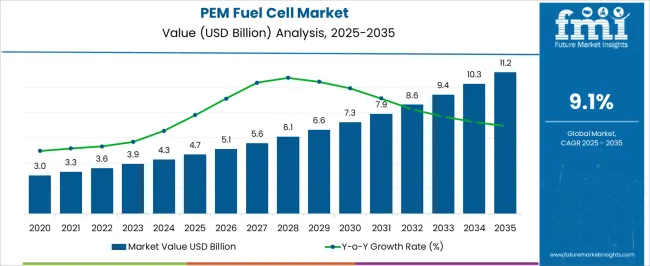

The PEM fuel cell market is expected to expand from USD 4.7 billion in 2025 to USD 11.2 billion by 2035, achieving a CAGR of 9.1%. During the early adoption phase (2020–2024), the technology saw gradual acceptance across niche applications such as specialty vehicles, backup power systems, and small-scale industrial setups.

By 2025, increasing awareness of operational efficiency and performance reliability will drive broader adoption. This period marks the transition from limited use to wider market penetration, as manufacturers expand production and early adopters demonstrate the feasibility of the technology across various sectors, setting the stage for the scaling phase in the years to follow.

From 2025 to 2030, the market enters a scaling phase, marked by accelerated uptake in commercial vehicles, stationary power, and industrial applications. Market value rises from USD 4.7 billion in 2025 as production capacity expands and adoption in larger fleets and facilities grows. By 2030, PEM fuel cells will gain recognition as a viable solution in multiple sectors, paving the way for consolidation. Between 2030 and 2035, the market is expected to reach USD 11.2 billion, driven by steady CAGR growth. Consolidation occurs as leading suppliers optimize manufacturing, distribution, and partnerships, resulting in a more mature and competitive market landscape.

| Metric | Value |

|---|---|

| PEM Fuel Cell Market Estimated Value in (2025 E) | USD 4.7 billion |

| PEM Fuel Cell Market Forecast Value in (2035 F) | USD 11.2 billion |

| Forecast CAGR (2025 to 2035) | 9.1% |

The PEM fuel cell market is a significant segment of the broader global fuel cell and hydrogen-based power solutions market. In 2025, PEM fuel cells account for approximately 35% of the overall fuel cell market, reflecting growing adoption in commercial vehicles, stationary power applications, and niche industrial setups. The broader fuel cell market is projected to grow at a CAGR of around 6–7% during 2025–2035, driven by increasing interest in reliable and flexible power sources.

Within the hydrogen fuel cell segment, PEM fuel cells hold an estimated 60% share in 2025, with the remainder comprising solid oxide and alkaline fuel cells. By 2030, scaling adoption is expected to raise the PEM share in the hydrogen fuel cell segment to nearly 65%, driven by expanding use in larger fleets, industrial applications, and backup power systems. Between 2030 and 2035, consolidation is anticipated as leading suppliers optimize production, supply chains, and distribution networks. By 2035, PEM fuel cells are projected to represent roughly 36–37% of the overall fuel cell market and over 65% of the hydrogen fuel cell segment, solidifying their position as a primary driver of growth and a key revenue contributor in the parent market.

The PEM fuel cell market is experiencing accelerated growth, supported by global decarbonization initiatives and the increasing adoption of clean energy technologies. Current market expansion is being driven by heightened investments in hydrogen infrastructure, government subsidies, and regulatory frameworks promoting zero-emission energy solutions. The ability of PEM fuel cells to operate efficiently at low temperatures, coupled with quick start-up capabilities, has positioned them as a preferred choice across diverse applications.

Ongoing advancements in membrane materials and catalyst technologies are further enhancing system durability and efficiency, thereby increasing commercial viability. The market outlook remains robust, with significant opportunities emerging from the transportation, portable power, and stationary energy sectors.

Rising energy demand in urban areas, coupled with the integration of renewable energy sources, is fostering a supportive environment for PEM fuel cell deployment. As industries and municipalities seek reliable, scalable, and environmentally sustainable power generation options, the PEM fuel cell market is anticipated to maintain strong upward momentum over the forecast period.

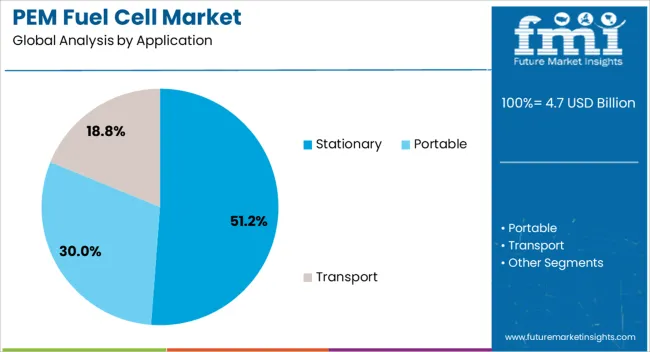

The pem fuel cell market is segmented by application, and geographic regions. By application, pem fuel cell market is divided into Stationary, Portable, and Transport. Regionally, the pem fuel cell industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The stationary segment holds the dominant position in the PEM fuel cell market, accounting for approximately 51.2% of the total share. This leadership is primarily attributed to the growing need for reliable and uninterrupted power supply solutions in both commercial and industrial facilities. Stationary PEM fuel cells are being adopted for distributed generation, backup power, and grid-support applications, benefiting from their low emissions, high efficiency, and operational flexibility.

The segment’s growth has been reinforced by the increasing integration of renewable energy systems, where PEM fuel cells serve as complementary technologies for stabilizing energy supply. Furthermore, government-led decarbonization projects and corporate sustainability commitments have encouraged large-scale deployments in urban infrastructure and remote installations.

The scalability of stationary PEM fuel cells, coupled with advancements in cost reduction through economies of scale, continues to strengthen their adoption rate. As the demand for cleaner, more resilient power generation intensifies globally, the stationary segment is expected to sustain its leading market position throughout the forecast period.

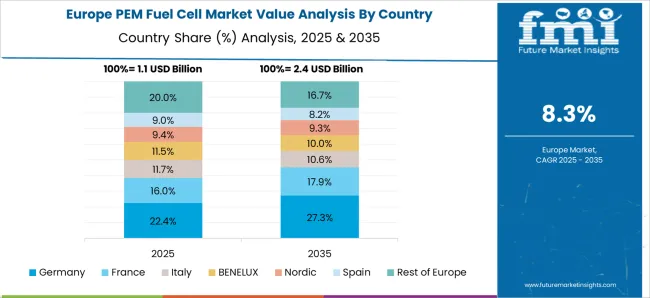

The PEM (Proton Exchange Membrane) fuel cell market is growing due to increasing demand for clean energy, transportation electrification, and backup power solutions. North America and Europe lead adoption with advanced hydrogen infrastructure, supportive policies, and automotive integration. Asia-Pacific is rapidly expanding with industrial-scale fuel cell deployments, government incentives, and transportation electrification initiatives. Manufacturers differentiate through efficiency, durability, and cost reduction. Regional differences in hydrogen availability, technology readiness, and policy support strongly influence adoption, application scope, and global competitiveness.

Transportation applications, including fuel cell electric vehicles (FCEVs) and buses, are a major driver for PEM fuel cell adoption. North America and Europe prioritize FCEVs to meet emission reduction targets and support hydrogen infrastructure development. Asia-Pacific markets are expanding rapidly, particularly in China, Japan, and South Korea, with government incentives, fleet deployments, and urban transit projects. Differences in hydrogen refueling infrastructure, vehicle adoption rates, and regulatory incentives influence regional growth. Leading suppliers develop fuel cells with higher power density, durability, and rapid start-up capabilities. Regional manufacturers focus on cost-effective, mid-range solutions. Adoption contrasts between mature automotive markets and emerging regions highlight varying infrastructure readiness, fleet scale, and market growth potential globally.

PEM fuel cells are increasingly used in stationary power generation and backup systems. North America and Europe adopt fuel cells for critical facilities, telecom towers, and microgrids due to reliability and emissions benefits. Asia-Pacific markets leverage fuel cells for industrial, residential, and remote applications where grid stability is limited. Differences in power demand, grid reliability, and environmental priorities shape adoption, fuel cell size, and operational hours. Leading suppliers offer high-efficiency, long-lifetime systems with integrated hydrogen storage, while regional players focus on cost-effective, modular units. Application contrasts drive market diversification, adoption, and competitiveness, ensuring PEM fuel cells serve both large-scale and decentralized energy needs globally.

Reducing costs and improving durability remain central to PEM fuel cell adoption. North America and Europe invest in advanced catalysts, membrane materials, and stack designs to enhance longevity and performance while lowering platinum use. Asia-Pacific markets adopt incremental improvements, balancing efficiency with affordability for automotive and stationary applications. Differences in R&D investment, production scale, and material availability influence system cost, performance metrics, and adoption timelines. Leading suppliers focus on high-efficiency, long-lifetime stacks, while regional manufacturers optimize for price-sensitive applications. Contrasts in cost-performance priorities shape technology development, adoption rates, and competitiveness across the global PEM fuel cell market.

Government initiatives and hydrogen infrastructure development play a critical role in PEM fuel cell adoption. North America and Europe support fuel cells through subsidies, tax incentives, and investment in hydrogen refueling stations. Asia-Pacific, particularly China, Japan, and South Korea, expands infrastructure with industrial hydrogen production, fleet programs, and strategic government backing. Differences in policy strength, hydrogen availability, and energy transition priorities influence adoption speed, vehicle fleet penetration, and stationary power deployment. Leading suppliers align with government programs and infrastructure projects, while regional players focus on scalable solutions for localized markets. Policy and infrastructure contrasts drive adoption, market expansion, and global competitiveness in the PEM fuel cell sector.

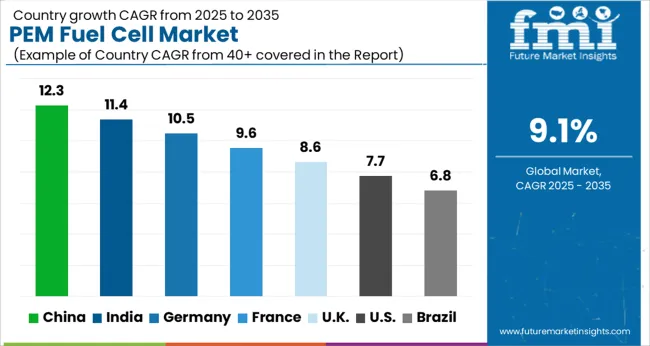

| Country | CAGR |

|---|---|

| China | 12.3% |

| India | 11.4% |

| Germany | 10.5% |

| France | 9.6% |

| UK | 8.6% |

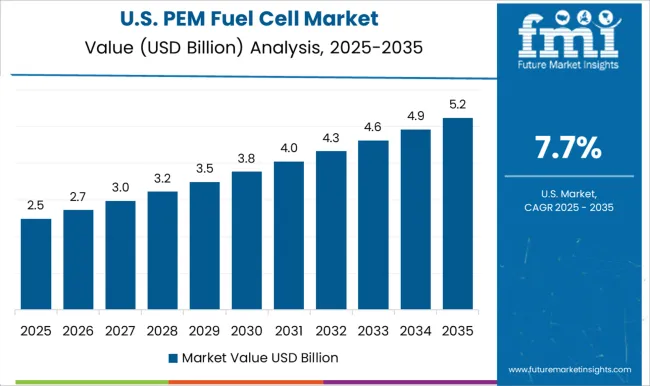

| USA | 7.7% |

| Brazil | 6.8% |

The global PEM fuel cell market is projected to grow at a 9.1% CAGR through 2035, driven by demand in clean energy applications, transport, and stationary power solutions. Among BRICS nations, China led with 12.3% growth as large-scale manufacturing and deployment of fuel cell systems were executed, while India at 11.4% expanded production and integration in transport and industrial sectors. In the OECD region, Germany at 10.5% maintained steady utilization under strict energy and safety standards, while the United Kingdom at 8.6% supported moderate-scale deployment across commercial and research applications. The USA, growing at 7.7%, sustained adoption in transport, stationary, and backup power applications while complying with federal and state-level energy regulations. This report includes insights on 40+ countries; the top countries are shown here for reference.

The PEM fuel cell market in China is growing at a 12.3% CAGR, driven by government support for clean energy and increasing demand for hydrogen-powered vehicles. Urbanization, industrial growth, and environmental regulations are encouraging adoption of fuel cell technologies in transportation, industrial, and stationary power applications. Leading domestic manufacturers are investing in research and development to improve efficiency, durability, and cost-effectiveness of PEM fuel cells. Infrastructure expansion, including hydrogen refueling stations, is accelerating market growth. Policies and incentives, such as subsidies and tax benefits, are encouraging both commercial and residential adoption. Partnerships between automotive companies, energy providers, and technology startups are fostering innovation. The market is characterized by high competition, continuous technological advancement, and increasing environmental awareness among end-users.

PEM fuel cell market in India is registering an 11.4% CAGR, supported by rising interest in clean and renewable energy solutions. The transportation sector, including buses and commercial vehicles, is a key driver for fuel cell deployment. Government policies and initiatives promoting hydrogen fuel adoption are accelerating market development. Domestic and international manufacturers are establishing production facilities and technology partnerships to enhance efficiency and reduce costs. Industrial and stationary applications, including backup power systems, are gaining traction. Public and private sector investment in hydrogen infrastructure, such as refueling stations, is gradually increasing. Research institutions and universities are collaborating with industry players to improve fuel cell technologies and adapt them to local requirements. Market growth is shaped by environmental goals, innovation, and supportive regulatory frameworks.

PEM fuel cell market in Germany is growing at a 10.5% CAGR, driven by strong government initiatives for clean transportation and renewable energy integration. Automotive manufacturers are increasingly deploying hydrogen fuel cell vehicles, while industrial and stationary applications are expanding. Domestic R&D efforts focus on improving efficiency, reducing platinum usage, and extending fuel cell lifespan. Hydrogen refueling infrastructure is being developed in key regions, enhancing adoption. Regulatory frameworks incentivize low-emission technologies, supporting private and commercial investment. Collaborative projects between automotive companies, research institutes, and energy providers are fostering innovation. The market is influenced by environmental policies, technological advancement, and growing public awareness of clean energy solutions. Germany’s strong industrial base ensures steady growth in both fuel cell manufacturing and deployment.

The United Kingdom PEM fuel cell market is expanding at an 8.6% CAGR, driven by government strategies for net-zero emissions and low-carbon transportation solutions. Hydrogen fuel cells are being increasingly deployed in buses, fleet vehicles, and industrial applications. Research and development programs focus on cost reduction, enhanced performance, and extending fuel cell lifespan. Public-private partnerships and pilot projects are encouraging technology adoption. Infrastructure development, including hydrogen refueling stations, is gradually increasing coverage in urban centers. Incentives and grants support both manufacturers and end-users in adopting fuel cell solutions. Market growth is supported by environmental awareness, regulatory compliance, and technological innovation, making the UK an emerging market for PEM fuel cells in Europe.

The United States PEM fuel cell market is growing at a 7.7% CAGR, supported by strong research initiatives and clean energy adoption policies. Hydrogen fuel cell vehicles, including buses, trucks, and commercial fleets, are key applications driving demand. Industrial and stationary power systems also contribute to market growth. Federal and state-level incentives, grants, and tax benefits encourage adoption among manufacturers and end-users. Domestic manufacturers focus on efficiency improvements, cost reduction, and durability enhancement. Expansion of hydrogen refueling infrastructure is gradually improving accessibility for vehicles. Collaboration between automotive companies, energy providers, and research institutes promotes innovation in fuel cell technology. Market growth is shaped by technological advancements, environmental awareness, and supportive policies across multiple sectors.

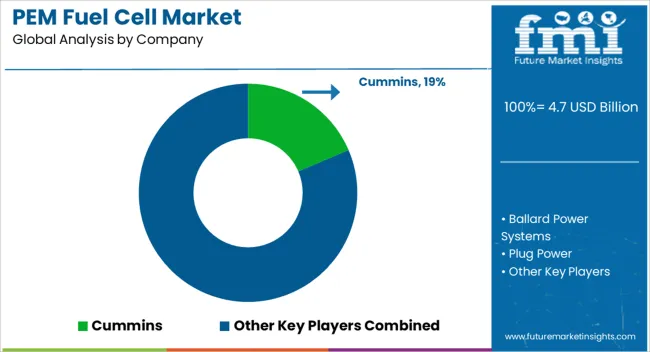

The PEM fuel cell market is driven by leading global suppliers including Cummins, Ballard Power Systems, Plug Power, Nuvera Fuel Cells, Nedstack Fuel Cell Technology, Panasonic Corporation, Doosan Fuel Cell, SFC Energy, Robert Bosch, TW Horizon Fuel Cell Technologies, Air Liquide Energies, and Hyundai Motor Company. These companies focus on developing proton exchange membrane fuel cells for applications in transportation, stationary power, and backup energy systems.

Market growth is fueled by the global push toward clean energy, carbon emission reduction, and the electrification of vehicles, with suppliers emphasizing high-efficiency, low-emission solutions. Regulatory support and government incentives for fuel cell adoption further strengthen the position of these market leaders. Innovation and technology development are central to maintaining a competitive edge in the PEM fuel cell market. Suppliers such as Ballard Power Systems and Plug Power are investing in next-generation PEM fuel cell designs that offer higher power density, durability, and cost-effectiveness. Companies like Cummins, Nuvera, and Doosan Fuel Cell are focusing on modular, scalable systems suitable for diverse applications ranging from heavy-duty transportation to industrial and residential energy storage.

Additionally, Panasonic and Robert Bosch leverage advanced manufacturing processes and material innovations to improve membrane performance and operational lifespan, ensuring consistent and reliable energy output. Strategic partnerships, joint ventures, and global expansions play a significant role in consolidating market positions. Hyundai Motor Company, Air Liquide Energies, and TW Horizon Fuel Cell Technologies are expanding production capabilities, establishing international collaborations, and developing infrastructure for hydrogen refueling to support PEM fuel cell adoption. By maintaining stringent quality standards, optimizing supply chains, and delivering innovative solutions, these companies continue to lead the market. With growing emphasis on sustainability, zero-emission mobility, and renewable energy integration, the PEM fuel cell market is expected to experience substantial growth, driven by the expertise and technological advancements of these leading suppliers.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.7 Billion |

| Application | Stationary, Portable, and Transport |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cummins, Ballard Power Systems, Plug Power, Nuvera Fuel Cells, Nedstack Fuel Cell Technology, Panasonic Corporation, Doosan Fuel Cell, SFC Energy, Robert Bosch, TW Horizon Fuel Cell Technologies, Air Liquide Energies, and Hyundai Motor Company |

| Additional Attributes | Dollar sales vary by product type, including proton exchange membrane (PEM) stacks, systems, and components; by application, such as automotive, stationary power, portable power, and material handling; by end-use, spanning transportation, industrial, and residential sectors; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by clean energy adoption, hydrogen infrastructure expansion, and demand for efficient fuel cell technologies. |

The global pem fuel cell market is estimated to be valued at USD 4.7 billion in 2025.

The market size for the pem fuel cell market is projected to reach USD 11.2 billion by 2035.

The pem fuel cell market is expected to grow at a 9.1% CAGR between 2025 and 2035.

The key product types in pem fuel cell market are stationary, portable and transport.

In terms of , segment to command 0.0% share in the pem fuel cell market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

PEM Small Capacity Electrolyzer Market Size and Share Forecast Outlook 2025 to 2035

PEM Electrolyzer Market Size and Share Forecast Outlook 2025 to 2035

Mucous Membrane Pemphigoid Treatment Market

Fuel rail for CNG Systems Market Size and Share Forecast Outlook 2025 to 2035

Fuel Storage Tank Market Size and Share Forecast Outlook 2025 to 2035

Fuel Capacitance Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fuel Gas Heater Market Size and Share Forecast Outlook 2025 to 2035

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Fuel Injection System Market Growth - Trends & Forecast 2025 to 2035

Fuel Additives Market Segmentation based on Type, Application, and Region: Forecast for 2025 and 2035

Fuel Analyzer Market

Fuel Vending Machines Market

Fuel Operated Heaters Market

Fuel Resistant Sealant Market

Fuel Feed Pumps Market

Fuel Measuring Devices Market

Fuel Cell Powertrain Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell UAV Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell Stack Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell Electric Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA