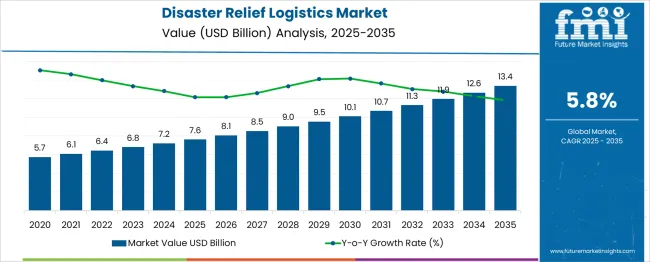

The Disaster Relief Logistics Market is estimated to be valued at USD 7.6 billion in 2025 and is projected to reach USD 13.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period. A peak-to-trough analysis based on extended data from 2020 to 2035 shows that the market value in 2020 stood at USD 5.7 billion, marking the initial point before consistent expansion. Following this, the market experienced steady growth, rising to USD 6.1 billion in 2021, USD 6.4 billion in 2022, and USD 6.8 billion in 2023, indicating gradual normalization and increased adoption of disaster relief logistics services. By 2024, the market further increased to USD 7.2 billion, setting a strong foundation for the forecast period beginning in 2025.

The peak projected for 2035 is USD 13.4 billion, marking a total increase of USD 7.7 billion from the 2020 value and demonstrating a growth multiplier of approximately 2.4 times over the 15-year span. The initial half of the forecast period, from 2020 to 2027, contributes USD 3.1 billion to this growth, while the latter half adds USD 4.6 billion, reflecting a back-weighted growth trajectory. This pattern is driven by rising global incidents of natural disasters, increasing focus on emergency preparedness, and investments in resilient supply chain infrastructure. Manufacturers and service providers focusing on rapid deployment capabilities, integration of digital technologies, and coordination with governmental and humanitarian agencies are expected to capitalize on this expanding market opportunity.

| Metric | Value |

|---|---|

| Disaster Relief Logistics Market Estimated Value in (2025 E) | USD 7.6 billion |

| Disaster Relief Logistics Market Forecast Value in (2035 F) | USD 13.4 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The disaster relief logistics market is expanding due to the increasing frequency and severity of natural disasters, growing humanitarian crises, and the need for efficient coordination of emergency response. Governments, NGOs, and private logistics providers are working together to optimize supply chain networks that can quickly mobilize resources under extreme conditions.

Real-time tracking, pre-positioned inventories, and multi-modal distribution strategies are becoming essential tools to enhance delivery speed and minimize disruption. The integration of geospatial intelligence, warehouse automation, and public-private coordination is driving systemic improvements in disaster readiness and responsiveness.

Additionally, climate-related events and geopolitical tensions have led to a stronger emphasis on localized sourcing, route optimization, and infrastructure resilience, all of which are transforming traditional relief logistics models.

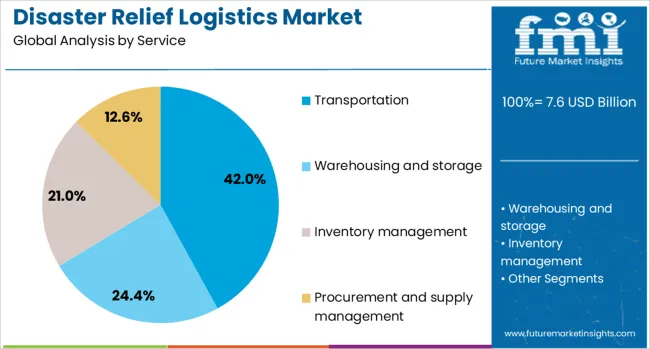

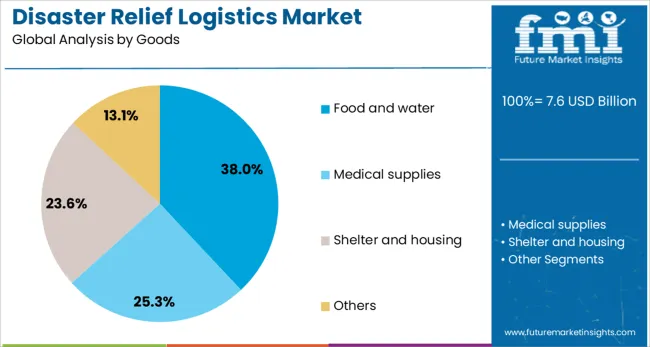

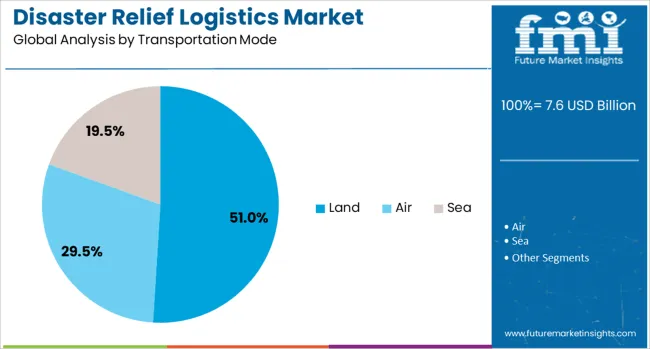

The disaster relief logistics market is segmented by service, goods, transportation modeend-user, and geographic regions. By service of the disaster relief logistics market is divided into Transportation, Warehousing and storage, Inventory managementProcurement and supply management. In terms of goods of the disaster relief logistics market is classified into Food and water, Medical supplies, Shelter and housingOthers. Based on transportation mode of the disaster relief logistics market is segmented into Land, AirSea. By end-user of the disaster relief logistics market is segmented into Government agencies, Non-Governmental Organizations (NGOs), Military organizationsCommercial enterprises. Regionally, the disaster relief logistics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Transportation is projected to hold 42.00% of the total market share in 2025, making it the largest service category within disaster relief logistics. This is driven by the urgent need to move goods quickly from centralized hubs to affected areas, often across challenging terrains and under limited visibility.

Land, air, and sea transport options must be coordinated efficiently, with land transport taking priority due to flexibility and reach. The ability to rapidly deploy trucks, vans, and off-road vehicles is critical for last-mile delivery of essential supplies.

Furthermore, strategic partnerships with third-party logistics providers and military transport assets enable scalable and time-sensitive operations during both rapid-onset and prolonged crises.

Food and water are expected to account for 38.00% of the total goods distributed in the disaster relief logistics market by 2025, making this the leading segment. These essentials form the core of emergency relief efforts, particularly in the first 72 hours after a disaster event.

Pre-packaged, non-perishable food items and potable water solutions are prioritized to stabilize affected populations and prevent secondary crises like disease outbreaks. Innovations in packaging, shelf-life extension, and purification technologies have further enabled the storage and efficient deployment of these critical supplies.

International aid frameworks and donor-driven logistics programs also emphasize food and water security as primary response objectives, reinforcing their position as the largest goods segment.

Land transport is anticipated to dominate the market with a 51.00% share in 2025, making it the most utilized transportation mode in disaster relief logistics. Its flexibility in reaching remote or infrastructure-damaged regions makes it indispensable for ground-level response operations.

Trucks, all-terrain vehicles, and even manual transport methods like carts are used extensively in last-mile delivery. Land-based logistics operations are also generally less weather-dependent compared to air or sea transport, allowing for greater reliability during adverse conditions.

Additionally, partnerships with local carriers, road network mapping, and modular transport solutions have made land transport both adaptable and scalable for diverse emergency contexts.

Disaster relief logistics relies on integrated planning, partnerships, and digital optimization to ensure timely response during emergencies. Growth is driven by demand for real-time visibility and coordinated global frameworks.

The disaster relief logistics landscape is becoming more intricate due to the surge in climate-induced calamities, geopolitical tensions, and health emergencies. Stakeholders must coordinate across multiple agencies and jurisdictions, which requires highly adaptive supply chains. Quick mobilization of resources is a priority, and real-time tracking systems have become a core component of effective operations. Multimodal transportation solutions are favored to overcome infrastructure disruptions and ensure timely delivery. Warehousing strategies now emphasize forward positioning of essential goods to minimize delays during the onset of disasters. As the frequency of unpredictable events grows, efficient coordination and preparedness have emerged as critical success factors for achieving effective relief distribution worldwide.

The market is witnessing greater emphasis on partnerships between governmental agencies, NGOs, and private logistics providers. These alliances enhance resource availability and operational capacity during large-scale emergencies. Joint exercises and simulation programs are being conducted to test preparedness levels and identify gaps in response mechanisms. Such collaborations are fostering shared use of infrastructure and digital platforms, improving cost efficiency in resource allocation. The inclusion of third-party logistics companies enables access to advanced freight networks and specialized transport equipment. This interconnected approach has strengthened the ability to deliver aid promptly, even in regions where infrastructure remains compromised during natural or man-made disasters.

Real-time visibility in disaster logistics has become indispensable for achieving timely intervention. Companies are adopting advanced tracking systems to monitor cargo movement, inventory status, and delivery timelines. Predictive analytics plays a role in anticipating demand surges, optimizing stock placement, and planning evacuation logistics in high-risk zones. Such digital integration minimizes delays by addressing supply bottlenecks early. Geospatial data and AI-based forecasting help assess route viability and resource allocation. Although the adoption of these tools requires investment, their role in reducing operational inefficiencies and saving lives has made them essential components of modern disaster relief strategies globally.

Logistical operations during disasters face persistent challenges due to damaged transport routes, congested ports, and insufficient storage facilities. These disruptions elevate delivery times and increase overall costs. Relief agencies often resort to premium freight services and air transport, which strain budgets. Maintaining pre-positioned stocks in strategic hubs offers partial relief but requires significant capital expenditure. Fuel price volatility and fragmented supply networks add further complexity, making cost control a pressing concern. Despite these constraints, organizations are adopting innovative packaging methods and lightweight materials to maximize payload efficiency, ensuring essential goods reach affected populations with minimal resource wastage during crisis events.

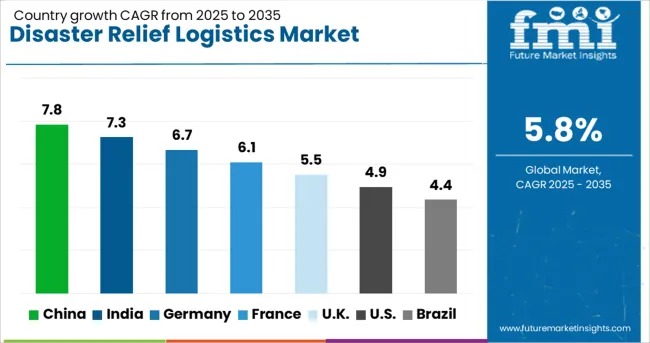

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

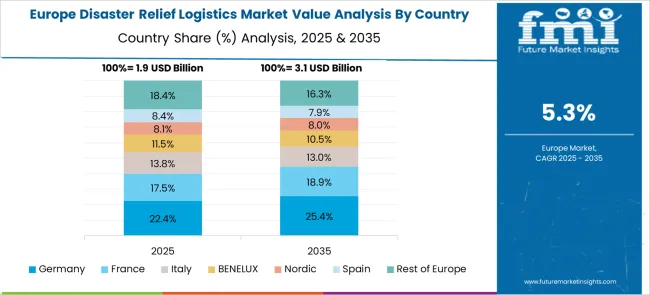

The disaster relief logistics market is projected to grow globally at a CAGR of 5.8% from 2025 to 2035, supported by heightened climate-related risks, geopolitical instability, and an increased focus on pre-positioning resources in vulnerable regions. China leads with a CAGR of 7.8%, driven by frequent large-scale natural disasters, expanded emergency response infrastructure, and government investments in disaster preparedness programs. India follows at 7.3%, fueled by recurring flood and cyclone events, urban migration challenges, and rapid expansion of regional logistics capabilities to support emergency relief. France records 6.1%, benefitting from integrated defense and civil protection frameworks that prioritize rapid mobilization and collaboration with private logistics partners. The United Kingdom grows at 5.5%, with emphasis on enhancing emergency warehousing and digital coordination platforms, while the United States reaches 4.9%, reflecting steady modernization of disaster management systems despite mature infrastructure and high compliance costs. The analysis covers over 40 global markets, highlighting these regions as benchmarks for policy development, infrastructure investment, and technology integration to improve speed and efficiency in disaster relief operations.

China is projected to register a CAGR of 7.8% for 2025–2035, up from an estimated 6.6% during 2020–2024, maintaining its position well above the global average of 5.8%. This increase is attributed to the country’s frequent exposure to floods, typhoons, and seismic events, which necessitate robust logistics infrastructure and rapid deployment systems. Government-driven initiatives for centralized stockpiling of relief materials and expansion of dedicated emergency corridors have further strengthened operational efficiency. Investments in multimodal transport networks, including rail-air integration, enhance resilience during disaster events. The growing role of predictive analytics and automation in regional hubs has elevated China’s preparedness for high-risk scenarios, making it a benchmark market in emergency logistics globally.

India is forecasted to achieve a CAGR of 7.3% from 2025–2035, up from approximately 6.1% recorded during 2020–2024, outpacing the global growth average. The rise is influenced by recurring floods, cyclones, and regional health emergencies, which have underlined the need for scalable and agile logistics networks. Expansion of cold chain infrastructure for temperature-sensitive aid, coupled with the government’s investment in disaster-ready warehouses, has improved response times significantly. Partnerships between public agencies and private logistics providers ensure optimized resource utilization, reducing bottlenecks during crises. Additionally, adoption of drone-based last-mile delivery in remote regions has accelerated the transition toward technology-enabled humanitarian response strategies.

France is expected to post a CAGR of 6.1% during 2025–2035, up from nearly 5.0% during 2020–2024, reflecting steady growth driven by EU disaster resilience policies and national risk management programs. Strategic initiatives for cross-border cooperation within the EU have facilitated faster mobilization of aid resources, especially for climate-induced events like floods and wildfires. Adoption of integrated control centers equipped with real-time monitoring systems has improved command efficiency during crisis scenarios. France has emphasized strengthening stockpiling for medical supplies and emergency shelters to address sudden surges in demand. This systematic approach ensures that disaster relief logistics remains an integral component of national and regional emergency preparedness.

The United Kingdom is projected to grow at a CAGR of 5.5% for 2025–2035, up from around 4.6% during 2020–2024, indicating moderate acceleration compared to the global average of 5.8%. This improvement is linked to government initiatives for modernizing emergency warehousing, strengthening transportation resilience, and enhancing digital coordination platforms. Increased reliance on integrated communication tools for real-time data sharing across agencies has reduced logistical delays. The UK is focusing on maintaining contingency inventory hubs to prepare for high-impact weather events and infrastructure disruptions. Strategic collaborations with private freight operators ensure continuity of supply chains, even during severe disruptions, positioning the UK as a proactive market in disaster management planning.

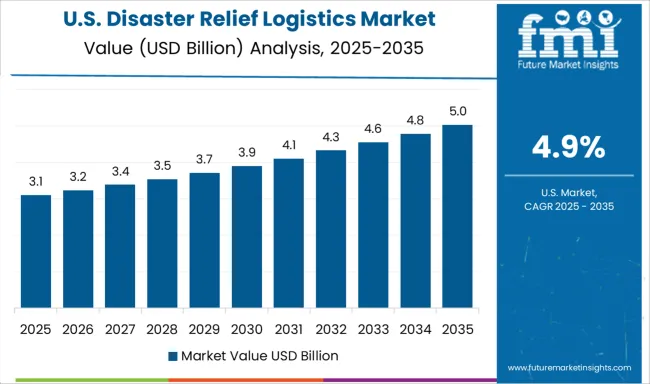

The United States is anticipated to record a CAGR of 4.9% from 2025–2035, up from approximately 4.1% during 2020–2024, reflecting moderate but steady growth. This increase stems from renewed emphasis on climate resilience planning and modernization of existing emergency logistics systems. Investments in AI-driven forecasting tools, improved fleet management technologies, and real-time cargo tracking platforms have enhanced operational efficiency. The federal government’s collaborations with third-party logistics providers enable optimized resource deployment across multiple disaster zones. Integration of unmanned aerial systems for supply drops and expansion of automated warehouses have reinforced disaster preparedness measures in high-risk states prone to hurricanes and wildfires.

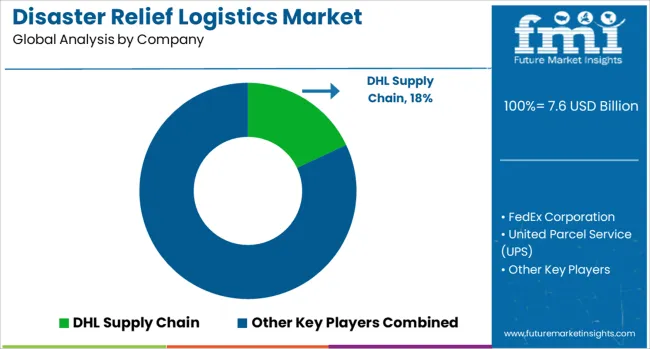

The disaster relief logistics market is dominated by global logistics leaders and integrated service providers, including DHL Supply Chain, FedEx Corporation, United Parcel Service (UPS), DB Schenker, Kuehne + Nagel, Nippon Express, Maersk Group, XPO Logistics, C.H. Robinson, and Agility. These companies compete on their ability to deliver rapid-response solutions, multimodal transport capabilities, and technology-driven visibility for critical aid distribution during emergencies. DHL Supply Chain is recognized for its specialized disaster response teams and pre-positioning strategies that ensure continuity in humanitarian operations across high-risk regions. FedEx and UPS leverage extensive air freight networks and express delivery systems, enabling timely movement of essential supplies during natural disasters and conflict zones. DB Schenker and Kuehne + Nagel have strengthened their positions by integrating digital tracking platforms and predictive analytics into relief supply chains, ensuring resource optimization under challenging conditions.

Nippon Express focuses on leveraging its Asia-Pacific footprint to provide scalable solutions for disaster-prone markets, while Maersk Group emphasizes ocean freight and intermodal solutions for bulk shipments of food, medicine, and temporary shelters. XPO Logistics and C.H. Robinson prioritize asset-light models combined with strong partner networks to provide flexible capacity during peak emergency demand. Agility, known for its experience in humanitarian logistics, collaborates extensively with NGOs and international agencies to deliver cost-effective, customized solutions in regions with limited infrastructure. The competitive environment is characterized by high operational costs, complex regulatory compliance, and the need for rapid adaptability to unpredictable events. Strategic priorities include investing in real-time visibility tools, expanding pre-disaster warehousing, and forming partnerships with humanitarian organizations and government agencies. Growth will depend on leveraging advanced technology, improving collaboration frameworks, and scaling operations to meet rising global demand for efficient, responsive disaster relief logistics solutions.

Strategies focus on expanding multimodal transport capacity, pre-positioning inventories in high-risk zones, and leveraging digital tracking for real-time visibility. Partnerships with NGOs and government agencies are being prioritized to improve coordination and response speed. Investments in automation, drone delivery for remote areas, and predictive analytics are enhancing operational resilience. Companies are also focusing on scalable warehouse networks and flexible freight solutions to manage surging demand during critical disaster events.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.6 Billion |

| Service | Transportation, Warehousing and storage, Inventory management, and Procurement and supply management |

| Goods | Food and water, Medical supplies, Shelter and housing, and Others |

| Transportation Mode | Land, Air, and Sea |

| End-User | Government agencies, Non-Governmental Organizations (NGOs), Military organizations, and Commercial enterprises |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DHL Supply Chain, FedEx Corporation, United Parcel Service (UPS), DB Schenker, Kuehne + Nagel, Nippon Express, Maersk Group, XPO Logistics, C.H. Robinson, and Agility |

| Additional Attributes | Dollar sales, share by service type and region, demand forecasts, competitive positioning, regulatory requirements, capacity expansion trends, cost structures, digital integration impact, and opportunities in government contracts and NGO partnerships. |

The global disaster relief logistics market is estimated to be valued at USD 7.6 billion in 2025.

The market size for the disaster relief logistics market is projected to reach USD 13.4 billion by 2035.

The disaster relief logistics market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in disaster relief logistics market are transportation, warehousing and storage, inventory management and procurement and supply management.

In terms of goods, food and water segment to command 38.0% share in the disaster relief logistics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Logistics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Logistics Robots Market Size and Share Forecast Outlook 2025 to 2035

Logistics Visibility Software Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in the Logistics Packaging Industry

Logistics Outsourcing Market Analysis - Growth & Forecast 2025 to 2035

AI-Enhanced Disaster Recovery – Ensuring Business Continuity

Logistics Visualization System Market

Logistics Automation Market

Cash Logistics Market Size and Share Forecast Outlook 2025 to 2035

Rail Logistics Market Size and Share Forecast Outlook 2025 to 2035

Intralogistics Automation Solutions Market Size and Share Forecast Outlook 2025 to 2035

Cold Relief Roll-On Market Analysis by Application, Distribution Channel, and Region through 2035

Drone Logistics & Transportation Market Size and Share Forecast Outlook 2025 to 2035

Smart Logistics Services Market Size and Share Forecast Outlook 2025 to 2035

Green Logistics Market Size and Share Forecast Outlook 2025 to 2035

Event Logistics Market Size and Share Forecast Outlook 2025 to 2035

Cloud Logistics Market Insights – Demand & Growth Forecast 2025 to 2035

Stress-Relief Skincare Market Size and Share Forecast Outlook 2025 to 2035

Eczema Relief Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Timber Logistics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA