The GNSS simulator market is experiencing steady growth driven by increasing demand for accurate navigation, positioning, and timing solutions across automotive, defense, aerospace, and research sectors. Market dynamics are being shaped by the rising need to test and validate GNSS receivers under complex signal environments and the growing emphasis on improving signal resilience against interference and spoofing. Advancements in simulation technologies, such as high-fidelity signal generation and real-time scenario modeling, are enhancing product performance and reliability.

The market outlook remains positive, supported by expanding applications in autonomous vehicles, UAV testing, and precision agriculture. Manufacturers are focusing on modular, scalable, and cost-efficient simulation systems to meet evolving customer needs.

Growth rationale is further reinforced by investments in R&D for multi-constellation support and higher frequency bandwidth simulation, ensuring compatibility with next-generation satellite systems This trend, combined with increased governmental and commercial focus on PNT accuracy, is expected to sustain robust market growth over the forecast period.

| Metric | Value |

|---|---|

| GNSS Simulator Market Estimated Value in (2025 E) | USD 246.7 million |

| GNSS Simulator Market Forecast Value in (2035 F) | USD 617.0 million |

| Forecast CAGR (2025 to 2035) | 9.6% |

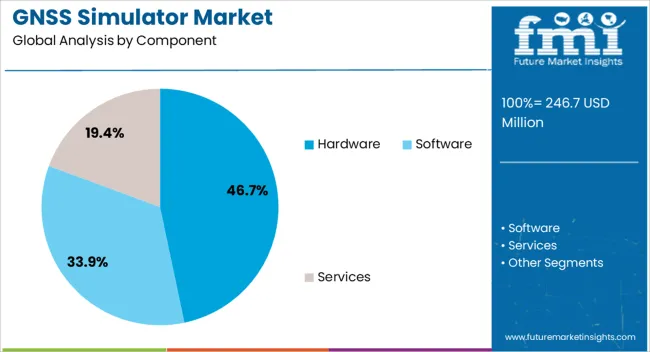

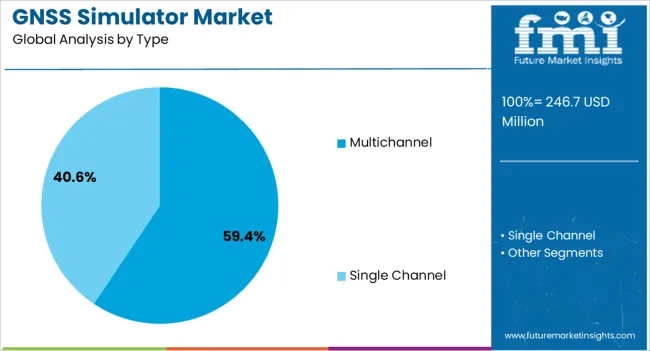

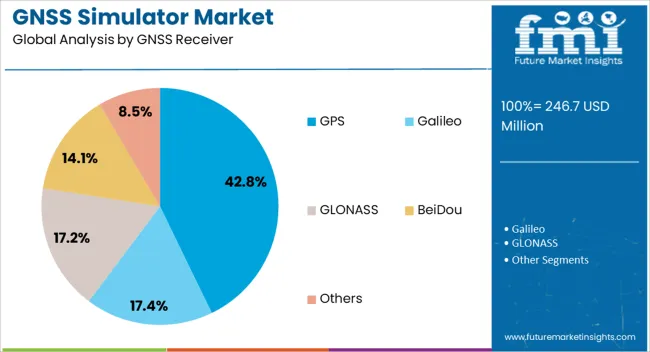

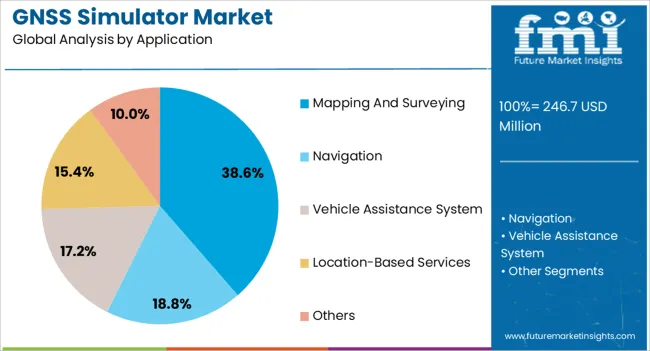

The market is segmented by Component, Type, GNSS Receiver, Application, and End-Use Industry and region. By Component, the market is divided into Hardware, Software, and Services. In terms of Type, the market is classified into Multichannel and Single Channel. Based on GNSS Receiver, the market is segmented into GPS, Galileo, GLONASS, BeiDou, and Others. By Application, the market is divided into Mapping And Surveying, Navigation, Vehicle Assistance System, Location-Based Services, and Others. By End-Use Industry, the market is segmented into Defense, Automotive, Aerospace, Consumer Electronics, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware segment, accounting for 46.70% of the component category, has been leading due to its essential role in enabling real-time GNSS signal generation and accurate testing capabilities. Market preference has been supported by the demand for reliable, high-performance hardware systems capable of simulating multiple satellite constellations simultaneously.

Enhanced system integration with advanced software interfaces has improved usability and customization, supporting its adoption across aerospace, defense, and automotive sectors. Continuous technological advancements in RF front-end design and signal processing have increased precision and reduced latency.

Hardware durability, scalability, and compatibility with multiple GNSS configurations have contributed to strong market retention As testing requirements grow in complexity, hardware-based simulators are expected to remain a critical component, ensuring accurate validation and performance optimization for next-generation GNSS receivers.

The multichannel segment, representing 59.40% of the type category, has maintained its dominance due to the increasing requirement for simultaneous simulation of multiple GNSS signals and scenarios. Its capability to emulate various constellations under dynamic environmental conditions has made it essential for high-accuracy testing and validation.

The segment’s growth is being supported by advancements in digital signal processing and real-time synchronization technologies. Manufacturers are integrating higher channel counts and flexible configuration options to meet diverse application needs.

Adoption has been particularly strong in defense, autonomous systems, and research institutions where multipath and interference testing are critical The multichannel simulator’s adaptability and precision are expected to sustain its leadership, supported by growing investment in advanced navigation research and next-generation satellite communication systems.

The GPS receiver segment, holding 42.80% of the GNSS receiver category, has been leading the market due to its extensive deployment across consumer, industrial, and defense applications. Its broad compatibility, established infrastructure, and consistent performance have reinforced its market dominance.

Continuous modernization of GPS systems, including enhanced accuracy and anti-jamming capabilities, has further strengthened adoption. The segment benefits from widespread technological integration into smart devices, transportation systems, and industrial automation.

Ongoing development of GPS-based applications and advancements in dual-frequency reception are enhancing reliability and precision With continuous upgrades in satellite constellations and signal formats, GPS receivers are expected to maintain a significant role in GNSS simulation, supporting research, testing, and development activities across multiple end-use industries.

Over the period from 2020 to 2025, the historical analysis indicates a robust CAGR of 12%. This signifies a period of significant growth and expansion within the market. Factors contributing to this growth may include technological advancements, increased consumer demand, and favorable economic conditions.

Companies operating within this timeframe likely experienced strong revenue growth and may have made strategic investments to capitalize on emerging opportunities.

Looking ahead to the forecasted period from 2025 to 2035, market projections suggest a slightly lower CAGR of 9.6%. While still indicating growth, this rate is slightly moderated compared to the previous five years. Several factors may contribute to this adjustment, including market saturation, regulatory changes, or shifts in consumer preferences.

Despite the slightly lower growth rate, the market is still expected to expand over this period, presenting opportunities for companies to innovate and adapt to changing dynamics.

| Historical CAGR from 2020 to 2025 | 12% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 9.6% |

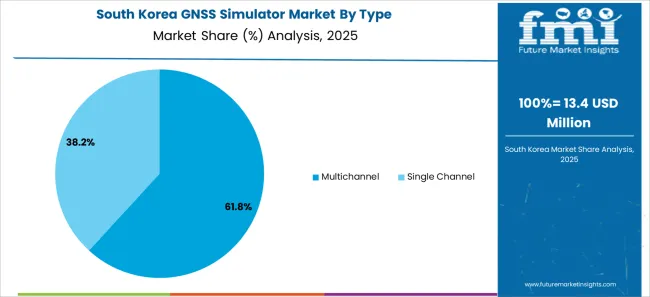

The provided table illustrates the top five countries in terms of revenue, with South Korea leading the list.

One major reason South Korea leads the GNSS simulator market is its advanced electronics and automotive industries, which heavily rely on precise navigation systems for products like smartphones and autonomous vehicles.

| Countries | The Forecast CAGRs from 2025 to 2035 |

|---|---|

| United States | 9.8% |

| South Korea | 11.2% |

| Japan | 10.8% |

| China | 9.9% |

| United Kingdom | 10.4% |

The forecasted CAGR for GNSS simulator usage in the United States is 9.8%. This high growth rate can be attributed to several factors. The United States is a global leader in technology and innovation, particularly in the aerospace, defense, and automotive industries.

As such, there is a significant demand for GNSS simulators in the country to support the development and testing of navigation systems for aircraft, unmanned aerial vehicles (UAVs), and autonomous vehicles.

The United States has a vast network of infrastructure, including highways, railways, and maritime routes, where precise positioning and navigation are essential for safety and efficiency. GNSS simulators play a crucial role in ensuring the reliability and accuracy of these navigation systems, driving their widespread adoption across various sectors in the country.

With a forecasted CAGR of 11.2%, South Korea demonstrates a strong demand for GNSS simulators. South Korea is known for its advanced technology ecosystem, particularly in the electronics and automotive industries.

In addition to consumer electronics and automotive applications, South Korea invests in emerging technologies such as smart cities and autonomous vehicles. GNSS simulators are essential for testing and validation purposes.

The government has been proactive in promoting the adoption of GNSS technology, further driving the GNSS simulators market growth in the country.

The forecasted CAGR for GNSS simulator usage is 10.8%, indicating a strong demand for these simulation tools. Japan is a global leader in various industries, including automotive, aerospace, and robotics, where GNSS technology plays a crucial role in navigation and positioning systems.

The aging population and mountainous terrain in Japan make precise positioning and navigation critical for transportation and disaster management applications, further driving the adoption of GNSS simulators in the country.

With a forecasted CAGR of 9.9%, China represents a significant market for GNSS simulators. As China is considered the largest automotive market and a growing technology innovation hub, it strongly demands GNSS simulation tools to support the development of autonomous vehicles, smart transportation systems, and precision agriculture applications.

The Belt and Road Initiative and space exploration efforts further contribute to the demand for GNSS simulators, crucial in satellite navigation and communication systems.

The United Kingdom has a forecasted CAGR of 10.4% for GNSS simulator usage, indicating a robust demand for these simulation tools in the country. The United Kingdom is a global leader in aerospace, defense, and maritime industries, where GNSS technology is essential for navigation, surveillance, and communication systems.

With the growing adoption of autonomous vehicles, drones, and unmanned aerial systems (UAS) in various sectors, including agriculture, infrastructure inspection, and emergency response, there is an increasing need for GNSS simulators to ensure the accuracy and reliability of these systems.

The commitment of the government to investing in space technology and satellite infrastructure further drives the demand for GNSS simulators in the country.

The below section shows the leading segment. Based on component, hardware type registers at 9.4% CAGR by 2035. Based on type, the single channel segment is anticipated to expand at 9.2% CAGR by 2035.

The demand for hardware components in GNSS simulators is driven by the increasing adoption of GNSS technology across various industries, including automotive, aerospace, and maritime.

The increasing adoption of GNSS technology in applications such as automotive navigation, precision agriculture, and surveying has created a demand for single-channel simulators that can accurately replicate GNSS signals for testing GNSS receivers and systems.

| Category | CAGR from 2025 to 2035 |

|---|---|

| Hardware | 9.4% |

| Single Channel | 9.2% |

The hardware type segment is forecasted to register a CAGR of 9.4% by 2035. This growth can be attributed to the increasing demand for physical components in GNSS simulators, such as signal generators, antennas, and receivers.

As the adoption of GNSS technology expands across various industries, there is a growing need for reliable and high-performance hardware components to support the development, testing, and validation of navigation systems.

The single channel segment is anticipated to expand at a CAGR of 9.2% by 2035. This growth is driven by the preference for single-channel GNSS simulators, which offer simplicity, cost-effectiveness, and ease of use compared to multi-channel simulators.

Single-channel simulators are commonly used to test and validate GNSS receivers and systems in applications such as automotive navigation, precision agriculture, and surveying. Advancements in single-channel simulation technology, such as improved accuracy and signal fidelity, further contribute to the growth of the segment.

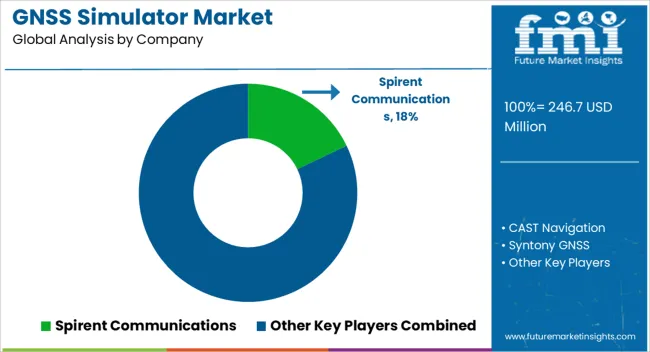

The competitive landscape of the GNSS simulator market is characterized by the presence of several key players, including leading companies that offer a wide range of GNSS simulation solutions tailored to various industries and applications, including automotive, aerospace, and telecommunications. Smaller players and niche providers offer specialized GNSS simulation products and services.

Competition in the market is driven by factors such as technological innovation, product performance, pricing, and customer service as companies strive to capture market share and meet the evolving needs of customers. Some of the key developments are:

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 225.1 million |

| Projected Market Valuation in 2035 | USD 565 million |

| Value-based CAGR 2025 to 2035 | 9.6% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD million |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East and Africa |

| Key Market Segments Covered | Component, Type, GNSS Receiver, Application, End-Use Industry, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | CAST Navigation; Syntony GNSS; Rohde & Schwarz; Keysight Technologies; VIAVI Solutions; Orolia; u-blox; Hexagon; Accord Software and System; Spirent Communications |

The global GNSS simulator market is estimated to be valued at USD 246.7 million in 2025.

The market size for the GNSS simulator market is projected to reach USD 617.0 million by 2035.

The GNSS simulator market is expected to grow at a 9.6% CAGR between 2025 and 2035.

The key product types in GNSS simulator market are hardware, software and services.

In terms of type, multichannel segment to command 59.4% share in the GNSS simulator market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

GNSS Chip Market Trends – Growth, Size & Forecast 2025 to 2035

GNSS IC Market - GPS & Navigation Growth 2025 to 2035

Automotive GNSS Chip Market Size and Share Forecast Outlook 2025 to 2035

Drone Simulator Market Size and Share Forecast Outlook 2025 to 2035

Solar Simulator Market Trends - Growth, Demand & Forecast 2025 to 2035

Gaming Simulators Market Size and Share Forecast Outlook 2025 to 2035

Dental Simulator Market Analysis - Growth, Trends & Forecast 2025 to 2035

Flight Simulator Market Report – Trends & Forecast 2020-2030

Driving Simulator Market

Satellite Simulator Market Size and Share Forecast Outlook 2025 to 2035

Vital Signs Simulator Market Size and Share Forecast Outlook 2025 to 2035

Ship Bridge Simulator Market

Power System Simulator Market Growth - Trends & Forecast 2025 to 2035

Automotive Crash Impact Simulator Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA