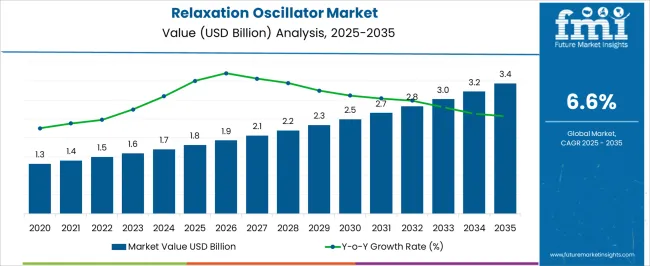

The relaxation oscillator market is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 3.4 billion by 2035, registering a compound annual growth rate (CAGR) of 6.6% over the forecast period.

The relaxation oscillator market, valued at USD 1.8 billion in 2025 and projected to reach USD 3.4 billion by 2035, exhibits a moderate CAGR of 6.6%, indicating a market in transition from early growth toward maturity. The adoption lifecycle reflects a progression through initial market penetration, characterized by early adopters integrating oscillators into consumer electronics, industrial instrumentation, and signal processing applications. The initial years up to 2027 show incremental growth from USD 1.8 billion to USD 2.1 billion, corresponding to cautious adoption by technologically advanced segments and early adoption in niche industrial applications.

From 2028 to 2032, the market accelerates, moving from USD 2.2 billion to USD 2.8 billion, suggesting a transition into the early majority phase. During this stage, standardization of oscillator designs, improved component reliability, and cost-effective manufacturing enhance accessibility and stimulate adoption across broader sectors such as automotive electronics, IoT devices, and power management systems.

By 2033 onward, the market approaches maturity, reaching USD 3.4 billion by 2035, reflecting widespread integration into established applications and the saturation of high-value segments. Technological refinements, including low-power designs, miniaturization, and integration with digital control circuits, facilitate adoption in mature segments, while legacy applications continue to support steady revenue streams. The market demonstrates a structured maturity curve, with a clear trajectory from early adoption to mainstream utilization, positioning Relaxation Oscillators as standard components in diversified electronic systems by the end of the forecast period.

| Metric | Value |

|---|---|

| Relaxation Oscillator Market Estimated Value in (2025 E) | USD 1.8 billion |

| Relaxation Oscillator Market Forecast Value in (2035 F) | USD 3.4 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

The relaxation oscillator market represents a specialized segment within the global electronic components and signal generation industry, emphasizing timing, waveform production, and low-frequency signal applications. Within the broader electronic circuits and components sector, it accounts for about 5.2%, driven by demand from industrial electronics, consumer devices, and communication systems. In the oscillator and signal generation segment, it secures 5.7%, reflecting reliance on reliable timing signals, pulse generation, and switching applications. Across the automotive and consumer electronics circuits market, the share is 4.3%, supporting integration in timing circuits, alarms, and display systems.

Within the instrumentation and measurement equipment category, it represents 3.9%, highlighting applications in testing, calibration, and signal simulation. In the industrial control and automation sector, it contributes about 3.5%, emphasizing use in motor control, lighting control, and switching devices. Recent developments in this market have focused on miniaturization, energy efficiency, and integration with advanced semiconductor technologies. Innovations include CMOS-based relaxation oscillators, low-power designs, and high-precision timing solutions suitable for compact electronics and IoT devices.

Key players are collaborating with semiconductor manufacturers, consumer electronics firms, and industrial automation companies to deliver optimized oscillator modules for diverse applications. Adoption of programmable, digitally tunable, and temperature-compensated oscillator designs is gaining traction to improve accuracy and reliability. The integration with sensor systems, microcontrollers, and low-voltage circuits is being deployed to enhance system efficiency and reduce power consumption. These trends demonstrate how precision, energy efficiency, and technological advancement are shaping the market.

The relaxation oscillator market is experiencing robust growth driven by rising demand for cost effective timing circuits, simplified design architectures, and versatility across multiple electronic applications. Their ability to generate non sinusoidal waveforms without the need for complex components has made them a preferred choice in low power and portable devices.

Technological improvements in integrated circuit design and the miniaturization of components have expanded their use in compact consumer electronics and industrial systems. Additionally, increasing adoption in applications such as signal generation, clock pulse creation, and LED lighting control is contributing to market expansion.

The future outlook remains positive as innovation in semiconductor manufacturing and the growing penetration of smart devices continue to create opportunities for high efficiency and low maintenance oscillator designs.

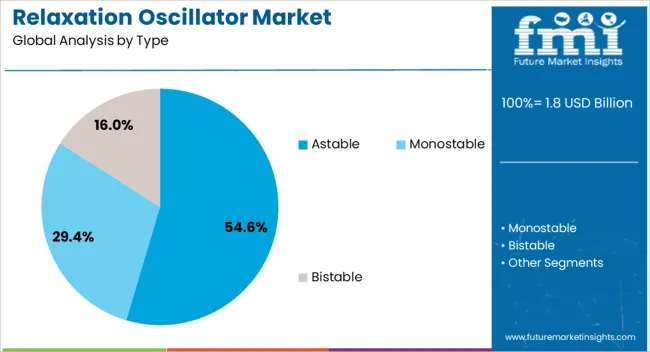

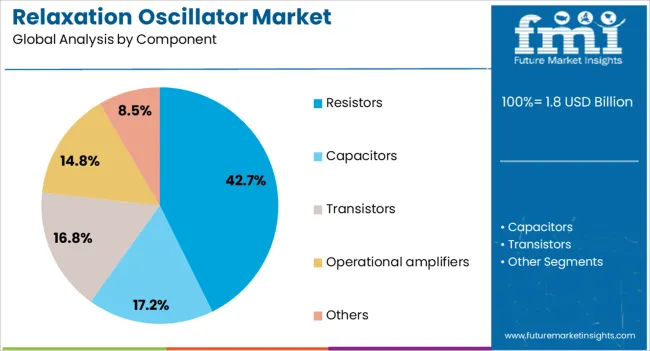

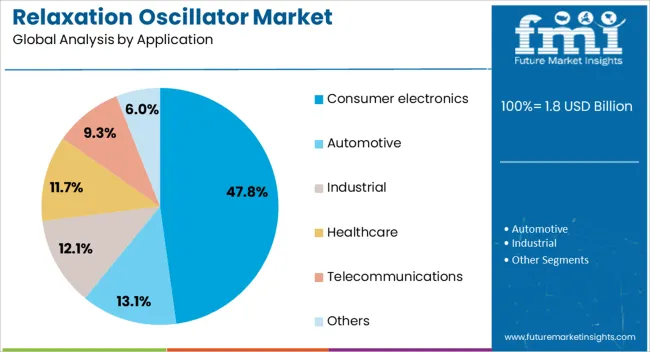

The relaxation oscillator market is segmented by type, component, application, end-use, and geographic regions. By type, relaxation oscillator market is divided into astable, monostable, and bistable. In terms of component, relaxation oscillator market is classified into resistors, capacitors, transistors, operational amplifiers, and others. Based on application, relaxation oscillator market is segmented into consumer electronics, automotive, industrial, healthcare, telecommunications, and others. By end-use, relaxation oscillator market is segmented into OEMs (original equipment manufacturers) and aftermarket. Regionally, the relaxation oscillator industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The astable type segment is projected to account for 54.6% of the total market revenue by 2025 within the type category, positioning it as the most prominent. This growth is attributed to its continuous oscillation capability without external triggering, making it suitable for a wide range of applications including LED flashers, tone generators, and timing circuits.

The simplicity of its configuration and its ease of integration into various devices enhance its appeal.

Low cost, reliability, and adaptability to different frequency requirements have further strengthened its presence in the oscillator market, ensuring its leadership position within the type category.

The resistors component segment is expected to contribute 42.7% of the total market revenue by 2025, making it the dominant component type. This dominance is due to their fundamental role in controlling timing intervals, frequency stability, and waveform shaping in relaxation oscillators.

Resistors are highly reliable, cost effective, and available in a wide range of tolerances, enabling precise circuit customization. Their integration in both discrete and integrated oscillator designs ensures consistent demand, particularly in mass produced electronics.

The balance of performance, cost, and availability continues to support the segment’s leading position in the component category.

The consumer electronics application segment is projected to represent 47.8% of the total market revenue by 2025, securing its position as the leading application area. This growth is driven by the extensive use of relaxation oscillators in gadgets, household devices, and personal electronics where timing control and waveform generation are essential.

The surge in demand for compact, battery powered devices and the proliferation of smart consumer products have increased reliance on efficient oscillator designs.

Their role in enhancing product performance, extending battery life, and enabling compact circuit layouts has ensured the continued dominance of consumer electronics within the application category.

The market has grown significantly due to its critical role in generating periodic waveforms in electronic circuits across consumer electronics, automotive, industrial, and medical applications. These oscillators are widely used in timers, pulse generators, LED drivers, audio devices, and frequency synthesizers due to their simplicity, cost-effectiveness, and stable performance. Rising demand for compact, energy-efficient, and reliable oscillators in low-power electronics has further boosted adoption. Technological advancements in integrated circuits, semiconductor materials, and design automation have enhanced performance, reduced noise, and enabled miniaturization.

Relaxation oscillators are increasingly utilized in consumer electronics and industrial systems where cost-effective waveform generation is required. In consumer devices, they are applied in LED lighting systems, timers, audio oscillators, and electronic toys. Industrial equipment employs these oscillators in control systems, signal generators, and monitoring circuits. Their ability to produce accurate pulse and frequency signals with minimal components reduces design complexity and cost. Growing demand for energy-efficient and compact electronic devices has driven manufacturers to integrate relaxation oscillators in embedded systems. Expansion of consumer electronics, industrial automation, and smart home technologies continues to strengthen the adoption of relaxation oscillators globally.

Technological developments in semiconductor design, integrated circuits, and component miniaturization have improved the performance of relaxation oscillators. Modern designs offer low power consumption, reduced jitter, and high waveform stability. Integration with microcontrollers, programmable logic devices, and embedded systems has expanded their versatility in electronic circuits. Materials such as silicon-on-insulator and advanced dielectric substrates have enhanced signal reliability, frequency range, and operational lifespan. The use of automated design tools and simulation software allows precise tuning and customization for application-specific requirements. These advancements enable oscillators to meet the growing demands of modern electronics for efficiency, performance, and compact form factors.

In automotive electronics, relaxation oscillators are used for timing circuits, sensors, and control modules that require consistent signal generation under variable conditions. Electric vehicles, driver-assistance systems, and infotainment devices increasingly rely on precise oscillators for operational efficiency and safety. In medical electronics, they are used in diagnostic equipment, pulse generators, and monitoring devices where stable waveforms are critical for accurate readings. The expansion of automotive and healthcare electronics, combined with the rising trend of digitalization and automation, has strengthened demand for reliable, low-cost, and energy-efficient relaxation oscillators across multiple sectors.

Despite growth, the relaxation oscillator market faces challenges in miniaturization and noise suppression. Compact circuit designs increase susceptibility to electromagnetic interference, temperature variations, and component tolerances, affecting waveform stability. Manufacturers must optimize circuit layout, shielding, and materials to maintain accuracy and reliability. The meeting diverse frequency and voltage requirements for different applications can complicate design and increase production costs. Research in low-noise materials, advanced packaging, and adaptive circuitry is crucial to overcome these challenges. While these technical hurdles exist, continuous innovation ensures that relaxation oscillators remain indispensable in modern electronics across consumer, industrial, automotive, and medical sectors.

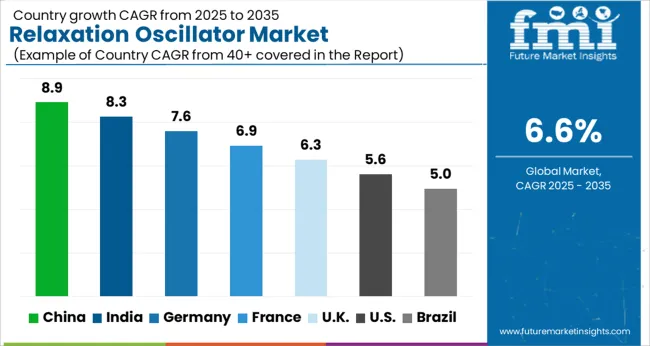

| Country | CAGR |

|---|---|

| China | 8.9% |

| India | 8.3% |

| Germany | 7.6% |

| France | 6.9% |

| UK | 6.3% |

| USA | 5.6% |

| Brazil | 5.0% |

The market is projected to expand at a CAGR of 6.6% between 2025 and 2035, driven by growing adoption in consumer electronics and industrial automation applications. Germany achieved 7.6%, supported by technological development and precision manufacturing. India recorded 8.3%, reflecting rising electronic component manufacturing and R&D activities. China led with 8.9%, fueled by large-scale electronics production and integration of advanced oscillator technologies. The United Kingdom registered 6.3%, supported by niche electronics applications and industrial automation adoption. The United States accounted for 5.6%, where demand is sustained by electronics upgrades and emerging circuit applications. These regions represent the leading markets driving production, innovation, and scaling of relaxation oscillators globally. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 8.9%, driven by rising electronics manufacturing, consumer electronics, and telecommunications equipment production. Adoption has been reinforced by demand for precision timing circuits, waveform generation, and switching applications in both industrial and consumer electronics. Domestic manufacturers focus on miniaturized, high reliability, and low power oscillators for smartphones, IoT devices, and smart appliances. Increasing electronics exports and integration of advanced oscillator designs in industrial automation further fuel market growth.

India is expected to grow at a CAGR of 8.3%, supported by the growing electronics sector, telecom infrastructure, and industrial automation. Adoption has been reinforced by increasing use in waveform generation, timers, and low frequency switching circuits. Domestic manufacturers collaborate with multinational electronics firms to meet rising demand in consumer devices, communication equipment, and automotive electronics. Government initiatives to boost electronics manufacturing further enhance market potential.

Germany is forecast to grow at a CAGR of 7.6%, driven by industrial automation, automotive electronics, and consumer electronics demand. Adoption has been reinforced by high reliability and precision requirements for timing circuits and waveform generation in automotive, industrial, and control systems. Domestic manufacturers focus on miniaturized and energy efficient designs while imports complement specialized applications.

The United Kingdom is projected to grow at a CAGR of 6.3%, supported by adoption in industrial electronics, communication equipment, and automotive applications. Imports dominate specialized oscillators, while domestic production focuses on standard frequency and low power designs. Rising integration of oscillators in automation, measurement, and signal processing devices drives steady growth.

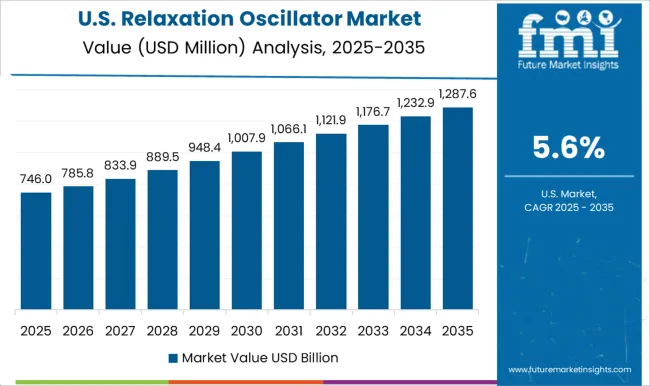

The United States is expected to grow at a CAGR of 5.6%, driven by demand in automotive electronics, consumer devices, industrial control systems, and IoT applications. Domestic manufacturers focus on precision, low power, and miniaturized oscillator designs for specialized applications. Increasing adoption in aerospace, medical electronics, and smart devices contributes to market expansion.

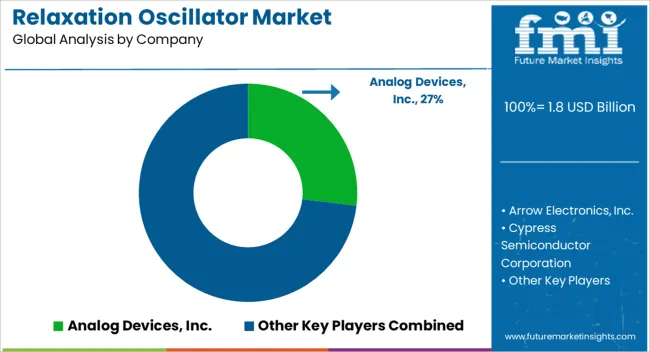

The market is shaped by key semiconductor and electronics companies offering integrated circuit solutions for timing, waveform generation, and signal modulation applications. Analog Devices, Inc. and STMicroelectronics N.V. provide high-performance oscillator ICs with low power consumption and precise frequency stability, serving industrial, automotive, and consumer electronics segments. Texas Instruments Incorporated and Maxim Integrated Products, Inc. focus on versatile oscillator solutions compatible with diverse electronic systems, emphasizing accuracy, reliability, and ease of integration.

Microchip Technology Inc. and Cypress Semiconductor Corporation offer programmable and analog-based relaxation oscillators, targeting embedded systems, communication devices, and instrumentation applications. Arrow Electronics, Inc. and RS Components Ltd. operate primarily as global distributors, providing extensive product portfolios and technical support, enabling end-users to access a wide range of oscillator solutions efficiently. Smaller players such as Japson and Mine Instruments Pvt. Ltd. serve regional markets with cost-effective and customized oscillator modules, catering to niche industrial and academic applications.

Competitive differentiation in this market relies on factors including frequency stability, power efficiency, integration flexibility, product miniaturization, and after-sales support. Continuous technological advancements, growing demand for precision timing devices, and expansion in electronics, automotive, and industrial automation sectors drive companies to innovate and enhance product offerings, maintaining a competitive edge in the market.

| Items | Values |

|---|---|

| Quantitative Units | USD 1.8 billion |

| Type | Astable, Monostable, and Bistable |

| Component | Resistors, Capacitors, Transistors, Operational amplifiers, and Others |

| Application | Consumer electronics, Automotive, Industrial, Healthcare, Telecommunications, and Others |

| End-use | OEMs (Original Equipment Manufacturers) and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Analog Devices, Inc., Arrow Electronics, Inc., Cypress Semiconductor Corporation, Japson, Maxim Integrated Products, Inc., Microchip Technology Inc., Mine Instruments Pvt. Ltd., RS Components Ltd., STMicroelectronics N.V., and Texas Instruments Incorporated |

| Additional Attributes | Dollar sales by oscillator type and application, demand dynamics across consumer electronics, automotive, and industrial sectors, regional trends in timing and waveform generation adoption, innovation in frequency stability, low-power operation, and integration, environmental impact of electronic component production and disposal, and emerging use cases in signal processing, sensor circuits, and communication systems. |

The global relaxation oscillator market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the relaxation oscillator market is projected to reach USD 3.4 billion by 2035.

The relaxation oscillator market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in relaxation oscillator market are astable, monostable and bistable.

In terms of component, resistors segment to command 42.7% share in the relaxation oscillator market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oscillators Market Trends - Growth & Forecast 2025 to 2035

MEMS Oscillators Market Size and Share Forecast Outlook 2025 to 2035

Crystal Oscillator Market Analysis - Size, Share, and Forecast 2025 to 2035

MHz Crystal Oscillator Market Size and Share Forecast Outlook 2025 to 2035

Atomic Clock Oscillators Market Forecast and Outlook 2025 to 2035

High Reliability Oscillators Market Size and Share Forecast Outlook 2025 to 2035

Voltage Controlled Oscillators Market Size and Share Forecast Outlook 2025 to 2035

Wide Temperature MEMS Oscillator Market Size and Share Forecast Outlook 2025 to 2035

Evacuated Miniature Crystal Oscillator (EMXO) Market Forecast and Outlook 2025 to 2035

Femtosecond Optical Parametric Oscillator Market Forecast and Outlook 2025 to 2035

5G Temperature-Compensated Crystal Oscillator (TCXO) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA