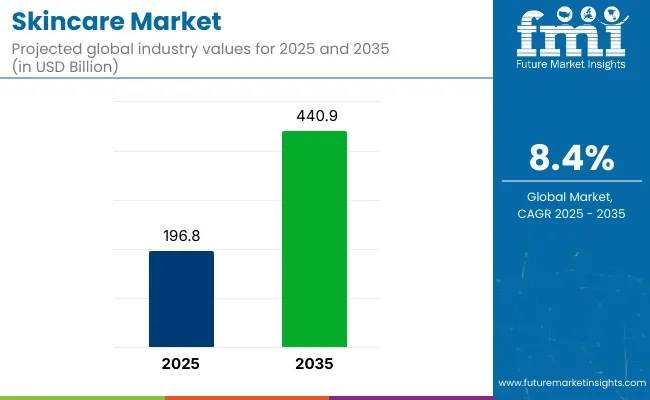

The skincare market is projected to be valued at USD 196.8 billion in 2025 and is anticipated to grow to USD 440.9 billion by 2035, registering a compound annual growth rate (CAGR) of 8.4% over the forecast period.

The global demand for skincare products is rising rapidly, driven by the increasing awareness of skin health, growing concerns about aging, and the expanding beauty and wellness sector. As consumers become more invested in personal care, the skincare market is benefiting from an increased focus on both aesthetic and health-related benefits of skincare.

A major driver of this market’s growth is the rising consumer interest in natural and organic skincare products. As people become more aware of the ingredients in their skincare routines, demand for products with clean, eco-friendly, and sustainable formulations has surged. Additionally, the growing influence of digital platforms, such as social media and influencer marketing, is playing a significant role in shaping consumer preferences and driving sales of skincare products globally.

Recent developments in the skincare market focus on innovations in product formulations, such as incorporating advanced anti-aging ingredients, hydration technology, and products targeting specific skin conditions like acne and hyperpigmentation. The use of biotechnology in developing skin care ingredients is also gaining momentum, with companies focusing on more effective, long-lasting skincare solutions.

| Attribute | Value |

|---|---|

| Market Size in 2025 | USD 196.8 billion |

| Market Size in 2035 | USD 440.9 billion |

| CAGR (2025 to 2035) | 8.4% |

On February 27, 2025, Beiersdorf announced the launch of its Eucerin Hyaluron-Filler Epigenetic Serum, marking a breakthrough in anti-aging skincare. Developed after 15 years of research, the serum features the innovative "Age Clock" technology and the active ingredient Epicelline®, aiming to rejuvenate skin by targeting epigenetic mechanisms. This was officially announced in the company's press release.

As the skincare market continues to expand, the demand for personalized and sustainable skincare products, along with continued technological advancements, will drive further growth in the coming years.

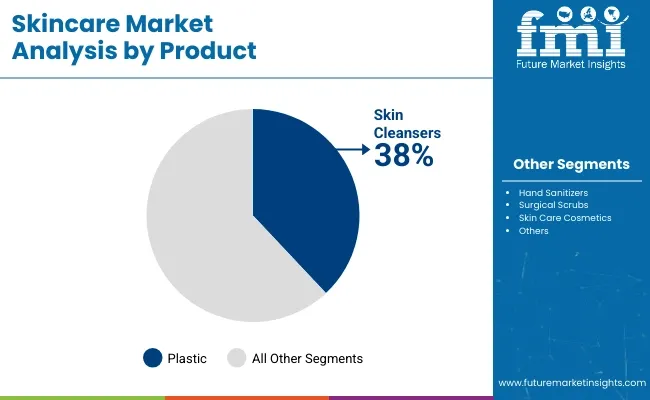

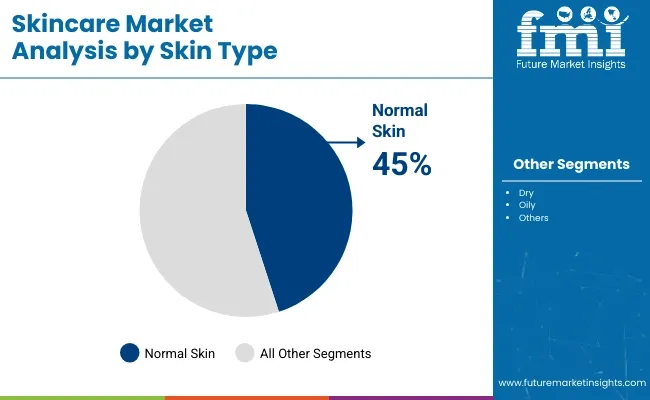

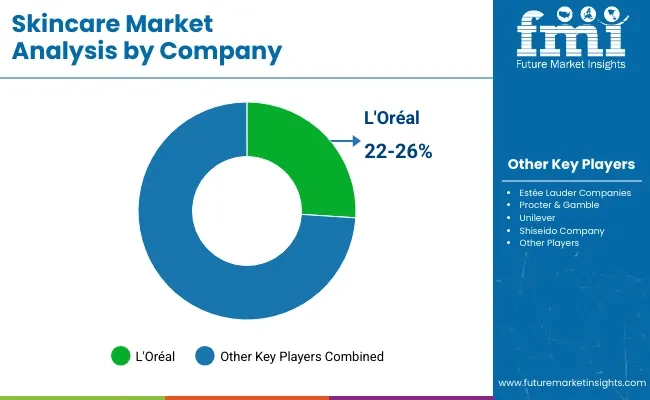

The global skincare market is set to grow significantly through 2035. In 2025, skin cleansers are projected to command 38% of the product type segment, while normal skin is expected to account for 45% of the skin type segment. Key players include L'Oréal, Unilever, and Estée Lauder.

The skin cleansers segment is projected to capture 38% of the market share in 2025. Positioned as an essential step in skincare routines, cleansers address dirt, oil, and pollution while preparing skin for active ingredients. Demand is rising for sulfate-free, pH-balanced, and microbiome-friendly formulas that cater to sensitive skin concerns.

Brands like CeraVe and La Roche-Posay lead with dermatologist-backed innovation and minimalist ingredient lists. Cleansing oils and micellar waters are also gaining traction among consumers seeking gentle, effective alternatives to traditional face washes. The segment’s strength lies in its universality and daily-use nature, making it a high-frequency repurchase category across genders and age groups.

The normal skin segment is projected to hold 45% of the skin type segment market share in 2025. Products targeted at this group emphasize balance and maintenance rather than correction, making them appealing to a wider demographic. Major brands like Neutrogena and Olay position their flagship products as suitable for all skin types, thus capturing a significant portion of the normal skin category.

The rise of hybrid products combining hydration, protection, and anti-aging further boosts this segment. Additionally, consumers with normal skin often drive adoption of clean, fragrance-free, and multi-functional products. Its broad appeal and low risk of adverse reactions keep this segment at the center of mass-market skincare innovation.

High Competition and Brand Saturation

Growing competition in the skincare market owing to the presence of a large number of global and regional players. The diverse range of brands at both the high and low end of the spectrum makes it difficult for newcomers and smaller manufacturers to capture market share.

Or, if you look at the trend of changing consumer preferences and the growing shift of people with their brand loyalties combined with the emergence of direct-to-consumer (DTC) brands, it is almost impossible for a traditional brand to maintain its monopoly. Brands must strive to differentiate themselves via innovation, individualized skincare solutions, and marketing strategies to maintain growth.

Regulatory Compliance and Ingredient Restrictions

And the industry is highly regulated, with strict rules on how ingredients can be used in products, how products are tested for safety and the kinds of claims that can be made about products. Different countries have different regulation systems for the use of chemicals, preservatives, and active ingredients which creates barriers for expansion aspirants companies.

Furthermore, increasing consumer awareness for clean beauty and sustainability is compelling brands to reformulate their products and meet environmental standards and certification requirements.

Growing Demand for Natural and Organic Skincare

Huge growth potential is in organic, vegan, and chemical-free beauty products. Plant-based ingredients, cruelty-free formulations, and sustainable packaging are actively sought by consumers. This trend is based on the growing knowledge of the dangers of synthetic chemicals and the interest in conscious companies. The company that is investing in clean beauty innovations and is transparent in the sourcing of ingredients will have a competitive edge.

Technological Advancements and Personalization

AI, AR and skin diagnosis tools are the new technologies that are changing the game in the skincare market. AI-enabled skin evaluation, DNA-driven formulation, and customized skin care regimen are taking over the beauty and wellness market. Brands using digital means to provide customized product suggestions and virtual fitting rooms are improving customer experience and increasing sales.

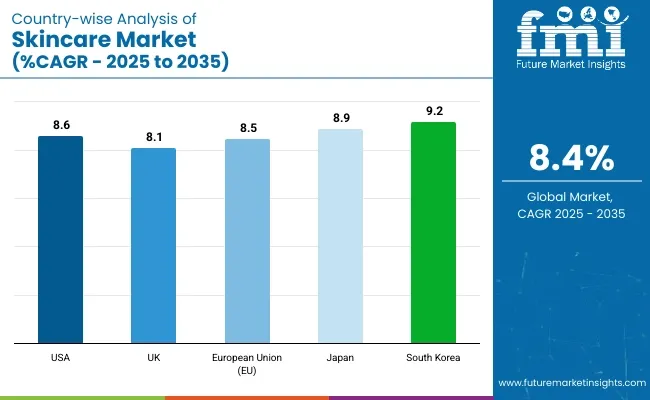

There is a booming market for skincare products in the USA as consumers are increasingly searching for natural, organic, and anti-aging skincare products. (The driving market growth includes a rise in the popularity of clean beauty trends and product development expertise in dermatology and customized skincare solutions. Sales continue to boost out on e-commerce platforms, and DTC brands are here to stay.

And in addition, purchasing behaviors are being influenced by social media, celebrity endorsements and dermatological innovations. Sustainable packaging and cruelty-free formulations are becoming important deciding factors, too.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.6% |

The Skincare market in UK is experiencing steady growth with rising focusing on skin care and prefer premium skincare brands. In recent times, due to these environmental factors and their effects on skin health, there has been an increased demand for anti-pollution skincare products, especially among the urban populace. Consumers are leaning toward multifunctional products that combine hydration, sun protection and anti-aging benefits in a single formula.

Moreover, government regulations encouraging sustainable beauty practices and prohibiting harmful ingredients in cosmetics aid in the adoption of cleaner formulations. Market growth is also supported by online shopping and subscription-based skin care services.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 8.1% |

With a large demand for organic and scientific beauty products, the EU has a fast-growing skincare market. The growth of the market is attributed to the high demand for dermatologist-recommended and clinically tested skincare solutions in the countries like Germany, France, and Italy. European skincare brands with a legacy of innovation ushering in the future of beauty around the globe.

Then again, the EU is known for strict rules on cosmetic ingredients-encouraging safer, more effective formulations. Also, the growth of gender neutral and minimalist skincare routines will help to incorporate even more products across brands. Increasing investments in biotechnology-based skincare are further shaping the market’s future.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 8.5% |

Japan’s cosmetics market is thriving, fueled by a cultural focus on skincare routines and innovative technology for beauty products. Fermented is also the buzzword here, as we all demand lightweight, hydrating and skin-brightening solutions.

The also had a globally influential approach of simplicity with long-term skin health has inspired the J-beauty. The popularity of AI-powered skincare analysis and personalized beauty recommendations is growing as well. Market expansion is also driven by availability of premium and luxury cosmetic brands and innovations in sustainable packaging.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.9% |

South Korea continues to lead the way in the skincare market, with K-beauty creations setting the tone for trends around the world. Continuous innovations in preparations, such as probiotic blended and microbiome friendly skincare drive the market. And the demand for high-performance sunscreens, glass skin routines and hybrid skincare-makeup products is burgeoning.

Social media and beauty influencers shape customers’ preferences, while real-time reviews drive sales. Smart beauty devices and AI-based personalized skincare recommendations are quickly gaining popularity, leading to enhanced personalized skincare. The growth of K-beauty brands in markets across the world also helped drive the sector.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 9.2% |

Driven by increasing awareness of prevention of skin diseases and skin health, demand for anti-aging products, technological advancements in dermatological research the Skincare market is growing steadily. Brands are increasingly focusing on sustainable formulations and eco-friendly packaging, driven by the shift towards natural and organic skincare products that are reshaping industry trends. There’s also a growing need for dermatologist-recommended, clinically tested, multifunctional skincare solutions, she added.

Moreover, the market landscape is being redefined by e-commerce expansion, personalized skincare innovations, and AI-powered skin diagnostics. According to the Global Compound Annual Growth Rate of the market for the period 2021 to 2030 was 8.4%, the market is expected to grow, due to customized skincare regimens, clean beauty trends and boost in investments in biotechnology-derived ingredients.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 196.8 billion |

| Projected Market Size (2035) | USD 440.9 billion |

| CAGR (2025 to 2035) | 8.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for dollar sales |

| Product Types Analyzed (Segment 1) | Skin Cleansers, Hand Sanitizers, Surgical Scrubs, Skin Care Cosmetics, Other |

| Skin Types Analyzed (Segment 2) | Normal, Dry, Oily |

| Forms Analyzed (Segment 3) | Liquid Skincare, Gel and Lotions, Wipes, Spray and Foams |

| End-users Analyzed (Segment 4) | Hospitals, Clinics, Ambulatory Surgical Centers, Diagnostic Laboratories, Reference Laboratories, Rehabilitation Centers, Long Term Care Centers, Critical Care Centers, Pharmaceutical and Biotechnology Companies, Academics and Research Institutes, Homecare Settings |

| Regions Covered | North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Skincare Market | 3M Company, Cardinal Health, Inc., Ecolab, Gojo Industries, Inc., Beiersdorf AG's NX NIVEA, Whiteley Corporation, Reckitt Benckiser Group PLC, Carroll Clean, Johnson & Johnson Consumer Inc., Galderma Laboratories, L.P. |

| Additional Attributes | dollar sales, CAGR trends, product type distribution, skin type preferences, form-based demand, end-user industry share, competitor dollar sales & market share, regional growth patterns |

The overall market size for skincare market was USD 196.8 billion in 2025.

The skincare market expected to reach USD 440.9 billion in 2035.

Rising consumer awareness, increasing demand for natural ingredients, technological advancements, expanding e-commerce, and growing anti-aging product adoption will drive the skincare market during the forecast period.

The top 5 countries which drives the development of skincare market are USA, UK, Europe Union, Japan and South Korea.

Normal skin products driving market growth to command significant share over the assessment period.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.