages have positioned the segment as clinically reliable, technically robust, and preferred for use in advanced image-guided and adaptive radiotherapy workflows.

The proton therapy segment has emerged as the leading modality for fiducial marker use in 2025, commanding 52.9% of the global market share. This dominance has been driven by the growing number of proton therapy centers worldwide and the need for extreme targeting precision due to the unique depth-dose characteristics of proton beams.

Fiducial markers, particularly those with minimal beam perturbation such as gold or biocompatible polymers, have become essential for accurate tumor localization and real-time motion tracking in proton-based treatments. Additionally, increased clinical deployment of pencil beam scanning techniques and adaptive planning protocols has required reliable marker visibility for intra-treatment verification.

The adoption of fiducials in pediatric oncology and prostate cancer cases-two key proton therapy applications-has further reinforced market traction. Technological integration of fiducials with image-guidance systems and robotic positioning devices has improved workflow efficiency and clinical outcomes, thereby sustaining demand for marker-supported proton therapy.

Challenges

High Costs and Limited Awareness in Emerging Markets

One big challenge in the fiducial markers market is the high cost of putting in markers. This is true for gold markers and special biodegradable fiducials. The need for advanced imaging tools and skilled staff for placement can limit its use in low-income areas.

Also, few people know about and can get fiducial marker-assisted IGRT in developing areas, which makes it hard to grow the market. Sometimes, patients choose other ways to find tumors because of high costs or no insurance coverage.

Opportunities

AI-Guided Tumor Tracking, Biodegradable Markers, and Expansion into Non-Oncology Applications

The fiducial markers market presents significant growth potential despite many challenges. Thanks to real-time adaptive radiotherapy, combining AI-powered tumor tracking systems with fiducial markers improves treatment precision and patient outcomes. Durable biodegradable fiducial markers, which permit non-surgical removal and lower the risk of post-treatment complications, are beginning to take off.

Moreover, the expanded use of fiducial markers in non-oncology applications such as electrophysiology of the heart or brain, surgical navigation in neurosurgery, and orthopedic procedures with robots is creating new market opportunities. The practice of veterinary oncology using fiducial markers, non-radiation surgical navigation by analogy with GPS, and intervention radiologists both widen its scope for adoption further.

In the USA, demand for fiducial markers is seeing significant growth, driven by increasing use of image-guided radiotherapy (IGRT), more cancer cases require precise tumor localization, and marker technology has advanced. To guarantee the accuracy of radiotherapy and interventional procedures, the Food and Drug Administration (FDA) and the American Society for Radiation Oncology legally regulate fiducial marker standards in national publications.

Fiducial marker utilization is spreading still further, using biocompatibility and biodegradability. There are also MRI-compatible markers available to doctors. Real-time tracking on patients with tumors plus AI-assisted radiation planning to help doctors achieve objectives better than before.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 10.1% |

With an increasing investment into precision oncology, the growing deployment of advanced radiotherapy techniques, and government initiatives to improve cancer care, the Fiducial Markers Market in the UK is expanding. The UK National Health Service (NHS) and Medicines and Healthcare Products Regulatory Agency (MHRA) support clinical progress in IGRT and stereotactic body radiotherapy (SBRT).

The integration of fiducial markers in robotic-assisted surgery and minimally invasive procedures helps to raise the market scale. In addition, growing research cooperation within radiation oncology and AI-based radiation dose optimization means that treatment qualitatively improves.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 9.5% |

Due to an increasing cancer incidence, a shift to adaptive radiotherapy, and further technological advancements in marker placement techniques the Fiducial Markers Market in the European Union is experiencing strong growth.

By disseminating best practices and quality assurance for fiducial marker procedures that can be followed all across the region, the European Society for Radiotherapy and Oncology (ESTRO) and European Medicines Agency (EMA) have effectively promoted more accurate radiotherapy treatment.

Meanwhile, in Germany, France, and Spain, biodegradable or polymer-based fiducial marker technology is being used extensively; real-time motion management technologies applicable to larger-scale operations are introduced for wider areas of cancer territory; those methods also offer 4D therapy integration. The expansion in proton therapy centers, as well as increased sophistication of fiducial marker tracking algorithms of all types, means market consumption amounts will still go up steadily.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 9.8% |

The fiducial markers market in Japan is growing. This happens because of more money in precise radiation care and more need for less invasive cancer care. The government helps with early finding of cancer. The Health, Labour, and Welfare Ministry (MHLW) is pushing advanced radiation methods like proton and heavy-ion care.

Hospitals in Japan now use robots to place markers and AI to plan treatments. They also use MRI to track markers. New trends include tracking without markers and smart image joining. These changes shape the future of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 10.0% |

Ongoing rapid growth of the fiducial markers business in South Korea is being driven by increasingly widespread adoption of precision drugs, the consistent growth in the number of centers offering radiation therapy methods, and heavy government funding in the area of cancer research. Fiducial markers used in radiotherapy procedures are subject to review by the South Korean Ministry of Food and Drug Safety (MFDS).

Biocompatible fiducial markers designed to serve other purposes, smart imaging technology integration, and the increasing use of fiducial markers in robotic-assisted imaging examinations have all helped increase market demand. Also, markers capable of tracking using AI-based algorithms real-time with motion compensation systems is driving sales up further yet keeping treatment accuracy high.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 10.3% |

The market for fiducial markers is growing fast. More people need image-guided radiotherapy (IGRT) for cancer, and new ways to treat cancer are better. The push comes from more prostate, lung, and pancreatic cancer cases. Better ways to place the markers help a lot, and new tech in radiotherapy brings changes.

Companies aim to make fiducial markers safe, MRI-friendly, and able to break down in the body to make cancer treatment better and safer. This market has top medical device makers, experts in radiotherapy, and cancer-focused firms. They all play a part in new gold, polymer, and hydrogel fiducial markers.

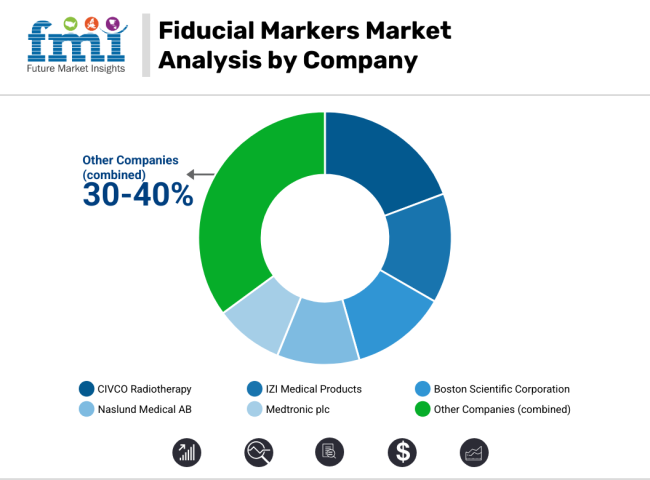

CIVCO Radiotherapy (18-22%)

CIVCO leads the fiducial markers market, offering gold, polymer, and specialized markers for high-precision radiation therapy applications.

IZI Medical Products (12-16%)

IZI Medical is a key provider of biodegradable markers, ensuring temporary localization without permanent implantation.

Boston Scientific Corporation (10-14%)

Boston Scientific’s Visicoil™ markers are widely used in IGRT, providing better tumor visibility and stability during radiation therapy.

Naslund Medical AB (8-12%)

Naslund focuses on MRI-compatible markers, enhancing image contrast for soft tissue tumor treatments.

Medtronic plc (6-10%)

Medtronic specializes in innovative marker placement techniques, integrating minimally invasive approaches for interventional radiology and oncology.

Other Key Players (30-40% Combined)

Several oncology-focused firms, radiotherapy technology providers, and biomaterial developers contribute to advancements in marker precision, biocompatibility, and treatment workflow efficiency. These include:

Table 01: Global Markers Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Product

Table 02: Global Markers Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Modality

Table 03: Global Markers Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Disease Site

Table 04: Global Markers Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by End User

Table 05: Global Markers Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Region

Table 06: North America Markers Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 07: North America Markers Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Product

Table 08: North America Markers Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Modality

Table 09: North America Markers Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Disease Site

Table 10: North America Markers Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by End User

Table 11: Latin America Markers Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 12: Latin America Markers Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Product

Table 13: Latin America Markers Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Modality

Table 14: Latin America Markers Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Disease Site

Table 15: Latin America Markers Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by End User

Table 16: Europe Markers Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 17: Europe Markers Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Product

Table 18: Europe Markers Market Analysis 2017 to 2022 and Forecast 2023 to 2033, by Modality

Table 19: Europe Markers Market Analysis 2017 to 2022 and Forecast 2023 to 2033, by Disease Site

Table 20: Europe Markers Market Analysis 2017 to 2022 and Forecast 2023 to 2033, by End User

Table 21: East Asia Markers Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 22: East Asia Markers Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Product

Table 23: East Asia Markers Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Modality

Table 24: East Asia Markers Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Disease Site

Table 25: East Asia Markers Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by End User

Table 26: South Asia Markers Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 27: South Asia Markers Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Product

Table 28: South Asia Markers Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Modality

Table 29: South Asia Markers Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Disease Site

Table 30: South Asia Markers Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by End User

Table 31: Oceania Markers Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 32: Oceania Markers Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Product

Table 33: Oceania Markers Market Analysis 2017 to 2022 and Forecast 2023 to 2033, by Modality

Table 34: Oceania Markers Market Analysis 2017 to 2022 and Forecast 2023 to 2033, by Disease Site

Table 35: Oceania Markers Market Analysis 2017 to 2022 and Forecast 2023 to 2033, by End User

Table 36: Middle East & Africa Markers Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 37: Middle East & Africa Markers Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Product

Table 38: Middle East & Africa Markers Market Analysis 2017 to 2022 and Forecast 2023 to 2033, by Modality

Table 39: Middle East & Africa Markers Market Analysis 2017 to 2022 and Forecast 2023 to 2033, by Disease Site

Table 40: Middle East & Africa Markers Market Analysis 2017 to 2022 and Forecast 2023 to 2033, by End User

Figure 01: Global Markers Market Value (US$ Million) Analysis, 2017 to 2022

Figure 02: Global Markers Market Forecast & Y-o-Y Growth, 2023 to 2033

Figure 03: Global Markers Market Absolute $ Opportunity (US$ Million) Analysis, 2022 to 2033

Figure 04: Global Markers Market Value Share (%) Analysis 2023 and 2033, by Product

Figure 05: Global Markers Market Y-o-Y Growth (%) Analysis 2022-2033, by Product

Figure 06: Global Markers Market Attractiveness Analysis 2023 to 2033, by Product

Figure 07: Global Markers Market Value Share (%) Analysis 2023 and 2033, by Modality

Figure 08: Global Markers Market Y-o-Y Growth (%) Analysis 2022-2033, by Modality

Figure 09: Global Markers Market Attractiveness Analysis 2023 to 2033, by Modality

Figure 10: Global Markers Market Value Share (%) Analysis 2023 and 2033, by Disease Site

Figure 11: Global Markers Market Y-o-Y Growth (%) Analysis 2022-2033, by Disease Site

Figure 12: Global Markers Market Attractiveness Analysis 2023 to 2033, by Disease Site

Figure 13: Global Markers Market Value Share (%) Analysis 2023 and 2033, by End User

Figure 14: Global Markers Market Y-o-Y Growth (%) Analysis 2022-2033, by End User

Figure 15: Global Markers Market Attractiveness Analysis 2023 to 2033, by End User

Figure 16: Global Markers Market Value Share (%) Analysis 2023 and 2033, by Region

Figure 17: Global Markers Market Y-o-Y Growth (%) Analysis 2022-2033, by Region

Figure 18: Global Markers Market Attractiveness Analysis 2023 to 2033, by Region

Figure 19: North America Markers Market Value (US$ Million) Analysis, 2017 to 2022

Figure 20: North America Markers Market Value (US$ Million) Forecast, 2023 to 2033

Figure 21: North America Markers Market Value Share, by Product (2023 E)

Figure 22: North America Markers Market Value Share, by Modality (2023 E)

Figure 23: North America Markers Market Value Share, by Disease Site (2023 E)

Figure 24: North America Markers Market Value Share, by End User (2023 E)

Figure 25: North America Markers Market Value Share, by Country (2023 E)

Figure 26: North America Markers Market Attractiveness Analysis by Product, 2023 to 2033

Figure 27: North America Markers Market Attractiveness Analysis by Modality, 2023 to 2033

Figure 28: North America Markers Market Attractiveness Analysis by Disease Site, 2023 to 2033

Figure 29: North America Markers Market Attractiveness Analysis by End User, 2023 to 2033

Figure 30: North America Markers Market Attractiveness Analysis by Country, 2023 to 2033

Figure 31: USA Markers Market Value Proportion Analysis, 2022

Figure 32: Global Vs. USA Growth Comparison, 2022 to 2033

Figure 33: USA Markers Market Share Analysis (%) by Product, 2022 to 2033

Figure 34: USA Markers Market Share Analysis (%) by Modality, 2022 to 2033

Figure 35: USA Markers Market Share Analysis (%) by Disease Site, 2022 to 2033

Figure 36: USA Markers Market Share Analysis (%) by End User, 2022 to 2033

Figure 37: Canada Markers Market Value Proportion Analysis, 2022

Figure 38: Global Vs. Canada. Growth Comparison, 2022 to 2033

Figure 39: Canada Markers Market Share Analysis (%) by Product, 2022 to 2033

Figure 40: Canada Markers Market Share Analysis (%) by Modality, 2022 to 2033

Figure 41: Canada Markers Market Share Analysis (%) by Disease Site, 2022 to 2033

Figure 42: Canada Markers Market Share Analysis (%) by End User, 2022 to 2033

Figure 43: Latin America Markers Market Value (US$ Million) Analysis, 2017 to 2022

Figure 44: Latin America Markers Market Value (US$ Million) Forecast, 2023 to 2033

Figure 45: Latin America Markers Market Value Share, by Product (2023 E)

Figure 46: Latin America Markers Market Value Share, by Modality (2023 E)

Figure 47: Latin America Markers Market Value Share, by Disease Site (2023 E)

Figure 48: Latin America Markers Market Value Share, by End User (2023 E)

Figure 49: Latin America Markers Market Value Share, by Country (2023 E)

Figure 50: Latin America Markers Market Attractiveness Analysis by Product, 2023 to 2033

Figure 51: Latin America Markers Market Attractiveness Analysis by Modality, 2023 to 2033

Figure 52: Latin America Markers Market Attractiveness Analysis by Disease Site, 2023 to 2033

Figure 53: Latin America Markers Market Attractiveness Analysis by End User, 2023 to 2033

Figure 54: Latin America Markers Market Attractiveness Analysis by Country, 2023 to 2033

Figure 55: Mexico Markers Market Value Proportion Analysis, 2022

Figure 56: Global Vs Mexico Growth Comparison, 2022 to 2033

Figure 57: Mexico Markers Market Share Analysis (%) by Product, 2022 to 2033

Figure 58: Mexico Markers Market Share Analysis (%) by Modality, 2022 to 2033

Figure 59: Mexico Markers Market Share Analysis (%) by Disease Site, 2022 to 2033

Figure 60: Mexico Markers Market Share Analysis (%) by End User, 2022 to 2033

Figure 61: Brazil Markers Market Value Proportion Analysis, 2022

Figure 62: Global Vs. Brazil. Growth Comparison, 2022 to 2033

Figure 63: Brazil Markers Market Share Analysis (%) by Product, 2022 to 2033

Figure 64: Brazil Markers Market Share Analysis (%) by Modality, 2022 to 2033

Figure 65: Brazil Markers Market Share Analysis (%) by Disease Site, 2022 to 2033

Figure 66: Brazil Markers Market Share Analysis (%) by End User, 2022 to 2033

Figure 67: Argentina Markers Market Value Proportion Analysis, 2022

Figure 68: Global Vs Argentina Growth Comparison, 2022 to 2033

Figure 69: Argentina Markers Market Share Analysis (%) by Product, 2022 to 2033

Figure 70: Argentina Markers Market Share Analysis (%) by Modality, 2022 to 2033

Figure 71: Argentina Markers Market Share Analysis (%) by Disease Site, 2022 to 2033

Figure 72: Argentina Markers Market Share Analysis (%) by End User, 2022 to 2033

Figure 73: Europe Markers Market Value (US$ Million) Analysis, 2017 to 2022

Figure 74: Europe Markers Market Value (US$ Million) Forecast, 2023 to 2033

Figure 75: Europe Markers Market Value Share, by Product (2023 E)

Figure 76: Europe Markers Market Value Share, by Modality (2023 E)

Figure 77: Europe Markers Market Value Share, by Disease Site (2023 E)

Figure 78: Europe Markers Market Value Share, by End User (2023 E)

Figure 79: Europe Markers Market Value Share, by Country (2023 E)

Figure 80: Europe Markers Market Attractiveness Analysis by Product, 2023 to 2033

Figure 81: Europe Markers Market Attractiveness Analysis by Modality, 2023 to 2033

Figure 82: Europe Markers Market Attractiveness Analysis by Disease Site, 2023 to 2033

Figure 83: Europe Markers Market Attractiveness Analysis by End User, 2023 to 2033

Figure 84: Europe Markers Market Attractiveness Analysis by Country, 2023 to 2033

Figure 85: UK Markers Market Value Proportion Analysis, 2022

Figure 86: Global Vs. UK Growth Comparison, 2022 to 2033

Figure 87: UK Markers Market Share Analysis (%) by Product, 2022 to 2033

Figure 88: UK Markers Market Share Analysis (%) by Modality, 2022 to 2033

Figure 89: UK Markers Market Share Analysis (%) by Disease Site, 2022 to 2033

Figure 90: UK Markers Market Share Analysis (%) by End User, 2022 to 2033

Figure 91: Germany Markers Market Value Proportion Analysis, 2022

Figure 92: Global Vs. Germany Growth Comparison, 2022 to 2033

Figure 93: Germany Markers Market Share Analysis (%) by Product, 2022 to 2033

Figure 94: Germany Markers Market Share Analysis (%) by Modality, 2022 to 2033

Figure 95: Germany Markers Market Share Analysis (%) by Disease Site, 2022 to 2033

Figure 96: Germany Markers Market Share Analysis (%) by End User, 2022 to 2033

Figure 97: Italy Markers Market Value Proportion Analysis, 2022

Figure 98: Global Vs. Italy Growth Comparison, 2022 to 2033

Figure 99: Italy Markers Market Share Analysis (%) by Product, 2022 to 2033

Figure 100: Italy Markers Market Share Analysis (%) by Modality, 2022 to 2033

Figure 101: Italy Markers Market Share Analysis (%) by Disease Site, 2022 to 2033

Figure 102: Italy Markers Market Share Analysis (%) by End User, 2022 to 2033

Figure 103: France Markers Market Value Proportion Analysis, 2022

Figure 104: Global Vs France Growth Comparison, 2022 to 2033

Figure 105: France Markers Market Share Analysis (%) by Product, 2022 to 2033

Figure 106: France Markers Market Share Analysis (%) by Modality, 2022 to 2033

Figure 107: France Markers Market Share Analysis (%) by Disease Site, 2022 to 2033

Figure 108: France Markers Market Share Analysis (%) by End User, 2022 to 2033

Figure 109: Spain Markers Market Value Proportion Analysis, 2022

Figure 110: Global Vs Spain Growth Comparison, 2022 to 2033

Figure 111: Spain Markers Market Share Analysis (%) by Product, 2022 to 2033

Figure 112: Spain Markers Market Share Analysis (%) by Modality, 2022 to 2033

Figure 113: Spain Markers Market Share Analysis (%) by Disease Site, 2022 to 2033

Figure 114: Spain Markers Market Share Analysis (%) by End User, 2022 to 2033

Figure 115: Russia Markers Market Value Proportion Analysis, 2022

Figure 116: Global Vs Russia Growth Comparison, 2022 to 2033

Figure 117: Russia Markers Market Share Analysis (%) by Product, 2022 to 2033

Figure 118: Russia Markers Market Share Analysis (%) by Modality, 2022 to 2033

Figure 119: Russia Markers Market Share Analysis (%) by Disease Site, 2022 to 2033

Figure 120: Russia Markers Market Share Analysis (%) by End User, 2022 to 2033

Figure 121: BENELUX Markers Market Value Proportion Analysis, 2022

Figure 122: Global Vs BENELUX Growth Comparison, 2022 to 2033

Figure 123: BENELUX Markers Market Share Analysis (%) by Product, 2022 to 2033

Figure 124: BENELUX Markers Market Share Analysis (%) by Modality, 2022 to 2033

Figure 125: BENELUX Markers Market Share Analysis (%) by Disease Site, 2022 to 2033

Figure 126: BENELUX Markers Market Share Analysis (%) by End User, 2022 to 2033

Figure 127: East Asia Markers Market Value (US$ Million) Analysis, 2017 to 2022

Figure 128: East Asia Markers Market Value (US$ Million) Forecast, 2023 to 2033

Figure 129: East Asia Markers Market Value Share, by Product (2023 E)

Figure 130: East Asia Markers Market Value Share, by Modality (2023 E)

Figure 131: East Asia Markers Market Value Share, by Disease Site (2023 E)

Figure 132: East Asia Markers Market Value Share, by End User (2023 E)

Figure 133: East Asia Markers Market Value Share, by Country (2023 E)

Figure 134: East Asia Markers Market Attractiveness Analysis by Product, 2023 to 2033

Figure 135: East Asia Markers Market Attractiveness Analysis by Modality, 2023 to 2033

Figure 136: East Asia Markers Market Attractiveness Analysis by Disease Site, 2023 to 2033

Figure 137: East Asia Markers Market Attractiveness Analysis by End User, 2023 to 2033

Figure 138: East Asia Markers Market Attractiveness Analysis by Country, 2023 to 2033

Figure 139: China Markers Market Value Proportion Analysis, 2022

Figure 140: Global Vs. China Growth Comparison, 2022 to 2033

Figure 141: China Markers Market Share Analysis (%) by Product, 2022 to 2033

Figure 142: China Markers Market Share Analysis (%) by Modality, 2022 to 2033

Figure 143: China Markers Market Share Analysis (%) by Disease Site, 2022 to 2033

Figure 144: China Markers Market Share Analysis (%) by End User, 2022 to 2033

Figure 145: Japan Markers Market Value Proportion Analysis, 2022

Figure 146: Global Vs. Japan Growth Comparison, 2022 to 2033

Figure 147: Japan Markers Market Share Analysis (%) by Product, 2022 to 2033

Figure 148: Japan Markers Market Share Analysis (%) by Modality, 2022 to 2033

Figure 149: Japan Markers Market Share Analysis (%) by Disease Site, 2022 to 2033

Figure 150: Japan Markers Market Share Analysis (%) by End User, 2022 to 2033

Figure 151: South Korea Markers Market Value Proportion Analysis, 2022

Figure 152: Global Vs South Korea Growth Comparison, 2022 to 2033

Figure 153: South Korea Markers Market Share Analysis (%) by Product, 2022 to 2033

Figure 154: South Korea Markers Market Share Analysis (%) by Modality, 2022 to 2033

Figure 155: South Korea Markers Market Share Analysis (%) by Disease Site, 2022 to 2033

Figure 156: South Korea Markers Market Share Analysis (%) by End User, 2022 to 2033

Figure 157: South Asia Markers Market Value (US$ Million) Analysis, 2017 to 2022

Figure 158: South Asia Markers Market Value (US$ Million) Forecast, 2023 to 2033

Figure 159: South Asia Markers Market Value Share, by Product (2023 E)

Figure 160: South Asia Markers Market Value Share, by Modality (2023 E)

Figure 161: South Asia Markers Market Value Share, by Disease Site (2023 E)

Figure 162: South Asia Markers Market Value Share, by End User (2023 E)

Figure 163: South Asia Markers Market Value Share, by Country (2023 E)

Figure 164: South Asia Markers Market Attractiveness Analysis by Product, 2023 to 2033

Figure 165: South Asia Markers Market Attractiveness Analysis by Modality, 2023 to 2033

Figure 166: South Asia Markers Market Attractiveness Analysis by Disease Site, 2023 to 2033

Figure 167: South Asia Markers Market Attractiveness Analysis by End User, 2023 to 2033

Figure 168: South Asia Markers Market Attractiveness Analysis by Country, 2023 to 2033

Figure 169: India Markers Market Value Proportion Analysis, 2022

Figure 170: Global Vs. India Growth Comparison, 2022 to 2033

Figure 171: India Markers Market Share Analysis (%) by Product, 2022 to 2033

Figure 172: India Markers Market Share Analysis (%) by Modality, 2022 to 2033

Figure 173: India Markers Market Share Analysis (%) by Disease Site, 2022 to 2033

Figure 174: India Markers Market Share Analysis (%) by End User, 2022 to 2033

Figure 175: Indonesia Markers Market Value Proportion Analysis, 2022

Figure 176: Global Vs. Indonesia Growth Comparison, 2022 to 2033

Figure 177: Indonesia Markers Market Share Analysis (%) by Product, 2022 to 2033

Figure 178: Indonesia Markers Market Share Analysis (%) by Modality, 2022 to 2033

Figure 179: Indonesia Markers Market Share Analysis (%) by Disease Site, 2022 to 2033

Figure 180: Indonesia Markers Market Share Analysis (%) by End User, 2022 to 2033

Figure 181: Malaysia Markers Market Value Proportion Analysis, 2022

Figure 182: Global Vs. Malaysia Growth Comparison, 2022 to 2033

Figure 183: Malaysia Markers Market Share Analysis (%) by Product, 2022 to 2033

Figure 184: Malaysia Markers Market Share Analysis (%) by Modality, 2022 to 2033

Figure 185: Malaysia Markers Market Share Analysis (%) by Disease Site, 2022 to 2033

Figure 186: Malaysia Markers Market Share Analysis (%) by End User, 2022 to 2033

Figure 187: Thailand Markers Market Value Proportion Analysis, 2022

Figure 188: Global Vs. Thailand Growth Comparison, 2022 to 2033

Figure 189: Thailand Markers Market Share Analysis (%) by Product, 2022 to 2033

Figure 190: Thailand Markers Market Share Analysis (%) by Modality, 2022 to 2033

Figure 191: Thailand Markers Market Share Analysis (%) by Disease Site, 2022 to 2033

Figure 192: Thailand Markers Market Share Analysis (%) by End User, 2022 to 2033

Figure 193: Oceania Markers Market Value (US$ Million) Analysis, 2017 to 2022

Figure 194: Oceania Markers Market Value (US$ Million) Forecast, 2023 to 2033

Figure 195: Oceania Markers Market Value Share, by Product (2023 E)

Figure 196: Oceania Markers Market Value Share, by Modality (2023 E)

Figure 197: Oceania Markers Market Value Share, by Disease Site (2023 E)

Figure 198: Oceania Markers Market Value Share, by End User (2023 E)

Figure 199: Oceania Markers Market Value Share, by Country (2023 E)

Figure 200: Oceania Markers Market Attractiveness Analysis by Product, 2023 to 2033

Figure 201: Oceania Markers Market Attractiveness Analysis by Modality, 2023 to 2033

Figure 202: Oceania Markers Market Attractiveness Analysis by Disease Site, 2023 to 2033

Figure 203: Oceania Markers Market Attractiveness Analysis by End User, 2023 to 2033

Figure 204: Oceania Markers Market Attractiveness Analysis by Country, 2023 to 2033

Figure 205: Australia Markers Market Value Proportion Analysis, 2022

Figure 206: Global Vs. Australia Growth Comparison, 2022 to 2033

Figure 207: Australia Markers Market Share Analysis (%) by Product, 2022 to 2033

Figure 208: Australia Markers Market Share Analysis (%) by Modality, 2022 to 2033

Figure 209: Australia Markers Market Share Analysis (%) by Disease Site, 2022 to 2033

Figure 210: Australia Markers Market Share Analysis (%) by End User, 2022 to 2033

Figure 211: New Zealand Markers Market Value Proportion Analysis, 2022

Figure 212: Global Vs New Zealand Growth Comparison, 2022 to 2033

Figure 213: New Zealand Markers Market Share Analysis (%) by Product, 2022 to 2033

Figure 214: New Zealand Markers Market Share Analysis (%) by Modality, 2022 to 2033

Figure 215: New Zealand Markers Market Share Analysis (%) by Disease Site, 2022 to 2033

Figure 216: New Zealand Markers Market Share Analysis (%) by End User, 2022 to 2033

Figure 217: Middle East & Africa Markers Market Value (US$ Million) Analysis, 2017 to 2022

Figure 218: Middle East & Africa Markers Market Value (US$ Million) Forecast, 2023 to 2033

Figure 219: Middle East & Africa Markers Market Value Share, by Product (2023 E)

Figure 220: Middle East & Africa Markers Market Value Share, by Modality (2023 E)

Figure 221: Middle East & Africa Markers Market Value Share, by Disease Site (2023 E)

Figure 222: Middle East & Africa Markers Market Value Share, by End User (2023 E)

Figure 223: Middle East & Africa Markers Market Value Share, by Country (2023 E)

Figure 224: Middle East & Africa Markers Market Attractiveness Analysis by Product, 2023 to 2033

Figure 225: Middle East & Africa Markers Market Attractiveness Analysis by Modality, 2023 to 2033

Figure 226: Middle East & Africa Markers Market Attractiveness Analysis by Disease Site, 2023 to 2033

Figure 227: Middle East & Africa Markers Market Attractiveness Analysis by End User, 2023 to 2033

Figure 228: Middle East & Africa Markers Market Attractiveness Analysis by Country, 2023 to 2033

Figure 229: GCC Countries Markers Market Value Proportion Analysis, 2022

Figure 230: Global Vs GCC Countries Growth Comparison, 2022 to 2033

Figure 231: GCC Countries Markers Market Share Analysis (%) by Product, 2022 to 2033

Figure 232: GCC Countries Markers Market Share Analysis (%) by Modality, 2022 to 2033

Figure 233: GCC Countries Markers Market Share Analysis (%) by Disease Site, 2022 to 2033

Figure 234: GCC Countries Markers Market Share Analysis (%) by End User, 2022 to 2033

Figure 235: Türkiye Markers Market Value Proportion Analysis, 2022

Figure 236: Global Vs. Türkiye Growth Comparison, 2022 to 2033

Figure 237: Türkiye Markers Market Share Analysis (%) by Product, 2022 to 2033

Figure 238: Türkiye Markers Market Share Analysis (%) by Modality, 2022 to 2033

Figure 239: Türkiye Markers Market Share Analysis (%) by Disease Site, 2022 to 2033

Figure 240: Türkiye Markers Market Share Analysis (%) by End User, 2022 to 2033

Figure 241: South Africa Markers Market Value Proportion Analysis, 2022

Figure 242: Global Vs. South Africa Growth Comparison, 2022 to 2033

Figure 243: South Africa Markers Market Share Analysis (%) by Product, 2022 to 2033

Figure 244: South Africa Markers Market Share Analysis (%) by Modality, 2022 to 2033

Figure 245: South Africa Markers Market Share Analysis (%) by Disease Site, 2022 to 2033

Figure 246: South Africa Markers Market Share Analysis (%) by End User, 2022 to 2033

Figure 247: North Africa Markers Market Value Proportion Analysis, 2022

Figure 248: Global Vs North Africa Growth Comparison, 2022 to 2033

Figure 249: North Africa Markers Market Share Analysis (%) by Product, 2022 to 2033

Figure 250: North Africa Markers Market Share Analysis (%) by Modality, 2022 to 2033

Figure 251: North Africa Markers Market Share Analysis (%) by Disease Site, 2022 to 2033

Figure 252: North Africa Markers Market Share Analysis (%) by End User, 2022 to 2033

The overall market size for the fiducial markers market was USD 186.8 Million in 2025.

The fiducial markers market is expected to reach USD 430.2 million in 2035.

Rising adoption of image-guided radiotherapy, increasing prevalence of cancer, and advancements in minimally invasive tumor localization techniques will drive market growth.

The USA, Germany, China, Japan, and the UK are key contributors.

Gold fiducial markers are expected to dominate due to their high visibility in imaging and biocompatibility in radiotherapy applications.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.