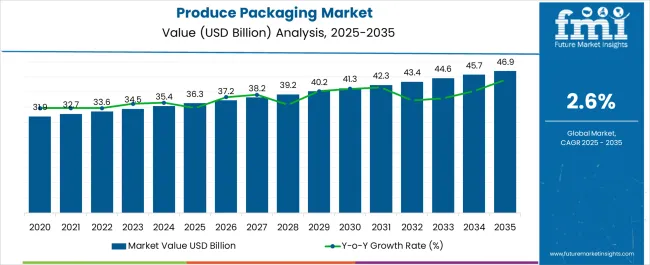

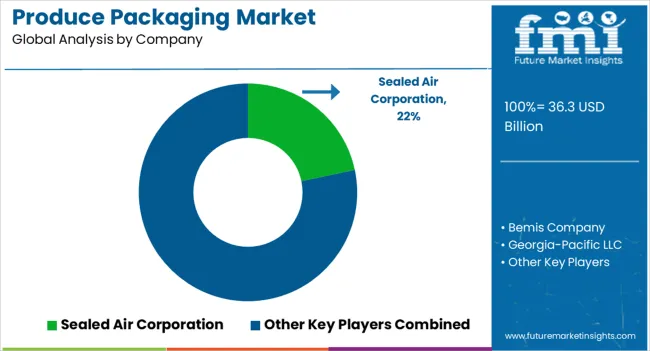

The Produce Packaging Market is estimated to be valued at USD 36.3 billion in 2025 and is projected to reach USD 46.9 billion by 2035, registering a compound annual growth rate (CAGR) of 2.6% over the forecast period.

| Metric | Value |

|---|---|

| Produce Packaging Market Estimated Value in (2025 E) | USD 36.3 billion |

| Produce Packaging Market Forecast Value in (2035 F) | USD 46.9 billion |

| Forecast CAGR (2025 to 2035) | 2.6% |

The produce packaging market is experiencing steady growth driven by the rising demand for safe, durable, and sustainable packaging solutions in the global fresh produce supply chain. Increasing consumer awareness around food safety and hygiene, coupled with stricter regulations on contamination control, is accelerating the adoption of advanced packaging formats. The shift toward recyclable, biodegradable, and eco friendly materials is also shaping the direction of innovation in this space.

Producers and retailers are investing in packaging that not only preserves freshness and reduces spoilage but also enhances branding and consumer appeal through modern design and labeling solutions. Logistics considerations, including ease of transport and storage efficiency, are further influencing packaging choices.

With e commerce platforms expanding fresh produce sales, there is growing emphasis on packaging formats that can withstand long distance transport while maintaining product quality. The outlook remains positive as sustainability commitments and technological improvements continue to drive adoption across key end use industries.

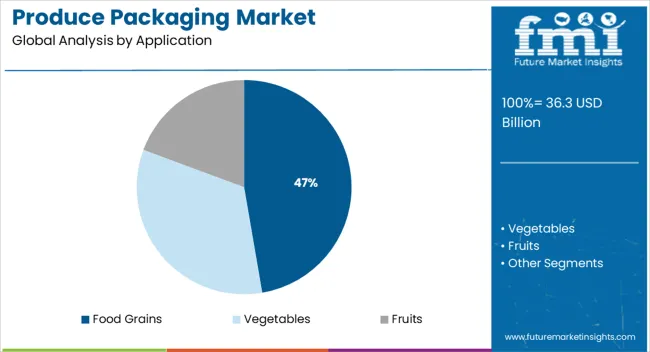

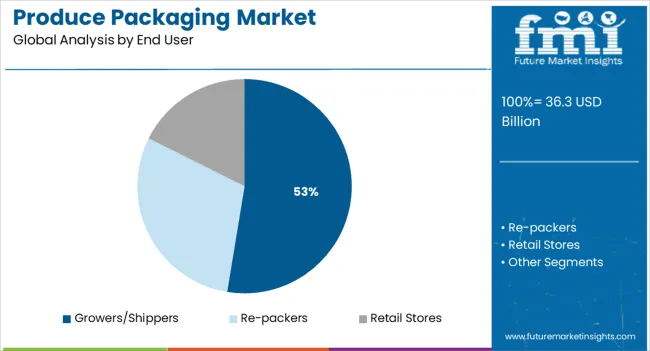

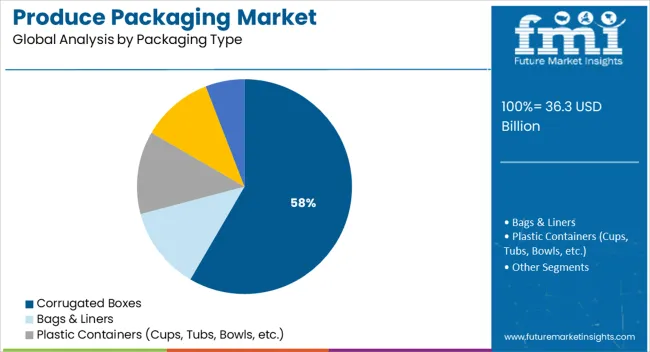

The market is segmented by Application, End User, and Packaging Type and region. By Application, the market is divided into Food Grains, Vegetables, and Fruits. In terms of End User, the market is classified into Growers/Shippers, Re-packers, and Retail Stores. Based on Packaging Type, the market is segmented into Corrugated Boxes, Bags & Liners, Plastic Containers (Cups, Tubs, Bowls, etc.), Trays, and Other Packaging (Plastic Film, Molded Pulp Containers, Wooden Crates, etc.). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The food grains application segment is expected to hold 47.30% of total market revenue by 2025, making it the leading application category. This dominance is attributed to the consistent global demand for cereals, pulses, and staple grains which require durable packaging to prevent contamination and spoilage.

The segment has benefited from the adoption of packaging formats that extend shelf life, preserve quality, and allow for efficient bulk handling in transportation and storage.

Growing reliance on safe and standardized packaging for both retail and export markets has further reinforced the importance of this application area in the overall market.

The growers shippers segment is projected to represent 52.60% of the market revenue by 2025 within the end user category, positioning it as the dominant segment. This growth is being driven by the need to ensure efficient and protective transport of fresh produce from farms to distributors and retailers.

Growers and shippers increasingly prefer packaging solutions that minimize post harvest losses, support branding opportunities, and comply with global trade regulations.

Their ability to implement large scale packaging systems that address sustainability requirements and cost efficiency has further supported this leadership.

The corrugated boxes segment is expected to account for 58.40% of total revenue by 2025 under the packaging type category, making it the most significant segment. This is due to the strength, versatility, and recyclability of corrugated packaging which is highly suitable for handling fresh produce across long distribution channels.

Its lightweight structure reduces transportation costs while offering superior protection against mechanical damage during shipment. The wide adoption of corrugated boxes in both domestic and export markets has been reinforced by the increasing focus on sustainable packaging.

As a result, this segment continues to dominate in produce packaging due to its functionality, cost effectiveness, and environmental benefits.

As per Our World in Data, a trend of single households is increasingly becoming common across the globe. In the United States, the share of adults living alone nearly doubled over the past 5 decades by over 28% in 2020.

This trend is catching up fast in Asia and Europe. Countries such as India, the United Kingdom, China, and Japan have a substantial share of single households. To cut down the cost of living coupled with improving the standard of living, single households are becoming increasingly common.

On the back of this trend, food service and packaging companies have increased the production of compact cardboard produce trays, fruit and vegetable packaging boxes, and various other packaging solutions as consumers are opting for smaller quantities of food to reduce wastage.

This is increasing the production of compact produce packaging. Besides this, with growing urbanization and sustainability concerns, innovation in the packaging industry is likely to transform the produce packaging industry.

Innovative packaging can also enhance the overall consumer experience and increase brand loyalty. Here are a few examples of how packaging innovations have encouraged produce packaging sales:

Modified Atmosphere Packaging (MAP): MAP is a technology that helps extend the shelf life of fresh produce by controlling the atmosphere inside packaging. This allows for the fresh produce to remain fresh for a longer time, which can encourage consumers to purchase and use the produce.

Biodegradable and Compostable Packaging: With a growing focus on sustainability and reducing the impact of packaging waste on the environment, biodegradable and compostable packaging has become increasingly popular. This type of packaging provides consumers with an environmentally friendly option, which can encourage them to purchase products that are packaged in this manner.

Reusable and Recyclable Packaging: Another trend in the market is the use of reusable and recyclable packaging. By using packaging that can be reused or recycled, companies are reducing their impact on the environment and also appealing to consumers who are looking for sustainable packaging options.

Aesthetically Appealing Packaging: Aesthetically appealing packaging can also encourage sales by grabbing the attention of consumers and creating a memorable and positive impression. For example, companies that sell fresh produce in clear plastic packaging with brightly colored labels and graphics have been successful in increasing sales through innovative packaging design.

| Attributes | Details |

|---|---|

| Produce Packaging Market CAGR (2025 to 2035) | 2.6% |

| Produce Packaging Market Size (2025) | USD 34,470.9 million |

| Produce Packaging Market Size (2035) | USD 44,447.6 million |

Driven by the staggering need for invoices and receipts in institutional and commercial sectors globally, the produce packaging market was expanding with a CAGR of 2% between 2020 and 2025.

| Particulars | Details |

|---|---|

| Jan-Jun (H1), 2024 (A) | 3.0% |

| Jan-Jun (H1), 2025 Projected (P) | 1.9% |

| Jan-Jun (H1), 2025 Outlook (O) | 2.5% |

| BPS: H1,2025 (O) - H1,2025 (A) | -50 |

| BPS: H1,2025 (O) - H1,2024 (A) | 60 |

Short-term Growth (2025 to 2029): Rising consumer preference for organic fresh produce such as fruits, vegetables, plant-based meat products, and grains is expected to spur the demand for produce packaging over the coming years.

Medium-term Growth (2029 to 2035): Increasing awareness regarding the benefits of organic and natural food products has resulted in higher consumption of organic fresh produce. Coupled with this, shifting consumer preference towards online grocery shopping has encouraged the production of high-quality and sustainable produce packaging.

Long-term Growth (2035 to 2035): The growing trend of single-households, surging demand for vegan and plant-based food products, and consumption of ready-to-eat and meat-free meal options are the factors propelling the use of produce packaging bags for fresh food delivery packaging.

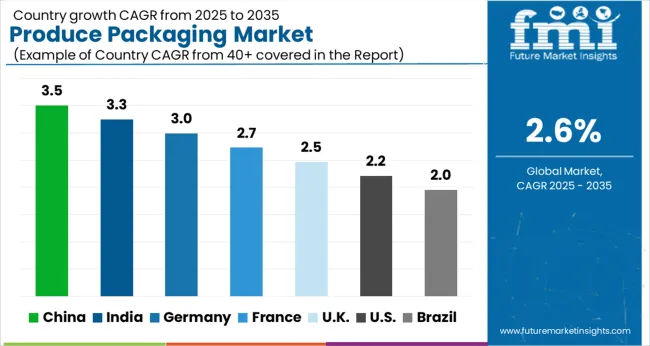

Regionally, Asia Pacific excluding Japan is expected to be the leading contributor to the global market. However, growing demand for organic food products and fresh produce in the United Kingdom, France, and Germany is expected to propel the growth in Europe produce packaging market.

Demand for meat-free food products such as plant-based pork is expected to rise at an exceptional 24% CAGR, as per a Future Market Insights study. With growing consciousness regarding the health benefits of organic and plant-based fresh produce, consumption of meat-free food products has increased.

Sales of meat-free fresh produce such as quinoa, plant-based pork, apples, and other fruits & vegetables are expected to witness a huge uptake over the coming years. Hence, retail store vendors and online grocery stores are increasingly stacking such food items.

In retail stores, demand for packaging of fresh produce, which is display-ready is expected to burgeon over the forthcoming years. In response to this, demand for produce packaging in the food service sector is expected to remain higher.

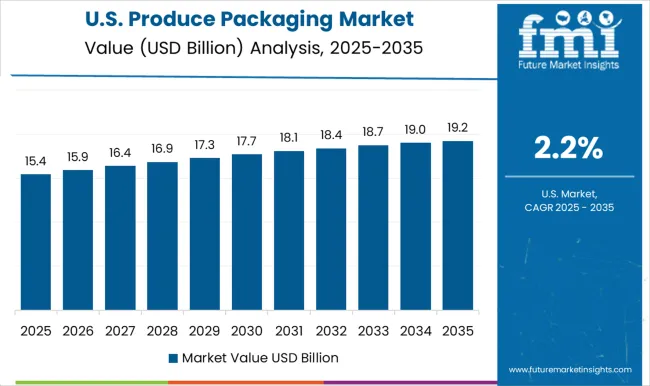

As per the United States Department of Agriculture, consumption of fresh fruits and vegetables has significantly increased in the country over the past five years. With the unprecedented outbreak of COVID-19, the intake of fresh fruits and vegetables increased in response to growing consciousness regarding health and wellness among consumers.

Over 60% of the USA population consumes fresh fruits as a whole or in the form of juice, frozen, or dried, as per Dietary Guidelines for Americans. Along with the shift in consumption of fresh fruits and vegetables, the country has witnessed a major shift in consumer buying behavior.

They are likely to purchase fresh produce through e-commerce and online retail stores. With the increasing demand for fresh fruits and organic vegetables, food service companies are exhibiting high demand for fresh produce packaging supplies such as corrugated boxes, trays, bags & liners, and wooden crates.

In response to this, some of the top produce packaging companies are introducing sustainable fresh packaging solutions to meet the requirements of end-users and gain a competitive edge.

For instance, in September 2024, Graphic Packaging International, announced the launch of ProducePack, which is a sustainable paperboard range of packaging designed for fresh produce applications, an effective and user-friendly solution to preserving fruit for Michigan apple distributor BelleHarvest.

| CAGR (2025 to 2035) | 3% |

|---|---|

| Market Value (2025) | USD 2,301.3 million |

| Forecasted Value (2035) | USD 3,012.3 million |

As per Future Market Insights, India is expected to dominate the South Asia produce packaging market. India is the second leading producer of grains, fruits, and vegetables across the globe, as per the India Brand Equity Foundation (IBEF).

As per IBEF, sales of organic food in India are expected to reach USD 36.3 billion by 2025. The growing trend of veganism coupled with increasing demand for organic food products is likely to propel the sales of produce packaging.

Increased penetration of smartphones and rising disposable income has encouraged consumers to opt for healthier lifestyle such as vegan and dietary foods. Awareness about the nutritional benefits of vegan and organic food has pushed their consumption in India.

This trend gained momentum following the COVID-19 outbreak, creating a conducive environment for the sales of produce packaging supplies in India.

Top Produce Packaging Companies in India

Uflex Ltd.: Uflex Ltd. is an Indian multinational company that provides packaging solutions for a variety of industries, including the fresh produce sector. The company offers a range of products for the produce packaging market, including modified atmosphere packaging, vacuum packaging, and shrink films. Uflex has a global presence, with facilities in India, the United States, the United Kingdom, Dubai, Egypt, and Mexico. The company's focus on innovation and its commitment to quality has made it one of the leading producers of packaging solutions for the fresh produce industry in India.

HPM Global Inc.: HPM Global Inc. is a multinational company that provides packaging solutions for a variety of industries, including the fresh produce sector. The company offers a range of corrugated boxes, crates, and trays. HPM Global has a strong presence in India, where it is known for its commitment to sustainability and innovation in packaging solutions. The company's focus on reducing waste and its commitment to using eco-friendly materials has made it a popular choice among customers looking for sustainable packaging solutions for fresh produce.

Ashok Industries: Ashok Industries is an Indian company that specializes in providing packaging solutions for the fresh produce industry. The company is known for using high-quality materials in its packaging solutions, which helps to ensure that fresh produce is protected during transportation and storage.

| CAGR (2025 to 2035) | 3% |

|---|---|

| Market Value (2025) | USD 2,893.5 million |

| Forecasted Value (2035) | USD 3,787.6 million |

According to FMI, Asia Pacific excluding Japan (APEJ) is expected to remain the substantial market for produce packaging throughout the forecast period. China is expected to lead the growth in the APEJ produce packaging market on the back of robust production of fresh produce in the country and consequent demand for effective packaging solutions.

Growth in the market is also attributable to the increasing demand for sustainable and eco-friendly packaging for organic food products. Food packaging companies are focusing on the expansion of their manufacturing facilities due to the easy availability of raw materials and cheap labor costs.

Top Produce Packaging Companies in China

Hubei Xiongye Machine Factory Co., Ltd.: Hubei Xiongye is a leading manufacturer of packaging solutions for the fresh produce industry. The company offers a range of products, including corrugated boxes, vacuum packaging, and shrink films.

Suzhou Lucky Time Pack Material Co., Ltd.: Suzhou Lucky Time Pack is a well-known producer of packaging solutions for the fresh produce industry. The company offers a range of products, including corrugated boxes, crates, and trays.

Zhejiang Feipeng Machinery Co., Ltd.: Zhejiang Feipeng Machinery is a leading provider of packaging solutions for the fresh produce market in China. The company offers a range of products, including corrugated boxes, vacuum packaging, and shrink films.

The growing trend towards healthier eating has increased the consumption of fresh fruits and vegetables. In response to this, local food vendors and retail stores are stacking up freshly diced and cut fruits and vegetables with premium quality packaging to woo the consumers. Hence, the application of produce packaging in fruits is expected to account for the key market revenue through 2035.

In addition to this, improving the penetration of online grocery stores, especially in economies such as India, has increased the application of produce packaging in fruits and vegetable packaging.

As per FMI, revenues from retail stores are projected to account for nearly 50% share of the market.

Hence, retail store vendors are increasing the adoption of superior packaging to keep the produce fresh and extend its shelf-life. This is expected to increase the sales of produce packaging through retail stores.

In terms of packaging type, corrugated boxes are expected to remain highly sought-after in the global produce packaging market. The corrugated boxes segment is expected to account for over 35.5% of sales through 2025.

As corrugated boxes are lightweight, have high graphics capabilities, are recyclable, and are cost-effective, end-users prefer corrugated boxes for produce packaging. Corrugated boxes also are stronger than average cardboard boxes.

Key players operating in produce packaging market are focusing on introducing sustainable and fiber-based produce packaging to gain a competitive edge. Some of the leading players are also adopting expansion strategies such as mergers, collaborations, and acquisitions to expand their product portfolio.

The global produce packaging market is estimated to be valued at USD 36.3 billion in 2025.

The market size for the produce packaging market is projected to reach USD 46.9 billion by 2035.

The produce packaging market is expected to grow at a 2.6% CAGR between 2025 and 2035.

The key product types in produce packaging market are food grains, vegetables and fruits.

In terms of end user, growers/shippers segment to command 52.6% share in the produce packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Produced Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Produce Bag Market Trends & Industry Growth Forecast 2024-2034

Fresh Produce Trays Market Analysis - Size, Trends & Forecast 2025 to 2035

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA