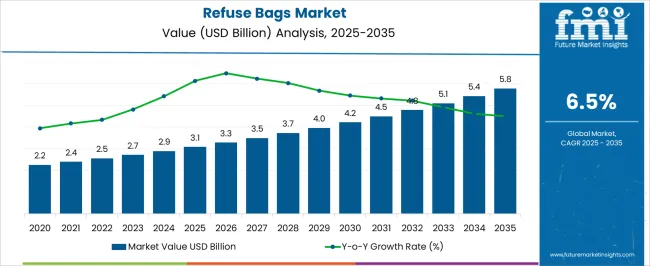

The Refuse Bags Market is estimated to be valued at USD 3.1 billion in 2025 and is projected to reach USD 5.8 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

| Metric | Value |

|---|---|

| Refuse Bags Market Estimated Value in (2025 E) | USD 3.1 billion |

| Refuse Bags Market Forecast Value in (2035 F) | USD 5.8 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The refuse bags market is experiencing steady expansion, influenced by rising waste generation across residential, commercial, and industrial sectors. Growing urban populations, coupled with stricter waste management regulations, have increased the demand for durable and reliable refuse bags. Industry announcements and sustainability-focused initiatives have highlighted a shift toward recyclable and biodegradable bag options, driven by regulatory pressures and consumer awareness of environmental issues.

At the same time, large-scale adoption in commercial spaces, healthcare, and hospitality has strengthened demand for high-capacity and puncture-resistant products. Technological improvements in polymer processing have enabled the production of stronger, lightweight bags that minimize material usage while maintaining durability.

Future growth is expected to be shaped by innovation in eco-friendly raw materials, the expansion of organized waste collection systems in developing economies, and policy-driven shifts toward responsible disposal solutions. Market leadership continues to be defined by polyethylene-based bags, mid-range capacity products, and high adoption across commercial applications.

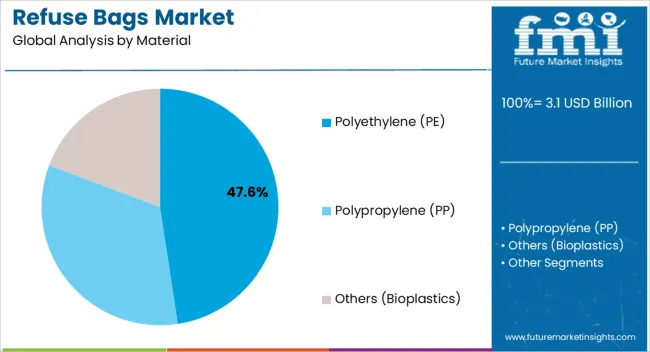

The polyethylene (PE) segment is projected to account for 47.60% of the refuse bags market revenue in 2025, retaining its dominance due to its cost efficiency, durability, and widespread availability. PE’s mechanical strength and resistance to tearing have made it the preferred material for both household and commercial waste handling.

Industry updates have emphasized that PE bags offer versatility across multiple waste categories while remaining lightweight and affordable. Additionally, advancements in recycled and bio-based polyethylene grades have allowed manufacturers to align with sustainability goals without compromising bag performance.

Strong supply chains and established processing technologies further support this segment’s leadership. With consumer and commercial users continuing to favor dependable and low-cost solutions, the PE segment is expected to sustain its market share, even as biodegradable alternatives gain traction in select regions.

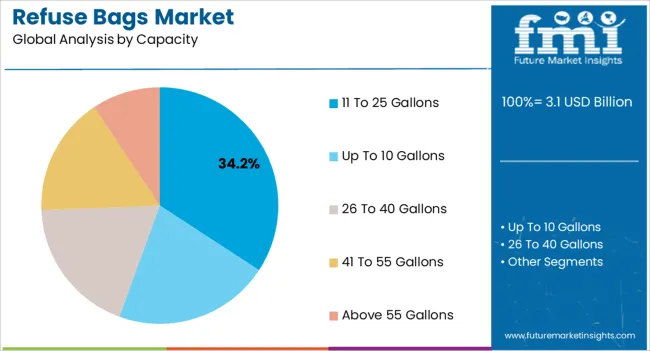

The 11 to 25 gallons capacity segment is projected to contribute 34.20% of the refuse bags market revenue in 2025, leading the market due to its adaptability for both residential and commercial use. This segment has been supported by its practicality in managing medium-sized waste volumes, making it suitable for households, offices, and retail spaces.

Waste management publications have reported that this size range provides an optimal balance between ease of handling and sufficient capacity for daily waste disposal needs. Its compatibility with standard bins and receptacles has further enhanced adoption.

Moreover, commercial establishments such as restaurants and small businesses have increasingly relied on 11 to 25 gallon bags for efficient waste collection without frequent bag changes. As urbanization and waste volumes rise, demand for mid-range capacity bags is expected to remain strong, ensuring their continued market leadership.

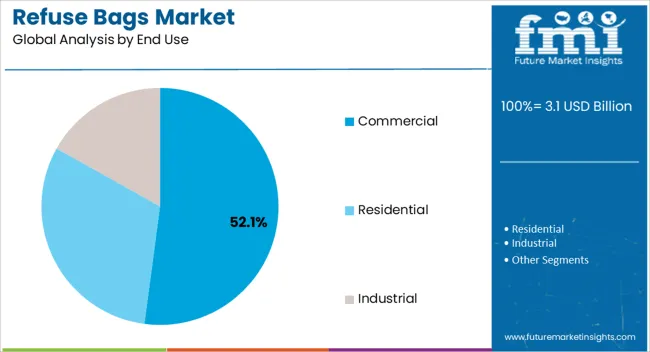

The commercial segment is projected to capture 52.10% of the refuse bags market revenue in 2025, maintaining its leading position as the primary end-use category. Growth in this segment has been driven by the large-scale use of refuse bags in retail, hospitality, healthcare, and office environments, where high volumes of waste are generated daily.

Regulatory requirements mandating proper waste segregation and disposal have accelerated commercial adoption. Industry updates have highlighted the increasing preference for heavy-duty, leak-resistant bags to ensure hygiene standards in these environments.

Furthermore, partnerships between waste management companies and commercial enterprises have reinforced steady procurement of refuse bags in bulk quantities. Expansion of the service industry and rising numbers of commercial establishments in urban centers have further boosted demand. With sustainability targets pushing businesses toward eco-friendly waste solutions, the commercial segment is expected to remain the cornerstone of the refuse bags market.

The global refuse bags market expanded at a 5.4% CAGR during the historical period between 2.2020 and 2.202.22.2. It generated a revenue of USD 3.1 billion in 2.202.22.2 from USD 2.2.0 billion in 2.2020.

Refuse bag sales are predicted to increase as a result of more intense environmental regulations on trash bag disposal. It might also benefit from rising consumer and legislative awareness about environmental issues. It is expected to help in strengthening the demand for refuse bags or eco-friendly/green plastic waste bags by 2.2035.

Growing restaurants and cafés throughout the world is predicted to drive up demand for refuse bags over the forecast period. Refuse bag sales are expected to further accelerate owing to its appeal of being stretchy and strong. These bags are capable of enabling odor control, thereby attracting more users from the retail sector.

Governments across the world have been implementing waste management policies, including measures to reduce single-use plastics. These policies might impact the types of materials used in refuse bags and encourage the use of sustainable alternatives.

The refuse bags industry was experiencing consolidation, with larger players acquiring small manufacturers to expand their product offerings and market reach. The retail sector plays a significant role in pushing the demand for refuse bags. Increasing awareness of waste management and hygiene has led to a high demand for various types of refuse bags for household use.

Manufacturers are set to introduce innovative features in refuse bags such as odor control, tie-up systems, and easy-to-carry handles. These features might help them in catering to varying preferences for user-friendly and hygienic products.

Hospitality and healthcare sectors were leading consumers of refuse bags in the historical period. This was due to their specific waste management needs. These sectors were witnessing steady growth, augmenting demand for specialized bags.

| Country | United States |

|---|---|

| Market Share (2025) | 21.9% |

| Market Share (2035) | 17.5% |

| BPS Analysis | -440 |

| Country | China |

|---|---|

| Market Share (2025) | 6.8% |

| Market Share (2035) | 7.7% |

| BPS Analysis | 100 |

| Country | Germany |

|---|---|

| Market Share (2025) | 5.8% |

| Market Share (2035) | 4.4% |

| BPS Analysis | -130 |

| Country | Japan |

|---|---|

| Market Share (2025) | 5.3% |

| Market Share (2035) | 6.4% |

| BPS Analysis | 120 |

| Country | India |

|---|---|

| Market Share (2025) | 5.0% |

| Market Share (2035) | 6.8% |

| BPS Analysis | 180 |

Take Back Bags to Gain Impetus in the United States with Rising Demand for Affordable Solutions

The United States refuse bags market is estimated to surge at a CAGR of 4.2% during the forecast period. The country is likely to dominate the global market due to the high standard of living and way of life of its citizens.

The United States’ high living standards are reflected by its GDP per capita, which in 2025 stands at over 76,000, as per data from the OECD. It enjoyed a y-o-y growth of about 10%.

The United States has a robust manufacturing and retail sectors. It might lead to the generation of a considerable amount of waste. Business, institutions, and sectors require a steady supply of refuse bags for waste management, which is set to contribute to growth.

The United States has a well-developed research and development infrastructure. It is expected to lead to continuous advancement in the materials and technologies used in refuse bags.

It is likely to result in the creation of more durable, eco-friendly, and cost-effective bags. It is further anticipated to lead to high refuse bag demand in the United States.

Low Labor Cost in Japan to Create Opportunities for Refuse Plastic Bags by 2035

Japan refuse bags market is projected to create an incremental opportunity of USD 3.1 billion from 2025 to 2035. Owing to rapid urbanization in the country, garbage bags have become not only increasingly popular but also considered to be more of an essential commodity than a luxury.

As per data from the United Nations, urbanization rate of Japan stands at over 90% as of 2025. Japan’s large-scale production facilities and cost-effective labor cost might allow for the mass production of refuse bags. Japan’s low production cost, owing to reduced labor and raw material cost compared to various other countries might also provide a competitive edge.

Polyethylene (PE) to be Rapidly Utilized for Making Garden Refuse Bags Worldwide

Based on material, the polyethylene (PE) segment is anticipated to hold around 79% of the global refuse bags market share by the end of 2035. Features such as high tensile strength and resistance to puncturing would make PE bags popular. These properties are likely to drive the market for PE refuse bags over the forecast period.

Polyethylene can be easily molded and extruded into various shapes and sizes. It might allow manufacturers to produce refuse bags in different thicknesses and capacities.

High versatility is set to make it suitable for a wide range of waste disposal needs. Consumers often prefer bags that can handle heavy loads and prevent spills & leaks.

Polyethylene bags are lightweight, which is advantageous for handling and transportation. They are easy to carry and dispose of when full.

Polyethylene is widely available and can be produced in large quantities. It might hence help in meeting the high demand for refuse bags worldwide.

Small Refuse Bags with Capacity of 11 to 25 Gallons to Witness Exponential Demand

Based on capacity, the 11 to 25 gallons segment is anticipated to dominate the market. It is poised to hold around 44% of the global market share by the end of 2035.

Refuse bags with a capacity ranging between 11 to 25 gallons are highly versatile without being excessively big or small. This is the reason why it is increasingly being utilized by both households and commercial establishments alike.

Refuse bags with a capacity of 11 to 25 gallons often strike a balance between capacity and cost-effectiveness. Large bags might be too expensive for small households, while small bags might not be sufficient for large families. The 11 to 25 gallons segment is set to hence offer a cost-effective option for a broad consumer base.

Growing Hygiene-related Awareness in Commercial Sector to Augment Demand for Garbage Bags

The commercial segment is expected to boost refuse bag sales in the global market. The segment is likely to show 6.2% CAGR over the forecast period. Growing hygiene-related awareness amongst millennial consumers are expected to fuel the segment forward.

Businesses, hospitals, restaurants, and other commercial areas tend to produce a significant amount of waste daily. All of these are anticipated to necessitate the use of large quantities of refuse bags.

Commercial buyers purchase refuse bags in bulk, allowing them to benefit from economies of scale. Bulk buying might enable them to get better pricing and discounts. It is likely to make it a cost-effective process to procure large quantities for their waste management needs.

Refuse bag manufacturers often invest in research and development to create innovative products that cater to specific customer needs. These innovations might include features such as increased durability, biodegradability, odor control, and various sizes to accommodate different waste volumes.

Key manufacturers have embraced sustainability as a core strategy. They might focus on using recycled materials in the production of refuse bags or develop biodegradable or compostable alternatives to traditional plastic bags.

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 3.1 billion |

| Projected Market Valuation (2035) | USD 5.8 billion |

| Value-based CAGR (2025 to 2035) | 6.5% |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Value (USD billion) |

| Segments Covered | Material, Capacity, End Use, Region |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, Italy, France, United Kingdom, Spain, Russia, GCC Countries, China, India, Australia |

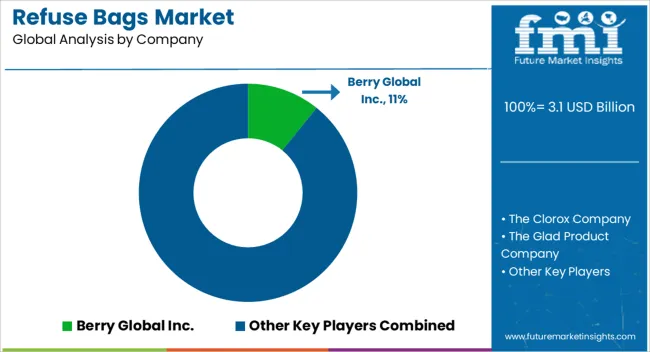

| Key Companies Profiled | Berry Global Inc.; The Clorox Company; The Glad Product Company; Four Star Plastics; Mirpack TM; Primax d.o.o; International Plastics Inc.; NOVPLAST s.r.o; DAGOPLAST AS; Terdex GmbH.; Kemii Garbage Bag Co. Ltd; Novolex; International Plastics Inc.; Luban Packing LLC; Cosmoplast Industrial Company LLC |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

The global refuse bags market is estimated to be valued at USD 3.1 billion in 2025.

The market size for the refuse bags market is projected to reach USD 5.8 billion by 2035.

The refuse bags market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in refuse bags market are polyethylene (pe), _low-density polyethylene (ldpe), _linear low-density polyethylene (lldpe), _high-density polyethylene (hdpe), polypropylene (PP) and others (bioplastics).

In terms of capacity, 11 to 25 gallons segment to command 34.2% share in the refuse bags market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Global Compostable & Biodegradable Refuse Bags Market Insights – Trends, Demand & Growth 2025–2035

Market Share Distribution Among Compostable Refuse Bag Manufacturers

Refuse Compactor Market

Polybags Market Size and Share Forecast Outlook 2025 to 2035

Net Bags Market

VCI Bags Market

Sandbags Market

Leno Bags Market Size and Share Forecast Outlook 2025 to 2035

Silo bags Market Size and Share Forecast Outlook 2025 to 2035

Food Bags Market Share, Size, and Trend Analysis for 2025 to 2035

Competitive Breakdown of Silo Bag Manufacturers

Paper Bags Market Size and Share Forecast Outlook 2025 to 2035

Jumbo Bags Market Size and Share Forecast Outlook 2025 to 2035

Blood Bags Market Size and Share Forecast Outlook 2025 to 2035

Craft Bags Market Growth, Trends, Forecast 2025 to 2035

Market Share Breakdown of Craft Bags Manufacturers

Competitive Breakdown of Paper Bags Providers

Market Share Analysis of Jumbo Bags & Key Players

Grout Bags Market Demand & Construction Industry Trends 2024 to 2034

Sugar Bags Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA