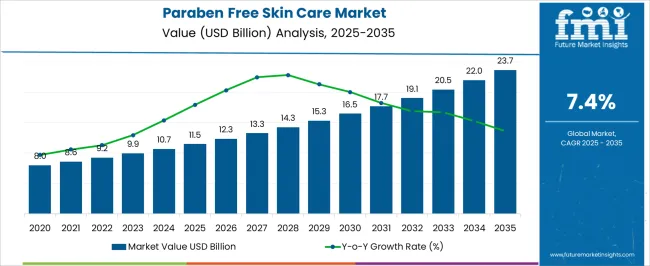

The Paraben Free Skin Care Market is estimated to be valued at USD 11.5 billion in 2025 and is projected to reach USD 23.7 billion by 2035, registering a compound annual growth rate (CAGR) of 7.4% over the forecast period.

| Metric | Value |

|---|---|

| Paraben Free Skin Care Market Estimated Value in (2025 E) | USD 11.5 billion |

| Paraben Free Skin Care Market Forecast Value in (2035 F) | USD 23.7 billion |

| Forecast CAGR (2025 to 2035) | 7.4% |

The paraben free skin care market is expanding steadily, driven by rising consumer awareness regarding the potential health concerns linked to parabens and the broader shift toward clean-label beauty products. Industry announcements and dermatological publications have emphasized increasing demand for formulations free from synthetic preservatives, aligning with consumer preference for natural and safe ingredients.

Cosmetic brands have been investing in research and development to create alternative preservation systems, ensuring both product safety and longer shelf life. Additionally, social media campaigns and influencer-driven marketing have heightened consumer engagement with paraben free solutions, particularly in urban and millennial demographics.

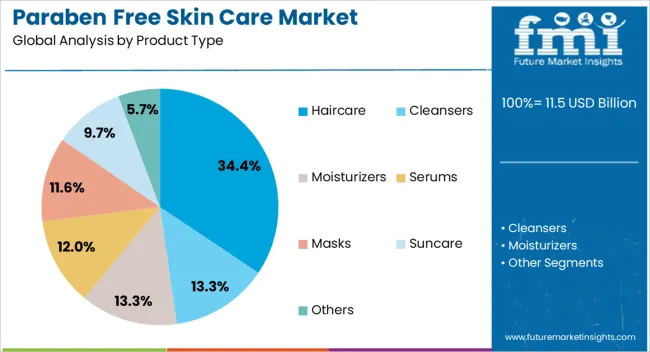

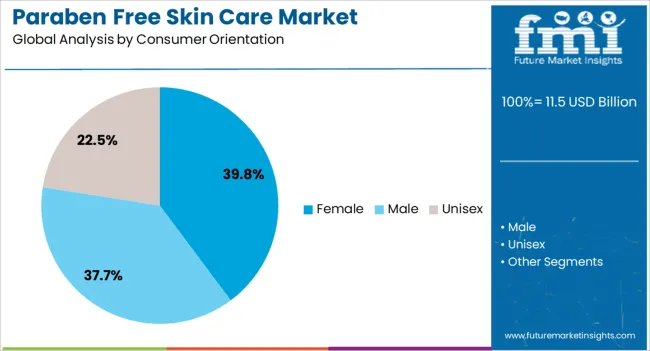

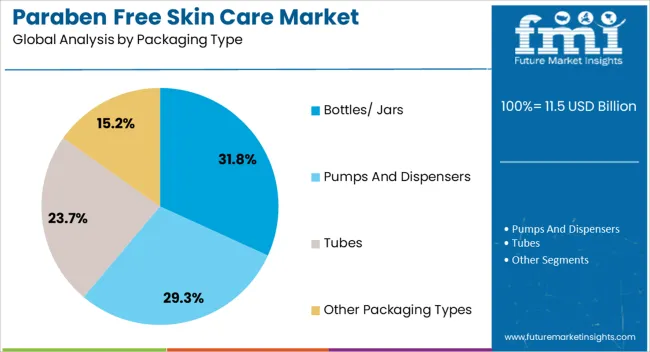

The premiumization of personal care products and regulatory scrutiny on chemical ingredients in cosmetics have further accelerated this trend. Looking forward, growth will be reinforced by rising disposable incomes, broader product availability across retail and e-commerce platforms, and expansion of tailored formulations that address specific skin and hair concerns. Segmental momentum is expected to be led by Haircare products, Female consumers, and Bottles/Jars packaging due to their higher visibility, adoption, and convenience in daily use.

The Haircare segment is projected to contribute 34.4% of the paraben free skin care market revenue in 2025, positioning itself as the leading product type. This dominance has been fueled by heightened consumer sensitivity to scalp health and growing awareness of long-term effects of chemical preservatives on hair texture and strength.

Industry updates have highlighted that paraben free shampoos, conditioners, and treatments have gained traction as consumers increasingly associate “clean” formulations with safety and efficacy. Additionally, innovation in plant-based preservatives and botanical blends has supported brand expansion in this category.

The rising influence of dermatological endorsements and consumer testimonials has reinforced trust in paraben free haircare, accelerating adoption across premium and mass-market brands. As consumer demand for holistic wellness and chemical-free grooming products continues to rise, the Haircare segment is expected to maintain strong growth momentum.

The Female segment is projected to hold 39.8% of the paraben free skin care market revenue in 2025, retaining its position as the primary consumer orientation category. Growth of this segment has been shaped by women’s heightened focus on ingredient transparency, product safety, and alignment with sustainable beauty trends.

Marketing campaigns and product launches by leading cosmetic companies have predominantly targeted female consumers, emphasizing paraben free formulations as part of safer daily care routines. Consumer surveys and retail data have indicated higher purchase frequency and brand loyalty among women, particularly for products addressing skincare, haircare, and anti-aging concerns.

Moreover, the rise of social commerce platforms has amplified female engagement with clean beauty products, leading to broader product adoption. As the availability of gender-specific and multi-functional cosmetic products expands, the Female segment is anticipated to sustain its leadership in driving demand for paraben free skincare solutions.

The Bottles/Jars segment is projected to account for 31.8% of the paraben free skin care market revenue in 2025, leading the packaging category. This segment’s growth has been influenced by the versatility and practicality of bottles and jars in storing creams, lotions, serums, and haircare products.

Packaging innovations, such as airless pump jars and recyclable bottle formats, have enhanced consumer convenience while maintaining product integrity. Cosmetic manufacturers have emphasized sustainability by adopting eco-friendly materials and refillable designs, aligning with consumer expectations for responsible packaging.

Furthermore, bottles and jars offer greater flexibility for branding and labeling, allowing companies to highlight their paraben free claims prominently. Consumer preference for easy-to-use, durable, and aesthetically appealing packaging has reinforced the popularity of this format. As sustainability continues to shape purchasing behavior, the Bottles/Jars segment is expected to retain its market leadership, supported by innovation in design and materials.

The producers that function in the paraben free skin care market strongly concentrate on widening the consumer base by leveraging the propsects offered in the Asia Pacific. New paraben free skin care vendors enter the market to reinforce the market's environmental consciousness.

They also take advantage of consumers' perceptions regarding organic choices as opposed to synthetic cosmetic products. This trend has caused many manufacturers to propose a wide organic product portfolio, like face washes, serums, and facials. Natural skin care products are organic and have no synthetic ingredients.

| Attributes | Details |

|---|---|

| Market Value for 2020 | USD 7,711.50 million |

| Market Value for 2025 | USD 9,995.20 million |

| Market CAGR from 2020 to 2025 | 6.70% |

The segmented paraben free skin care market analysis is mentioned in the below subsection. Based on comprehensive studies, the hair care sector is predominant in the product type category. Meanwhile, the female sector is controlling the consumer orientation category.

| Segment | Hair Care |

|---|---|

| Share (2025) | 34.40% |

Paraben free haircare demand supports the ascending trend towards organic ingredients, attracting health-conscious people. Paraben free ingredients in haircare align with buyers concerned about prospective adverse effects, boosting inclination towards safer options.

Haircare items are important for daily grooming regimes, satisfying an extensive consumer base looking for healthier hair. The haircare segment acquires the top spot owing to the economic opportunities for producers to cash on the flourishing paraben free skin care market.

| Segment | Female |

|---|---|

| Share (2025) | 39.80% |

The flexibility of paraben free items satisfies diverse skincare requirements of women, from anti-aging to reactive skin care, prompting significant sales in the female segment. The predominant beauty influencers and media platforms convince primarily the female customer base, imprinting the idea of paraben free skin care advantages.

The augmenting awareness in women regarding the prospective health risks related to parabens escalates their choice of non-toxic replacements. The beauty sector’s concentration on organic and clean ingredients appeals strongly to female consumers, affecting their decisions.

The organic skin care market can be observed in the subsequent tables, which focus on the leading regions in North America, Europe, and the Asia Pacific. A comprehensive evaluation demonstrates that Asia Pacific has enormous market potential for paraben free skin care.

Demand Analysis of Paraben Free Skin Care in North America

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 4.70% |

| Canada | 8.10% |

Major retail outlets in the United States are mushrooming their product portfolio of paraben free skin care products to serve the booming demand for toxin-free beauty items. Regulatory examination and consumer guidance groups are propelling stricter labeling needs, encouraging producers to recompound products to fulfil paraben free benchmarks.

Influencer promotional campaigns and social media are critical in enhancing paraben free beauty options and persuading consumer preferences. This escalates the United States paraben free skin care market growth.

A trend inclined towards transparency and ingredient integrity is witnessed by the skincare industry of Canada. Brands stress the removal of parabens in their formulations to lure health-conscious shoppers. Environmental awareness and sustainability are key catalysts transforming purchasing decisions in Canada, steering to amplify demand for chemical-free skin care products that go well with sustainable values. The online boom is also a catalyst for the Canadian market’s growth.

Opportunities for Paraben Free Skin Care in Europe

| Countries | CAGR (2025 to 2035) |

|---|---|

| Spain | 6.10% |

| Italy | 5.70% |

| Germany | 5.40% |

| France | 5.10% |

| United Kingdom | 4.90% |

The skincare market in Spain observes a remarkable inclination towards paraben free products as consumers are mindful of ingredient security. Consumers in Spain grab paraben free skin care alternatives, ushered by issues of health risks and ecological influence. The amplifying consciousness regarding the probable harm of parabens ushers Spanish consumers to find paraben free cosmetic options, aiding paraben free skin care market growth.

An inclination for natural and organic beauty products intensifies Spain's paraben free beauty products demand. The Spanish skincare industry acts optimistically towards consumer requirements for better alternatives with an expansion of paraben free formulations.

The skincare industry in Italy witnesses an amplification in demand as customers prioritize safer and environment-friendly alternatives. Consumers in Italy are inclined towards paraben free beauty solutions, indicating an escalating alternative in favor of organic beauty products.

The heightened consciousness about the detrimental impacts of parabens surges the paraben free skin care market expansion in Italy. The trend of paraben free skin care goes with an expansive movement towards cleaner and energy-efficient beauty alternatives. The Italian skincare industry has a dramatic inclination towards paraben free formulations amplified by shifting consumer choices and regulatory fluctuations.

Opportunities in the Asia Pacific Industry

| Countries | CAGR (2025 to 2035) |

|---|---|

| Singapore | 9.60% |

| India | 9.40% |

| Japan | 9.10% |

| China | 8.90% |

| Australia | 6.30% |

The prosperous population in Singapore is progressively seeking natural and safer alternatives in skincare, aiding the advent of paraben free products. The cosmopolitan culture and susceptibility to global beauty trends in Singapore induce consumers to pick organic skin care solutions.

Strict regulations and consumer cognizance pertaining to health risks enhance the demand for clean skincare alternatives in Singapore. The escalation of ecological efficiency and clean environment trends in Singapore is leading skincare producers to provide cleaner formulations.

The flourishing e-commerce market in India bolsters accessibility to an array of chemical-free skincare products, satisfying consumer demand. The inclination of Indian customers towards Ayurvedic and herbal skincare solutions escalates the demand.

The emergence of organic and natural beauty movements in India amplifies the adoption of paraben free skin care products by health-aware consumers. The surging awareness regarding the environmental impact of chemical-based cosmetics instigates Indian consumers to switch to cruelty-free skincare alternatives.

Numerous manufacturers dot the competitive terrain of the paraben free skin care market, obligated to dispense consumers with effective and clean skincare. Established producers like Burt's Bees, Alba Botanica, Aveeno, and Dr. Hauschka are prominent for their commitment to organic and carbon-neutral ingredients. Paula's Choice, Caudalie, and The Body Shop are distinctive for their concentration on 0% paraben formulations and ethical activities.

Advancements are an impetus in the market, with paraben free skin care vendors like Kiehl's, Juice Beauty, and Andalou Naturals persistently pushing boundaries to provide premium skincare products that are paraben free. Tata Harper, Avalon Organics, and Acure Organics satisfy the strengthening demand for organic and greener alternatives, while Desert Essence and Ren Clean Skincare emphasize controlling the power of natural extracts.

The paraben free skin care manufacturers are devoted to ethical activities. As consumer recognition of substance safety escalates, the market is slated to witness amplified growth, with the potential for established providers and emerging startups to leave their impression on the paraben free skin care market.

Noteworthy Observations

| Company | Haeckels |

|---|---|

| Headquarter | United Kingdom |

| Recent Advancement |

|

| Company | e.l.f. Cosmetics |

|---|---|

| Headquarter | United States |

| Recent Advancement |

|

| Company | L'Oreal |

|---|---|

| Headquarter | France |

| Recent Advancement |

|

| Company | The Body Shop |

|---|---|

| Headquarter | United Kingdom |

| Recent Advancement |

|

| Company | Phy |

|---|---|

| Headquarter | India |

| Recent Advancement |

|

The global paraben free skin care market is estimated to be valued at USD 11.5 billion in 2025.

The market size for the paraben free skin care market is projected to reach USD 23.7 billion by 2035.

The paraben free skin care market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in paraben free skin care market are haircare, cleansers, moisturizers, serums, masks, suncare and others.

In terms of consumer orientation, female segment to command 39.8% share in the paraben free skin care market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Parabens Market

Methylparaben Market Forecast and Outlook 2025 to 2035

Propylparaben Market

Freezer Label Market Size and Share Forecast Outlook 2025 to 2035

Freezer Liner Market Size and Share Forecast Outlook 2025 to 2035

Freeze Neutralising Kit Market Size and Share Forecast Outlook 2025 to 2035

Freeze Drying Market - Size, Share, and Forecast Outlook 2025 to 2035

Freeze Dried Fruit Powder Market Size and Share Forecast Outlook 2025 to 2035

Freeze-dried Food Market Analysis - Size, Growth, and Forecast 2025 to 2035

Freeze Dried Fruits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Freeze Drying Equipment Market Size and Share Forecast Outlook 2025 to 2035

Freezer Paper Market Size and Share Forecast Outlook 2025 to 2035

Freeze Dried Fruits And Vegetables Market Size and Share Forecast Outlook 2025 to 2035

Free-from Titanium Dioxide Market Size, Growth, and Forecast for 2025 to 2035

Freeze-Dried Vegetables Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Freeze-Dried Pet Food Market Anlysis by Pet Type, Nature, Source, Process Type, and Sales Channel Through 2035

Freeze Dried Melt Market Analysis by Product Form, Fruit Type, Sales Channel, Packaging, , and Region Through 2035

Free Standing Display Units Market by Material & End-Use Forecast 2025 to 2035

Freezer Bags Market Growth, Trends and Demand from 2025 to 2035

Freestanding Large Cooking Appliance Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA