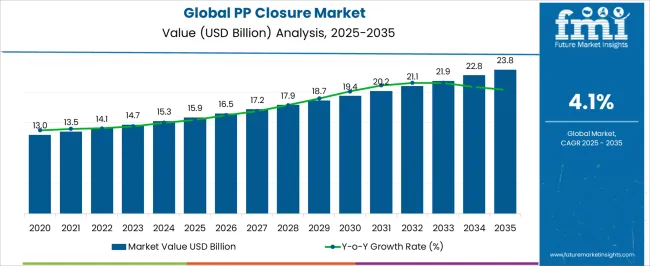

The Global PP Closure Market is estimated to be valued at USD 15.9 billion in 2025 and is projected to reach USD 23.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

| Metric | Value |

|---|---|

| Global PP Closure Market Estimated Value in (2025 E) | USD 15.9 billion |

| Global PP Closure Market Forecast Value in (2035 F) | USD 23.8 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

The global PP closure market is experiencing sustained growth driven by the expanding consumption of packaged beverages and food products, coupled with rising consumer preference for convenient and tamper evident packaging solutions. Increasing use of polypropylene closures in both carbonated and non carbonated beverages has been reinforced by their durability, lightweight properties, and recyclability.

Technological improvements in molding processes are enabling greater production efficiency and enhanced closure performance. Regulatory focus on sustainable packaging and circular economy practices is further encouraging manufacturers to adopt recyclable polypropylene closures across diverse industries.

The market outlook remains favorable as brand owners continue to prioritize cost effectiveness, functionality, and sustainability in packaging, paving the way for long term adoption across global consumer goods supply chains.

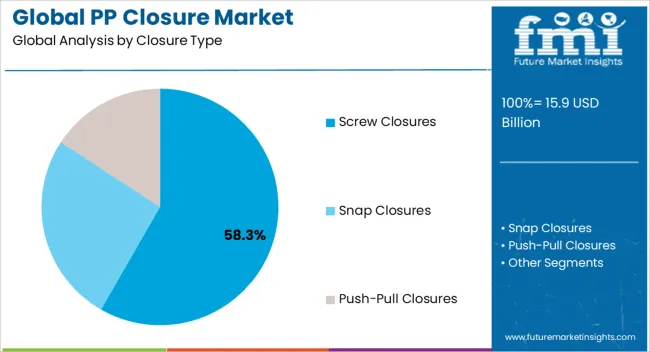

The screw closures segment is projected to account for 58.30% of total revenue by 2025 within the closure type category, establishing it as the leading segment. This dominance is driven by its reliable sealing performance, user convenience, and compatibility with a wide range of packaging formats.

Screw closures are widely adopted across beverages, condiments, and pharmaceutical packaging due to their reusability and ease of opening and closing. Their adaptability to different bottle neck finishes and their ability to preserve product integrity have further strengthened demand.

This functional efficiency and widespread applicability have positioned screw closures as the dominant choice in the closure type category.

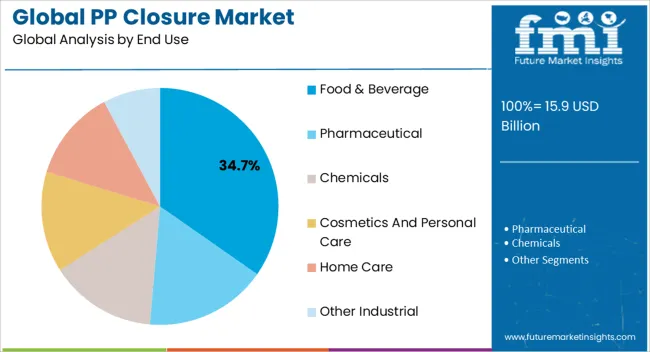

The food and beverage segment is expected to hold 34.70% of total market revenue by 2025 within the end use category, making it the leading segment. Increasing demand for packaged drinks, dairy products, sauces, and ready to consume food items has significantly boosted the requirement for reliable and tamper evident closures.

The growth of convenience oriented lifestyles and the global shift toward on the go consumption have reinforced reliance on PP closures within the food and beverage industry.

The ability of these closures to maintain product freshness, ensure safety, and provide user convenience has established this segment as the primary driver of market expansion.

From 2020 to 2025, global sales of PP Closure increased at a CAGR of about 2.5%, reaching a market size of USD 15.9 billion in 2025.

Looking forwards, the global market for PP closures is expected to witness a CAGR of 4.30% during the assessment period. According to Future Market Insights’ (FMI) latest report, total market value is expected to increase to around USD 23.8 billion by 2035.

Growth in the global market is driven by various factors. This includes the rising demand for packaged goods, especially in food and beverages sector, and the growing use of PP closures in other pharmaceutical and personal care sectors.

Automation is expected to enable manufacturers to produce PP closures more efficiently and cost-effectively, while also reducing waste and improving quality.

Similarly, digitalization is expected to become important in the PP closure quality. This could lead to the adoption of technologies such as artificial intelligence, robotics, and the IoT in the production process.

Demand is likely to remain high across Asia-Pacific nations including China & India due to the rapid urbanization, high demand for packaged goods, and increasing need for high-quality packaging solutions.

Focus on Diversifying PP Closure Products to Fuel Market Expansion in the United States

| Country | United States |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 23.8 billion |

| CAGR from 2025 to the End of Forecast (2035) | 3.4% |

As per Future Market Insights (FMI), the United States PP closure market is set to thrive at 3.4% CAGR, reaching a valuation of USD 23.8 billion by 2035. Growth in the market is driven by rising demand for PP closures from food & beverage, cosmetic, and healthcare sectors and focus on product diversification.

The United States is indeed eager to diversify its PP (polypropylene) closure market for several reasons. One such reason is the extensive usage of PP closures in the packaging vertical, particularly in food and beverage sector.

The United States is one of the leading consumers of PP closures in the world. However, a reliance on a limited number of suppliers can create vulnerabilities in the supply chain, such as price volatility, quality issues, and disruptions in production.

To address these challenges, the United States is pursuing a range of strategies to diversify its PP closure market. One approach is to encourage domestic production, by providing tax incentives and other forms of support for manufacturers, and by promoting policies that incentivize companies to invest in the United States. This can help to create jobs and support local industries, while also reducing reliance on foreign suppliers.

Another strategy is to develop alternative sources of supply, such as by exploring new suppliers in other regions, or by developing new materials and technologies that can replace or supplement traditional PP closures.

For example, various companies are exploring the use of bioplastics or other sustainable materials as alternatives to PP closures. This can help to reduce environmental impact and increase sustainability, while also diversifying the market and reducing risk.

Diversifying the PP closure product lineup is seen as a key strategic priority for the United States, as it helps to reduce risk, promote sustainability, and support domestic sectors.

High Consumption of Packaged Food & Beverages Driving PP Closure Demand in the United Kingdom

| Country | United Kingdom |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 0.728 billion |

| CAGR from 2025 to the End of Forecast (2035) | 23.8% |

The United Kingdom PP closure industry is anticipated to cross a valuation of USD 0.728 billion by 2035. From 2025 to 2035, PP closure demand in the country is projected to increase at 23.8% CAGR.

The United Kingdom is one of the prominent markets for PP closures in Europe and has a strong market base for the PP closure market.

Growth in the United Kingdom market is driven by several factors. This includes the increasing demand for packaged food and beverages, rise in e-commerce, and growing focus on sustainability.

The demand for packaged food and beverages in the United Kingdom is increasing due to factors such as changing lifestyles, urbanization, and rising disposable income. This is driving the demand for high-quality PP closures that are compatible with a variety of packaging formats and can ensure the safety and freshness of the products.

Rapid rise of e-commerce in the United Kingdom is also supporting the expansion of the PP closure industry. The growth of online shopping has increased the demand for secure and convenient packaging solutions. This in turn is driving demand for PP closures as they can seal products effectively and maintain their quality during transportation.

Availability of Customized PP Closures Boosting Growth in China

| Country | China |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 2.8 billion |

| CAGR from 2025 to the End of Forecast (2035) | 5.7% |

The PP closure industry in China is expected to progress at a steady CAGR of 5.7% CAGR from 2025 to 2035. Total market valuation in China is likely to exceed USD 2.8 billion by the end of 2035.

Growth in China market is driven by several factors. This includes rapid expansion of food & beverage sector, technological advancements, and increasing demand for customized and value-added products.

With the growing demand for PP closures in China, manufacturers are expected to invest in research and development to introduce new and innovative products, further driving market growth.

Manufacturers in Japan Embracing Automation to Improve Productivity and Gain Profits

| Country | Japan |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 0.874 billion |

| CAGR from 2025 to the End of Forecast (2035) | 2.6% |

Japan PP closure industry is projected to reach a valuation of USD 0.874 billion by 2035. Over the next ten years, PP closure sales in Japan market are likely to soar at 2.6% CAGR.

Increasing demand from food & beverage sector, growing trend of automation in the manufacturing sector, and the need for enhanced efficiency and productivity are key factors driving Japan market.

Manufacturers are increasingly using automated systems to produce PP closures, which helps to improve efficiency, reduce labor costs, and enhance productivity. Automation also allows manufacturers to produce high-quality products consistently, which is driving the demand for PP closures with advanced features and customization options.

Demand Remains High for Screw Closures in the Global Market

Based on closure type, the global market is segmented into screw closures, snap closures, and push-pull closures. Among these, demand is expected to remain high for screw closures. This is due to rising usage of these closures across a wide range of sectors.

According to Future Market Insights (FMI), the screw closures segment is anticipated to progress at a CAGR of 4.8% during the forecast period. It is likely to hold around 57% of the global market by 2035.

PP screw closures are widely used in a variety of sectors for their versatility, durability, and cost-effectiveness. They are particularly popular for use in the food and beverage sector, where they are used to seal containers for products such as sauces, condiments, and beverages.

The screw closure segment holds a key market share in the PP closure industry. These closures are compatible with a wide range of container sizes and shapes. They are also easy to use and can be quickly applied and removed, making them a popular choice for both consumers and manufacturers.

Manufacturers Prefer Injection Molding Technology for Producing PP Closures

As per Future Market Insights (FMI), inject molding is likely to remain a commonly opted PP closure manufacturing technology globally. The target is anticipated to thrive at 3.8% CAGR during the forecast period, accounting for a prominent market share of around 71% in 2035.Top of Form

Injection molding technology is becoming increasingly popular in the PP closure industry because it allows for the production of closures with high precision and consistency.

Injection molding machines can produce large quantities of closures quickly and efficiently, with minimal variation in size, shape, and quality. This makes injection molding an ideal choice for manufacturers that need to produce high volumes of closures with tight tolerances and consistent performance.

Food and Beverage Sector to Create Lucrative Opportunities for PP Closure Manufacturers

Based on end use, adoption of PP closures is expected to remain high in the food & beverage sector. This is due to various benefits that PP closures provide to food & beverage businesses.

PP closures are easy to use and provide a secure seal. They can be quickly applied and removed, making them a popular choice for both food manufacturers and consumers.

PP closures offer a tight seal that is resistant to leakage, ensuring that the product remains fresh and free from contamination. Adoption of these closures helps companies to protect their products from external factors and extend their shelf life.

Rising need for protective packaging solutions across the thriving food & beverage sector globally is expected to bolster PP closures sales during the next ten years.

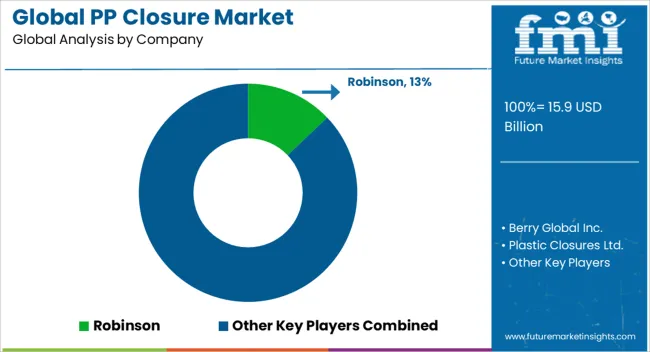

Key manufacturers of PP (polypropylene) closure are adopting various strategies such as innovation, customization, quality control, sustainability, and customer service to differentiate themselves from their competitors and meet the changing needs of their customers.

Developing Innovative Product:

Companies are investing in research and development to find new materials that can improve the performance of PP closures. For instance, they may explore the use of bioplastics or recycled plastics, which are more sustainable and eco-friendly.

Companies also look for new additives or modifiers that can enhance the properties of PP closures, such as UV stabilizers, anti-static agents, and anti-blocking agents.

Customization:

Leading PP closure companies can customize their products by offering a wide range of closure sizes and shapes. This allows customers to select closures that fit their specific packaging needs.

Companies offer closures in different diameters and heights to fit different types of bottles, jars, and containers. Several companies also offer closures with various neck finishes, such as screw-on, snap-on, or press-on, to match different types of packaging.

Sustainability:

Companies are creating more sustainable products by using recycled materials. They are using post-consumer recycled polypropylene (PCR-PP) to manufacture closures, which reduces the amount of plastic waste that goes to landfills. The use of recycled materials also conserves natural resources and reduces the carbon footprint of the product.

Strategic Expansion:

Several companies are expanding their product lines by introducing new closure designs that cater to specific market segments. They are conducting market research to identify the needs and preferences of different customer groups and developing closures that meet these requirements.

For instance, companies are developing closures with specific tamper-evidence features for the pharmaceutical industry or closures with improved pour spouts for the food and beverage industry.

Acquisition:

The companies in the PP closure industry can expand their product offerings through acquisitions. They are acquiring companies that specialize in the production of complementary closure products to solidify their position.

Key Players in the PP Closure Industry:

Key Developments:

| Attribute | Details |

|---|---|

| Estimated Market Value (2025) | USD 15.9 billion |

| Projected Market Value (2035) | USD 23.8 billion |

| Anticipated Growth Rate (2025 to 2035) | 4.1% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Argentina, Rest of Latin America, China, Japan, South Korea, India, ASEAN, Oceania, Rest of South Asia & Pacific, Germany, Italy, France, United Kingdom, Spain, BENELUX, Nordics, Rest of Western Europe, Poland, Hungary, Romania, Czech Republic, Rest of Eastern Europe, Central Asia, Russia & Belarus, Balkan & Baltics, Saudi Arabia, United Arab Emirates, Turkiye, Northern Africa, South Africa, Israel, Rest of Middle East & Africa |

| Key Segments Covered | Closure Type, Technology, End Use, and Region |

| Key Companies Profiled | Robinson; Berry Global; Plastic Closures Ltd.; Weener Plastics; Amcor; Silgan Plastics; Comar; Rieke Packaging |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global global PP closure market is estimated to be valued at USD 15.9 billion in 2025.

The market size for the global PP closure market is projected to reach USD 23.8 billion by 2035.

The global PP closure market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in global PP closure market are screw closures, snap closures and push-pull closures.

In terms of technology, compression molding segment to command 62.1% share in the global PP closure market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Video Extensometer Market Size and Share Forecast Outlook 2025 to 2035

Fluorescence Spectrophotometer Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Grinders Market Size and Share Forecast Outlook 2025 to 2035

Automated Biochemical Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Vapor Pressure Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Ultrapycnometer Market Size and Share Forecast Outlook 2025 to 2035

Global Positioning Systems Market Size and Share Forecast Outlook 2025 to 2035

Global Glycidol Market Size and Share Forecast Outlook 2025 to 2035

Global Tert-Amylbenzene Market Size and Share Forecast Outlook 2025 to 2035

Global Sodium Hypochlorite Market Size and Share Forecast Outlook 2025 to 2035

Global Stannic Chloride Market

Global Tyre Inflators Market

Global Wine Tanks Market

Global Bench Scale Market

Global Nutating Mixers Market

Global HVAC Filter Market

Global Nitrite Market

Global Gas Leak Detectors Market

Global Aircraft Brake System Market

Global Loaders Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA