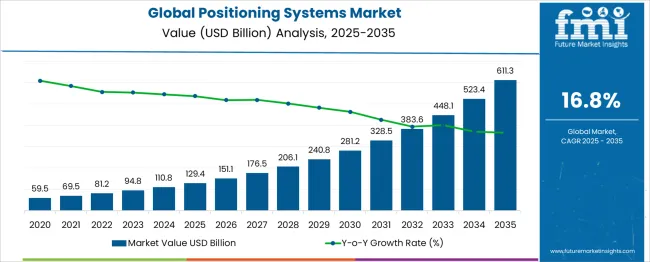

The global positioning systems market is set to grow from USD 129.4 billion in 2025 to approximately USD 611.3 billion by 2035, recording an absolute increase of USD 482 billion over the forecast period. This translates into a total growth of 372.5%, with the market forecast to expand at a compound annual growth rate (CAGR) of 16.8% between 2025 and 2035. The overall market size is expected to grow by nearly 4.7X during the same period, supported by the rising adoption of location-based services and increasing demand for precise positioning solutions across autonomous vehicles, smartphones, and IoT applications worldwide.

Between 2025 and 2030, the global positioning systems market is projected to expand from USD 129.4 billion to USD 266.52 billion, resulting in a value increase of USD 137.15 billion, which represents 28.5% of the total forecast growth for the decade. This phase of growth will be shaped by rising smartphone adoption with advanced GPS capabilities, increasing deployment of autonomous vehicle technologies, and growing demand for precision agriculture and surveying applications. Technology providers are expanding their satellite constellation capabilities to address the growing complexity of location-based services across diverse industries.

From 2030 to 2035, the market is forecast to grow from USD 266.52 billion to USD 611.3 billion, adding another USD 344.79 billion, which constitutes 71.5% of the overall ten-year expansion. This period is expected to be characterized by widespread deployment of next-generation satellite systems, integration of 5G connectivity with GPS technologies, and development of centimeter-level accuracy solutions for industrial applications. The growing emphasis on smart city infrastructure and autonomous transportation systems will drive demand for more sophisticated positioning technologies with enhanced precision and real-time processing capabilities.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 129.4 billion |

| Forecast Value in (2035F) | USD 611.3 billion |

| Forecast CAGR (2025 to 2035) | 16.8% |

Market expansion is being supported by the rapid increase in location-based service applications and the corresponding need for precise positioning data that can enable navigation, tracking, and location intelligence across consumer and enterprise applications. Modern digital services rely on GPS technology to provide real-time location information, route optimization, and geographical context for mobile applications and IoT devices. The growing complexity of autonomous systems and increasing emphasis on location-aware technologies are driving demand for advanced GPS solutions from certified providers with appropriate accuracy capabilities and system integration expertise.

The expanding Internet of Things ecosystem and rising adoption of connected devices are creating significant demand for embedded GPS modules that can provide continuous location tracking and asset monitoring capabilities. Government infrastructure investments in smart transportation and emergency services are establishing new requirements for high-precision positioning systems that require advanced satellite technology and comprehensive ground-based augmentation systems.

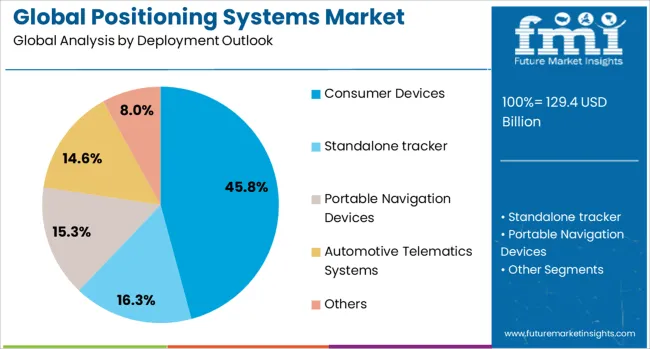

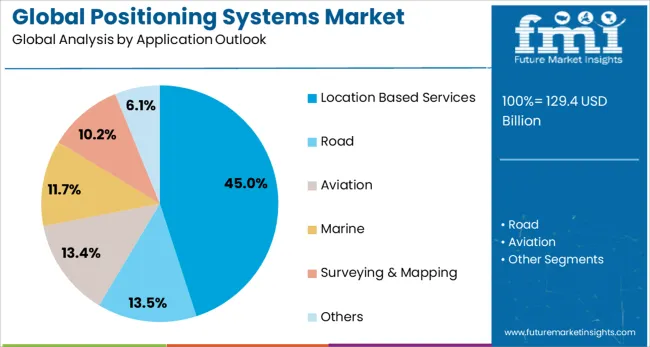

The market is segmented by deployment, application, and region. By deployment, the market is divided into consumer devices, standalone tracker, portable navigation devices, automotive telematics systems, and others. Based on application, the market is categorized into location based services, road, aviation, marine, surveying & mapping, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Consumer devices are projected to account for 45.8% of the global positioning systems market in 2025. This leading share is supported by the widespread integration of GPS technology in smartphones, tablets, wearable devices, and other consumer electronics. Consumer device GPS applications provide essential navigation, location sharing, and location-based service capabilities that have become fundamental features of modern mobile technology. The segment benefits from continuous advancement in GPS chip miniaturization and power efficiency optimization for portable devices.

Location based services are expected to represent 45% of the application segment in 2025. This dominant share reflects the critical importance of GPS technology in enabling mobile applications, navigation services, ride-sharing platforms, and location-aware business services. Location based services leverage GPS data to provide personalized content, targeted advertising, emergency services, and business intelligence based on geographical context. The segment benefits from increasing smartphone penetration and growing demand for location-aware mobile applications.

The global positioning systems market is advancing rapidly due to increasing location-based service demand and growing recognition of GPS technology importance across diverse applications. However, the market faces challenges including signal interference in urban environments, privacy concerns regarding location tracking, and power consumption limitations in battery-powered devices. Technology advancement and satellite infrastructure development continue to influence market growth and application expansion.

The growing deployment of centimeter-level accuracy GPS systems and real-time kinematic (RTK) technologies is enabling precise positioning applications for surveying, agriculture, and autonomous vehicle navigation. High-precision GPS solutions provide enhanced accuracy through differential correction systems and advanced signal processing capabilities. These advanced technologies are particularly valuable for industrial applications where precise positioning is critical for operational efficiency and safety requirements.

Modern GPS providers are incorporating multi-constellation satellite systems (GPS, GLONASS, Galileo, BeiDou) and 5G connectivity that enhance positioning accuracy and service reliability. Integration of terrestrial and satellite positioning systems enables seamless location services in challenging environments and comprehensive coverage across diverse geographical conditions. Advanced connectivity also supports real-time data processing and cloud-based location intelligence applications.

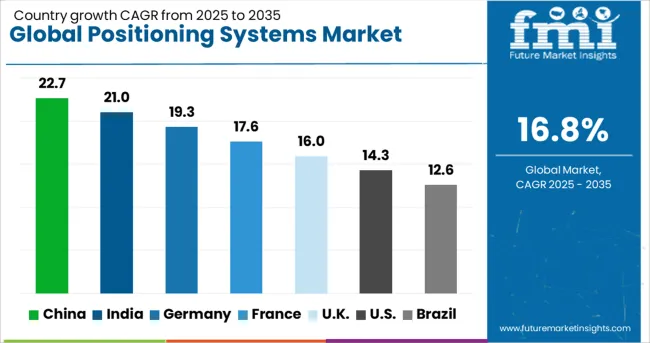

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 22.7% |

| India | 21% |

| Germany | 19.3% |

| France | 17.6% |

| United Kingdom | 16% |

| United States | 14.3% |

| Brazil | 12.6% |

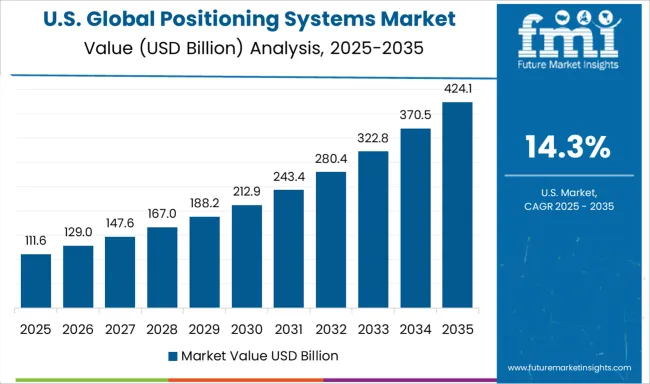

The global positioning systems market demonstrates exceptional growth across major economies, with China leading at a 22.7% CAGR through 2035, driven by massive smartphone adoption and autonomous vehicle development. India follows at 21%, supported by expanding mobile device penetration and growing location-based service demand. Germany records 19.3% growth, emphasizing automotive GPS integration and precision industrial applications. France shows 17.6% expansion, driven by aerospace technology development and smart city initiatives. The United Kingdom demonstrates 16% growth, focusing on navigation services and location-based applications. The United States records 14.3% growth, supported by established GPS infrastructure, while Brazil grows at 12.6% with developing mobile technology adoption.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from global positioning systems in China is projected to exhibit the highest growth rate with a CAGR of 22.7% through 2035, driven by massive smartphone adoption and comprehensive autonomous vehicle development programs. The country's expanding mobile technology ecosystem and increasing demand for location-based services are creating significant opportunities for GPS technology integration. Major technology companies and automotive manufacturers are establishing comprehensive positioning capabilities to support the growing requirements of mobile applications and intelligent transportation systems.

Government smart city development initiatives are mandating deployment of advanced positioning technologies and establishing supportive frameworks for location-based service innovation, driving investment in GPS capabilities throughout major metropolitan and industrial regions. Digital infrastructure modernization programs are supporting integration of satellite positioning with terrestrial networks and comprehensive location intelligence platforms that enhance service capabilities across diverse applications.

Revenue from global positioning systems in India is expanding at a CAGR of 21%, supported by rapid mobile device adoption and growing demand for location-based services across diverse consumer and enterprise applications. The country's expanding smartphone penetration and increasing digital service utilization are driving interest in GPS technologies that can support navigation, tracking, and location-aware applications. Technology providers and mobile service operators are gradually establishing comprehensive positioning capabilities to serve the growing requirements of digital consumers and business applications.

Mobile technology development and digital service expansion initiatives are creating opportunities for GPS solution providers that can deliver cost-effective positioning technologies and comprehensive service integration. Professional technology development and industry partnership programs are building technical expertise among service providers, enabling GPS technology deployment that meets diverse application requirements and international service standards.

Demand for global positioning systems in Germany is projected to grow at a CAGR of 19.3%, supported by the country's leadership in automotive GPS integration and comprehensive precision industrial positioning applications. German automotive manufacturers are implementing advanced GPS technologies that support autonomous driving development and comprehensive vehicle telematics systems. The market is characterized by focus on precision engineering, advanced signal processing, and compliance with comprehensive automotive safety standards.

Automotive industry investments are prioritizing GPS technologies that demonstrate superior accuracy and reliability while meeting German automotive quality standards and autonomous vehicle requirements. Professional engineering certification programs are ensuring comprehensive technical expertise among technology providers, enabling specialized GPS solutions that support diverse automotive applications and export requirements.

Demand for global positioning systems in France is expanding at a CAGR of 17.6%, driven by aerospace industry capabilities and comprehensive smart city development programs across major metropolitan areas. French technology companies are incorporating advanced GPS technologies that support satellite system development and location-based service innovation. The market benefits from established aerospace industry expertise and comprehensive government support for positioning technology advancement.

Aerospace technology development programs are facilitating adoption of advanced GPS solutions that provide enhanced accuracy and comprehensive satellite system integration capabilities. Professional technology development initiatives are ensuring comprehensive capabilities among engineering professionals, enabling specialized GPS technology deployment that meets evolving aerospace requirements and international service standards.

Demand for global positioning systems in the United Kingdom is projected to grow at a CAGR of 16%, supported by established navigation service providers and comprehensive location-based application development across consumer and enterprise markets. British technology companies are implementing GPS solutions that provide enhanced service capabilities and comprehensive location intelligence. The market is characterized by focus on service innovation, comprehensive data privacy compliance, and advanced application integration.

Navigation service investments are enabling deployment of GPS technologies that demonstrate superior user experience and comprehensive location-based service capabilities while maintaining data privacy standards. Professional service development programs are ensuring specialized expertise among technology providers, enabling comprehensive GPS applications supporting evolving consumer requirements and enterprise location intelligence needs.

Demand for global positioning systems in the United States is expanding at a CAGR of 14.3%, driven by established GPS satellite infrastructure and continued innovation in positioning technology applications. American technology companies are maintaining comprehensive GPS capabilities through adoption of advanced signal processing and multi-constellation integration technologies. The market benefits from substantial private sector investment and established satellite technology leadership.

GPS technology investments are enabling continued advancement of positioning capabilities through integration of enhanced accuracy systems and comprehensive application development platforms. Professional development programs are maintaining technical expertise among technology professionals, enabling comprehensive GPS capabilities that support diverse consumer electronics, automotive, and industrial application requirements.

Revenue from global positioning systems in Brazil is growing at a CAGR of 12.6%, driven by expanding mobile technology adoption and increasing demand for location-based services across consumer and transportation applications. Brazilian technology providers and service operators are investing in GPS technologies that can support growing smartphone utilization and navigation service requirements. Mobile service providers and application developers are establishing positioning capabilities to serve evolving consumer needs.

Mobile technology development programs are facilitating adoption of GPS solutions that support comprehensive location-based service applications across diverse consumer and business environments. Professional technology capability development initiatives are enhancing expertise among service providers, enabling GPS technology deployment that meets evolving mobile application requirements and service quality standards.

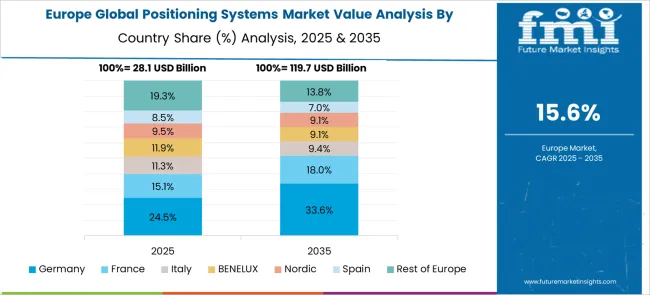

The global positioning systems market in Europe is projected to grow substantially across major countries, with Germany leading the regional market development. The United Kingdom maintains strong demand for GPS technologies, supported by established navigation service providers and comprehensive automotive GPS integration. France demonstrates consistent investment in satellite positioning technologies, driven by aerospace industry capabilities and smart transportation initiatives.

Germany is expected to maintain its leadership position in European GPS technology adoption, supported by its advanced automotive industry and comprehensive industrial automation requirements. The country benefits from established precision positioning applications and supportive regulatory environment for autonomous vehicle development.

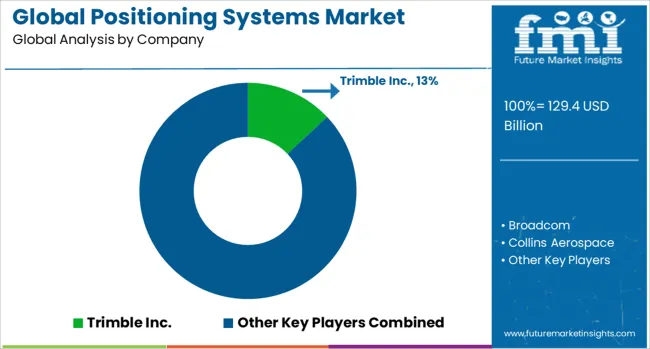

The global positioning systems market is defined by competition among satellite technology providers, semiconductor manufacturers, and location-based service companies. Companies are investing in advanced satellite constellation development, precision positioning technologies, comprehensive software platforms, and system integration capabilities to deliver accurate, reliable, and cost-effective GPS solutions. Strategic partnerships, technology innovation, and market expansion strategies are central to strengthening product portfolios and service offerings.

Trimble Inc., United States-based, offers comprehensive GPS solutions with focus on precision positioning and surveying applications. Broadcom Inc., United States, provides advanced GPS semiconductor technologies with emphasis on consumer device integration and power efficiency. Collins Aerospace, United States, delivers specialized GPS systems for aviation and aerospace applications. Garmin Ltd., United States, focuses on consumer GPS devices and automotive navigation systems. Hemisphere GNSS Inc., United States, emphasizes precision agriculture and industrial GPS applications. Hexagon AB, Sweden, provides comprehensive positioning solutions for surveying and industrial applications. MiTAC Holdings Corporation, Taiwan, offers GPS navigation devices and automotive telematics systems. Qualcomm Technologies Inc., United States, Quectel Wireless Solutions Co. Ltd., China, Septentrio N.V., Belgium, Sierra Wireless, Canada, Swift Navigation, United States, Texas Instruments Incorporated, United States, TomTom International B.V., Netherlands, and Topcon Positioning Systems Inc., United States, provide specialized GPS expertise, advanced semiconductor solutions, and comprehensive location-based service capabilities across global consumer electronics, automotive, and industrial markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 129.4 billion |

| Deployment | Consumer devices, standalone tracker, portable navigation devices, automotive telematics systems, others |

| Application | Location based services, road, aviation, marine, surveying & mapping, others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Trimble Inc., Broadcom Inc., Collins Aerospace, Garmin Ltd., Hemisphere GNSS Inc., Hexagon AB, MiTAC Holdings Corporation, Qualcomm Technologies Inc., Quectel Wireless Solutions Co. Ltd., Septentrio N.V., Sierra Wireless, Swift Navigation, Texas Instruments Incorporated, TomTom International B.V., Topcon Positioning Systems Inc. |

| Additional Attributes | Dollar sales by deployment and application, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established satellite technology providers and emerging location-based service companies, development capabilities for different accuracy requirements and application environments, integration with advanced satellite constellation systems and terrestrial positioning networks, innovations in high-precision positioning and real-time kinematic solutions, and adoption of multi-constellation and 5G connectivity technologies with enhanced accuracy and comprehensive location intelligence for optimized navigation and positioning applications. |

The global global positioning systems market is estimated to be valued at USD 129.4 billion in 2025.

The market size for the global positioning systems market is projected to reach USD 611.3 billion by 2035.

The global positioning systems market is expected to grow at a 16.8% CAGR between 2025 and 2035.

The key product types in global positioning systems market are consumer devices, standalone tracker, portable navigation devices, automotive telematics systems and others.

In terms of application outlook, location based services segment to command 45.0% share in the global positioning systems market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Video Extensometer Market Size and Share Forecast Outlook 2025 to 2035

Fluorescence Spectrophotometer Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Grinders Market Size and Share Forecast Outlook 2025 to 2035

Automated Biochemical Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Vapor Pressure Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Ultrapycnometer Market Size and Share Forecast Outlook 2025 to 2035

Global PP Closure Market Size and Share Forecast Outlook 2025 to 2035

Global Glycidol Market Size and Share Forecast Outlook 2025 to 2035

Global Tert-Amylbenzene Market Size and Share Forecast Outlook 2025 to 2035

Global Sodium Hypochlorite Market Size and Share Forecast Outlook 2025 to 2035

Global Stannic Chloride Market

Global Tyre Inflators Market

Global Wine Tanks Market

Global Bench Scale Market

Global Nutating Mixers Market

Global HVAC Filter Market

Global Nitrite Market

Global Gas Leak Detectors Market

Global Aircraft Brake System Market

Global Loaders Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA