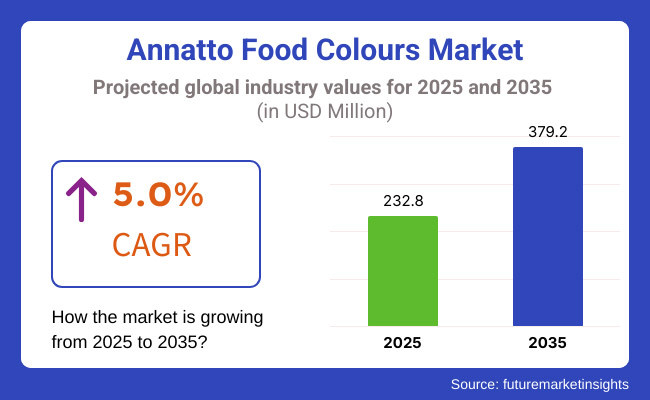

The Global Annatto Food Colours Market was worth around USD 232.8 Million in 2025 and is estimated to be growing at a CAGR of 5.0%, to reach a value of around USD 379.2 Million by 2035. Increasing acceptance of plant-based ingredients/products, coupled with their application as a natural food colourant, are key factors driving annatto food color market demand worldwide.

As the food industry shifts towards clean-label and plant-based ingredients, Bixa orellana tree seeds from annatto are also growing in favour among food manufacturers. Furthermore, the high penetration of annatto in the dairy, bakery, confectionery, beverages and prepared food sector is also expected to drive the growth of the market.

The market is estimated to attain a market value of USD 232.8 Million in 2025 with a growth rate of 5.0% over the predicted timeframe 2035. Expanding consumer interest in allergen-free, non-GMO, and chemical-free edible products has spurred the demand for annatto-based colorants.

Emerging is new growth opportunity driven by the emergence of an increasing vegan and vegetarian community, along with expanding organic food marketplace. Advancement in extraction methods, product stability and formulation developments are certainly enhancing the flexibility and use of annatto in the food sector.

The North America annatto food colours market is characterised by a growing demand for natural food additives, robust food safety regulations, and expansion of the organic food sector. The United States and Canada are among the top markets, where food manufacturers are working actively to reformulate products to replace synthetic dyes with plant-based alternatives.

The Food and Drug Administration (FDA) has tightened its restrictions on synthetic food colours, prompting some food makers to speed up the adoption of natural colorants such as annatto. The increasing trend of functional and fortified foods is also propelling the demand for the market. Moreover, key food manufacturers are working to develop new extraction methods in order to increase the stability and colour strength of annatto for its different applications in processed food.

The annatto food colours market in Europe accounts for a substantial volume share attributed to stringent regulatory frameworks coupled with increasing health awareness and heightened demand for clean-label and organic products. Country-wise Germany, the UK, France, and Italy are leading the way when it comes to natural ingredients, and food brands focusing on sustainable, traceable food source, are on a high.

In the EU, the food colorant annatto is sanctioned as safe by the European Food Safety Authority (EFSA), increasing its consumption in dairy items, sauces, snacks, and plant-based substitutes. Increase in vegan population and rise in demand for free-from products (things that are free from artificial preservatives, colours and flavour`) are also propelling the shift towards natural colouring solutions. Moreover, due to various organic farming and sustainable ingredient extraction development in the region are creating further opportunities for the manufacturers.

Asia-Pacific is projected to witness significant growth in the annatto food colours market due to the quick development of urbanization, rising disposable incomes, and growing processed food industries. Shifts in dietary habits and regulatory reforms are boosting the demand for natural food additives in Asia-Pacific countries including China, India, Japan and South Korea.

Growing populace of middle-class combined with need-of-the-hour concerns with respect to synthetic food-additives, have compelled majority of food manufacturers to adopt natural colorants. Market growth is further driven by government initiatives promoting food safety and clean-label transparency. Moreover, the robust dairy and bakery industries, coupled with rising consumer demand for natural and vegan ingredients, are adding to the growth of annatto in regional food applications.

Challenge

Regulatory Hurdles and Compliance Issues

Regulatory challenges: Different countries have different food safety, labelling, and quality standards for natural colorants, which puts strong regulatory pressure on the annatto market. However, it can be tricky for manufacturers as they have to go through complex approval processes and comply with certain guidelines on what the usage levels have to be, allergens and clean-label claims.

These regulations often necessitate significant testing, certification, and reformulation efforts, which contribute to higher costs and longer time-to-market for annatto-based products. To overcome barriers below those are focusing on transparent sourcing; collaboration with regulators; and innovative technologies that ensure consistent compliance across global markets.

Opportunity

Growing Demand for Plant-Based and Vegan Products

Growing trends toward plant-based and vegan diets are increasing demand for natural food colorants such as annatto, a clean label substitute for synthetic dyes. As consumers demand dairy-free, organic and minimally processed ingredients, food manufacturers are adding annatto to an expanding array of plant-based products, including non-dairy cheeses, vegan spreads and alternative meats.

Not only is this trend expanding the applications for annatto, it also is encouraging brands to invest in sustainable sourcing and formulation improvements that cater to changing consumer preferences for food that fits their ethics and health choices, Amoroso adds.

2020 to 2024: Surge in Demand for Natural Food Colouring and Clean-Label Trends

Market share of annatto food colours market in 2020 to 2024 was high due to increasing demand for natural plant-based food additives will increase the annatto food colours market. Consumers grew more health conscious, prompting food manufacturers to swap synthetic dyes for natural ones. Annatto, obtained from the seeds of the achiote tree, has recently attracted a great interest as a clean-label food colorant owing to its non-toxic, antioxidant and antimicrobial activity.

Annatto has been extensively used as a colouring agent in dairy, bakery and confectionery, and processed foods in the food and beverage industry. The biggest consumer was the dairy sector, which used annatto to give cheese, butter and margarine yellow and orange tonalities. Multiple regulatory approvals and strict bans for artificial food dyes in several countries have further propelled the shift towards annatto-based food colours.

Extract and formulation technology advances were applied by food brands, which enabled improved stability, solubility, and shelf life of the annatto colours. Through microencapsulation technology, it is possible to develop resistance to heat and pH, and thus this technique increases its application in processed and packaged foods. Nonetheless, market expansion was constrained by increases in raw material prices and difficulties in sourcing.

Moreover, the growing consumer preference for organic and sustainably sourced ingredients, resulted in high demand for non-GMO, organic annatto extracts. The growth of e-commerce and direct-to-consumer sales channels enabled specialty food brands to better market annatto-based food products.

2025 to 2035: Innovation in Sustainable Sourcing, Advanced Extraction, and Functional Benefits

Technological advancements in extraction and applications across the food and cosmetic end-use industries are expected to transform the annatto food colours market landscape in between 2025 and 2035. Manufacturers will use green and water-saving processing technologies in order to minimize waste and maximize yield. Enzyme-Aided Extraction, Fermentation-Derived Annatto, Purity and Performance

The functional food and nutraceutical sectors will be a driver of growth. As research illustrates annatto’s antioxidant and anti-inflammatory properties, food brands will soon be touting it as a functional rather than just a food-grade colorant. Fortified dairy product, plant-based meats and health drinks are expecting to use annatto extracts for the purpose of improving Visual appeal and Nutritional value.

Sustainable will be one of the key elements defining the market. Corporate leaders will adopt traceable, regenerative farms to provide ethical procurement and enhance biodiversity. Carbon-neutral production facilities and sustainable packaging solutions will be the norm for all, as all industries align with global sustainability goals.

Further developments in Nano encapsulation and hybrid pigment formulations will allow for better colour stability, higher water solubility, and enhanced resistance to light and thermal fluctuations. This will fuel demand in meals to go, snacks, and beverage formulations. Furthermore, AI-driven food formulation technologies will use annatto more efficiently in food processing, minimizing loss and maximizing cost-benefit.

In addition, regulatory harmonisation and clean-label certifications together will add to the credibility of annatto-based products and enable even broader acceptance across the global food markets.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Bans on synthetic dyes led to increased adoption of natural colours. |

| Technological Advancements | Improved microencapsulation for better stability and shelf life. |

| Industry Adoption | High demand in dairy, processed foods, and beverages. |

| Sustainability Trends | Consumers preferred organic and non-GMO annatto extracts. |

| Market Growth Drivers | Rising demand for clean-label, plant-based food ingredients. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Governments will mandate sustainably sourced, non-GMO, and carbon-neutral food colours. |

| Technological Advancements | Enzyme-assisted extraction, fermentation-derived annatto, and AI-optimized formulation. |

| Industry Adoption | Expansion into nutraceuticals, functional foods, and plant-based meat alternatives. |

| Sustainability Trends | Regenerative agriculture, zero-waste processing, and biodegradable packaging will dominate. |

| Market Growth Drivers | Functional benefits, enhanced stability, and expansion into pharmaceutical applications will fuel growth. |

Annatto Food Colours Market is growing in the United States due to the growing interest in clean-label and natural ingredients in food and beverage applications. More and more consumers are avoiding synthetic colourings, driving food makers to adopt annatto as a natural solution. Regulatory approvals and the growing plant-based food industry also contribute to market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.8% |

United Kingdom’s annatto food colours market is expanding due to increasing demand of consumers for transparency regarding the ingredients of food. The growing demand for organic and minimally processed foods has driven manufacturers in search of natural colour solutions. While government policies promoting the curtailment of artificial additives continue to promote the shifts, food manufacturers are meeting its regulations by replacing synthetic colorations with annatto-based alternatives, which leads the market to grow.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.7% |

In the European Union, annatto food colours are high in demand owing to clean-label food trends governing the consumer preference, especially in countries such as France, Germany, and Italy. Stringent policies on synthetic food colorants by the European Food Safety Authority (EFSA), in addition to the fat consumer trend and preference for naturally-derived colours, have fuelled the growth of annatto-based food colorants. Moreover, increasing dairy and processed food industries are generating revenues for the market participants.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.9% |

Growing demand for traditional and synthetic food products also contributes to the growth of Japan's annatto food colours market. This is the reason why Japanese consumers closely take safety and quality of food into consideration, thus helped natural colorants substantiate the claim in Figure 1. To meet with emerging consumer trends including clean-label colour, more and more major food manufacturers are investing in product innovations which will subsequently fuse the market for annatto food colours for the future.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.1% |

Demand for annatto-based food colorants in South Korea is surging, according to a new analysis, as the processed foods and beverages industry booms. One of the major driving forces for the market is the rising consumer awareness about food ingredient transparency and growing trends for organic products. Further, the market of Annatto Food Colours in the country is also increasing due to customary food additives (natural) promoted by the government.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.2% |

It is well established that the market for natural food colorants is growing rapidly with consumers continuing to seek natural food-colouring agents in preference to synthetic food colorants. Annatto is an orange pigment extracted from the seeds of the Bixa orellana plant and is widely used to colour various food products yellow to reddish-orange. The trend towards clean-label, plant-based, and chemical-free food ingredients has increased the demand for annatto in the food and beverage industry.

Annatto food colours are preferred by manufacturers as they are stable, highly pigmented and can be used along with several food processing methods. The antioxidant and antimicrobial nature of annatto makes it also more appealing, especially to brands trying to enhance both appearance and shelf-life in their formulations for food.

Organic Annatto Gains Popularity as Clean-label and Sustainable Practices Evolve

Due to the demand for healthy and eco-friendly products among consumers, the organic annatto segment is also increasing at a higher pace. Organic annatto food colours are derived from non-GMO, pesticide-free Bixa orellana seeds, making them suitable for natural and organic food manufacturers.

Usages of organic annatto blend within clean-label, no-preservatives as well as recently formed minimally processed products targeting higher end as well as health-aware shoppers. The focus on extraction techniques has also been driven by the growing preference for certified organic food colours and for naturally derived colours ensuring maximum retention of pigment without the need for semi chemical additives.

As mentioned above, organic annatto has a higher price than conventional annatto; however, the appreciation for health-conscious consumers and environment-friendly brands has made this the fastest-growing segment in the annatto market.

Conventional Annatto Maintains Strong Market Share Due to Cost-effectiveness and Versatility

The market is largely dominated by the conventional segment accounts for the larger share of the annatto, as it is cost-effective, widely available, and convenient for large food production. Conventional annatto food colours are considered minimally processed, still natural, and plant-derived, which make them the preferred solution among budgetary food manufacturers.

This category flourishes in mass-produced dairy products, processed foods, and baked goods where uniformity, shelf stability, colour and low cost to producers are key factors. While there is greater awareness around more organic alternatives, in general, conventional annatto holds a large slice of the market, specifically in mainstream and industrial food processing sectors.

Dairy Industry Relies on Annatto for Natural Colouring in Cheese and Butter

Dairy food products end-use industry which holds the largest market demand for annatto food colours, especially in cheese, butter, and dairy-based spreads. In dairy (as well as other edible fat products), annatto’s contribution of a stable, uniform yellow-orange colouring, without interfering with flavour and texture, or nutritional profile, guarantees its position.

Cheese makers use annatto in varieties such as cheddar, colby, gouda, and processed cheese to give uniformity of colour, even when milk composition changes from season to season. Butter and margarine manufacturers also look to annatto to give their product an extra desirable tint for appearance to contribute to a perceived richness and, therefore, better product.

Bakery and Confectionery Industry Utilizes Annatto for Visual Enhancement

Another significant consumer of annatto food colours is the bakery and confectionery sector, where they are used in cakes, pastries, cookies, icings, and sweet fillings. Annatto lends eye-catching golden hues and vibrant yellow tones to baked goods, which is appealing to consumers.

In sweet confectionery products annatto was an efficient substitute for synthetic yellow and orange colorants (especially in candies, chocolates and gelatine-based candies). As demand for naturally coloured and preservative-free baked products increases, annatto continues to be a favoured colorant for manufacturers looking to provide clean-label products.

Although it remains stable through baking processes, some manufacturers are testing alternative natural food colorants that work for products that need to be heated for longer periods. Nonetheless, with ongoing development in annatto extraction and processing technologies, the colour is suitable for use in high-temperature baking applications.

Food and beverage manufacturers driving the demand for natural and clean-label colorants in dairy, confectionery and processed foods are expanding the annatto food colours market. To do so, companies are focusing on organic extraction techniques, enhanced stability formulations, and sustainable sourcing of Bixa orellana seeds to meet regulatory compliance and consumer preferences.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| AVT Natural Products | 14-18% |

| Aarkay Food Products | 12-16% |

| FMC Corporation | 10-14% |

| Plant Lipids | 8-12% |

| Amerilure | 6-10% |

| D. Williamson & Co. Inc. | 5-9% |

| Kalsec Inc. | 5-9% |

| BASF SE | 4-8% |

| Akay Group | 3-7% |

| Sensient Technology Corporation | 3-7% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| AVT Natural Products | Manufactures natural annatto colour extracts, focusing on high-purity bixin and norbixin formulations for dairy and processed foods. |

| Aarkay Food Products | Specializes in powdered and liquid annatto extracts, offering customized colour intensity for cheese, snacks, and beverages. |

| FMC Corporation | Develops food-grade annatto colorants, integrating advanced stability solutions to improve shelf life and heat resistance. |

| Plant Lipids | Produces organic and sustainable annatto extracts, emphasizing non-GMO and allergen-free formulations for global markets. |

| Amerilure | Supplies highly concentrated annatto colour solutions, targeting dairy, sauces, and snack food applications. |

| D. Williamson & Co. Inc. | Provides liquid and powder-based annatto colorants, ensuring consistency in natural food colouring applications. |

| Kalsec Inc. | Innovates in oil- and water-soluble annatto formulations, improving colour retention and stability under processing conditions. |

| BASF SE | Develops synthetic and natural colorant solutions, leveraging advanced extraction technologies for purity and efficiency. |

| Akay Group | Produces clean-label annatto colorants, offering customized solutions for plant-based and dairy alternatives. |

| Sensient Technology Corporation | Manufactures annatto-derived natural pigments, incorporating colour innovation with extended heat and pH stability. |

Key Company Insights

AVT Natural Products (14-18%)

AVT Natural Products leads the natural annatto extracts market, focusing on high-purity bixin and norbixin formulations for cheese, dairy, and processed food applications.

Aarkay Food Products (12-16%)

Aarkay Food Products specializes in powdered and liquid annatto solutions, offering customized colour intensity and stability for global food manufacturers.

FMC Corporation (10-14%)

FMC Corporation integrates advanced stabilization technology into annatto formulations, ensuring consistent colour in high-temperature and extended-shelf-life applications.

Plant Lipids (8-12%)

Plant Lipids promotes organic and sustainably sourced annatto extracts, catering to the clean-label movement and non-GMO food markets.

Amerilure (6-10%)

Amerilure supplies high-concentration annatto solutions, targeting global dairy, sauces, and processed snack manufacturers.

D. Williamson & Co. Inc. (5-9%)

D. Williamson & Co. Inc. develops liquid and powder-based annatto colorants, ensuring stability and consistency in dairy and food processing applications.

Kalsec Inc. (5-9%)

Kalsec Inc. enhances oil- and water-soluble annatto formulations, optimizing colour retention and performance under variable processing conditions.

BASF SE (4-8%)

BASF SE advances synthetic and natural colorant solutions, utilizing innovative extraction technologies to enhance efficiency and purity.

Akay Group (3-7%)

Akay Group manufactures customized annatto colorants, focusing on plant-based alternatives and dairy-free applications.

Sensient Technology Corporation (3-7%)

Sensient Technology Corporation pioneers natural pigment innovations, integrating heat- and pH-stable annatto extracts for diverse food applications.

Other Key Players (30-40% Combined)

Several emerging companies contribute to natural pigment innovation, organic annatto sourcing, and advanced extraction techniques to improve stability, sustainability, and regulatory compliance. These include:

The overall market size for the Annatto Food Colours Market was USD 232.8 Million in 2025.

The Annatto Food Colours Market is expected to reach USD 379.2 Million in 2035.

The demand is driven by increasing consumer preference for natural food colorants, stringent regulations on synthetic dyes, rising demand in dairy and processed food industries, and growing clean-label product trends.

The top 5 countries driving market growth are the USA, UK, Japan, South Korea and Europe.

The dairy products segment is expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Form, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 10: Global Market Volume (MT) Forecast by Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 18: North America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 20: North America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 26: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 28: Latin America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 30: Latin America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 34: Western Europe Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: Western Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 38: Western Europe Market Volume (MT) Forecast by Form, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 40: Western Europe Market Volume (MT) Forecast by Type, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 44: Eastern Europe Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: Eastern Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 48: Eastern Europe Market Volume (MT) Forecast by Form, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 50: Eastern Europe Market Volume (MT) Forecast by Type, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (MT) Forecast by Application, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (MT) Forecast by Form, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (MT) Forecast by Type, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 64: East Asia Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 66: East Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 68: East Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 70: East Asia Market Volume (MT) Forecast by Type, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 74: Middle East and Africa Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 76: Middle East and Africa Market Volume (MT) Forecast by Application, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 78: Middle East and Africa Market Volume (MT) Forecast by Form, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 80: Middle East and Africa Market Volume (MT) Forecast by Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Nature, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 11: Global Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 15: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 19: Global Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 23: Global Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 26: Global Market Attractiveness by Nature, 2023 to 2033

Figure 27: Global Market Attractiveness by Application, 2023 to 2033

Figure 28: Global Market Attractiveness by Form, 2023 to 2033

Figure 29: Global Market Attractiveness by Type, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 41: North America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 45: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 49: North America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 53: North America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 56: North America Market Attractiveness by Nature, 2023 to 2033

Figure 57: North America Market Attractiveness by Application, 2023 to 2033

Figure 58: North America Market Attractiveness by Form, 2023 to 2033

Figure 59: North America Market Attractiveness by Type, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 71: Latin America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 75: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 79: Latin America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 83: Latin America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Nature, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 101: Western Europe Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 105: Western Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 109: Western Europe Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 113: Western Europe Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Nature, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Form, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 131: Eastern Europe Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 135: Eastern Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 139: Eastern Europe Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 143: Eastern Europe Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Nature, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Form, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Nature, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Form, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Nature, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Form, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Nature, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Form, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 191: East Asia Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 195: East Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 199: East Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 203: East Asia Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Nature, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Form, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Nature, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Form, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Nature, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Form, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Annatto Market

Annatto Extract Market

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA