The inclusion bags market is seeing strong growth across the segments in which it is feasible and growing demand for safe, controlled, and crease-efficient packaging solutions among the applications for fire extinguishers, pharmaceuticals, food & beverages, chemicals, industrial applications, and others.

By virtue of offering superior contamination control, durability, and recyclability, inclusion bags have arisen as most important in the handling of any sensitive/ hazardous material. Advances in biodegradable materials, tamper-proof designs, and smart packaging technologies will propel the market into a tremendous expansion phase in the coming decade.

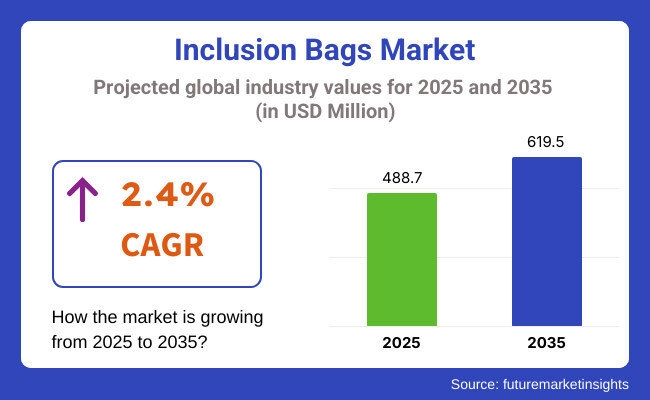

Inclusion bags market is estimated to grow at a CAGR of 2.4% from 2025 to 2035, reaching USD 619.5 Million. The market size is estimated to be USD 488.7 Million in 2025. This growth is expected to come from increasing demand for precision packaging, increasing regulatory requirements for safety compliance, and technological innovations in multilayer and anti-static materials. Further, with advances in automated filling systems and IoT-enabled tracking solutions, more industries switch to inclusion bags.

The flexibility of quality bags along with better moisture resistance and security features propel general growth in the market. Emerging trends in green packaging, government programs seeking to stimulate the usage of environmentally friendly alternatives, and investment in smart logistics technologies are some of the factors pushing growth within the inclusion bags market.

Furthermore, development of anti-counterfeit technologies, RFID-enabled tracking, and improved barrier properties led to an enhanced value proposition for the market.

Perpetual industrialization, growing pharmaceutical and food industries, and regulations supporting safety and hygiene packaging solutions are expected to help Asia-Pacific in becoming the leader in the inclusion bags market. China, India, and Japan have a substantial demand for inclusion bags for pharmaceutical handling, food preservation, and industrial chemical packaging.

Growth in this area is backed by the development of biodegradable and tamper-proof inclusion bags, low-cost production technologies, and automation in material handling. Innovations in packaging are further enhanced by government regulations that insist on workplace safety and contamination-free packaging. Global packaging manufacturers are now strengthening local production capacity with their presence in Asia-Pacific.

North America is a promising and crucial region for inclusion bags, as those pertaining to pharmaceutical packaging, food safety, and hazardous material handling regulations are stringent. The USA and Canada lead the region in technological enhancement in anti-static, moisture-resistant, and leak-proof packaging solutions. Furthermore, the increase in automation and AI-derived quality checks in packaging production encourages efficiency and reduces material wastage.

Regulatory policies on waste and environmental sustainability are guiding the transition towards sustainable and reusable packaging solutions, which, in turn, influence the market. Further development in R&D investments towards high-barrier, thief-proof, recyclable inclusion bags will also lend hands towards the market's enhancement. Along with these developments, smart packaging will tend to provide real-time tracking and authentication features, making it a desirable area of growth for supply chain transparency and safety compliance.

Europe indeed enjoys a fairly large chunk of the inclusion bags market induced by rigorous sustainability regulations, the rising demands for contamination-free packaging, and a quickly growing focus on recyclability. Germany, France, and the UK are the three leading trends in innovation concerning biodegradable materials, multilayer barrier films, and antimicrobial coatings.

Policies in Europe are directed toward the high maintenance of hygiene standards, elimination of single-use plastics, and promotion of eco-friendly packaging solutions. Improved performance inclusion bags with high resistance to moisture, oxygen, and UV rays are some of the leading contributors to the extensive market.

The region shows a strong connect among packaging manufacturers-regulatory bodies-research institutions, resulting in the development of next-generation inclusion bags where higher durability, sustainability, and safety features are being added. Progress in Artificial Intelligence production optimization, smart labels, and RFID-enabled authentication will be instrumental in driving the market innovations.

Challenges

Opportunities

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Early focus on hygiene and contamination-free packaging. |

| Material and Formulation Innovations | Development of moisture-resistant and anti-static inclusion bags. |

| Industry Adoption | Widely used in pharmaceuticals, chemicals, and food packaging. |

| Market Competition | Dominated by conventional inclusion bag manufacturers. |

| Market Growth Drivers | Growth fueled by demand for contamination control and product safety. |

| Sustainability and Environmental Impact | Initial adoption of recyclable and biodegradable materials. |

| Integration of AI and Process Optimization | Limited AI use in contamination control and traceability. |

| Advancements in Packaging Technology | Basic improvements in tamper-proof and leak-proof designs. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global mandates on fully recyclable, tamper-proof, and eco-friendly inclusion bags. |

| Material and Formulation Innovations | Expansion of AI-driven, antimicrobial, and smart packaging solutions. |

| Industry Adoption | Increased adoption in hazardous material transport, medical waste disposal, and IoT-enabled supply chain tracking. |

| Market Competition | Rise of sustainability-driven startups and high-tech packaging firms integrating digital security features. |

| Market Growth Drivers | Market expansion driven by automation, IoT-enabled tracking, and fully recyclable inclusion bags. |

| Sustainability and Environmental Impact | Large-scale transition to compostable, reusable, and plastic-free inclusion bags. |

| Integration of AI and Process Optimization | AI-driven predictive analytics, automated packaging quality checks, and real-time authentication technologies. |

| Advancements in Packaging Technology | Development of smart packaging with embedded RFID, QR code tracking, and interactive consumer engagement features. |

The USA dominates the market for inclusion bags because of growing demand for high-barrier, tamper-evident, and eco-friendly packaging solutions for industries such as pharmaceuticals, food processing, and specialty chemicals. Growing attention to contamination avoidance, longer shelf life, and green packaging has prompted manufacturers to develop biodegradable, recyclable, and FDA-approved inclusion bags.

Additionally, government regulations promoting sustainable material use and plastic-reducing initiatives are pressuring companies to innovate with toxin-free and compostable alternatives. Technological innovations in multi-layered, high-density polymer inclusion packaging that is moisture- and UV-resistant are also fueling growth in the market.

Companies are further spending on smart packaging innovations, including QR-coded traceability, anti-counterfeiting features, and resealability for increasing customer convenience and supply chain safety. Moreover, the increased application of inclusion bags in regulated-environment applications, such as pharmaceuticals and hazardous materials packaging, is also driving innovation for high-performance and eco-friendly package solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.6% |

The UK inclusion bags market is on a growth path because industries make sustainable packaging, regulatory compliance, and product safety a priority. The demand for tamper-proof strength and recyclable inclusion bags is increasing in various sectors such as food production, pharmaceuticals, and agricultural applications. Initiatives by the governments to promote a circular economy, reduce plastic waste, and sustainable packaging solutions, are further encouraging investments into the production of these biodegradable and eco-friendly inclusion bags.

Innovations such as high-barrier, puncture resistance and vacuum-sealed inclusion bags are also improving the functionality of inclusion bags for storage and transport. Companies are exploring digital branding, advanced sealing technologies as well as antimicrobial bag materials to further improve efficiency and hygiene.

There is growing demand for high-performance, moisture resistant and customized inclusion bags for food safety, specimen storage, and industrial applications, motivating the demand for premium packaging solutions in the UK market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.2% |

The markets in Japan for inclusion bags keep on increasing steadily with the constant growing demand in industries like pharmaceuticals, electronics, and food preservation, for high quality precision cut and heat sealable bags. Competition in the industry drives firms to develop inclusion bags with superior oxygen and moisture barrier properties, enhanced tensile strength, and ultra-thin lamination that meet Japan's stringent quality and safety requirements.

With strict regulations in material recyclability and food contact safety, companies are now finding ways to switch to non-toxic, fully compostable, low-carbon feet inclusion bags. Innovations in nanoparticle-infused films and temperature-resistant polymers are driving gas-flushable inclusion bags for applications that need to prolong product freshness and protection.

Furthermore, businesses are investing in AI-powered quality control, digital authentication technologies, and automated bag manufacturing to increase their efficiency and reduce wastage. Finally, the rising trend of smart food packaging, pharmaceutical-grade containment, and eco-conscious packaging in industry are some of the demand-increasing factors for next-generation, high-tech inclusion bag solutions in Japan.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.0% |

Now the growth of the inclusion bag market in South Korea is absorbing more and more momentum amid an increasing demand for food, medical, and industrial applications requiring moisture-proof, odor-proof, and ecologically acceptable containment solutions.

Quite clearly, manufacturers must manufacture polymer blends of high barrier, very leak-proof, and tamper-evident inclusion bags, which can provide maximum structural integrity and sustainability. And with the additional support of government regulations for plastic wastes, sustainable materials, and recyclable packaging, the market will flourish even more.

Companies are now using digital tracking technologies in their packaging, such as RFID-enabled smart packaging, blockchain-based authentication, and AI-enabled quality assurance systems, to ensure product safety and supply chain efficiency. There is increasing demand for resealable, antimicrobial, and high-temperature-resistant inclusion bags in pharmaceuticals and specialty packaging, further fuelling market uptake.

Also, R&D for plant-based biodegradable films, fully compostable alternatives, and chemical-resistant industrial liners helps companies towards the development of new and sustainable-designed inclusion bag solutions responding to shifting industry requirements.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5,4% |

The inclusion bags market is actively moved in high barriers, tamper evident and recyclable inclusion bags because industries are looking for stable, secure and eco-friendly packaging solutions. The manufacturers are improving the strength, resistance to chemicals and barriers of oxygen of bags to meet industry needs.

In addition, companies are focusing on promoting bar application by producing moisture and puncture resistant lightweight alternatives. In addition, innovations in artificial intelligence-based manufacturing, high-speed lamination and biodegradable polymer coatings improve the sustainability, product protection and cost efficiency in inclusion bag production.

The high-barrier inclusion bag market continues to be dominant as companies pursue long-lasting, contamination-proof, and FDA-compliant options for pharmaceuticals, chemicals, and perishable food uses. Companies are creating multi-layered high-barrier bags with high-end polymer compositions and reinforced designs to maximize performance in key industries.

Furthermore, the incorporation of solvent-free production methods and recyclable materials is further enhancing sustainability efforts. Additionally, companies are investigating ultra-thin, high-durability high-barrier inclusion bags to meet minimal-waste and sustainable packaging initiatives.

The tamper-evident inclusion bag market is experiencing growth due to industries demanding foolproof, security-enhanced, and digitally traceable packaging solutions for pharmaceuticals, forensic storage, and handling sensitive documents. Reinforced seals, void-evident marking, and holographic verification are being invested in by companies to enhance security.

Research on smart RFID-embedded bags and temperature-sensitive security elements is pushing the innovation in this space. In addition, the growth of track-and-trace supply chain management, pharmaceutical-quality packaging, and e-commerce-enabled secure shipments is driving demand for top-quality tamper-evident inclusion bags.

The recyclable inclusion bag market is more and more adopting bio-based polymers, reusable configurations, and closed-loop material recycling systems for food, healthcare, and industrial packaging. Compostable, water-soluble, and totally biodegradable bag materials that improve environmental sustainability without compromising on product integrity are being developed by manufacturers. Material engineering is also being enhanced with the help of AI to improve the efficiency and tailor-made recyclable inclusion bags for industrial, retail, and consumer uses.

Also, companies are looking at carbon-neutral, light, and high-performance recyclable bags for increased sustainability and waste impact reduction. The use of smart printing, high-clarity barrier films, and resealable packaging in professional and domestic uses is also contributing to market growth.

Development of better gas barrier coatings, heat-resistant films, and AI-based defect detection is improving the useability and sustainability of inclusion bags. AI-based optimization of the supply chain is also enhancing production efficiency and minimizing waste in bag-making operations.

With industries focusing on safety, durability, and eco-friendly packaging solutions, the market for inclusion bags will continue to expand steadily. Material science innovations, green manufacturing, and intelligent packaging will continue to define the future of this market, making inclusion bags a must-have element in many medical, industrial, and consumer applications.

The market for inclusion bags is growing consistently as more demand is seen for customized packaging products in industries like pharma, food, agri, and chemicals. These bags are developed to house and protect diverse contents in a safe manner while facilitating easy handling, storage, and transportation.

Inclusion bags are increasingly attracting attention with the capacity to extend barrier properties, controlled permeation, and contaminant resistance. Precision-demanding industries in the areas of storage and transportation are resorting to advanced inclusion bag technologies to attain product integrity as well as effectiveness.

The growing focus on sustainability, regulatory requirements, and cost savings is influencing the market dynamics. Packagers are turning to biodegradable, recyclable, and multi-layer packaging materials to drive innovation in line with changing industry benchmarks and minimize environmental footprint.

The demand for inclusion bags is increasing across various industries due to their versatility, durability, and ability to handle sensitive materials. Innovations in high-barrier films, anti-static coatings, and moisture-resistant technologies are further driving market penetration.

The pharmaceutical and food industries are key contributors to the growth of the inclusion bags market. These industries require highly protective packaging solutions to maintain product stability, prevent contamination, and ensure compliance with safety regulations.

Regulatory standards such as FDA, EU packaging directives, and ISO certifications are playing a crucial role in shaping the demand for high-quality inclusion bags.

The agriculture and chemical industries require inclusion bags for safe handling, bulk storage, and transport of seeds, fertilizers, and hazardous materials. High-strength, puncture-resistant, and UV-resistant inclusion bags are witnessing increased adoption due to their durability and safety features.

Despite their advantages, challenges such as fluctuating raw material costs, stringent environmental policies, and supply chain disruptions persist. However, ongoing innovations in smart packaging solutions, AI-integrated tracking, and automation in packaging processes are helping overcome these hurdles and fueling market expansion.

The market for inclusion bags is seeing more investment in innovative materials, intelligent packaging solutions, and sustainable manufacturing practices. Firms are emphasizing light-weight, adjustable, and high-barrier packing solutions while satisfying global quality and safety standards.

Strategic collaborations among packaging makers, logistics players, and industry players are spurring innovation and expanding market presence.

In addition, developments in digital printing technology are improving branding and traceability elements on inclusion bags. Increasing use of AI-based supply chain management is assisting in streamlining packaging logistics and eliminating operational inefficiencies.

Manufacturers are also making investments in antimicrobial packaging solutions to enhance the shelf life of sensitive products. Sustainability continues to remain a focus area, with companies incorporating post-consumer recycled materials into the production of inclusion bags.

Regulatory guidelines are also changing to enable the use of biodegradable and compostable inclusion bag materials to further drive market growth.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Amcor plc | 12-16% |

| Mondi Group | 10-14% |

| Berry Global, Inc. | 8-12% |

| Sealed Air Corporation | 6-10% |

| Sonoco Products Company | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Amcor plc | Specializes in sustainable, high-performance inclusion bags for pharmaceuticals and food industries. |

| Mondi Group | Develops eco-friendly, fiber-based, and recyclable inclusion bag solutions. |

| Berry Global, Inc. | Expands its portfolio with moisture-resistant and anti-static inclusion bags for chemical and industrial use. |

| Sealed Air Corporation | Focuses on advanced barrier packaging, vacuum-sealed inclusion bags, and food safety packaging. |

| Sonoco Products Company | Invests in biodegradable, lightweight, and cost-effective inclusion bag designs. |

Key Company Insights

Other Key Players (45-55% Combined) Several specialized packaging manufacturers contribute to the growing inclusion bags market. These include:

The overall market size for the Inclusion Bags Market was USD 488.7 Million in 2025.

The Inclusion Bags Market is expected to reach USD 619.5 Million in 2035.

The market will be driven by increasing demand from the food, pharmaceutical, agricultural, and chemical industries, along with the rising adoption of sustainable and smart packaging solutions.

Key challenges include rising raw material costs, environmental regulations, and supply chain disruptions. However, advancements in eco-friendly materials and automated manufacturing processes are mitigating these challenges.

North America and Europe are expected to dominate due to stringent packaging regulations and high demand for sustainable packaging. The Asia-Pacific region is also experiencing rapid growth, driven by expanding industrial sectors and increasing adoption of flexible packaging solutions.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 16: Global Market Attractiveness by Material Type, 2023 to 2033

Figure 17: Global Market Attractiveness by End Use, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 34: North America Market Attractiveness by Material Type, 2023 to 2033

Figure 35: North America Market Attractiveness by End Use, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Material Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Material Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Material Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Material Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polybags Market Size and Share Forecast Outlook 2025 to 2035

Net Bags Market

VCI Bags Market

Sandbags Market

Leno Bags Market Size and Share Forecast Outlook 2025 to 2035

Silo bags Market Size and Share Forecast Outlook 2025 to 2035

Food Bags Market Share, Size, and Trend Analysis for 2025 to 2035

Competitive Breakdown of Silo Bag Manufacturers

Paper Bags Market Size and Share Forecast Outlook 2025 to 2035

Jumbo Bags Market Size and Share Forecast Outlook 2025 to 2035

Blood Bags Market Size and Share Forecast Outlook 2025 to 2035

Craft Bags Market Growth, Trends, Forecast 2025 to 2035

Market Share Breakdown of Craft Bags Manufacturers

Competitive Breakdown of Paper Bags Providers

Market Share Analysis of Jumbo Bags & Key Players

Grout Bags Market Demand & Construction Industry Trends 2024 to 2034

Sugar Bags Market

Cotton Bags Market Size and Share Forecast Outlook 2025 to 2035

Refuse Bags Market Size and Share Forecast Outlook 2025 to 2035

Emesis Bags Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA