The global decorations and inclusions market is projected to grow from USD 11.9 billion in 2025 to USD 21.1 billion by 2035, registering a CAGR of 5.9%.

The market expansion is being driven by increasing demand for premium and customized bakery and confectionery products. Innovations in food decoration techniques and the rise of artisanal baking trends are contributing to broader market adoption across retail, HoReCa, and industrial applications.

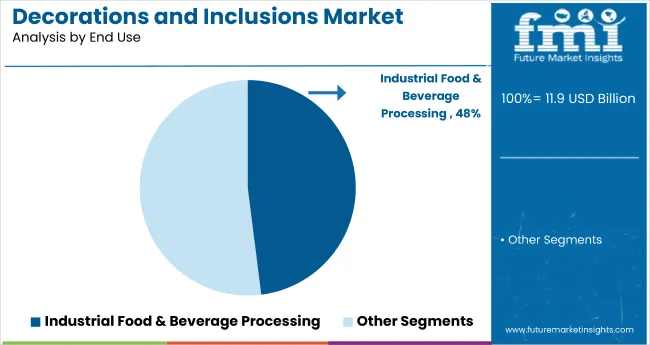

The market holds 48% of the global food and beverage decoration segment, reflecting its central role in visual enhancement and flavor enrichment. Within the bakery ingredients market, it accounts for nearly 27%, driven by demand for decorative toppings in pastries, cakes, and baked goods.

It contributes about 15% to the confectionery ingredients market due to widespread use in chocolates and candies. In the specialty food ingredients segment, it represents around 5%, while in the broader processed food additives market, its share is modest at nearly 1.3%, highlighting its niche yet essential function across categories.

Government regulations impacting the market focus on food safety, colorant usage, and allergen declarations. The Food Safety and Standards (Food Products Standards and Food Additives) Regulations, 2011 and the Food Safety and Standards (Labeling and Display) Regulations, 2020 in India mandate the use of approved additives and transparent labeling.

Global standards such as Codex Alimentarius and EFSA regulations also guide permissible decoration components. These frameworks are driving the adoption of clean-label and natural decorations, encouraging manufacturers to innovate with fruit- and nut-based inclusions, edible colors, and allergen-free options to ensure compliance and enhance consumer trust.

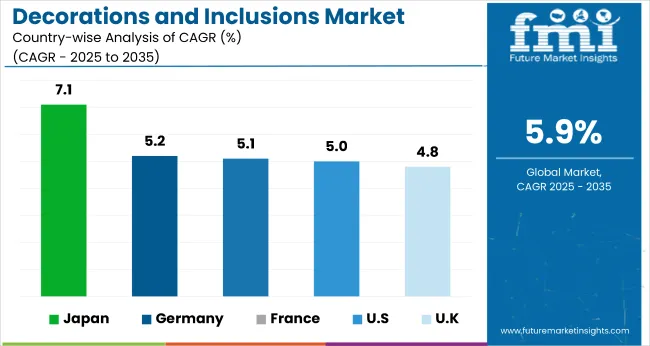

Japan is projected to be the fastest-growing market, expected to expand at a CAGR of 7.1% from 2025 to 2035. Industrial food & beverage processing will lead the end use segment with a 48% share, while indirect sales will dominate the sales channel segment with a 68% share. The USA and Germany markets are also expected to grow steadily at CAGRs of 5% and 5.2%, respectively. The UK and France are projected to expand at 4.8% and 5.1% CAGRs, respectively.

Quality assurance programs must address not only traditional food safety parameters but also aesthetic consistency standards, color stability requirements, and sensory evaluation criteria that ensure products maintain visual appeal throughout shelf life and across different application conditions. Testing protocols encompass color measurement, particle size distribution, coating integrity, and stability assessments under various temperature, humidity, and light exposure conditions that simulate real-world storage and display environments. These quality control requirements demand specialized analytical equipment and trained personnel with expertise in both food science and aesthetic evaluation methodologies.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 11.9 billion |

| Industry Value (2035F) | USD 21.1 billion |

| CAGR (2025 to 2035) | 5.9% |

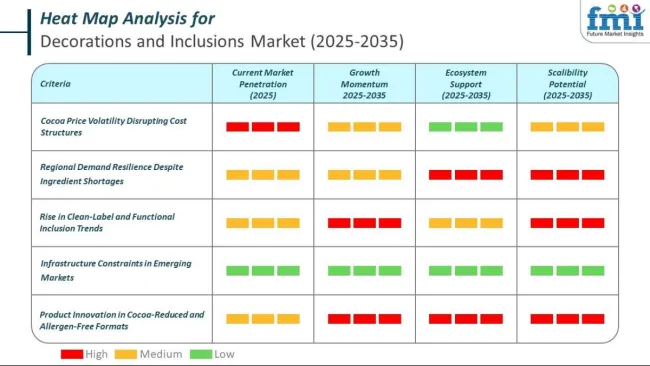

The decorations and inclusions market in 2025 is navigating volatility due to sharp cocoa price fluctuations. A dramatic swing from late 2024 highs to mid-2025 corrections has disrupted procurement cycles and increased complexity in production planning. In response, brands are reevaluating sourcing contracts and reformulating products to stabilize cost exposure.

While cocoa remains unstable, sugar pricing is more predictable, supported by steady global output. In the USA, evolving dietary regulations and healthier eating trends are reshaping demand for conventional sweeteners and decorations.

Fluctuations in the availability of nuts, fruits, and chocolate-based elements are creating uneven sourcing conditions across geographies. Still, the industry is adapting, and sales continue to hold strong in key product types and regions. USA bakeries and confectionery brands remain leaders, while Sweden maintains steady consumer interest in candy and decorative formats. Regional players are using agile sourcing and rapid innovation to navigate rising input costs.

Current product-level demand trends include:

The shift toward clean-label ingredients continues to shape product design in the decorations and inclusions market. Manufacturers are removing artificial additives, emphasizing plant-based and fortified options, and enhancing visual clarity through natural colorants. Functional coating systems are also being introduced to improve shelf life and preserve texture across storage and distribution conditions.

Innovation themes include:

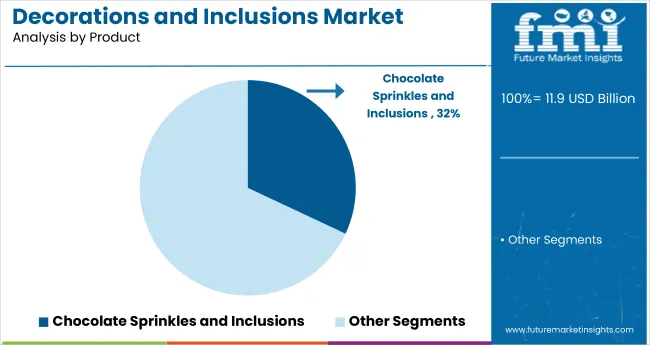

The global market is segmented by product, end use, sales channel, and region. By product, the market includes chocolate sprinkles and inclusions, chocolate shapes, chocolate cups and shells, sugar sprinkles and inclusions, sugar shapes, preserved/dried fruit pieces, sweetened/caramelised nuts, roasted nuts, baked pieces, and sugar pastes & icings.

By end use, the market covers industrial food & beverage processing (cakes, pastries, sweet biscuits, breakfast cereals, chocolate confectionery, sugar confectionery, ice cream & frozen desserts, snack bars, beverages), bakery & pastry shops, confectionery shops, restaurants & hotels, and household.

By sales channel, the market is bifurcated into direct sales and indirect sales (intermediate/bulk distributors, brick & mortar retailers, and online retailers). Regionally, the market spans North America, Latin America, Western Europe, Eastern Europe, Asia Pacific, and the Middle East & Africa.

Chocolate sprinkles and inclusions are projected to lead the product type segment, capturing 32% of the global market share by 2025. They are widely used in cakes, pastries, and frozen desserts.

Industrial food and beverage processing is projected to hold 48% of the market share by 2025, fueled by the increasing use of decorative ingredients in packaged foods, bakery products, and confectionery applications.

Indirect sales are projected to dominate the market with a 68% share in 2025, driven by the extensive reach of retailers and distributors across both consumer and industrial markets.

The global decorations and inclusions market is witnessing consistent growth, fueled by rising demand for visually appealing and premium-quality food products. These components enhance the texture, flavor, and visual appeal of baked goods, desserts, and confectionery, making them essential in food product innovation and consumer appeal.

Recent Trends in the Decorations and Inclusions Market

Challenges in the Decorations and Inclusions Market

Japan decorations and inclusions market growth is propelled by a strong focus on visual presentation in confectionery, clean-label product development, and integration of traditional flavors into modern applications.

Germany and France maintain steady demand, supported by consumer interest in organic, non-artificial decorations and EU mandates promoting clean-label, allergen-free ingredients. Developed economies such as the USA (5.0% CAGR), UK (4.8%), and Japan (7.1%) are expected to expand at 0.85-1.20x of the global growth rate.

Germany follows with strong demand for organic, gluten-free, and functional inclusions supported by EU food standards. France maintains steady momentum through its artisanal bakery sector and preference for fruit- and nut-based decorations.

The United States sees rising demand for seasonal sprinkles, decorative chocolates, and in-store customization, particularly in private-label bakery items. The UK shows the slowest growth, with stable demand in hospitality and foodservice segments, despite post-Brexit challenges affecting ingredient imports and regulatory adjustments.

The report includes detailed analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The Japan decorations and inclusions market is projected to grow at a CAGR of 7.1% from 2025 to 2035. Growth is driven by traditional-meets-modern dessert trends and consumer preference for detailed, minimalist product presentation.

The decorations and inclusions revenue in Germany is expected to expand at a CAGR of 5.2% through 2035, slightly below the global average but supported by health-conscious consumer behavior and EU-wide food ingredient policies. German bakeries and confectioners emphasize functional inclusions, such as high-protein nuts and reduced-sugar coatings.

The French decorations and inclusions market is projected to grow at a CAGR of 5.1% from 2025 to 2035, closely mirroring Germany in regulatory-driven expansion. Demand is primarily from the bakery and artisanal pastry sectors, with growing use of fruit-based decorations and inclusions.

The decorations and inclusions market in the USA is forecasted to grow at a CAGR of 5% between 2025 and 2035, equivalent to 0.85x the global rate. The market is characterized by strong demand for decorative chocolate, seasonal sprinkles, and ready-to-use icing and toppings.

The UK decorations and inclusions market is expected to grow at a CAGR of 4.8% from 2025 to 2035, the slowest among the leading OECD countries, at 0.81x the global pace. Post-Brexit adjustments have slowed import of certain decorative ingredients, although domestic production of sugar sprinkles, dried fruit toppings, and allergen-free decorations is growing.

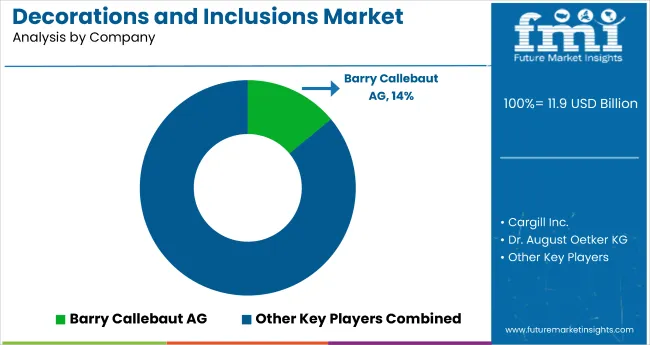

The Decorations and Inclusions Market is expanding steadily as the bakery, confectionery, dairy, and snack industries elevate product appeal through texture, flavor, and visual enhancement. Growth is being driven by rising consumer demand for premium, artisanal, and indulgent food experiences. Leading manufacturers such as Barry Callebaut AG, Cargill Incorporated, and Kerry Group plc are spearheading innovation with customizable chocolate decorations, compound coatings, and flavor inclusions tailored to global bakery and dessert applications. Their focus on clean-label, sustainable ingredients and natural colorants aligns with evolving consumer preferences for authenticity and transparency.

Dobla B.V., Delicia B.V., and Ulmer Schokoladen GmbH & Co. KG are leading suppliers of high-quality chocolate decorations and shapes, catering to professional bakers and large-scale manufacturers seeking aesthetic refinement and product differentiation. Dawn Foods Inc. and Orchard Valley Foods Ltd. specialize in ready-to-use decoration kits, sugar inclusions, and sprinkles that enhance both functionality and shelf stability.

Dr. August Oetker KG and Mavalerio USA Inc. are focusing on consumer-ready decoration lines and vibrant confectionery inclusions designed for home baking and retail confectionery markets. ICAM S.p.A., HLR Praliné, and Carroll Industries NZ Limited emphasize artisanal craftsmanship, developing premium praline, caramel, and nut-based inclusions for gourmet and private-label confectionery products.

Kanegrade Ltd. and Pecan Deluxe Candy Company contribute through natural flavor and color inclusions, leveraging real fruit, nuts, and chocolate to elevate sensory appeal. The market’s momentum is supported by increasing demand for product customization, experiential indulgence, and visually rich food presentations. Sustainable sourcing and plant-based ingredient development are shaping the next phase of innovation in decorations and inclusions.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 11.9 billion |

| Projected Market Size (2035) | USD 21.1 billion |

| CAGR (2025 to 2035) | 5.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value / volume in metric tons |

| Product Analyzed | Chocolate Sprinkles and Inclusions, Chocolate Shapes, Chocolate Cups and Shells, Sugar Sprinkles and Inclusions, Sugar Shapes, Preserved/Dried Fruit Pieces, Sweetened/Caramelised Nuts, Roasted Nuts, Baked Pieces, Sugar Pastes & Icings |

| End Use Analyzed | Industrial Food & Beverage Processing (Cakes, Pastries, Sweet Biscuits, Breakfast Cereals, Chocolate Confectionery, Sugar Confectionery, Ice Cream & Frozen Desserts, Snack Bars, Beverages), Bakery & Pastry Shops, Confectionery Shops, Restaurants & Hotels, Household |

| Sales Channel Analyzed | Direct Sales, Indirect Sales (Intermediate/Bulk Distributors, Brick & Mortar Retailers, Online Retailers) |

| Regions Covered | North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia and 40+ countries |

| Key Players Influencing the Market |

Barry Callebaut AG, Dobla B.V., Cargill Incorporated, Carroll Industries NZ Limited, Dawn Foods Inc., Delicia B.V., Dr. August Oetker KG, HLR Praliné, ICAM S.p.A., Kanegrade Ltd., Orchard Valley Foods Ltd., Mavalerio USA Inc., Pecan Deluxe Candy Company, Ulmer Schokoladen GmbH & Co. KG, Kerry Group plc. |

| Additional Attributes | Dollar sales by product type, share by end use, regional demand trends, labeling regulations, clean-label influence, competitive benchmarking |

The global decorations and inclusions market is estimated to be valued at USD 11.9 billion in 2025.

The market size for the decorations and inclusions market is projected to reach USD 21.1 billion by 2035.

The decorations and inclusions market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in decorations and inclusions market are chocolate sprinkles and inclusions, chocolate shapes, chocolate cups and shells, sugar sprinkles and inclusions, sugar shapes, preserved/dried fruit pieces, sweetened/caramelized nuts, roasted nuts, baked pieces and sugar pastes & icings.

In terms of end use, industrial/food and beverage processing segment to command 42.7% share in the decorations and inclusions market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Decorations and Inclusions Market in EU Size and Share Forecast Outlook 2025 to 2035

Chocolate Inclusions and Decorations Market Analysis by Type, End Use, and Region Through 2035

Frosting, Toppings, and Decorations Market Trends - Growth & Industry Forecast 2025 to 2035

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Handheld Electrostatic Meter Market Size and Share Forecast Outlook 2025 to 2035

Hand Towel Automatic Folding Machine Market Size and Share Forecast Outlook 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA