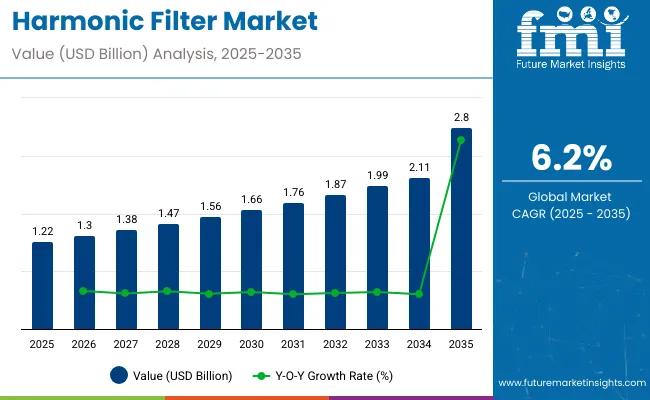

The global harmonic filter market is projected to grow from USD 1.22 billion in 2025 to USD 2.80 billion by 2035, reflecting a CAGR of 6.2%. This growth is fueled by escalating demand for improved power quality and mitigation of harmonic distortions caused primarily by non-linear loads-such as variable frequency drives, solar inverters, and industrial machinery. Industries that rely heavily on sensitive electronic equipment in sectors like data centers, manufacturing, healthcare, and utilities are driving this trend.

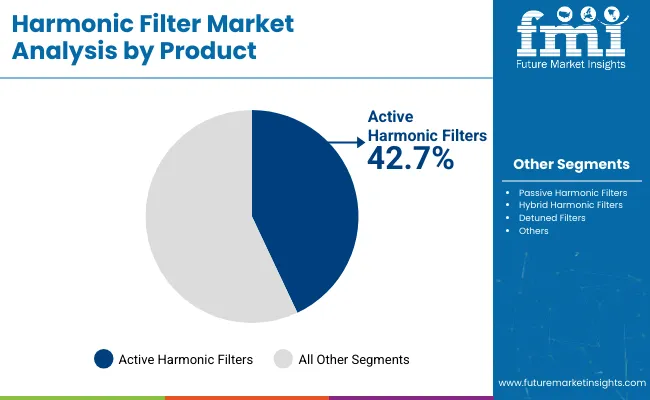

Advancements in filter technology are shaping market dynamics. Active harmonic filters are rapidly gaining market share due to their dynamic response and superior ability to eliminate a broader range of harmonic frequencies. In industrial settings, they offer real-time compensation to improve energy efficiency and maintain equipment reliability. In fact, passive filters remain the most widely used type, but active filters are set to post higher growth during the forecast period.

| Attributes | Description |

|---|---|

| Estimated Harmonic Filter Market Size (2025E) | USD 1.22 billion |

| Projected Harmonic Filter Market Value (2035F) | USD 2.80 billion |

| Value-based CAGR (2025 to 2035) | 6.2% |

In 2024, a key development was launched in Asia-Pacific, where ABB India introduced the ACH180, a compact drive with built-in harmonic mitigation aimed at HVAC-R systems. This launch addressed space constraints and rising demand for cleaner power in India’s fast-expanding industrial hubs. In parallel, manufacturers like Siemens and Schneider Electric continue to enhance filter designs through modular builds and IoT-enabled monitoring, enabling predictive maintenance and smarter grid integration.

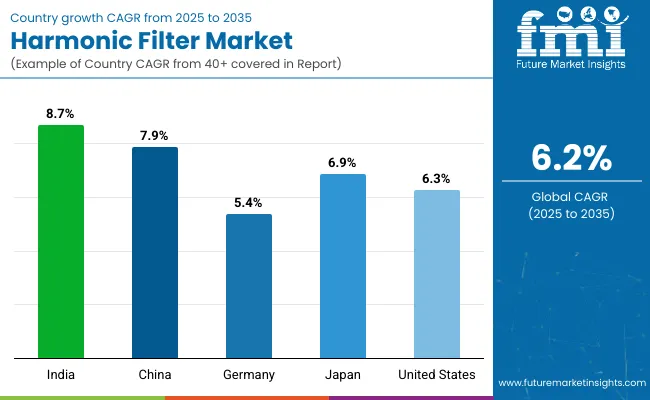

Regional trends vary across markets. North America holds the largest share, backed by significant data center density, stringent regulations, and industrial infrastructure. Europe follows closely, driven by renewable energy integration and grid harmonization standards, especially under EU climate policy frameworks. Meanwhile, Asia-Pacific is set to record the fastest growth, led by investments in power infrastructure, industrial expansion, and accelerating urbanization in countries like China and India.

With continuous innovation, especially in active and hybrid filter systems, adoption of IoT diagnostics, and mounting regulatory pressure for cleaner power, the harmonic filter market is poised for robust expansion through 2035.

The global trade of harmonic filters is driven by increasing demand from industries such as power generation, manufacturing, and utilities aiming to improve power quality and reduce electrical disturbances. As industries expand and adopt more electronic equipment, the need for harmonic mitigation solutions is growing, fueling cross-border trade of various harmonic filter types including passive, active, and hybrid filters.

Government regulations in the harmonic filters market primarily focus on ensuring electrical safety, power quality standards, and environmental compliance. As harmonic filters help in reducing electrical distortions, regulatory bodies emphasize their role in maintaining stable and efficient power systems.

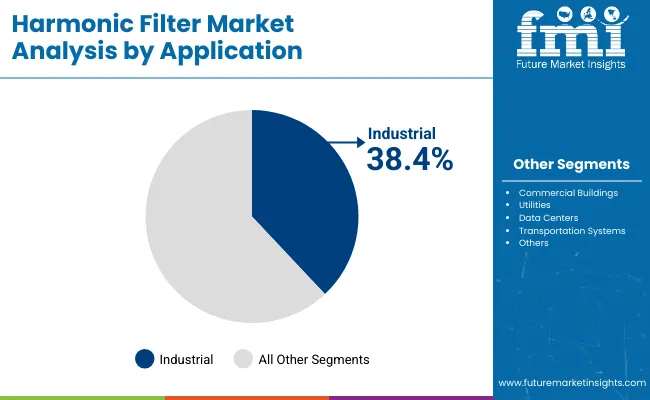

The harmonic filter market is expanding rapidly due to growing power-quality needs in automation and industrial sectors. Between 2025 and 2035, active harmonic filters are predicted to secure around 42.7% market share, while industrial applications are expected to account for 38.4% share. Strong regulatory support and technological innovation are key growth drivers.

Active harmonic filters are projected to claim approximately 42.7% share of the global harmonic filter market between 2025 and 2035. These filters are favored for their ability to dynamically correct harmonic distortion, making them essential in environments with variable-frequency drives and sensitive electronics. Unlike passive counterparts, active filters can quickly adapt to changing load conditions and deliver precise compensation, improving power quality.

Their increased adoption in data centers, smart manufacturing facilities, and modern electric grids is driven by the rising digitization and regulation of harmonic standards. Manufacturers such as ABB Ltd., Siemens, Eaton, and Schneider Electric are enhancing their active filter portfolios to meet demand.

Advanced power electronics, AI-based control algorithms, and compact modular designs have improved the efficiency and reliability of these systems. As global electrical networks evolve toward renewable integration and digitalization, active harmonic filters will remain essential tools for ensuring stable and efficient power-supporting their sustained market dominance through 2035.

The industrial application segment is anticipated to contribute around 38.4% of global revenue from 2025 through 2035. Industrial facilities-especially in manufacturing, metal processing, automotive, and oil & gas-generate significant harmonic distortion due to the widespread use of variable-frequency drives and heavy machinery. These harmonics can damage equipment, reduce efficiency, and increase operational costs.

Harmonic filters are being increasingly deployed to mitigate these issues and comply with power-quality regulations. Global companies such as ABB Ltd., Siemens, Emerson, Eaton, and Schneider Electric are addressing this need through customized filter solutions designed for industrial environments.

Stringent energy-efficiency policies and the rising cost of downtime drive filter integration in new facilities and retrofit projects. As industrial automation and electrification expand, dependence on harmonic filters within this segment will continue to grow, anchoring the market’s long-term revenue leadership.

The global market is growing at a steady pace due to the various factors such as growing need for power quality control in diversified industries. All industries focus on high-capacity filters as a safety measure to secure sensitive devices from voltage fluctuations and enhance operational efficacy.

Commercial structures, such as office buildings and shopping centers, require cost-efficient and space-saving filters to provide energy efficiency. Renewable power plants require specialized filters that can manage varying power loads in solar and wind power systems.

Data centers emphasize low-loss filters to reduce power disturbance and ensure continuous operations. Utility companies need massive harmonic mitigation systems to stabilize the grid. Increasing use of variable frequency drives (VFDs), automation technology, and energy-saving solutions is fueling growth.

Conformance with IEEE, IEC, and other regulatory requirements, coupled with evolution in passive and active filtering technologies, is influencing purchase decisions across segments.

| Company | Contract Value (USD million) |

|---|---|

| ABB Ltd. | Approximately USD 20 |

| Schneider Electric | Approximately USD 35 |

The rising adoption of industrial automation, smart grids, and energy-efficient commercial buildings is driving demand for these filters to maintain power quality. Industries integrating robotics, IoT, and CNC machines face harmonic distortions, necessitating power stabilization solutions. Governments worldwide are funding smart manufacturing and grid modernization, boosting the adoption of filters.

The commercial sector, reliant on stable power for HVAC and digital systems, also embraces these solutions. However, high initial costs deter SMEs from investing, as budget constraints and long ROI periods make power conditioning a lower priority. Despite this, growing regulations and renewable energy integration will continue driving expansion.

Harmonic Filters Market faces some risks, such as technological, regulatory, and economic threats. One significant threat is the fast-moving technology on the power quality solutions.

Strict Implementation of Regulatory Compliance is also a serious problem. Many countries have adopted strict standards on power quality, and failing to comply with them can lead to penalties or reduced industry access. Businesses have to spend their money on constant research to make sure that their products comply with shifting electrical safety and efficiency regulations.

Uncertainties in raw material costs, such as capacitors, inductors, and resistors, are another aspect of financial risk. The rise of expenses all of a sudden can either decrease profit margins or compel enterprises to make adjustments in pricing, thus affecting the demand. The issue of a supply chain, mainly in semiconductor and electrical parts fabrication, is yet another factor that worsens this risk.

Additionally, the competition from complementary products such as active filters and power factor correction devices can mostly limit the development of passive filters. Manufacturers should against this by improving the efficiency, durability as well as reduce the cost of their products more than competitors.

Above all, installation and maintenance are the two main hurdles in practicals. The end-users might think twice before spending on these filters for their perceived difficulty and the long-term upkeep charge. Elaborating on after-sales service and providing solutions that are simply integrated can be of value here.

Tier 1 vendors are large, multinational corporations with extensive resources and a significant global presence. These companies offer a comprehensive range of solutions catering to various industries and applications. Their strong research and development capabilities enable them to innovate continuously, maintaining a competitive edge. Additionally, their robust distribution networks and strategic partnerships allow them to serve a broad customer base effectively.

Tier 2 vendors are medium-sized companies that operate on a regional or national level. While they may not have the extensive global reach of Tier 1 companies, they possess substantial industry knowledge and cater to specific regions or industries. These companies often focus on niche industries, providing tailored solutions that meet the unique requirements of their clients. Their agility allows them to adapt quickly to industry changes and customer needs, offering competitive pricing and personalized services.

Tier 3 vendors are typically smaller firms or startups that serve local industries or specialize in particular segments. These companies may have limited resources but often bring innovative approaches and specialized expertise. Their focus on specific applications or customer segments allows them to carve out unique positions within the industry. Despite their size, Tier 3 vendors play a crucial role in driving innovation and addressing specific gaps that larger companies might overlook.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 8.7% |

| China | 7.9% |

| Germany | 5.4% |

| Japan | 6.9% |

| United States | 6.3% |

India's "Make in India" policy has boosted domestic manufacturing across sectors, including Electrical and Power Management solutions. The policy framework incentivizes local manufacturing via tax benefits, financial incentives, and relaxed regulatory norms, enhancing self-sufficiency and reducing dependence on imported power-quality equipment.

Also, these government plans have contributed to the local production of filters, which are essential equipment for increasing power quality in the industrial and commercial sectors.

With the recent INR 76,000 crore allocation for semiconductor and electronics manufacturing by the Ministry of Heavy Industries, the entire inclusive process ensures that adequate components of the filter are locally available, thereby indirectly strengthening the industry.

Moreover, the PLI scheme has drawn more than 100 enterprises to set up production facilities in India, thus aiding cost-effective and innovative power quality solutions. The harmonic filter market in India grows at a cumulative annual growth rate (CAGR) of 8.7% during the forecast period, according to FMI.

| Key Drivers | Details |

|---|---|

| USA Manufacturing Growth | Local production of these filters is encouraged through government policies. |

| Increasing Industrialization | The demand for power quality solutions is driven by rapid urbanization and growth in manufacturing sectors. |

China leads the world in renewable energy generation, sinking vast investments into solar, wind, and hydropower projects. With the inclusion of such energy sources onto the national grid, stable power quality becomes harder to maintain. Harmonic distortions are produced by renewable energy systems in which inverters and power electronics are in widespread use, thus requiring widespread applications to enhance energy efficiency and voltage stability.

The Chinese government has implemented grid stabilization policies that mandate energy producers to add power conditioning solutions such as harmonic filters. These regulations have pushed their adoption, with China playing a leadership role in the global harmonic filter market. China is expected to expand at 7.9% CAGR during forecast period, according to FMI.

| Key Drivers | Details |

|---|---|

| Grid Stabilization Policies | Energy producers are required to adopt power conditioning solutions due to government mandates. |

| Expansion of Smart Grids | Growing demand for harmonic filtering systems in advanced power infrastructure. |

Harmonic filters are being adopted across the industrial and commercial space in Germany due to the focus on energy efficiency and power quality management. The nation's ambitious push to shift to renewable energy sources has left a gap in power stability, as variable energy sources like wind and solar introduce harmonic distortions into the grid.

Stringent regulatory requirements for addressing power quality issues have been established by the German government, which mandates industries to install harmonic filtering systems owing to efficiency standards. Moreover, owing to Industry 4.0 and smart manufacturing, there is increasing demand for power quality solutions for automated production facilities. The harmonic filter market in Germany is set to witness a CAGR of 5.4% during the forecast period, according to FMI.

| Key Drivers | Details |

|---|---|

| Energy Transition Initiatives | A general move to renewables creates the extra need grid smoothing. |

| Regulatory Compliance | Industries are required to implement solutions abiding strict power regulations. |

The adoption of these filters in Japan has been predominantly seen across industries such as electronics, automotive, and industrial automation, owing to the country's focus on energy efficiency and advanced power management systems. The growth of clean energy has led to an increase in grid integration of solar and wind power, greatly influencing the need for grid stability and causing an increase in the demand for filtering solutions.

To facilitate energy-efficient industrial activities, the Japanese government has undertaken to boost financial incentives for companies adopting advanced electrical load management technologies. These filters are also in demand due to the growing deployment of electric vehicle (EV) charging infrastructure, where EV chargers require power quality stabilization to avoid electrical disturbance. The Japanese harmonic filter market is expected to grow at a CAGR of 6.9%. during the forecast period, according to FMI.

| Key Drivers | Details |

|---|---|

| Integrating Renewable Energy | As solar and wind power expand, harmonic filters are necessary to ensure grid reliability. |

| Expansion of EV Infrastructure | Charging stations are a major area where harmonic filters are required to maintain stable power delivery. |

The harmonic filter market has grown as industries make power quality, energy efficiency, and regulatory compliance priorities. Increased adoption of variable frequency drives (VFDs), renewable energy systems and industrial automation has brought along an increased demand for active, passive and hybrid harmonic filters which minimize power distortions.

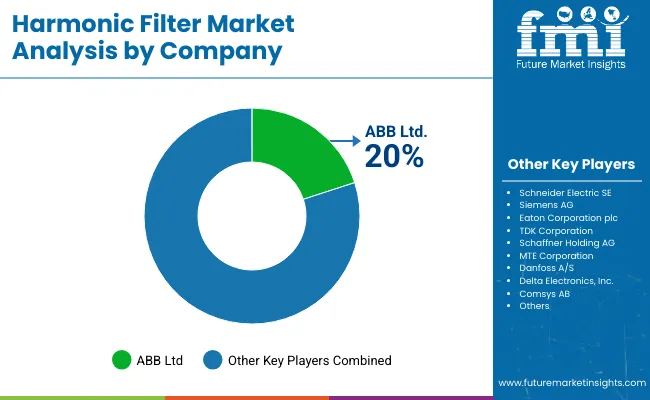

The major players include ABB, Schneider Electric, Siemens, Eaton, and TDK Corporation, who are well known for their high-performance power filtering solutions in the industrial, commercial, and utility markets. Emerging companies are focusing on building cost-effective, modular, and AI-driven adaptive filtering technologies, thus intensifying competition.

Market driving forces thus include real-time harmonic compensation, compact filter designs for easy installation, and monitoring systems through IoT. All governmental mandates enforce stringent power quality; hence, companies investing in smart grid-compatible and energy-efficient filtering solutions increase their reliability and compliance.

Strategic factors aligning the industry include customization capabilities, integration into digital power management systems, and solutions for specific applications. This will put vendors achieving scalable, high-performance, and low-cost harmonic mitigation technologies in a competitive edge in the harmonic filter market.

Recent Developments

A market leader in industrial-grade active and hybrid filters, ABB focuses on real-time power correction and smart grid integration.

The Company offers solutions for predictive maintenance and energy optimization in its harmonic filters, which integrate IOT-based monitoring solutions.

Develops grid-compatible harmonic filtering solutions, being a leader in renewable energy and industrial automation industries.

Strengthen its market position with modular and customizable filter solutions for heavy industries, commercial buildings, and data centers.

A leader in the production of passive harmonic filters, with experience in electronic component miniaturization and high-frequency applications.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 1.22 Billion |

| Projected Market Size (2035) | USD 2.80 Billion |

| CAGR (2025 to 2035) | 6.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and thousand units for volume |

| Products Analyzed (Segment 1) | Passive Harmonic Filters, Active Harmonic Filters, Hybrid Harmonic Filters, Detuned Filters, Others |

| Applications Analyzed (Segment 2) | Industrial Settings, Commercial Buildings, Utilities, Data Centers, Transportation Systems |

| Regions Covered | North America; Latin America; East Asia; South Asia & Pacific; Western Europe; Eastern Europe; Middle East & Africa; Europe |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, France, United Kingdom, Italy, Spain, China, India, Japan, South Korea, Australia, GCC Countries, South Africa |

| Key Players influencing the Harmonic Filter Market | ABB Ltd., Schneider Electric SE, Siemens AG, Emerson Electric Co, Eaton Corporation, Danfoss A/S, Schaffner Holding AG, TDK Corporation, Comsys AB, MTE Corporation |

| Additional Attributes | Market size in dollar sales and CAGR, share by filter type (active, passive, hybrid), application trends (industrial, commercial, utilities), regional dollar sales, competitive dollar sales, regulatory impact, power quality trends, demand in emerging markets. |

In terms of Product, the segment is divided into Passive Harmonic Filters, Active Harmonic Filters, Hybrid Harmonic Filters, Detuned Filters and Others.

In terms of Application, the segment is segregated into Industrial Settings, Commercial Buildings, Utilities, Data Centers, and Transportation Systems.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

The Harmonic Filter industry is projected to witness CAGR of 6.2% between 2025 and 2035.

The Harmonic Filter industry stood at USD 1.22 billion in 2025.

The Harmonic Filter industry is anticipated to reach USD 2.80 billion by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 7.9% in the assessment period.

The key players operating in the Global marker Industry are ABB Ltd., Schneider Electric SE, Siemens AG, Eaton Corporation plc, TDK Corporation, Schaffner Holding AG, MTE Corporation, Danfoss A/S, Delta Electronics, Inc., and Comsys AB.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Voltage, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Voltage, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Modality, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Modality, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Voltage, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Voltage, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Modality, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Modality, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Voltage, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Voltage, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Modality, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Modality, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 34: Western Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Voltage, 2018 to 2033

Table 36: Western Europe Market Volume (Units) Forecast by Voltage, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Modality, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Modality, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Voltage, 2018 to 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by Voltage, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Modality, 2018 to 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by Modality, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Type, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Voltage, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Voltage, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Modality, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Units) Forecast by Modality, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 64: East Asia Market Volume (Units) Forecast by Type, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Voltage, 2018 to 2033

Table 66: East Asia Market Volume (Units) Forecast by Voltage, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Modality, 2018 to 2033

Table 68: East Asia Market Volume (Units) Forecast by Modality, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 70: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Voltage, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by Voltage, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Modality, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by Modality, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Voltage, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Modality, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Voltage, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Voltage, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Voltage, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Voltage, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Modality, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Modality, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Modality, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Modality, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 26: Global Market Attractiveness by Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Voltage, 2023 to 2033

Figure 28: Global Market Attractiveness by Modality, 2023 to 2033

Figure 29: Global Market Attractiveness by Application, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Voltage, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Modality, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Voltage, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Voltage, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Voltage, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Voltage, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Modality, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Modality, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Modality, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Modality, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 56: North America Market Attractiveness by Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Voltage, 2023 to 2033

Figure 58: North America Market Attractiveness by Modality, 2023 to 2033

Figure 59: North America Market Attractiveness by Application, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Voltage, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Modality, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Voltage, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Voltage, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Voltage, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Voltage, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Modality, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Modality, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Modality, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Modality, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Voltage, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Modality, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Voltage, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Modality, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Voltage, 2018 to 2033

Figure 105: Western Europe Market Volume (Units) Analysis by Voltage, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Voltage, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Voltage, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Modality, 2018 to 2033

Figure 109: Western Europe Market Volume (Units) Analysis by Modality, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Modality, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Modality, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 113: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Voltage, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Modality, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Voltage, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Modality, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Voltage, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by Voltage, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Voltage, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Voltage, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Modality, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by Modality, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Modality, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Modality, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Voltage, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Modality, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Voltage, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Modality, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Voltage, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Voltage, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Voltage, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Voltage, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Modality, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by Modality, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Modality, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Modality, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Voltage, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Modality, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Voltage, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Modality, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 191: East Asia Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Voltage, 2018 to 2033

Figure 195: East Asia Market Volume (Units) Analysis by Voltage, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Voltage, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Voltage, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Modality, 2018 to 2033

Figure 199: East Asia Market Volume (Units) Analysis by Modality, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Modality, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Modality, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 203: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Voltage, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Modality, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Voltage, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Modality, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Voltage, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Voltage, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Voltage, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Voltage, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Modality, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Modality, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Modality, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Modality, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Voltage, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Modality, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Filter Integrity Test Systems Market Size and Share Forecast Outlook 2025 to 2035

Filter Coatings Market Size and Share Forecast Outlook 2025 to 2035

Industry Share Analysis for Filter Paper Companies

Filter Paper Market Trends – Growth, Demand & Forecast through 2035

Filter Bag Market Insights - Growth & Demand 2024 to 2034

RF Filters Market Size and Share Forecast Outlook 2025 to 2035

SAW Filter Market Size and Share Forecast Outlook 2025 to 2035

Air Filters Market Growth - Trends & Forecast 2025 to 2035

Global Tea Filter Paper Market Analysis – Growth & Forecast 2024-2034

Spin Filters Market Size and Share Forecast Outlook 2025 to 2035

Wine Filtering Machine Market Expansion - Filtration & Winemaking Technology 2025 to 2035

Beer Filter System Market insights by Equipment Type, Type, Filtration Process, Application, and Region 2025 to 2035

EMI, Filter Kits Market

Coffee Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Fabric Filter System Market Size & Forecast 2025 to 2035

Market Share Distribution Among Coffee Filter Paper Manufacturers

TC-SAW Filter Market

Pleated Filters Market Size and Share Forecast Outlook 2025 to 2035

Tunable Filter Market Report – Growth & Forecast 2017-2027

Beverage Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA