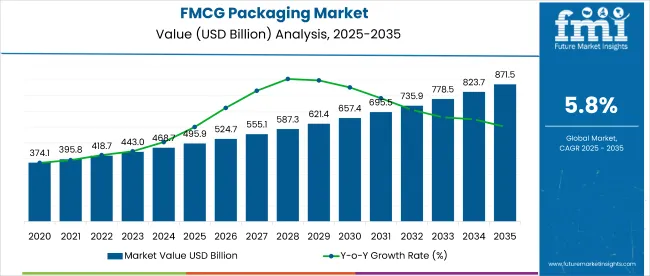

The global FMCG Packaging Market is projected to expand from USD 495.9 billion in 2025 to USD 871.6 billion by 2035, growing at a CAGR of 5.8%. Flexible packaging, led by its operational efficiency and cost-effectiveness, dominates the product landscape, while food & beverage applications drive the end-use category. Plastic remains the material of choice despite mounting environmental pushback.

The FMCG packaging market remains driven by demand for portability, single-serve convenience, and shelf-ready designs across food, beverage, and personal care SKUs. Growing urban consumption and proliferation of retail formats-including e-commerce, discounters, and specialty stores-have sustained demand for modular, brand-forward packaging systems.

Regulatory mandates around traceability and unit-level coding (notably in North America and East Asia) have intensified digital print adoption, especially in short-run packaging.

On the restraint side, rising raw material volatility-especially for plastics and aluminum-has compressed converter margins and exposed supply chains to cost pass-through risks. Moreover, regional bans on single-use plastics and increased compliance costs have discouraged long-term capital allocation for certain materials.

Emerging opportunities lie in recyclable mono-material formats and digitally integrated packaging that enables consumer engagement, anti-counterfeit checks, and ESG disclosures.

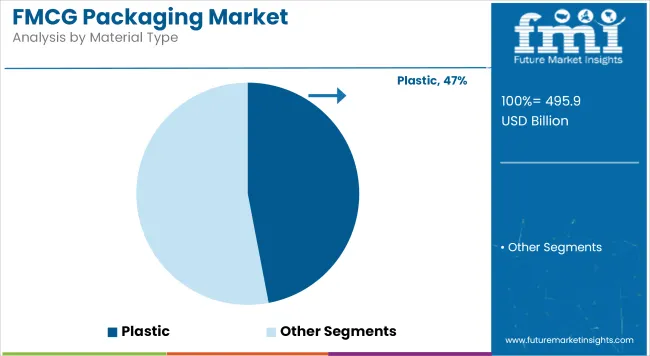

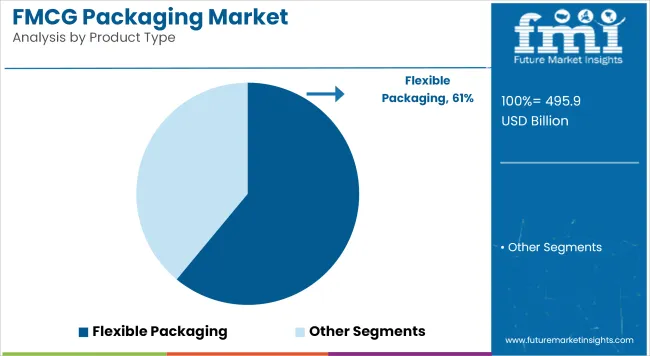

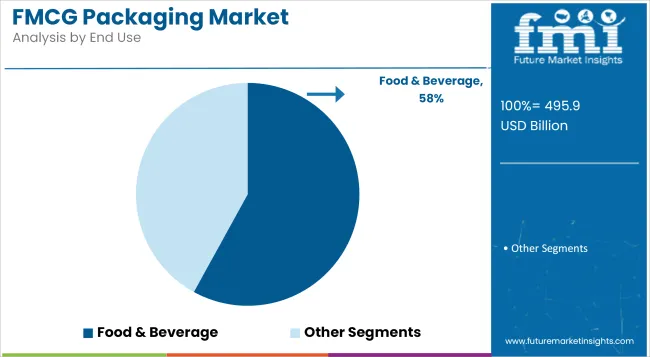

The FMCG packaging market has been segmented comprehensively to reflect material preference, format type, and application diversity across global markets. By material type, the market includes plastic, paper & paperboard, metal, glass, and others. Under product type, segments include flexible packaging; rigid boxes; bottles & jars; cans; pouches; tubes; sachets; blisters; wraps & films; and others.

On the end-use front, the market is categorized into food & beverage, personal care & cosmetics, healthcare & pharmaceuticals, homecare products, and others. This tri-layer segmentation enables stakeholders to align investments with demand hotspots, material substitution shifts, and evolving compliance mandates.

Plastic held the dominant share of 47% in the FMCG packaging market in 2025, offering cost-efficient scalability and functional versatility across moisture-sensitive applications. Its edge lies in lightweighting, durability, and established converter infrastructure.

Growth has been supported by its barrier performance and adaptability to thermoforming and extrusion processes. However, tightening restrictions on single-use plastics-especially across the EU and parts of Asia-have elevated compliance costs and discouraged long-term capital deployment in virgin resin lines.

Bio-based plastics and recyclable mono-materials are emerging as disruptive substitutes. These are forecast to account for 8.3% of plastic packaging volume by 2030, enabling regional producers to offset regulatory risk while maintaining performance consistency.

Flexible Packaging led the FMCG packaging market in 2025 with a commanding 61% share, driven by its lightweight structure, cost efficiency, and adaptability across multiple SKUs. It outperformed rigid alternatives in terms of shelf presence and logistics optimization.

Demand has been bolstered by e-commerce fulfillment growth and short-run packaging demand across personal care and snack categories. However, limited recyclability and consumer perception issues continue to restrict its acceptability in premium health and wellness segments.

Mono-material flexible films and barrier-coated laminates are gaining traction, with FMI projecting a 12-14% increase in demand from private-label brands by 2028. This shift supports operational agility and margin recovery for converters.

Food & Beverage emerged as the dominant end-use category in 2025, accounting for 58% of total FMCG packaging demand. This leadership is supported by high-frequency consumption, shelf-life sensitivity, and the surge in ready-to-eat and single-serve formats.

Convenience, portion control, and brand visibility have continued to fuel adoption across dairy, bakery, beverage, and snack applications. However, volatility in food-grade packaging inputs and supply chain disruptions in cold storage regions have introduced fulfilment risks.

Private-label expansion and SKU fragmentation are projected to add 18% more unique packaging variants annually by 2029, requiring converter agility and shorter print-to-shelf cycles.

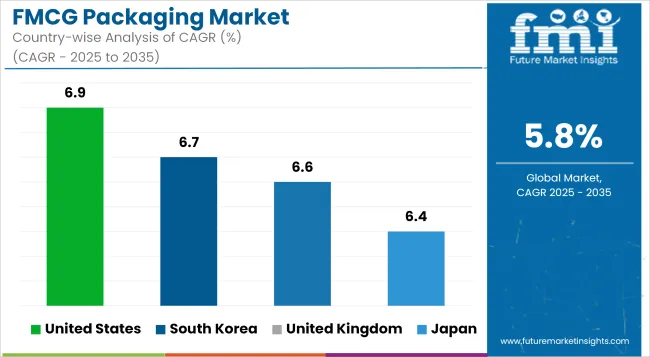

The USA FMCG packaging market is projected to expand at a CAGR of 6.9% from 2025 to 2035, outpacing the global average of 5.8%. Growth is supported by short-run packaging formats tailored for e-commerce fulfillment and premium private-label adoption across grocery chains.

Regulatory tailwinds-particularly around labeling transparency and extended producer responsibility-have prompted a shift toward digitally printed, recyclable formats. Packaging suppliers are recalibrating lines to meet FDA traceability mandates, especially in food and healthcare segments.

Consumer preferences are shifting toward on-the-go, resealable, and smart-labeled products. A 2024 FMI survey showed 62% of urban USA buyers associate flexible packaging with freshness and portion control.

South Korea’s FMCG packaging market is anticipated to grow at a CAGR of 6.7% through 2035, driven by urban premiumization and innovations in food-on-the-go formats. High smartphone penetration has enabled seamless integration of QR/NFC-enabled packs in retail.

The country’s 2030 circular packaging law is accelerating brand shift to recyclable and refillable formats. Domestic players are innovating in barrier-coating technologies for single-layer film structures.

Packaging aesthetics influence purchase intent, with 74% of South Korean consumers preferring minimalist, resealable designs according to a 2025 FMI Survey.

The UK FMCG packaging market is forecast to grow at a CAGR of 6.6% from 2025 to 2035, supported by private-label expansion and regulatory shifts following post-Brexit compliance reforms.

Retailers are phasing out non-recyclable formats under the UK Plastic Packaging Tax. Investment in localized converting units is growing, aimed at cutting downstream emissions and turnaround time.

Consumer behavior is skewing toward waste reduction, with 69% preferring products in recyclable or returnable packs per the 2025 FMI survey.

Japan’s FMCG packaging sector is set to expand at a CAGR of 6.4% between 2025 and 2035, led by healthy-aging food products and ultra-convenience personal care SKUs.

The government’s 2030 zero-waste roadmap incentivizes mono-material adoption and digital watermarking for recycling automation. Retail formats favor compact, stackable, and tamper-evident solutions.

A 2025 FMI survey noted that 61% of Japanese consumers value one-handed usage and resealability in packaging formats.

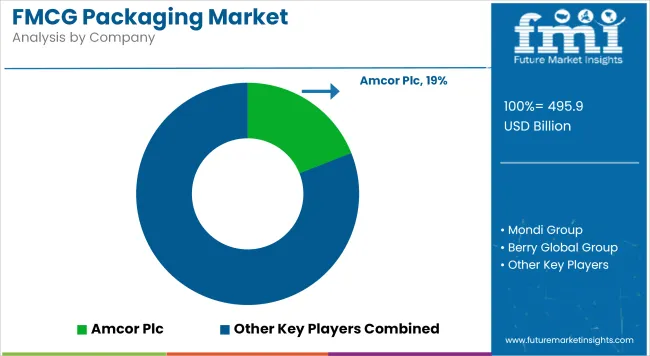

The players in the FMCG packaging market are focusing on recyclable material innovation, regional supply integration, and format agility to align with evolving retailer mandates and regulatory pressure. Amcor, Mondi, and Berry Global continue to lead due to their ability to service multinational clients with large-volume consistency and rapid custom print runs. Meanwhile, firms such as Smurfit Kappa and Huhtamaki have expanded paper-based and molded fiber portfolios to meet demand in sustainability-conscious markets.

Converter consolidation is intensifying, particularly in North America and Europe, where scale efficiencies and substrate diversification are critical. Small-to-mid converters are struggling with capital requirements for digital print transitions and mono-material compatibility. This has created acquisition opportunities for Tier-1 firms looking to regionalize production and reduce lead times.

Startups are entering niche areas like compostable sachets, digital watermarking, and refillable pouch systems. These entrants-backed by seed and VC capital-are projected to account for 4-6% of new SKUs launched annually in flexible formats by 2030.

By 2035, winners will likely be those with pre-validated substrate libraries and vertically integrated traceability infrastructure; laggards will be converters unable to adapt to short-run, high-turn cycles.

| Attribute | Details |

|---|---|

| Market Size 2025 | USD 495.9 billion |

| Market Size 2035 | USD 871.6 billion |

| CAGR (2025 to 2035) | 5.8% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2035 |

| Historical Data | 2020 to 2024 |

| Units | Revenue in USD Billion |

| Segments Covered | Material Type, Product Type, End Use |

| Material Types | Plastic; Paper & Paperboard; Metal; Glass; Others |

| Product Types | Flexible Packaging; Rigid Boxes; Bottles & Jars; Cans; Pouches; Tubes; Sachets; Blisters; Wraps & Films; Others |

| End Uses | Food & Beverage; Personal Care & Cosmetics; Healthcare & Pharmaceuticals; Homecare Products; Others |

| Countries Covered | United States, United Kingdom, Japan, South Korea, and 40+ others |

| Key Players Covered | Amcor Plc, Mondi Group, Berry Global Group, Huhtamaki Oyj, Sonoco, Sealed Air, Constantia Flexibles, Smurfit Kappa, Tetra Pak, DS Smith |

The market is valued at USD 495.9 billion in 2025.

The market is expected to reach USD 871.6 billion by 2035.

Flexible packaging holds the largest share at 61% in 2025.

Food & Beverage leads with a 58% share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Breaking Down Market Share in FMCG Packaging

FMCG Logistic Market Size and Share Forecast Outlook 2025 to 2035

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Packaging Coating Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA