The soil aerators market is estimated to be valued at USD 32.3 billion in 2025 and is projected to reach USD 62.3 billion by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period. Key factors contributing to market growth include the adoption of modern farming techniques, mechanization in agriculture, and government initiatives promoting sustainable agricultural practices. Soil aeration enhances nutrient absorption, water retention, and crop yield, making aerators essential equipment for both commercial and small-scale farmers. Technological advancements in aeration equipment, such as automated and precision aerators, are also driving demand by improving efficiency and reducing labor costs.

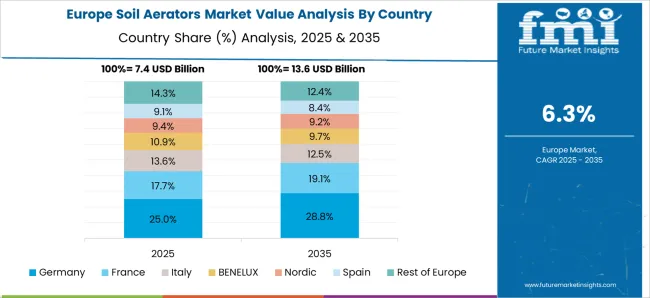

Geographically, regions with intensive agriculture, such as North America, Europe, and parts of Asia-Pacific, are likely to witness substantial market growth due to high adoption rates and increasing investments in agricultural infrastructure. Additionally, the growing emphasis on organic farming and soil conservation practices further strengthens market prospects.

| Metric | Value |

|---|---|

| Soil Aerators Market Estimated Value in (2025 E) | USD 32.3 billion |

| Soil Aerators Market Forecast Value in (2035 F) | USD 62.3 billion |

| Forecast CAGR (2025 to 2035) | 6.8% |

Farmers and commercial agricultural operators are increasingly investing in solutions that enhance soil structure, reduce compaction, and improve water infiltration. The push toward precision farming and increasing mechanization in mid and large-scale farms is further driving the adoption of soil aerating technologies. The shift in agricultural policies promoting soil health management and the adoption of integrated nutrient strategies are contributing significantly to long-term market expansion.

Manufacturers are focusing on product innovations that improve durability, coverage efficiency, and compatibility with modern tractors and implements. The increasing demand for enhanced yield per hectare, coupled with climate-related challenges impacting soil quality, is expected to shape continued demand for soil aerators across key agricultural regions.

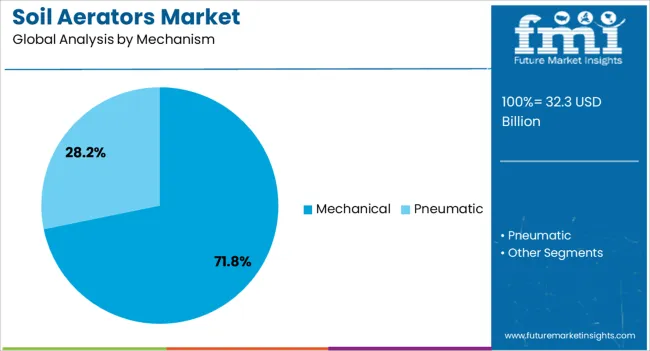

The soil aerators market is segmented by product type, mechanism, mobility, price, end use, and geographic regions. By product type, the soil aerators market is divided into Soil aerating equipment, Primary tillage equipment, Secondary tillage equipment, and Weeding equipment. In terms of the mechanism, the soil aerators market is classified into Mechanical and Pneumatic.

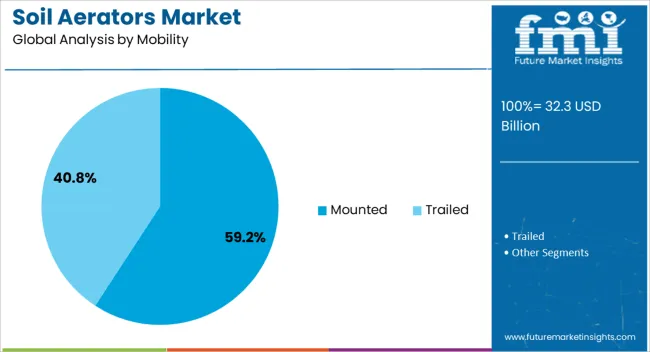

Based on mobility, the soil aerators market is segmented into Mounted and Trailed. By price, the soil aerators market is segmented into Medium, Low, and High. By end use of the soil aerators market is segmented into Agriculture, Commercial, Municipalities & Government agencies, and Others (horticulture etc.). Regionally, the soil aerators industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The soil aerating equipment segment is projected to hold 36.4% of the Soil Aerators market revenue in 2025, making it the leading product type. This dominance is being driven by the essential role such equipment plays in maintaining optimal soil conditions for crop growth.

The segment’s growth has been supported by increasing use in commercial farming operations where deep soil penetration and efficient aeration are required to improve root development and nutrient absorption. Soil aerating equipment is preferred due to its ability to reduce compaction and enhance air and moisture movement in the soil profile, leading to improved plant health.

As farmers seek cost-effective ways to increase productivity without excessive use of fertilizers, these systems offer a viable long-term solution Additionally, compatibility with a wide range of tractors and ease of operation in diverse soil conditions are contributing to the growing preference for dedicated soil aerating equipment.

The mechanical segment is expected to account for 71.8% of the Soil Aerators market revenue in 2025, emerging as the most utilized mechanism. The strong adoption of mechanical soil aeration systems is being driven by their effectiveness in large-scale field operations where power-driven solutions are required for deeper and more consistent aeration.

Unlike pneumatic or chemical-based alternatives, mechanical aerators are widely used due to their low maintenance costs, reliability, and ability to operate under a range of field conditions. This mechanism has gained traction particularly in regions where large farm sizes and dense soil types demand robust and high-throughput aeration.

Farmers are increasingly choosing mechanical systems as they offer greater control over penetration depth and coverage area. As the demand for durable and high-performance solutions continues to rise, mechanical aerators are expected to remain the primary choice for most field operations.

The mounted segment is projected to contribute 59.2% of the Soil Aerators market revenue in 2025, establishing itself as the leading category by mobility. The preference for mounted soil aerators is being attributed to their operational convenience and integration with existing farm machinery, particularly tractors. Mounted units allow efficient coverage of large agricultural fields without the need for standalone propulsion systems, which reduces overall operational costs.

This segment has witnessed increased adoption among farmers aiming for streamlined field operations and improved fuel efficiency. The ability to attach aerators to commonly used farm vehicles makes them suitable for a wide range of applications, from field preparation to seasonal maintenance.

Additionally, their adaptability across various farm sizes and terrain types has solidified the segment's leading position. As the trend toward multi-function farm equipment continues to gain momentum, the demand for mounted soil aerators is expected to remain strong.

The soil aerators market is driven by the need for efficient land management and soil health improvement. Regional adoption is influenced by cost, infrastructure, and farming mechanization.

The demand for soil aerators is driven by the increasing focus on improving soil health for agricultural productivity. These devices play a crucial role in enhancing soil oxygenation, which is essential for root growth and nutrient uptake. As farmers seek efficient solutions to combat soil compaction and improve water infiltration, soil aerators have emerged as a critical tool in both large-scale farming and residential lawn care. The rising popularity of organic farming and the need for high-quality yields are further bolstering their demand. Additionally, government policies promoting sustainable agriculture and organic farming practices contribute to the growing adoption of soil aeration equipment across various regions.

Despite their growing popularity, the high initial cost of soil aerators remains a barrier for many small-scale farmers and residential users. These devices often require significant upfront investment, which can deter adoption, especially in regions with limited access to financial support or subsidies. Furthermore, the need for regular maintenance and occasional repairs adds to the overall operating costs. Soil aerators are also not a one-size-fits-all solution, as factors like soil type, climate, and the scale of operations can influence their efficiency. Consequently, the cost-to-benefit ratio must be carefully evaluated, especially for users with smaller budgets or limited operational scale.

The integration of soil aerators into precision agriculture presents significant opportunities for growth. As farmers seek to optimize their farming practices, there is a rising interest in equipment that can offer targeted, data-driven solutions for soil health. Soil aerators equipped with GPS and automated systems are helping farmers improve soil treatment by applying the right amount of aeration at the right time. This approach not only maximizes efficiency but also minimizes unnecessary interventions, contributing to cost savings. With the global shift toward more efficient farming practices, the role of soil aerators in precision agriculture is becoming increasingly valuable, driving further market adoption.

The soil aerators market is experiencing substantial growth in North America and Europe, where large-scale farming operations dominate. These regions benefit from advanced agricultural practices and a strong focus on improving soil quality and crop yields. The Asia-Pacific region, particularly countries like India and China, is seeing an increase in demand as smallholder farms recognize the benefits of soil aeration. Governments in these regions are encouraging farmers to adopt advanced agricultural technologies, further fueling market growth. The rise in urban farming and residential lawn care also contributes to the demand for soil aerators in emerging markets.

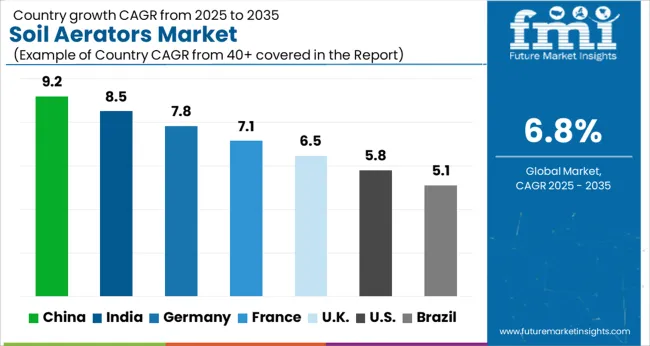

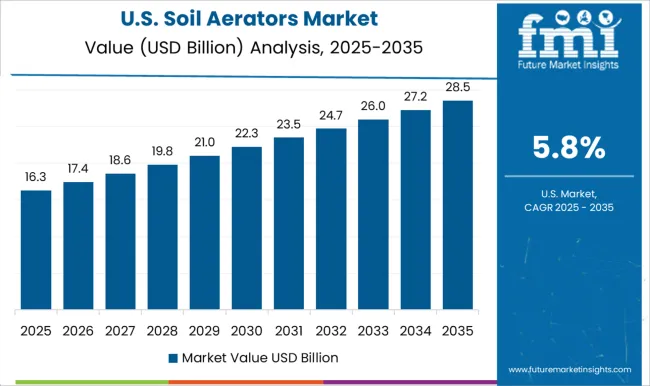

The soil aerators market is projected to grow globally at a CAGR of 6.8% between 2025 and 2035, driven by increasing demand for soil health improvement in agriculture and lawn care. China leads with a CAGR of 9.2%, backed by large-scale farming and the adoption of advanced soil management techniques. India follows with a growth rate of 8.5%, supported by an expanding agricultural sector and increasing awareness about soil aeration. France sees a growth rate of 7.1%, reflecting the strong demand for soil aerators in both commercial and residential farming. The United Kingdom stands at 6.5%, driven by the adoption of soil management systems in both urban and rural farming. The United States records a 5.8% growth rate, reflecting steady demand driven by agricultural innovation and technology adoption. This analysis covers more than 40 countries, with these six serving as primary benchmarks for capacity planning, export potential assessment, and strategic investment decisions in the global soil aerators industry.

China is projected to achieve a CAGR of 9.2% for 2025–2035, up from approximately 8.1% during 2020–2024, surpassing the global average of 6.8%. The previous growth phase was driven by large-scale agricultural practices and government initiatives aimed at improving soil quality. The higher CAGR in the next decade reflects expanding adoption in commercial farming, increased use of technology in agriculture, and improved irrigation practices. These shifts are supplemented by the growing interest in organic farming and the recognition of soil aerators' benefits in optimizing crop yields and water management. Investments in rural farming infrastructure and eco-friendly agricultural practices are fueling demand.

India is expected to grow at a CAGR of 8.5% for 2025–2035, rising from 7.0% during 2020–2024, exceeding the global average of 6.8%. The earlier period was influenced by the growing awareness of soil health among smallholder farmers and the gradual introduction of mechanized farming solutions. The projected increase reflects greater adoption of precision farming techniques, driven by government support for advanced agriculture and sustainable land management. India's rural sector, with its large farming population, is increasingly turning to technology such as soil aerators for improving productivity and addressing water scarcity. Regional subsidies and support schemes are aiding this transition.

France is projected to grow at a CAGR of 7.1% for 2025–2035, an increase from 6.0% during 2020–2024, remaining in line with the global market average of 6.8%. The earlier growth was supported by strong demand for eco-friendly farming practices and a focus on improving soil health. The increase in the next decade is attributed to the expansion of precision agriculture, with a growing focus on optimizing crop yields through technology. France’s agricultural policies promoting sustainability, in conjunction with increasing interest in reducing water and fertilizer use, are expected to drive demand for soil aerators as farmers seek efficient, eco-friendly soil management solutions.

The United Kingdom is expected to grow at a CAGR of 6.5% for 2025–2035, an increase from 5.3% during 2020–2024, indicating a steady rise in adoption. The early phase of growth was fueled by the push toward more sustainable farming practices, which encouraged the use of soil aerators to optimize land productivity. The acceleration in growth can be attributed to the country’s focus on high-tech farming solutions, government policies promoting sustainable agriculture, and the transition to organic farming. The adoption of precision farming tools, including GPS-driven aerators, is poised to increase, especially in both large-scale agricultural and residential sectors.

The United States is projected to achieve a CAGR of 5.8% for 2025–2035, an increase from 5.3% during 2020–2024, remaining below the global average. The earlier phase of growth was driven by the increased adoption of precision farming and advanced soil management techniques. As the market matures, growth is expected to continue at a moderate pace, supported by the continued shift toward sustainable farming practices, particularly in organic agriculture. With large-scale farms seeking efficiency in land management, the role of soil aerators is expected to expand, but at a slower rate compared to other regions. Investments in equipment modernization and environmental regulations are expected to further boost adoption.

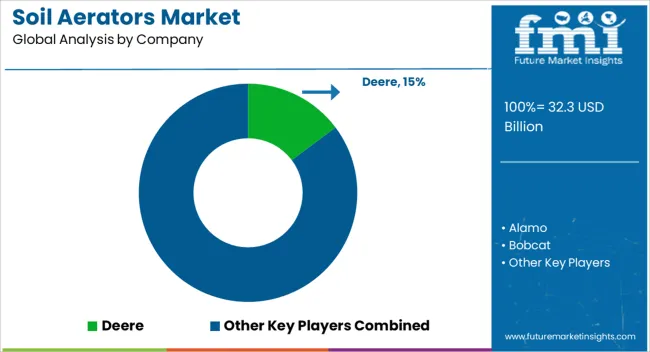

The soil aerators market features several prominent global and regional players, such as Deere, Alamo, Bobcat, Briggs & Stratton, Bucher, Evers Agro, Kenney Machinery, Kondex, Kubota, Lemken, Northstar Attachments, Orthman, Rata Industries, Salford, and Toro. These companies compete by offering diverse, high-performance soil aerators tailored for agricultural and residential use. Deere, a leader in agricultural equipment, is known for its wide range of soil aeration tools and advanced precision farming technologies. Kubota, with its strong presence in the machinery sector, offers aerators designed for use in large-scale farms and landscaping applications. Bobcat and Toro are also significant players, providing versatile machines for both commercial and residential lawn care. Briggs & Stratton, primarily recognized for its engines, also supplies reliable and durable soil aeration equipment. Other competitors like Lemken and Salford emphasize advanced land management solutions, integrating aeration tools into larger farming systems for improved efficiency. Meanwhile, companies like Northstar Attachments and Kondex specialize in providing high-quality attachments for tractors and other farming machinery, enhancing the utility of soil aerators. Competition in the sector is shaped by product innovation, performance reliability, and regional market needs, with key strategies focusing on expanding product portfolios and enhancing customer service networks globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 32.3 Billion |

| Product Type | Soil aerating equipment, Primary tillage equipment, Secondary tillage equipment, and Weeding equipment |

| Mechanism | Mechanical and Pneumatic |

| Mobility | Mounted and Trailed |

| Price | Medium, Low, and High |

| End Use | Agriculture, Commercial, Municipalities & Government agencies, and Others (horticulture etc.) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Deere, Alamo, Bobcat, Briggs & Stratton, Bucher, Evers Agro, Kenney Machinery, Kondex, Kubota, Lemken, Northstar Attachments, Orthman, Rata Industries, Salford, and Toro |

| Additional Attributes | Dollar sales, market share by region and product type, growth drivers, emerging trends, competitive landscape, and customer preferences. This data helps in identifying strategic opportunities, market segmentation, and potential threats. |

The global soil aerators market is estimated to be valued at USD 32.3 billion in 2025.

The market size for the soil aerators market is projected to reach USD 62.3 billion by 2035.

The soil aerators market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in soil aerators market are soil aerating equipment, primary tillage equipment, secondary tillage equipment and weeding equipment.

In terms of mechanism, mechanical segment to command 71.8% share in the soil aerators market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Soil Erosion Testing Market Size and Share Forecast Outlook 2025 to 2035

Soil Health Nano-Sensors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Soil Moisture Sensor Market Size and Share Forecast Outlook 2025 to 2035

Soil Hardening Agent Market Size and Share Forecast Outlook 2025 to 2035

Soil Field Testing Equipment Market Growth - Trends & Forecast 2025 to 2035

Soil Testing Market Growth - Trends & Forecast 2025 to 2035

Soil Stabilization Material Market Outlook 2025 to 2035

Soil Testing Kit Market Growth - Trends & Forecast 2025 to 2035

Soil Treatment Chemicals Market

Soil Inoculants Market

Soil Sampling Services Market

Soil Stabilizers Market

Soil Testing, Inspection, and Certification Market Growth – Forecast 2017-2027

Anti-Soiling Coating Market Growth - Trends & Forecast 2025 to 2035

Impact Soil Tester Market Size and Share Forecast Outlook 2025 to 2035

Silicon Soil Conditioner Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Professional Potting Soil Market Size and Share Forecast Outlook 2025 to 2035

Lawn Aerators Market

Wastewater Treatment Aerators Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA