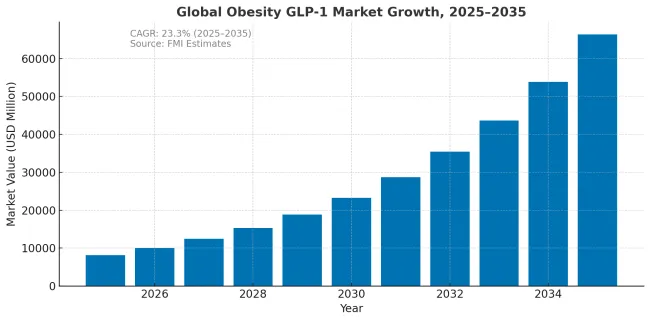

The obesity GLP-1 market is projected to grow from USD 8169 million in 2025 to approximately USD 65,364 million by 2035, recording an absolute increase of USD 57,195 million over the forecast period. This translates into a total growth of 700%, with the market forecast to expand at a compound annual growth rate (CAGR) of 23.1% between 2025 and 2035. The overall market size is expected to grow by 8X during the same period, supported by expanding treatment eligibility, increasing public reimbursement coverage, and growing clinical evidence for cardiovascular risk reduction benefits.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 8,169 million |

| Industry Value (2035F) | USD 65,364 million |

| CAGR (2025 to 2035) | 23.1% |

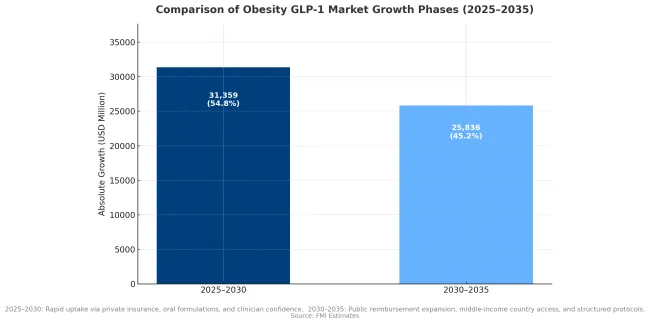

Between 2025 and 2030, the obesity GLP-1 market is projected to expand from USD 8169.0 million to USD 39,528 million, resulting in a value increase of USD 31359.0 million, which represents 54.8% of the total forecast growth for the decade. This phase of growth will be shaped by rapid expansion in treatment access through private insurance and self-pay channels, increasing clinical adoption for cardiovascular risk reduction, and growing physician confidence in long-term safety profiles. The introduction of oral formulations and improved supply capacity are expected to accelerate market penetration across major developed markets.

From 2030 to 2035, the market is forecast to grow from USD 39,528 million to USD 65,364 million, adding another USD 25836.0 million, which constitutes 45.2% of the overall ten-year expansion. This period is expected to be characterized by expansion of public reimbursement programs in major European and Asian markets, maturation of cardiovascular-anchored treatment protocols, and broader adoption across middle-income countries. The growing recognition of obesity as a chronic disease requiring sustained intervention will drive demand for structured treatment pathways and outcomes-based reimbursement arrangements.

Market expansion is being supported by the growing recognition of obesity as a chronic disease requiring pharmacological intervention and the compelling clinical evidence demonstrating substantial cardiovascular risk reduction in treated populations. Modern GLP-1 receptor agonists have demonstrated average weight loss of 15-20% of body weight with sustained treatment, representing a breakthrough in obesity pharmacotherapy that approaches the effectiveness of bariatric surgery. The SELECT cardiovascular outcomes trial established that semaglutide reduces major adverse cardiovascular events by 20%, providing a strong clinical rationale for treatment that extends beyond weight management alone.

The expanding treatment eligibility criteria and increasing willingness of payers to cover GLP-1 medications are driving accelerated market growth. Public health systems in developed markets are establishing structured access pathways based on BMI thresholds combined with cardiovascular or metabolic comorbidities. The availability of oral formulations addresses patient preferences for non-injectable medications while the entry of additional manufacturers beyond the current duopoly is expected to improve supply availability and create pricing competition that will facilitate broader access.

| Perspective | Analytical Insight |

|---|---|

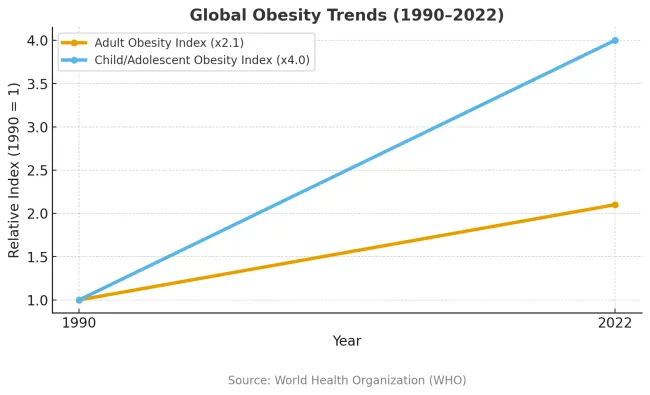

| Addressable vs Total Population | Only a subset of the 2.5 billion overweight adults meet medical criteria for GLP-1 therapy. Most people with obesity now live in low- and middle-income countries (LMICs), where adoption will be slower due to affordability, access, and policy barriers. Prevalence ≠ near-term demand. |

| Pediatric Dynamics | Obesity among children aged 5-19 has quadrupled since 1990, but GLP-1 use in youth is restricted under tight regulatory and ethical controls. These demographics shape future potential, not immediate sales. |

| Measurement Limitations (BMI) | BMI remains the global surveillance standard but misclassifies individuals at both ends of the health spectrum. For commercial targeting, prevalence data must be adjusted for comorbidities, payer criteria, and reimbursement frameworks the true gating factors for GLP-1 adoption. |

| Geographic Paradox | The Americas record the highest obesity rates, yet policy coverage and payer willingness drive uptake more than raw prevalence. Pacific Island nations show extreme obesity rates but contribute little to volume due to small populations. |

The market is segmented by molecule class, route of administration, payer type, use-case framing, and region. By molecule class, the market is divided into semaglutide, tirzepatide, and other molecules. Based on route of administration, the market is categorized into injectables and oral formulations. In terms of payer type, the market is segmented into public coverage and private or self-pay arrangements. By use-case framing, the market is classified into weight management and cardiovascular risk anchored indications. Regionally, the market is divided into North America, Europe, East Asia, South Asia and Pacific, Latin America, and Middle East and Africa.

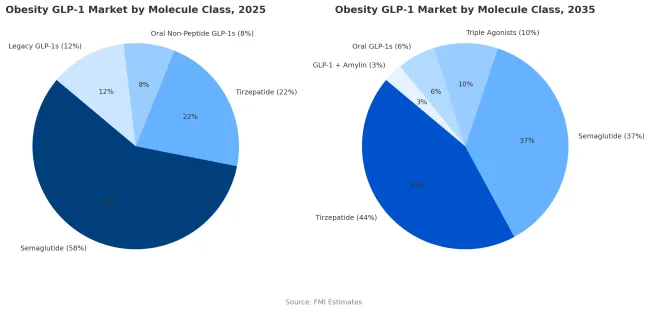

Semaglutide holds a commanding 58% share of the obesity GLP-1 market in 2025, underpinned by robust clinical validation from the STEPandSELECT trials, proven cardiovascular benefits, and extensive real-world use. Its first-mover advantage, combined with strong reimbursement coverage in major developed markets, has made it the reference molecule for obesity pharmacotherapy. The drug delivers a mean weight loss of around 15% with consistent tolerability, supporting long-term adherence and prescriber confidence. Broad familiarity among endocrinologists and primary care physicians carried over from type 2 diabetes care continues to reinforce its clinical dominance. The availability of both weekly injectable and daily oral formulations further broadens its reach across diverse patient and prescriber segments.

However, semaglutide’s share is projected to decline to 37% by 2035, as tirzepatide emerges as the new market leader. Tirzepatide’s dual GIP/GLP-1 mechanism has demonstrated superior weight-loss efficacy in both clinical trials and real-world studies, enabling stronger payer uptake and prescriber preference. Its growing cardiovascular-outcomes evidence, combined with expanding reimbursement and manufacturing capacity, positions it to capture an estimated 44% share of global obesity GLP-1 sales by 2035.

Beyond these two front-runners, next-generation molecules including triple agonists (GLP-1/GIP/glucagon) and GLP-1 + amylin combination therapiesare expected to gain low-to-mid-teens market share in the early 2030s as manufacturing and cardiovascular data mature. While semaglutide will remain a foundational therapy in the class, the market’s center of gravity is shifting toward multi-agonist and combination-based innovations that deliver higher efficacy with comparable safety and durability.

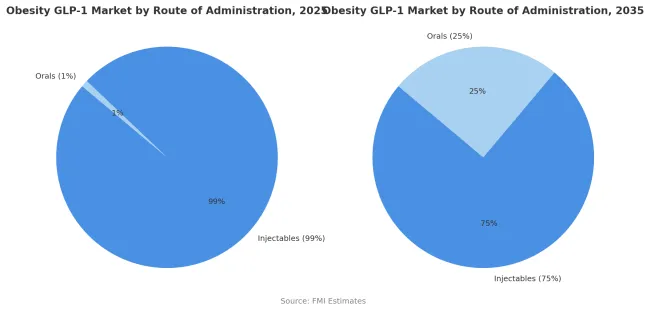

Injectable formulations account for nearly 99% of obesity GLP-1 therapy use in 2025, reflecting their status as the established delivery route for both semaglutide and tirzepatide. Weekly subcutaneous injections currently offer the most reliable pharmacokinetics, bioavailability, and efficacy, producing consistent weight-loss outcomes and strong cardiovascular benefits. The segment’s dominance is reinforced by mature patient education systems, easy-to-use pen devices, and broad prescriber familiarity built over years of diabetes-care experience.

While patient preference is clearly shifting toward non-injectable options, injectables are projected to retain a 75% market share by 2035, not the minority. The continued strength of this route stems from its superior efficacy, durable outcomes, and expanding reimbursement for high-performing injectable therapies. Oral formulations will grow to capture 25% share as bioavailability improves and new small-molecule GLP-1s reach the market, appealing to segments seeking greater convenience or avoiding injection-site issues.

The transition toward oral delivery will be evolutionary, not disruptive, dependent on regulatory approvals, proven equivalence in cardiovascular outcomes, and competitive pricing. In the long term, injectables are expected to coexist with orals, with each addressing distinct patient and payer priorities rather than one displacing the other.

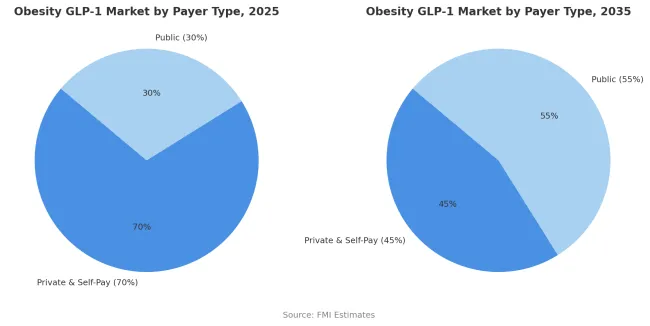

Private insurance and self-pay arrangements are projected to contribute 70% of the market in 2025, representing patients who access treatment through commercial health insurance or direct cash payment. These payers demonstrate greater flexibility in coverage decisions and faster adoption of new obesity pharmacotherapy compared to public health systems with formal health technology assessment requirements. Private insurance plans in the United States and employer-sponsored health benefits increasingly include GLP-1 medications in formularies, though often with prior authorization requirements and step therapy protocols.

The self-pay segment includes patients willing to bear substantial out-of-pocket costs averaging USD 1000 per month to access treatment not covered by their insurance plans. The segment is supported by growing consumer awareness of GLP-1 medications through social media and direct-to-consumer marketing that has created strong patient demand. However, the private and self-pay share is projected to decline to 45% by 2035 as public health systems expand coverage. This transition will be driven by accumulating health economic evidence demonstrating cost-effectiveness through reduced cardiovascular events and progression of metabolic disease, leading to structured public reimbursement programs in Europe, Japan, and middle-income countries.

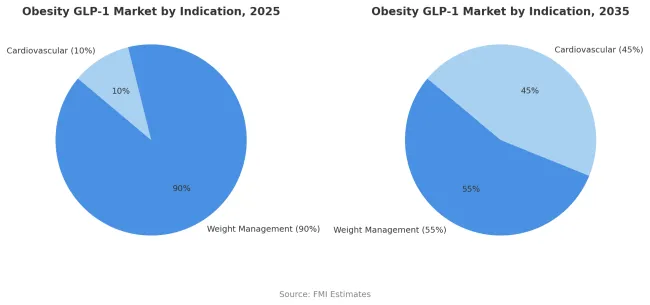

Weight management indications are estimated to hold 90% of the market share in 2025. This dominance reflects the current treatment paradigm where GLP-1 medications are primarily positioned and reimbursed for obesity management based on BMI criteria rather than cardiovascular risk reduction. Regulatory approvals have focused on weight loss efficacy as the primary endpoint with cardiovascular benefits considered secondary outcomes. Prescribers and patients approach treatment with weight reduction as the primary goal while cardiovascular benefits are viewed as additional advantages rather than primary treatment rationales.

Insurance coverage decisions typically require demonstration of obesity through BMI thresholds with or without metabolic comorbidities but do not specifically require established cardiovascular disease. However, this paradigm is shifting as health systems recognize the substantial cardiovascular benefits demonstrated in dedicated outcomes trials. The weight management share is projected to decline to 55% by 2035 as cardiovascular risk anchored indications grow to 45% of the market. This evolution will be driven by expanded clinical evidence, development of cardiovascular-specific treatment protocols, and modification of reimbursement criteria to include primary prevention of cardiovascular events in high-risk populations regardless of weight loss magnitude.

Source: UMIC countries as per World Bank definition

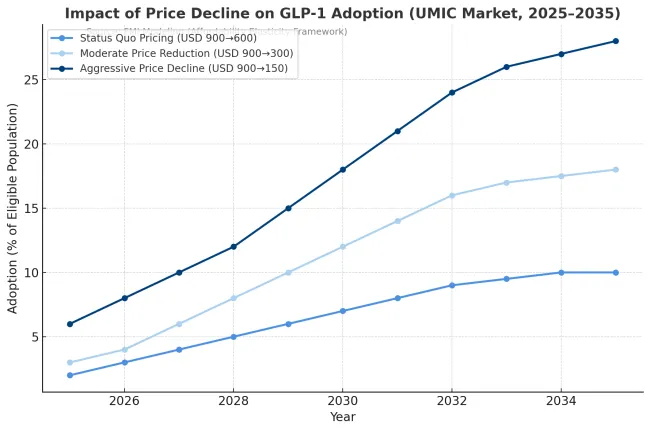

In price-sensitive markets, affordability not awareness is the dominant adoption gate for GLP-1 obesity therapies. Where public coverage is limited and self-pay remains the main route, adoption follows a clear S-curve tied to the affordability ratio (AR) the share of a consumer’s disposable income required for one month of therapy. Once the AR falls below roughly 12% in upper-middle-income countries and 8% in lower-middle-income countries, adoption accelerates sharply. Above these thresholds, uptake stays confined to high-income percentiles despite strong demand signals. Current pricing levels (~USD 900/month) keep adoption in single digits, but every halving of net price can nearly double penetration, provided supply and prescriber infrastructure are stable.

Over the forecast period, price declines and payer diversification will reshape adoption curves more than marketing or awareness efforts. If net monthly costs fall to USD 300 or lower through local fill-finish operations, biosimilar competition, or dose optimization, adoption could reach 25-30% of eligible patients in upper-middle-income markets by 2035, versus <10% under status-quo pricing. In contrast, price-driven adoption in lower-middle-income countries remains capped near 15% unless public reimbursement expands. The underlying red pill: price elasticity alone cannot deliver scale it must coincide with supply reliability, clinician coverage, and payer-side incentives. Markets that treat affordability thresholds as strategic levers, not afterthoughts, will own the volume growth phase of global GLP-1 adoption.

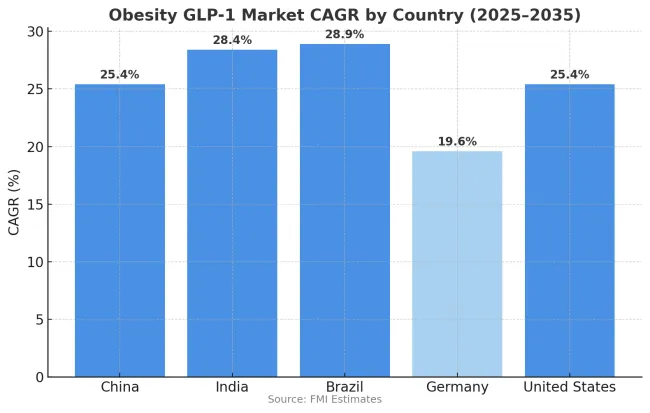

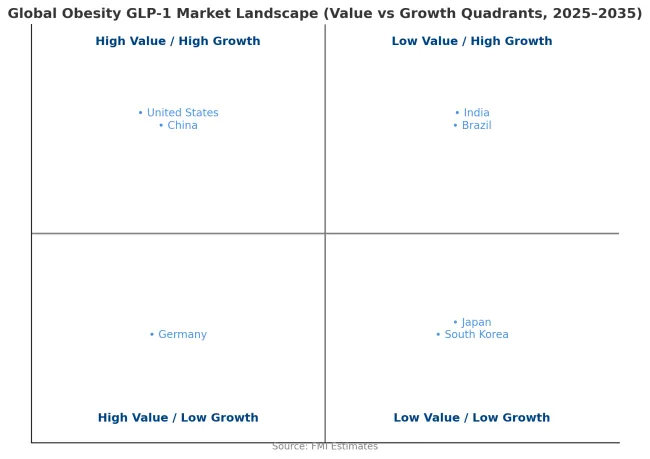

The obesity GLP-1 market is growing rapidly across major economies, with China and the United States both recording 25.4% CAGR through 2035, driven by large treatment-eligible populations and expanding access frameworks. India demonstrates the highest growth at 28.4%, supported by rising obesity prevalence in urban populations and increasing availability of treatment through private healthcare channels. Brazil records 28.9% growth, reflecting rapid expansion of private insurance coverage and growing physician adoption of obesity pharmacotherapy.

Germany shows more moderate growth at 19.6%, reflecting the statutory health insurance exclusion of anti-obesity medications that limits public reimbursement. Overall, middle-income markets in Asia and Latin America are emerging as key drivers of global market expansion as treatment access improves and physician familiarity with GLP-1 medications increases.

Revenue from obesity GLP-1 treatment in China is projected to exhibit strong growth with a CAGR of 25.4% through 2035, driven by rapidly increasing obesity rates in urban populations and growing consumer demand for weight management solutions. The country's expanding middle class demonstrates willingness to pay for effective obesity treatment through private healthcare channels and international prescription services. Major pharmaceutical manufacturers are establishing local production capacity and distribution networks to improve treatment access and reduce costs. The growing recognition of obesity as a major public health challenge is driving government consideration of structured treatment programs and potential reimbursement frameworks for effective pharmacotherapy.

Revenue from obesity GLP-1 treatment in India is expanding at a CAGR of 28.4%, supported by increasing obesity rates in metropolitan areas and growing awareness of cardiovascular risk factors. The country's expanding private healthcare sector demonstrates willingness to adopt new obesity pharmacotherapy despite high treatment costs. Endocrinologists and cardiologists in major cities are gaining experience with GLP-1 medications through diabetes management applications, facilitating confidence in prescribing for obesity indications. The development of patient assistance programs and structured payment options is improving treatment affordability for middle-income populations.

Revenue from obesity GLP-1 treatment in Brazil is growing at a CAGR of 28.9%, driven by expanding private health insurance coverage and increasing physician adoption of obesity pharmacotherapy. The country's established pharmaceutical distribution infrastructure facilitates treatment access in major metropolitan areas. Private healthcare providers are developing comprehensive weight management programs that integrate GLP-1 medications with nutritional counseling and behavioral support. Growing consumer awareness of obesity health risks and treatment options is driving increased consultation rates with endocrinology specialists.

Demand for obesity GLP-1 treatment in Germany is projected to grow at a CAGR of 19.6%, constrained by statutory health insurance exclusions for anti-obesity medications that limit public reimbursement. German patients access treatment primarily through private insurance arrangements or self-pay mechanisms. The country's well-developed private healthcare sector demonstrates strong uptake of obesity pharmacotherapy among patients willing to bear treatment costs. Medical professionals maintain high standards for treatment protocols and patient selection criteria based on comprehensive clinical guidelines.

Demand for obesity GLP-1 treatment in the United States is expanding at a CAGR of 25.4%, driven by growing commercial insurance coverage and strong consumer awareness of available treatments. Large employer health benefit plans increasingly include GLP-1 medications in formularies, though typically with prior authorization requirements and step therapy protocols. The market benefits from robust direct-to-consumer marketing efforts that drive patient demand and consultation rates. Professional medical organizations are developing comprehensive obesity treatment guidelines that position pharmacotherapy as integral component of multimodal management strategies.

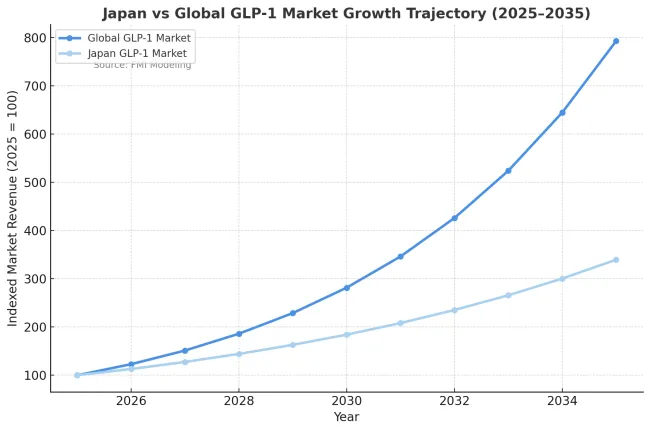

Japan will be an outlier on size, not direction. Expect steady but smallerGLP-1 revenues versus the USA/China/Brazil because obesity prevalence is among the lowest in the OECD on the BMI≥30 cut and coverage and pricing are tightly controlled under national insurance. Japan clinically labels "obesity" at BMI≥25, so the eligible pool is larger than the BMI≥30 headline suggests, but still far below USA levels. I’m not sure of the exact latest percentages, but the relative ranking (Japan low vs peers) holds.

Public reimbursement, HTA-style conservatism, and price revisions dominate adoption not self-pay hype. GLP-1 uptake for obesity-only stays cautious; CV-anchored protocols will drive the bigger wave. Net prices will be cut on schedule (NHI revisions), DTC pull is muted, and prescribers are conservative. Result: high adherence, slower initiation, lower commercial upside for premium brands. Orals may do well with preference-sensitive patients, but injectables remain the backbone unless pills hit efficacy/CV parity at better net price.

In South Korea, the market is expected to remain dominated by private insurance and self-pay arrangements, which hold an 85% share in 2025. These payer mechanisms reflect limited public reimbursement coverage for obesity pharmacotherapy under the National Health Insurance system. Korean patients demonstrate willingness to invest in weight management treatments through private payment, supported by cultural emphasis on appearance and health optimization. Private healthcare clinics specializing in aesthetic and metabolic medicine provide primary access channels for GLP-1 treatment. Public reimbursement accounts for only 15% of the market, primarily covering patients with severe obesity and documented metabolic complications.

| Player | Core asset(s) | Strengths | Exposed flanks |

|---|---|---|---|

| Novo Nordisk | Semaglutide (inj /oral); GLP-1+amylin combo in dev | Global scale in pens/APIs; SELECT CV evidence; payer relationships | Reliance on sema; supply has been tight; efficacy gap vs tirzepatide; China/EU price compression |

| Eli Lilly | Tirzepatide; triple agonist in dev | Best-in-class weight loss; rapid prescriber adoption; heavy capex in capacity | GI/tolerability management; must prove long-term CV + maintenance superiority; supply ramp risk |

| Boehringer Ingelheim + Zealand Pharma | GLP-1/glucagon (survodutide) | Strong efficacy signal; NASH crossover optionality | CVOT + scale pending; payer proof not yet locked |

| Amgen | Long-acting GLP-1 (e.g., monthly) | Dosing convenience; antibody-peptide tech; big balance sheet | Timelines; need head-to-head vs class leaders; manufacturing learning curve |

| Chinese manufacturers (multiple) | Domestic GLP-1s; duals/triples | Local cost base; NRDL access potential; massive volume | Initial efficacy gaps; IP/quality scrutiny; export credibility |

| Pfizer/AZ/others (orals & combos) | Oral GLP-1s; small molecules; combos | If parity on efficacy + lower COGS → big unlock | Many orals to date trade efficacy/tolerability; CV parity uncertain |

The global GLP-1 and obesity drug landscape is entering a transformative phase as patent protections for semaglutide near expiry in key markets such as India and China by 2026. This shift is unlocking a wave of biosimilar and next-generation innovation from Asian pharmaceutical majors. Companies such as Biocon, Sun Pharma, Cipla, Dr. Reddy’s Laboratories, and Glenmarkin India, along with Huadong Medicine, Benemae Pharmaceutical, Hangzhou Jiuyuan Gene Engineering, and Innovent Biologics in China, are actively developing biosimilar and modified GLP-1 analogues targeting both domestic and global markets.

Across the full GLP-1 and obesity drug space, the post-2026 picture is a price-expansion wave led by Indian and Chinese biosimilars and by new dual or triple-agonist molecules, yet real uptake in the USA and EU will be shaped less by tariffs and more by regulatory timing, drug-device parity on pens and human-factors equivalence for AB-substitution, secondary IP and Orange Book hurdles, and payer or formulary contracting.

Incumbents will defend with brand trust, real-world outcomes, rebate economics, patient programs, and next-gen pipelines, while entrants counter with cost leadership, domestic-first capture, and localized fill-finish to blunt rules-of-origin. Winners will pair low price with fast regulatory clearance, device equivalence, and contracted access; otherwise even a large list-price gap will not force rapid switching in premium markets, while emerging markets tilt quickly to the lowest credible supplier.

As a result, Novo Nordisk and Eli Lilly’s historical dominance will face its first real structural challenge, not from USA or European biotech startups, but from Indian and Chinese players scaling biosimilars and new molecular entities for export. These entrants are leveraging strengths in peptide synthesis, low-cost biologics manufacturing, and regulatory agility to shorten development cycles and undercut price points, potentially halving or even reducing cost to one-tenth of current therapy levels.

Analysts expect this wave to expand the addressable market dramatically, as millions of patients priced out of branded GLP-1s finally gain access. However, brand trust, IP defense, and clinical validation will remain Novo and Lilly’s strongest moats in premium markets such as the USA, EU, and Japan, where regulatory standards and reimbursement frameworks still favor established innovators.

| Item | Value |

|---|---|

| Quantitative Units | Million |

| Molecule Class | Semaglutide, tirzepatide, and other GLP-1 receptor agonists |

| Route of Administration | Injectables and oral formulations |

| Payer Type | Public coverage, private insurance, and self-pay arrangements |

| Use-Case Framing | Weight management and cardiovascular risk anchored indications |

| Regions Covered | North America, Europe, East Asia, South Asia and Pacific, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, Japan, China, India, Brazil, Australia, South Korea, and others |

| Key Companies Profiled | Novo Nordisk, Eli Lilly and Company, Amgen, Boehringer Ingelheim, AstraZeneca, Pfizer, Roche, Viking Therapeutics, Structure Therapeutics, Zealand Pharma |

| Additional Attributes | Market value by molecule class, route of administration, and payer type, regional treatment adoption patterns across North America, Europe, and Asia Pacific, competitive landscape with established manufacturers and emerging biotechnology companies, reimbursement frameworks and health technology assessment outcomes, cardiovascular outcomes evidence and clinical practice guideline development, manufacturing capacity expansion and supply chain considerations, and patient access programs addressing treatment affordability barriers |

The global obesity GLP-1 market is valued at USD 8,169 million in 2025.

The size for the obesity GLP-1 market is projected to reach USD 65,364 million by 2035.

The obesity GLP-1 market is expected to grow at a 23.1% CAGR between 2025 and 2035.

The key molecule class segments in the obesity GLP-1 market are semaglutide, tirzepatide, and other GLP-1 receptor agonists.

In terms of molecule class, semaglutide segment is set to command 58.0% share in the obesity GLP-1 market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Obesity-Diabetes Drugs Market Size and Share Forecast Outlook 2025 to 2035

Obesity Management Market Analysis – Trends & Forecast 2025 to 2035

Anti-Obesity Therapeutics Market

Pediatric Obesity Management Market Analysis by Drug Class, Route of Administration, Distribution Channel and Region: Forecast for 2025 to 2035

Weight Loss and Obesity Management Market Analysis - Size Share and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA