The obesity-diabetes drugs market is witnessing accelerated growth due to the rising global prevalence of metabolic disorders and increasing awareness of the interrelationship between obesity and type 2 diabetes. Clinical research publications and pharmaceutical investor briefings have emphasized the convergence of treatment protocols, with dual-benefit drugs targeting both conditions simultaneously.

This convergence has been reinforced by clinical trials showing improved glycemic control and weight reduction through combination therapies and GLP-1 receptor agonists. Healthcare systems have also intensified efforts to manage these comorbidities with early pharmacological interventions, supported by expanded reimbursement coverage and public health programs.

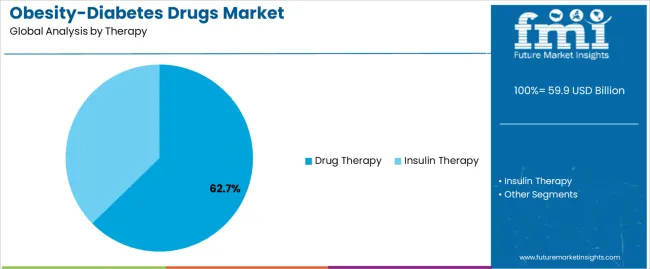

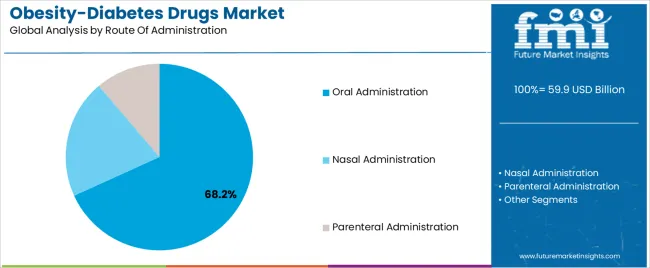

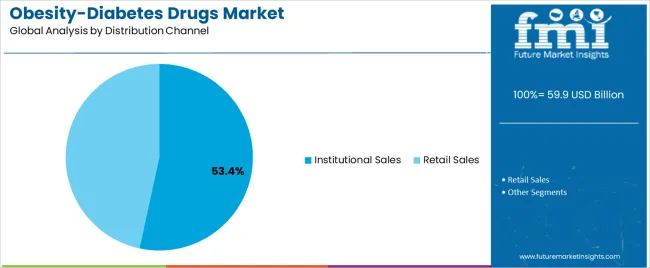

Additionally, pharmaceutical innovation in oral drug formulations, once-weekly injectables, and fixed-dose combinations is improving patient adherence and therapy outcomes. Future market growth is expected to be driven by the launch of novel therapies, pipeline drugs targeting dual pathways, and the increasing adoption of chronic care models in managing lifestyle diseases. Segmental strength is expected to be led by Drug Therapy, Oral Administration, and Institutional Sales, each shaped by clinical efficacy, patient convenience, and structured healthcare delivery.

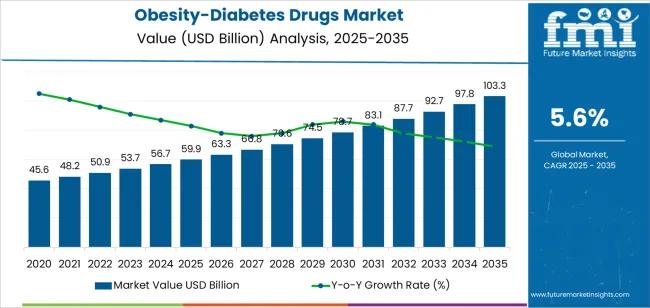

| Metric | Value |

|---|---|

| Obesity-Diabetes Drugs Market Estimated Value in (2025 E) | USD 59.9 billion |

| Obesity-Diabetes Drugs Market Forecast Value in (2035 F) | USD 103.3 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The market is segmented by Therapy, Route Of Administration, and Distribution Channel and region. By Therapy, the market is divided into Drug Therapy and Insulin Therapy. In terms of Route Of Administration, the market is classified into Oral Administration, Nasal Administration, and Parenteral Administration. Based on Distribution Channel, the market is segmented into Institutional Sales and Retail Sales. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Drug Therapy segment is projected to account for 62.7% of the obesity-diabetes drugs market revenue in 2025, asserting its dominance as the leading therapeutic approach. This growth has been supported by the clinical effectiveness of pharmacological interventions in controlling weight and blood glucose levels simultaneously.

Healthcare providers have increasingly prescribed pharmacotherapy as the frontline treatment for patients with overlapping metabolic conditions, particularly when lifestyle interventions have shown limited results. The development and regulatory approval of multi-target drugs, including GLP-1 receptor agonists and SGLT2 inhibitors, have expanded the therapeutic landscape and boosted adoption rates.

Furthermore, treatment guidelines from leading medical associations have incorporated drug therapy into standard care protocols, driving wider clinical use. As pharmaceutical companies continue to invest in novel molecules that offer dual metabolic benefits, the Drug Therapy segment is expected to sustain its leadership position, reinforced by both clinical outcomes and growing patient demand.

The Oral Administration segment is projected to capture 68.2% of the obesity-diabetes drugs market revenue in 2025, making it the most preferred delivery method. Growth of this segment has been attributed to the convenience, ease of use, and high patient adherence associated with oral medications.

Clinical trials and pharmacological studies have highlighted strong patient preference for oral drug regimens, particularly in chronic disease management where long-term compliance is essential. The pharmaceutical industry has prioritized the development of oral formulations that combine multiple therapeutic agents, enabling simplified dosing schedules and reduced pill burden.

Additionally, oral drugs have been cost-effective for healthcare systems, especially in primary care settings, which has increased their accessibility through public and private insurance programs. As new oral agents with favorable safety profiles and improved efficacy reach the market, and as digital health tools support medication adherence, the Oral Administration segment is expected to remain the primary route of therapy in this space.

The Institutional Sales segment is projected to contribute 53.4% of the obesity-diabetes drugs market revenue in 2025, holding its position as the dominant distribution channel. This growth has been driven by the structured and large-scale procurement models used by hospitals, clinics, and government health programs.

Institutional buyers have favored obesity-diabetes drug procurement for formulary inclusion due to increasing hospitalizations linked to metabolic complications and the need for immediate intervention. Public health agencies and insurance-backed programs have bulk-purchased medications for distribution through national or regional healthcare systems, contributing to predictable and large-volume sales.

Moreover, institutional channels have enabled better control over prescription protocols, ensuring that therapies align with clinical guidelines and treatment algorithms. As integrated healthcare systems expand and centralized purchasing grows in both developed and emerging markets, Institutional Sales are expected to maintain a significant role in driving drug access and adoption across healthcare facilities.

Product Portfolio Expansion by Receiving Approval for New and Existing Drugs

Growing number of obesity diabetes cases has brought new opportunities for key players in the industry to expand their product portfolio by receiving approval for their drugs in the industry. For instance, in May 2025, Eli Lilly and Company received approval from the United States Food and Drug Administration (FDA) for their Mounjaro drug which is a GLP-1 receptor agonist and is indicated for improving the glycemic controls in adults with type 2 diabetes.

Rising Prevalence of Obese People Augments the Demand for Obesity-Diabetes Drugs

Individuals sitting for long continuous hours in front of screen, reduced number of physical activities, and the increased accessibility and consumption of wide range of unhealthy food items are some of the major reasons contributing to increase in number of people suffering from obesity diabetes. For instance, according to a press released by the Economic Times in April 2025, poor and unhealthy diet has contributed to over 45.6 million cases of type 2 diabetes in the year 2020 which represented over 70.0% of new diagnosis globally.

Emerging Trends in Personalized Nutrition and Functional Supplements

The landscape of obesity diabetes drugs is rapidly evolving, driven by increasing number of people following sedentary lifestyle and opting for products that can aid them in management of their obesity-diabetes. In order to reach more number of people seeking for the treatment and expand their customer base many of the key players operating in the industry are focusing on strategic collaboration for raising awareness of the disease through new diabetic awareness program.

There is also growing preference for personalized medicines that are tailored to individual needs, reflecting a shift in the approach to obesity-diabetes management. Recognizing that one-size-fits-all is not the way to go, more consumers and manufacturers are gravitating toward personalized obesity-diabetes drugs.

Global obesity-diabetes drugs sales increased at a CAGR of 3.9% from 2020 to 2025. For the next ten years, projections are that expenditure on obesity-diabetes drugs will rise at 5.6% CAGR

The rising prevalence of obesity diabetes among younger population has significantly contributed to increase in demand for drugs that are effective in the management of their chronic condition. The rising prevalence has created opportunities for new players to develop and launch their new product to the industry and mark their presence in the existing concentrated industry.

For instance, in January 2025, Adipo Therapeutics, a late stage, preclinical biopharmaceutical company raised a funding of USD 1.9 million in the bridge fund round. The company has planned to invest this amount for the advancement of their asset ADPO-002, a first in class weight loss and diabetes drug.

Going forward the growing focus of emerging nations on improving the affordability of the healthcare services surges the demand for obesity-diabetes drugs in the industry. Surplus, to this, the marketing initiatives taken by pharmaceutical manufacturers for spreading awareness of obesity-diabetes in the untapped markets of the developing regions with an aim of expanding their geographical footprint in the industry further propels the industry growth.

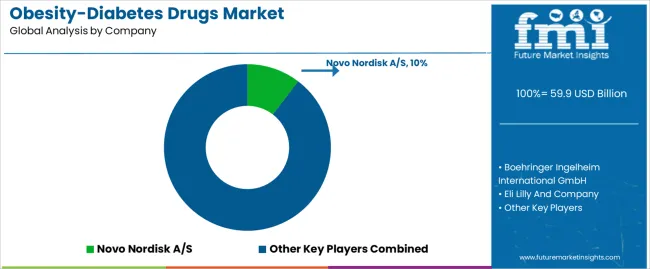

The Tier 1 players in this industry dominate the industry and are expected to acquire 52.5% market share in 2025. A few of the Tier 1 players include Boehringer Ingelheim International GmbH, Eli Lilly and Company, Sanofi, Novo Nordisk A/S, AstraZeneca, Novartis, Pfizer, Merck & Co., Inc., Takeda Pharmaceuticals, Bayer AG, and Janssen Pharmaceuticals Inc. Tier 1 companies in the worldwide obesity-diabetes drugs market are using their substantial research and development skills to create novel treatments.

They make considerable investments in clinical studies to demonstrate efficacy and safety, obtain regulatory clearances, and form strategic alliances to broaden industry reach. They use aggressive marketing methods to promote their products and gain a greater piece of the profitable industry.

The Tier 2 companies in this industry include companies like Vertex Pharmaceuticals Incorporated, Mankind Corporation, Xeris Pharmaceuticals, and Amphastar Pharmaceuticals, Inc. All of them together are going to constitute an industry share of 28.3% in 2025.

Tier 2 pharmaceutical firms are adopting new drug delivery methods or specialty therapeutic areas to differentiate themselves. They want to capitalize on industry shortages by providing customized therapies or enhanced formulations. They may seek collaborations with larger companies or enter into license arrangements to have access to the resources and expertise required for product development as well as commercialization.

The following table shows the estimated growth rates of the top three markets. China and India are set to exhibit high obesity-diabetes drugs consumption, recording CAGRs of 5.7% and 6.4%, respectively, through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| The United States | 4.7% |

| China | 5.7% |

| Germany | 3.8% |

| The United Kingdom | 4.0% |

| India | 6.4% |

The obesity-diabetes drugs industry in the United States held a market share of 24.8% and is projected to exhibit a CAGR of 4.7% during the assessment period.

The growing number of people following sedentary lifestyle in the country is majorly contributing to the growth of the industry in the country. The support of healthcare insurance coverage extended by the government of the United States, propels the growth of the industry.

For instance, according to an article published by the National Archives and Records Administration in March 2025, The Office of the Federal Register (OFR) of the National Archives and Records Administration (NARA) have expanded the healthcare coverage nationwide and have lowered the healthcare cost for Americans. They also have a vision of preventing and reducing the pervasiveness of diabetes across the United States by 2035.

Obesity-diabetes drugs market held a industry share of 3.7% in Germany and is calculated to rise at a value CAGR of 3.8% during the forecast period.

The ageing population of the country along with increasing number of young populations following sedentary lifestyle contribute to the rising prevalence of obesity-diabetic patients. For instance, according to an article published by Deutsches Zentrum fur Diabetesforschung in February 2020, an approximate of 7.2% of the population in Germany is suffering from diabetes among which more common is type 2 diabetes.

The growing prognosis has contributed to the growing demand for trained experts and the establishment of new specialized centers in the country, which is ultimately escalating the demand for obesity-diabetes drugs in the industry.

Consumption of obesity-diabetes drugs in Japan is projected to increase at a value CAGR of 5.7% over the next ten years. By 2035, the industry size is forecasted to reach USD 9,458.8 million, with a current share of 9.4% in the global industry in 2025.

The increasing number of people consuming unhealthy diet with their limited focus on performing physical activities have majorly contributed to increase in number of overweight and obese population in China. Such factors put Chinese population at the increased risk of type 2 diabetes.

For instance, according to the statistics published by World Health Organization (WHO), more than one-third of the Chinese adult population is overweight, while 7% of adults are obese, which puts them at the risk of developing type 2 diabetes.

| Segment | Drug Therapy (Therapy Type) |

|---|---|

| Value Share (2025) | 55.9% |

The ability of drug therapy to aid patients in controlling the blood sugar levels in an effective manner has attributed to its increased industry share. Its safety and tolerance in among all age groups has further contributed to its increased industry share. For instance, according to an article published by National Library of Medicine in January 2024, metformin remains the preferred first line pharmacological drug for the treatment of type 2 diabetes.

| Segment | Institutional Sales (Sale Channel) |

|---|---|

| Value Share (2025) | 39.7% |

Institutional sales channel accounted for a significant industry share and dominated the industry. The segment is anticipated to advance at 4.7% CAGR during the projection period.

The institutional segment consists of sub-segment including hospitals, specialty clinics and others. The hospital segment accounted for the major share of the industry owing to the increasing number of patients suffering from obesity-diabetes contributing to increase in number of footfall of patients to the hospital.

In the dynamic landscape of the obesity-diabetes drugs market, key companies operating in the industry are focusing on research and development and launch of new products to the industry. The major aim of these players is to expand their product portfolio and strengthen their product portfolio in the industry. Many of the players are also focusing on strategic acquisitions for expansion of their product portfolio.

For instance

As per product type, the industry has been categorized into drug therapy (Meglitinides, sulfonylureas, Dipeptidyl-peptidase 4 (DPP-4) inhibitors, biguanides, thiazolidinediones, alpha-glucosidase inhibitors, sodium-glucose co-transporter 2 (SGLT2) inhibitors, bile acid sequestrants and GLP-1 receptor agonists), and insulin therapy (rapid acting insulin, short acting insulin, intermediate acting insulin, long acting insulin and biphasic insulin.

This segment is further categorized into oral administration, nasal administration and parenteral administration (subcutaneous, intramuscular and intravenous).

Different sales channels include Institutional sales (hospitals, specialty clinics, and others), retail sales (retail pharmacies, and drug stores) and online pharmacy.

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The global obesity-diabetes drugs market is estimated to be valued at USD 59.9 billion in 2025.

The market size for the obesity-diabetes drugs market is projected to reach USD 103.3 billion by 2035.

The obesity-diabetes drugs market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in obesity-diabetes drugs market are drug therapy, _meglitinides, _sulfonylureas, _dipeptidyl-peptidase 4 (dpp-4) inhibitors, _biguanide, _thiazolidinediones, _alpha-glucosidase inhibitors, _sodium-glucose co-transporter 2 (sglt2) inhibitors, _bile acid sequestrants, _incretin mimetic (glp-1 receptor agonists), insulin therapy, _rapid acting insulin, _short acting insulin, _intermediate acting insulin, _long acting insulin and _biphasic insulin.

In terms of route of administration, oral administration segment to command 68.2% share in the obesity-diabetes drugs market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Drugs Glass Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Orphan Drugs Market Size and Share Forecast Outlook 2025 to 2035

Topical Drugs Packaging Market Growth & Forecast 2025 to 2035

Retinal Drugs And Biologics Market

Antiviral Drugs Market Size and Share Forecast Outlook 2025 to 2035

Cytotoxic Drugs Market Analysis – Growth, Trends & Forecast 2025-2035

3D Printed Drugs Market Outlook – Growth, Demand & Forecast 2025-2035

Depression Drugs Market

Parenteral Drugs Packaging Market

Brain Tumor Drugs Market Forecast & Analysis: 2025 to 2035

Infertility Drugs Market Analysis - Size, Share & Forecast 2025 to 2035

Expectorant Drugs Market Trend Analysis Based on Drug, Dosage Form, Product, Distribution Channel, and Region 2025 to 2035

Cannabinoid Drugs Market

Clot Busting Drugs Market Size and Share Forecast Outlook 2025 to 2035

Psychotropic Drugs Market Growth - Industry Trends & Outlook 2025 to 2035

Critical Care Drugs Market Analysis – Trends, Demand & Forecast 2024-2034

Anti-Malarial drugs Market

Antimetabolite Drugs Market Size and Share Forecast Outlook 2025 to 2035

Fish-Oil Based Drugs Market Analysis – Trends, Share & Growth Forecast 2024-2034

Plasma-Derived Drugs Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA