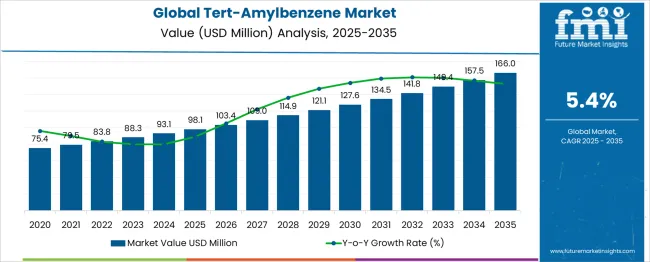

The global tert-amylbenzene market is estimated to be valued at USD 98.1 million in 2025 and is projected to reach USD 166.0 million by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period. Between 2025 and 2030, the market is projected to grow steadily, reaching USD 127.6 million. In 2025, the market stands at USD 98.1 million, increasing to USD 103.4 million in 2026 and USD 109.0 million in 2027. The growth continues with USD 114.9 million in 2028, USD 121.1 million in 2029, and USD 127.6 million by 2030. Tert-amylbenzene is primarily used as a chemical intermediate in the production of additives, solvents, and other value-added compounds. Its demand is rising in petrochemicals and specialty chemicals due to its ability to improve stability and efficiency in final formulations. Manufacturers are increasingly targeting applications that require high thermal and chemical resistance. With steady industrial expansion in regions like Asia-Pacific and a shift toward customized chemical solutions, demand for tert-amylbenzene remains consistent. The market's moderate but reliable growth reflects its niche yet essential role in chemical manufacturing, particularly where high-performance specifications are required across coatings, fuels, and intermediates.

| Metric | Value |

|---|---|

| Global Tert-Amylbenzene Market Estimated Value in (2025 E) | USD 98.1 million |

| Global Tert-Amylbenzene Market Forecast Value in (2035 F) | USD 166.0 million |

| Forecast CAGR (2025 to 2035) | 5.4% |

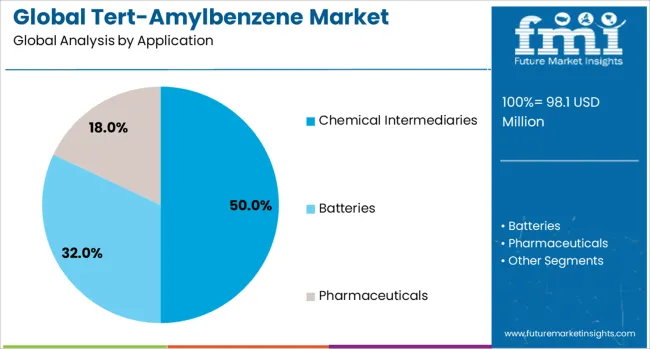

The tert-amylbenzene (TAB) market is closely tied to several parent markets, with its usage distributed across chemical intermediates, battery additives, pharmaceuticals, and industrial solvents. The most dominant segment is the chemical intermediates market, where TAB accounts for approximately 75%–80% of its demand. This is driven by its critical role in producing compounds like hydrogen peroxide and pharmaceutical active ingredients. TAB’s reactivity and compatibility with various synthesis processes make it valuable in industrial chemistry. Another key segment is the battery additives market, where it holds about 21.3% of its share. It serves as an effective redox shuttle and stabilizer in lithium-ion batteries, improving safety and performance by mitigating overcharging risks. In the pharmaceutical sector, TAB contributes roughly 25% of demand, mainly used as a solvent or intermediate in the production of antifungal medications and specialty drug formulations. In the coatings and solvent industry, TAB accounts for more than 20% due to its strong solvency power and stability, especially in automotive paints and specialty adhesives. Regionally, North America leads with around 35% share, followed by Europe (26%) and Asia-Pacific (25%). These figures reflect the compound’s diverse industrial applications and steady integration across global manufacturing processes.

The global tert-amylbenzene market is witnessing steady expansion driven by its increasing use as a specialty aromatic compound in diverse industrial processes. The current market scenario is shaped by growing demand from the chemical and pharmaceutical industries, as reported in corporate disclosures, investor updates and trade journals. Advancements in synthetic chemistry and rising investments in research and development are supporting the adoption of Tert-Amylbenzene as a versatile raw material.

Companies are focusing on improving production efficiency and ensuring compliance with environmental and safety regulations, which is encouraging sustainable growth in supply and consumption. The future outlook remains positive as emerging economies continue to invest in industrial chemicals and expand manufacturing capabilities.

Industry announcements and product news further highlight that increased focus on high-purity intermediates for downstream applications is fostering market potential.

The global tert-amylbenzene market is segmented by application and geographic regions. By application of the global tert-amylbenzene market is divided into Chemical Intermediaries, Batteries, and Pharmaceuticals. Regionally, the global tert-amylbenzene industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The chemical intermediaries application segment is anticipated to hold 50.0% of the Global Tert-Amylbenzene market revenue share in 2025 making it the leading segment. This leadership has been attributed to the extensive utilization of Tert-Amylbenzene as an intermediate in the production of various specialty chemicals and additives as noted in industry press releases and technical bulletins.

Its unique chemical properties and compatibility with a range of synthesis processes have been instrumental in its adoption by chemical manufacturers seeking efficiency and quality. The ability of Tert-Amylbenzene to serve as a key building block in creating advanced compounds has been highlighted in industry publications which reinforces its strategic importance.

Additionally the segment’s dominance has been driven by the growing need for high-purity intermediates in pharmaceuticals agrochemicals and polymers which rely on reliable and consistent raw materials. These factors combined with expanding production capacities and focus on cost effective processes have secured the chemical intermediaries segment’s leading position in the market.

The tert‑amylbenzene (TAB) market is growing as demand expands across chemical intermediates, solvents, battery additives, agrochemical synthesis, and pharmaceutical ingredient production. Market growth is driven by its use in coatings, paints, adhesives, lubricants, and hydrogen peroxide synthesis applications. Adoption is rising in industries such as detergents, fragrances, crop protection, and lithium‑ion batteries for safety additive use. Regional markets such as North America and Asia‑Pacific support momentum through industrialization and robust end use sectors. TAB’s versatility as a stable aromatic solvent and intermediate underlies its growing utility across diverse value chains.

Regulatory frameworks vary substantially by region and impose differing compliance benchmarks on TAB producers. In Europe, strict chemical evaluation and environmental standards raise operating costs for manufacturers, particularly under chemical safety mandates. In some Asian countries, regulations are still evolving, allowing lower cost production but also higher price volatility. Import restrictions and regional certification requirements in regulated markets create pricing bifurcation and supply uncertainty. Tab suppliers may issue compliance claims for different jurisdictions, increasing complexity in international trade. These disparities result in price divergence, regional arbitrage opportunities, and elevated overhead for companies maintaining multiple product variants. Until regulation harmonizes globally, these fragmented frameworks continue to restrict seamless commercialization. References highlight regulatory-driven cost differentials and trade impacts across Europe, North America, and Asia‑Pacific.

Tert‑amylbenzene offers multiple growth avenues across industries due to its role as a versatile chemical building block. It is used in detergent and personal care ingredient synthesis, lubricant additives, pharmaceutical intermediates, agrochemicals, and battery electrolyte safety additives. As global demand grows for high-performance specialty chemicals, TAB usage expands. In battery applications, TAB acts as a redox shuttle that improves lithium‑ion cell safety and thermal stability. It is increasingly applied in amorolfine antifungal synthesis and hydrogen peroxide production, supporting pulp and paper processing. These application areas provide multiple anchor segments for market growth. Suppliers investing in tailored grades for specific end uses gain access to higher value sectors. This multiplicity of roles supports a market expanding across sectors aligned with chemical, energy and industrial product evolution.

Recent shifts in TAB production technologies focus on optimization of catalytic routes and process controls that reduce cost and enhance purity. Improved synthesis methods are enabling lower energy use and minimized byproduct formation. These operational improvements support better chemical quality for high‑end applications. Efficient production techniques reduce batch variability and improve reaction selectivity, making the chemical more reliable for use in battery additives and fragrance intermediates. Producers are also leveraging automation and digital monitoring to streamline operations. As quality thresholds tighten for lithium battery and pharmaceutical applications, these process improvements become critical. TAB producers that can scale high‑purity manufacturing while controlling cost are better positioned to serve both regulated markets in developed regions and high-volume producers in emerging economies. Recent industry research notes technological optimization as a key factor in market competitiveness.

The tert‑amylbenzene market is constrained by volatile petrochemical feedstock inputs and competition from alternative solvents. TAB production relies on upstream benzene derivatives, making it sensitive to oil price fluctuations. Sudden changes in feedstock cost affect producer margins and downstream formulation costs. Substitute aromatics like linear alkylbenzene may offer lower-cost alternatives for detergent and surfactant synthesis, decreasing TAB adoption unless performance advantages are clear. Additionally, health and environmental concerns around aromatic solvents reinforce interest in greener options. Rising regulatory restrictions on volatile organic compounds and hazardous solvents further intensify competitive pressure. Until feedstock sourcing stabilizes and TAB producers position their product advantage clearly, margin pressure and substitution risk will restrict broader uptake, especially in cost-sensitive segments.

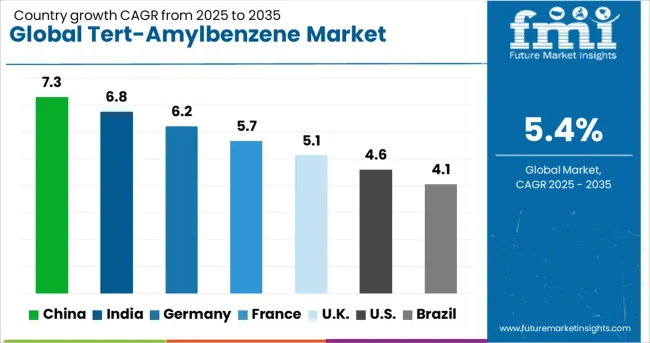

| Country | CAGR |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| France | 5.7% |

| UK | 5.1% |

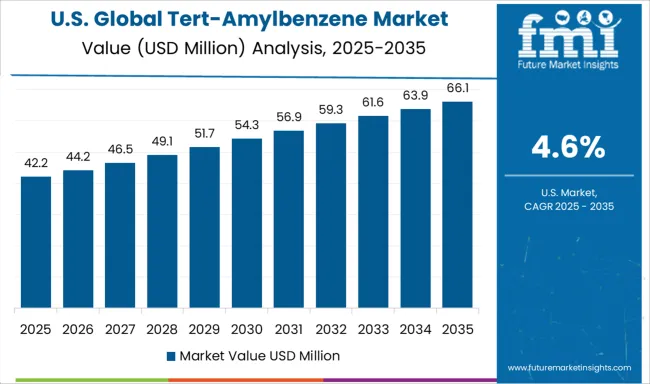

| USA | 4.6% |

| Brazil | 4.1% |

The global tert-amylbenzene market is expected to expand at a CAGR of 5.4% through 2035, supported by its use as an intermediate in chemical synthesis and specialty formulations. China leads with 7.3% growth, where high-volume production has been driven by demand in fine chemicals and downstream derivatives. India follows at 6.8%, with usage concentrated in resin manufacturing and lubricant additives. Germany, reporting 6.2% growth, continues to support applications in chemical processing and high-purity solvents. The United Kingdom, at 5.1%, sustains demand through controlled distribution in research and specialty industries. The United States, at 4.6%, remains a stable market with production governed by purity regulations and handling standards. Market activity has been shaped by hazardous classification guidelines, transport protocols, and industrial use authorizations. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Significant expansion has been recorded in chemical intermediates industry in China, pushing the tert-amylbenzene market to a growth rate of 7.3%. Increased usage has been observed in high-performance solvents and additives, where this compound supports synthesis stability and thermal resistance. Local production facilities have benefited from integrated supply chains involving aromatics and alkylating agents, enabling cost-effective output. Custom formulations for agrochemicals and pharmaceutical intermediates have contributed to steady downstream demand. Refinery clusters in provinces like Jiangsu and Shandong have reported greater output of tert-amylbenzene due to favorable feedstock availability and rising demand for specialized performance chemicals. Environmental and process efficiency standards have led to continuous optimization in catalyst systems that utilize tert-amylbenzene as a processing aid. Export-oriented operations have remained active, targeting markets in Southeast Asia and the Middle East.

Tert-amylbenzene market has been expanding steadily, with a projected CAGR of 6.8 percent. The compound has found rising application in coatings, lubricants, and polymer additives, all of which are in demand due to industrial and automotive growth. Specialty chemical firms have increased procurement of tert-amylbenzene for its functional use in heat- and oxidation-resistant products. Domestic manufacturing has been reinforced by improvements in aromatic compound processing and capacity expansions in Gujarat and Maharashtra. Blending operations by local formulators have helped maintain consistent offtake, particularly in paint, textile auxiliary, and agro-intermediate segments. Regulatory compliance has been facilitated by product adaptability across different industrial chemistries. Trade links with ASEAN nations and domestic supply contracts have encouraged investment in storage and distribution networks. Adoption of value-added chemical strategies is expected to continue supporting demand.

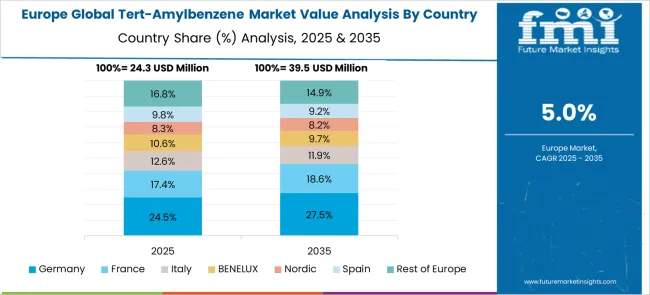

Germany has demonstrated consistent demand for tert-amylbenzene across advanced manufacturing and specialty chemical sectors, with market growth estimated at 6.2 percent. The chemical has been employed in lubricant formulation, rubber processing, and synthetic resin development, particularly for its role in providing thermal stability and chemical resistance. Demand has also been supported by its use in catalyst carrier systems and as a base compound for intermediates. Industrial clusters in North Rhine-Westphalia and Bavaria have reported stable consumption linked to manufacturing precision components and coatings. Import reliance for raw aromatic precursors has remained moderate due to strong intra-EU chemical trade links. Environmentally aligned formulations using tert-amylbenzene derivatives have gained interest among green chemistry developers. Innovations in downstream processing, such as continuous flow systems, have further strengthened the role of tert-amylbenzene in fine chemical applications.

The United Kingdom has witnessed moderate expansion of the tert-amylbenzene market, currently growing at 5.1% CAGR. Utilization has been centered on fine chemical production, adhesive blending, and coating formulations. Integration into additive systems for specialty lubricants and corrosion-resistant paints has encouraged interest among mid-sized chemical companies. Import-driven supply chains have kept product availability stable, especially for use in formulation labs and specialty compounding. Custom blending operations in industrial parks across the Midlands and Southeast England have led to application-specific use cases. Focus has been placed on compliance with regulatory benchmarks through the use of low-toxicity tert-amylbenzene grades. Opportunities have emerged in niche areas such as electrical insulation fluids and polymer modifiers. Collaboration with European chemical distributors has ensured continuity in sourcing and logistics.

The United States has maintained a stable presence in the global tert-amylbenzene market, with a projected CAGR of 4.6%. Adoption has been primarily driven by the specialty chemicals industry, where the compound has been incorporated into process solvents, polymer additives, and stabilizers. Domestic production facilities have leveraged advanced alkylation technologies for high-purity synthesis, especially in Texas and Louisiana. The compound has been evaluated favorably in next-generation lubricants and resin applications requiring superior performance at elevated temperatures. Increased use has been noted in coatings and sealants for aerospace and industrial maintenance. Market expansion has also benefited from strong quality and environmental controls, which have been required by downstream buyers in paints and automotive parts. Strategic partnerships with distributors have ensured targeted supply chain access across regional markets.

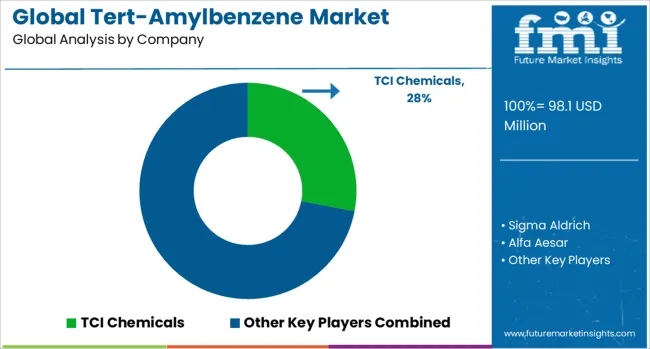

The global tert-amylbenzene market is experiencing steady growth, projected to expand at a compound annual growth rate (CAGR) of 5.4%, driven by rising demand in pharmaceuticals, fine chemicals, and specialty intermediates. Tert-amylbenzene’s stability and branched alkyl structure make it valuable as a solvent and synthetic building block, particularly in applications requiring high-purity reagents. TCI Chemicals is a major supplier of laboratory and industrial-grade tert-amylbenzene, known for its wide catalog of specialty organic chemicals and its focus on academic, R&D, and pilot-scale markets. Its global distribution network supports diverse end-users with small to mid-volume needs.

Sigma-Aldrich (part of Merck KGaA) provides high-purity tert-amylbenzene for research and development, analytical applications, and synthesis of advanced intermediates. The company leverages its extensive scientific distribution channels and regulatory certifications to serve pharmaceutical and academic sectors.Alfa Aesar (a Thermo Fisher Scientific brand) offers tert-amylbenzene within its portfolio of specialty organics and research-grade chemicals, targeting laboratories and custom synthesis markets that require traceable purity and batch consistency.

Solvay, a global specialty chemicals leader, brings industrial-scale capabilities and regulatory expertise to the production of tert-amylbenzene derivatives, supporting applications in agrochemicals, polymers, and advanced materials. Its integrated manufacturing and compliance systems make it a preferred supplier for high-volume customers. Frontier Scientific Inc. focuses on supplying rare and specialized organic compounds, including tert-amylbenzene, for pharmaceutical discovery, material science, and fine chemical synthesis.

The company’s strength lies in rapid delivery of catalog and custom molecules in both bulk and research quantities. As the market shifts toward higher purity, greener synthesis, and regulatory alignment, suppliers who can balance flexibility, quality assurance, and global reach are expected to lead. The growing use of tert-amylbenzene in advanced chemical processes will continue to drive innovation and competitive differentiation in this specialized segment.

Recent Development

As mentioned on Solvay’s official website, Solvay is the sole producer of Tert-Amylbenzene in Europe, offering industrial, special, and ultrapure grades. Used in hydrogen peroxide production, antifungal APIs like amorolfine, and lithium-ion batteries, this REACH-compliant product supports Solvay’s strategy of delivering high-purity specialty chemicals for advanced applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 98.1 Million |

| Application | Chemical Intermediaries, Batteries, and Pharmaceuticals |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | TCI Chemicals, Sigma Aldrich, Alfa Aesar, Solvay, and Frontier Scientific Inc. |

| Additional Attributes | Dollar sales by TAB application type include pharmaceuticals, chemical intermediates, and batteries such as electrolyte additives; by industry use in pharma, electronics, and energy storage; by geographic region including North America, Europe, and Asia-Pacific; demand driven by lithium-ion battery adoption, antifungal pharmaceutical synthesis, and clean chemical routes; innovation in integrated supply partnerships and forward-controlled synthesis; costs influenced by feedstock availability, purification complexity, and interdisciplinary certification overhead. |

The global global tert-amylbenzene market is estimated to be valued at USD 98.1 million in 2025.

The market size for the global tert-amylbenzene market is projected to reach USD 166.0 million by 2035.

The global tert-amylbenzene market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in global tert-amylbenzene market are chemical intermediaries, batteries and pharmaceuticals.

In terms of , segment to command 0.0% share in the global tert-amylbenzene market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Video Extensometer Market Size and Share Forecast Outlook 2025 to 2035

Fluorescence Spectrophotometer Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Grinders Market Size and Share Forecast Outlook 2025 to 2035

Automated Biochemical Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Vapor Pressure Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Ultrapycnometer Market Size and Share Forecast Outlook 2025 to 2035

Global PP Closure Market Size and Share Forecast Outlook 2025 to 2035

Global Positioning Systems Market Size and Share Forecast Outlook 2025 to 2035

Global Glycidol Market Size and Share Forecast Outlook 2025 to 2035

Global Sodium Hypochlorite Market Size and Share Forecast Outlook 2025 to 2035

Global Stannic Chloride Market

Global Tyre Inflators Market

Global Wine Tanks Market

Global Nutating Mixers Market

Global Bench Scale Market

Global HVAC Filter Market

Global Nitrite Market

Global Optical Comparator Market

Global Loaders Market

Global Aircraft Brake System Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA