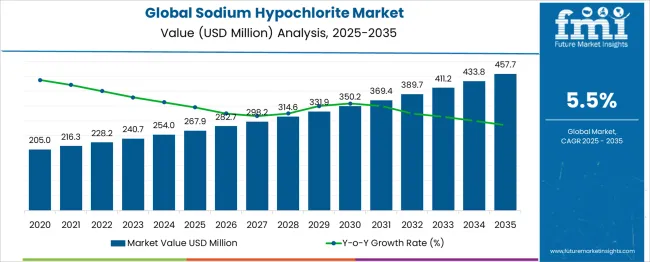

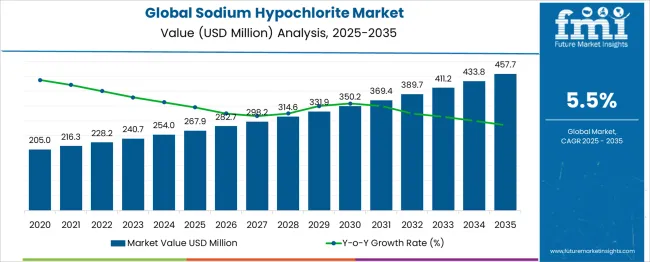

The Global Sodium Hypochlorite Market is estimated to be valued at USD 267.9 million in 2025 and is projected to reach USD 457.7 million by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

| Metric | Value |

|---|---|

| Global Sodium Hypochlorite Market Estimated Value in (2025 E) | USD 267.9 million |

| Global Sodium Hypochlorite Market Forecast Value in (2035 F) | USD 457.7 million |

| Forecast CAGR (2025 to 2035) | 5.5% |

The global sodium hypochlorite market is expanding steadily, supported by increasing demand for effective water treatment solutions and sanitation practices. Rising urbanization and industrial growth have elevated the need for safe and reliable water disinfection methods to meet health regulations and prevent waterborne diseases.

Advances in water treatment technologies and growing investments in infrastructure have driven the adoption of sodium hypochlorite as a preferred disinfectant. Public health initiatives emphasizing clean drinking water and wastewater management have further encouraged the use of this chemical.

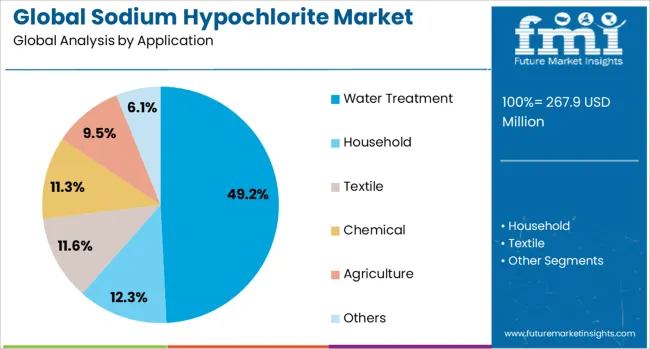

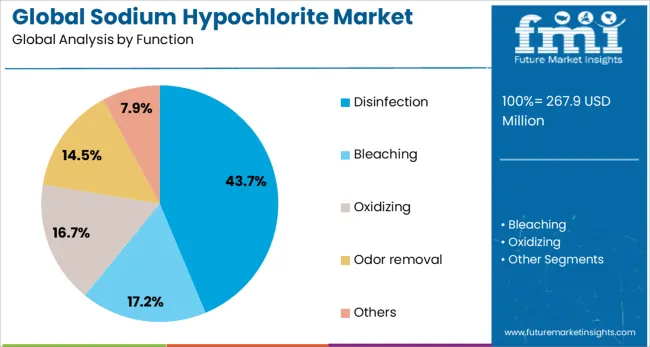

Additionally, sodium hypochlorite’s versatility across industrial and municipal applications has broadened its market reach. The expanding focus on hygiene and environmental safety globally continues to fuel demand. Segmental growth is expected to be led by the water treatment application and disinfection function owing to their critical roles in ensuring water quality and safety.

The global sodium hypochlorite market is segmented by application and function and geographic regions. By application of the global sodium hypochlorite market is divided into Water Treatment, Household, Textile, Chemical, Agriculture, and Others. In terms of function of the global sodium hypochlorite market is classified into Disinfection, Bleaching, Oxidizing, Odor removal, and Others. Regionally, the global sodium hypochlorite industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Water treatment segment is projected to hold 49.2% of the sodium hypochlorite market revenue in 2025, maintaining its position as the dominant application area. Growth in this segment is driven by the increasing need for disinfection of potable water and wastewater to comply with stringent regulatory standards. Municipal water treatment facilities rely on sodium hypochlorite for its effective pathogen elimination and ease of dosing.

Industrial water treatment processes also utilize this chemical to control microbial growth and maintain system integrity. The segment benefits from ongoing urban development and the expansion of water infrastructure in emerging economies.

As global demand for clean and safe water intensifies, the Water Treatment segment is expected to remain a primary driver of market growth.

The Disinfection function segment is projected to account for 43.7% of the sodium hypochlorite market revenue in 2025, sustaining its lead in the market. Sodium hypochlorite’s strong oxidizing properties make it an effective disinfectant against a broad spectrum of microorganisms. Its widespread use in eliminating bacteria, viruses, and algae has made it indispensable in water sanitation and surface cleaning.

The chemical’s rapid action and cost-effectiveness contribute to its preference over alternative disinfectants. Disinfection applications extend beyond water treatment to include food processing, healthcare, and sanitation sectors.

As the focus on public health and hygiene intensifies worldwide, the demand for sodium hypochlorite in disinfection is anticipated to continue growing, reinforcing the segment’s market dominance.

Sodium hypochlorite is gaining traction across water treatment, sanitation, and industrial bleaching. Utilities in Asia, the Middle East, and South America are adding on-site bleach generators to minimize logistics issues and reduce chemical loss. India and Brazil are scaling local production due to chlorine feedstock volatility. Industrial users prefer modular systems that provide flexible dosing and lower safety risks. Tight supply conditions in North America and Europe, along with rising electrolysis costs, continue to affect smaller operators. Certification hurdles and power instability further restrict expansion in regions lacking robust infrastructure.

Water utilities in Brazil, Indonesia, and South Africa are transitioning to localized sodium hypochlorite production to reduce shipment delays and leakage. Smaller facilities are investing in modular electrochlorination units with remote dosing controls. Textile mills and food processors in India reported better output consistency after switching to on-demand bleach generation. Pulp processors have reduced batch rejection by 11 % due to improved chlorine stability. These units also helped lower occupational risk by removing the need for large chemical storage. In Latin America, operators using smart dispensers cut hypochlorite overuse by 14 % during Q2 2025.

Access to chlorine feedstock remains uneven, especially in North America and parts of Europe, where supply cuts raised input costs by over 10 % in early 2025. Smaller water treatment contractors have delayed capacity upgrades due to higher electrolysis electricity use, which increased operating costs by up to 15 %. In areas with poor power reliability, downtime from system failures rose sharply. Requirements for potable-grade certification extended timelines, with food sector clients waiting 5–7 weeks for approval. Despite this, larger facilities with access to stable energy and compliance teams continue to add capacity, particularly near coastal desalination hubs and industrial clusters.

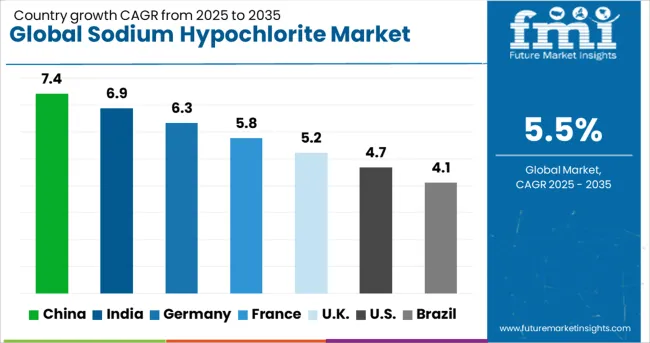

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The global sodium hypochlorite market is forecast to grow at a 5.5% CAGR from 2025 to 2035. China tops the list with 7.4%, offering a +35% premium over the global average. India follows at 6.9%, a +25% increase, and Germany at 6.3% sits +15% above baseline. The UK, at 5.2%, remains slightly below average, while the US posts 4.7%, underperforming by -15%. China's growth is tied to industrial-scale use in water treatment and disinfectants. India sees similar trends along with rising usage in municipal sanitation. Germany benefits from product upgrades in healthcare and manufacturing. In contrast, slower industrial upgrades in the US and UK limit growth rates. The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

Saled of sodium hypochlorite in China is forecast to grow at a CAGR of 7.4% through 2035. High demand from municipal water treatment and textile processing facilities is the core driver. Local producers like Hubei Yihua and Tianjin Chemical Co. dominate supply for both domestic consumption and exports. Industrial cleaning products and surface disinfectants make up a growing share, particularly in urban centers. Manufacturing hubs in Shandong and Jiangsu account for over 60% of national production. Cost-competitive distribution networks enable expansion into lower-tier cities.

Demand of sodium hypochlorite in India is projected to grow at a CAGR of 6.9% during the forecast period. Usage in sanitation programs and household disinfectants drives consistent demand. State tenders for bulk chlorination of water sources remain a key volume segment. Domestic producers such as Chemfab Alkalis and GACL are expanding capacity to address demand from institutional and rural markets. Textile dyeing units in Gujarat and Tamil Nadu remain major industrial users. Distribution challenges in hilly regions are being addressed through regional warehousing.

The sodium hypochlorite market in Geramy is expected to expand at a CAGR of 6.3% over the next decade. Regulatory preference for chlorine-based disinfectants in healthcare and public sanitation supports stable growth. BASF and Brenntag supply bulk volumes to commercial laundries, hospitals, and sanitation agencies. Strict environmental handling norms influence packaging and storage methods. Demand for on-site generation systems in municipal water treatment is growing. Industrial cleaning firms have shifted to concentrated variants to reduce logistics costs.

The United Kingdom sodium hypochlorite market is forecast to grow at a CAGR of 5.2%. Public hygiene programs in schools and hospitals contribute significantly to demand. Domestic manufacturing is supplemented by imports from Belgium and the Netherlands. Industrial cleaning services and food processing plants are steady end users. Leading distributors include Univar Solutions and Cleenol Group. Packaging formats are shifting toward refillable bulk tanks, especially for institutional buyers. Post-Brexit import checks have led to storage expansion at regional ports.

The United States sodium hypochlorite market is projected to grow at a CAGR of 4.7% through 2035. Municipal disinfection and household cleaning products make up most consumption. Olin Corporation and Occidental Chemical remain primary producers, supplying water utilities and branded consumer products. Demand from commercial laundries and industrial degreasing remains steady. Cost increases in chlorine feedstock have impacted pricing since 2022. Regional distributors are adopting automated filling units for efficiency. Bleach packaging in recyclable HDPE bottles has gained traction among retailers.

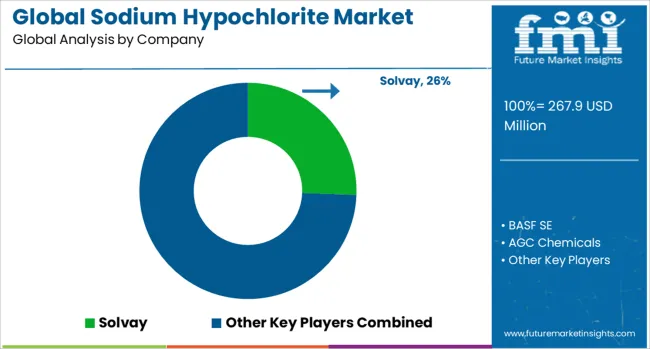

The global sodium hypochlorite market is dominated by Solvay, with major competitors including BASF SE, Olin Corporation, and AGC Chemicals supplying water treatment and disinfectant applications. Regional leaders such as Aditya Birla Chemicals in India and Sumitomo Chemical in Asia-Pacific meet local demand for bleaching and sanitation products. The market experienced unprecedented growth during the COVID-19 pandemic due to heightened disinfection needs, with production capacities expanding 18% globally in 2020-2022. Manufacturers are now focusing on stabilizing supply chains and improving production efficiency as demand normalizes. Key challenges include managing chlorine price volatility and transportation restrictions, while opportunities exist in developing stabilized sodium hypochlorite formulations for extended shelf life. The water treatment sector remains the primary end-user, accounting for 62% of global consumption, particularly in municipal drinking water applications across North America and Europe.

| Item | Value |

|---|---|

| Quantitative Units | USD 267.9 Million |

| Application | Water Treatment, Household, Textile, Chemical, Agriculture, and Others |

| Function | Disinfection, Bleaching, Oxidizing, Odor removal, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Solvay, BASF SE, AGC Chemicals, Aditya Birla Chemicals (India) Limited, Olin corporation, Sumitomo Chemical Co., Ltd, and BONDALTI |

| Additional Attributes | Dollar sales by concentration grade (household, industrial, food-grade) and application (water treatment, cleaning products, pulp and paper), demand dynamics across municipal disinfection, healthcare sanitation, and textile bleaching, regional trends led by Asia‑Pacific with North America expanding municipal supply contracts, innovation in membrane cell electrolysis and corrosion-resistant packaging, and environmental impact of chlorine handling regulations, effluent discharge limits, and storage safety compliance. |

The global global sodium hypochlorite market is estimated to be valued at USD 267.9 million in 2025.

The market size for the global sodium hypochlorite market is projected to reach USD 457.7 million by 2035.

The global sodium hypochlorite market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in global sodium hypochlorite market are water treatment, household, textile, chemical, agriculture and others.

In terms of function, disinfection segment to command 43.7% share in the global sodium hypochlorite market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Video Extensometer Market Size and Share Forecast Outlook 2025 to 2035

Fluorescence Spectrophotometer Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Grinders Market Size and Share Forecast Outlook 2025 to 2035

Automated Biochemical Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Vapor Pressure Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Ultrapycnometer Market Size and Share Forecast Outlook 2025 to 2035

Global PP Closure Market Size and Share Forecast Outlook 2025 to 2035

Global Positioning Systems Market Size and Share Forecast Outlook 2025 to 2035

Global Glycidol Market Size and Share Forecast Outlook 2025 to 2035

Global Tert-Amylbenzene Market Size and Share Forecast Outlook 2025 to 2035

Global Stannic Chloride Market

Global Tyre Inflators Market

Global Wine Tanks Market

Global Bench Scale Market

Global Nutating Mixers Market

Global HVAC Filter Market

Global Nitrite Market

Global Gas Leak Detectors Market

Global Optical Comparator Market

Global Loaders Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA