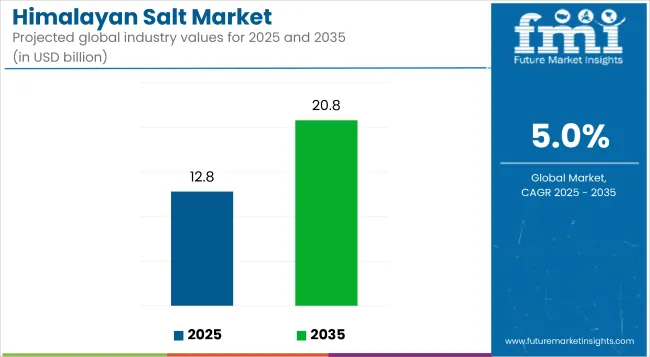

The global Himalayan salt market is projected to grow from USD 12.8 billion in 2025 to USD 20.8 billion by 2035, registering a CAGR of 5%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 12.8 billion |

| Industry Value (2035F) | USD 20.8 billion |

| CAGR (2025 to 2035) | 5% |

The market expansion is being driven by escalating health and wellness trends, with consumers increasingly preferring mineral-rich and natural salt alternatives over regular table salt. Marketing strategies that highlight Himalayan salt’s purity, mineral content, and perceived health benefits are fuelling its adoption across culinary and wellness applications.

The market holds a notable share within the global specialty salts market, accounting for 25-30%, driven by its popularity as a premium mineral-rich salt. Within the global salt market, its share is relatively small at around 3-5%, given the dominance of regular table salt and sea salt.

In the functional food ingredients market, Himalayan salt represents roughly 1-2%, while in the gourmet food market, its share is higher at 8-10% due to its positioning as an artisanal and luxury ingredient. Its presence in the overall food ingredients market remains minimal, under 1%.

Government regulations impacting the market focus on food safety standards, mineral fortification, and labelling norms. For instance, iodization mandates by WHO and UNICEF continue to drive the demand for iodized Himalayan salt to address iodine deficiency disorders. Additionally, global and national food safety regulations emphasize accurate labelling of mineral content and sourcing claims, ensuring consumer trust and compliance.

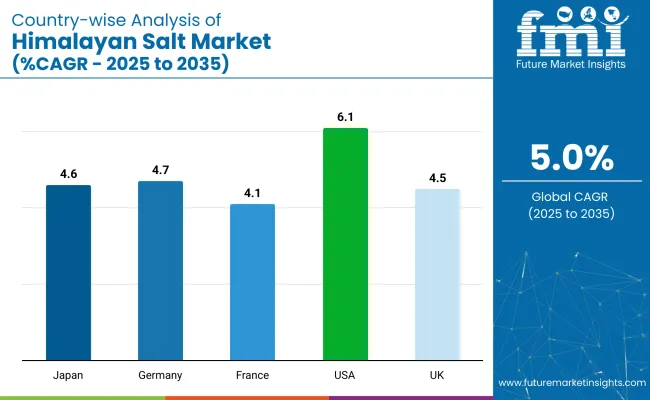

The USA is projected to be the fastest-growing market, expected to expandat a CAGR of 6.1% from 2025 to 2035. Iodized salt will lead the product type segment with a 71.4% share, while food & beverage will dominate the application segment with a 74% share. The UK, Germany, Japan, and France markets are also expected to grow steadily at CAGRs of 4.7%, 4.6%, 4.1%, and an estimated 4.5%, respectively.

The market is segmented by product type, application, sales channel, and region. By product type, the market is divided into iodized salt and non-iodized salt. Based on application, the market is segmented into food & beverage, bath salts, salt lamps, and others (massage stones, animal licks, inhalers, spa treatments).

By sales channel, the market is bifurcated into offline sales channel (supermarkets/hypermarkets, departmental stores, convenience stores, other sales channel) and online sales channel (company website and e-commerce platform). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and Middle East & Africa.

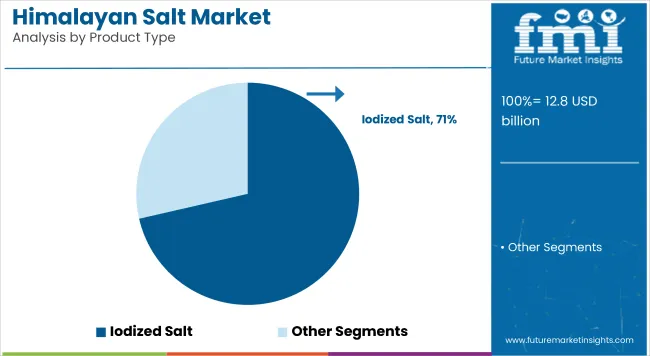

Iodized salt is expected to dominate the product type segment with a 71.4% market share by 2025, driven by growing consumer preference for iodine-fortified salts that support health and nutritional needsworldwide.

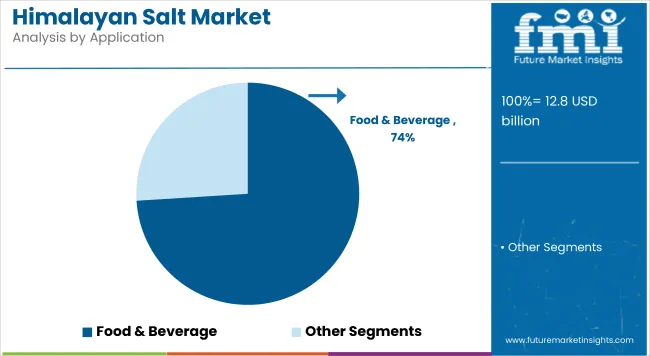

Food & beverage is projected to lead the application segment, capturing 74% of the global market share by 2025, driven by Himalayan salt’s natural purity, mineral content, and versatile use in culinary preparations.

The offline sales channelis expected to dominate the sales channel segment with a 65% market share by 2025, driven by strong consumer preference for in-store purchases, product evaluation, and immediate availability across supermarkets and department stores.

The global Himalayan salt market is experiencing steady growth, driven by rising health and wellness trends and increasing consumer preference for natural, mineral-rich alternatives to table salt. Himalayan salt plays a crucial role in culinary applications and wellness products due to its purity and mineral content.

Recent Trends in the Himalayan Salt Market

Challenges in the Himalayan Salt Market

The USA (6.1% CAGR) is the fastest-growing market, driven by premium culinary trends, natural wellness products, and rising demand for decorative salt lamps. Japan (4.6% CAGR) shows momentum anchored in culinary fusion and salt therapy.

Germany (4.7% CAGR) and France (4.1% CAGR) maintain consistent demand driven by clean-label food regulations and preference for mineral-rich salts. In contrast, developed economies such as the USA (6.1% CAGR), UK (4.5% CAGR), and Japan (4.6% CAGR) are expected to expandat a steady 0.91-1.22x of the global growth rate.

The USA leads the Himalayan salt market, driven by strong demand for premium snacks, organic food, and wellness products. Germany follows, supported by EU clean-label regulations and high demand in gourmet foods and wellness sectors. Japan shows growth due to culinary fusion trends, spa products, and decorative lamps.

The UK records the slowest growth among these countries, supported by gourmet culinary salts and wellness retail products despite post-Brexit import challenges. France grows steadily, driven by preference for artisanal, eco-certified Himalayan salt and high adoption in beauty, spa, and gourmet cooking applications.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The Japan Himalayan salt revenue is growing at a CAGR of 4.6% from 2025 to 2035. Growth is driven by strong culinary fusion trends, wellness products like bath salts and inhalers, and premium decorative applications. As a technology and wellness-driven OECD economy, Japan prioritizes natural ingredients and holistic health solutions in consumer products.

The sales of Himalayan salt in Germany are expected to expandat 4.7% CAGR during the forecast period, slightly below the global average but strongly regulation-led. EU food safety regulations, clean-label movements, and sustainable sourcing standards are pushing adoption of Himalayan salt across retail and foodservice.

The French Himalayan salt market is projected to grow at a 4.1% CAGR during the forecast period. Demand is driven by rising consumer preference for natural, additive-free salts and increased spa and wellness product usage. Sectors such as gourmet food, beauty, and wellness are major consumers.

The USA Himalayan salt market is projected to grow at 6.1% CAGR from 2025 to 2035, translating to 1.22x the global rate. Unlike emerging markets focused mainly on culinary applications, US demand spans premium snacks, salt lamps, bath salts, and gourmet seasonings.

The UK Himalayan salt revenue is projected to grow at a CAGR of 4.5% from 2025 to 2035, representing the slowest growth among the top OECD nations, at 0.91 times the global pace. Growth is supported by health-conscious culinary trends and clean-label salt preferences in retail. Post-Brexit import regulations have slightly slowed product diversification.

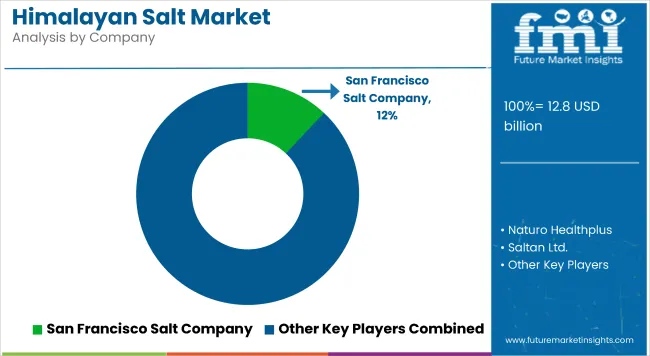

The market is moderately consolidated, with leading players like San Francisco Salt Company, NaturoHealthplus, Saltan Ltd., Morton Salt Inc., and The Spice Lab dominating the industry. These companies provide high-quality Himalayan salt products catering to segments such as food & beverage, wellness, and home décor. San Francisco Salt Company focuses on gourmet salts and bath salts, while NaturoHealthplus specializes in natural and organic Himalayan salt offerings.

Saltan Ltd. delivers premium-grade Himalayan salt for culinary and industrial applications. Morton Salt Inc. offers iodized and non-iodized variants with strong distribution networks, and The Spice Lab is known for its artisanal and gourmet Himalayan salt products. Other key players like HimalayanChef, Viva Doria, Evolution Salt Co., and Kutch Brine Chem Industries contribute by providing diverse, mineral-rich Himalayan salt products for global markets.

Recent Himalayan Salt Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 12.8 billion |

| Projected Market Size (2035) | USD 20.8 billion |

| CAGR (2025 to 2035) | 5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value/volume in metric tons |

| Product Type Analyzed | Iodized Salt and Non-Iodized Salt |

| Application Analyzed | Food & Beverage, Bath Salts, Salt Lamps, and O thers (Massage Stones, Animal Licks, Inhalers, Spa Treatments) |

| Sales Channel Analyzed | Offline Sales Channel (Supermarkets/Hypermarkets, Departmental Stores, Convenienc e Stores, Other Sales Channel) and Online Sales Channel (Company Website, E-commerce Platform) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia |

| Key Players Influencing the Market | San Francisco Salt Company, Naturo Healthplus, Saltan Ltd., Morton Salt Inc., The Spice Lab, HimalayanChef, Viva Doria, Evolution Salt Co., and Kutch Brine Chem Industries |

| Additional Attributes | Dollar sales by product type, share by application, regional demand growth, regulatory influence, wellness trends, competitive benchmarking |

The market is valued at USD 12.8 billion in 2025.

The market is forecasted to reach USD 20.8 billion by 2035, reflecting a CAGR of 5%.

Iodized salt will lead the product type segment, accounting for 71.4% of the global market share in 2025.

Food & beverage will dominate the application segment with a 74% share in 2025.

The USA is projected to grow at the fastest rate, with a CAGR of 6.1% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Salt Content Reduction Ingredients Market Size & Trends 2035

Salt Meter Market

Salt Hydrate Market

Basalt Rock Market Size and Share Forecast Outlook 2025 to 2035

Basalt Fiber Reinforced Polymer BFRP Market Size and Share Forecast Outlook 2025 to 2035

Basalt Fibre Market Size & Forecast 2024-2034

Sea Salt Market Analysis – Size, Share & Forecast 2024 to 2034

Soap Salts Market Size and Share Forecast Outlook 2025 to 2035

Bath Salts Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Salt Market Size and Share Forecast Outlook 2025 to 2035

Lemon Salt Market Trends - Citrus-Infused Seasoning Demand 2025 to 2035

Cobalt Salt for Tires Market Size and Share Forecast Outlook 2025 to 2035

Cesium Salts Market Size and Share Forecast Outlook 2025 to 2035

Smoked Salt Market Trends - Growth, Demand & Forecast 2025 to 2035

Ginger Salt Market Trends – Flavor Innovation & Industry Demand 2025 to 2035

Analyzing Celtic Salt Market Share & Industry Leaders

Pretzel Salt Market Size and Share Forecast Outlook 2025 to 2035

Acetate Salt Market Size and Share Forecast Outlook 2025 to 2035

Gourmet Salt Market Size and Share Forecast Outlook 2025 to 2035

Gourmet Salts Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA