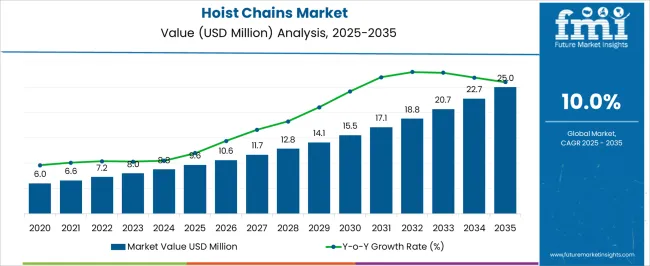

The Hoist Chains Market is estimated to be valued at USD 9.6 million in 2025 and is projected to reach USD 25.0 million by 2035, registering a compound annual growth rate (CAGR) of 10.0% over the forecast period. The data reveals a steady upward momentum with yearly increments increasing from USD 9.6 million to USD 25.0 million.

Early years show moderate growth, with the market rising from USD 9.6 million in 2025 to USD 12.8 million by 2028. This period suggests initial market development fueled by increasing demand in industries such as construction, manufacturing, and logistics. From 2028 onward, growth accelerates noticeably, with the market value reaching USD 18.8 million by 2031 and continuing to climb to USD 25.0 million by 2035.

This acceleration phase points to intensified adoption and possibly technological advancements improving hoist chain efficiency and safety. The growth momentum reflects a dynamic market with increasing investment and adoption rates. For stakeholders, the steady and accelerating growth pattern suggests a compelling opportunity to capitalize on emerging trends and expanding industrial applications within the Hoist Chains Market over the next decade.

| Metric | Value |

|---|---|

| Hoist Chains Market Estimated Value in (2025 E) | USD 9.6 million |

| Hoist Chains Market Forecast Value in (2035 F) | USD 25.0 million |

| Forecast CAGR (2025 to 2035) | 10.0% |

The hoist chains market is witnessing steady expansion, driven by increased infrastructure spending, material handling automation, and rising safety standards across industrial operations. Advances in chain metallurgy, fatigue resistance, and heat treatment technologies have contributed to extended service life and performance efficiency, making modern hoist chains indispensable across construction, manufacturing, and logistics sectors.

Regulatory emphasis on safe load handling and workplace compliance has pushed end-users to upgrade to certified, high-load-capacity chain systems. Global construction recovery and industrialization in emerging economies are further accelerating demand.

Additionally, strategic investments in warehouse automation and cross-border logistics are increasing the deployment of hoist systems that rely heavily on chain durability and operational precision. As industries prioritize uptime, safety, and maintenance efficiency, the hoist chains market is expected to gain traction through innovations in materials and load-monitoring capabilities.

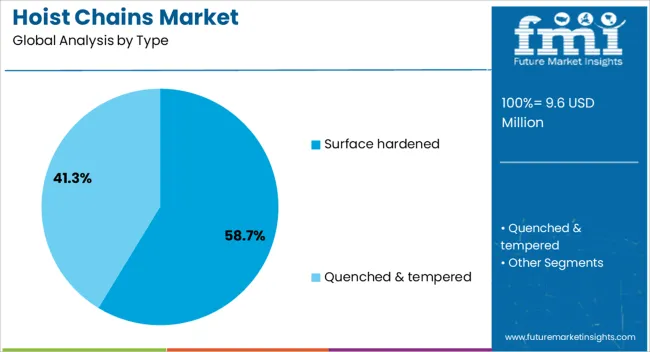

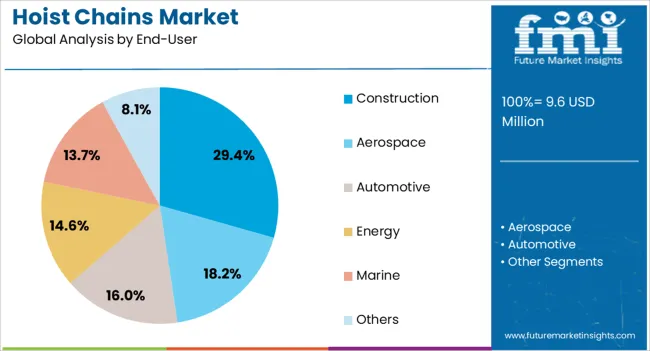

The hoist chains market is segmented by type, end-user, and geographic regions. By type of the hoist chains market is divided into Surface hardened and Quenched & tempered. In terms of end-user of the hoist chains market is classified into Construction, Aerospace, Automotive, Energy, Marine, and Others. Regionally, the hoist chains industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Surface hardened hoist chains are expected to dominate the market with a 58.7% share in 2025, emerging as the leading chain type. This leadership is being reinforced by their superior wear resistance, fatigue strength, and enhanced load-bearing capacity under high-stress industrial environments.

The hardening process imparts a tough exterior while retaining core ductility, allowing chains to endure repetitive motion, abrasive conditions, and high-impact lifting applications. Their longer operational lifespan and lower failure rate reduce the total cost of ownership, making them ideal for use in critical lifting tasks.

Industries have increasingly adopted surface hardened chains to comply with stringent safety norms and to minimize downtime due to equipment failures. Additionally, compatibility with both manual and electric hoist systems has made them the preferred choice in sectors demanding consistent performance under varied operating loads.

The construction industry is anticipated to account for 29.4% of the total hoist chains market revenue in 2025, positioning it as the leading end-user segment. This dominance is attributed to the sector's high dependence on heavy material handling, structural lifting, and on-site equipment mobility.

Hoist chains play a pivotal role in crane systems, scaffold lifting, and concrete formwork, all of which are integral to modern construction projects. The growing number of residential and commercial infrastructure projects, particularly in developing economies, is creating robust demand for high-strength lifting components.

Increased mechanization of job sites and emphasis on operational safety have accelerated the replacement of older chain systems with advanced, heat-treated variants. Additionally, the need for reliable hoisting solutions in high-rise and urban construction is further solidifying hoist chain adoption within the construction sector.

The market has experienced consistent growth driven by increasing industrial activities and infrastructure development worldwide. Hoist chains are essential components for lifting and material handling equipment used across construction, manufacturing, mining, and logistics sectors. The demand for high-strength, durable chains capable of withstanding heavy loads and harsh environments has intensified. Innovations in alloy composition and heat treatment processes have improved chain strength, fatigue resistance, and longevity. The adherence to stringent safety and quality standards is critical, influencing product design and certification.

Expanding industrial and construction activities globally have amplified the need for reliable hoist chains capable of managing heavy lifting tasks safely. The increasing scale of infrastructure projects, manufacturing plants, and logistics operations requires chains with superior load-bearing capacity and resistance to wear and corrosion. The mining sector also significantly contributes to demand, where hoist chains must endure abrasive and high-stress conditions. Enhanced safety protocols and regulatory requirements have emphasized the use of certified, tested chains to mitigate accidents. This growing emphasis on workplace safety and operational efficiency is driving manufacturers to produce chains with improved mechanical properties and quality assurance.

Advancements in metallurgy and manufacturing techniques have led to the production of hoist chains with superior mechanical properties, including higher tensile strength and enhanced fatigue resistance. The use of high-grade alloy steels and refined heat treatment processes improves durability and operational lifespan. Surface treatments such as galvanization and powder coating provide corrosion resistance, extending usability in harsh environments such as the marine and chemical industries. Innovations in chain link design optimize weight distribution and flexibility, facilitating safer and more efficient lifting operations. These technological improvements have enabled broader application of hoist chains in demanding industrial contexts, increasing market appeal.

Compliance with international safety standards and certifications such as ISO, OSHA, and ASME is fundamental in the hoist chains market. These regulations ensure that chains meet specified load ratings, undergo rigorous testing, and maintain traceability, thereby reducing the risk of accidents and equipment failure. Manufacturers invest heavily in quality control, testing infrastructure, and certification processes to align with regulatory requirements and customer expectations. End-users increasingly demand documented compliance to guarantee safety and reliability in critical lifting operations. Regulatory frameworks also stimulate continuous innovation, encouraging development of safer, more reliable hoist chain solutions that meet evolving industry demands.

The market is affected by the volatility of raw material prices, particularly steel alloys essential for manufacturing. Fluctuations in global steel markets driven by geopolitical tensions, trade restrictions, and demand-supply imbalances create cost uncertainties. Supply chain disruptions, including transportation delays and supplier shortages, further complicate production and delivery schedules. Manufacturers are adopting strategies such as supplier diversification, local sourcing, and inventory optimization to mitigate risks. Additionally, investments in lean manufacturing and waste reduction are helping manage costs. Addressing these supply chain and raw material challenges is critical to maintaining market competitiveness and ensuring the timely fulfillment of growing industrial demand.

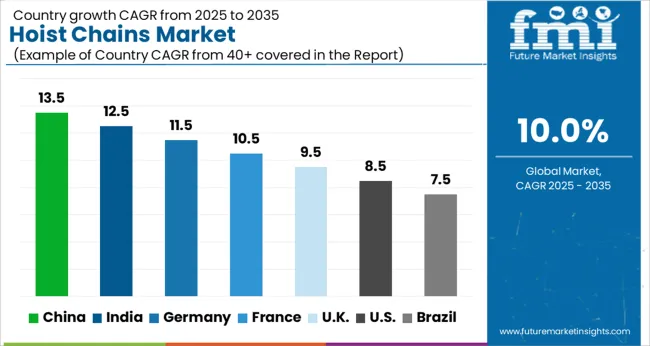

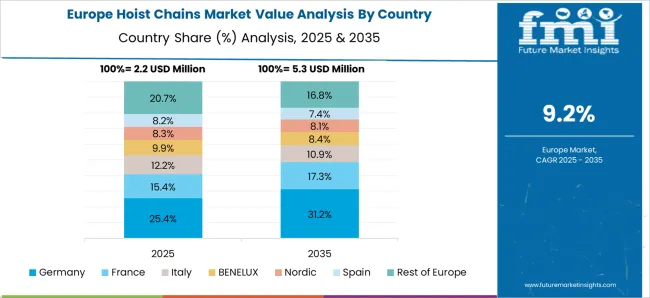

The market is forecasted to expand at a CAGR of 10.0% between 2025 and 2035, supported by growing demand in construction, manufacturing, and logistics industries. China leads with a 13.5% CAGR, driven by rapid industrialization and large infrastructure projects. India follows at 12.5%, fueled by expanding construction activities and increased mechanization.

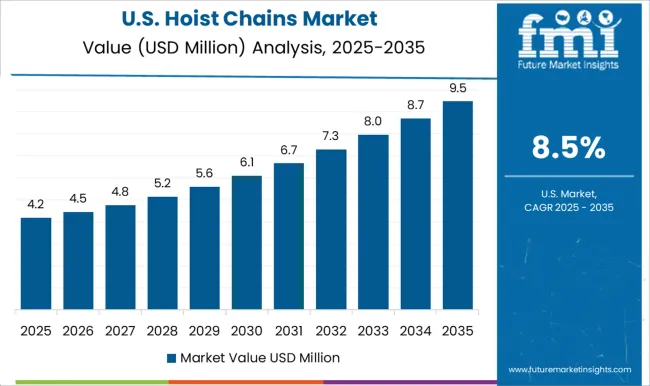

Germany, growing at 11.5%, benefits from advanced production techniques and strict safety regulations. The UK, with a 9.5% CAGR, experiences steady demand from industrial and warehousing sectors. The USA, at 8.5%, reflects continuous investment in heavy machinery and material handling equipment upgrades. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is expected to expand at a CAGR of 13.5% from 2025 to 2035, driven by rapid industrialization and infrastructure development. Leading manufacturers focus on producing high-strength, durable chains that meet rigorous safety standards for construction, mining, and logistics sectors. Investments in advanced manufacturing techniques such as heat treatment and precision forging have improved product quality and load capacity. Domestic companies like Zhongtong Hoist Chain Company are increasing production capabilities to meet rising domestic and export demands. Government policies promoting industrial growth and modernization have further accelerated market expansion.

India’s industry is anticipated to grow at a CAGR of 12.5% over 2025 to 2035, supported by expanding construction activities and mechanization in mining operations. Focus on enhancing product safety and quality has become a key priority, with manufacturers adopting superior alloy steel materials and rigorous testing procedures. Increasing demand for lifting equipment in infrastructure and logistics sectors has propelled sales growth. Collaborations with international technology providers have facilitated access to advanced manufacturing processes and improved product standards.

Germany is forecasted to grow at a CAGR of 11.5% from 2025 to 2035, driven by demand from automotive, manufacturing, and heavy machinery industries. Emphasis on precision engineering and quality control has positioned German manufacturers as leaders in reliable and durable chain solutions. The automation trend in manufacturing facilities is fueling demand for high-performance lifting equipment. Exports to European markets remain significant. Investments in eco-friendly production methods and recycling initiatives align with the country’s environmental policies.

The United Kingdom’s market is projected to grow at a CAGR of 9.5% from 2025 to 2035, supported by expansion in construction, shipping, and industrial sectors. Product innovations focusing on corrosion resistance and load-bearing capacity have gained traction. Suppliers are catering to specialized lifting requirements in maritime and manufacturing applications. Investment in R&D for enhanced coatings and tensile strength improvements has bolstered product reliability. Growing port activities and infrastructure upgrades remain key demand drivers.

The industry in the United States is anticipated to grow at a CAGR of 8.5% from 2025 to 2035, driven by manufacturing, logistics, and construction sectors. Compliance with stringent safety regulations such as OSHA standards has encouraged adoption of high-quality chains with enhanced durability. Innovations in alloy composition and heat treatment techniques have improved load capacity and fatigue resistance. The rise in warehouse automation and e-commerce logistics has further increased demand for reliable lifting equipment.

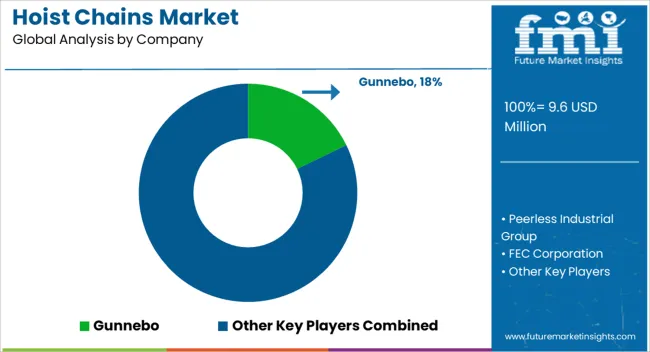

The market comprises specialized manufacturers producing high-strength lifting chains for industrial, construction, and maritime sectors. Gunnebo is a global leader known for durable chains that comply with stringent safety regulations and load capacity standards. Peerless Industrial Group combines quality craftsmanship with extensive product certifications, serving a broad range of heavy-duty lifting applications.

FEC Corporation and J.D. Theile focus on engineered chain solutions designed for critical environments, ensuring reliability and extended service life. Weissenfels and Campbell are established players with diversified product lines catering to various chain grades and configurations. Retezarna A.S and McKinnon Chain emphasize precision manufacturing techniques and customized hoist chains for specialized industries.

Atli Industry Co., Ltd., Juli Sling Co., Ltd., and Force Chain offer competitive products with an emphasis on cost-effectiveness and regional market penetration. Hangzhou Modern Lifting Machinery Works complements the market with innovative lifting equipment integrated with chain assemblies.

Market dynamics center on product durability improvements, enhanced corrosion resistance, and adherence to international standards such as ISO and DIN. Building strategic alliances with equipment manufacturers and distributors remains key for market penetration. Entry barriers include the need for metallurgical expertise, capital investment in production technology, and rigorous certification processes, limiting new competitors and maintaining dominance of established manufacturers.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.6 Million |

| Type | Surface hardened and Quenched & tempered |

| End-User | Construction, Aerospace, Automotive, Energy, Marine, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Gunnebo, Peerless Industrial Group, FEC Corporation, J.D. Theile, Weissenfels, Campbell, Retezarna A.S, McKinnon Chain, Atli Industry Co., Ltd., Juli Sling Co., Ltd., Force Chain, and Hangzhou Modern Lifting Machinery Works |

| Additional Attributes | Dollar sales by chain type and end-use industry, demand dynamics across construction, manufacturing, mining, and maritime sectors, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in high-tensile strength alloys, corrosion-resistant treatments, and modular chain link designs, environmental impact of raw material extraction, metal recycling practices, and lifecycle durability, and emerging use cases in automated material handling, heavy equipment safety systems, and offshore platform operations. |

The global hoist chains market is estimated to be valued at USD 9.6 million in 2025.

The market size for the hoist chains market is projected to reach USD 25.0 million by 2035.

The hoist chains market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in hoist chains market are surface hardened and quenched & tempered.

In terms of end-user, construction segment to command 29.4% share in the hoist chains market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hoist Sling Chains Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Hoist and Elevator Motors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Rescue Hoist System Market Growth - Trends & Forecast 2025 to 2035

Automotive Tire Chains Market Size and Share Forecast Outlook 2025 to 2035

Tech Savvy Hotel Chains Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA