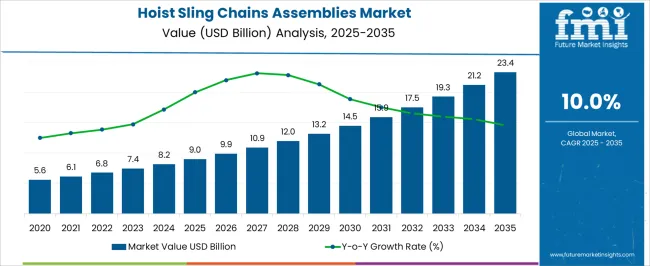

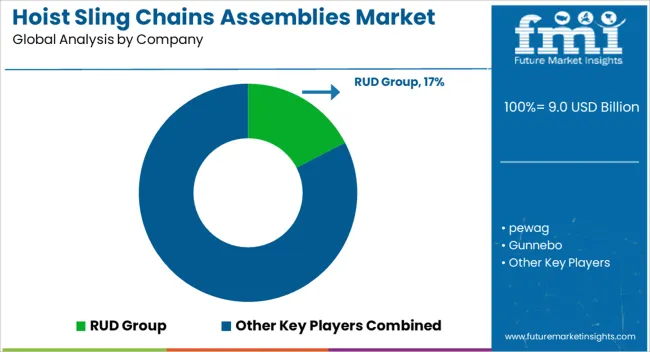

The Hoist Sling Chains Assemblies Market is estimated to be valued at USD 9.0 billion in 2025 and is projected to reach USD 23.4 billion by 2035, registering a compound annual growth rate (CAGR) of 10.0% over the forecast period. This steady progression illustrates a strong contribution from various growth drivers over the forecast period. The incremental increases each year show the market’s expanding footprint.

Starting at USD 9.0 billion in 2025, the market grows to USD 9.9 billion in 2026 and continues this trend upward, reaching USD 23.4 billion by 2035. The consistent growth highlights effective adoption and increasing demand within industries relying on hoist sling chains and assemblies. The Growth Contribution Index, derived from this data, indicates a balanced distribution of growth influence across the decade.

Early years contribute moderately with steady gains, while the latter half demonstrates stronger annual increases, signifying accelerating market momentum. This pattern suggests that investments in technology, enhanced product quality, and expanded industrial applications are fueling market expansion.

The market benefits from cumulative growth contributions, with no evident volatility or declines. This reinforces market stability and attractiveness to stakeholders. The data-driven Growth Contribution Index confirms that sustained efforts and market drivers progressively enhance value, creating promising opportunities for investors and industry participants through 2035.

| Metric | Value |

|---|---|

| Hoist Sling Chains Assemblies Market Estimated Value in (2025 E) | USD 9.0 billion |

| Hoist Sling Chains Assemblies Market Forecast Value in (2035 F) | USD 23.4 billion |

| Forecast CAGR (2025 to 2035) | 10.0% |

The hoist sling chains assemblies market is experiencing steady expansion, supported by rising industrial load-handling demands and the need for robust, reliable lifting solutions in heavy-duty operations. Growth is being fueled by advancements in metallurgy, enhanced fatigue resistance in chain links, and evolving safety standards across core industrial sectors.

Increased capital expenditure in construction, oil & gas, and marine industries is further elevating the demand for high-strength chain systems that can withstand variable load dynamics. The growing importance of certification, traceability, and failure-resilient configurations is also reinforcing the adoption of advanced sling chain assemblies.

Automation in rigging and crane systems has led to stronger compatibility requirements, favoring engineered lifting assemblies that can integrate seamlessly with smart equipment. Looking forward, innovations in corrosion-resistant coatings, high-alloy materials, and safety-integrated designs are anticipated to expand application scope and drive next-phase adoption.

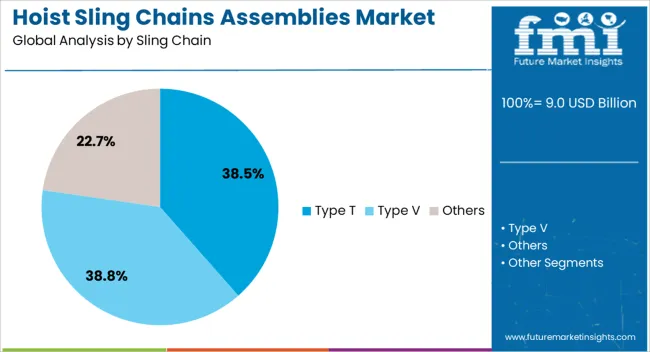

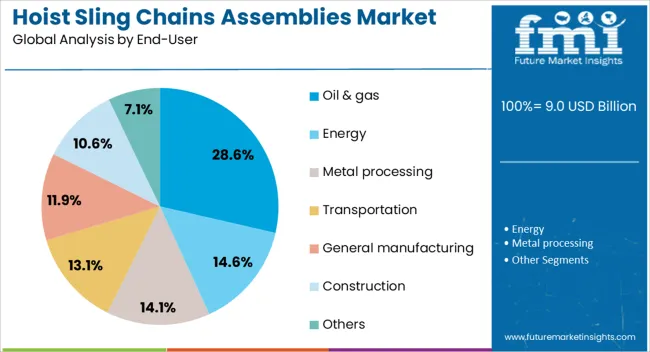

The hoist sling chains assemblies market is segmented by sling chain, assemblies end-user, and geographic regions. By sling chain, the hoist sling chains assembly market is divided into Type T, Type V, and Others. In terms of assemblies of the hoist sling chains, the market is classified into Assemblies. Based on the end-user of the hoist sling chains assemblies market, it is segmented into Oil & gas, Energy, Metal processing, Transportation, General manufacturing, Construction, and Others. Regionally, the hoist sling chains assemblies industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Type T sling chains are expected to account for 38.50% of the total market revenue in 2025, making them the dominant sling chain type. This segment’s leadership is attributed to its high-grade alloy composition, enhanced fatigue life, and suitability for temperature-intensive and heavy lifting applications.

Type T chains offer superior load-bearing capacity and durability under shock loads, aligning well with the requirements of large-scale industrial, mining, and offshore projects. Their widespread availability in various link diameters and standard configurations supports easy integration into diverse rigging setups.

The segment's growth is further driven by evolving compliance needs, as Type T chains consistently meet EN 818 standards for chain slings. As end-users place higher value on service life, reliability, and safety, Type T continues to gain preference in mission-critical hoisting environments.

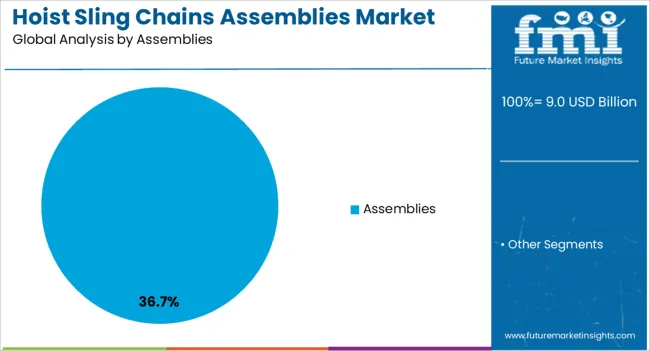

Assemblies are projected to hold 36.70% of the total market revenue in 2025, making them the leading configuration type in this space. This position is supported by growing demand for ready-to-use, pre-engineered lifting solutions that minimize setup time and human error during operations.

Assemblies are favored for their consistent quality assurance, compatibility with a wide range of hooks and master links, and compliance with international safety certifications. These systems offer modular flexibility, enabling customized load arrangements without compromising strength or balance.

Additionally, as multi-leg assemblies become standard in large industrial lifts, the ability to handle uneven and multidirectional forces has made this segment indispensable. The rising need for traceable components and periodic inspection readiness is further promoting the adoption of full sling assemblies in regulated industries.

The oil & gas sector is anticipated to contribute 28.60% of total market revenue in 2025, establishing it as the top end-user industry. This dominance stems from the sector's continual need for reliable and high-capacity lifting equipment in exploration, drilling, subsea, and refinery operations.

Sling chains and assemblies used in oil & gas must endure corrosive environments, extreme temperatures, and cyclical stress, making premium-grade chains essential. Offshore platforms, FPSOs, and pipeline installations require certified and fatigue-tested assemblies that ensure operational uptime and personnel safety.

The segment’s strength is further underpinned by regulatory scrutiny and lifting compliance audits, pushing operators to invest in traceable, durable, and certified chain systems. As energy companies scale operations in harsh terrain and deep-sea projects, the demand for high-performance hoist sling chain assemblies in this sector is expected to remain strong.

The market has witnessed notable growth due to rising industrialization and infrastructure development worldwide. These assemblies are critical for heavy lifting and material handling in sectors such as construction, manufacturing, shipping, and mining. Demand is driven by the need for durable, high-strength chains capable of handling varying load capacities safely and efficiently. The adoption of advanced alloys and heat treatment processes has enhanced the strength, wear resistance, and fatigue life of sling chains. Compliance with rigorous safety standards and certifications has become paramount, influencing product design and quality assurance.

Industrial growth, particularly in construction, manufacturing, and shipping, has increased the need for reliable hoist sling chains capable of safely lifting heavy loads. Large infrastructure projects and expanding manufacturing plants require sling assemblies that can withstand harsh operating conditions, including high temperatures, abrasive environments, and dynamic forces. The versatility of these chains in lifting and rigging applications has made them indispensable for safe material transport and equipment positioning. The rise in offshore oil and gas exploration also contributes to demand for specialized sling chains with corrosion resistance. Continuous investments in industrial automation and safety protocols further drive adoption of certified and high-quality sling assemblies.

Technological advancements in metallurgy and heat treatment processes have significantly improved the mechanical properties of sling chains. Use of high-grade alloy steels, enhanced tensile strength, and improved surface treatments have increased resistance to wear, fatigue, and corrosion. These innovations allow sling chains to perform reliably under extreme load conditions and extended usage cycles. Manufacturers are developing chains with optimized link geometry to balance strength and flexibility while reducing weight. Enhanced coating technologies, such as galvanization and powder coating, protect against environmental degradation, especially in marine and chemical industry applications. These material innovations support longer service life and improved safety in critical lifting operations.

Strict adherence to international safety standards and certifications, such as ISO, OSHA, and ASME, is crucial in the hoist sling chains market to ensure user safety and operational reliability. Compliance with load rating, testing, and traceability requirements has become mandatory for industrial and commercial applications. Governments and industry bodies enforce regulations aimed at preventing lifting accidents and equipment failures. This has prompted manufacturers to invest in quality control systems, advanced testing laboratories, and certification processes. End-users increasingly demand certified sling assemblies with documented compliance, promoting transparency and accountability in procurement and use. Regulatory frameworks influence product development and foster industry-wide improvements in safety performance.

The market faces challenges due to the volatility of raw material prices, particularly steel alloys, which are impacted by global demand-supply imbalances and geopolitical tensions. These fluctuations affect production costs and profit margins, especially for manufacturers dependent on imported metals. Supply chain disruptions caused by logistics constraints, trade restrictions, and raw material scarcity can delay order fulfillment and increase lead times. To mitigate risks, companies are diversifying supplier bases, investing in local sourcing, and adopting lean inventory practices. Additionally, efforts to improve production efficiency and reduce waste are being implemented to manage costs without compromising product quality or safety standards.

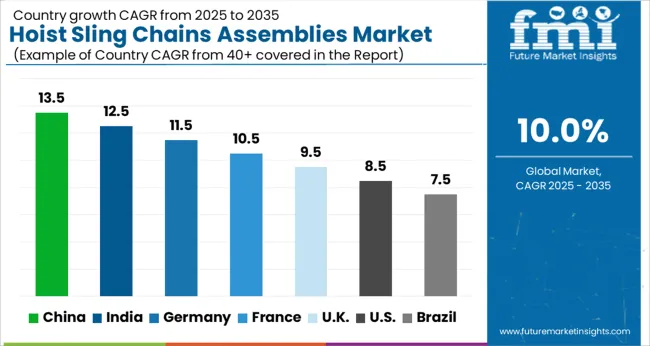

The market is forecasted to grow at a CAGR of 10.0% between 2025 and 2035, driven by expanding industrialization, infrastructure development, and increasing demand for heavy lifting equipment. China leads with a 13.5% CAGR, supported by large-scale manufacturing and rapid industrial growth. India follows at 12.5%, fueled by infrastructure projects and construction activities.

Germany, growing at 11.5%, benefits from advanced manufacturing technologies and stringent safety standards. The UK, with a 9.5% CAGR, experiences steady demand in industrial and logistics sectors. The USA, at 8.5%, reflects ongoing upgrades in material handling and heavy machinery applications. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is forecasted to grow at a CAGR of 13.5% from 2025 to 2035, propelled by expansion in construction, manufacturing, and logistics industries. Domestic manufacturers focus on producing high-strength chains with enhanced durability and corrosion resistance. Investments in automated welding and heat treatment technologies have improved product quality and load capacity. Key players such as Zhongtong Hoist and Hebei Iron Chain Company are expanding production capacities to meet rising demand from infrastructure and heavy machinery projects. The government’s infrastructure development plans continue to stimulate market growth across urban and industrial zones.

India is expected to grow at a CAGR of 12.5% between 2025 and 2035, driven by growth in construction, mining, and heavy manufacturing sectors. Focus on safety standards and product certifications has gained importance among manufacturers. Local firms are adopting advanced alloy steel technologies to enhance chain strength and durability. Demand from infrastructure projects and increasing mechanization in mining activities have supported steady sales growth. Strategic collaborations with international suppliers are improving technology access and quality benchmarks.

Germany’s market is projected to expand at a CAGR of 11.5% during 2025 to 2035, underpinned by demand from automotive manufacturing, logistics, and heavy machinery sectors. Emphasis on high-quality steel grades and precision manufacturing distinguishes German producers. The industrial automation trend has increased demand for reliable and durable lifting equipment. Export to neighboring European countries remains a key revenue stream. Sustainability initiatives have led to investments in recyclable materials and eco-friendly manufacturing processes.

The United Kingdom is anticipated to grow at a CAGR of 9.5% from 2025 to 2035, driven by expanding construction and shipping industries. The focus on compliance with safety and load-bearing standards remains a priority. Suppliers are introducing customized chain assemblies for specialized lifting operations. Investment in R&D for corrosion-resistant coatings and improved tensile strength has enhanced product reliability. The maritime sector contributes significantly to market demand due to increased port activity.

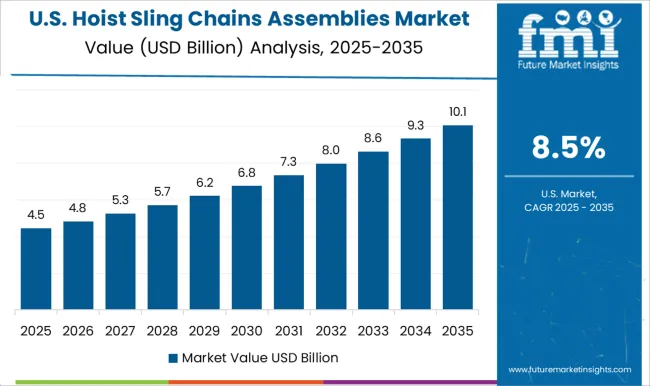

The United States market is expected to grow at a CAGR of 8.5% between 2025 and 2035, supported by growth in manufacturing, construction, and logistics sectors. Industry players are focusing on enhancing product safety and durability to comply with stringent OSHA regulations. Innovations in alloy compositions and heat treatment processes have improved chain strength and fatigue resistance. The rise in e-commerce and warehouse automation has further increased demand for lifting equipment with high load capacity and reliability.

The market is dominated by specialized manufacturers delivering robust lifting and rigging solutions for construction, manufacturing, and maritime industries. RUD Group is recognized globally for its high-strength chain assemblies, offering a wide range of products designed to meet rigorous safety standards and demanding load requirements. pewag combines decades of experience with innovative manufacturing processes to produce durable chains resistant to wear and corrosion.

Gunnebo stands out with its comprehensive product portfolio, including customized sling assemblies tailored for heavy lifting applications in industrial environments. Peerless Industrial Group emphasizes engineered solutions and certification compliance, serving sectors such as oil and gas and transportation. J.D. Theile offers a balance of quality and cost-efficiency, catering primarily to regional markets with adaptable chain configurations.

Market participants focus on continuous product testing, enhancement of load-bearing capacity, and expanding global distribution channels. Strategic partnerships with equipment manufacturers and contractors help solidify long-term supply agreements. Entry barriers include stringent regulatory certifications, the necessity for advanced metallurgical expertise, high capital investment for quality control infrastructure, and established trust among industrial customers. These factors restrict new competitors and ensure dominance by leading manufacturers in the market.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.0 Billion |

| Sling Chain | Type T, Type V, and Others |

| Assemblies | Assemblies |

| End-User | Oil & gas, Energy, Metal processing, Transportation, General manufacturing, Construction, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | RUD Group, pewag, Gunnebo, Peerless Industrial Group, and J.D. Theile |

| Additional Attributes | Dollar sales by sling type and industry application, demand dynamics across construction, manufacturing, maritime, and logistics sectors, regional trends in usage across North America, Europe, and Asia-Pacific, innovation in high-strength alloy materials, corrosion-resistant coatings, and modular assembly designs, environmental impact of raw material extraction, wear-and-tear waste, and recycling practices, and emerging use cases in automated lifting systems, heavy equipment maintenance, and offshore construction projects. |

The global hoist sling chains assemblies market is estimated to be valued at USD 9.0 billion in 2025.

The market size for the hoist sling chains assemblies market is projected to reach USD 23.4 billion by 2035.

The hoist sling chains assemblies market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in hoist sling chains assemblies market are type t, type v and others.

In terms of assemblies, assemblies segment to command 36.7% share in the hoist sling chains assemblies market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hoist Chains Market Size and Share Forecast Outlook 2025 to 2035

Slingshot/3 Wheeled Motorcycle Market Size and Share Forecast Outlook 2025 to 2035

Hoist and Elevator Motors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Baby Sling Market Size and Share Forecast Outlook 2025 to 2035

Cable Assemblies Market

Rescue Hoist System Market Growth - Trends & Forecast 2025 to 2035

Wire Rope Sling Market - Trends & Forecast 2025 to 2035

Switchrack Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Indoor Cable Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Microwave Cable Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tire Chains Market Size and Share Forecast Outlook 2025 to 2035

Ceramic to Metal Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Tech Savvy Hotel Chains Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Hose Assemblies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fibre Optic Cable Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Satellite Cables And Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Single-use Filtration Assemblies Market Growth – Trends & Forecast 2025 to 2035

Aircraft Tube and Duct Assemblies Market Growth - Trends & Forecast 2025 to 2035

Waveguide Components and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA