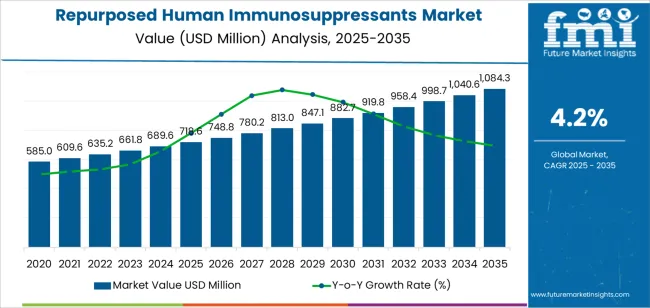

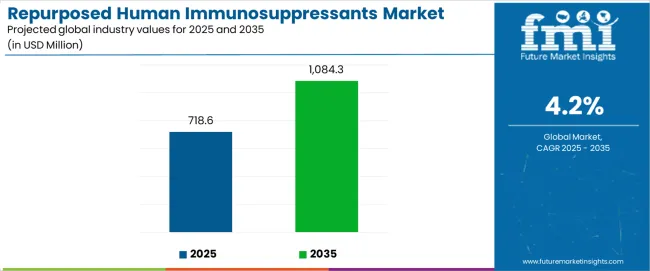

The repurposed human immunosuppressants market stands at the threshold of a decade-long expansion trajectory that promises to reshape drug repurposing strategies and therapeutic innovation across healthcare systems. The market's journey from USD 718.6 million in 2025 to USD 1,084.3 million by 2035 represents substantial growth, demonstrating the accelerating adoption of repurposed immunosuppressant therapies and treatment optimization across hospitals, specialty clinics, and advanced care facilities.

The first half of the decade (2025 to 2030) will witness the market climbing from USD 718.6 million to approximately USD 871.9 million, adding USD 153.3 million in value, which constitutes 42% of the total forecast growth period. This phase will be characterized by the rapid adoption of calcineurin inhibitors and mTOR inhibitors for repurposed indications, driven by increasing clinical evidence and the growing need for advanced treatment solutions in oncology and fibrosis management worldwide. Enhanced therapeutic effectiveness and expanded indication portfolios will become standard expectations rather than premium options.

The latter half (2030 to 2035) will witness continued growth from USD 871.9 million to USD 1,084.3 million, representing an addition of USD 212.5 million or 58% of the decade's expansion. This period will be defined by mass market penetration of biologics and newer small molecules, integration with comprehensive treatment protocols, and seamless compatibility with existing therapeutic infrastructure. The market trajectory signals fundamental shifts in how healthcare systems approach drug repurposing and indication expansion, with participants positioned to benefit from growing demand across multiple drug classes and repurposed indication segments.

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | Calcineurin inhibitors | 31.9% | Established efficacy, transplant foundation |

| mTOR inhibitors | 24.5% | Oncology applications, combination therapies | |

| Biologics / monoclonal antibodies | 18.7% | Precision targeting, premium positioning | |

| Hospitals | 51.2% | Complex case management, acute care | |

| Oncology / immuno-oncology | 34.6% | Primary growth driver, indication expansion | |

| Future (3-5 yrs) | Advanced calcineurin platforms | 28-32% | Indication expansion, combination protocols |

| Targeted biologics | 22-26% | Personalized approaches, biomarker-driven | |

| Novel small molecules | 14-18% | Emerging mechanisms, improved profiles | |

| Specialty care ecosystems | 26-30% | Outpatient transition, expert management | |

| Digital monitoring integration | 8-12% | Real-time tracking, outcome optimization |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 718.6 million |

| Market Forecast (2035) | USD 1,084.4 million |

| Growth Rate | 4.2% CAGR |

| Leading Drug Class | Calcineurin inhibitors |

| Primary Indication | Oncology / Immuno-oncology |

The market demonstrates strong fundamentals with calcineurin inhibitors capturing a dominant share through established clinical evidence and repurposing capabilities. Oncology and immuno-oncology indications drive primary demand, supported by increasing research into immunosuppressant mechanisms and therapeutic repositioning development. Geographic expansion remains concentrated in developed markets with advanced research infrastructure, while emerging economies show accelerating adoption rates driven by clinical innovation initiatives and expanding treatment access.

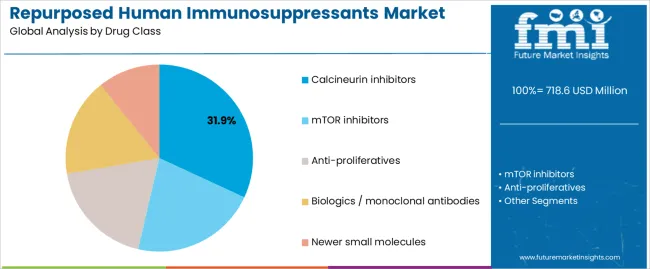

Primary Classification: The market segments by drug class into calcineurin inhibitors, mTOR inhibitors, anti-proliferatives, biologics/monoclonal antibodies, and newer small molecules, representing the evolution from traditional immunosuppression approaches to specialized repurposed therapeutic solutions for comprehensive indication management.

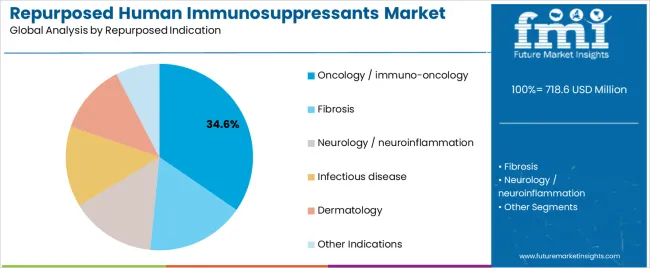

Secondary Classification: Repurposed indication segmentation divides the market into oncology/immuno-oncology (34.6%), fibrosis (18.5%), neurology/neuroinflammation (14.6%), infectious disease (12.3%), dermatology (8.5%), and other indications (11.6%), reflecting distinct requirements for therapeutic repositioning, clinical evidence, and treatment protocol standards.

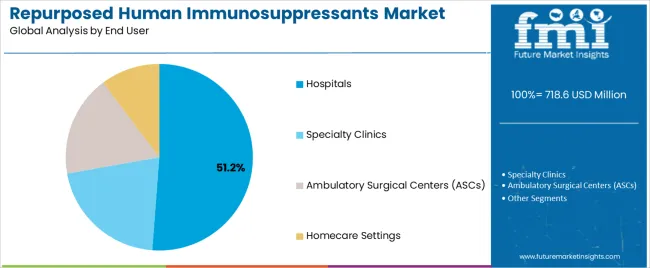

Tertiary Classification: End-use segmentation covers hospitals (51.2%), specialty clinics (24.3%), homecare settings (16.1%), and ambulatory surgical centers (8.4%), demonstrating varied treatment environments and care delivery standards.

The segmentation structure reveals therapeutic progression from traditional immunosuppression applications toward specialized repurposed formulations with enhanced indication versatility and therapeutic capabilities, while application diversity spans from hospital settings to specialty care environments requiring evidence-based treatment solutions.

Market Position: Calcineurin inhibitors command the leading position in the repurposed human immunosuppressants market with 31.9% market share through established mechanism features, including well-characterized immunosuppression pathways, extensive safety data, and repurposing potential that enable researchers to achieve optimal therapeutic outcomes across diverse oncology and inflammatory indication applications.

Value Drivers: The segment benefits from clinical familiarity with proven therapeutic systems that provide consistent mechanism understanding, extensive safety databases, and repurposing optimization without requiring significant regulatory pathway modifications. Established clinical features enable indication expansion protocols, mechanism exploitation, and integration with existing treatment paradigms, where therapeutic knowledge and safety profiles represent critical research requirements.

Competitive Advantages: Calcineurin inhibitors differentiate through proven mechanism understanding, extensive clinical experience, and integration with drug repurposing strategies that enhance indication expansion while maintaining established safety standards for diverse oncology and inflammatory management applications.

Key market characteristics:

mTOR inhibitors maintain a 24.5% market position in the repurposed human immunosuppressants market due to their enhanced anti-proliferative properties and oncology application characteristics. These compounds appeal to researchers requiring specialized mechanisms with established positioning for cancer therapy and combination treatment applications. Market growth is driven by oncology segment expansion, emphasizing targeted therapeutic solutions and treatment effectiveness through optimized mechanism exploitation.

Biologics and monoclonal antibodies capture 18.7% market share through specialized targeting requirements in immuno-oncology applications, autoimmune conditions, and precision medicine applications. These therapies demand advanced development systems capable of specific pathway modulation while providing effective therapeutic integration and mechanism selectivity capabilities.

Market Context: Oncology and immuno-oncology applications demonstrate market leadership in the repurposed human immunosuppressants market with 34.6% share due to widespread adoption of immunomodulation strategies and increasing focus on cancer treatment optimization, immune checkpoint modulation, and therapeutic innovation applications that maximize clinical benefit while maintaining safety standards.

Appeal Factors: Oncology researchers prioritize mechanism novelty, clinical efficacy, and integration with existing cancer treatment infrastructure that enables coordinated therapy management across multiple treatment modalities. The segment benefits from substantial oncology investment and drug repurposing programs that emphasize the development of immunosuppressant-based cancer therapies for patient optimization and survival enhancement applications.

Growth Drivers: Cancer research programs incorporate repurposed immunosuppressants as investigational therapies for tumor management, while immunotherapy advances increase demand for novel immune modulation capabilities that comply with safety standards and maximize treatment synergies.

Application dynamics include:

Fibrosis applications capture 18.5% market share through comprehensive treatment requirements in organ fibrosis management, chronic inflammatory conditions, and tissue remodeling applications. These indications demand effective immunosuppressant systems capable of addressing fibrotic processes while providing therapeutic modulation and disease progression management capabilities.

Neurology and neuroinflammation applications account for 14.6% market share, including neurodegenerative conditions, autoimmune neurological disorders, and central nervous system inflammation requiring targeted immunomodulation solutions for treatment optimization and neuroprotection enhancement.

Market Context: Hospital applications demonstrate market leadership in the repurposed human immunosuppressants market with 51.2% share due to widespread adoption of complex therapeutic protocols and increasing focus on acute care optimization, specialized treatment delivery, and inpatient management applications that maximize therapeutic outcomes while maintaining clinical standards.

Appeal Factors: Healthcare providers prioritize treatment complexity management, clinical oversight, and integration with advanced hospital infrastructure that enables coordinated patient care across multiple clinical departments. The segment benefits from substantial hospital investment and specialty drug programs that emphasize the delivery of repurposed immunosuppressant therapies for complex patient management and clinical excellence applications.

Growth Drivers: Hospital expansion programs incorporate repurposed immunosuppressants as advanced therapeutic options for complex condition management, while clinical specialization increases demand for sophisticated treatment capabilities that comply with hospital protocols and minimize treatment complications.

Specialty clinic applications capture 24.3% market share through targeted treatment requirements in oncology centers, rheumatology practices, and specialized therapeutic facilities. These settings demand expert-managed immunosuppressant systems capable of handling complex repurposed applications while providing effective therapeutic delivery and outcome monitoring capabilities.

Homecare applications account for 16.1% market share, including oral immunosuppressant therapies, chronic disease management, and patient-administered treatments requiring practical therapeutic solutions for treatment continuity and quality of life optimization.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Drug repurposing momentum & cost efficiency (reduced development timelines, established safety profiles) | ★★★★★ | Pharmaceutical companies require faster, cost-effective development pathways with proven safety data and mechanism understanding across therapeutic repositioning applications. |

| Driver | Oncology innovation demand & immunotherapy expansion (immuno-oncology growth, combination strategies) | ★★★★★ | Drives demand for novel immune modulation approaches and mechanism diversity; researchers offering immunosuppressant-based cancer therapies gain competitive advantage. |

| Driver | Mechanistic understanding & pathway knowledge (immunology advances, target identification) | ★★★★☆ | Clinical researchers need well-characterized, evidence-based therapeutic mechanisms; demand for mechanism-driven repurposing expanding addressable indication segments. |

| Restraint | Regulatory pathway complexity & approval challenges (new indication requirements, safety reassessment) | ★★★★☆ | Pharmaceutical developers face regulatory pressure; increases development cost sensitivity and affects indication expansion timelines in regulatory-intensive markets. |

| Restraint | Safety profile limitations & adverse event concerns (immunosuppression risks, infection susceptibility) | ★★★☆☆ | Safety-focused applications face challenges with toxicity management and patient selection concerns, limiting adoption in risk-sensitive clinical segments. |

| Trend | Precision medicine integration & biomarker-driven selection (pharmacogenomics, patient stratification) | ★★★★★ | Growing demand for personalized immunosuppressant therapy; biomarker approaches become core value proposition in targeted therapeutic segments. |

| Trend | Artificial intelligence in drug discovery & computational repurposing (mechanism prediction, indication mapping) | ★★★★☆ | Drug development transformation drives demand for AI-guided repurposing strategies; computational capabilities drive competition toward data-driven indication discovery. |

The repurposed human immunosuppressants market demonstrates varied regional dynamics with growth leaders including India (6.1% growth rate) and China (5.5% growth rate) driving expansion through pharmaceutical innovation initiatives and drug repurposing research development. Steady Performers encompass Brazil (3.7% growth rate), France (2.9% growth rate), and USA (2.5% growth rate), benefiting from established pharmaceutical industries and advancing repurposing adoption. Mature Markets feature UK(2.5% growth rate) and Germany (1.9% growth rate), where therapeutic innovation and regulatory standardization requirements support consistent growth patterns.

Regional synthesis reveals South Asian and East Asian markets leading adoption through pharmaceutical research expansion and clinical innovation development, while Western countries maintain steady expansion supported by regulatory frameworks and mechanism understanding requirements. Emerging markets show strong growth driven by drug development investment and research infrastructure improvement trends.

| Region/Country | 2025-2035 Growth | How to win | What to watch out |

|---|---|---|---|

| India | 6.1% | Focus on cost-effective repurposing | Infrastructure gaps; clinical capacity |

| China | 5.5% | Lead with mechanism research | Regulatory complexity; data requirements |

| Brazil | 3.7% | Provide accessible formulations | Economic volatility; regulatory timelines |

| France | 2.9% | Offer clinical evidence programs | Reimbursement challenges; guidelines |

| USA | 2.5% | Push FDA repurposing pathways | Regulatory scrutiny; competition |

| UK | 2.5% | NHS indication expansion | Budget constraints; evidence requirements |

| Germany | 1.9% | Premium innovation positioning | Market saturation; pricing pressure |

India establishes fastest market growth through aggressive pharmaceutical research programs and comprehensive drug repurposing infrastructure development, integrating repurposed immunosuppressant applications as innovative therapeutic approaches in hospital and specialty clinic installations. The country's 6.1% growth rate reflects government initiatives promoting pharmaceutical innovation and clinical research capabilities that support the development of repurposed immunosuppressant therapies in therapeutic facilities. Growth concentrates in major pharmaceutical hubs, including Mumbai, Hyderabad, and Bangalore, where drug development showcases integrated repurposing strategies that appeal to researchers seeking cost-effective indication expansion capabilities and clinical innovation applications.

Indian pharmaceutical companies are developing affordable repurposed formulations that combine domestic research advantages with clinical evidence generation, including mechanism validation systems and safety monitoring capabilities. Distribution channels through hospital networks and specialty care distributors expand market access, while government support for pharmaceutical innovation supports adoption across diverse therapeutic segments.

Strategic Market Indicators:

In major research centers including Beijing, Shanghai, and Guangzhou, pharmaceutical institutions and hospitals are implementing repurposed immunosuppressant research as priority therapeutic development for oncology treatment and immune modulation enhancement, driven by increasing government pharmaceutical investment and drug innovation programs that emphasize the importance of mechanism-based repurposing capabilities. The market holds a 5.5% growth rate, supported by pharmaceutical modernization initiatives and clinical infrastructure development programs that promote repurposed immunosuppressant therapies for patient care. Chinese researchers are adopting repurposing strategies that provide consistent mechanism validation and safety assessment features, particularly appealing in regions where therapeutic innovation and evidence generation represent critical research requirements.

Market expansion benefits from growing pharmaceutical research capabilities and international collaboration agreements that enable domestic development of repurposed immunosuppressant applications for therapeutic innovation. Repurposing adoption follows patterns established in drug development, where mechanism understanding and clinical potential drive research decisions and therapeutic deployment.

Brazil's advancing pharmaceutical market demonstrates growing repurposed immunosuppressant integration with developing clinical effectiveness in hospital facilities and research centers through integration with existing therapeutic systems and healthcare infrastructure. The country leverages emerging pharmaceutical expertise in drug repurposing and clinical research to maintain a 3.7% growth rate. Pharmaceutical centers, including São Paulo, Rio de Janeiro, and Brasília, showcase developing installations where repurposed immunosuppressants integrate with treatment protocols and research platforms to optimize therapeutic delivery and clinical outcomes.

Brazilian researchers prioritize treatment accessibility and clinical evidence generation in repurposing development, creating demand for affordable systems with practical features, including simplified regulatory pathways and clinical support programs. The market benefits from expanding pharmaceutical infrastructure and commitment to therapeutic innovation that provide clinical benefits and compliance with regional research standards.

France's established pharmaceutical market demonstrates sophisticated repurposed immunosuppressant development with documented clinical effectiveness in hospital applications and specialty care facilities through integration with existing research systems and healthcare infrastructure. The country maintains a 2.9% growth rate, leveraging traditional pharmaceutical expertise and clinical research systems in therapeutic repurposing. Research centers, including Paris, Lyon, and Marseille, showcase established installations where repurposed immunosuppressants integrate with treatment protocols and evidence generation platforms to optimize therapeutic development and maintain clinical quality standards.

French pharmaceutical developers prioritize clinical evidence rigor and mechanism validation in repurposing programs, creating demand for well-characterized systems with advanced features, including biomarker integration and outcome monitoring. The market benefits from established clinical research infrastructure and commitment to evidence-based medicine that provide therapeutic benefits and compliance with European regulatory standards.

The USA advanced pharmaceutical market demonstrates comprehensive repurposed immunosuppressant adoption with established regulatory frameworks in academic centers and pharmaceutical companies through integration with existing drug development systems and clinical infrastructure. The country leverages regulatory expertise in drug repurposing and indication expansion to maintain a 2.5% growth rate. Research institutions, including major centers across Boston, San Francisco, and Research Triangle, showcase mature programs where repurposed immunosuppressants integrate with clinical trial platforms and regulatory strategies to optimize approval timelines and therapeutic access.

American pharmaceutical developers prioritize FDA pathway navigation and clinical evidence generation in repurposing initiatives, creating demand for well-documented systems with comprehensive features, including mechanism characterization and safety databases. The market benefits from established pharmaceutical infrastructure and willingness to invest in repurposing technologies that provide regulatory advantages and compliance with federal approval standards.

The UK established pharmaceutical market demonstrates advancing repurposed immunosuppressant adoption with developing clinical programs in NHS facilities and research institutions through integration with existing healthcare systems and therapeutic infrastructure. The country maintains a 2.5% growth rate, leveraging traditional clinical research expertise and integrated care approaches in drug repurposing. Research centers, including London, Oxford, and Cambridge, showcase developing programs where repurposed immunosuppressants integrate with NHS research platforms and clinical guidelines to optimize therapeutic delivery and evidence generation.

British researchers prioritize NHS compatibility and health economics in repurposing development, creating demand for cost-effective systems with clinical features, including NICE appraisal readiness and real-world evidence generation. The market benefits from established clinical research infrastructure and commitment to evidence-based approaches that provide therapeutic benefits and compliance with NHS evaluation protocols.

Germany's advanced pharmaceutical market demonstrates sophisticated repurposed immunosuppressant research with documented mechanistic understanding in university hospitals and pharmaceutical research centers through integration with existing drug development systems and clinical infrastructure. The country maintains a 1.9% growth rate, leveraging traditional pharmaceutical excellence and precision research systems in therapeutic repurposing. Research institutions, including major centers in Munich, Heidelberg, and Berlin, showcase premium programs where repurposed immunosuppressants integrate with translational research platforms and mechanism validation systems to optimize therapeutic development and maintain research quality standards.

German pharmaceutical researchers prioritize mechanism precision and regulatory excellence in repurposing initiatives, creating demand for highly characterized systems with advanced features, including target validation and pathway analysis. The market benefits from established pharmaceutical research infrastructure and commitment to scientific rigor that provide therapeutic insights and compliance with European drug development standards.

The European repurposed human immunosuppressants market is projected to grow from USD 194.2 million in 2025 to USD 258.9 million by 2035, representing 28.2% of the global market in 2025. Germany is expected to maintain its leadership position with USD 54.1 million in 2025, accounting for 27.9% of the European market, supported by its advanced pharmaceutical research infrastructure and major academic medical centers.

France follows with USD 29.1 million, representing 15.0% of the European market in 2025, driven by comprehensive clinical research programs and pharmaceutical innovation initiatives. Italy holds USD 22.0 million with 11.3% market share through specialized oncology applications and drug development capabilities. Spain commands USD 16.5 million representing 8.5% share, while BENELUX accounts for USD 13.4 million or 6.9% in 2025. Nordic Countries maintain USD 11.5 million or 5.9% market share in 2025. The rest of Western Europe region maintains USD 47.6 million, representing 24.5% of the European market, attributed to increasing repurposed immunosuppressant adoption across regional research facilities and emerging pharmaceutical programs implementing drug repurposing initiatives.

| Stakeholder | What they actually control | Typical strengths | Typical blind spots |

|---|---|---|---|

| Global pharmaceutical companies | Compound libraries, clinical development infrastructure, regulatory expertise | Proven mechanism knowledge, multi-indication experience, comprehensive safety data | Repurposing agility; indication flexibility |

| Biotech innovators | Novel mechanism insights; biologics development; precision targeting | Latest therapeutic understanding; attractive efficacy on specialized indications | Scale-up capacity outside core areas; commercialization complexity |

| Generic pharmaceutical companies | Manufacturing efficiency, regulatory pathways, distribution networks | "Fast-follow" advantage; practical pricing; established supply chains | Innovation limitations; novel indication gaps |

| Academic medical centers | Clinical research expertise, patient populations, mechanism research | Deepest mechanism understanding; comprehensive patient characterization | Commercialization pathways; scalability challenges |

| Contract research organizations | Clinical trial management, regulatory support, data generation | Win evidence-intensive programs; flexible research support | Mechanism ownership limitations; therapeutic development depth |

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 718.6 million |

| Drug Class | Calcineurin inhibitors, mTOR inhibitors, Anti-proliferatives, Biologics/monoclonal antibodies, Newer small molecules |

| Repurposed Indication | Oncology/immuno-oncology, Fibrosis, Neurology/neuroinflammation, Infectious disease, Dermatology, Other Indications |

| End User | Hospitals, Specialty Clinics, Homecare Settings, Ambulatory Surgical Centers |

| Regions Covered | South Asia Pacific, East Asia, North America, Western Europe, Latin America, Middle East & Africa |

| Countries Covered | India, China, United States, Japan, Germany, France, United Kingdom, Brazil, South Korea, and 20+ additional countries |

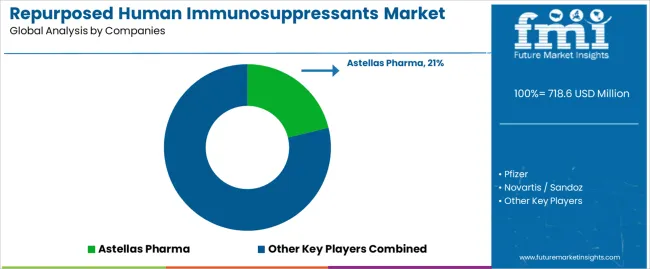

| Key Companies Profiled | Astellas Pharma, Pfizer, Novartis/Sandoz, Roche, Bristol-Myers Squibb, Sanofi, Veloxis Pharmaceuticals, Dr. Reddy's |

| Additional Attributes | Dollar sales by drug class and repurposed indication categories, regional adoption trends across South Asia Pacific, East Asia, and North America, competitive landscape with pharmaceutical manufacturers and biotech innovators, clinical research preferences for mechanism understanding and indication versatility, integration with drug repurposing platforms and clinical trial systems, innovations in therapeutic repositioning and mechanism exploitation, and development of biomarker-driven repurposing strategies with enhanced clinical outcomes and regulatory efficiency capabilities. |

The global repurposed human immunosuppressants market is estimated to be valued at USD 718.6 million in 2025.

The market size for the repurposed human immunosuppressants market is projected to reach USD 1,084.3 million by 2035.

The repurposed human immunosuppressants market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in repurposed human immunosuppressants market are calcineurin inhibitors, mtor inhibitors, anti-proliferatives, biologics / monoclonal antibodies and newer small molecules.

In terms of repurposed indication, oncology / immuno-oncology segment to command 34.6% share in the repurposed human immunosuppressants market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Human Papilloma Virus Testing Market Size and Share Forecast Outlook 2025 to 2035

Human-Centric Lighting Market Size and Share Forecast Outlook 2025 to 2035

Human Identification Market Size and Share Forecast Outlook 2025 to 2035

Human Immunodeficiency Virus Type 1 (HIV 1) Market Size and Share Forecast Outlook 2025 to 2035

Humanoid Robot Market Size and Share Forecast Outlook 2025 to 2035

Humanized Mouse Model Market Size and Share Forecast Outlook 2025 to 2035

Human Milk Oligosaccharides Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Human Combinatorial Antibody Libraries (HuCAL) Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Human Growth Hormone (HGH) Treatment and Drugs Market Trends - Growth & Forecast 2025 to 2035

Human Augmentation Technology Market Growth - Trends & Forecast 2025 to 2035

Key Companies & Market Share in the Human Milk Oligosaccharides Sector

Human RSV Treatment Market Insights - Innovations & Forecast 2025 to 2035

Human Osteoblasts Market – Growth & Forecast 2024-2034

Human Capital Management Market

Human Anatomical Models Market

Human Machine Interface Market

UK Human Milk Oligosaccharides Market Trends – Size, Demand & Forecast 2025-2035

USA Human Milk Oligosaccharides Market Insights – Growth & Demand 2025-2035

ASEAN Human Milk Oligosaccharides Market Report – Size, Demand & Growth 2025–2035

Europe Human Milk Oligosaccharides Market Growth – Trends, Demand & Innovations 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA