The hidradenitis suppurativa (HS) treatment market is relatively nascent, but it growing at steady pace owing to increasing prevalence, improving awareness, and advancements in therapeutic options. HS is a painful chronic inflammatory dermatological condition characterized by recurrent abscesses, nodules, and scarring. However, market growth is primarily driven by the need for effective treatment options such as antibiotics, biologics, and surgical treatment.

In addition, advancements in diagnostic tools, an increase in healthcare spending, and a heightening government support for rare disease treatment are also anticipated to boost the market growth. The market is expected to advance noticeably over the forecast period owing to ongoing research towards targeted biologic therapeutics and newer drug formulation.

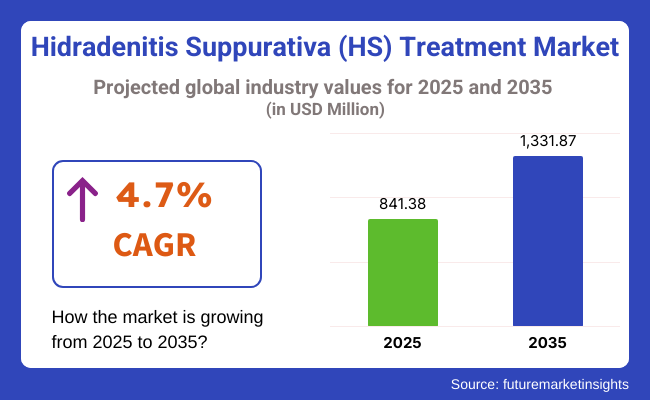

In 2025, the Hidradenitis Suppurativa treatment market was valued at approximately USD 841.38 million. By 2035, it is projected to reach USD 1,331.87 million, expanding at a compound annual growth rate (CAGR) of 4.7%. The market’s growth is largely fueled by the increasing adoption of biologic therapies such as TNF inhibitors, which have shown significant efficacy in managing severe cases.

Moreover, the availability of novel combination treatments, including immunomodulators and hormonal therapies, is expected to further drive demand. Companies are investing in research and development to enhance treatment outcomes, improve patient compliance, and reduce disease burden. Additionally, the integration of artificial intelligence in dermatology and telemedicine solutions is expected to streamline disease diagnosis and treatment monitoring.

The HS treatment market is primarily worked in North America, owing to advanced healthcare facilities, high prevalence of HS in North America, and high research and development investments. The United States and Canada are top-ranking in both biologic drug approvals and dermatology clinical trials.

Market growth is fueled by the increasing uptake of FDA-approved treatments and rising insurance coverage for novel therapies. Moreover, advocacy groups for patients and awareness campaigns are making a difference in early diagnosis and access to treatment.

The HS treatment space in Europe is expanding in line with growing awareness along with increased funding from governments for research related to skin diseases. Countries including Germany, the UK and France report increased demand for biologic therapies and surgical procedures.

Key factors supporting market growth include the increasing presence of major pharmaceutical companies involved in dermatology research and the expansion of healthcare reimbursement policies. Moreover, clinical trials in progress for advanced therapeutic modalities will present further avenues for growth.

Asia-Pacific is anticipated to be a lucrative HS treatment market, owing to the developing healthcare infrastructure, increasing disposable income, and rising patient awareness. The demand for dermatological treatments, including innovative biologics as well as minimally invasive surgeries, is increasing in countries like China, Japan and India.

Market expansion is also being driven by the expanding pharmaceutical sector and the growing partnerships between local and international healthcare firms. Moreover, more attention on dermatologists in terms of medical education and training will help patients reach to quality treatment.

The hidradenitis suppurativa treatment market is expected to witness a steady growth over the period of 2035, which can be attributed to the rising patient demand, ongoing research and development, advancement in therapeutic solutions and the research investment.

Advancements in precision medicine, treatment modalities tailored to the needs of patients, and improved access in lower-income regions around the world will define the ongoing development of HS management and treatment, ensuring that all patients have the best chance of recovery regardless of where they live.

Challenge

Limited Treatment Options and High Recurrence Rates

With limited treatment options available and the nature of the disease being chronic and recurrent, the HS treatment market has been going through challenges. Current treatment options, such as antibiotics, corticosteroids, and biologics, are effective at alleviating symptoms, but they do not provide a permanent cure.

The absence of such targeted therapeutics causes disease recurrence, which eventually panders a worse quality of life in patients. The long-term outcomes of patients could be improved with the further development of drugs such as immunomodulators and gene-based therapies, which would require investment from pharmaceutical companies.

High Treatment Costs and Insurance Barriers

Despite advances in treatment options, the high cost of HS treatment, especially for newer biologic therapies, continues to pose a challenge to patients and stakeholders in healthcare systems alike. Many biologics, including TNF inhibitors, are costly, and access is further restricted by insurance coverage limitations and reimbursement challenges.

Surgery for severe cases also adds to bills and costs. In order to tackle these challenges, organizations must investigate affordable medication formulations, campaign for comprehensive insurance coverage, and create patient help programs to make them more available and affordable.

Opportunity

Advancements in Biologic and Targeted Therapies

Growing investment in biologics and targeted therapies is an important opportunity for the HS treatment market. New therapeutic approaches with monoclonal antibodies, as well as JAK and IL-17 inhibitors, have shown promise in treating inflammation and preventing flare-ups.

Key Trends and Emerging Opportunities: Companies focused on developing innovative drug delivery mechanisms, combination therapies and precision medicine approaches will continue to have a competitive advantage in the market. Additionally, the expansion of clinical trials and subsequent regulatory approvals for new biologic drugs will also drive the growth of the market.

Increasing Awareness and Early Diagnosis

Increasing awareness of HS among health care providers and patients is propelling early diagnosis and intervention. Educational campaigns, patient advocacy organizations and better diagnostic criteria are increasing disease recognition and promoting early treatment.

The widespread use of these technologies not only significantly reduces waiting times for patients, but also increases access to dermatological care defined by geographic constraints and specialist availability. Increased patient engagement and early treatment adoption will reward physician training, digital health solutions and awareness programs.

Advancements observed in HS treatment market: 2020 to 2024 (2025 to 2035): Trends, updates, in the HS treatment market: The HS treatment market was characterized by significant advancements, including the emergence of innovative biologic therapies, an increasing focus on patient-centered care, and advancements in diagnostic strategies.

Reported challenges such as high drug costs, insurance hurdles and disease complexity remained at the forefront. The increasing use of targeted therapies and minimally invasive interventions reflected a shift in approaches to patient management.

In the coming years (2025 to 2035), the market will witness innovative development in gene therapy, AI-enabled diagnostic models, and personalized medicine mechanisms. These will form the basis for the next generation of treatment paradigms, with the development of oncogenic pathways targeted by more advanced immunotherapies, hot-off-the-shelf inhibitors of small-molecule inhibitors, regenerative medicine solutions. Innovation will drive research-based drug development, digital health solutions, affordability solutions and a path forward for patient access and outcomes.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | FDA and EMA approvals for new biologics |

| Technological Advancements | Growth in monoclonal antibody and JAK inhibitor research |

| Industry Adoption | Increasing adoption of targeted biologics |

| Supply Chain and Sourcing | Dependence on limited biologic manufacturing |

| Market Competition | Dominance of major pharmaceutical brands |

| Market Growth Drivers | Awareness campaigns and improved diagnosis |

| Sustainability and Energy Efficiency | Focus on ethical drug manufacturing |

| Integration of Smart Monitoring | Limited use of digital health tracking |

| Advancements in Product Innovation | Introduction of novel IL-17 inhibitors |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of gene therapy approvals and personalized treatments |

| Technological Advancements | AI-driven diagnostics and regenerative medicine breakthroughs |

| Industry Adoption | Widespread use of precision medicine and combination therapies |

| Supply Chain and Sourcing | Expansion of biosimilar production and cost-effective solutions |

| Market Competition | Rise of biotech startups and personalized healthcare models |

| Market Growth Drivers | Integration of AI, wearable health tech, and telemedicine |

| Sustainability and Energy Efficiency | Transition to eco-friendly production and sustainable packaging |

| Integration of Smart Monitoring | AI-powered patient monitoring and predictive analytics |

| Advancements in Product Innovation | Personalized immunotherapy and next-generation biologics |

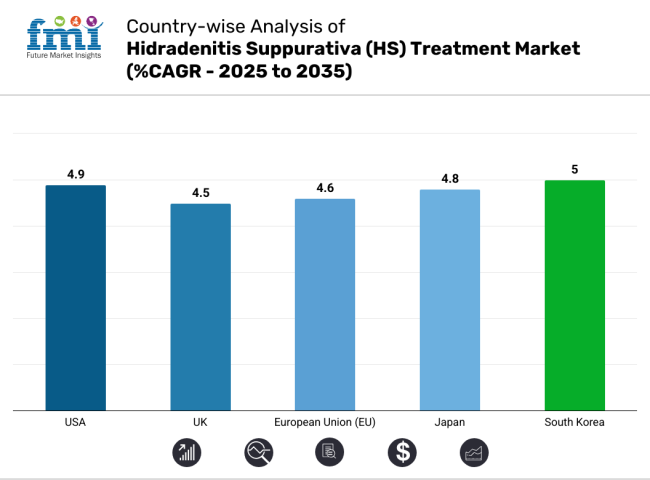

United States is a prominent market for hidradenitis suppurativa (HS) treatment, which is characterized by the growing prevalence of the disease and increasing numbers of therapeutic options. Market growth is backed by the presence of key pharmaceutical companies and ongoing research & development of novel biologics and targeted therapies.

The treatment landscape is conducive, with approved drug availability through the FDA, and an expanding healthcare infrastructure. Furthermore, more affected patients are coming out to seek for medical treatment and more insurance coverage for HS treatment are also available, attracting more patients to seek medical treatment.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.9% |

The expansion of the UK HS treatment market can also be attributable to rising number of diagnosed cases and rising focus on early intervention. The market is driven by government efforts to improve dermatological healthcare services and the growing trend of conducting clinical trials for innovative treatments.

The National Health Service (NHS) aims to improve overall patient outcomes for HS patients by making access to biologics and cutting-edge treatment modalities as promotion. Increasing preference for minimally invasive procedures are also boosting the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.5% |

Countries like Germany, France, and Italy are creating rapid expansion in the HS treatment market, credited to growing financing in dermatological investigation and the evolution of products. Key benefit factors driving market growth include an increase in the number of biologic treatment options for HS and institutionalization of government health policy to support HS management.

Since healthcare services and patient advocacy groups are raising awareness about the disease, leading to early diagnosis and treatment access. Market dynamics are further strengthening due to the presence of multinational pharmaceutical companies investing in HS-specific therapies.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.6% |

Japan is expanding its HS treatment market driven by enhance diagnostic capabilities and a growing number of dermatology clinics focusing on autoimmune and inflammatory skin diseases. We are seeing in the country a move toward biologics, and pharmaceutical companies are concentrating on the introduction of targeted therapies.

Government backed drug development and better reimbursement policies are also improving access. The increase in acceptance of laser therapy and minimally invasive surgical techniques also contributes to the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.8% |

With rising awareness of the disease and greater access to dermatological care in South Korea, the HS treatment market there is growing. Market growth is being driven by the country’s strong healthcare system and the development of biologic drugs.

Growing interest for personalized medicine and targeted therapies including immunomodulators and monoclonal antibodies are influencing Market dynamics. Partnerships between research institutions and pharmaceutical companies are also producing new therapeutic possibilities.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.0% |

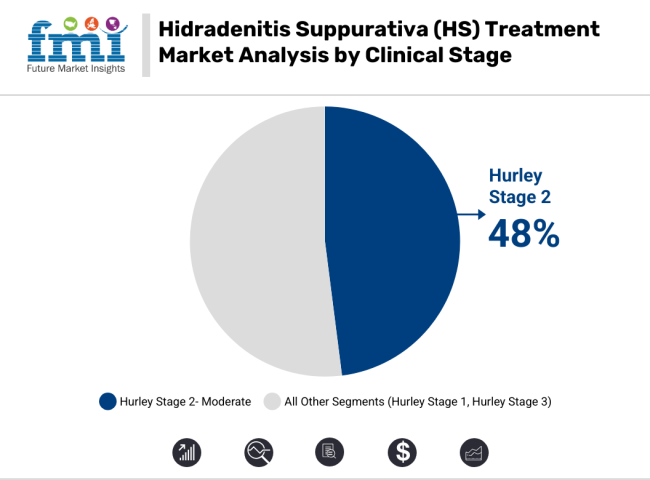

The predominant stage of diagnosed HS cases is Hurley Stage 2, as awareness and treatment at the early stages have continued to grow. These patients need comprehensive medical support beyond opioids and antibiotics, which leads to increased utilization and demand for biologics and hormonal treatments.

Cases in Stage 2 require treatment in specialized plans to prevent progression of the disease, unlike Stage 1 - mild symptoms which can be managed conservatively. The increasing number of specialty dermatology clinic and better accessibility to healthcare facilities worldwide also propel the prominent share of this segment.

The moderate HS segment holds the largest shares for the forecast period due to rising research for newer therapeutic agents and treatment modalities that shall improve outcomes for the moderate HS patients. Increasing clinical research on new biologic formulations and combination therapies is likely to lead to more treatment options, decreasing the burden on patients with limited alternative options.

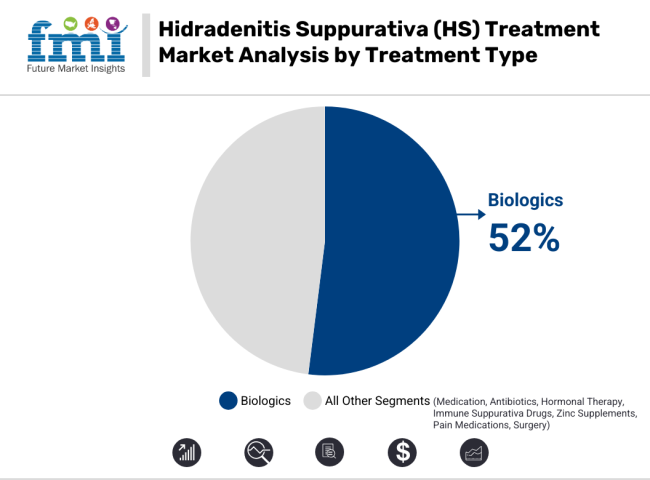

Given their targeted mechanism in reducing inflammation and preventing flares, the HS treatment market is dominated by biologics. Substantial control of moderate to severe HS symptoms has only been observed with TNF-alpha inhibitors and interleukin inhibitors. Unlike antibiotics or hormonal therapy, biologics can help manage symptoms over the long-term with less likelihood of relapse.

Regulatory approvals for innovative biologic therapies coupled with rising investment levels in research and development are driving segment growth. In addition, an increasing awareness of biologics among patients and their effectiveness in enhancing the quality of life is driving adoption rates.

This trend towards HS increasing reliance on precision medicine in dermatology is likely to continue to develop with the advent of more biologics into the HS treatment paradigm. Moreover, favorable reimbursement for biologics and continuous efforts in making them more affordable through biosimilars development are anticipated to improve access and affordability, thus driving the market growth.

Hidradenitis suppurativa (HS) treatment market is expanding at a high rate with increasing awareness, rising prevalence of the disease and the increasing biologic therapies. Innovations in the treatment landscape, including biologics targeted to specific pathways, minimally invasive surgical techniques, and a range of combination therapies, are changing the treatment paradigm.

Pharmaceutical companies are currently working on novel drug formulations to enhance patient compliance to the drugs and also to develop personalized medicine approaches with a global Compound Annual Growth Rate (CAGR) of 4.7%. Robust government initiatives, growth in R&D investments, and improved diagnostics capabilities are also stimulating market growth.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| AbbVie Inc. | 22-26% |

| UCB S.A. | 15-19% |

| Novartis AG | 12-16% |

| Eli Lilly and Company | 10-14% |

| Pfizer Inc. | 8-12% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| AbbVie Inc. | In 2025, AbbVie Inc. expanded its HS treatment portfolio with new biologics targeting TNF-alpha and IL-17 , enhancing therapeutic options. |

| UCB S.A. | In 2024 , UCB S.A. launched a novel monoclonal antibody therapy , improving remission rates and reducing disease progression in moderate-to-severe HS patients. |

| Novartis AG | In 2025 , Novartis AG introduced an oral JAK inhibitor designed for HS treatment, providing an alternative for biologic-refractory patients. |

| Eli Lilly and Company | In 2024 , Eli Lilly and Company focused on clinical trials for dual-action biologics , combining anti-inflammatory and immunomodulatory effects for better patient outcomes. |

| Pfizer Inc. | In 2025 , Pfizer Inc. launched a next-generation IL-23 inhibitor , aiming to provide long-term remission with fewer side effects. |

Key Company Insights

AbbVie Inc. (22-26%)

AbbVie is leading the HS treatment market with targeted biologic therapies; the focus is on TNF-alpha and IL-17 inhibitors. Additionally, rigorous investment in clinical trials and novel offerings of immunotherapies ensure stability. AbbVie is also committed to conducting real-world evidence studies and obtaining expanded indications, which will enhance its competitive strengths.

UCB S.A. (15-19%)

UCB is devoted to the development of innovative monoclonal antibody therapeutics, which are different from and novel as biologic agents targeting HS. Company Pipeline Should Expand with Next-Generation Immune Modulators with Better Efficacy and Safety Profile UCB specializes in tailored medicine and biomarker-centric treatments that further improve patient care.

Novartis AG (12-16%)

Perhaps this is not surprising as Novartis are big players in oral and biologic based HS therapies and they were innovators with JAK inhibitors and precision medicine approaches. It invests in artificial intelligence (AI) driven drug discovery to design better and more patient-centric treatment models approved drugs.

Eli Lilly and Company (10-14%)

Eli Lilly develops dual-action biologics that exert anti-inflammatory and gammabody immunomodulatory mechanisms of action to target more than one pathway simultaneously to enhance treatment efficacy in patients with HS. The company’s significant R&D investment and advanced clinical trial commitments propel it to a position of assurance and strength in the market. As a leader in long-term remission strategies, Eli Lilly is a formidable competitor.

Pfizer Inc. (8-12%)

Pfizer Embraces Next-Generation Biologics and Small-Molecule Therapies for HS Management IL-23 inhibitors. The company claims that its therapies offer low side-effect profiles, improved dosing regimens, and treatment durability, making them appealing for long-term disease control.

Other Key Players (25-35% Combined)

Other pharmaceutical companies supplement the HS treatment market with novel options:

The overall market size for hidradenitis suppurativa (HS) treatment market was USD 841.38 million in 2025.

The hidradenitis suppurativa (HS) treatment market expected to reach USD 1,331.87 million in 2035.

Rising HS prevalence, increasing awareness and early diagnosis, growing adoption of biologic therapies, advancements in treatment options, and expanding healthcare infrastructure will drive market demand.

The top 5 countries which drives the development of hidradenitis suppurativa (HS) treatment market are USA, UK, Europe Union, Japan and South Korea.

Biologics driving market growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Clinical Stages, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Treatment Type, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 6: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Clinical Stages, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Treatment Type, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 12: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Clinical Stages, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Treatment Type, 2018 to 2033

Table 16: Latin America Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 18: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Value (US$ Million) Forecast by Clinical Stages, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Treatment Type, 2018 to 2033

Table 22: Europe Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 24: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 25: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: South Asia Market Value (US$ Million) Forecast by Clinical Stages, 2018 to 2033

Table 27: South Asia Market Value (US$ Million) Forecast by Treatment Type, 2018 to 2033

Table 28: South Asia Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 29: South Asia Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 30: South Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 31: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: East Asia Market Value (US$ Million) Forecast by Clinical Stages, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Treatment Type, 2018 to 2033

Table 34: East Asia Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 36: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 37: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Oceania Market Value (US$ Million) Forecast by Clinical Stages, 2018 to 2033

Table 39: Oceania Market Value (US$ Million) Forecast by Treatment Type, 2018 to 2033

Table 40: Oceania Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 41: Oceania Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 42: Oceania Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 43: MIDDLE EAST & AFRICA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: MIDDLE EAST & AFRICA Market Value (US$ Million) Forecast by Clinical Stages, 2018 to 2033

Table 45: MIDDLE EAST & AFRICA Market Value (US$ Million) Forecast by Treatment Type, 2018 to 2033

Table 46: MIDDLE EAST & AFRICA Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 47: MIDDLE EAST & AFRICA Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 48: MIDDLE EAST & AFRICA Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Clinical Stages, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Treatment Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End Users, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Clinical Stages, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Clinical Stages, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Clinical Stages, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Treatment Type, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Treatment Type, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Treatment Type, 2023 to 2033

Figure 16: Global Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 23: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 24: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 25: Global Market Attractiveness by Clinical Stages, 2023 to 2033

Figure 26: Global Market Attractiveness by Treatment Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Route of Administration, 2023 to 2033

Figure 28: Global Market Attractiveness by End Users, 2023 to 2033

Figure 29: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Clinical Stages, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Treatment Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by End Users, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 36: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Clinical Stages, 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Clinical Stages, 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Clinical Stages, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Treatment Type, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Treatment Type, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Treatment Type, 2023 to 2033

Figure 46: North America Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 47: North America Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 48: North America Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 49: North America Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 55: North America Market Attractiveness by Clinical Stages, 2023 to 2033

Figure 56: North America Market Attractiveness by Treatment Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Route of Administration, 2023 to 2033

Figure 58: North America Market Attractiveness by End Users, 2023 to 2033

Figure 59: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Clinical Stages, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Treatment Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by End Users, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 67: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Clinical Stages, 2018 to 2033

Figure 71: Latin America Market Value Share (%) and BPS Analysis by Clinical Stages, 2023 to 2033

Figure 72: Latin America Market Y-o-Y Growth (%) Projections by Clinical Stages, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) Analysis by Treatment Type, 2018 to 2033

Figure 74: Latin America Market Value Share (%) and BPS Analysis by Treatment Type, 2023 to 2033

Figure 75: Latin America Market Y-o-Y Growth (%) Projections by Treatment Type, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 77: Latin America Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 78: Latin America Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 83: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 84: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 85: Latin America Market Attractiveness by Clinical Stages, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Treatment Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Route of Administration, 2023 to 2033

Figure 88: Latin America Market Attractiveness by End Users, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Clinical Stages, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Treatment Type, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by End Users, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 97: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Clinical Stages, 2018 to 2033

Figure 101: Europe Market Value Share (%) and BPS Analysis by Clinical Stages, 2023 to 2033

Figure 102: Europe Market Y-o-Y Growth (%) Projections by Clinical Stages, 2023 to 2033

Figure 103: Europe Market Value (US$ Million) Analysis by Treatment Type, 2018 to 2033

Figure 104: Europe Market Value Share (%) and BPS Analysis by Treatment Type, 2023 to 2033

Figure 105: Europe Market Y-o-Y Growth (%) Projections by Treatment Type, 2023 to 2033

Figure 106: Europe Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 107: Europe Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 108: Europe Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 109: Europe Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 113: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 114: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 115: Europe Market Attractiveness by Clinical Stages, 2023 to 2033

Figure 116: Europe Market Attractiveness by Treatment Type, 2023 to 2033

Figure 117: Europe Market Attractiveness by Route of Administration, 2023 to 2033

Figure 118: Europe Market Attractiveness by End Users, 2023 to 2033

Figure 119: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Market Value (US$ Million) by Clinical Stages, 2023 to 2033

Figure 122: South Asia Market Value (US$ Million) by Treatment Type, 2023 to 2033

Figure 123: South Asia Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 124: South Asia Market Value (US$ Million) by End Users, 2023 to 2033

Figure 125: South Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 126: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 127: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 128: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: South Asia Market Value (US$ Million) Analysis by Clinical Stages, 2018 to 2033

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Clinical Stages, 2023 to 2033

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Clinical Stages, 2023 to 2033

Figure 133: South Asia Market Value (US$ Million) Analysis by Treatment Type, 2018 to 2033

Figure 134: South Asia Market Value Share (%) and BPS Analysis by Treatment Type, 2023 to 2033

Figure 135: South Asia Market Y-o-Y Growth (%) Projections by Treatment Type, 2023 to 2033

Figure 136: South Asia Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 137: South Asia Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 138: South Asia Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 139: South Asia Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 140: South Asia Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 141: South Asia Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 142: South Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 143: South Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 144: South Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 145: South Asia Market Attractiveness by Clinical Stages, 2023 to 2033

Figure 146: South Asia Market Attractiveness by Treatment Type, 2023 to 2033

Figure 147: South Asia Market Attractiveness by Route of Administration, 2023 to 2033

Figure 148: South Asia Market Attractiveness by End Users, 2023 to 2033

Figure 149: South Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 150: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: East Asia Market Value (US$ Million) by Clinical Stages, 2023 to 2033

Figure 152: East Asia Market Value (US$ Million) by Treatment Type, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 154: East Asia Market Value (US$ Million) by End Users, 2023 to 2033

Figure 155: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 156: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 158: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: East Asia Market Value (US$ Million) Analysis by Clinical Stages, 2018 to 2033

Figure 161: East Asia Market Value Share (%) and BPS Analysis by Clinical Stages, 2023 to 2033

Figure 162: East Asia Market Y-o-Y Growth (%) Projections by Clinical Stages, 2023 to 2033

Figure 163: East Asia Market Value (US$ Million) Analysis by Treatment Type, 2018 to 2033

Figure 164: East Asia Market Value Share (%) and BPS Analysis by Treatment Type, 2023 to 2033

Figure 165: East Asia Market Y-o-Y Growth (%) Projections by Treatment Type, 2023 to 2033

Figure 166: East Asia Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 167: East Asia Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 168: East Asia Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 169: East Asia Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 170: East Asia Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 171: East Asia Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 172: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 173: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 174: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 175: East Asia Market Attractiveness by Clinical Stages, 2023 to 2033

Figure 176: East Asia Market Attractiveness by Treatment Type, 2023 to 2033

Figure 177: East Asia Market Attractiveness by Route of Administration, 2023 to 2033

Figure 178: East Asia Market Attractiveness by End Users, 2023 to 2033

Figure 179: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 180: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 181: Oceania Market Value (US$ Million) by Clinical Stages, 2023 to 2033

Figure 182: Oceania Market Value (US$ Million) by Treatment Type, 2023 to 2033

Figure 183: Oceania Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 184: Oceania Market Value (US$ Million) by End Users, 2023 to 2033

Figure 185: Oceania Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 186: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: Oceania Market Value (US$ Million) Analysis by Clinical Stages, 2018 to 2033

Figure 191: Oceania Market Value Share (%) and BPS Analysis by Clinical Stages, 2023 to 2033

Figure 192: Oceania Market Y-o-Y Growth (%) Projections by Clinical Stages, 2023 to 2033

Figure 193: Oceania Market Value (US$ Million) Analysis by Treatment Type, 2018 to 2033

Figure 194: Oceania Market Value Share (%) and BPS Analysis by Treatment Type, 2023 to 2033

Figure 195: Oceania Market Y-o-Y Growth (%) Projections by Treatment Type, 2023 to 2033

Figure 196: Oceania Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 197: Oceania Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 198: Oceania Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 199: Oceania Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 200: Oceania Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 201: Oceania Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 202: Oceania Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 203: Oceania Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 204: Oceania Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 205: Oceania Market Attractiveness by Clinical Stages, 2023 to 2033

Figure 206: Oceania Market Attractiveness by Treatment Type, 2023 to 2033

Figure 207: Oceania Market Attractiveness by Route of Administration, 2023 to 2033

Figure 208: Oceania Market Attractiveness by End Users, 2023 to 2033

Figure 209: Oceania Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 210: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 211: MIDDLE EAST & AFRICA Market Value (US$ Million) by Clinical Stages, 2023 to 2033

Figure 212: MIDDLE EAST & AFRICA Market Value (US$ Million) by Treatment Type, 2023 to 2033

Figure 213: MIDDLE EAST & AFRICA Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 214: MIDDLE EAST & AFRICA Market Value (US$ Million) by End Users, 2023 to 2033

Figure 215: MIDDLE EAST & AFRICA Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 216: MIDDLE EAST & AFRICA Market Value (US$ Million) by Country, 2023 to 2033

Figure 217: MIDDLE EAST & AFRICA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 218: MIDDLE EAST & AFRICA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: MIDDLE EAST & AFRICA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: MIDDLE EAST & AFRICA Market Value (US$ Million) Analysis by Clinical Stages, 2018 to 2033

Figure 221: MIDDLE EAST & AFRICA Market Value Share (%) and BPS Analysis by Clinical Stages, 2023 to 2033

Figure 222: MIDDLE EAST & AFRICA Market Y-o-Y Growth (%) Projections by Clinical Stages, 2023 to 2033

Figure 223: MIDDLE EAST & AFRICA Market Value (US$ Million) Analysis by Treatment Type, 2018 to 2033

Figure 224: MIDDLE EAST & AFRICA Market Value Share (%) and BPS Analysis by Treatment Type, 2023 to 2033

Figure 225: MIDDLE EAST & AFRICA Market Y-o-Y Growth (%) Projections by Treatment Type, 2023 to 2033

Figure 226: MIDDLE EAST & AFRICA Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 227: MIDDLE EAST & AFRICA Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 228: MIDDLE EAST & AFRICA Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 229: MIDDLE EAST & AFRICA Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 230: MIDDLE EAST & AFRICA Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 231: MIDDLE EAST & AFRICA Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 232: MIDDLE EAST & AFRICA Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 233: MIDDLE EAST & AFRICA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 234: MIDDLE EAST & AFRICA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 235: MIDDLE EAST & AFRICA Market Attractiveness by Clinical Stages, 2023 to 2033

Figure 236: MIDDLE EAST & AFRICA Market Attractiveness by Treatment Type, 2023 to 2033

Figure 237: MIDDLE EAST & AFRICA Market Attractiveness by Route of Administration, 2023 to 2033

Figure 238: MIDDLE EAST & AFRICA Market Attractiveness by End Users, 2023 to 2033

Figure 239: MIDDLE EAST & AFRICA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 240: MIDDLE EAST & AFRICA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hirschsprung Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

HSV Testing Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

HSM-as-a-Service Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

GHS Label Market Size and Share Forecast Outlook 2025 to 2035

Leading Providers & Market Share in GHS Label Industry

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Fuchs Endothelial Corneal Dystrophy (FECD) Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Touchscreen Controller Market Growth - Trends & Outlook 2025 to 2035

Touchscreen Gloves Market

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA