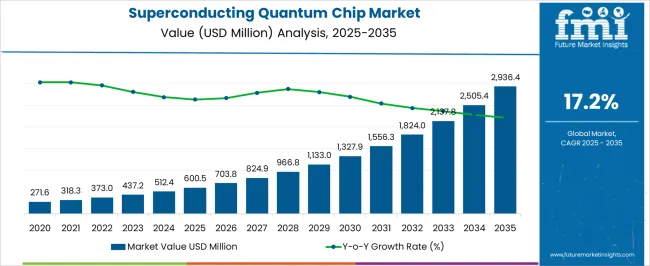

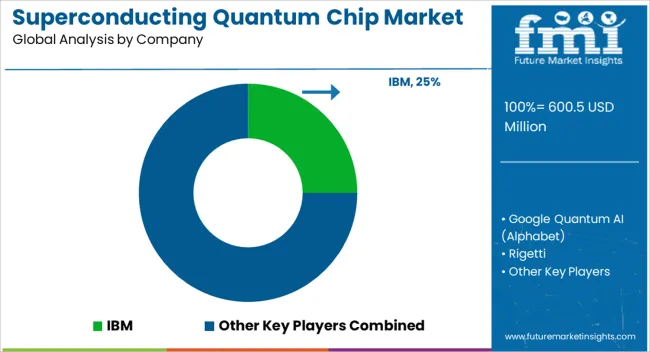

The superconducting quantum chip market is estimated to be valued at USD 600.5 million in 2025 and is projected to reach USD 2936.4 million by 2035, registering a compound annual growth rate (CAGR) of 17.2% over the forecast period.

This translates into an absolute dollar sales opportunity of over USD 2.3 billion during the forecast period. Early expansion between 2025 and 2030 is expected to be driven by increasing adoption of quantum computing in industries such as financial modeling, drug discovery, logistics optimization, and advanced materials research. Superconducting chips are being recognized as the leading architecture in quantum development due to their scalability, stability, and compatibility with existing semiconductor fabrication techniques. This phase of growth underscores how demand is rising not only from research institutions but also from corporations exploring commercial applications of quantum computing.

From 2030 to 2035, the market is forecast to accelerate further as quantum computing transitions from pilot projects to broader deployment across enterprise and government systems. The value increase from just over USD 600 million in 2025 to nearly USD 3 billion by 2035 reflects strong momentum in investment and adoption. The absolute sales opportunity highlights the shift toward practical commercialization of superconducting architectures, with global players competing to secure leadership positions in quantum hardware. The surge in demand will be fueled by breakthroughs in error correction, processor scaling, and integration into cloud-based computing platforms. This growth curve suggests that superconducting quantum chips will remain at the forefront of the quantum race, positioning them as a critical component in shaping the future of computational power.

| Metric | Value |

|---|---|

| Superconducting Quantum Chip Market Estimated Value in (2025 E) | USD 600.5 million |

| Superconducting Quantum Chip Market Forecast Value in (2035 F) | USD 2936.4 million |

| Forecast CAGR (2025 to 2035) | 17.2% |

The superconducting quantum chip market holds varied shares across multiple technology-oriented parent markets, with its strongest presence in specialized areas linked directly to quantum research. Within the quantum computing hardware market, superconducting quantum chips represent about 40%, since this architecture is currently the leading platform adopted by companies and institutions for building scalable quantum processors. In the advanced semiconductor and microelectronics market, their contribution is close to 3%, reflecting their niche status compared with established silicon-based devices. Within the high-performance computing market, superconducting quantum chips account for nearly 2%, as quantum computing remains an emerging complement to classical supercomputing. In the artificial intelligence hardware acceleration market, their presence is about 1%, given that AI systems are still predominantly powered by GPUs and custom silicon, with quantum applications only beginning to emerge.

Finally, within the research and development infrastructure for quantum technologies, superconducting chips hold approximately 35%, highlighting their dominant role in funded projects, national initiatives, and academic research targeting quantum breakthroughs. Taken together, these percentages show that superconducting quantum chips command significant influence in quantum-specific domains, particularly in hardware development and R&D, while maintaining a smaller footprint in larger electronics and computing markets. Their rising share in quantum-focused ecosystems underlines their importance as the most commercially advanced path toward practical quantum systems, even as other architectures such as trapped ions and photonics continue to compete for long-term scalability.

The market is advancing rapidly as global demand for high-performance quantum computing solutions intensifies. Technological breakthroughs in superconducting circuit design and cryogenic engineering have enhanced the scalability and stability of qubit systems, making them more viable for commercial and research applications. Strategic investments by technology companies, coupled with strong government funding for quantum research, are propelling development and accelerating time to market for advanced quantum processors.

The increasing focus on solving complex computational problems in areas such as cryptography, materials science, and financial modeling is further boosting adoption. Cloud-based quantum services are enabling broader access to superconducting quantum chips, lowering entry barriers for enterprises and academic institutions.

As performance metrics such as coherence time, gate fidelity, and qubit connectivity continue to improve, the market is expected to witness sustained growth The convergence of hardware innovation with quantum software development is creating new opportunities, solidifying the position of superconducting quantum chips in the next generation of computing technologies.

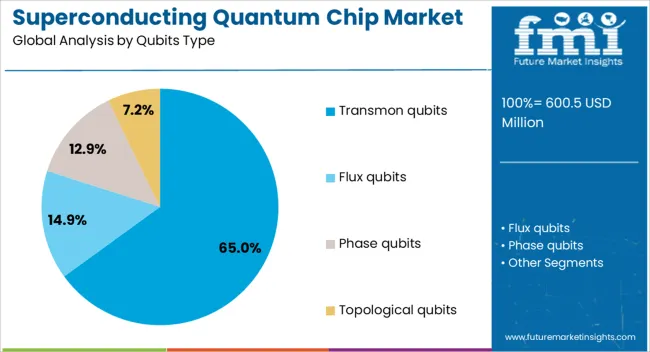

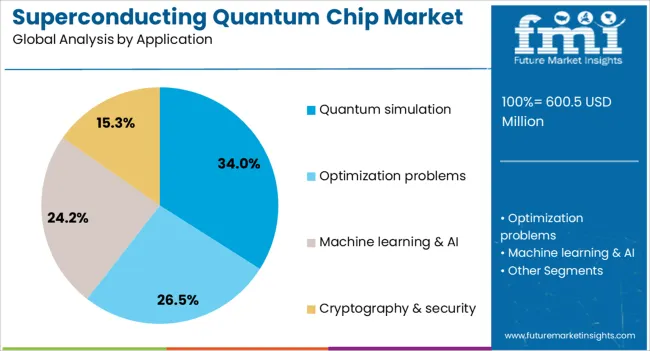

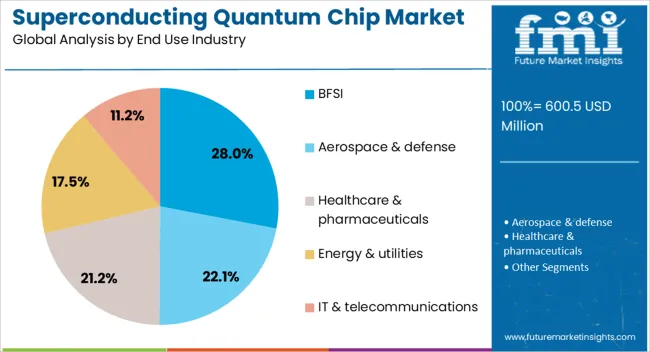

The superconducting quantum chip market is segmented by qubits type, application, end use industry, and geographic regions. By qubits type, superconducting quantum chip market is divided into transmon qubits, flux qubits, phase qubits, and topological qubits. In terms of application, superconducting quantum chip market is classified into quantum simulation, optimization problems, machine learning & AI, and cryptography & security. Based on end use industry, superconducting quantum chip market is segmented into BFSI, aerospace & defense, healthcare & pharmaceuticals, energy & utilities, and IT & telecommunications. Regionally, the superconducting quantum chip industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The transmon qubits segment is projected to hold 65% of the superconducting quantum chip market revenue share in 2025, making it the leading qubit type. This dominance has been supported by the segment’s ability to offer longer coherence times and reduced sensitivity to charge noise, which are critical for stable quantum operations.

Transmon qubits have been preferred in large-scale superconducting architectures due to their compatibility with established fabrication techniques and integration into scalable chip designs. Their performance stability under varying operational conditions has contributed to their widespread use in both research and commercial systems.

The adaptability of transmon qubits for multi-qubit coupling and their suitability for high-fidelity quantum gates have also reinforced their position Continued advancements in error correction protocols and microwave control techniques are enhancing their efficiency, ensuring their role remains central in the evolution of superconducting quantum computing platforms.

The quantum simulation segment is anticipated to command 34% of the superconducting quantum chip market revenue share in 2025, emerging as the leading application. This leadership position has been driven by the increasing demand to model complex quantum systems that are beyond the capabilities of classical computing. Quantum simulation has been vital in fields such as materials science, chemistry, and condensed matter physics, where precise modeling can accelerate innovation.

Superconducting quantum chips, equipped with high-performance qubits, have enabled the execution of large-scale simulations with enhanced accuracy and speed. The growing focus on developing quantum algorithms tailored for simulation tasks has further boosted adoption.

Additionally, advancements in qubit interconnectivity and coherence have strengthened the effectiveness of superconducting platforms for simulation purposes As industries seek solutions for intricate optimization and modeling challenges, the role of quantum simulation is expected to expand, ensuring its sustained prominence within the market.

The BFSI segment is expected to account for 28% of the superconducting quantum chip market revenue share in 2025, making it the dominant end-use industry. Growth in this segment has been fueled by the sector’s need for advanced computational capabilities to enhance risk analysis, portfolio optimization, fraud detection, and cryptographic security.

The potential of superconducting quantum chips to process vast datasets and perform highly complex calculations in near real time has been particularly attractive to financial institutions. As concerns over the security of classical encryption methods grow, the BFSI industry has been proactive in exploring quantum-resistant cryptography and quantum key distribution, leveraging the processing power of superconducting platforms.

Strategic collaborations between quantum hardware developers and major banks or financial technology companies have accelerated pilot projects and early implementations The ability to gain a competitive edge through faster, more accurate computational modeling is expected to keep BFSI at the forefront of end-use adoption in this market.

The superconducting quantum chip market is gaining momentum as demand for advanced quantum computing intensifies across research institutions and commercial sectors. Opportunities are expanding in finance, pharmaceuticals, and logistics, while trends highlight qubit scaling, hybrid architectures, and improved error correction. Challenges persist in fabrication precision, cryogenic infrastructure, and competition from rival platforms. In my opinion, companies that strengthen fabrication capabilities, reduce system complexity, and establish strategic partnerships will secure a dominant role, accelerating the transition from prototypes to commercially impactful superconducting quantum computing systems.

Demand for superconducting quantum chips has been accelerated by their central role in building scalable quantum computers. These chips leverage superconducting circuits to achieve qubits with longer coherence times and faster gate operations compared to competing platforms. Research institutions, cloud service providers, and technology giants are driving adoption for complex simulations, cryptography, and optimization problems. In my opinion, demand will continue to rise as governments and private investors fund quantum initiatives, recognizing superconducting chips as a leading contender for realizing practical quantum computing breakthroughs.

Opportunities are expanding in both research-driven projects and emerging commercial use cases. Universities and national laboratories are collaborating with semiconductor companies to refine chip fabrication and reduce error rates. Commercial opportunities are growing in finance, pharmaceuticals, and logistics, where quantum computing is expected to solve large-scale computational challenges. I believe companies that form strategic alliances and invest in fabrication capabilities will capture significant opportunities, as end-users increasingly seek early access to quantum hardware and cloud-based quantum computing services powered by superconducting chips.

Trends in the superconducting quantum chip market focus on scaling qubit counts and advancing error correction methods. Players are racing to develop architectures with hundreds of qubits, while research continues on surface codes and novel circuit designs to improve stability. Hybrid systems that combine superconducting chips with other quantum technologies are also gaining traction. In my opinion, these trends indicate the market’s progression from experimental prototypes toward practical, commercial-grade systems, where advances in scaling and error correction will define competitive advantage among global technology leaders.

Challenges remain in chip fabrication precision, as superconducting quantum circuits require ultra-pure materials and advanced lithography methods. Maintaining cryogenic environments adds complexity and costs, restricting accessibility for smaller institutions and startups. Energy consumption and system stability issues during prolonged operations pose additional hurdles. Competition from alternative quantum platforms such as trapped ions and photonics further intensifies the landscape. In my assessment, only players that overcome fabrication bottlenecks and develop efficient cryogenic infrastructure will sustain long-term leadership, while others may struggle to scale commercially viable superconducting quantum chip systems.

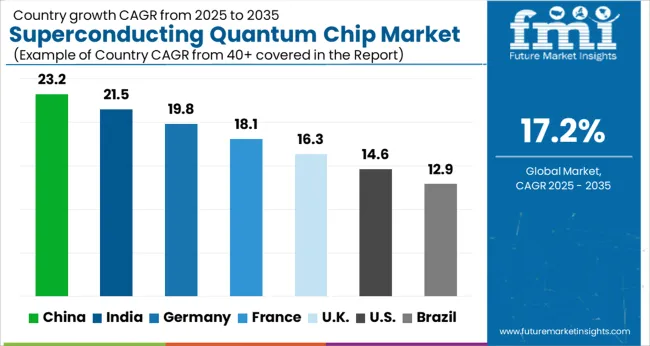

| Country | CAGR |

|---|---|

| China | 23.2% |

| India | 21.5% |

| Germany | 19.8% |

| France | 18.1% |

| UK | 16.3% |

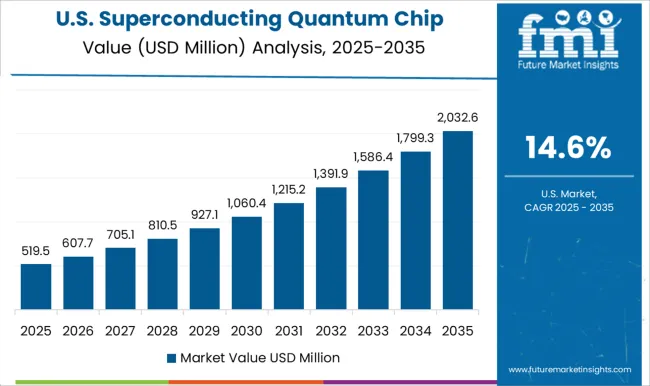

| USA | 14.6% |

| Brazil | 12.9% |

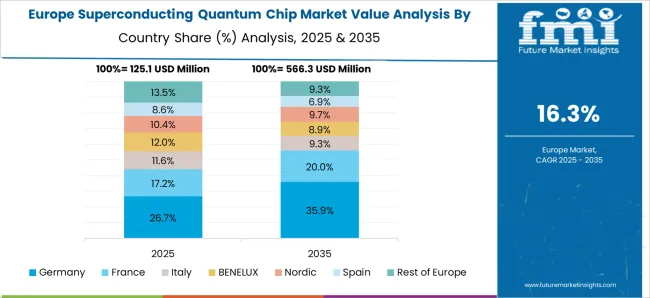

The global superconducting quantum chip market is projected to grow at a CAGR of 17.2% from 2025 to 2035. China leads with a growth rate of 23.2%, followed by India at 21.5%, and France at 18.1%. The United Kingdom records a growth rate of 16.3%, while the United States shows the slowest growth at 14.6%. Expansion is driven by heavy investments in quantum computing R&D, strategic government initiatives, and collaborations between universities, research labs, and technology companies. Emerging markets such as China and India are accelerating adoption through state-backed programs and infrastructure investments, while developed economies like the USA, UK, and France emphasize breakthroughs in scalable qubit design, error correction, and integration into commercial computing systems. This analysis incorporates insights from 40+ countries, highlighting top markets for reference.

The superconducting quantum chip market in China is projected to grow at a CAGR of 23.2%. Strong government support, massive R&D funding, and rapid expansion of domestic quantum computing labs are driving growth. China is heavily investing in scaling up qubit performance and developing commercial-ready quantum processors. Collaborations between national universities, research institutes, and technology firms are fueling breakthroughs in fabrication and chip integration. With strategic goals to reduce dependency on foreign technologies, China is strengthening its position as a global leader in superconducting quantum chips.

The superconducting quantum chip market in India is expected to grow at a CAGR of 21.5%. Government initiatives such as the National Quantum Mission are propelling investments in quantum technologies. Growing collaborations with global technology companies and academic institutions are enhancing India’s ecosystem for superconducting quantum research. Expanding digital infrastructure and demand for high-performance computing solutions in fields such as cybersecurity, pharmaceuticals, and AI are fueling adoption. India’s emphasis on building indigenous capabilities in semiconductor and chip design is positioning the country as an emerging hub for quantum innovation.

The superconducting quantum chip market in France is projected to grow at a CAGR of 18.1%. France is a key European player in quantum R&D, supported by strong government funding and EU-wide initiatives. National labs and technology firms are focusing on error correction, qubit stability, and scaling challenges in superconducting chips. France’s growing investment in semiconductor facilities and strong academic research in physics and quantum mechanics enhance innovation. With demand rising in industries such as defense, finance, and pharmaceuticals, France is emerging as a strong hub for applied quantum research.

The superconducting quantum chip market in the UK is projected to grow at a CAGR of 16.3%. The UK is advancing through its National Quantum Technologies Programme, with significant investments in chip research and commercialization. Universities and startups are actively collaborating to improve qubit coherence and processor scalability. The defense sector and financial services are key adopters, driving demand for advanced computing applications. The country’s supportive regulatory environment and focus on public-private partnerships ensure that superconducting quantum chip innovations continue to gain traction.

The superconducting quantum chip market in the USA is projected to grow at a CAGR of 14.6%. While growth is slower than in emerging economies, the USA remains a global leader in quantum research and commercialization. Leading technology companies and national labs are pioneering advancements in qubit design, quantum error correction, and cryogenic technologies. Federal initiatives and defense funding continue to support large-scale quantum projects. Strong venture capital interest and partnerships between academia and industry reinforce the USA position as a major hub for quantum innovation, with growing emphasis on transitioning research into commercial applications.

Competition in the superconducting quantum chip market has been led by technology pioneers and specialized startups that continue to shape the pace of hardware progress. IBM has been regarded as a front-runner, with superconducting quantum processors forming the foundation of its roadmap for quantum advantage. Google Quantum AI, operating under Alphabet, has been competing strongly by emphasizing speed and gate fidelity in its superconducting qubit systems, using public demonstrations to signal progress. Rigetti has been positioned as an agile innovator, building superconducting quantum chips tailored for hybrid cloud deployment and collaborative research.

Quantinuum, formed from Honeywell’s quantum division, has been leveraging its industrial heritage to provide highly reliable hardware while pushing partnerships with academic and enterprise users. D-Wave has been focusing on quantum annealing platforms, differentiating itself from gate-based competitors, while simultaneously advancing superconducting hardware for optimization problems. IonQ, although historically associated with trapped ion systems, has been active in positioning its architecture against superconducting rivals, creating a competitive benchmark that influences investment in different modalities. Together, these players have been setting the competitive environment around qubit count, coherence times, error correction progress, and ecosystem integration.

Strategic positioning among these companies has been dictated by credibility in scaling quantum chips and securing industrial partnerships. IBM and Google Quantum AI have been acknowledged as technology leaders, where strong investments in research infrastructure and partnerships with cloud providers have reinforced their influence. Rigetti has been presenting itself as an accessible player, offering superconducting quantum chips to enterprises and researchers through open platforms. Quantinuum has been emphasizing reliability and long-term partnerships, building authority through consistent performance metrics. D-Wave has been steering attention toward practical use cases in logistics, finance, and materials, even as it seeks to refine its superconducting platforms. IonQ has been shaping debate around architectural diversity, highlighting trapped ions as a viable counterpoint while engaging with the superconducting narrative. The market has therefore been shaped by a dual contest of hardware engineering and ecosystem building, with leadership assigned to those that can prove scalability, application relevance, and long-term reliability in superconducting quantum chips.

| Item | Value |

|---|---|

| Quantitative Units | USD 600.5 million |

| Qubits Type | Transmon qubits, Flux qubits, Phase qubits, and Topological qubits |

| Application | Quantum simulation, Optimization problems, Machine learning & AI, and Cryptography & security |

| End Use Industry | BFSI, Aerospace & defense, Healthcare & pharmaceuticals, Energy & utilities, and IT & telecommunications |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | IBM, Google Quantum AI (Alphabet), Rigetti, Quantinuum (Honeywell spin-out), D-Wave Quantum Inc., IonQ Inc. |

| Additional Attributes | Dollar sales by product type (transmon, flux, topological qubits), Dollar sales by application (computing, cryptography, sensing, research), Trends in quantum error correction and scalable architectures, Use in quantum processors and secure communication networks, Growth of government and corporate R&D funding, Regional development clusters in North America, Europe, and Asia-Pacific. |

The global superconducting quantum chip market is estimated to be valued at USD 600.5 million in 2025.

The market size for the superconducting quantum chip market is projected to reach USD 2,936.4 million by 2035.

The superconducting quantum chip market is expected to grow at a 17.2% CAGR between 2025 and 2035.

The key product types in superconducting quantum chip market are transmon qubits, flux qubits, phase qubits and topological qubits.

In terms of application, quantum simulation segment to command 34.0% share in the superconducting quantum chip market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Superconducting Detector Market Size and Share Forecast Outlook 2025 to 2035

Superconducting Materials Market Size and Share Forecast Outlook 2025 to 2035

Superconducting Magnets Market Growth – Trends & Forecast 2025 to 2035

Superconducting Wire Market

Quantum Detector Market Size and Share Forecast Outlook 2025 to 2035

Quantum Cascade Laser Market Size and Share Forecast Outlook 2025 to 2035

Quantum Imaging Devices Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Quantum Sensors Market Size and Share Forecast Outlook 2025 to 2035

Quantum Cascade Lasers Market Growth - Trends & Forecast 2025 to 2035

Quantum Cryptography Market Insights - Growth & Forecast 2025 to 2035

Quantum Computing Market Growth – Trends & Forecast 2025 to 2035

Quantum Dot Market Analysis by Application, End-Use Industry, Material Type, Technology, and Region Through 2035

Quantum Photonics Market Analysis – Growth & Forecast 2024-2034

Post-Quantum Cryptography (PQC) Migration Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Automotive Quantum Computing Market Size and Share Forecast Outlook 2025 to 2035

Integrated Quantum Optical Circuits Market Size and Share Forecast Outlook 2025 to 2035

ADC & DAC In Quantum Computing Market Size and Share Forecast Outlook 2025 to 2035

Photonic Integrated Circuit & Quantum Computing Market - Trends & Forecast 2025 to 2035

Chip-on-the-Tip Endoscopes Market Size and Share Forecast Outlook 2025 to 2035

Chipless RFID Industry Analysis in United States Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA