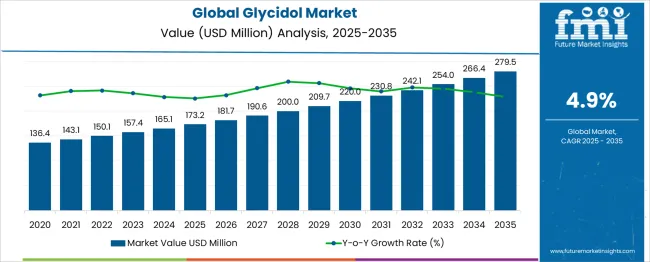

The Global Glycidol Market is estimated to be valued at USD 173.2 million in 2025 and is projected to reach USD 279.5 million by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period. A Year-on-Year (YoY) growth analysis reveals steady, consistent growth throughout the forecast period. Between 2025 and 2026, the market grows from USD 173.2 million to USD 181.7 million, contributing USD 8.5 million in growth, with a YoY growth rate of 4.9%.

This early-stage growth is driven by increasing demand for glycidol in industries such as pharmaceuticals, cosmetics, and chemical manufacturing, where it is used as a precursor in various chemical syntheses and formulations. From 2026 to 2030, the market expands from USD 181.7 million to USD 200.0 million, contributing USD 18.3 million in growth, with an average YoY growth rate of 5.3%.

This period reflects a higher growth rate, driven by advancements in production technologies, new applications in various sectors, and growing global awareness of glycidol’s benefits. Between 2030 and 2035, the market continues to grow from USD 200.0 million to USD 279.5 million, contributing USD 79.5 million in growth, with a YoY growth rate of 6.7%.

This phase shows stronger demand in emerging markets and increased adoption in specialized applications. The YoY analysis illustrates a steady and stable growth trajectory with slight acceleration as glycidol’s industrial applications expand across multiple sectors.

| Metric | Value |

|---|---|

| Global Glycidol Market Estimated Value in (2025 E) | USD 173.2 million |

| Global Glycidol Market Forecast Value in (2035 F) | USD 279.5 million |

| Forecast CAGR (2025 to 2035) | 4.9% |

The Global Glycidol market is experiencing notable growth driven by its extensive use in producing a variety of industrial and specialty chemicals. The current market is characterized by increasing demand from end-use industries such as pharmaceuticals, cosmetics, and polymers where glycidol acts as a key intermediate.

Industry press releases and corporate disclosures have indicated that advancements in synthesis techniques and improvements in product purity are enabling wider application and compliance with stringent quality standards. The market outlook remains positive as innovations in bio-based production methods, along with rising environmental regulations favoring safer chemical intermediates, are encouraging manufacturers to expand capacity.

Furthermore, the growing awareness of sustainable and efficient production processes is pushing investments toward technologies that minimize byproducts and waste. These factors collectively are creating favorable conditions for continued growth in the global glycidol market, with both established and emerging economies contributing to rising consumption.

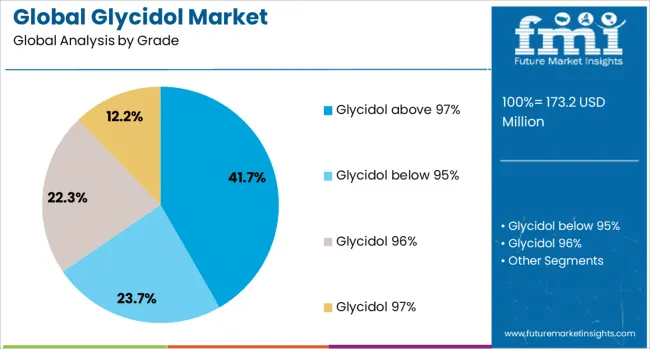

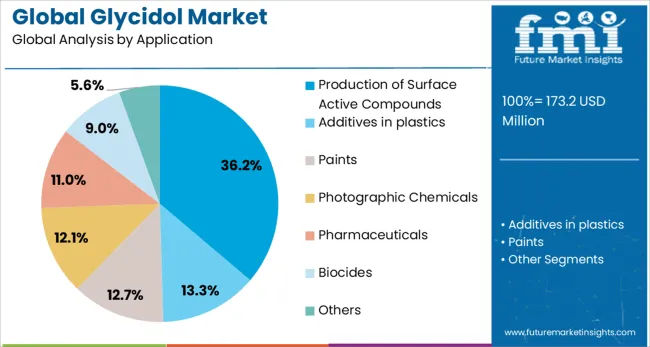

The global glycidol market is segmented by grade, application, distribution channel, and geographic regions. The global glycidol market is divided into Glycidol above 97%, Glycidol below 95%, and Glycidol 96%Glycidol 97%. In terms of application, the global glycidol market is classified into the Production of Surface Active Compounds, Additives in plastics, Paints, Photographic Chemicals, Pharmaceuticals, Biocides, and others.

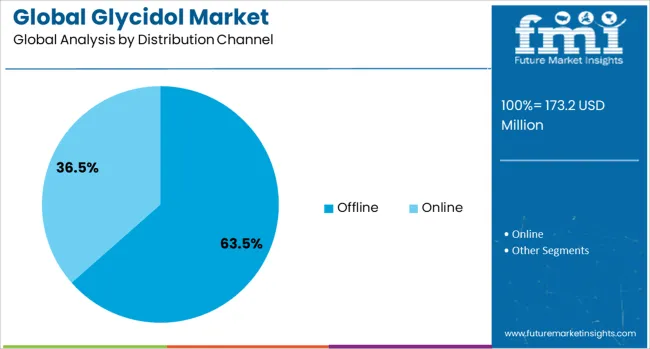

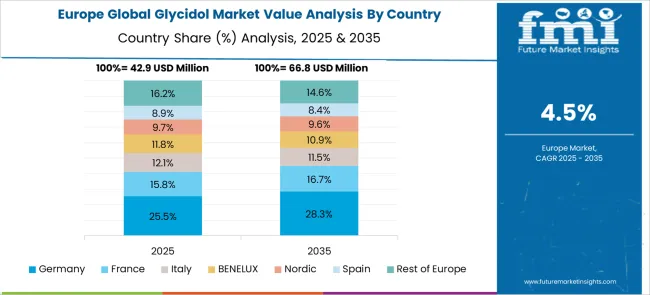

The global glycidol market is segmented into offline and online. Regionally, the global glycidol industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The glycidol above 97% grade segment is expected to hold 41.7% of the Global Glycidol market revenue share in 2025, making it the leading grade segment. This dominance is being attributed to its superior purity, which is essential for high-performance applications in pharmaceuticals and fine chemicals.

Corporate announcements and technical datasheets have highlighted that higher purity levels ensure consistent reactivity and reduce contamination risks, which are critical in sensitive formulations. The segment has also been supported by increased regulatory scrutiny in end-use industries that require high-quality intermediates to meet safety and efficacy standards.

It has been observed in industry publications that producers are investing in refining processes to achieve and maintain purity above 97% which aligns with global market preferences. These factors together have strengthened the demand for this grade, ensuring its prominent position in the market.

The production of surface active compounds application segment is projected to account for 36.2% of the Global Glycidol market revenue share in 2025, making it the leading application segment. This leadership is being driven by the extensive use of glycidol in manufacturing surfactants that are widely utilized across industries such as personal care, detergents, and emulsifiers.

Trade journals and product release notes have reported that the increasing demand for biodegradable and efficient surfactants is favoring glycidol as a preferred raw material due to its favorable chemical properties. Additionally, corporate statements have pointed out that innovations in surfactant formulations require higher-quality intermediates, which have elevated the importance of glycidol in this segment.

The segment’s growth has also been influenced by rising consumer awareness of sustainable products, which has encouraged manufacturers to adopt glycidol-based solutions meeting both performance and environmental standards.

The offline distribution channel segment is forecasted to capture 63.5% of the Global Glycidol market revenue share in 2025 maintaining its dominance as the leading distribution channel. This position is being reinforced by the preference of industrial buyers for direct engagement with suppliers to ensure quality assurance, customized logistics, and negotiated pricing, as highlighted in corporate sales presentations and supply chain reports.

The segment has been further supported by the established networks of chemical distributors and the trust built through long-term relationships, which continue to facilitate bulk purchasing and technical support. Industry news has noted that offline channels offer enhanced transparency and immediate access to technical documentation and certifications, which are critical in industries with stringent compliance requirements. These attributes have solidified the offline channel’s relevance, ensuring it remains the most relied upon method for glycidol procurement globally.

These attributes have solidified the offline channel’s relevance, ensuring it remains the most relied upon method for glycidol procurement globally.

The demand for glycidol is increasing as it becomes essential in the production of key chemicals across industries such as pharmaceuticals, personal care, and chemicals. This versatile substance is used as an intermediate in creating active pharmaceutical ingredients, surfactants, and coatings. Glycidol’s ability to improve product performance and manufacturing efficiency is driving its widespread adoption. Despite challenges like high production costs and stringent regulations, opportunities exist in expanding its use in specialty chemicals and biomedical research, providing substantial growth potential.

The demand for glycidol is being driven by its critical role as a versatile chemical intermediate used in various industries, including pharmaceuticals, personal care, and chemicals. In the pharmaceutical industry, glycidol is a key component in the production of active pharmaceutical ingredients (APIs) and other specialty chemicals. Its ability to enhance the efficacy of surfactants in cleaning and personal care products also contributes to its adoption. Glycidol plays a vital role in the manufacturing of coatings, plastics, and other high-performance materials. As industries continue to seek higher quality and performance from their chemical intermediates, glycidol’s role in these applications is likely to expand, further driving its demand.

The high production cost of glycidol is a major challenge in the market. The specialized raw materials and complex production processes required to manufacture glycidol make it more expensive than many alternative chemical intermediates. These high costs are passed on to manufacturers, which can limit the widespread adoption of glycidol, particularly in price-sensitive markets. Glycidol’s use in food and pharmaceuticals requires compliance with strict regulatory standards. Meeting these safety, quality, and environmental regulations involves rigorous testing, quality control, and certification, which adds complexity and cost to the production process. This regulatory burden can be a barrier to entry for smaller manufacturers.

There are significant opportunities for glycidol in the specialty chemicals and biomedical fields. In the specialty chemicals sector, its role as a precursor in the development of bio-based surfactants, polymers, and other materials is growing. The push for environmentally friendly solutions in these industries is boosting glycidol’s demand, as it provides an effective and safe alternative to traditional chemicals. In the biomedical field, glycidol is being increasingly used for drug delivery, tissue engineering, and other advanced medical applications. As pharmaceutical companies and researchers look for safer, more efficient drug formulations, the demand for glycidol in these sectors is likely to continue to rise, offering long-term growth opportunities.

A notable trend in the glycidol industry is the innovation in production methods, focusing on more efficient and cost-effective processes. Researchers and manufacturers are exploring ways to reduce the environmental impact of glycidol production through greener chemistry approaches. The development of new, renewable feedstocks and more efficient catalysts is improving the sustainability of glycidol production. Additionally, the industry is seeing an increase in the use of glycidol in applications such as biodegradable polymers and functional coatings, driven by demand for environmentally friendly alternatives. These advancements in production technology and the expanding range of applications are shaping the future of glycidol and positioning it as a key ingredient in various high-value industries.

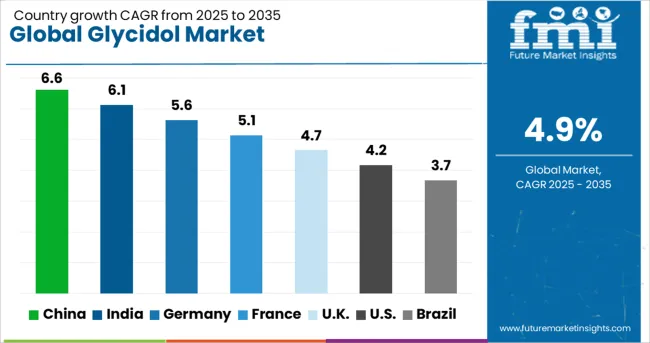

| Country | CAGR |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| France | 5.1% |

| UK | 4.7% |

| USA | 4.2% |

| Brazil | 3.7% |

The glycidol market is projected to grow at a CAGR of 4.9%, driven by applications in pharmaceuticals, personal care, and food industries. China leads with a growth rate of 6.6%, followed by India at 6.1%. Developed markets like the UK and USA show steady growth, fueled by increasing demand for high-purity glycidol in various sectors. As China and India expand their chemical sectors, their market share continues to grow, while the UK and USA benefit from regulatory frameworks and technological innovations. The market is expanding globally, with different growth trajectories across regions. The analysis covers 40+ countries, with the leading markets shown below.

China is expected to lead the glycidol market with a projected CAGR of 6.6%. Rapidly expanding pharmaceutical, chemical, and personal care industries are significant drivers of growth. With increasing investments in research and development, China is adopting new production technologies for high-purity glycidol. Glycidol is gaining traction in the food and beverage sector, particularly in natural ingredient formulations. The market benefits from strong industrial base, favorable government policies, and the growing demand for advanced personal care products. The country’s expanding middle class and the increasing adoption of organic and natural ingredients are fueling the demand for glycidol-based products, making it a key growth market.

India is projected to grow at a CAGR of 6.1% in the glycidol market. The country’s pharmaceutical industry is experiencing significant growth, and the demand for glycidol in personal care and wellness products is increasing. India’s rising middle class, coupled with greater health awareness, has led to a shift towards natural and organic products, driving glycidol adoption. Government initiatives aimed at promoting the chemical industry, along with rapid industrialization, are boosting glycidol production. The country’s growing export potential further supports market expansion, as demand for glycidol in both domestic and international markets rises. The increasing demand for high-quality glycidol-based formulations in food, personal care, and pharmaceuticals contributes to the ongoing market growth.

Germany is expected to grow at a CAGR of 5.6% in the glycidol market. Established pharmaceutical and chemical industries, coupled with stringent regulatory standards, drive the demand for high-purity glycidol. As a leader in industrial automation and chemical production, Germany continues to innovate in the production of glycidol for pharmaceutical, personal care, and food applications. The demand for natural ingredients in cosmetics and functional food products is also increasing, further driving glycidol consumption. Germany’s commitment to quality, combined with its emphasis on sustainability in production processes, strengthens the market for glycidol. The position as a key player in the European chemical sector ensures continued demand for high-quality glycidol formulations.

The glycidol market in the United Kingdom is expected to grow at a CAGR of 4.7%. The UK benefits from its well-established chemical industry, which drives the demand for glycidol in pharmaceutical and personal care applications. The increasing consumer preference for clean-label products has led to a greater demand for natural ingredients, particularly in the personal care sector. Glycidol, being a key ingredient in many natural formulations, is seeing growing use in skincare and cosmetic products. Stringent regulatory standards in the UK ensure that glycidol used in these products is of high purity and quality. The demand for organic and eco-friendly products further accelerates the adoption of glycidol, making it an essential ingredient in various applications.

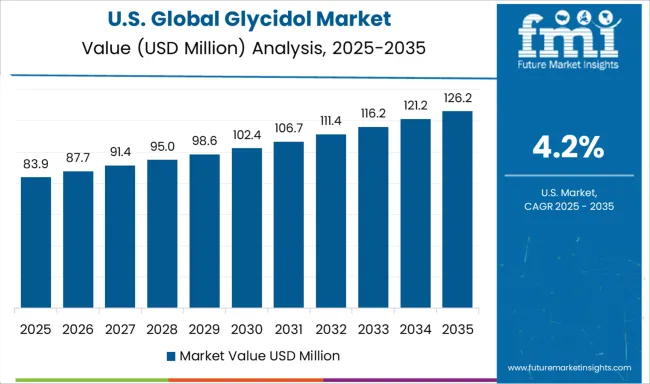

In the United States, the glycidol market is expected to grow at a CAGR of 4.2%. The country’s strong pharmaceutical and chemical industries are key drivers of glycidol demand. As consumers increasingly seek natural and organic products, the demand for glycidol-based formulations in food, skincare, and personal care products continues to rise. USA manufacturers are focusing on the development of high-purity glycidol to meet stringent regulatory requirements and consumer preferences for safe, effective products. Innovation in product formulations, particularly in clean-label food and personal care products, further boosts glycidol consumption. With its robust R&D sector, the USA continues to lead in glycidol product development, enhancing its market share.

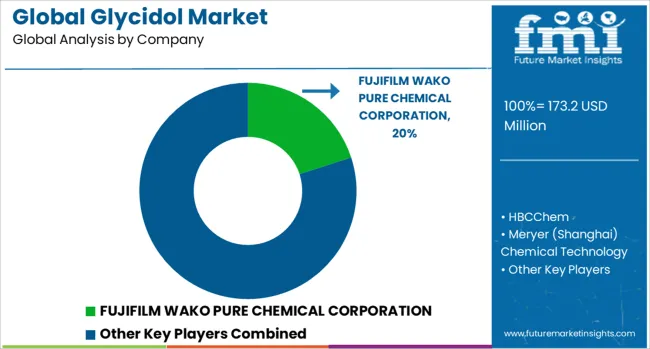

The global glycidol market is driven by key chemical and pharmaceutical companies specializing in the production and supply of glycidol, which is used in various applications such as cosmetics, pharmaceuticals, and as a chemical intermediate. FUJIFILM Wako Pure Chemical Corporation is a market leader, providing high-quality glycidol for use in laboratory research, industrial applications, and the pharmaceutical sector.

HBC Chem offers a broad range of chemical solutions, including glycidol, focusing on high purity and safety standards for manufacturing and chemical synthesis. Meryer (Shanghai) Chemical Technology and Acros Organics offer glycidol and other specialty chemicals to research labs and industrial clients, with an emphasis on quality and availability for various chemical processes. KANTO CHEMICAL CO., INC and Hangzhou Dayangchem contribute to the market by supplying glycidol for large-scale industrial applications, ensuring cost-effective solutions for chemical manufacturers.

Nacalai Tesque and The Good Scents Company are key players in providing glycidol for research and fragrance applications, meeting the growing demand for high-quality, specialized chemicals. FINETECH INDUSTRY LIMITED and LGC Group offer glycidol products to the pharmaceutical and cosmetic industries, focusing on product purity and regulatory compliance.

Competitive differentiation in the glycidol market is driven by factors such as product purity, reliability of supply, regulatory compliance, and the ability to offer customized solutions for various industries. Barriers to entry include high production costs, strict regulatory standards, and the need for specialized manufacturing capabilities. Strategic priorities include improving product quality, expanding distribution networks, and enhancing supply chain management to meet global demand.

| Item | Value |

|---|---|

| Quantitative Units | USD 173.2 Million |

| Grade | Glycidol above 97%, Glycidol below 95%, Glycidol 96%, and Glycidol 97% |

| Application | Production of Surface Active Compounds, Additives in plastics, Paints, Photographic Chemicals, Pharmaceuticals, Biocides, and Others |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | FUJIFILM WAKO PURE CHEMICAL CORPORATION, HBCChem, Meryer (Shanghai) Chemical Technology, Acros Organics, KANTO CHEMICAL CO. INC, Hangzhou Dayangchem, Nacalai Tesque, The Good Scents Company, FINETECH INDUSTRY LIMITED, and LGC Group. |

| Additional Attributes | Dollar sales by product type (glycidol for pharmaceuticals, glycidol for cosmetics, glycidol for industrial applications) and end-use segments (pharmaceuticals, cosmetics, chemical synthesis, research). Demand dynamics are driven by the increasing use of glycidol as an intermediate in the synthesis of drugs, personal care products, and its growing adoption in chemical research. Regional trends show strong growth in North America and Europe, driven by the pharmaceutical and cosmetic industries, while Asia-Pacific is expanding due to increased industrial activity and chemical manufacturing. |

The global global glycidol market is estimated to be valued at USD 173.2 million in 2025.

The market size for the global glycidol market is projected to reach USD 279.5 million by 2035.

The global glycidol market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in global glycidol market are glycidol above 97%, glycidol below 95%, glycidol 96% and glycidol 97%.

In terms of application, production of surface active compounds segment to command 36.2% share in the global glycidol market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Video Extensometer Market Size and Share Forecast Outlook 2025 to 2035

Fluorescence Spectrophotometer Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Grinders Market Size and Share Forecast Outlook 2025 to 2035

Automated Biochemical Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Vapor Pressure Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Ultrapycnometer Market Size and Share Forecast Outlook 2025 to 2035

Global PP Closure Market Size and Share Forecast Outlook 2025 to 2035

Global Positioning Systems Market Size and Share Forecast Outlook 2025 to 2035

Global Tert-Amylbenzene Market Size and Share Forecast Outlook 2025 to 2035

Global Sodium Hypochlorite Market Size and Share Forecast Outlook 2025 to 2035

Global Stannic Chloride Market

Global Tyre Inflators Market

Global Wine Tanks Market

Global Nutating Mixers Market

Global Bench Scale Market

Global HVAC Filter Market

Global Nitrite Market

Global Optical Comparator Market

Global Loaders Market

Global Aircraft Brake System Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA