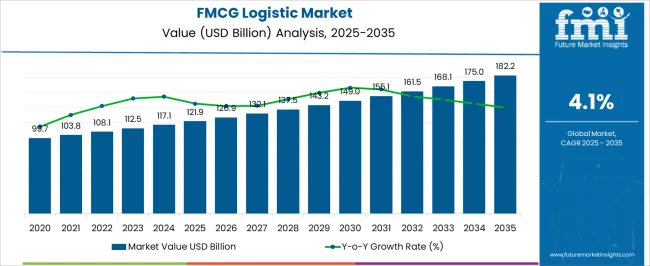

The FMCG Logistic Market is estimated to be valued at USD 121.9 billion in 2025 and is projected to reach USD 182.2 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

The FMCG Logistic market is experiencing strong growth, driven by the increasing demand for fast, efficient, and reliable supply chain solutions in the fast-moving consumer goods sector. Rising consumer expectations for timely deliveries, coupled with the expansion of e-commerce and retail networks, are fueling the need for optimized logistics solutions. Advanced transportation management systems, real-time tracking, and automated inventory management are enhancing operational efficiency and reducing transit delays.

Companies are increasingly focusing on cost-effective modes of transportation, route optimization, and temperature-controlled logistics to maintain product quality and minimize losses. The growth of the food and beverages segment, which demands strict adherence to freshness and safety standards, further supports market expansion.

Additionally, regulatory compliance, sustainability initiatives, and carbon footprint reduction strategies are shaping investment in more efficient transport modes As FMCG companies strive to meet rising consumer demand and improve supply chain resilience, the market is expected to maintain sustained growth, supported by technological innovations and integrated logistics solutions that enhance visibility, reliability, and overall performance.

| Metric | Value |

|---|---|

| FMCG Logistic Market Estimated Value in (2025 E) | USD 121.9 billion |

| FMCG Logistic Market Forecast Value in (2035 F) | USD 182.2 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

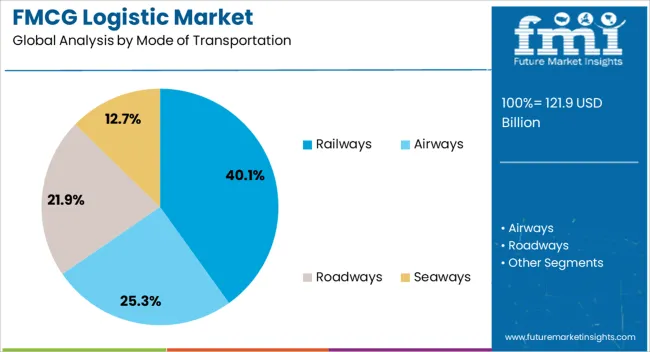

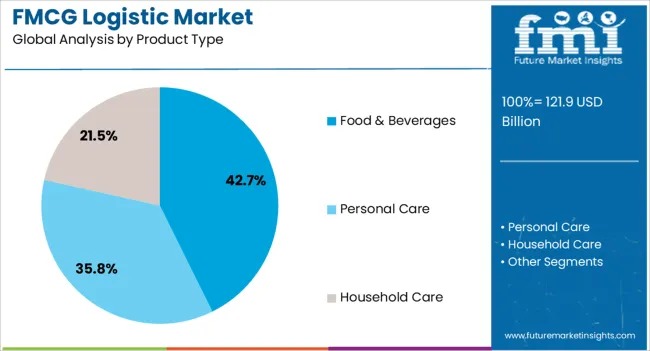

The market is segmented by Mode of Transportation and Product Type and region. By Mode of Transportation, the market is divided into Railways, Airways, Roadways, and Seaways. In terms of Product Type, the market is classified into Food & Beverages, Personal Care, and Household Care. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The railways segment is projected to hold 40.1% of the FMCG Logistic market revenue in 2025, establishing it as the leading transportation mode. Its dominance is being driven by the cost efficiency, scalability, and reliability that rail transport provides for bulk shipments over long distances. Rail networks enable the movement of large volumes of goods while minimizing fuel consumption and reducing transportation costs compared to road alternatives.

The integration of modern freight rail technologies, real-time tracking systems, and improved scheduling has enhanced operational efficiency and delivery predictability. Rail transport also supports sustainability goals by reducing carbon emissions relative to other modes of transportation, aligning with increasing environmental regulations and corporate responsibility initiatives.

The ability to transport high-volume FMCG products efficiently, including non-perishable food and beverage items, reinforces its market leadership As FMCG companies focus on optimizing supply chains for cost, speed, and environmental compliance, the railways segment is expected to maintain its leading share, driven by ongoing investments in infrastructure and intermodal connectivity.

The food and beverages product type segment is anticipated to account for 42.7% of the FMCG Logistic market revenue in 2025, making it the leading product category. Growth in this segment is being driven by the critical need to maintain product freshness, safety, and quality throughout the supply chain. Temperature-controlled logistics, refrigerated transport, and advanced packaging solutions are increasingly being deployed to ensure product integrity from production facilities to retail outlets.

Rising consumer demand for packaged and ready-to-eat foods, coupled with the expansion of modern retail and e-commerce channels, has intensified the need for specialized logistics solutions. The ability to track shipments in real-time and manage inventory dynamically enhances efficiency, reduces waste, and improves delivery timelines.

Regulatory requirements for food safety and quality standards further reinforce the importance of reliable logistics for this product category As FMCG companies continue to optimize supply chain operations to meet growing demand, the food and beverages segment is expected to remain the dominant product type, supported by investment in advanced transportation, cold chain infrastructure, and supply chain automation.

Expansion of the eCommerce industry and developments

Rapid expansion of the eCommerce industry is pushing the FMCG logistics market forward. Consumer preferences are moving toward online shopping for FMCG products in the current period. Several investors are increasingly investing in the industry as a result of this shift. With the integration of better technology and convenience, the market is anticipated to gain much potential during the forecast period.

Activities related to research and development are growing across the world, and the FMCG industry is no exception. FMCG companies are actively investing in research and development activities to provide convenience to their consumers.

Furthermore, urbanization is making a significant contribution to multiplying the market share in the industry. As more people move to urban areas, the demand for products such as packaged beverages, food, and others keeps on going.

Disposable Income and Retail Industry Landscape

The rate of disposable income among middle-class people is on the rise. Individuals are spending money on beverages, personal care products, and others significantly, which is ominously contributing to market growth.

Furthermore, lifestyle changes of contemporary people are also making a significant contribution to market share during the forecast period. For instance, working professionals, millennials, and Gen Z populations prefer ready-to-eat meals and snacks. Therefore, the demand for FMCG logistic services is increasing.

The retail landscape is changing considerably in the current period. By offering a wide range of FMCG products, retailers such as supermarkets, hypermarkets, and online stores have become popular in recent years. Considering the hype of the retail segment, there could be a high demand for FMCG logistics over the period.

| Attributes | Details |

|---|---|

| Mode of Transportation | Roadways |

| Market CAGR from 2025 to 2035 | 3.9% |

With the need for efficient and timely deliveries of consumer goods, the roadway mode of transportation is becoming increasingly popular for logistic providers. To make transportation more reliable and efficient, logistics providers are moving their preferences toward roadway transportation.

Technological advancements are also contributing to the segment's growth. Market players are integrating the latest technologies, such as real-time tracking and AI, to make roadway transportation more competent.

| Attributes | Details |

|---|---|

| Product Type | Food & Beverages |

| Market CAGR from 2025 to 2035 | 3.7% |

The rise of eCommerce and online food delivery is carrying the segment’s growth upward. People are increasingly ordering food through online platforms. Thus, the demand for FMCG logistic services is at its peak in this field. The perishable nature of foods is giving the segment an edge in the current period, as food products require special transportation.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| United States | 4.3% |

| China | 4.8% |

| United Kingdom | 5.1% |

| Japan | 5.6% |

| South Korea | 6.0% |

The United States has a well-known retail market in the world, with key players like Walmart operating here. According to our source, total retail sales reached USD 7.24 trillion in 2025 in the United States. There is a huge need for greater logistics, as retailers in the United States are expanding their product offerings and their footprints in the country.

FMCG companies are increasingly investing in sustainable supply chains to reduce carbon footprints and make the industry more eco-friendly in the country.

The development of new and innovative technology in the transportation sector has been seen in the United States. Logistics and suppliers are upgrading their systems with the integration of AI, the Internet of Things, and blockchains to improve supply visibility and reduce costs.

The FMCG logistics market in China has witnessed steady growth in recent years. Massive investment in FMCG logistics in China is currently being observed. As a technologically advanced country, logistics providers are increasingly improving their services with advanced technology in China.

The expansion of the eCommerce industry in China is leading to market growth. Services such as rapid home deliveries are gaining popularity in the country. Moreover, the government of China is actively improving the logistic infrastructure in the country, including ports, railways, and highways.

Changing preferences toward green logistics in the United Kingdom are a key market trend. The government in the United Kingdom is actively promoting sustainability initiatives in the current period. Thus, logistic providers are searching for innovative ways to cope with these initiatives in their services without harming the environment.

The FMCG packaging industry in the United Kingdom is on the rise, which is positively impacting the market. In urban areas, the adoption of the latest technologies in packaging and transportation has been seen in the United Kingdom. The trend of online shopping has gained much popularity in the country, sparking market growth.

Demand for convenience products has increased over the years in Japan. The delivery needs for these products are fueled by the FMCG market growth in the country. Research and development activities are rapidly growing in the region to maintain innovative standards and meet the changing needs of consumers.

FMCG companies in South Korea are actively looking to develop products that are eco-friendly as the government is implementing sustainability and eco-friendly initiatives in the country. Individuals are seeking instant deliveries of their products. Thus, logistics providers are focusing on improving their services according to consumer preferences.

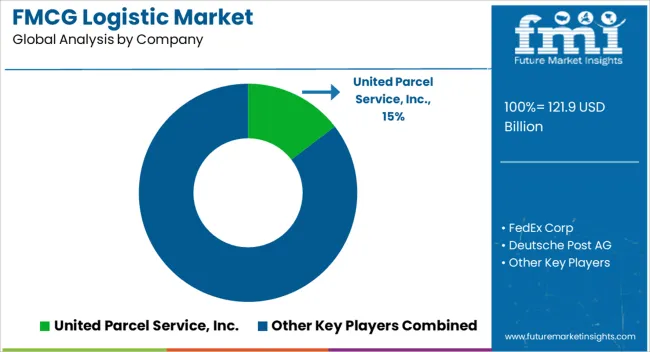

Market players are looking to improvising consumer experience by implementing new marketing strategies. The market is anticipated to gain exponential growth during the forecast period owing to innovations and research activities by top players. These players are investing in their logistics services to improve their services and gain maximum share in the market.

Many governments and governmental bodies are offering financial support to logistics providers to boost their research and development activities. Several strategies, like partnerships, mergers, and acquisitions, are changing the market landscape by disrupting traditional logistics methods and introducing unique methods.

Partnerships and Collaborations

In 2025, C.H. Robinson Worldwide, Inc. formed a strategic partnership with Waymo Via with the aim of driving the development of autonomous trucking solutions for supply chain management. This partnership plans to bring about significant advancements in the field of self-driving technology, particularly for long-haul trucking.

Through this collaboration, C.H. Robinson and Waymo Via are going to work together to explore new possibilities for integrating autonomous technology into the logistics industry. The ultimate motive is to improve efficiency, reduce costs, and enhance safety across the supply chain.

Recent Developments

The global FMCG logistic market is estimated to be valued at USD 121.9 billion in 2025.

The market size for the FMCG logistic market is projected to reach USD 182.2 billion by 2035.

The FMCG logistic market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in FMCG logistic market are railways, airways, roadways and seaways.

In terms of product type, food & beverages segment to command 42.7% share in the FMCG logistic market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

FMCG Packaging Market Analysis - Size, Share & Forecast 2025 to 2035

Breaking Down Market Share in FMCG Packaging

Logistics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Logistics Robots Market Size and Share Forecast Outlook 2025 to 2035

Logistics Visibility Software Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in the Logistics Packaging Industry

Logistics Outsourcing Market Analysis - Growth & Forecast 2025 to 2035

Logistics Visualization System Market

Logistics Automation Market

Cash Logistics Market Size and Share Forecast Outlook 2025 to 2035

Rail Logistics Market Size and Share Forecast Outlook 2025 to 2035

Intralogistics Automation Solutions Market Size and Share Forecast Outlook 2025 to 2035

Drone Logistics & Transportation Market Size and Share Forecast Outlook 2025 to 2035

Smart Logistics Services Market Size and Share Forecast Outlook 2025 to 2035

Green Logistics Market Size and Share Forecast Outlook 2025 to 2035

Event Logistics Market Size and Share Forecast Outlook 2025 to 2035

Cloud Logistics Market Insights – Demand & Growth Forecast 2025 to 2035

Timber Logistics Market Size and Share Forecast Outlook 2025 to 2035

Retail Logistics Market Size and Share Forecast Outlook 2025 to 2035

Secure Logistics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA