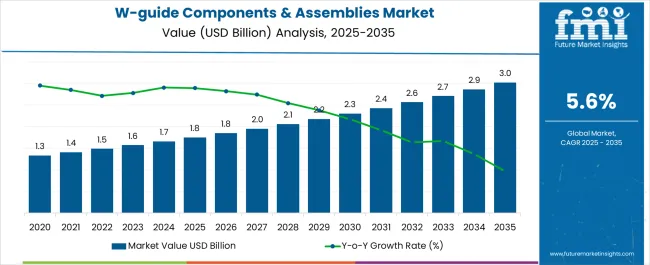

The waveguide components and assemblies market is projected to reach USD 1.7 billion in 2025 and expand to USD 3.0 billion by 2035, reflecting a CAGR of 5.6% over the forecast period. The absolute dollar opportunity between 2025 and 2035 is estimated at USD 1.3 billion, highlighting significant revenue potential for manufacturers, distributors, and technology providers.

Growth is fueled by increasing adoption of high-frequency communication systems, including satellite communications, radar systems, 5G infrastructure, and defense applications, which require reliable waveguide components for signal transmission with minimal loss. Aerospace, telecommunications, and military sectors are increasingly investing in advanced materials, precision manufacturing, and modular designs to enhance performance, durability, and integration with complex RF systems.

The market is also influenced by regional expansion in North America and Asia-Pacific, where infrastructure modernization, space exploration programs, and defense modernization projects are driving demand. Product innovations, including lightweight alloys, low-loss ceramics, and integrated assembly solutions, are further enabling system miniaturization, higher bandwidth handling, and efficient thermal management.

Strategic collaborations between component manufacturers, system integrators, and research institutions are anticipated to accelerate the adoption of next-generation waveguide assemblies globally, creating incremental revenue streams and reinforcing competitive positioning across diverse end-use industries.

| Metric | Value |

|---|---|

| Waveguide Components and Assemblies Market Estimated Value in (2025 E) | USD 1.8 billion |

| Waveguide Components and Assemblies Market Forecast Value in (2035 F) | USD 3.0 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The waveguide components and assemblies market is shaped by several interconnected parent markets, each contributing significantly to overall demand and growth. The telecommunications and 5G infrastructure market holds the largest share at 35%, driven by the need for efficient high-frequency signal transmission in mobile networks, base stations, and fiber-optic communication systems.

The aerospace and defense market contributes 25%, as radar, satellite communication, and avionics systems increasingly rely on precision waveguide assemblies for minimal signal loss and enhanced reliability. The industrial and scientific research market accounts for 15%, supporting laboratory, particle accelerator, and spectroscopy applications where waveguides are critical for controlled signal propagation. The automotive and electric vehicle market holds a 10% share, leveraging millimeter-wave radar and advanced sensor systems for autonomous driving, collision avoidance, and adaptive cruise control.

The retail and system integration market represents 15%, facilitating distribution, turnkey solutions, and end-user customization for commercial and institutional applications. The telecommunications, aerospace, and industrial segments account for 75% of overall demand, highlighting that high-frequency communication, defense applications, and scientific research are the primary growth drivers, while automotive adoption and system integration channels provide steady incremental growth opportunities worldwide.

The waveguide components and assemblies market is experiencing robust momentum, supported by advancements in high-frequency communication systems and the proliferation of radar, satellite, and aerospace applications. Current market conditions are defined by increasing adoption in defense, aviation, and commercial sectors, driven by the need for high-performance transmission with minimal signal loss.

Technological innovations in material engineering and manufacturing precision are enhancing efficiency, reducing system weight, and improving operational bandwidth. Global demand is further bolstered by large-scale defense modernization programs and expanding space exploration initiatives.

Competitive dynamics are characterized by the integration of waveguide solutions into advanced electronic warfare systems and high-capacity communication links, with suppliers focusing on customization to meet sector-specific standards Over the forecast period, the market is expected to benefit from sustained governmental and commercial investments, strategic collaborations, and the rapid development of 5G and satellite-based broadband infrastructure, reinforcing its long-term growth trajectory.

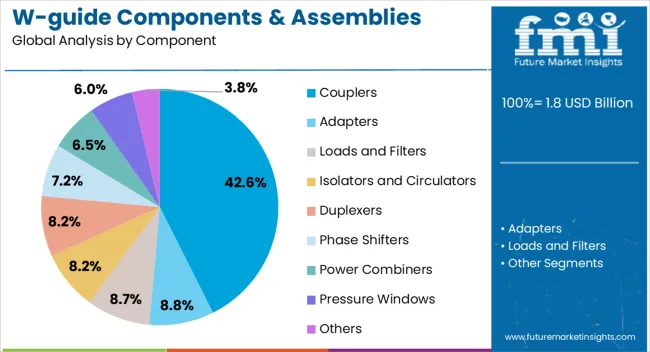

The waveguide components and assemblies market is segmented by component, spectrum, sector, and geographic regions. By component, waveguide components and assemblies market is divided into Couplers, Adapters, Loads and Filters, Isolators and Circulators, Duplexers, Phase Shifters, Power Combiners, Pressure Windows, and Others.

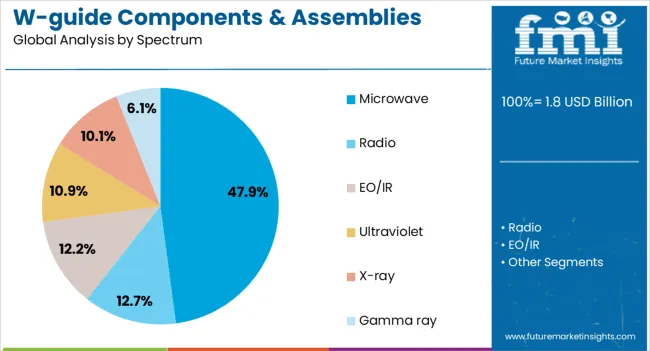

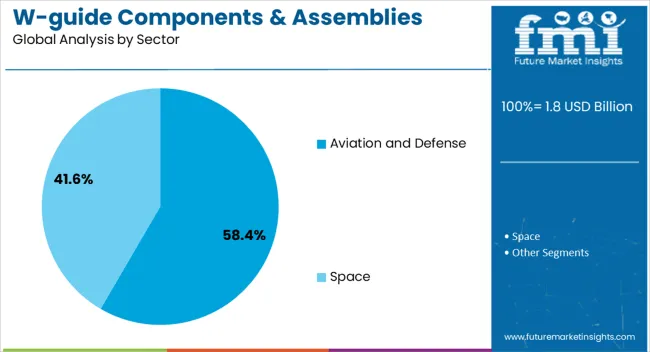

In terms of spectrum, waveguide components and assemblies market is classified into Microwave, Radio, EO/IR, Ultraviolet, X-ray, and Gamma ray. Based on sector, waveguide components and assemblies market is segmented into Aviation and Defense and Space. Regionally, the waveguide components and assemblies industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The couplers segment, holding 42.60% of the component category, has maintained its lead due to its critical role in monitoring, sampling, and distributing signals in high-frequency systems. Demand is being driven by its application versatility across radar, satellite communications, and test measurement setups, where precise power division and directional signal control are essential.

Performance enhancements through advanced machining techniques and precision assembly have improved coupler reliability under extreme environmental conditions, aligning with aerospace and defense specifications. Manufacturers are focusing on miniaturization without compromising insertion loss or isolation performance, enabling integration into compact, high-power systems.

Stable procurement from defense and aerospace programs has provided predictable volume demand, while commercial telecommunications infrastructure upgrades are opening additional growth opportunities With ongoing R&D investment in broadband capabilities and high-frequency extension, the couplers segment is positioned to retain its market dominance.

The microwave spectrum segment, representing 47.90% of the spectrum category, leads the market owing to its extensive use in radar, communication satellites, and wireless backhaul systems. Its dominance is underpinned by superior signal transmission properties at long ranges and the maturity of supporting technologies, making it integral to defense, aviation, and high-capacity communication networks.

Rising deployment of radar systems for air traffic control, weather monitoring, and defense surveillance is sustaining demand, while next-generation satellite constellations are expanding the requirement for microwave-based waveguide solutions. The segment benefits from established frequency allocations that provide operational stability, encouraging long-term infrastructure investment.

Innovations in low-loss materials and thermal stability are further enhancing performance, ensuring compatibility with high-power, mission-critical systems. Continued adoption across both government and commercial programs is expected to secure the microwave segment’s strong position in the market.

The aviation and defense sector, accounting for 58.40% of the sector category, remains the dominant end-use segment due to the high reliability and precision requirements inherent to mission-critical operations. The segment’s share is driven by substantial procurement of waveguide components for radar, navigation, and secure communication systems, supported by ongoing defense modernization efforts and increasing air traffic management needs.

Stringent compliance standards and the necessity for rugged, high-performance assemblies have reinforced demand for specialized manufacturing capabilities. Long-term defense contracts and recurring maintenance cycles ensure stable revenue streams, while investments in next-generation aircraft and unmanned aerial systems are expanding application scope.

The sector’s emphasis on advanced surveillance and electronic warfare systems further amplifies demand for waveguide solutions capable of operating at higher frequencies and under extreme conditions.

Waveguide components and assemblies are primarily driven by telecommunications, aerospace, and research applications, with growing adoption in automotive and system integration. High-frequency performance, precision, and reliability remain the key growth determinants globally.

The waveguide components and assemblies market is witnessing strong growth due to escalating demand for high-speed, low-loss communication networks. Telecommunications providers increasingly rely on waveguides in 5G base stations, fiber-optic networks, and microwave backhaul systems to maintain signal integrity and reduce attenuation. Mobile network operators are expanding network coverage and enhancing bandwidth to meet growing consumer and enterprise connectivity requirements. The deployment of advanced communication equipment in urban and semi-urban areas is driving demand for compact, reliable, and high-performance waveguide assemblies. Increased adoption of mmWave frequencies for enhanced data throughput and reduced latency further propels market uptake, while equipment manufacturers focus on modular, standardized, and scalable waveguide solutions for efficient deployment in telecommunications infrastructure.

The aerospace and defense sector accounts for a significant portion of waveguide demand, driven by radar, satellite communication, and avionics systems. Military and defense organizations are deploying high-frequency radar systems and secure communication networks that rely on precise waveguide assemblies to minimize signal loss and interference. Commercial aircraft increasingly integrate waveguide components for navigation, telemetry, and communication with ground stations. Demand is also rising for satellite-based internet services, remote sensing, and surveillance applications, which require high-performance waveguides for long-distance signal propagation. Manufacturers focus on producing ruggedized and temperature-resistant components to withstand harsh environmental conditions in aerospace and defense applications, enabling reliable operations under extreme stress while meeting stringent regulatory standards.

Waveguide components and assemblies are critical in laboratories, particle accelerators, spectroscopy, and scientific instrumentation, supporting controlled propagation of high-frequency signals. Research institutions and industrial labs invest in waveguides for experiments in microwave photonics, material characterization, and RF testing. Increasing adoption in industrial automation and process monitoring enhances demand for precision waveguides capable of consistent performance under variable conditions. Universities, research centers, and government-funded projects drive innovation in signal measurement and analysis, necessitating high-quality components. Suppliers are focusing on custom waveguide solutions to meet specific research and industrial requirements, ensuring accurate signal transmission and minimal distortion, which is crucial for achieving reliable experimental outcomes and operational efficiency in complex industrial processes.

The automotive industry is emerging as a growth segment for waveguide components, primarily due to millimeter-wave radar applications in autonomous vehicles, adaptive cruise control, and collision-avoidance systems. Vehicle manufacturers integrate compact waveguide assemblies into sensors and communication modules to support advanced driver-assistance systems (ADAS) and V2X connectivity.

Additionally, system integrators and commercial solution providers are leveraging waveguides for turnkey communication, radar, and IoT applications across diverse sectors. The demand for modular, lightweight, and precision-engineered components facilitates easy integration into vehicle electronics and industrial systems. Continuous collaboration between manufacturers and integrators ensures compliance with safety standards and performance specifications, expanding market penetration in automotive and commercial system integration sectors.

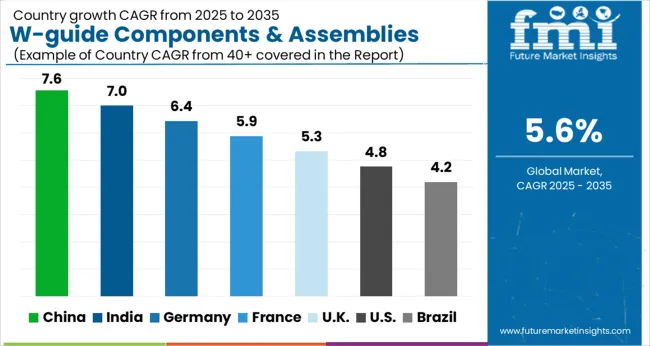

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| USA | 4.8% |

| Brazil | 4.2% |

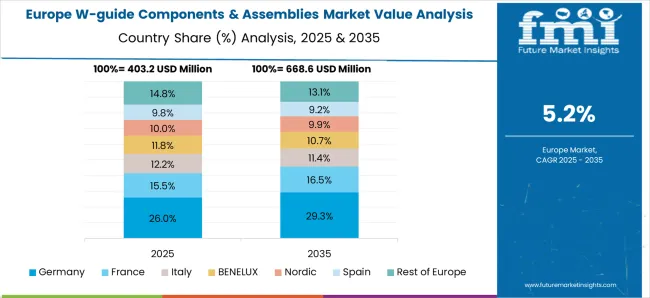

The global waveguide components and assemblies market is projected to grow at a CAGR of 5.6% from 2025 to 2035. China leads at 7.6%, followed by India at 7.0%, Germany at 6.4%, the UK at 5.3%, and the USA at 4.8%. Growth is driven by increasing deployment of 5G networks, radar systems, satellite communications, and high-frequency industrial applications. Asia, particularly China and India, demonstrates rapid adoption due to expanding telecommunications infrastructure, industrial automation, and aerospace programs. Europe emphasizes precision engineering, defense-grade components, and research-focused applications, while North America focuses on advanced telecommunications, defense, and scientific instrumentation. Integration with mmWave, satellite, and radar systems continues to enhance demand globally. The analysis spans over 40+ countries, with the leading markets shown below.

The waveguide components and assemblies market in China is projected to grow at a CAGR of 7.6% from 2025 to 2035, driven by expanding 5G infrastructure, satellite communication, and defense radar applications. Manufacturers are investing in high-precision engineering and mmWave-compatible components to support telecommunications and aerospace projects. Increasing demand for high-frequency industrial systems and radar modules is further boosting market adoption. Domestic companies are collaborating with global players to enhance technological capabilities and meet performance standards. E-commerce and specialized B2B distribution channels are making components more accessible to SMEs and large-scale enterprises alike, while R&D efforts focus on miniaturization, improved insertion loss, and bandwidth efficiency.

The waveguide components and assemblies market in India is expected to expand at a CAGR of 7.0% from 2025 to 2035, supported by government-backed telecom expansion, defense modernization, and satellite communication projects. Industrial automation and high-frequency test systems are increasing demand for robust and low-loss waveguides. Domestic manufacturers are introducing cost-effective solutions with improved reliability for 5G, radar, and aerospace applications. Strategic partnerships with global technology providers are enabling knowledge transfer and compliance with international standards. E-commerce and specialized industrial supply channels are improving accessibility for small and medium enterprises, while public and private investment in high-tech infrastructure accelerates adoption across metropolitan and semi-urban regions.

The waveguide components and assemblies market in Germany is projected to grow at a CAGR of 6.4% from 2025 to 2035, driven by aerospace, defense, and high-frequency industrial applications. German manufacturers emphasize precision engineering, low insertion loss, and high durability for radar, satellite, and telecommunications systems. Government contracts for defense radar modernization and civil aviation communication upgrades provide steady demand. Collaborations with European technology leaders are facilitating innovation in lightweight, compact, and high-bandwidth components. Integration with mmWave, 5G, and satellite networks is increasing market adoption, while specialized distributors ensure timely delivery and technical support for industrial clients. R&D efforts focus on enhancing bandwidth efficiency, reducing electromagnetic interference, and optimizing manufacturing processes.

The waveguide components and assemblies market in the UK is expected to expand at a CAGR of 5.3% from 2025 to 2035, fueled by investments in defense communication systems, satellite applications, and 5G network deployment. Manufacturers focus on lightweight, high-performance components suitable for radar, telecom, and aerospace use. Partnerships with global suppliers enable access to advanced fabrication techniques and quality certifications. Research initiatives in universities and defense labs support innovative designs for high-frequency and mmWave waveguides. Distribution through specialized industrial suppliers and B2B channels ensures availability for small and large-scale enterprises, while public and private investments in telecommunications and defense programs accelerate overall adoption.

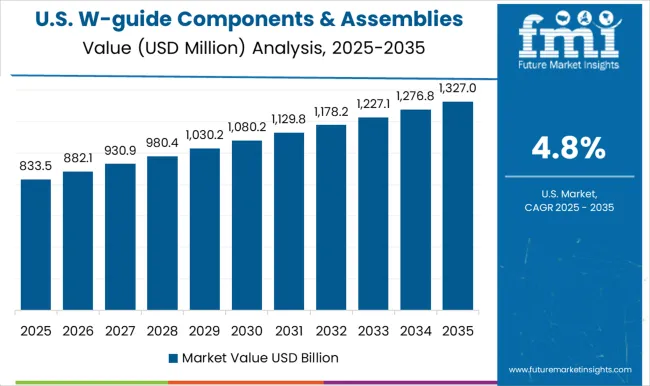

The waveguide components and assemblies market in the USA is projected to grow at a CAGR of 4.8% from 2025 to 2035, driven by aerospace, defense, and high-frequency telecom applications. USA manufacturers focus on high-precision, low-loss components for radar, satellite communication, and 5G mmWave systems. Government contracts for defense modernization and NASA projects provide sustained demand. Strategic alliances with global technology providers facilitate innovation in compact, lightweight, and high-bandwidth components. Industrial adoption in testing, instrumentation, and telecommunications accelerates market growth. Distribution through specialized B2B channels, along with strong after-sales and technical support, ensures wide accessibility. R&D initiatives continue to enhance reliability, bandwidth efficiency, and miniaturization to meet evolving high-frequency application requirements.

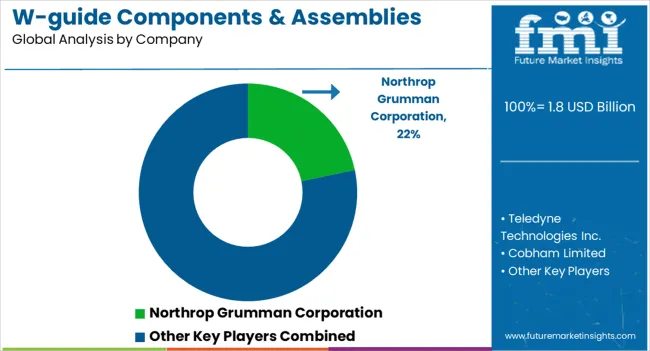

Competition in the waveguide components and assemblies market is defined by precision engineering, high-frequency performance, and reliability. Northrop Grumman Corporation leads with advanced radar, defense, and aerospace solutions, offering high-precision waveguides compatible with mmWave and satellite applications. Teledyne Technologies Inc. differentiates through custom-designed components for test instrumentation, radar systems, and secure communication networks. Cobham Limited emphasizes lightweight, low-loss components for aerospace, defense, and industrial high-frequency applications, focusing on durability and efficiency under harsh operating conditions.

Ducommun Incorporated competes with miniaturized, high-bandwidth waveguide solutions for 5G, aerospace, and radar modules, supporting both commercial and defense contracts. Emerging and specialized players such as Quantic Electronics, Amplitech, and Eravant focus on niche markets, offering high-performance, compact, and customizable components suitable for telecommunications, satellite, and military applications. Strategies center on precision manufacturing, material innovation, and adherence to international quality standards. Partnerships with defense contractors, telecom operators, and aerospace integrators are leveraged to enhance technological capability and expand global reach. Product offerings emphasize insertion loss, bandwidth efficiency, thermal stability, and environmental resilience to meet rigorous performance specifications.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 Billion |

| Component | Couplers, Adapters, Loads and Filters, Isolators and Circulators, Duplexers, Phase Shifters, Power Combiners, Pressure Windows, and Others |

| Spectrum | Microwave, Radio, EO/IR, Ultraviolet, X-ray, and Gamma ray |

| Sector | Aviation and Defense and Space |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Northrop Grumman Corporation, Teledyne Technologies Inc., Cobham Limited, Ducommun Incorporated, Quantic Electronics, Amplitech, and Eravant |

| Additional Attributes | Dollar sales, share, growth trends by application (aerospace, defense, telecom), regional demand, high-frequency vs low-frequency adoption, material preferences, supply chain risks, competitive landscape, and technology differentiation, all quantified and segmented for strategic planning, investment, and product development decisions. |

The global waveguide components and assemblies market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the waveguide components and assemblies market is projected to reach USD 3.0 billion by 2035.

The waveguide components and assemblies market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in waveguide components and assemblies market are couplers, adapters, loads and filters, isolators and circulators, duplexers, phase shifters, power combiners, pressure windows and others.

In terms of spectrum, microwave segment to command 47.9% share in the waveguide components and assemblies market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Optical Waveguide Market Growth – Trends & Forecast 2025 to 2035

Bicycle Components Aftermarket Size and Share Forecast Outlook 2025 to 2035

HCV Brake Components Market

Precision Components And Tooling Systems Market Size and Share Forecast Outlook 2025 to 2035

Distribution Components Market Size and Share Forecast Outlook 2025 to 2035

Transmission Components Market Size and Share Forecast Outlook 2025 to 2035

Sewing machine components Market Size and Share Forecast Outlook 2025 to 2035

Passive Optical Components Market Size and Share Forecast Outlook 2025 to 2035

Radio Frequency Components Market Growth – Trends & Forecast 2025 to 2035

Gas Fittings & Components Market – Market Demand & Safety Insights 2025 to 2035

Casted Automotive Components Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Components Aftermarket Market

Aircraft Fluid Power Components Market

Two-Wheeler Aftermarket Components & Consumables Market Size and Share Forecast Outlook 2025 to 2035

Satellite Communication Components Market Size and Share Forecast Outlook 2025 to 2035

Automotive Brake System & Components Market Growth - Trends & Forecast 2025 to 2035

Automotive Interior Plastic Components Market Size and Share Forecast Outlook 2025 to 2035

Mechanical Performance Tuning Components Market Growth - Trends & Forecast 2025 to 2035

Power Distribution Automation Components Market Analysis by Component, End-Use and Region: Forecast for 2025 to 2035

Automotive Electric Drivetrain Components Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA