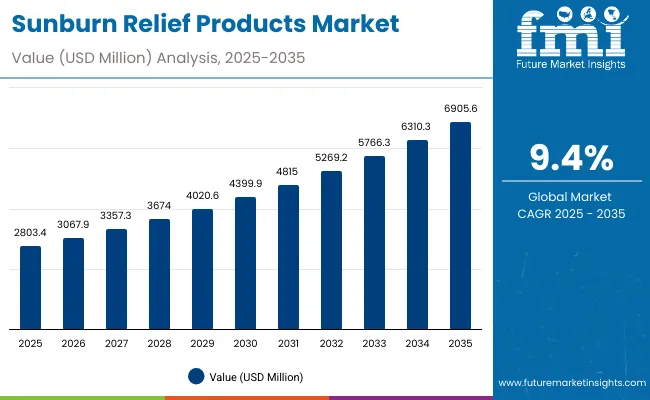

The Sunburn Relief Products Market is expected to record a valuation of USD 2,803.4 million in 2025 and USD 6,905.6 million in 2035, with an increase of USD 4,102.2 million, which equals a growth of 146% over the decade. The overall expansion represents a CAGR of 9.4% and more than a 2X increase in market size.

Sunburn Relief Products Market Key Takeaways

| Metric | Value |

|---|---|

| Sunburn Relief Products Market Estimated Value in 2025E | USD 2,803.4 million |

| Sunburn Relief Products Market Forecast Value in 2035F | USD 6,905.6 million |

| Forecast CAGR (2025 to 2035) | 9.4% |

During the first five-year period from 2025 to 2030, the market increases from USD 2,803.4 million to USD 4,399.9 million, adding USD 1,596.5 million, which accounts for 39% of the total decade growth. This phase records steady adoption of OTC after-sun gels, sprays, and lotions, driven by consumer demand for quick relief and hydration. Cooling/soothing products dominate this period as they cater to over 51% of applications, with aloe vera emerging as the leading active ingredient.

The second half from 2030 to 2035 contributes USD 2,505.7 million, equal to 61% of total growth, as the market jumps from USD 4,399.9 million to USD 6,905.6 million. This acceleration is powered by rising consumer preference for fragrance-free and dermatologist-tested claims, premium hydrogel patches, and the penetration of e-commerce channels across emerging markets. Natural actives like panthenol and vitamin E also gain share, while Asia-Pacific markets such as China and India outpace mature regions with CAGRs of 18.8% and 20.8%, respectively.

From 2020 to 2024, the Sunburn Relief Products Market grew steadily as OTC after-sun products gained traction, particularly in North America and Europe. Growth during this period was driven by aloe-based gels and moisturizing lotions, which became household staples for mild to moderate sunburn treatment.

The competitive landscape was dominated by multinational consumer health and skincare brands such as Beiersdorf (Nivea Sun, Eucerin), Johnson & Johnson (Aveeno, Neutrogena), and Edgewell (Banana Boat, Hawaiian Tropic). Differentiation relied on ingredient credibility (aloe vera, panthenol, hydrocortisone), dermatologist-tested claims, and wide retail distribution. E-commerce was emerging but still secondary, contributing less than 15% of market value.

Demand for Sunburn Relief Products is projected to reach USD 2,803.4 million in 2025, with a forecast value of USD 6,905.6 million by 2035. The revenue mix will shift as fragrance-free and sensitive-skin formulations grow to nearly 50% share, while e-commerce and specialty retail accelerate channel penetration.

Traditional mass-market leaders face rising competition from dermocosmetic players (La Roche-Posay, Bioderma) and lifestyle sun-care brands (Sun Bum, Solarcaine) offering premium, clean-label, and reef-friendly positioning. The competitive advantage is moving away from basic after-sun moisturization toward ecosystem strength built on ingredient innovation, multi-claim positioning (cooling + soothing + repair), and recurring seasonal bundles through digital platforms.

One strong reason for market growth is the intensification of global UV exposure levels caused by climate change and extreme heat events. Rising frequency of heatwaves in regions like North America, Southern Europe, and Asia-Pacific has increased the incidence of sunburns, driving higher seasonal demand for quick-relief products. Consumers are no longer restricting purchases to summer months; they are stocking products year-round, especially in regions where sun intensity remains high across multiple seasons.

Another key growth driver is the shift toward multifunctional after-sun formulations that combine cooling, soothing, and repair properties in one product. Manufacturers are integrating active ingredients like aloe vera, panthenol, and vitamin E into fragrance-free and sensitive-skin safe lines.

This appeals to consumers seeking targeted efficacy for inflamed skin without harsh additives. The innovation pipeline, particularly in hydrogel patches and spray-based formats, is expanding the premium product base and attracting dermatology-oriented buyers.

Function, product type, active ingredient, claim, end user, channel, and region segment the market. Functions include cooling/soothing, moisturizing, and repair, highlighting key areas of consumer need. Product types cover aloe vera gels, after-sun lotions, sprays or mists, and balms for varied applications. Based on active ingredient, segmentation includes aloe vera, panthenol, menthol/cooling actives, vitamin E, and botanical blends. In terms of claim, categories encompass fragrance-free, natural/organic, dermatologist-tested, and vegan.

End users include households, clinics, spas, and travel kits. Sales channels span pharmacies/drugstores, mass retail, e-commerce, and specialty beauty retail. Regionally, the scope covers North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa, with country-level analysis for the USA, China, India, Japan, Germany, the UK, Brazil, and South Africa.

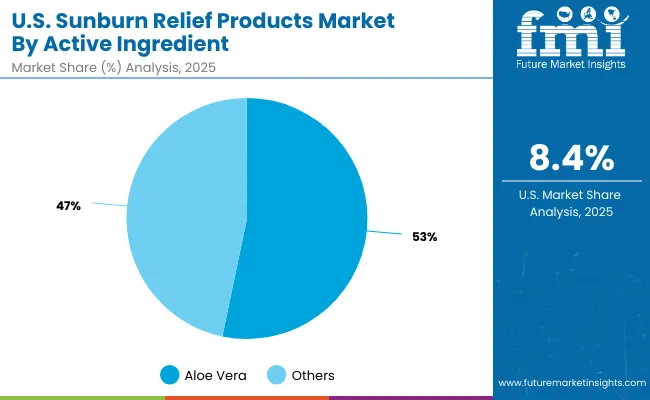

| Active Ingredient | Value Share % 2025 |

|---|---|

| Aloe vera | 52.5% |

| Others | 47.5% |

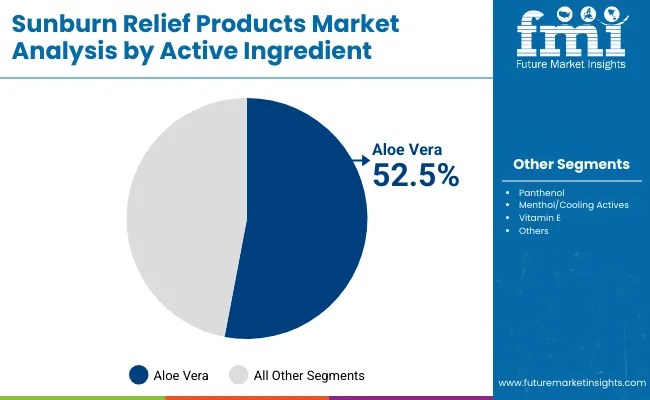

The aloe vera segment is projected to contribute 52.5% of the Sunburn Relief Products Market revenue in 2025, maintaining its lead as the dominant active ingredient category. This leadership is driven by aloe’s strong consumer recognition, trusted soothing effect, and cultural acceptance across both mature and emerging markets.

Aloe-based gels and creams have become the first-choice product for mild to moderate burns, supported by high OTC availability in pharmacies and mass retail. Innovation in stabilized aloe formulations and clean-label, preservative-free variants further strengthens its dominance. Aloe vera is expected to remain the cornerstone of after-sun care over the forecast period.

| Function | Value Share % 2025 |

|---|---|

| Cooling/soothing | 51.5% |

| Others | 48.5% |

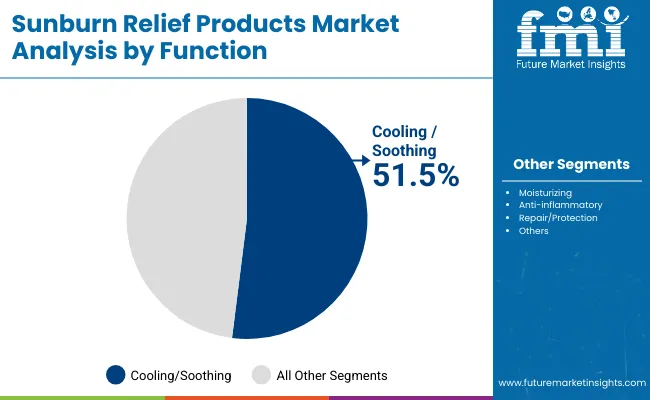

The cooling/soothing segment is forecasted to hold 51.5% of the market share in 2025, led by its role in providing instant relief from burning, redness, and discomfort. Consumers favor cooling gels, sprays, and mists for their fast-acting benefits, particularly after outdoor activities, beach exposure, and sports events.

The growth of this segment is supported by the incorporation of menthol, panthenol, and hydrogel technologies that enhance the cooling sensation and extend hydration. With seasonal heatwaves and rising UV indexes increasing the incidence of acute sunburns, cooling/soothing products are expected to retain their leading position across global markets.

| Claim | Value Share % 2025 |

|---|---|

| Fragrance-free | 49.5% |

| Others | 50.5% |

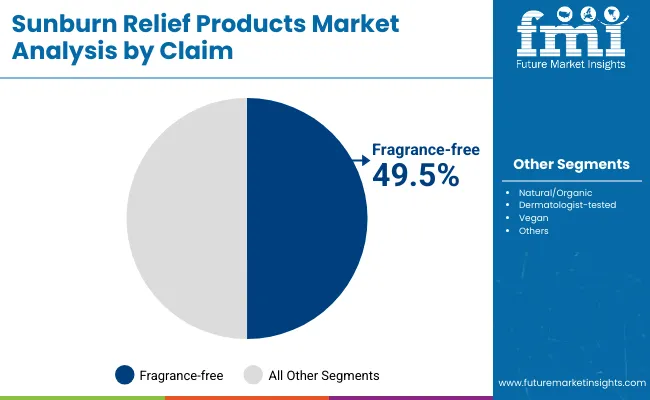

The fragrance-free segment is projected to account for 49.5% of the Sunburn Relief Products Market revenue in 2025, establishing it as one of the most influential claim categories. This preference stems from consumer sensitivity toward irritants, with post-burn skin requiring gentle, hypoallergenic care. Brands leveraging fragrance-free claims are gaining stronger traction in dermatology channels and among parents seeking safe after-sun care for children.

Product development is increasingly aligning with this trend, combining fragrance-free positioning with vegan, reef-friendly, and dermatologist-tested assurances. As sensitive-skin demand continues to grow, fragrance-free sunburn relief products are expected to expand their share across both premium and mass-market price tiers.

Rising Heatwaves and UV Exposure

The increasing frequency of heatwaves and higher UV index levels are directly driving demand for sunburn relief products. Regions such as North America, Europe, and Asia-Pacific are experiencing longer summers with more extreme temperatures, which heightens the risk of sunburn among outdoor workers, travelers, and beachgoers.

This shift is expanding sales beyond traditional summer months, encouraging year-round stocking. As awareness of UV-related skin damage grows, consumers are prioritizing immediate-relief products like aloe gels, sprays, and hydrogel patches.

Premiumization through Clean-Label and Sensitive-Skin Claims

Consumer preference is shifting toward formulations that combine safety, efficacy, and sustainability, fueling growth in fragrance-free, dermatologist-tested, and reef-friendly products. Sensitive-skin safe positioning is especially appealing in sunburn care, where irritated skin requires non-irritating, gentle solutions.

This trend is encouraging manufacturers to launch premium SKUs with transparent labeling, vegan claims, and natural ingredients such as aloe vera, panthenol, and vitamin E. Premiumization enables higher margins while capturing the rising middle-class segment in Asia-Pacific and affluent buyers in Western markets.

Regulatory Scrutiny of Active Ingredients

Strict regulations on the use of certain topical anesthetics, preservatives, and corticosteroids act as a restraint for the market. Products containing lidocaine or hydrocortisone often require clear labeling, usage restrictions, and in some regions, pharmacist guidance for safe dispensing.

This limits product positioning flexibility and slows innovation cycles. Moreover, heightened consumer awareness of potentially harmful additives has pushed brands to reformulate, raising production costs. Such regulatory and compliance pressures restrict rapid expansion in certain markets and can delay product launches.

Expansion of E-commerce and Seasonal Bundling

A defining trend is the rapid rise of e-commerce as a distribution channel, with brands increasingly offering seasonal bundles that combine sunscreens with after-sun products. Subscription models for summer months, quick delivery options, and online-exclusive SKUs are expanding consumer reach.

Social media campaigns highlight travel kits, hydrogel patches, and multipacks, creating cross-selling opportunities. In emerging markets like China and India, online platforms are accelerating penetration, while in mature regions, digital channels allow premium brands to differentiate with personalized routines and refill programs.

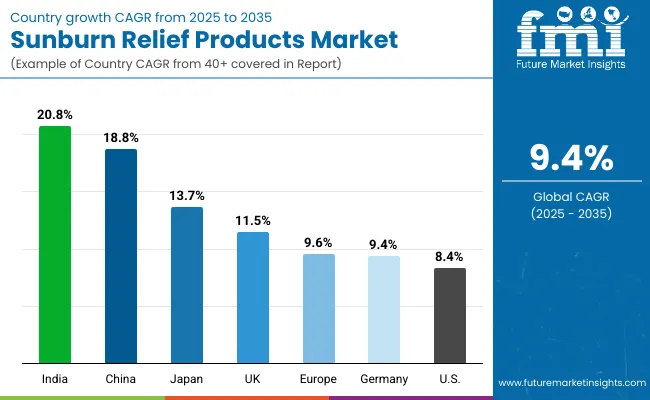

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 18.8% |

| USA | 8.4% |

| India | 20.8% |

| UK | 11.5% |

| Germany | 9.4% |

| Japan | 13.7% |

The global Sunburn Relief Products Market shows a clear regional disparity in growth, strongly influenced by climate severity, consumer skincare preferences, and retail expansion.

Asia-Pacific emerges as the fastest-growing region, anchored by India at 20.8% CAGR and China at 18.8% CAGR. India’s rapid acceleration is fueled by rising disposable incomes, growing outdoor leisure activities, and widening pharmacy penetration. Clean-label, aloe-based gels and sprays are gaining traction among urban consumers. China’s surge reflects heightened skincare awareness, premiumization of OTC after-sun lines, and explosive growth of e-commerce platforms that drive seasonal bundling and subscription sales.

Europe maintains strong momentum, led by the UK at 11.5% CAGR and Germany at 9.4% CAGR. Warmer summers, stricter cosmetic regulations, and demand for dermatologist-tested, fragrance-free products underpin growth. Premium dermocosmetic players such as La Roche-Posay, Bioderma, and Eucerin capitalize on consumer trust and pharmacy dominance in distribution. Japan records a CAGR of 13.7%, supported by innovation in hydrogel patches, sensitive-skin formulations, and strong consumer preference for biotech-enhanced actives like panthenol and vitamin E.

North America shows moderate expansion, with the USA at 8.4% CAGR. The market is relatively mature, but steady growth is driven by lifestyle-focused brands (Banana Boat, Coppertone, Neutrogena) and innovation in spray-based delivery formats. Growth is also linked to rising awareness of sun-related skin damage among children and seniors, pushing higher household stocking rates during peak summer.

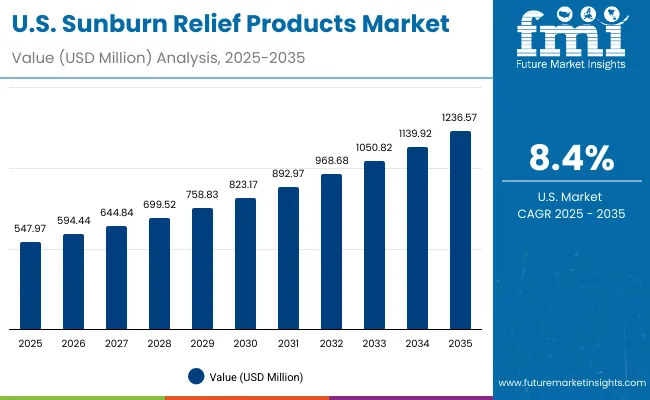

| Year | USA Sunburn Relief Products Market (USD Million) |

|---|---|

| 2025 | 547.97 |

| 2026 | 594.44 |

| 2027 | 644.84 |

| 2028 | 699.52 |

| 2029 | 758.83 |

| 2030 | 823.17 |

| 2031 | 892.97 |

| 2032 | 968.68 |

| 2033 | 1,050.82 |

| 2034 | 1,139.92 |

| 2035 | 1,236.57 |

The Sunburn Relief Products Market in the United States is projected to grow at a CAGR of 8.4% from 2025 to 2035, with total value rising from USD 547.97 million in 2025 to USD 1,236.57 million in 2035. Growth is led by the increasing incidence of heatwaves, heightened consumer awareness of UV damage, and the shift toward dermatologist-tested, fragrance-free, and sensitive-skin formulations.

Pharmacies and drugstores remain the dominant distribution channel, though e-commerce is accelerating, especially through multipacks and seasonal bundles. Premium dermocosmetic players are gaining share, leveraging consumer trust in safety and efficacy.

The Sunburn Relief Products Market in the United Kingdom is expected to grow at a CAGR of 11.5% from 2025 to 2035, supported by rising awareness of UV-related skin damage, hotter summer conditions, and premium skincare adoption. Consumers are increasingly shifting toward dermatologist-tested and fragrance-free formulations, with aloe-based gels and after-sun lotions leading adoption.

Pharmacies and supermarkets dominate retail distribution, but e-commerce is expanding through multipacks, seasonal kits, and loyalty-driven online platforms. Premium dermocosmetic players such as La Roche-Posay, Bioderma, and Eucerin are gaining share due to strong pharmacist endorsement and consumer trust.

India is witnessing rapid growth in the Sunburn Relief Products Market, which is forecast to expand at a CAGR of 20.8% through 2035, the highest among major global markets. Rising disposable incomes, expanding middle-class lifestyles, and increased outdoor leisure are fueling demand for affordable aloe vera gels, sprays, and after-sun lotions.

Penetration is no longer limited to metros; pharmacies and mass retail in tier-2 and tier-3 cities are reporting double-digit sales growth. Educational campaigns highlighting the dangers of UV exposure, coupled with seasonal peaks during vacations and festivals, are strengthening market adoption. E-commerce platforms are accelerating expansion through low-cost bundles and subscription models.

The Sunburn Relief Products Market in China is expected to grow at a CAGR of 18.8% from 2025 to 2035, making it one of the fastest-expanding markets globally. Growth is fueled by rising awareness of UV-related skin conditions, increased outdoor leisure activities, and rapid expansion of e-commerce platforms.

Aloe vera gels and cooling sprays dominate demand, with strong traction among younger consumers seeking quick relief and sensitive-skin safe solutions. Premiumization is evident as dermocosmetic players introduce fragrance-free and dermatologist-tested lines, while domestic brands compete aggressively on price through online marketplaces.

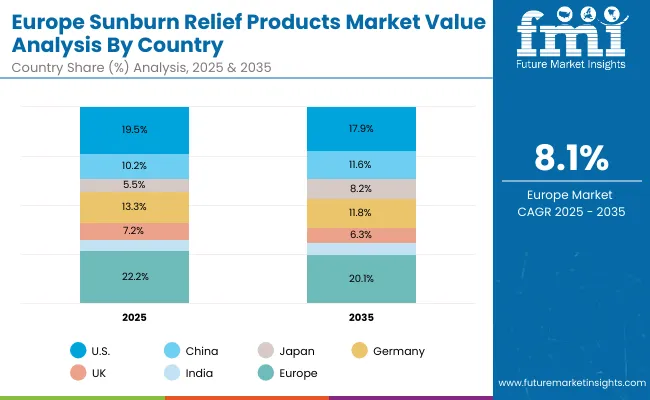

| Country | 2025 Share (%) |

|---|---|

| USA | 19.5% |

| China | 10.2% |

| Japan | 5.5% |

| Germany | 13.3% |

| UK | 7.2% |

| India | 4.5% |

| Country | 2035 Share (%) |

|---|---|

| USA | 17.9% |

| China | 11.6% |

| Japan | 8.2% |

| Germany | 11.8% |

| UK | 6.3% |

| India | 5.1% |

The Sunburn Relief Products Market in Germany is projected to grow at a CAGR of 8.1% from 2025 to 2035, increasing from USD 372.9 million in 2025 to USD 814.9 million in 2035. Germany’s growth is supported by strong consumer trust in pharmacy-driven distribution, where brands like Eucerin, La Roche-Posay, and Bioderma dominate.

Stricter EU cosmetic regulations reinforce demand for fragrance-free, dermatologist-tested, and sensitive-skin formulations. Rising incidence of heatwaves, combined with increased travel and leisure, is boosting year-round adoption of aloe vera gels, cooling sprays, and moisturizing lotions.

| USA by Active Ingredient | Value Share % 2025 |

|---|---|

| Aloe vera | 53.3% |

| Others | 46.7% |

The Sunburn Relief Products Market in Germany is projected to grow at a CAGR of 8.1% between 2025 and 2035, expanding from USD 372.9 million in 2025 to USD 814.9 million in 2035. Germany’s strong pharmacy-led distribution network and a consumer base that prioritizes dermatologist-tested, fragrance-free, and sensitive-skin formulations support growth.

Leading brands such as Eucerin, Bioderma, and La Roche-Posay benefit from pharmacist endorsements and compliance with EU cosmetic standards, which emphasize clean-label, hypoallergenic, and safe ingredient use. Seasonal heatwaves and increased outdoor leisure activities further amplify demand for aloe vera gels, cooling sprays, and repair lotions.

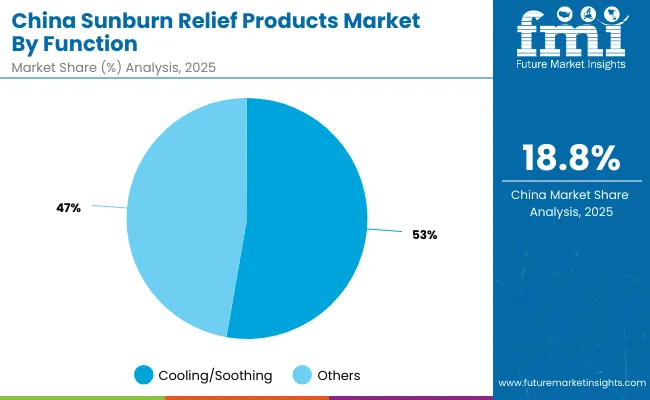

| China by Function | Value Share % 2025 |

|---|---|

| Cooling/soothing | 52.5% |

| Others | 47.5% |

The Sunburn Relief Products Market in China is projected to expand at a strong CAGR of 18.8% from 2025 to 2035, one of the highest among global markets. Cooling/soothing products dominate with 52.5% share in 2025, reflecting consumer preference for fast relief through aloe vera gels, cooling sprays, and menthol-based formulations. Demand is being fueled by higher UV exposure during summers, growing middle-class spending power, and strong adoption among younger consumers in coastal and urban areas.

E-commerce platforms such as Tmall, JD.com, and Douyin are transforming access, offering bundled after-sun kits and exclusive travel packs. Domestic players are competing aggressively on price while international dermocosmetic brands build share through dermatologist-tested and fragrance-free positioning. The market’s premiumization path is supported by innovation in hydrogel patches, spray formats, and sensitive-skin safe solutions, catering to rising health-conscious consumers.

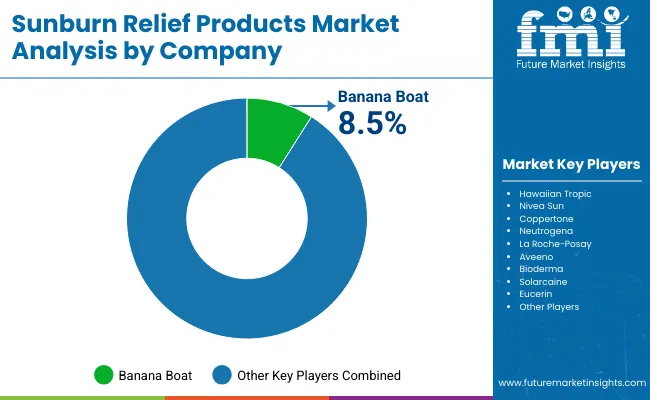

| Company | Global Value Share 2025 |

|---|---|

| Banana Boat | 8.5% |

| Others | 91.5% |

The Sunburn Relief Products Market is moderately fragmented, with global FMCG leaders, dermocosmetic specialists, and lifestyle-focused brands competing across multiple price tiers and channels. Banana Boat, with 8.5% share in 2025, leads globally through strong brand recall, mass-market affordability, and broad distribution in supermarkets, pharmacies, and travel retail.

Mass-market leaders such as Hawaiian Tropic, Coppertone, and Neutrogena leverage established sun-care portfolios, pairing prevention and after-sun care to capture seasonal demand. These players rely on multi-channel availability and aggressive summer marketing campaigns.

Dermocosmetic specialists including La Roche-Posay, Bioderma, Aveeno, and Eucerin are gaining traction through fragrance-free, dermatologist-tested, and sensitive-skin safe claims, making them the preferred choice in pharmacies and among health-conscious consumers. Their clinical positioning and regulatory compliance support steady premiumization. Lifestyle and niche brands such as Solarcaine and Sun Bum differentiate through spray-based formats, hydrogel innovations, and reef-friendly or vegan formulations, resonating strongly with younger, eco-conscious demographics and online shoppers.

Competitive differentiation is shifting from basic after-sun moisturization toward multi-functional formulations, premium ingredient integration, and e-commerce exclusivity. Subscription models, bundled seasonal kits, and clean-label certifications are becoming key levers for sustained growth.

Key Developments in Sunburn Relief Products Market

| Item | Value |

|---|---|

| Quantitative Units | USD 2,803.4 Million |

| Function | Cooling/soothing, Moisturizing, Anti-inflammatory, Repair/protection |

| Product Type | Aloe vera gels, After-sun lotions, Sprays/mists, Balms |

| Active Ingredient | Aloe vera , Panthenol , Menthol/cooling actives, Vitamin E |

| Channel | Pharmacies/drugstores, Mass retail, E-commerce, Specialty beauty retail |

| Claim | Natural/organic, Fragrance-free, Dermatologist-tested, Vegan |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Banana Boat, Hawaiian Tropic, Nivea Sun, Coppertone, Neutrogena, La Roche- Posay , Aveeno, Bioderma , Solarcaine , Eucerin |

| Additional Attributes | Dollar sales by function and active ingredient, adoption trends in cooling/soothing and fragrance-free formulations, rising demand for aloe vera -based gels and spray formats, sector-specific growth in pharmacies, e-commerce, and specialty beauty retail, premiumization through dermatologist-tested and sensitive-skin safe claims, regional trends shaped by heatwaves and UV exposure, and innovations in hydrogel patches, panthenol blends, and clean-label formulations. |

The global Sunburn Relief Products Market is estimated to be valued at USD 2,803.4 million in 2025.

The market size for the Sunburn Relief Products Market is projected to reach USD 6,905.6 million by 2035.

The Sunburn Relief Products Market is expected to grow at a 9.4% CAGR between 2025 and 2035.

The key product types in the Sunburn Relief Products Market are Aloe vera gels, After-sun lotions, Sprays/mists, and Balms.

In terms of function, the Cooling/soothing segment is expected to command the largest share at 51.5% in the Sunburn Relief Products Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cold Relief Roll-On Market Analysis by Application, Distribution Channel, and Region through 2035

Stress-Relief Skincare Market Size and Share Forecast Outlook 2025 to 2035

Eczema Relief Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Stress Relief Supplement Market Analysis by Source, Form, Category and Distribution Channel Through 2035

Redness-Relief Skincare Market Size and Share Forecast Outlook 2025 to 2035

Pressure Relief Dressing Market Size and Share Forecast Outlook 2025 to 2035

Disaster Relief Logistics Market Size and Share Forecast Outlook 2025 to 2035

Pressure Relief Valve Market Size and Share Forecast Outlook 2025 to 2035

Pressure Relief Valve (PRV) Market

Itchy Skin Relief Lotions Market Size and Share Forecast Outlook 2025 to 2035

Global Topical Pain Relief Market Insights – Size, Trends & Forecast 2024-2034

Products from Food Waste Industry Analysis in Korea Size, Share and Forecast Outlook 2025 to 2035

Products from Food Waste in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Products from Food Waste Market Analysis - Size, Growth, and Forecast 2025 to 2035

USA Products from Food Waste Market Growth – Trends, Demand & Outlook 2025-2035

Teff Products Market

Detox Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Algae Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pulse Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Products Market Analysis by Product Type, End Use, Distribution Channel and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA