The flat suction cup market is projected to grow from USD 350.2 million in 2025 to USD 466.0 million by 2035, supported by expanding automation requirements and increased emphasis on reliable part handling across industrial production lines. The initial growth phase from 2025 to 2030 brings the market to approximately USD 403.9 million, adding USD 53.7 million and representing 46 percent of total decade expansion. This period is defined by strong adoption in automotive component assembly, consumer electronics manufacturing, and high-speed packaging machinery, where flat suction cups are used for lifting, transferring, positioning, and sorting smooth-surfaced items. Round flat suction cup geometries are gaining priority due to their stable sealing performance, quick-change mount compatibility, and suitability for robotic end-effectors and pick-and-place systems.

From 2030 to 2035, the market continues toward USD 466.0 million, driven by broader standardization of vacuum gripping solutions in modular automation environments. Advancements in polyurethane, silicone, and high-friction elastomer formulations are improving wear resistance, seal consistency, and performance across varied temperature and surface conditions. The rise of collaborative robots, lightweight grippers, and adaptive handling systems is also increasing demand for suction cups capable of maintaining grip reliability while minimizing surface marking. As factories pursue higher throughput and reduced downtime, suction cups designed for longer service life, chemical resistance, and rapid replacement are expected to shape competitive differentiation across global manufacturing sectors.

The latter half (2030-2035) will witness sustained growth from USD 403.9 million to USD 466.0 million, representing an addition of USD 62.1 million or 54% of the decade's expansion. This period will be defined by mass market penetration of specialized suction cup designs, integration with comprehensive automation platforms, and seamless compatibility with existing material handling infrastructure. The market trajectory signals fundamental shifts in how manufacturers approach handling optimization and production quality management, with participants positioned to benefit from sustained demand across multiple shape types and end-use industry segments.

The Flat Suction Cup market demonstrates distinct growth phases with varying market characteristics and competitive dynamics. Between 2025 and 2030, the market progresses through its technology adoption phase, expanding from USD 350.2 million to USD 403.9 million with steady annual increments averaging 2.9% growth. This period showcases the transition from basic vacuum handling formulations to advanced round shape systems with enhanced grip capabilities and integrated durability control systems becoming mainstream features.

The 2025-2030 phase adds USD 53.7 million to market value, representing 46% of total decade expansion. Market maturation factors include standardization of material handling and automation protocols, declining component costs for specialized suction formulations, and increasing industry awareness of automated handling benefits reaching optimal grip effectiveness in automotive and electronics applications. Competitive landscape evolution during this period features established vacuum component manufacturers like Schmalz and Piab expanding their suction cup portfolios while specialty manufacturers focus on advanced design development and enhanced performance capabilities.

From 2030 to 2035, market dynamics shift toward advanced shape integration and global manufacturing expansion, with growth continuing from USD 403.9 million to USD 466.0 million, adding USD 62.1 million or 54% of total expansion. This phase transition centers on specialized shape systems, integration with robotic handling networks, and deployment across diverse automotive and electronics scenarios, becoming standard rather than specialized applications. The competitive environment matures with focus shifting from basic handling capability to comprehensive automation optimization systems and integration with production monitoring platforms.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 350.2 million |

| Market Forecast (2035) | USD 466.0 million |

| Growth Rate | 2.9% CAGR |

| Leading Technology | Round Shape Type |

| Primary Application | Automotive Application Segment |

The market demonstrates strong fundamentals with round shape systems capturing a dominant share through advanced handling design and grip optimization capabilities. Automotive applications drive primary demand, supported by increasing automated production and precision handling technology requirements. Geographic expansion remains concentrated in developed markets with established manufacturing infrastructure, while emerging economies show accelerating adoption rates driven by industrial automation expansion and rising quality standards.

Market expansion rests on three fundamental shifts driving adoption across the automotive, electronics, and packaging sectors. First, manufacturing automation demand creates compelling operational advantages through flat suction cups that provide immediate handling precision and material security without compromising production efficiency, enabling manufacturers to meet stringent quality standards while maintaining manufacturing productivity and reducing material damage. Second, industrial handling modernization accelerates as manufacturers worldwide seek advanced vacuum systems that complement traditional handling processes, enabling precise grip customization and quality control that align with industry standards and automation requirements.

Third, production efficiency enhancement drives adoption from automated facilities and specialty manufacturers requiring effective handling solutions that maximize throughput while maintaining operational productivity during assembly and transfer operations. However, growth faces headwinds from material compatibility challenges that vary across suction cup suppliers regarding the handling of porous materials and specialty surfaces, which may limit adoption in diverse material environments. Technical limitations also persist regarding vacuum stability and surface dependency concerns that may reduce effectiveness in dusty or uneven surface scenarios, which affect grip performance and handling requirements.

The flat suction cup market represents a specialized yet critical automation opportunity driven by expanding global manufacturing automation, material handling modernization, and the need for superior grip precision in diverse industrial applications. As manufacturers worldwide seek to achieve optimal handling effectiveness, reduce material damage, and integrate advanced vacuum systems with robotic platforms, flat suction cups are evolving from basic handling components to sophisticated automation solutions ensuring production quality and operational efficiency.

The market's growth trajectory from USD 350.2 million in 2025 to USD 466.0 million by 2035 at a 2.9% CAGR reflects fundamental shifts in manufacturing automation requirements and handling optimization. Geographic expansion opportunities are particularly pronounced in Asia Pacific markets, while the dominance of round shape systems and automotive applications provides clear strategic focus areas.

Strengthening the dominant round shape segment through enhanced material formulations, superior grip stability, and automated handling systems. This pathway focuses on optimizing suction design, improving handling reliability, extending operational effectiveness to optimal vacuum rates, and developing specialized formulations for diverse applications. Market leadership consolidation through advanced material engineering and automated production integration enables premium positioning while defending competitive advantages against alternative handling technologies. Expected revenue pool: USD 18-24 million

Rapid industrial automation and manufacturing growth across Asia Pacific creates substantial expansion opportunities through local production capabilities and technology transfer partnerships. Growing automated production volumes and government manufacturing initiatives drive sustained demand for advanced suction cup systems. Localization strategies reduce import costs, enable faster technical support, and position companies advantageously for procurement programs while accessing growing domestic markets. Expected revenue pool: USD 15-20 million

Expansion within the dominant automotive segment through specialized suction designs addressing assembly line standards and high-speed production requirements. This pathway encompasses robotic integration systems, quality control compatibility, and alignment with diverse automotive manufacturing processes. Premium positioning reflects superior handling precision and comprehensive automation compliance supporting modern automotive production. Expected revenue pool: USD 13-17 million

Strategic expansion into electronics applications requires enhanced handling capabilities and specialized suction formulations addressing delicate component operational requirements. This pathway addresses precision grip design, static control enhancement, and sensitive material handling with advanced material engineering for demanding electronics standards. Premium pricing reflects specialized design requirements and extended reliability standards. Expected revenue pool: USD 11-15 million

Development of specialized suction cup formulations for packaging applications addressing high-speed handling requirements and flexible material demands. This pathway encompasses hybrid designs, material-optimized formulations, and cost-effective alternatives for emerging packaging segments. Technology differentiation through proprietary formulations enables diversified revenue streams while reducing dependency on single application platforms. Expected revenue pool: USD 9-12 million

Expansion of oval shape segment through enhanced grip distribution, specialized material handling, and unique surface contact requirements. This pathway encompasses elongated product applications, specialty material handling, and formulations requiring superior contact area characteristics. Market development through advanced shape engineering enables differentiated positioning while accessing specialized markets requiring optimized grip distribution solutions. Expected revenue pool: USD 8-11 million

Development of advanced suction cup formulations addressing material compatibility and surface handling requirements across automotive and electronics applications. This pathway encompasses porous material integration, surface treatment technologies, and comprehensive performance documentation. Premium positioning reflects material handling expertise and surface compatibility excellence while enabling access to specialized procurement programs and challenging material handling partnerships. Expected revenue pool: USD 7-10 million

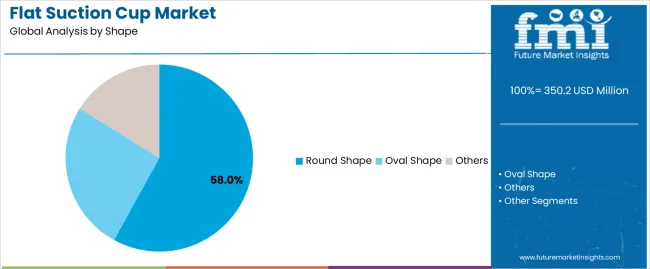

Primary Classification: The market segments by shape into Round Shape, Oval Shape, and Others categories, representing the evolution from basic suction designs to specialized shape solutions for comprehensive handling optimization.

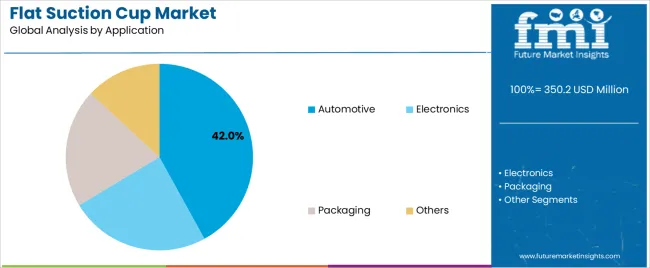

Secondary Classification: Application segmentation divides the market into Automotive, Electronics, Packaging, and Others sectors, reflecting distinct requirements for handling precision, grip capacity, and material compatibility standards.

Regional Classification: Geographic distribution covers Asia Pacific, Europe, North America, Latin America, and Middle East & Africa, with developed markets leading adoption while emerging economies show accelerating growth patterns driven by industrial automation expansion programs.

The segmentation structure reveals technology progression from standard round-based formulations toward specialized shape systems with enhanced grip and handling capabilities, while application diversity spans from automotive assembly to specialized electronics and packaging applications requiring precise suction solutions.

Market Position: Round shape systems command the leading position in the Flat Suction Cup market with approximately 58.0% market share through advanced design properties, including superior grip distribution, optimal vacuum stability capability, and handling optimization that enable manufacturers to achieve optimal material control across diverse industrial environments.

Value Drivers: The segment benefits from engineer preference for versatile suction systems that provide consistent handling performance, reduced material slippage, and production reliability without requiring significant system modifications. Advanced design features enable automated integration, handling consistency, and compatibility with existing robotic equipment, where suction performance and grip reliability represent critical operational requirements.

Competitive Advantages: Round shape systems differentiate through proven vacuum characteristics, consistent contact properties, and integration with automated handling systems that enhance operational effectiveness while maintaining optimal grip suitable for diverse material handling applications.

Key market characteristics:

Oval shape systems maintain specialized positioning in the Flat Suction Cup market due to their elongated contact properties and specialized handling advantages. These systems appeal to manufacturers requiring directional grip with adequate performance for elongated material and specialty handling applications. Market adoption is driven by specialized automation expansion, emphasizing reliable handling solutions and operational efficiency through optimized shape design systems while maintaining competitive performance characteristics.

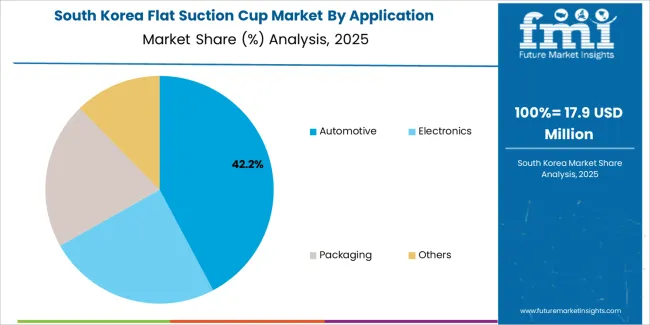

Market Context: Automotive applications dominate the Flat Suction Cup market with approximately 42.0% market share due to widespread adoption of automated handling and increasing focus on assembly line efficiency, material protection, and quality management applications that minimize handling failures while maintaining manufacturing standards.

Appeal Factors: Automotive manufacturers prioritize handling reliability, grip consistency, and integration with existing robotic infrastructure that enables coordinated suction application across multiple assembly lines. The segment benefits from substantial automation investment and quality programs that emphasize the acquisition of vacuum handling for precision control and material protection applications.

Growth Drivers: Assembly automation expansion programs incorporate flat suction cups as standard components for industrial manufacturing operations, while electric vehicle industry growth increases demand for precision handling capabilities that comply with quality standards and minimize production defects.

Market Challenges: Varying automotive standards and material surface differences may limit suction standardization across different production facilities or operational scenarios.

Application dynamics include:

Electronics applications capture approximately 32.0% market share through specialized handling requirements in component assembly, circuit board production, and delicate material handling applications. These facilities demand precise suction systems capable of handling sensitive components while providing static protection and damage prevention capabilities.

Packaging applications account for approximately 18.0% market share, while other segments capture 8.0%, including food handling, pharmaceutical production, and specialty manufacturing requiring suction capabilities for diverse material types and handling scenarios.

Growth Accelerators: Manufacturing automation expansion drives primary adoption as flat suction cups provide superior handling capabilities that enable industrial facilities to meet stringent quality standards without excessive equipment costs, supporting production operations and manufacturing missions that require precise material handling applications. Automated handling infrastructure demand accelerates market expansion as manufacturers seek effective vacuum systems that minimize material damage while maintaining operational effectiveness during production and assembly scenarios. Industrial automation spending increases worldwide, creating sustained demand for handling systems that complement traditional manufacturing processes and provide efficiency improvement in competitive markets.

Growth Inhibitors: Material compatibility challenges vary across suction suppliers regarding the handling of porous materials and specialty surfaces, which may limit operational flexibility and market penetration in regions with diverse material types or specialized production operations. Technical performance limitations persist regarding vacuum stability and surface dependency that may reduce effectiveness in dusty, oily, or uneven surface conditions, affecting handling reliability and application requirements. Market fragmentation across multiple industry standards and material specifications creates compatibility concerns between different suction suppliers and existing automation infrastructure.

Market Evolution Patterns: Adoption accelerates in automotive assembly and electronics manufacturing sectors where handling precision justifies suction costs, with geographic concentration in developed markets transitioning toward mainstream adoption in emerging economies driven by industrial automation expansion and quality awareness. Technology development focuses on enhanced material formulations, improved surface compatibility, and integration with robotic systems that optimize handling precision and grip effectiveness. The market could face disruption if alternative handling technologies or magnetic grip innovations significantly limit the deployment of vacuum-based suction in industrial applications, though suction technology's unique combination of versatility, reliability, and material compatibility continues to make it preferred in automated handling.

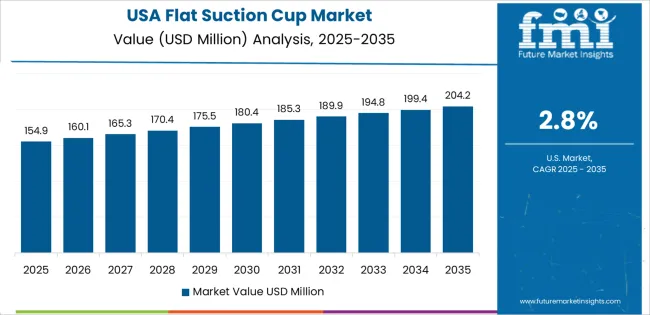

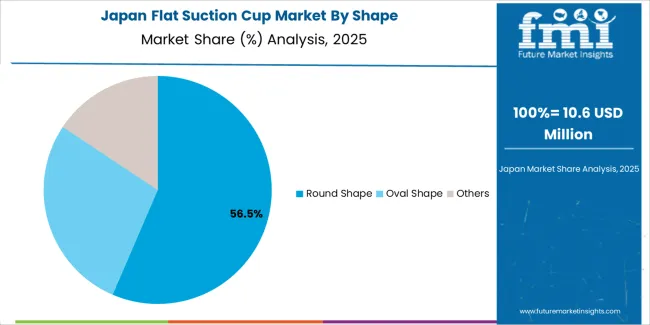

The Flat Suction Cup market demonstrates varied regional dynamics with Growth Leaders including China (3.9% CAGR) and India (3.6% CAGR) driving expansion through manufacturing capacity additions and automation programs. Steady Performers encompass Germany (3.3% CAGR), Brazil (3.0% CAGR), and United States (2.8% CAGR), benefiting from established industrial sectors and advanced automation adoption. Mature Markets feature United Kingdom (2.5% CAGR) and Japan (2.2% CAGR), where specialized automotive applications and precision handling integration support consistent growth patterns.

| Country | CAGR (2025-2035) |

|---|---|

| China | 3.9% |

| India | 3.6% |

| Germany | 3.3% |

| Brazil | 3.0% |

| United States | 2.8% |

| United Kingdom | 2.5% |

| Japan | 2.2% |

Regional synthesis reveals Asia Pacific markets leading adoption through manufacturing infrastructure expansion and automation facility development, while European countries maintain steady expansion supported by industrial technology advancement and quality standardization requirements. North American markets show moderate growth driven by automotive industry applications and manufacturing automation integration trends.

The Chinese market emphasizes advanced handling features, including precision grip control and integration with comprehensive robotic platforms that manage production quality, handling optimization, and automation applications through unified monitoring systems. The country demonstrates strong growth at 3.9% CAGR, driven by manufacturing infrastructure expansion, automation initiatives, and emerging industrial development that support suction cup integration. Chinese manufacturers prioritize operational effectiveness with flat suction cups delivering consistent material handling through advanced design capabilities and production adaptation features.

Technology deployment channels include major automotive manufacturers, specialized automation suppliers, and industrial procurement programs that support professional applications for complex assembly handling and material transfer applications. Robotic platform integration capabilities with established automation systems expand market appeal across diverse operational requirements seeking handling benefits and efficiency improvement. The expanding manufacturing base and accelerating industrial automation create sustained demand, while innovative applications in electronics assembly and logistics automation open new growth avenues.

Performance Metrics:

Germany's advanced manufacturing market demonstrates sophisticated suction cup deployment with documented operational effectiveness in automotive assembly applications and industrial facilities through integration with existing automation systems and production infrastructure. The country leverages engineering expertise in precision handling and manufacturing systems integration to maintain strong growth at 3.3% CAGR. Industrial centers, including Stuttgart, Munich, and Frankfurt, showcase advanced installations where suction cup systems integrate with comprehensive automation platforms and quality management systems to optimize production efficiency and handling effectiveness.

German manufacturers prioritize system reliability and EU compliance in suction cup development, creating demand for precision-engineered systems with advanced features, including robotic integration and automated monitoring systems. The market benefits from established industrial infrastructure and willingness to invest in automation technologies that provide long-term efficiency benefits and compliance with international quality and safety standards.

Market Intelligence Brief:

The USA flat suction cup market demonstrates sophisticated deployment across industrial applications with documented effectiveness in automotive assembly and electronics manufacturing facilities through integration with comprehensive automation systems and production infrastructure. The country leverages advanced manufacturing capabilities in handling innovation and automation technologies to maintain moderate growth at 2.8% CAGR. Industrial centers, including Detroit, Chicago, and San Jose, showcase advanced installations where suction cup systems integrate with comprehensive robotic platforms and quality control networks to optimize production efficiency and handling effectiveness.

American manufacturers prioritize handling precision and automation compatibility in suction cup development, creating demand for innovative vacuum systems with advanced features, including sensor integration and automated adjustment systems. The market benefits from established industrial infrastructure and willingness to invest in automation technologies that provide long-term efficiency benefits and compliance with OSHA and quality standards.

Market Intelligence Brief:

The UK flat suction cup market demonstrates advanced automation deployment with documented operational effectiveness in manufacturing applications and industrial facilities through integration with existing quality systems and production infrastructure. The country leverages manufacturing expertise in automation and production systems integration to maintain steady growth at 2.5% CAGR. Industrial centers, including Birmingham, Manchester, and London, showcase advanced installations where suction cup systems integrate with comprehensive automation platforms and quality management systems to optimize compliance and handling effectiveness.

British manufacturers prioritize system reliability and regulatory compliance in suction cup development, creating demand for certified systems with advanced features, including safety integration and performance tracking. The market benefits from established industrial infrastructure and commitment to invest in automation technologies that provide long-term efficiency benefits and compliance with UK and EU manufacturing standards. Automotive applications, electronics assembly systems, and packaging automation drive diversified demand across multiple end-use segments.

Strategic Market Indicators:

India's flat suction cup market demonstrates rapid expansion deployment with documented operational effectiveness in manufacturing applications and industrial facilities through integration with emerging automation systems and production infrastructure. The country leverages growing industrial capabilities in automated handling and manufacturing systems integration to achieve high growth at 3.6% CAGR. Industrial centers, including Mumbai, Chennai, and Pune, showcase expanding installations where suction cup systems integrate with comprehensive automation platforms and production networks to optimize market penetration and handling effectiveness.

Indian manufacturers prioritize automation capability and international standards in suction cup development, creating demand for reliable systems with advanced features, including robotic integration and quality control systems. The market benefits from expanding industrial infrastructure and willingness to invest in international-standard automation technologies that provide efficiency differentiation and compliance with global quality standards.

Market Intelligence Brief:

Brazil's flat suction cup market demonstrates expanding automation deployment with documented effectiveness in manufacturing applications and industrial facilities through integration with developing production systems and automation infrastructure. The country leverages growing industrial capabilities in automated handling and production systems to achieve growth at 3.0% CAGR. Industrial centers, including São Paulo, Rio de Janeiro, and Campinas, showcase expanding installations where suction cup systems integrate with automation platforms and manufacturing networks to optimize production efficiency and market penetration.

Brazilian manufacturers prioritize handling reliability and quality compliance in suction cup development, creating demand for proven systems with advanced features, including standardized integration and performance monitoring. The market benefits from expanding automotive infrastructure and commitment to invest in automation technologies that provide efficiency benefits and compliance with regional manufacturing standards.

Strategic Market Indicators:

Japan's flat suction cup market demonstrates precision deployment with documented operational effectiveness in automotive applications and electronics facilities through integration with advanced automation systems and quality infrastructure. The country leverages manufacturing excellence in precision handling and systems integration to maintain steady growth at 2.2% CAGR. Industrial centers, including Tokyo, Nagoya, and Osaka, showcase advanced installations where suction cup systems integrate with comprehensive quality platforms and robotic systems to optimize production excellence and handling effectiveness.

Japanese manufacturers prioritize system precision and reliability validation in suction cup development, creating demand for ultra-precision systems with advanced features, including micro-adjustment capabilities and quality integration systems. The market benefits from established industrial infrastructure and commitment to invest in highest-quality automation technologies that provide superior handling precision and compliance with stringent Japanese manufacturing standards.

Strategic Market Indicators:

The Flat Suction Cup market in Europe is projected to grow substantially over the forecast period, with Germany expected to maintain its leadership position with a significant market share supported by its advanced industrial infrastructure and major manufacturing centers in Stuttgart and Munich. France follows with strong market presence, driven by comprehensive automotive programs and industrial automation initiatives.

The United Kingdom holds substantial market share through specialized manufacturing activities, automation programs, and automotive production. Italy commands notable market presence through strong industrial projects and manufacturing expansion. Spain accounts for growing market share aided by automotive manufacturing growth and automation adoption. The Netherlands maintains steady share driven by specialty manufacturing applications and logistics automation demand. The Rest of Europe region is anticipated to show steady adoption, reflecting consistent growth in Nordic countries, industrial expansion in Central European markets, and automation upgrades across Eastern European manufacturing facilities.

In Japan, the Flat Suction Cup market prioritizes round shape systems, which capture the dominant share of automotive and electronics installations due to their advanced features, including precision grip optimization and seamless integration with existing robotic infrastructure. Japanese manufacturers emphasize reliability, precision, and long-term performance excellence, creating demand for round shape systems that provide consistent handling capabilities and superior design performance based on manufacturing requirements and quality standards. Oval shape maintains secondary positions primarily in specialized handling applications and elongated material installations where comprehensive grip distribution meets operational requirements without compromising production efficiency.

Market Characteristics:

How Are Automation Distributors Strengthening Industrial Handling Capabilities in South Korea?

In South Korea, the market structure favors international automation manufacturers, including Schmalz, Piab, and SMC Corporation, which maintain dominant positions through comprehensive product portfolios and established industrial networks supporting both automotive assembly and electronics manufacturing installations.

These providers offer integrated solutions combining advanced suction cup systems with technical engineering services and ongoing application support that appeal to Korean manufacturers seeking reliable handling systems. Local distributors and automation suppliers capture moderate market share by providing localized service capabilities and competitive pricing for standard handling installations, while domestic manufacturers focus on specialized applications and cost-effective solutions tailored to Korean manufacturing market characteristics.

Channel Insights:

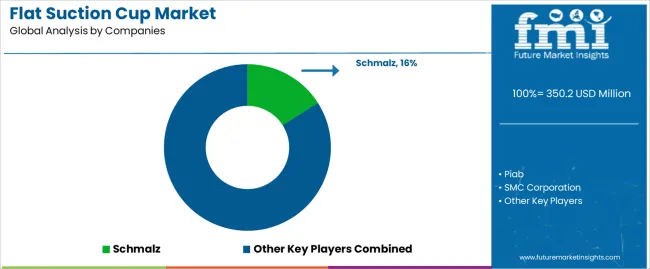

The Flat Suction Cup market operates with moderate concentration, featuring approximately 18-22 meaningful participants, where leading companies control roughly 48-52% of the global market share through established industrial relationships and comprehensive vacuum handling portfolios. Competition emphasizes advanced design capabilities, material reliability, and automation integration rather than price-based rivalry. The leading company, Schmalz, commands approximately 16.0% market share through its extensive vacuum handling product line and global industrial presence.

Market Leaders encompass Schmalz, Piab, and SMC Corporation, which maintain competitive advantages through extensive vacuum handling expertise, global automation networks, and comprehensive system integration capabilities that create customer loyalty and support premium pricing. These companies leverage decades of automation technology experience and ongoing innovation investments to develop advanced suction cup systems with precision grip control and durability features. Technology Innovators include AIRBEST and regional specialists, which compete through specialized material technology focus and innovative design capabilities that appeal to manufacturers seeking advanced handling solutions and production differentiation.

These companies differentiate through rapid design development cycles and specialized industrial application focus. Regional Specialists feature automation component manufacturers focusing on specific geographic markets and specialized applications, including custom handling systems and integrated robotic solutions. Market dynamics favor participants that combine reliable suction formulations with advanced handling capabilities, including precision grip control and automatic performance optimization features. Competitive pressure intensifies as traditional pneumatic component suppliers expand into specialized suction systems, while automation companies challenge established players through innovative material solutions and integrated platforms targeting automotive assembly and electronics manufacturing segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 350.2 million |

| Shape | Round Shape, Oval Shape, Others |

| Application | Automotive, Electronics, Packaging, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 20+ additional countries |

| Key Companies Profiled | Schmalz, Piab, SMC Corporation, AIRBEST, ANVER Corporation, Vacuforce, COVAL, VUOTOTECNICA, Camozzi Automation, EuroTECH Vacuum Technologies, Elesa, NOVA, COMB, Better Silicone, PISCO, VMECA |

| Additional Attributes | Dollar sales by shape and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with vacuum handling manufacturers and automation suppliers, manufacturer preferences for reliability and handling precision, integration with robotic platforms and production quality monitoring systems, innovations in material formulations and design excellence, and development of automated handling solutions with enhanced performance and manufacturing optimization capabilities. |

The global flat suction cup market is estimated to be valued at USD 350.2 million in 2025.

The market size for the flat suction cup market is projected to reach USD 285,077,021.1 million by 2035.

The flat suction cup market is expected to grow at a 290.0% CAGR between 2025 and 2035.

The key product types in flat suction cup market are round shape, oval shape and others.

In terms of application, automotive segment to command 42.0% share in the flat suction cup market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flat Vacuum Suction Cup Market Size and Share Forecast Outlook 2025 to 2035

Flat Nylon Webbing Market Size and Share Forecast Outlook 2025 to 2035

Flat Bag Back-blowing Dust Collector Market Size and Share Forecast Outlook 2025 to 2035

Flatback Tape Market Size and Share Forecast Outlook 2025 to 2035

Flat Rack Containers Market Size and Share Forecast Outlook 2025 to 2035

Flatting Agents Market Size and Share Forecast Outlook 2025 to 2035

Flatbed Die Cutters Market Size and Share Forecast Outlook 2025 to 2035

Flat Panel Antenna Market Size and Share Forecast Outlook 2025 to 2035

Flatbed Trucks Market Size and Share Forecast Outlook 2025 to 2035

Flat Valve Caps And Closures Market Size and Share Forecast Outlook 2025 to 2035

Flat Bottom Pouch Market Size and Share Forecast Outlook 2025 to 2035

Flat Bottom Bags Market Size and Share Forecast Outlook 2025 to 2035

Flat Glass Market Growth & Demand 2025 to 2035

Flat Panel Display Market Analysis by Technology, Application, and Region through 2025 to 2035

Flatware Market Analysis - Growth & Demand Forecast 2025 to 2035

Flat Panel X-Ray Detectors Market Analysis by Application, Product, and Region Forecast Through 2035

Analyzing Flatback Tape Market Share & Industry Leaders

Leading Providers & Market Share in Flat Bottom Pouch Manufacturing

Market Share Insights of Leading Flat Glass Coating Providers

Flat Steel Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA