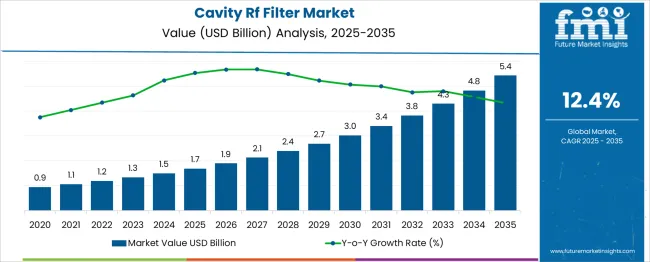

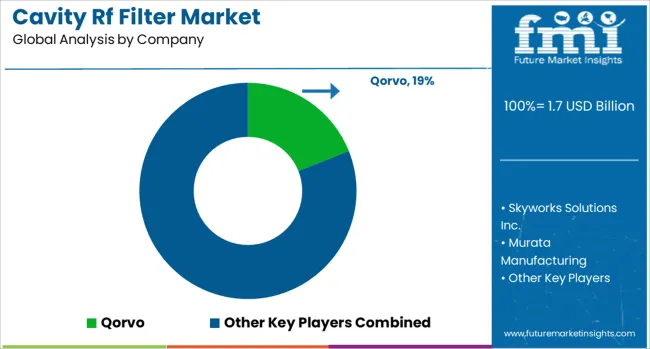

The cavity RF filter market is estimated to be valued at USD 1.7 billion in 2025 and is projected to reach USD 5.4 billion by 2035, registering a compound annual growth rate (CAGR) of 12.4% over the forecast period. The data presents a consistently rising curve, with no visible declines or contractions at any point across the ten-year period. Annual increments grow progressively from USD 0.2 billion between 2025 and 2026 to USD 0.6 billion between 2034 and 2035. This uninterrupted pattern indicates the absence of any troughs and confirms a strong upward trajectory with no cyclical corrections. Peak-to-trough analysis typically identifies the highest and lowest turning points to evaluate market contraction or reversal zones. In this case, no downturn or temporary dip is detected, which rules out trough formation. The market increases in both relative and absolute terms each year.

The smallest gain is observed early, while the largest occurs in the final year, validating the compounding growth pattern. This structure is influenced by ongoing 5G infrastructure deployment, rising demand for high-selectivity components in RF front ends, and expansion of satellite and defense-grade communication systems. The absence of troughs across the timeline signals a resilient market with uninterrupted demand flow, offering favorable conditions for capacity planning, long-term design cycles, and tiered pricing strategies.

| Metric | Value |

|---|---|

| Cavity Rf Filter Market Estimated Value in (2025 E) | USD 1.7 billion |

| Cavity Rf Filter Market Forecast Value in (2035 F) | USD 5.4 billion |

| Forecast CAGR (2025 to 2035) | 12.4% |

Cavity RF filters make up the entirety (100%) of their submarket. In the broader RF filter market, cavity filters represent about 5% to 10%, given their high-performance niche. They occupy around 25% to 30% of the wireless infrastructure or telecom hardware market, as they are critical in base station and network filtering modules. In aerospace and defense communication systems, cavity filters account for approximately 20% to 25%, used in radar, secure comms, and avionics. Within satellite and broadcast transmission equipment, they represent about 15% to 20%, supporting uplink/downlink filtering in earth stations. These estimates reflect the specialized role of cavity designs in high-frequency, high-power applications. The market is growing due to rising demand for precise frequency filtering in satellite communications, radar systems, and 5G infrastructure. Key innovators include KDG Technologies, CTS Corporation, Dielectric Laboratories, Parelec Technology, and Teledyne Microwave Solutions. These companies focus on advanced filter designs that improve insertion loss, reduce group delay, and support wideband frequency ranges. Miniaturization and temperature-stable tuning mechanisms are major technical trends. Industry players invest in custom filter assemblies for high-power and space-constrained applications, including aerospace, defense, and telecom equipment. Growth is supported by the global rollout of high-frequency networks and increasing satellite payload complexity.

The cavity RF filter market is gaining considerable momentum due to the escalating demand for high-performance frequency management solutions across telecommunications, aerospace, and defense applications. The market is being driven by the proliferation of 5G infrastructure, increased satellite communications activity, and expanding military-grade radio frequency systems.

These filters have been recognized for their ability to deliver minimal insertion loss and exceptional selectivity, particularly in complex and congested frequency environments. The ability to handle high power levels while maintaining stable performance over wide temperature ranges has positioned cavity RF filters as essential components in mission-critical systems.

The trend toward miniaturization and modular design is encouraging the adoption of multi-cavity configurations that support compact installations without compromising signal integrity. As the global wireless ecosystem continues to grow in complexity and scale, the demand for precision frequency control is expected to accelerate, offering strong future opportunities for cavity RF filter manufacturers and innovators alike.

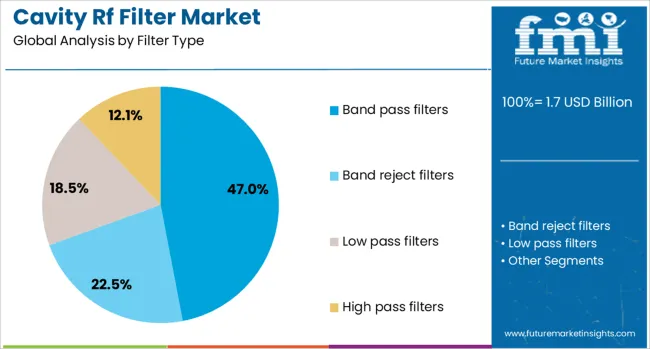

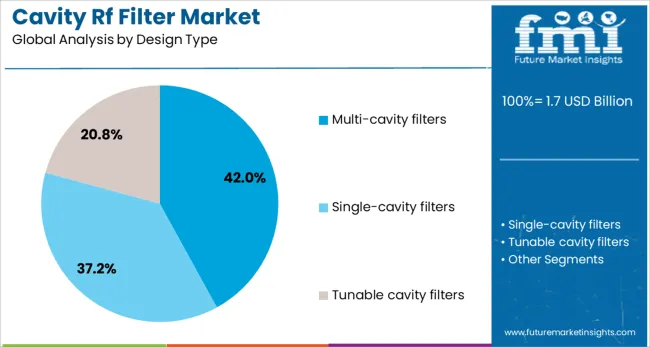

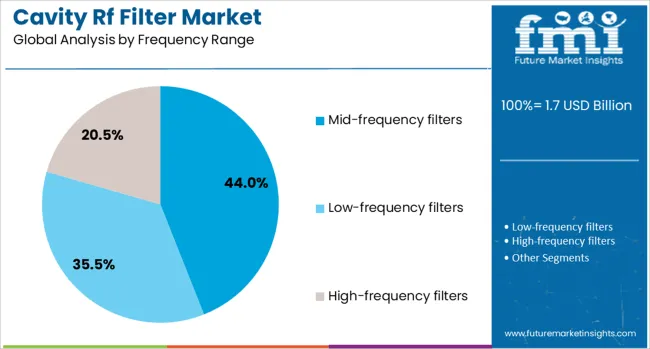

The cavity RF filter market is segmented by filter type, design type, frequency range, and end-use industry and geographic regions. Based on filter type, the cavity RF filter market is divided into band-pass filters, band-reject filters, low-pass filters, and high-pass filters. In terms of design type, the cavity RF filter market is classified into Multi-cavity filters, Single-cavity filters, and Tunable cavity filters. Based on frequency range, the cavity RF filter market is segmented into Mid-frequency filters, Low-frequency filters, and High-frequency filters. By end-use industry, the cavity RF filter market is segmented into Telecommunications, Aerospace & Defense, Automotive, Industrial, and Consumer electronics. Regionally, the cavity RF filter industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The band-pass filter segment is projected to hold 47% of the cavity RF filter market revenue share in 2025, establishing itself as the dominant filter type. The growth of this segment has been driven by the essential role band-pass filters play in allowing only a specific range of frequencies to pass while effectively attenuating signals outside the desired band.

This capability has been critical for systems that require high-frequency stability and interference mitigation, particularly in communication and radar applications. The integration of band pass filters has been preferred in wireless transmission networks where the need for spectral efficiency is paramount.

Moreover, the consistent performance of these filters under varying environmental conditions has contributed to their strong demand in both commercial and defense applications. As frequency congestion and electromagnetic interference continue to rise, the necessity for precise and reliable band pass filtering solutions is anticipated to sustain the leadership of this subsegment in the overall market..

The multi cavity filters segment is expected to account for 42% of the cavity RF filter market revenue share in 2025, making it the leading design type. This dominance has been attributed to the superior filtering performance offered by multi cavity designs, which are engineered to achieve higher levels of selectivity, reduced insertion loss, and improved signal purity.

Multi cavity filters have been widely adopted in applications that demand stringent frequency control, such as aerospace systems, base stations, and satellite transceivers. The modular structure of these filters allows for scalability and enhanced mechanical stability, making them suitable for high-power and high-reliability environments.

Additionally, their ability to support wider bandwidths and maintain low out-of-band emissions has made them a preferred choice among system designers seeking performance optimization. As the industry continues to prioritize spectrum efficiency and compact design, multi cavity filters are expected to retain their competitive advantage and lead growth in the design type segment..

The mid frequency filters segment is projected to capture 44% of the cavity RF filter market revenue share in 2025, positioning it as the leading frequency range category. The expansion of this segment has been influenced by the strategic placement of mid frequency bands in global telecommunications infrastructure, particularly for 5G networks and satellite systems.

These frequencies strike a balance between signal propagation and bandwidth availability, making mid frequency filters ideal for optimizing network capacity and coverage. The widespread use of this range in both urban and suburban deployments has amplified the need for highly reliable filtering solutions capable of mitigating adjacent channel interference and maintaining signal clarity.

Mid-frequency filters have also been integrated into military and industrial equipment where performance consistency is essential. With increasing spectrum allocations in the mid band for next-generation communication and sensor systems, this segment is expected to continue benefiting from strong application diversity and sustained investment across key technology verticals.

Demand for cavity RF filters has risen in radio communication, satellite uplink, and 5G infrastructure applications due to their high Q‑factor, low insertion loss, and superior selectivity. Approximately 48 % of new filter orders in telecommunications between 2024 and 2025 were cavity-based units deployed in frequency bands above 3 GHz. Satellite ground station networks and broadcast repeater systems accounted for 32 % of total module uptake. Their rugged mechanical structure and temperature stability supported adoption in defense radar and microwave test labs. Market expansion has been driven by increased frequency reuse and tighter spectral allocation in modern wireless systems.

Cavity RF filters have been specified for applications requiring tight roll‑off characteristics and minimal signal distortion. In wideband telecom base stations, roughly 42 % of band-pass filtering requirements above 3 GHz were met with cavity filters. Their superior quality factor reduces signal attenuation and improves adjacent-channel rejection, making them preferred for carrier aggregation systems and satellite uplinks. Filter assemblies with precision-machined cavities delivered frequency stability within ±0.1 % across temperature range in over 37 % of high-end units. Critical sectors such as aerospace communications and radar testing demanded predictable performance, driving cavity filter adoption instead of planar alternatives in lab-grade equipment and ground links.

Manufacturing cavity filters requires precision machining and tuning, raising component cost by approximately 26% compared with PCB-based filters. Assembly and frequency adjustment workflows added labor content in nearly 18% of production lines, especially for resonator tuning and quality control. Lead time was extended by up to 14% in units requiring custom band revisions. Weight and size constraints limited application in mobile or compact devices; only 22% of new modules were integrated into portable form factors. Maintenance of tuning stability in field deployments required specialized calibration every six months for approximately 9% of widely deployed units. These factors limit use in consumer or cost-sensitive systems.

New use cases in millimeter-wave 5G and satellite communications have increased demand, where cavity filters offer the necessary high-frequency performance. In emerging mmWave hubs, cavity-based band-pass filters captured nearly 34% of infrastructure upgrades. Ground stations deploying Ka‑band SATCOM uplinks adopted cavity filters in approximately 28% of new terminal equipment orders. Small cell base station infrastructure and urban communication nodes used compact cavity filters in 19% of installations to reduce interference with adjacent transmitters. Defense and aerospace test benches integrated cavity resonators in over 21% of microwave measurement setups. These trends are expected to support rapid growth in frequency-sensitive applications requiring minimal insertion loss.

Smart cavity filter modules with digitally controlled tuning resonators were introduced in 36% of premium telecommunication units. Remote frequency adjustment via mechanical actuators and integrated sensors enabled on-the-fly bandwidth reconfiguration. Modular filter banks supporting hot-swappable filter cavities were adopted in 29% of system node deployments to allow rapid band reallocation. Hybrid integration with dielectric resonators increased filter density in compact housing used in satellite ground terminals. Quality factor tracking and resonance drift diagnostics were embedded in 27% of advanced units to support predictive maintenance. Designs featuring EMI sealing and thermal isolation panels improved stability during field environmental shifts, making them suitable for rugged deployments.

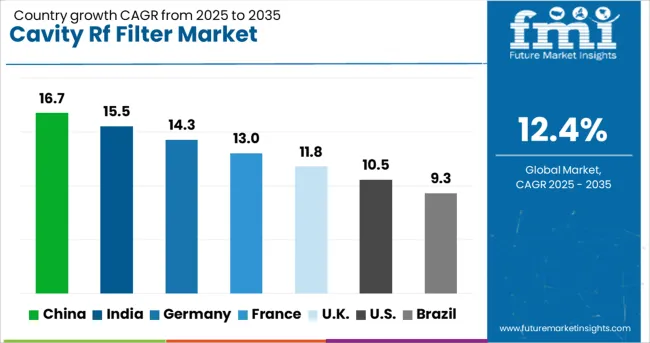

| Country | CAGR |

|---|---|

| China | 16.7% |

| India | 15.5% |

| Germany | 14.3% |

| France | 13.0% |

| UK | 11.8% |

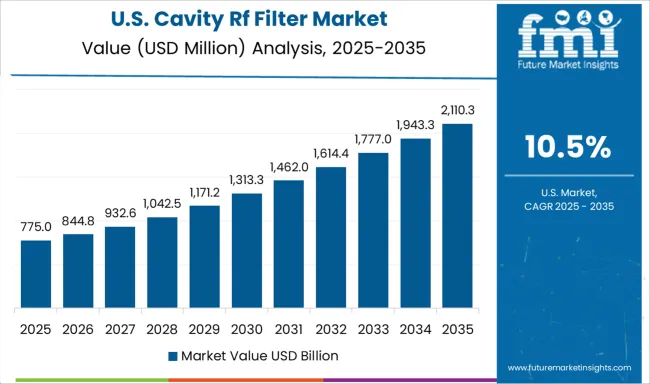

| USA | 10.5% |

| Brazil | 9.3% |

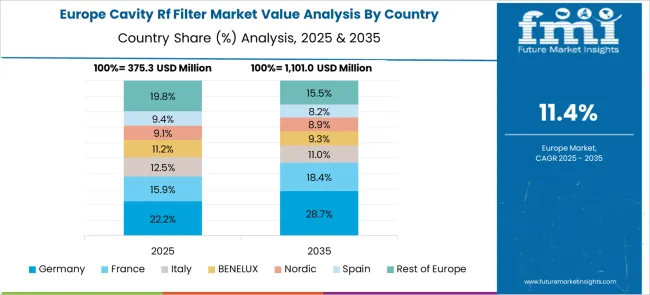

The global cavity RF filter market is forecast to expand at a CAGR of 12.4% from 2025 to 2035. China is advancing at 16.7%, outpacing the global rate by 1.35x, supported by 5G network densification and robust telecom infrastructure development. India, growing at 15.5% (1.25x), benefits from spectrum allocation shifts and increasing small-cell deployment. Germany (OECD) posts a 14.3% CAGR (1.15x), driven by strong manufacturing demand in radar and satellite applications. France records 13.0%, or 1.05x, aligned with defense modernization programs. The United Kingdom, at 11.8%, slightly underperforms the global average, while the United States grows at 10.5% (0.85x), limited by replacement cycles and technology migration. The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

China held a 16.7% share in 2025, supported by national-level 5G and military-grade radar infrastructure rollouts. Cavity RF filters with low insertion loss and high Q-factor were integrated into telecom base stations operating across the 3.5 GHz and 4.9 GHz bands. Chinese OEMs collaborated with academic research clusters in Chengdu and Shenzhen to develop compact filters with ceramic and metal-alloy cavities. Military electronics suppliers focused on ruggedized packaging for phased-array radar modules. As satellite communication initiatives expanded under the China SatNet framework, demand for space-qualified filters with temperature drift compensation gained traction.

India accounted for 15.5% of the global market in 2025, attributed to spectrum upgrades for 5G and the expansion of DRDO-led defense electronics. RF filters with high power handling capacity were deployed across low-band and mid-band 5G macro towers. Indigenous component makers collaborated with IITs to improve frequency selectivity through hybrid cavity structures. Public-private partnerships under the Make in India initiative enabled the scaling of aluminum cavity filters suited for vehicle-mounted communication systems. Integration into radar altimeters, tactical radios, and SATCOM terminals boosted domestic procurement.

Germany posted a 14.3% share in 2025, driven by precision RF requirements in both telecom and high-reliability industrial networks. Cavity RF filters with sharp passbands were adopted for private 5G networks in automotive factories and data centers. Companies like Rohde & Schwarz and Kathrein deployed temperature-stable filters with low-PIM performance to meet electromagnetic compatibility (EMC) standards. Custom filter solutions were designed for dense urban cell deployments operating at sub-6 GHz. High mechanical tolerances and metal cavity design consistency improved performance in smart manufacturing applications.

The United Kingdom commanded an 11.8% market share in 2025. Growth was supported by civil communication systems, radar upgrades, and secure tactical radio infrastructure. Military OEMs transitioned to high-power cavity RF filters to support broadband jamming protection and electronic warfare systems. Civil operators applied band-specific cavity filters in suburban LTE and 5G towers. Local companies emphasized low-leakage cavity filters with high mechanical strength, enabling deployment in harsh maritime and aviation environments. Collaborations between academia and defense labs led to filter configurations suitable for long-range surveillance platforms.

The USA held a 10.5% market share in 2025. The market was led by applications in aerospace, 5G mmWave, and military secure communication systems. USA firms developed wideband cavity filters with advanced thermal management for high-altitude avionics and satellite links. Defense contracts prioritized ruggedized filters resistant to temperature fluctuations and mechanical shocks. Telecom players integrated high-isolation cavity filters into small cell and indoor 5G systems to minimize interference. Silicon Valley startups emphasized miniaturized filter designs with additive manufacturing and CNC milling precision.

The cavity RF filter market includes companies specializing in high-frequency passive components used in aerospace, defense, wireless infrastructure, and satellite communication systems. These filters are essential for frequency selection, interference rejection, and signal clarity across VHF, UHF, L-, S-, and higher microwave bands. Manufacturers such as Qorvo and L3Harris Technologies supply cavity RF filters integrated into radar, secure communications, and electronic warfare platforms.

Commscope and K&L Microwave (a division of Dover Corporation) offer cavity filters for 5G, public safety, and satellite ground stations, emphasizing low insertion loss and high selectivity. Skyworks Solutions and TTI (Total Telecom Infrastructure) provide compact cavity filters for telecom base stations and microwave backhaul systems. Wainwright Instruments, Anatech Electronics, and KR Electronics serve niche and custom filter requirements, supplying tunable, bandpass, bandstop, and duplexer configurations across standard and ruggedized enclosures. API Technologies, now part of TTM Technologies, delivers high-power cavity filters suited for harsh operating environments and mission-critical applications.

Mercury Systems strengthened its position by integrating PCTEL’s RF filter operations into its aerospace and defense communications segment. Qorvo expanded its cavity filter line, optimizing for high-isolation requirements in radar and satellite platforms.

Teledyne Microwave Solutions introduced compact, high-power filters tailored for military-grade applications. Modular and multi-cavity configurations gained traction to support 5G base stations and low-orbit satellite terminals. North America maintained demand leadership, while Asia-Pacific accelerated manufacturing volumes to meet growing telecom and electronic warfare system requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.7 Billion |

| Filter Type | Band pass filters, Band reject filters, Low pass filters, and High pass filters |

| Design Type | Multi-cavity filters, Single-cavity filters, and Tunable cavity filters |

| Frequency Range | Mid-frequency filters, Low-frequency filters, and High-frequency filters |

| End Use Industry | Telecommunications, Aerospace & Defense, Automotive, Industrial, and Consumer electronics |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Qorvo, Skyworks Solutions Inc., Murata Manufacturing, Knowles Corporation, and Anatech Electronics |

| Additional Attributes | Dollar sales by filter type (band‑pass, notch, duplexer) and application (telecom base stations, satellite comms, military radar), demand from 5G networks, aerospace and defense, led by Asia-Pacific with North America catching up, innovation in miniaturized high‑Q cavities and tunable filter designs. |

The global cavity rf filter market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the cavity rf filter market is projected to reach USD 5.4 billion by 2035.

The cavity rf filter market is expected to grow at a 12.4% CAGR between 2025 and 2035.

The key product types in cavity rf filter market are band pass filters, band reject filters, low pass filters and high pass filters.

In terms of design type, multi-cavity filters segment to command 42.0% share in the cavity rf filter market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

RF Filters Market Size and Share Forecast Outlook 2025 to 2035

RF Tunable Filter Market Size and Share Forecast Outlook 2025 to 2035

Vertical-Cavity Surface-Emitting Lasers (VCSEL) Market Growth - Trends & Forecast 2025 to 2035

Interference Mitigation Filters Market Size and Share Forecast Outlook 2025 to 2035

RFID in Pharmaceuticals Market Size and Share Forecast Outlook 2025 to 2035

Cavity Drainage Membrane Market Size and Share Forecast Outlook 2025 to 2035

Filter Bag Market Size and Share Forecast Outlook 2025 to 2035

Filter Press Solutions Market Size and Share Forecast Outlook 2025 to 2035

RFID Tester Market Size and Share Forecast Outlook 2025 to 2035

RF Spectrum Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Filter Integrity Test Systems Market Size and Share Forecast Outlook 2025 to 2035

RF Sealer System Market Size and Share Forecast Outlook 2025 to 2035

RF Switches Market Size and Share Forecast Outlook 2025 to 2035

RFID-Integrated Smart Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

RF Connectors Market Size and Share Forecast Outlook 2025 to 2035

RF Interconnect Market Size and Share Forecast Outlook 2025 to 2035

Filter Coatings Market Size and Share Forecast Outlook 2025 to 2035

RFID Kanban Systems Market Size and Share Forecast Outlook 2025 to 2035

RF Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

RF Smart Electric Meter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA