The Paprika Colour Industry is projected to experience strong growth during the forecast period, between 2025 and 2035, with demand from the food and beverage industry for natural food colorants being the primary catalyst of this growth.

Since consumers are becoming increasingly aware of and concerned about clean-label, plant-based ingredients, and synthetic dye substitutes are widely available, nutrition-based paprika-based colorants are gaining acceptance. The growing preference for organic, non-GMO, and additive-free formulations in food processing, along with strict regulatory policies prohibiting artificial colours, is further spurring the market adoption.

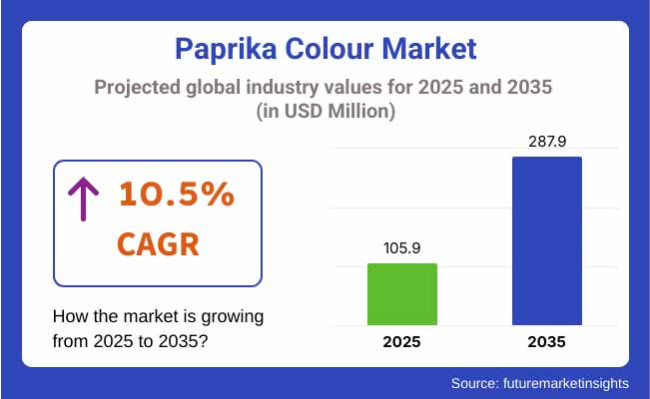

This written report income was predicted to expand from USD 105.9 million in 2025 to USD 287.9 million, at a CAGR of 10.5% throughout 2035. Growing requirement in processed foods, beverages, dairy products, confectionary and cosmetics are driving the market growth. In addition, increasing use in animal feed and pharmaceuticals owing to their carotenoid-rich properties and antioxidant properties is boosting the demand.

The United States & Canada, known as a key market for Paprika Colour in North America has witnessed high demand for natural colorants from processed foods, beverage & dietary supplements industries. Adoption is being driven by the region’s stringent FDA regulations on artificial dyes and increasing consumer demand for organic and clean-label food products. Major food processors are increasingly utilizing paprika extracts in sauces, dairy, and snacks, which are also continuing to fuel the growth of the market.

Europe accounts for a significant share of the food colour market, and Germany, the UK, and France are leading the way in adopting natural food colours. Moreover, the stringent regulations governing synthetic additives imposed by the European Food Safety Authority (EFSA) have turned paprika-based colorants as an attractive alternative.

The growing demand for natural pigments in meat processing, confectionery, and dairy products is driving the market for paprika extracts, with leading food manufacturers focused on procuring organic and sustainable paprika extract.

Asia-Pacific is projected to exhibit the fastest growth rate with China, India, and Japan dominating the regional markets and strong demand coming from the expanding food processing industries and increasing number of health-conscious consumers.

Strong exports of paprika-based colorants for India's status as a leading paprika producer while China’s growing packaged food industry, is encouraging their home consumption. Functional and fortified foods are gaining popularity in Japan, driving demand for paprika-derived carotenoids in nutraceutical and dietary supplements.

Challenge

Price Fluctuations and Sourcing Issues

Paprika colour is heavily influenced by climate, agricultural crops, and local spice growing practices. Seasonal supply constraints, geopolitical trade policies and quality inconsistencies drive price fluctuations that pose a challenge for manufacturers. Stability in the concentration of pigment and uniformity in colour between batches is also still a big issue to address. To solve these problems, companies are scaling up contract farming, refining extraction methods, and creating standardized formulations.

Opportunity

Expanding Applications in Non-Food Industries

Aside from food and drinks, the market for paprika colour is increasing in pharmaceuticals, cosmetics, and animal feed. Its carotenoid content (capsanthin and capsorubin) with a high presence of antioxidants also makes it an interesting ingredient for applications such as skin care, dietary supplements and pet food formulations.

Also, the movement toward sustainable, plant-based cosmetics opens up opportunities for paprika-derived pigments in the natural beauty products space. Therefore, companies focusing on advanced extraction methods, organic certifications, and tailored pigment solutions are expected to benefit from this growing market.

The market is expected to be lucrative in the period between 2020 & 2024 as a natural food ingredient or product is preferred over synthetic additives. Pushback from consumers and regulators for cleaner labels prompted food and beverage manufacturers to replace artificial colours with paprika-based products.

The food industry especially in snack foods, vegetarian processed meats, sauces and dairy products particularly fuelled demand as paprika colour provided an appealing and bright red to orange colour, without sacrificing food safety. Following the clean-label trend, paprika-derived colours were also employed in the beverage sector (flavoured drinks, fruit juices, various plant-based beverages).

Global availability of paprika colour increased with regulatory approvals of FDA (Food and Drug Administration), EFSA (European Food Safety Authority), and FSSAI (Food Safety and Standards Authority of India). The cosmetics industry was also expanding market perspective as the paprika extracts were used in lip products, cosmetics, skin care products, and nutraceuticals in the pharmaceutical industries.

Nonetheless, it further added complexities to the industry such as raw paprika price variation, supply chain disruption, and heat and pH sensitivity stability concerns. Manufacturers developed microencapsulation techniques and advanced extraction processes to improve colour stability and shelf life.

Between 2025 and 2035, paprika color will have the biggest market transformation spurred on by biotechnology improvements, sustainable sourcing, and stability solutions.

For the food and beverage industry, heat and light-stable high-purity paprika extracts that can be used in a wider applicational area are being developed for bakery, confectionery, and ready-to-eat meals. Microencapsulation and nano-emulsion technologies for a more even dispersion will continue to address well-defined coloring needs across various product matrices.

As demand grows and organic & non-GMO paprika production expands, sustainability will be a major factor. Natural color producers will need to respond to consumer demand and move toward fair-trade-sourced, carbon-neutral-farmed, and ecologically processed ingredients.

The cosmetic and pharmaceutical industries will increase their use of paprica color, with bioactive-rich extracts playing both aesthetic and functional roles in skin health, as well as in nutraceutical applications. The increasing popularity of plant-derived beauty products will increase acceptance for pigments derived from paprika.

In addition, these technologies like AI and blockchain will bring transparency to supply chains, providing traceability from farm to fork. These innovations, in turn, are enabling manufacturers to uphold consistency in their quality and regulatory compliance across regions.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Food & Beverage Applications | Growth in snacks, dairy, sauces, and beverages. |

| Color Stability | Heat and pH sensitivity issues affecting formulations. |

| Sustainability Focus | Initial shift to organic and non-GMO paprika sources. |

| Cosmetic & Pharma Use | Limited to lipsticks and basic nutraceutical applications. |

| Supply Chain Transparency | Challenges in traceability and raw material fluctuations. |

| Regulatory Compliance | Expanding FDA, EFSA, and global regulatory approvals. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Food & Beverage Applications | Expansion to bakery, confectionery, and heat-stable formulations. |

| Color Stability | Adoption of microencapsulation and nano-emulsion technologies. |

| Sustainability Focus | Large-scale adoption of carbon-neutral farming and ethical sourcing. |

| Cosmetic & Pharma Use | Growth in plant-based beauty and functional skincare formulations. |

| Supply Chain Transparency | AI and blockchain-based real-time supply chain monitoring. |

| Regulatory Compliance | Increased standardization and harmonized international guidelines. |

The Paprika Colour Market in the United States is projected to grow at a rapid pace with the growing consumer preference for natural vs synthetic food colorants. The increasing need for clean-label and organic products in the food and beverage industry drive the market.

Furthermore, the growth of processed food industry, especially in the snacks, sauces, and meat products, is driving the demand for colorants derived from paprika. The market scope is also getting expanded due to regulatory support for natural ingredients and the constant innovations in extraction processes.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 10.2% |

Paprika Color Market is showing steady growth in UK owing to the rising use of natural colorants among food processing and cosmetic industries. Consumers are gaining a better awareness of ingredient transparency and actively selecting food products with natural additives.

Demand is also being further enhanced by the trend towards plant-based and organic foods. Moreover, the shift towards naturally derived food-based ingredients is providing a boost to the market growth also the growing demand from the ready-to-eat meals section is boosting the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 10.3% |

The European region is a prime driver for the Paprika Color Market as it includes dominant production and consumption countries like Germany, France, and Spain. Tight food safety regulations, as witnessed by the European Food Safety Authority (EFSA), support natural colorants used in food applications.

Furthermore, a booming organic food industry and increasing needs for natural cosmetics are augments the market growth. The growing attention to sustainable sourcing and eco-friendly extraction processes also adds to a bright market outlook in this region.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 10.4% |

Japan Paprika Color Market is gaining grow with the rising demand of natural raw material in conventional and packaged foods. With high importance of being healthy and focus towards wellness, the Japanese consumers have increased preference toward food products with natural additives.

Paprika-based colorants have enhanced colour stabilization and this is beneficial for the texturing long shelf-life products available in the market. The growth of the market might be additionally attributed to the cosmetics and pharmaceutical industries, as they are also developing and incorporating paprika extracts for their antioxidant properties.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 10.6% |

The paprika colorants market in the food, beverage, and cosmetics sectors is progressively adopting in South Korea. Demand for paprika-based colorants is increasing due to the growing consumer preference for natural and functional food ingredients in chewable candy, processed food, and plant-based alternatives.

Paprika extracts are becoming a new staple in the beauty industry due to their skin-rejuvenating benefits as well. Moreover, the proliferation of e-commerce channels and the growing consumer inclination towards clean-label products are further augmenting the market growth in South Korea.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 10.7% |

Sales of paprika color adding space are growing as the food makers look for natural, vibrant and reliable colorants for a wide range of applications. Paprika color is derived from red pepper pods (Capsicum annuum) and produces vivid red to orange shades, making it a frequently used substitute for synthetic food dyes.

Consumers are leading the charge toward clean-label, natural, and organic ingredients, forcing foodwich manufacturers to include colorations in snacks, dairy, seasonings, et cetera derived from paprika. Paprika color demand continues to grow across international food markets as regulatory bodies enact stricter guidelines on the use of artificial additives.

Organic Paprika Color - A Clean-Label Favorite

The organic portion is reaping quick momentum because consumers are more concerned about chemical-free, non-GMO, and sustainably sourced food ingredients. Organic paprika color is produced according to stringent agricultural guidelines, meaning it is free from synthetics, pesticides, and genetically modified organisms (GMOs).

With clean-label and organic food movement on the rise in the food industry, food manufacturers are capitalizing on the use of organic paprika extracts This segment appeals to health-conscious consumers and brands that are positioning themselves as premium, sustainable, and environmentally responsible.

Conventional Paprika Color - A Widely Used, Cost-Effective Solution

The market is dominated by conventional paprika color because it is the most cost-effective, readily available, and provides a consistent color. Large-scale food manufacturers still strongly depend on normal paprika extracts which are well-known honestly at a low cost and high balance to put into action different food use.

Not certified organic but conventional paprika color is natural compared to synthetic dyes, thus, is a fundamental ingredient in seasonings, snack foods, processed meats, and sauces.

Beverage - Adding Natural Hues to Drinks

Paprika color is commonly employed in the beverage sector to elevate the aesthetic allure of fruit-based beverages, sports drinks, flavored water, and liquor. Consumers would like to see a natural food colourant in their beverages, with growing interest in clean-label, plant-based, and additive-free drink options.

Paprika extracts are used by beverage manufacturers due to their light stability, heat resistance, as well as their capacity to produce attractive shades in fruit punches, soft drinks, flavored alcoholic drinks.

Bakery, Snacks, & Cereal - Elevating Color Appeal in Baked Goods

A prominent market for paprika color is the bakery and snacks sector, wherein manufacturers are constantly focused on product differentiation by incorporating vibrant aspects in their products, utilizing paprika color. Cereal coatings, also snack seasonings, bread, biscuits, and crackers, use coloring agents derived from paprika to make them look more appetizing without using artificial additives.

Paprika color has the added benefit of combining with other naturally occurring colorants to produce unique shades, making it an ideal choice for high-end artisanal baked goods that target health-aware consumers.

Meat, Poultry, Fish, & Eggs - Enhancing Natural Coloration

The bakery & snacks industry is a leading market with respect to augmenting the market of paprika color as manufacturers are continuously keen on redefining their products with colour elements paprika color. Cereal coatings (as well as snack seasonings) Coloring agents obtained from previous paprika make these also bread, biscuits, and crackers look more appetizing without artificial additives.

Paprika color even has the added advantage of mixing with other natural occurring colorants to create unique shades, a perfect fit for premium artisan baked goods targeting the health aware consumer.

Seasonings - Bringing Rich Color to Spices & Blends

Paprika color is in high use in the seasonings segment to deliver deep colors in spice blends, dry rubs, and dry coatings. A natural, label-friendly solution, paprika extract also improves the visual appeal of spices. As consumers requiring all-natural seasonings and spice blends process decisions or changes in colorants, food manufacturers are being forced to substitute synthetic red and orange dyes for paprikas.

The Paprika Color Market grows as companies develop natural and organic color solutions for food, beverages, cosmetics, and pharmaceuticals. Increasing demand for clean-label products and plant-based food ingredients drives market expansion. Companies focus on product innovation, supply chain optimization, and sustainability initiatives to maintain a competitive edge.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| DDW Color | 18-22% |

| Synthite Industries Ltd. | 15-20% |

| Plant Lipids | 12-16% |

| Ungerer & Company (Unilever Food Solution) | 10-14% |

| Blue Lily Organics | 8-12% |

| Natural Solution | 5-10% |

| ColorMaker Inc. | 5-9% |

| Bioconcolors | 4-8% |

| Ingredients Naturales Seleccionados | 3-7% |

| Kalsec Natural Ingredients | 3-7% |

| Company Name | Key Offerings/Activities |

|---|---|

| DDW Color | Develops premium paprika extracts with customized color intensities for various food applications. |

| Synthite Industries Ltd. | Leverages advanced extraction techniques to produce highly concentrated paprika oleoresins. |

| Plant Lipids | Focuses on natural and organic paprika color solutions, catering to clean-label trends. |

| Ungerer & Company (Unilever Food Solution) | Expands its portfolio with sustainable and versatile paprika-based colorants. |

| Blue Lily Organics | Strengthens its presence in organic and non-GMO paprika colour markets with premium-grade products. |

| Natural Solution | Develops cost-effective, stable, and vibrant paprika color solutions for food and beverage industries. |

| ColorMaker Inc. | Specializes in custom-blended paprika colors tailored for food manufacturing and cosmetic applications. |

| Bioconcolors | Focuses on biotechnology-based paprika color development to enhance stability and solubility. |

| Ingredients Naturales Seleccionados | Expands in European and Latin American markets by offering high-purity paprika extracts. |

| Kalsec Natural Ingredients | Innovates sustainable, heat-stable paprika formulations for processed food applications. |

Key Company Insights

DDW Color (18-22%)

DDW leads the market by offering high-quality paprika-based natural colors with excellent stability and color vibrancy. The company enhances formulation customization to meet diverse industry needs.

Synthite Industries Ltd. (15-20%)

Synthite invests in advanced oleoresin extraction technologies, producing superior paprika color solutions with extended shelf life.

Plant Lipids (12-16%)

Plant Lipids capitalizes on organic and plant-based trends, offering non-GMO, clean-label paprika colors for global food brands.

Ungerer & Company (Unilever Food Solution) (10-14%)

Ungerer & Company expands its food ingredient portfolio, introducing sustainable paprika-based colors with enhanced performance in processed foods.

Blue Lily Organics (8-12%)

Blue Lily Organics strengthens its organic product line, focusing on health-conscious consumers and premium food brands.

Other Market Players (Combined 20-30%)

The overall market size for the Paprika Colour Market was USD 105.9 Million in 2025.

The Paprika Colour Market is expected to reach USD 287.9 Million in 2035.

The demand is driven by increasing consumer preference for natural food colorants, rising applications in the food & beverage industry, growing awareness about clean-label ingredients, and expanding use in cosmetics and pharmaceuticals.

The top 5 countries driving market growth are the USA, UK, Europe, Japan and South Korea.

The food & beverage segment is expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 16: Latin America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 22: Europe Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 25: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Asia Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Asia Pacific Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 28: Asia Pacific Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 29: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Asia Pacific Market Volume (MT) Forecast by Application, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: MEA Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 34: MEA Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 35: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: MEA Market Volume (MT) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Nature, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 9: Global Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Nature, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 27: North America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Nature, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 45: Latin America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Nature, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 63: Europe Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Europe Market Attractiveness by Nature, 2023 to 2033

Figure 71: Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Asia Pacific Market Value (US$ Million) by Nature, 2023 to 2033

Figure 74: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Asia Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 78: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Asia Pacific Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 81: Asia Pacific Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 82: Asia Pacific Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 83: Asia Pacific Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Asia Pacific Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Asia Pacific Market Attractiveness by Nature, 2023 to 2033

Figure 89: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 90: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: MEA Market Value (US$ Million) by Nature, 2023 to 2033

Figure 92: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 96: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: MEA Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 99: MEA Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 100: MEA Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 101: MEA Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 102: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: MEA Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 104: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: MEA Market Attractiveness by Nature, 2023 to 2033

Figure 107: MEA Market Attractiveness by Application, 2023 to 2033

Figure 108: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Colour Changing Packaging Market Size and Share Forecast Outlook 2025 to 2035

Coloured Gemstone Market Analysis - Size, Share, and Forecast 2025 to 2035

Colour Cosmetics Market Insights – Growth & Forecast 2024-2034

Colourless Polyimide Films Market

Water Colour Palette Market Trends and Forecast 2025 to 2035

Single Colour Pad Printing Machines Market Size and Share Forecast Outlook 2025 to 2035

Leading Providers & Market Share in Single Colour Pad Printing Machines

Annatto Food Colours Market Trends - Natural Pigments & Industry Growth 2025 to 2035

Oil-Dispersible Colours Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA