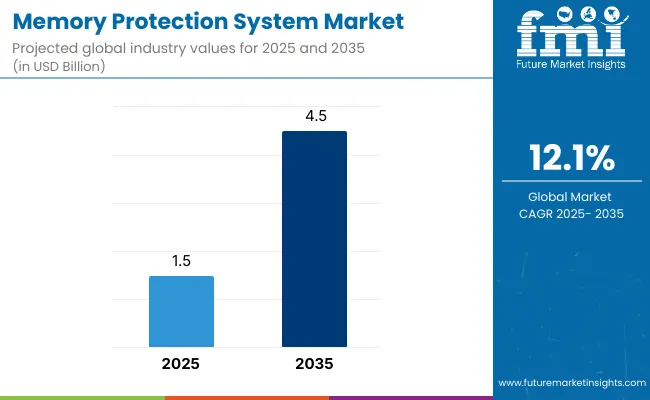

The global memory protection system market is valued at USD 1.5 billion in 2025. It is slated to reach USD 4.5 billion by 2035, recording an absolute increase of USD 3.1 billion over the forecast period. This translates into a total growth of 213.6%, with the market forecast to expand at a CAGR of 12.1% between 2025 and 2035. The overall market size is expected to grow by nearly 3.13X during the same period, supported by escalating cybersecurity threats, increasing regulatory requirements for data protection, and rising adoption of memory protection technologies across financial services, aerospace, medical equipment, and software development sectors.

Between 2025 and 2030, the memory protection system market is projected to expand from USD 1.5 billion to USD 2.3 billion, resulting in a value increase of USD 840.4 million, which represents 27.1% of the total forecast growth for the decade. This phase of development will be shaped by the growing sophistication of cyberattacks targeting memory vulnerabilities, expanding deployment of hardware-based protection mechanisms, and increasing awareness of memory corruption exploits in enterprise systems. Software developers and IT security teams are expanding their memory protection capabilities to address the growing demand for robust security solutions that ensure system integrity and protect against buffer overflow attacks and unauthorized memory access attempts.

From 2030 to 2035, the market is forecast to grow from USD 2.3 billion to USD 4.5 billion, adding another USD 2.3 billion, which constitutes 72.9% of the overall ten-year expansion. This period is expected to be characterized by the expansion of cloud-native security architectures and containerized application protection, the development of artificial intelligence-driven memory anomaly detection systems, and the growth of specialized solutions for Internet of Things devices and edge computing environments. The growing adoption of zero-trust security frameworks and automated threat response mechanisms will drive demand for memory protection systems with enhanced detection capabilities and real-time threat neutralization features.

Between 2020 and 2025, the memory protection system market experienced steady growth, driven by increasing awareness of memory-based vulnerabilities and growing recognition of memory protection as essential technology for preventing data breaches and system compromises across enterprise, government, and critical infrastructure applications. The market developed as security architects and system administrators recognized the potential for memory protection technology to prevent exploitation of stack overflow vulnerabilities, heap corruption, and use-after-free conditions while meeting compliance requirements. Technological advancement in hardware-assisted virtualization and software instrumentation began emphasizing the critical importance of maintaining memory isolation and access control in complex computing environments.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1.5 billion |

| Forecast Value in (2035F) | USD 4.5 billion |

| Forecast CAGR (2025 to 2035) | 12.1% |

Market expansion is being supported by the increasing frequency and sophistication of cyberattacks exploiting memory vulnerabilities driven by expanding attack surfaces in cloud computing and remote work environments, alongside the corresponding need for advanced security technologies that can prevent buffer overflow exploits, detect memory corruption attempts, and maintain system integrity across various financial services, aerospace, medical equipment, and software development applications. Modern IT security teams and system architects are increasingly focused on implementing memory protection solutions that can block zero-day exploits, prevent privilege escalation attacks, and provide consistent security coverage in demanding operational conditions.

The growing emphasis on regulatory compliance and data protection standards is driving demand for memory protection systems that can support secure coding practices, enable vulnerability-free software deployments, and ensure comprehensive security posture. Enterprise organizations' preference for security technologies that combine threat prevention capabilities with operational transparency and minimal performance overhead is creating opportunities for innovative memory protection implementations. The rising influence of cloud migration initiatives and containerized application architectures is also contributing to increased adoption of memory protection systems that can provide superior security characteristics without compromising application functionality or development workflows.

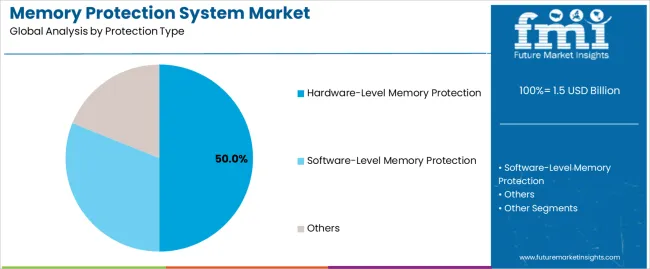

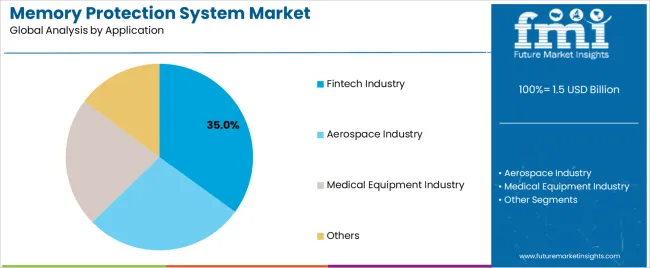

The market is segmented by protection type, application, and region. By protection type, the market is divided into hardware-level memory protection, software-level memory protection, and others. Based on application, the market is categorized into fintech industry, aerospace industry, medical equipment industry, and others. Regionally, the market is divided into China, India, Germany, Brazil, United States, United Kingdom, and Japan.

The hardware-level memory protection segment is projected to maintain its leading position in the memory protection system market in 2025 with a 50% market share, reaffirming its role as the preferred protection category for critical infrastructure and high-security computing applications. Enterprise IT departments and security teams increasingly utilize hardware-level protection for its superior performance characteristics, minimal system overhead, and proven effectiveness in preventing sophisticated memory exploitation attempts while maintaining application compatibility. Hardware-based protection technology's proven effectiveness and deployment versatility directly address the industry requirements for zero-trust security architectures and defense-in-depth strategies across diverse computing platforms and application categories.

This protection segment forms the foundation of modern secure computing environments, as it represents the technology with the greatest contribution to exploit prevention and established security record across multiple operating systems and processor architectures. Technology industry investments in hardware security features continue to strengthen adoption among system manufacturers and enterprise security teams. With regulatory pressures requiring enhanced data protection and improved breach prevention, hardware-level memory protection aligns with both compliance objectives and operational requirements, making it the central component of comprehensive security strategies.

The fintech industry application segment is projected to represent the largest share of memory protection system demand in 2025 with a 35% market share, underscoring its critical role as the primary driver for memory protection adoption across digital banking platforms, payment processing systems, and cryptocurrency exchanges. Financial technology companies prefer memory protection systems for security implementation due to exceptional threat prevention capabilities, regulatory compliance benefits, and ability to protect sensitive financial data while supporting transaction processing requirements and customer trust objectives. Positioned as essential technology for modern financial services, memory protection systems offer both security advantages and operational reliability.

The segment is supported by continuous innovation in financial technology and the growing availability of advanced protection solutions that enable superior security posture with enhanced threat detection and reduced false positive rates. Fintech companies are investing in comprehensive security integration programs to support increasingly stringent data protection regulations and customer expectations for secure financial transactions. As digital payment adoption accelerates and compliance standards increase, the fintech industry application will continue to dominate the market while supporting advanced protection utilization and security optimization strategies.

The memory protection system market is advancing steadily due to increasing demand for cybersecurity solutions driven by escalating data breach incidents and growing adoption of cloud computing platforms that require specialized security technologies providing enhanced threat prevention characteristics and compliance capabilities across diverse financial, aerospace, medical, and software development applications. The market faces challenges, including high implementation costs and integration complexity with legacy systems, performance overhead concerns in real-time processing environments, and skills shortage related to security expertise and configuration requirements. Innovation in machine learning-based threat detection and automated security orchestration continues to influence product development and market expansion patterns.

The growing adoption of cloud-native architectures is driving demand for specialized memory protection solutions that address unique security requirements including container isolation, microservices protection, and serverless function security. Cloud environments require advanced memory protection implementations that deliver superior threat detection across distributed systems while maintaining scalability and cost-effectiveness. Software development teams are increasingly recognizing the competitive advantages of memory protection integration for cloud application security and risk mitigation, creating opportunities for innovative protection technologies specifically designed for next-generation computing platforms.

Modern memory protection system vendors are incorporating artificial intelligence algorithms and automated response capabilities to enhance threat detection accuracy, reduce false positive rates, and support comprehensive security objectives through optimized analysis processes and anomaly identification techniques. Leading companies are developing machine learning models for memory access pattern analysis, implementing behavioral analytics for threat classification, and advancing detection technologies that minimize security team workload and operational complexity. These technologies improve security effectiveness while enabling new deployment opportunities, including autonomous threat neutralization, predictive vulnerability assessment, and real-time attack prevention. Advanced automation integration also allows organizations to support comprehensive security operations objectives and threat response beyond traditional signature-based detection methods.

The expansion of confidential computing initiatives, secure enclave technologies, and trusted execution environments is driving demand for hardware-assisted memory protection with precisely controlled isolation boundaries and exceptional cryptographic integration. These advanced implementations require specialized protection mechanisms with stringent security specifications that exceed traditional software-based approaches, creating premium market segments with differentiated value propositions. Vendors are investing in processor integration capabilities and security validation systems to serve emerging high-assurance computing applications while supporting innovation in secure multi-party computation, privacy-preserving analytics, and confidential data processing industries.

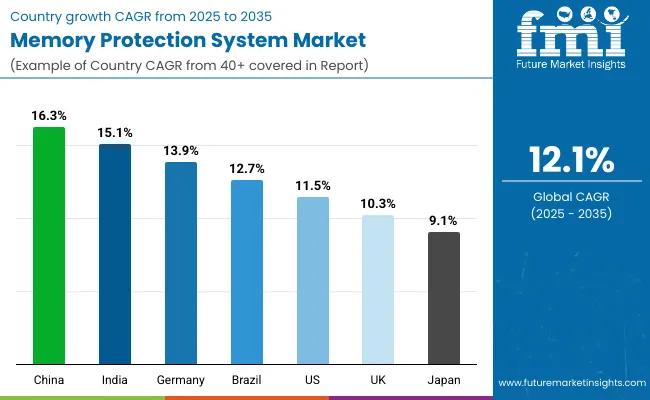

| Country | CAGR (2025-2035) |

|---|---|

| India | 15.1% |

| China | 16.3% |

| Brazil | 12.7% |

| United States | 11.5% |

| Germany | 13.9% |

| United Kingdom | 10.3% |

| Japan | 9.1% |

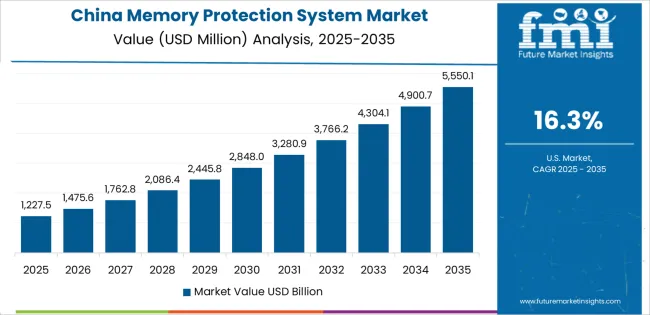

The memory protection system market is experiencing solid growth globally, with China leading at a 16.3% CAGR through 2035, driven by expanding technology sector, government cybersecurity initiatives, and increasing adoption of indigenous security solutions across financial services and critical infrastructure. India follows at 15.1%, supported by rapid digital transformation, expanding fintech ecosystem, and growing demand for secure software development practices in IT services exports.

Germany shows growth at 13.9%, emphasizing industrial cybersecurity, automotive software protection, and manufacturing system security. Brazil demonstrates 12.7% growth, supported by financial sector modernization, payment system security requirements, and growing awareness of memory-based threats. The United States records 11.5%, focusing on advanced threat detection, cloud security integration, and government defense applications. The United Kingdom exhibits 10.3% growth, emphasizing financial services security and regulatory compliance frameworks. Japan shows 9.1% growth, supported by industrial control system protection and precision manufacturing security requirements.

The report covers an in-depth analysis of 40 countries, with top-performing countries highlighted below.

Revenue from memory protection systems in China is projected to exhibit exceptional growth with a CAGR of 16.3% through 2035, driven by expanding domestic technology sector and government-led cybersecurity initiatives supported by national security policies and digital infrastructure modernization programs. The country's massive technology industry expansion and increasing investment in indigenous security technologies are creating substantial demand for memory protection solutions. Major technology companies and cybersecurity firms are establishing comprehensive memory protection development capabilities to serve both domestic markets and international opportunities.

Government support for cybersecurity industry development and critical infrastructure protection is driving demand for memory protection systems throughout major technology hubs and industrial centers across financial institutions, government agencies, and telecommunications networks. Strong technology sector growth and an expanding network of software development organizations are supporting the rapid adoption of hardware and software protection technologies among enterprises seeking enhanced security posture and threat resilience.

Demand for memory protection systems in India is expanding at a CAGR of 15.1%, supported by the country's position as a global IT services leader, expanding fintech sector, and increasing demand for secure software development practices in banking, healthcare, and government applications. The country's comprehensive digital transformation initiatives and technology workforce are driving sophisticated memory protection capabilities throughout diverse sectors. Leading IT companies and security vendors are establishing extensive development and delivery facilities to address growing domestic and export demand.

Rising digital payment adoption and expanding software development activities are creating opportunities for memory protection system deployment across financial technology platforms, enterprise applications, and cloud service providers in major technology centers. Growing government focus on data protection regulations and cybersecurity frameworks is driving adoption of memory protection technologies among organizations seeking enhanced compliance capabilities and security certifications.

Revenue from memory protection systems in Germany is growing at a CAGR of 13.9%, supported by the country's leadership in industrial automation, expanding automotive software development, and strong manufacturing sector utilizing memory protection in control systems and embedded applications. The nation's advanced engineering infrastructure and emphasis on security excellence are driving sophisticated memory protection capabilities throughout industrial sectors. Leading automotive manufacturers and industrial technology companies are investing extensively in memory protection technologies and secure development practices.

Advanced manufacturing requirements and automotive software complexity are creating demand for robust memory protection solutions among technology companies seeking superior system reliability and security assurance. Strong engineering discipline and growing focus on functional safety are supporting the adoption of verified protection mechanisms in automotive control systems and industrial automation platforms across major manufacturing regions.

Demand for memory protection systems in Brazil is anticipated to expand at a CAGR of 12.7%, supported by the country's modernizing financial sector, expanding digital payment infrastructure, and growing emphasis on cybersecurity capabilities in banking and fintech applications. The nation's comprehensive financial technology development and regulatory evolution are driving demand for sophisticated memory protection solutions. Banks and payment processors are investing in security infrastructure expansion and threat prevention capabilities to serve both domestic and regional markets.

Advanced payment system development and financial inclusion initiatives are creating demand for effective memory protection technologies among financial institutions seeking superior fraud prevention and transaction security. Strong banking sector modernization and growing digital payment adoption are driving deployment of protection systems in core banking platforms and mobile payment applications across major financial centers.

Revenue from memory protection systems in the United States is projected to grow at a CAGR of 11.5%, supported by the country's focus on advanced cybersecurity technologies, established cloud computing industry, and growing emphasis on defense applications and critical infrastructure protection. The nation's comprehensive technology sector and security research capabilities are driving demand for sophisticated memory protection solutions. Technology companies and government agencies are investing in protection capability development and threat intelligence integration to serve both civilian and defense requirements.

Advanced threat landscape complexity and cloud migration initiatives are creating demand for comprehensive memory protection platforms among enterprises seeking superior breach prevention and incident response capabilities. Strong cybersecurity industry expertise and growing regulatory requirements are driving adoption of memory protection systems in software development lifecycles and production environments across technology clusters.

Demand for memory protection systems in the United Kingdom is anticipated to expand at a CAGR of 10.3%, driven by the country's leading financial services sector, sophisticated regulatory environment, and strong emphasis on data protection compliance supporting advanced memory protection adoption for banking and insurance applications. The United Kingdom's financial industry sophistication and security standards are driving memory protection capabilities throughout regulated sectors. Financial institutions and technology service providers are establishing comprehensive security programs for threat prevention and compliance assurance.

Advanced regulatory frameworks and financial services innovation are creating demand for verified memory protection technologies among banks seeking enhanced security certifications and audit readiness. Strong compliance culture and growing cyber insurance requirements are supporting the adoption of memory protection systems throughout financial operations and customer-facing applications.

Revenue from memory protection systems in Japan is expanding at a CAGR of 9.1%, supported by the country's leadership in industrial automation, precision manufacturing applications, and strong emphasis on reliability engineering for production systems and quality control platforms. Japan's technological precision and manufacturing excellence are driving demand for verified memory protection products. Leading manufacturers and automation vendors are investing in specialized capabilities for industrial security applications.

Advanced manufacturing automation and quality assurance requirements are creating opportunities for memory protection systems throughout industrial facilities and production control environments. Strong manufacturing discipline and operational excellence culture are driving adoption of protection technologies in programmable logic controllers and supervisory control systems meeting rigorous reliability and safety standards.

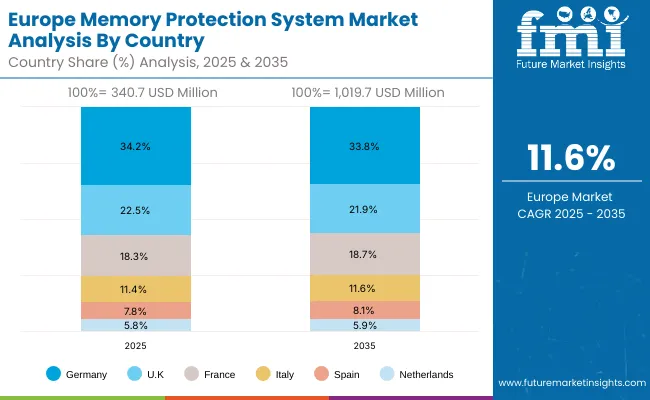

The memory protection system market in Europe is projected to grow from USD 340.7 million in 2025 to USD 1,019.7 million by 2035, registering a CAGR of 11.6% over the forecast period. Germany is expected to maintain leadership with a 34.2% market share in 2025, moderating to 33.8% by 2035, supported by industrial cybersecurity requirements, automotive software security, and strong engineering-focused security implementations.

The United Kingdom follows with 22.5% in 2025, projected at 21.9% by 2035, driven by financial services security, regulatory compliance frameworks, and advanced threat detection capabilities in banking infrastructure. France holds 18.3% in 2025, reaching 18.7% by 2035 on the back of government cybersecurity programs and defense applications. Italy commands 11.4% in 2025, rising slightly to 11.6% by 2035, while Spain accounts for 7.8% in 2025, reaching 8.1% by 2035 aided by telecommunications security and emerging fintech adoption.

The Netherlands maintains 5.8% in 2025, up to 5.9% by 2035 due to financial services concentration and technology sector growth. The Rest of Europe region, including Nordics, Central & Eastern Europe, and other markets, is anticipated to hold 0.0% in 2025 and 0.0% by 2035, reflecting concentrated deployment in major technology and financial centers.

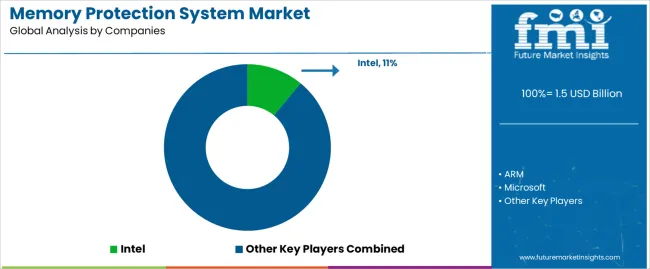

The memory protection system market is characterized by competition among established semiconductor manufacturers, cybersecurity software providers, and specialized security technology companies. Companies are investing in machine learning integration, hardware-software co-design, product portfolio expansion, and application-specific solution development to deliver high-performance, scalable, and cost-effective memory protection systems. Innovation in artificial intelligence-based anomaly detection, hardware-assisted isolation technologies, and automated threat response mechanisms is central to strengthening market position and competitive advantage.

Intel leads the market with an 11.0% share, offering comprehensive hardware-based memory protection solutions with a focus on processor-integrated security features, virtualization support, and control-flow enforcement technologies across server, desktop, and mobile computing platforms. The company continues advancing its Software Guard Extensions and Memory Protection Extensions capabilities for secure enclave processing and memory safety enforcement. ARM provides hardware intellectual property with emphasis on TrustZone technology and memory tagging extensions for mobile and embedded security applications.

Microsoft delivers operating system-integrated protection features with focus on Windows Defender System Guard and hypervisor-based code integrity mechanisms. CrowdStrike offers endpoint security solutions with advanced memory protection capabilities and cloud-delivered threat intelligence. Synopsys provides software security testing tools with memory error detection and secure development lifecycle integration. Trend Micro specializes in enterprise security solutions including memory protection for virtual environments and cloud workloads. Sangfor focuses on network security and endpoint protection with memory threat prevention capabilities. Qi An Xin Technology Group emphasizes cybersecurity solutions for government and enterprise markets. Huawei offers integrated security capabilities across networking and computing infrastructure. Tencent provides security technologies for cloud platforms and application ecosystems.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1.5 billion |

| Protection Type | Hardware-Level Memory Protection, Software-Level Memory Protection, Others |

| Application | Fintech Industry, Aerospace Industry, Medical Equipment Industry, Others |

| Regions Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40 countries |

| Key Companies Profiled | Intel, ARM, Microsoft, CrowdStrike, Synopsys, Trend Micro, Sangfor, Qi An Xin Technology Group, Huawei, Tencent |

| Additional Attributes | Dollar sales by protection type and application category, regional demand trends, competitive landscape, technological advancements in memory protection technologies, artificial intelligence integration, hardware-software co-design innovation, and security effectiveness optimization |

The global memory protection system market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the memory protection system market is projected to reach USD 223,256,553,259.7 billion by 2035.

The memory protection system market is expected to grow at a 1210.0% CAGR between 2025 and 2035.

The key product types in memory protection system market are hardware-level memory protection , software-level memory protection and others.

In terms of application, fintech industry segment to command 35.0% share in the memory protection system market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Memory Support Supplement Market Size and Share Forecast Outlook 2025 to 2035

Memory-Enhancing Drugs Market Size and Share Forecast Outlook 2025 to 2035

Memory Integrated Circuits (IC) Market Growth - Trends & Forecast 2025 to 2035

In-Memory Database Market Size and Share Forecast Outlook 2025 to 2035

In-Memory Analytics Tools Market Growth - Trends & Forecast through 2034

Shape Memory Alloy Market Size and Share Forecast Outlook 2025 to 2035

Shape Memory Polymer Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Memory Cube Market Size and Share Forecast Outlook 2025 to 2035

Polymer Memory Market Size and Share Forecast Outlook 2025 to 2035

India Shape Memory Alloy Market Analysis by Material Type, Component Type, Application, End Use Industry, and Region Forecast Through 2025 to 2035

3D NAND Flash Memory Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Memory Market Size and Share Forecast Outlook 2025 to 2035

Static Random Access Memory (SRAM) Market Size and Share Forecast Outlook 2025 to 2035

Dynamic Random Access Memory (DRAM) Market Size and Share Forecast Outlook 2025 to 2035

Digital Radio Frequency Memory (DRFM) Market Size and Share Forecast Outlook 2025 to 2035

Non-volatile Dual In-line Memory Module (NVDIMM) Market Analysis - Growth & Forecast 2025 to 2035

Next Generation Non Volatile Memory Market Size and Share Forecast Outlook 2025 to 2035

Flu Protection Kits Market Size and Share Forecast Outlook 2025 to 2035

Eye Protection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Teleprotection Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA