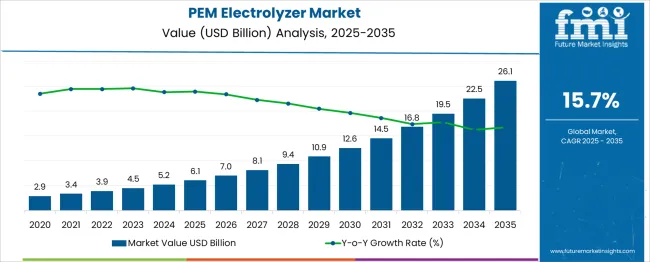

The PEM electrolyzer market is estimated to be valued at USD 6.1 billion in 2025 and is projected to reach USD 26.1 billion by 2035, registering a compound annual growth rate (CAGR) of 15.7% over the forecast period. The acceleration pattern is evident in the absolute year-on-year gains, which rise progressively across the timeline. Between 2025 and 2026, the market grows by USD 0.9 billion, while the final year, 2034 to 2035, contributes an increase of USD 3.6 billion. This rising increment suggests that the market is in a compound acceleration phase, where scaling capacity, falling per-kW costs, and procurement commitments are being layered in sequence.

Acceleration is most visible between 2030 and 2035, where annual additions exceed USD 2.5 billion per year, compared to sub-USD 1.5 billion gains between 2025 and 2029. Deceleration is not observed across the forecast period, as the year-on-year growth maintains both nominal and real intensity. This continuous upward slope reflects infrastructure deployment backed by decarbonization mandates in ammonia, refining, steel, and long-duration energy storage sectors. Peer-reviewed hydrogen energy journals point to PEM systems being favored where rapid load following and compact integration are prioritized. The growth curve remains consistent with industries scaling from megawatt- to gigawatt-level electrolysis, supported by supply chain localization and electrolyzer stack efficiency improvements.

| Metric | Value |

|---|---|

| PEM Electrolyzer Market Estimated Value in (2025 E) | USD 6.1 billion |

| PEM Electrolyzer Market Forecast Value in (2035 F) | USD 26.1 billion |

| Forecast CAGR (2025 to 2035) | 15.7% |

In estimated shares, around 30% of PEM electrolyzer demand is driven by renewable energy applications, where intermittent solar and wind power generate green hydrogen for storage. About 25% stems from industrial hydrogen production, especially in sectors like electronics, metal processing, and fertilizer manufacturing. Nearly 20% ties to fuel cell vehicles and hydrogen-powered transit, using PEM units for onboard or refill infrastructure. Another 15% is linked to oil refining and chemical synthesis plants that require high-purity hydrogen.

The remaining 10% originates from energy storage and grid services, leveraging hydrogen as a buffer to balance loads and support demand response. The market is growing rapidly as it captures over 53% of global electrolyzer installations by 2025, outpacing alternatives like alkaline and solid oxide systems. Manufacturers are increasingly integrating PEM units with solar and wind farms, driving 10–15% gains in renewable utilization and grid stabilization through flexible, decentralized hydrogen production.

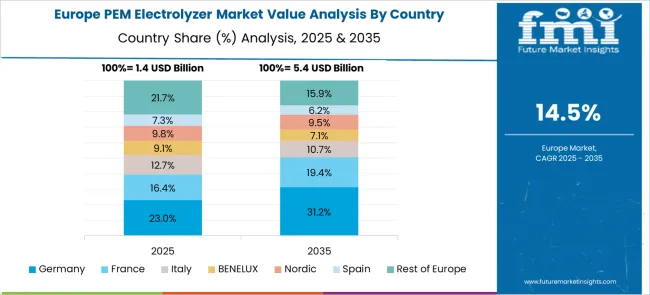

Modular PEM designs now account for roughly 60% of small-scale installations under 500 kW, enabling plug-and-play setups in industrial parks and remote sites. AI and IoT tools are extending stack lifespans while lowering hydrogen production costs by up to 30%. Asia Pacific leads growth with nearly 30% market share, while Europe holds around 40%, supported by strong government incentives and deployment mandates.

The PEM electrolyzer market is experiencing strong growth driven by the global push toward green hydrogen production and decarbonization initiatives across industries. The current market scenario is being shaped by significant investments in renewable energy integration and the growing need for flexible, efficient hydrogen generation systems.

As observed in company press releases, investor presentations, and energy sector news, advancements in proton exchange membrane technology have enhanced efficiency, reduced operational costs, and improved system scalability. The future outlook appears positive as governments continue to announce supportive policies and funding to achieve net-zero emission targets, encouraging further adoption of PEM electrolyzers.

Annual reports and industry journals highlight how improved durability and modular designs are enabling broader deployment across industrial and energy sectors. Rising awareness of energy security, coupled with innovation in storage and distribution infrastructure, is also creating favorable conditions for sustained market growth in the coming years.

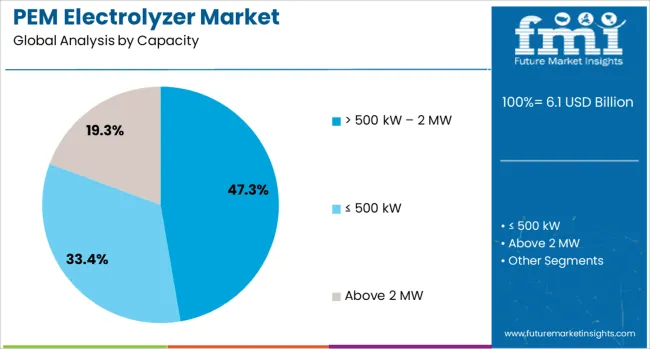

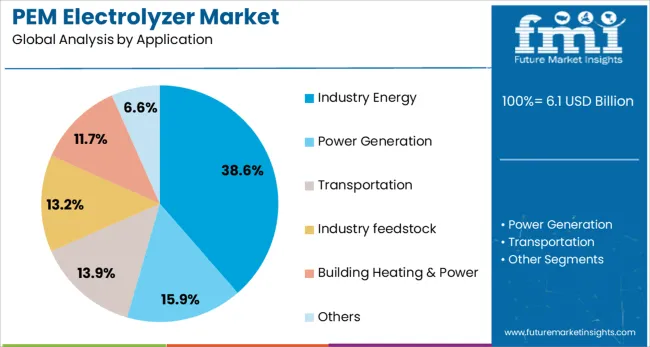

The PEM electrolyzer market is segmented by capacity, application and geographic regions. The capacity of the PEM electrolyzer market is divided into > 500 kW – 2 MW, ≤ 500 kW, and above 2 MW. In terms of application, the PEM electrolyzer market is classified into Industrial Energy, Power Generation, Transportation, Industrial Feedstock, Building Heating & Power, and Others. Regionally, the PEM electrolyzer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The > 500 kW – 2 MW capacity segment is expected to hold 47.30% of the PEM Electrolyzer market revenue share in 2025, making it the leading capacity segment. This dominance is being driven by its suitability for medium to large-scale industrial and energy applications, as outlined in corporate product announcements and energy sector publications.

It has been observed that this capacity range offers an optimal balance between output and cost-effectiveness, supporting the demands of industries transitioning toward green hydrogen without incurring excessive capital expenditure. The segment’s growth has been further supported by advancements in modular system design, allowing seamless scalability and easy integration with renewable energy sources.

Investor briefings have noted that enterprises prefer this capacity range to meet decarbonization goals while maintaining operational flexibility and compliance with emerging environmental regulations. Its prominence has also been reinforced by improved efficiency, lower maintenance needs, and its adaptability to diverse operational environments, solidifying its position as the leading segment.

The industry energy application segment is projected to account for 38.60% of the PEM Electrolyzer market revenue share in 2025, establishing itself as the largest application segment. This leadership is being attributed to the growing adoption of green hydrogen as a clean energy carrier within industrial operations, as highlighted in government energy policy statements and corporate sustainability reports.

It has been widely recognized that industries are increasingly relying on PEM electrolyzers to replace fossil fuels, reduce carbon emissions, and comply with stricter environmental standards. Annual reports from energy companies have noted that industries find PEM systems advantageous due to their high efficiency, rapid response capability, and compatibility with intermittent renewable energy sources.

The segment’s expansion has also been driven by rising demand in sectors such as chemicals, refineries, and steel manufacturing, where hydrogen plays a critical role in production processes. These factors have collectively strengthened the industry energy segment’s leadership in the market by 2025.

Global deployment of PEM (proton exchange membrane) electrolyzers has accelerated, with capacity additions growing by 24% year-on-year. Green hydrogen projects in industrial clusters and renewable energy zones have prioritized PEM technology for rapid response capabilities. Market share led by alkaline systems declined to approximately 42% as PEM captured the balance. Modular PEM units under 1 MW represent nearly 38% of new installations due to flexibility and ease of scaling in distributed energy use cases.

The flexibility of PEM electrolyzers to follow variable solar and wind power output has enabled integration in over 45% of newly commissioned green hydrogen facilities. Fast ramp-up and load-follow capability have supported coupling with inverter systems in hybrid renewable-plus-storage configurations. Plant operators have preferred PEM units for peak-hour electrolysis cycles, capturing a 28% cost advantage in energy arbitrage when compared with fixed load alkaline units. The compact, modular footprint has facilitated deployment in urban, offshore, and brownfield renewable sites where space is constrained and response speed matters.

High capital expenditure has remained a barrier, with system capex estimated to be 18% higher for PEM platforms versus alkaline equivalents. The use of platinum group metal catalysts has created dependency on critical material availability, with platinum loading optimized only in 26% of commercial systems. Sensitivity to water purity has driven additional filtration infrastructure costs, adding 12% to overall project budgets. Pressurized PEM designs introduced for efficiency posed higher engineering complexity for about 19% of early-adopter installations.

Opportunities have expanded in microgrid and industrial utility sites where decentralized hydrogen production aligns with zero-carbon fuel strategies. Micro PEM electrolysis units were deployed in 34% of new ammonia and methanol projects for on-site feedstock generation. Demand from chemical plants, refineries, and data centers for carbon-free backup generation has driven corporate offtake contracts comprising 22% of PEM sales pipelines. Integration with battery storage and VPP platforms has opened black-start and peak-shaving use cases, reinforcing long-term service and maintenance engagement models.

Hybrid systems combining PEM electrolyzers with alkaline or solid oxide backup modules have been implemented in over 31% of utility-scale projects to balance cost and flexibility. Remote monitoring, digital twin oversight, and predictive maintenance algorithms have been embedded in 27% of newly commissioned PEM systems. Stack replacement intervals are being extended via AI-enabled diagnostics, improving uptime by 14%. Performance benchmarking dashboards showing hydrogen purity, cold-start ramp times, and stack voltage decay have become standard in 39% of project service contracts.

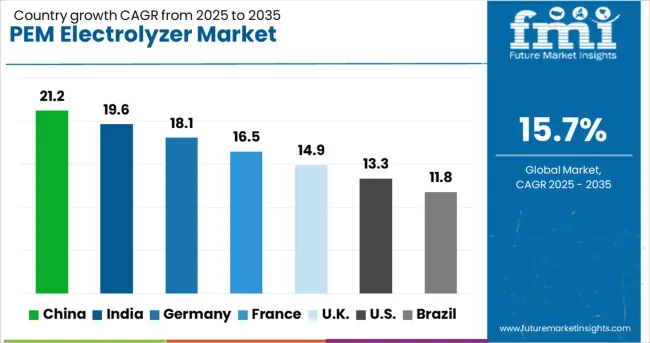

| Country | CAGR |

|---|---|

| China | 21.2% |

| India | 19.6% |

| Germany | 18.1% |

| France | 16.5% |

| UK | 14.9% |

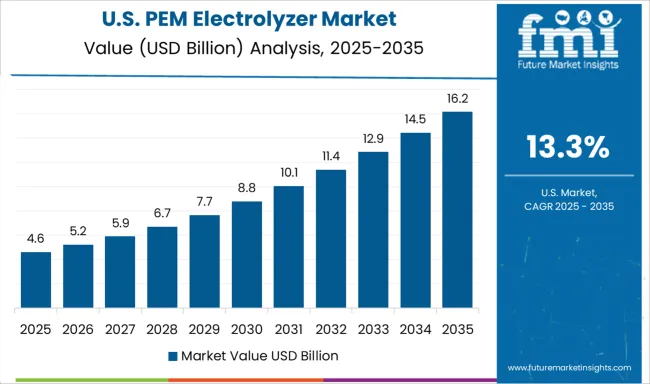

| USA | 13.3% |

| Brazil | 11.8% |

The global PEM electrolyzer market is projected to expand at a CAGR of 15.7% from 2025 to 2035. China leads with 21.2%, exceeding the global average by 5.5%, supported by large-scale green hydrogen initiatives and vertically integrated electrolyzer production. India follows at 19.6%, with state-supported pilot projects and industrial hydrogen demand contributing to above-average growth. Germany (OECD) stands at 18.1%, 2.4% above the global benchmark, driven by decarbonization mandates across refining and chemical sectors. The United Kingdom (OECD) records 14.9%, slightly below the global rate, while the United States (OECD) trails at 13.3%, 2.4% under the global CAGR, limited by slower rollout of federal funding. The report includes detailed analysis of 40+ countries, with the top five countries shared as a reference.

China accounted for 21.2% of the global PEM electrolyzer market in 2025. Expansion has been driven by industrial decarbonization programs across ammonia, methanol, and steel sectors. State-owned entities have deployed PEM systems in hybrid hydrogen parks, combining solar, wind, and battery storage. Project-scale electrolyzer procurement contracts have been issued through provincial clean hydrogen policies targeting energy transition mandates.

India captured 19.6% of the market in 2025. Public-private partnerships under the National Green Hydrogen Mission have catalyzed electrolyzer production and downstream application. PEM technology has been prioritized for decentralized hydrogen generation in refineries, fertilizer units, and mobility clusters. Indigenous manufacturers have ramped up MW-scale stack output aligned with demand from SEZ-based hydrogen corridors.

Germany held 18.1% of the global share in 2025. PEM deployment has been advanced through H2Global auction schemes and bilateral hydrogen trade partnerships. Export-ready PEM systems have been adopted in port-based hydrogen terminals and power-to-gas hubs. OEMs have emphasized modular stacks, integrated diagnostics, and containerized systems for scalable installation across industrial clusters.

The United Kingdom accounted for 14.9% of global share in 2025. Deployment momentum has been supported by offshore wind-hydrogen coupling and industrial cluster decarbonization programs. PEM electrolyzers have been preferred in marine hydrogen bunkering sites and power balancing infrastructure. Stakeholders have emphasized system footprint, start-stop efficiency, and stack responsiveness under grid-coupled operation.

The United States accounted for 13.3% of the PEM electrolyzer market in 2025. Interest in PEM technology has come from distributed hydrogen production and utility-scale demonstration projects under DOE programs. Mobility sectors, especially hydrogen refueling stations, have preferred PEM systems due to compact stack configuration and variable load handling. Manufacturers have developed water-cooled stack variants tailored to US temperature zones.

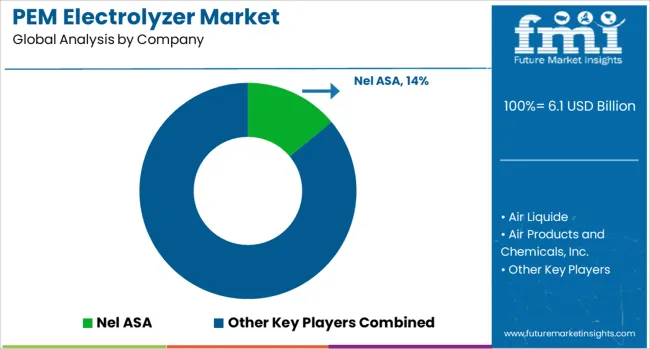

The PEM electrolyzer market includes engineering firms, gas suppliers, and power system specialists supporting hydrogen generation for mobility, industrial, and energy storage applications. Nel ASA supplies modular PEM electrolyzers designed for scalable hydrogen refueling infrastructure, with installations across Europe and North America.

Siemens Energy offers industrial-grade PEM systems that integrate with renewable power sources and smart grid platforms. Plug Power supports vertical integration through PEM stacks and turnkey hydrogen plants deployed in logistics and manufacturing sectors. Cummins Inc. supplies compact and industrial-scale PEM systems, combining stack technology with proven engineering for grid and off-grid deployments.

Air Liquide and Air Products and Chemicals, Inc. use PEM electrolyzers to support captive hydrogen generation and refueling solutions in internal and partner networks. ITM Power delivers containerized PEM units, with its systems often integrated into energy hubs across the UK and Germany. Elogen focuses on compact, modular PEM solutions for on-site industrial hydrogen production. Giner supports military and aerospace applications with customized PEM units designed for mission-critical reliability. Erre Due s.p.a. and ostermeier H2ydrogen Solutions GmbH target mid-scale users requiring continuous hydrogen supply. LARSEN & TOUBRO LIMITED has entered the PEM space with EPC capabilities and localized production, expanding its role in domestic energy transition strategies.

The market is progressing with innovations in membrane efficiency, platinum group metal catalyst reduction, and stack modularization. These systems are increasingly favored for green hydrogen production due to their compact design, fast response time, and compatibility with intermittent renewable energy sources. Containerized units are being deployed across industrial zones, mobility hubs, and off-grid power systems, offering scalable solutions for localized hydrogen generation.

Digital platforms integrated with IoT and AI enable real-time performance monitoring, predictive maintenance, and energy optimization. Focus has shifted toward reducing iridium and platinum loading without compromising durability. Despite strong momentum, the market faces supply chain bottlenecks, limited hydrogen distribution networks, and high capital costs, particularly in emerging economies where infrastructure development remains uneven.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.1 Billion |

| Capacity | > 500 kW – 2 MW, ≤ 500 kW, and Above 2 MW |

| Application | Industry Energy, Power Generation, Transportation, Industry feedstock, Building Heating & Power, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nel ASA, Air Liquide, Air Products and Chemicals, Inc., Cummins Inc., Erre Due s.p.a., Elogen, Giner, ITM Power, LARSEN & TOUBRO LIMITED, ostermeier H2ydrogen Solutions GmbH, Plug Power, and Siemens Energy |

| Additional Attributes | Dollar sales by stack size (small, midsize, large) and application (green hydrogen, industry, mobility), demand driven by clean hydrogen goals, led by Asia-Pacific with North America catching up, innovation in compact high-efficiency stacks and smart system control. |

The global pem electrolyzer market is estimated to be valued at USD 6.1 billion in 2025.

The market size for the pem electrolyzer market is projected to reach USD 26.1 billion by 2035.

The pem electrolyzer market is expected to grow at a 15.7% CAGR between 2025 and 2035.

The key product types in pem electrolyzer market are > 500 kw – 2 mw, ≤ 500 kw and above 2 mw.

In terms of application, industry energy segment to command 38.6% share in the pem electrolyzer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

PEM Small Capacity Electrolyzer Market Size and Share Forecast Outlook 2025 to 2035

PEM Fuel Cell Market Size and Share Forecast Outlook 2025 to 2035

Mucous Membrane Pemphigoid Treatment Market

Electrolyzer Market Growth – Trends & Forecast 2024-2034

Hydrogen Electrolyzer Market Size and Share Forecast Outlook 2025 to 2035

USA Hydrogen Electrolyzer Market Growth - Trends & Forecast 2025 to 2035

Small Capacity Electrolyzer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA