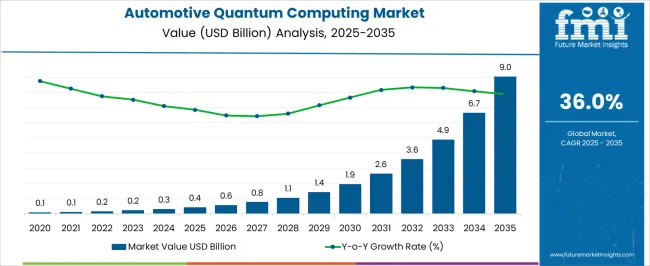

The automotive quantum computing market is projected to experience rapid expansion, increasing from USD 0.4 billion in 2025 to USD 9.0 billion by 2035, corresponding to a remarkable CAGR of 36.0%. Contribution analysis by technology highlights the varying impact of different quantum computing approaches on overall market growth. Superconducting qubits currently constitute the largest segment, driven by their relative maturity, scalability in qubit counts, and compatibility with error-correction protocols.

The initial adoption of superconducting technologies supports early-stage applications in vehicle route optimization, battery management, and predictive maintenance algorithms, contributing substantially to early revenue. Trapped ion quantum computing, though emerging at a smaller scale, demonstrates strong growth potential due to high-fidelity operations and robust qubit coherence, making it increasingly relevant for complex automotive simulations and optimization tasks in design and production.

The adoption of photonic quantum computing technologies, while nascent, is expected to accelerate in the latter half of the forecast period, enabling enhanced data processing capabilities for autonomous vehicle navigation and traffic prediction systems. Hybrid quantum-classical computing solutions also contribute incrementally to revenue, as automotive manufacturers leverage near-term quantum processors integrated with classical high-performance computing infrastructure to reduce computational complexity in logistics and vehicle safety simulations.

The superconducting qubits dominate initial market contributions, while trapped ion, photonic, and hybrid quantum technologies collectively drive accelerating adoption and revenue growth, reflecting a diverse technological landscape shaping the automotive quantum computing sector over the next decade.

| Metric | Value |

|---|---|

| Automotive Quantum Computing Market Estimated Value in (2025 E) | USD 0.4 billion |

| Automotive Quantum Computing Market Forecast Value in (2035 F) | USD 9.0 billion |

| Forecast CAGR (2025 to 2035) | 36.0% |

The automotive quantum computing market represents an emerging segment within the automotive technology and advanced computing industry, emphasizing optimization, simulation, and artificial intelligence driven vehicle development. Within the overall automotive software and computing solutions market, it accounts for about 2.9%, reflecting early adoption by OEMs and R&D teams. In the connected and autonomous vehicle segment, it holds nearly 3.4%, supporting route optimization, battery management, and sensor data processing. Across the automotive simulation and design market, the segment captures 2.7%, enhancing materials modeling, crash simulations, and powertrain optimization.

Within the predictive maintenance and operational analytics category, it represents 2.3%, highlighting applications in fleet management and real-time diagnostics. In the automotive research and innovation ecosystem, it secures 3.1%, emphasizing collaboration with technology providers and research institutions. Recent developments in this market have focused on algorithm optimization, hybrid quantum-classical computing, and industry partnerships. Innovations include quantum computing applications for traffic flow modeling, battery optimization, and autonomous vehicle decision making. Key players are collaborating with automotive manufacturers, semiconductor firms, and quantum computing startups to enhance computational speed and solution accuracy.

Cloud-based quantum platforms and software development kits are enabling broader access for simulation and modeling tasks. The pilot projects in materials discovery and route optimization are accelerating proof of concept deployments.

The automotive quantum computing market is progressing rapidly, propelled by advancements in computational capabilities that address complex optimization and simulation problems in the automotive sector. Industry updates and technology consortium announcements have emphasized growing collaboration between automakers, quantum computing providers, and cloud service companies to develop scalable solutions.

These developments are supported by increasing demand for advanced vehicle routing systems, next-generation autonomous driving algorithms, and battery material simulations for electric vehicles. The adoption of cloud-based quantum computing platforms has lowered entry barriers, enabling broader experimentation and deployment across global automotive players.

Future market expansion is expected to be fueled by progress in quantum algorithms tailored for automotive applications, strategic partnerships for R&D, and integration of hybrid quantum-classical computing systems to solve real-time transportation challenges.

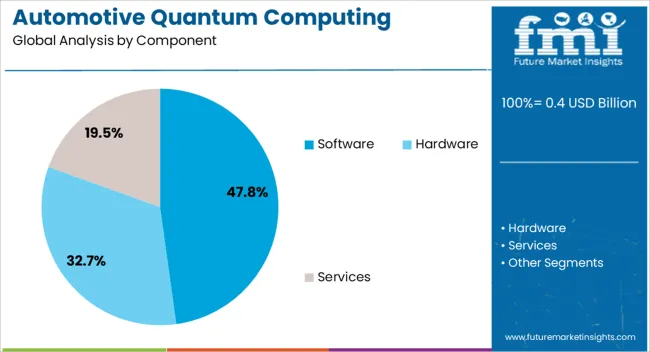

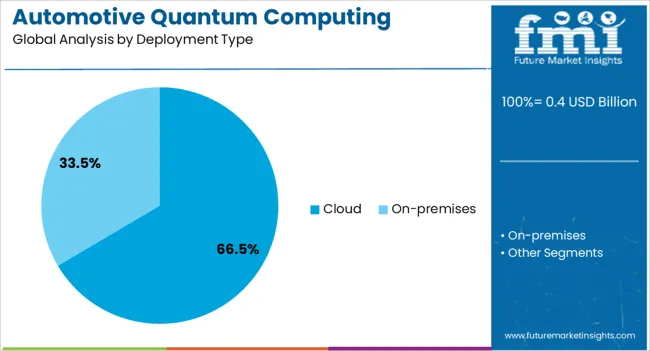

The automotive quantum computing market is segmented by component, deployment type, application, and geographic regions. By component, automotive quantum computing market is divided into Software, Hardware, and Services. In terms of deployment type, automotive quantum computing market is classified into Cloud and On-premises.

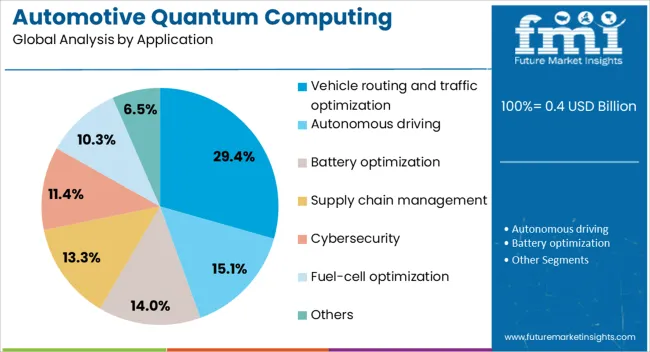

Based on application, automotive quantum computing market is segmented into Vehicle routing and traffic optimization, Autonomous driving, Battery optimization, Supply chain management, Cybersecurity, Fuel-cell optimization, and Others. Regionally, the automotive quantum computing industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Software segment is projected to account for 47.8% of the automotive quantum computing market revenue in 2025, positioning it as the leading component category. Growth in this segment is driven by the development of specialized quantum algorithms designed for automotive optimization, simulation, and machine learning tasks.

Automotive companies have prioritized software investments to leverage cloud-based quantum platforms for problem-solving without the need for in-house quantum hardware. Continuous improvement in programming frameworks, developer toolkits, and simulation environments has enabled faster prototyping of automotive use cases.

As quantum software providers introduce domain-specific solutions for routing optimization, energy efficiency, and materials modeling, the Software segment is expected to remain the most critical value driver in the market.

The Cloud segment is projected to hold 66.5% of the automotive quantum computing market revenue in 2025, maintaining its dominant position. This segment’s leadership is underpinned by the flexibility, scalability, and cost-efficiency of accessing quantum computing resources via cloud platforms.

Automotive enterprises have adopted cloud deployment to test and scale quantum applications without investing in costly on-premise infrastructure. Partnerships between quantum computing firms and major cloud service providers have expanded accessibility, enabling real-time experimentation and collaborative development across geographically dispersed teams.

Cloud-based models also facilitate integration with existing automotive IT ecosystems, supporting seamless deployment of hybrid quantum-classical workflows. As cloud infrastructure continues to evolve, offering higher reliability and lower latency, the Cloud segment is expected to maintain its primary role in enabling quantum adoption in the automotive sector.

The Vehicle Routing and Traffic Optimization segment is projected to capture 29.4% of the automotive quantum computing market revenue in 2025, emerging as a leading application area. Growth in this segment is driven by the increasing need for highly efficient traffic management systems and optimized logistics operations.

Quantum computing algorithms have demonstrated significant potential in solving complex routing problems with multiple constraints, reducing travel time, fuel consumption, and congestion. Automotive manufacturers, fleet operators, and urban mobility planners have initiated pilot projects to integrate quantum-powered routing into smart transportation networks.

As urbanization accelerates and connected vehicle ecosystems expand, the ability of quantum computing to deliver real-time, large-scale optimization is expected to reinforce the importance of this application segment in the automotive industry.

The market has been emerging as a transformative segment within advanced mobility and intelligent vehicle systems. Quantum computing is being explored to solve complex automotive challenges such as optimization of supply chains, traffic flow, battery chemistry simulations, and real-time autonomous vehicle decision-making. Its capability to process massive datasets and perform complex computations at unprecedented speeds is being leveraged for predictive analytics, material discovery, and energy efficiency modeling. The market growth has been supported by the increasing adoption of connected and autonomous vehicles, rising investments in R&D by OEMs, and collaboration with technology firms specializing in quantum hardware and software.

Automotive supply chains have been increasingly challenged by global disruptions, demand fluctuations, and complex logistics. Quantum computing offers the potential to optimize production schedules, inventory management, and distribution networks by processing combinatorial optimization problems far more efficiently than classical systems. Simulations for assembly line configurations, resource allocation, and predictive maintenance are being enhanced with quantum algorithms, improving operational efficiency and reducing downtime. Vehicle manufacturers are also using quantum computing to design modular manufacturing strategies, accommodating diverse vehicle variants and customization requests. By integrating quantum solutions with existing enterprise resource planning systems, automakers can model multiple scenarios simultaneously, resulting in cost-effective, time-efficient, and flexible manufacturing processes. These applications position quantum computing as a strategic tool in strengthening supply chain resilience and production agility.

The development of autonomous and connected vehicles has generated a need for advanced computational frameworks capable of handling massive sensor and telemetry data streams. Quantum computing has been explored to optimize routing, real-time decision-making, and vehicle-to-everything communication, allowing safer and more efficient autonomous navigation. Traffic flow simulations, risk assessment models, and AI-driven path planning are being accelerated using quantum-enhanced algorithms. Furthermore, quantum computing aids in battery management system optimization, energy consumption modeling, and predictive maintenance, enhancing vehicle performance and safety. Collaboration between automotive OEMs and quantum technology providers has enabled prototyping of quantum-assisted simulation platforms, reinforcing the technology’s potential to revolutionize intelligent mobility solutions. The integration of quantum computing into autonomous systems represents a high-value growth area for the automotive sector.

Battery performance, energy density, and thermal management remain critical challenges for electric vehicles, making battery research a key focus for quantum computing applications. Quantum simulations allow precise modeling of molecular interactions, enabling discovery of new materials, electrolytes, and cathode/anode combinations with improved efficiency and durability. Beyond batteries, quantum computing facilitates material design for lightweight structural components, thermal management systems, and coatings, contributing to vehicle energy efficiency and performance. Computational speed and parallel processing capabilities allow faster evaluation of potential compounds compared with classical methods. Automotive firms collaborating with quantum software providers are exploring quantum-enabled molecular simulations to accelerate product development cycles. These capabilities position quantum computing as a strategic innovation driver in electric mobility and next-generation vehicle materials.

Despite potential, the market faces technological, operational, and commercial hurdles. High costs of quantum hardware, limited availability of error-corrected qubits, and complexity of quantum algorithm development are slowing widespread adoption. Integration with existing IT infrastructure and cloud platforms requires expertise and robust cybersecurity frameworks. Standardization of quantum computing solutions for automotive-specific applications is still evolving, and the skill gap in quantum programming presents an additional challenge. The uncertain return on investment and nascent commercial applications may restrain near-term deployment. However, strategic partnerships, pilot projects, and government-supported initiatives are helping OEMs and suppliers to explore use cases. As technology matures, adoption is expected to expand across autonomous systems, battery research, and intelligent manufacturing operations.

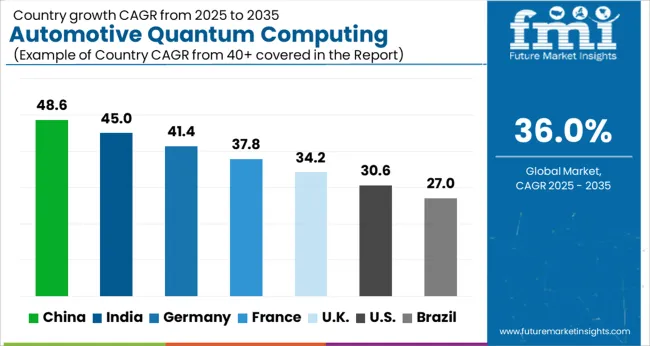

| Country | CAGR |

|---|---|

| China | 48.6% |

| India | 45.0% |

| Germany | 41.4% |

| France | 37.8% |

| UK | 34.2% |

| USA | 30.6% |

| Brazil | 27.0% |

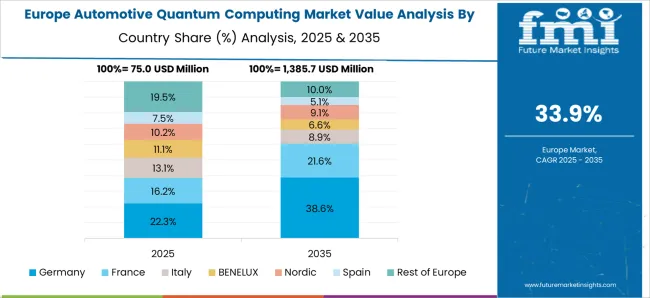

China dominates the market with a forecast growth rate of 48.6%, propelled by substantial investments in research, autonomous vehicle technologies, and AI-driven traffic management systems. India follows at 45.0%, driven by adoption in smart mobility solutions and emerging quantum software development. Germany records 41.4%, supported by integration of quantum computing in automotive design, simulation, and manufacturing processes. The United Kingdom reaches 34.2%, where government-backed research and innovation in vehicle optimization contribute to growth. The United States maintains 30.6%, fueled by developments in autonomous driving, advanced computing platforms, and AI-driven logistics. Together, these countries reflect the forefront of technological adoption, innovation, and market scaling in automotive quantum computing. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is anticipated to grow at a CAGR of 48.6%, driven by increasing adoption of quantum computing technologies for autonomous vehicles and advanced driver-assistance systems. Market expansion is supported by strong government initiatives in research and development for next-generation automotive technologies. Collaborations between automotive OEMs and quantum computing startups are accelerating integration of quantum algorithms for real-time vehicle data processing. Growing investments in AI-enabled quantum platforms for predictive maintenance, traffic optimization, and battery management systems are fueling growth. The market is further propelled by rising consumer interest in connected vehicles and smart mobility solutions. Advanced material simulations for battery development are also enhancing performance. China remains a strategic hub for innovation in quantum computing applications for the automotive sector.

India’s market is projected to expand at a CAGR of 45%, fueled by rising interest in autonomous vehicles and AI-powered driving technologies. Adoption of quantum computing is gaining momentum due to government-backed innovation programs and collaborations with global technology providers. The market is witnessing growth as automotive manufacturers explore quantum-enabled optimization for battery efficiency, traffic management, and predictive maintenance. Investment in research for quantum algorithms tailored to Indian road conditions is creating new opportunities. Partnerships between tech startups and vehicle OEMs are accelerating implementation. The increasing push for connected and intelligent vehicles, along with focus on next-generation mobility solutions, is reinforcing market expansion. Initiatives to train talent in quantum computing for automotive applications are also enhancing capabilities.

Germany is expected to grow at a CAGR of 41.4%, driven by strong automotive engineering capabilities and government support for next-generation technologies. Adoption of quantum computing is enabling real-time processing of vehicle sensor data and simulations for advanced driver-assistance systems. Partnerships between leading automakers and quantum technology firms are facilitating innovative solutions for predictive maintenance and energy-efficient battery management. The market is influenced by growing demand for autonomous and connected vehicles. Research and development investments in quantum computing algorithms for automotive applications are supporting market growth. European initiatives focused on smart mobility and emission reduction are also positively impacting adoption. Germany’s established automotive ecosystem provides an ideal platform for integrating quantum computing into production-grade vehicle technologies.

The United Kingdom’s market is projected to expand at a CAGR of 34.2%, driven by investments in next-generation vehicle technologies and AI integration. Growth is fueled by partnerships between automotive OEMs, research institutions, and quantum technology providers to develop optimized algorithms for autonomous driving. The market is witnessing adoption of quantum-based simulations to enhance battery efficiency, traffic prediction, and vehicle safety features. Government initiatives promoting smart mobility and low-carbon transport solutions are further encouraging adoption. Increasing investments in AI-enabled quantum platforms for real-time vehicle data analysis are also supporting market development. Focus on connected vehicles, predictive maintenance, and traffic optimization is enhancing the commercial viability of quantum computing solutions in the automotive sector.

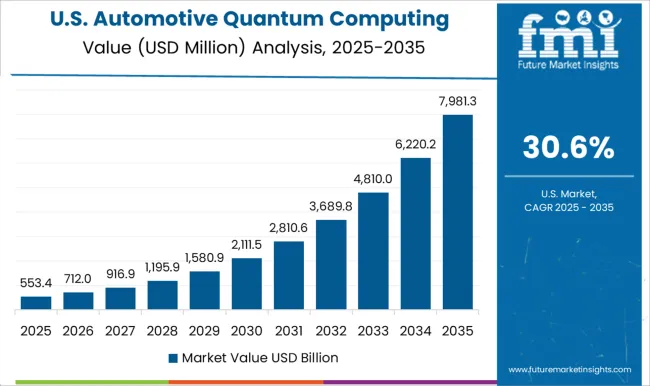

The United States market is expected to grow at a CAGR of 30.6%, supported by rapid adoption of quantum computing for connected, autonomous, and electric vehicles. Growth is influenced by investments from technology giants and automotive OEMs in quantum-enabled AI platforms for predictive maintenance, route optimization, and battery management. Strategic collaborations with quantum computing startups and research institutions are facilitating development of advanced algorithms tailored to real-world driving scenarios. Market expansion is further propelled by the increasing push toward smart mobility, connected vehicle ecosystems, and enhanced vehicle safety. Federal and state support for quantum research and next-generation automotive technologies is strengthening the market landscape. Continuous innovation in vehicle sensor analytics and energy optimization is also driving adoption.

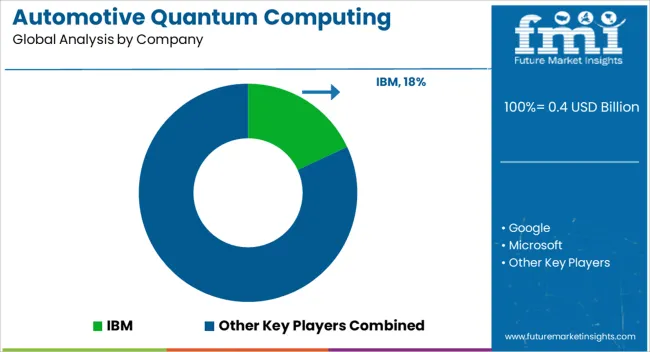

The market is witnessing rapid evolution as automakers and technology firms explore quantum computing to enhance vehicle design, battery optimization, traffic management, and autonomous driving algorithms. IBM and Google lead with robust quantum hardware platforms and cloud-based quantum services, enabling automotive companies to simulate complex systems, optimize logistics, and accelerate material discovery for next-generation batteries. Microsoft provides hybrid quantum-classical solutions through its Azure Quantum platform, offering scalable frameworks for vehicle manufacturers to test and refine quantum algorithms for performance improvements. D-Wave Systems focuses on quantum annealing techniques that facilitate optimization problems in route planning, supply chain management, and energy efficiency.

Rigetti Computing contributes with integrated quantum cloud services designed for simulation and predictive modeling in automotive applications. IonQ specializes in trapped-ion quantum systems, delivering high-precision computation for advanced vehicle simulations and AI integration. Quantinuum merges quantum hardware and software innovations to provide automotive firms with tools for computational chemistry, vehicle system optimization, and real-time analytics. Together, these providers are shaping a transformative landscape where quantum computing supports enhanced efficiency, design innovation, and competitive advantage across the automotive sector.

| Item | Value |

|---|---|

| Quantitative Units | USD 0.4 Billion |

| Component | Software, Hardware, and Services |

| Deployment Type | Cloud and On-premises |

| Application | Vehicle routing and traffic optimization, Autonomous driving, Battery optimization, Supply chain management, Cybersecurity, Fuel-cell optimization, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | IBM, Google, Microsoft, D-Wave Systems, Rigetti Computing, IonQ, and Quantinuum |

| Additional Attributes | Dollar sales by computing solution type and vehicle application, demand dynamics across autonomous, connected, and electric vehicles, regional trends in quantum technology adoption, innovation in processing speed, optimization algorithms, and data security, environmental impact of energy consumption and hardware production, and emerging use cases in traffic optimization, predictive maintenance, and next-generation vehicle design. |

The global automotive quantum computing market is estimated to be valued at USD 0.4 billion in 2025.

The market size for the automotive quantum computing market is projected to reach USD 9.0 billion by 2035.

The automotive quantum computing market is expected to grow at a 36.0% CAGR between 2025 and 2035.

The key product types in automotive quantum computing market are software, hardware and services.

In terms of deployment type, cloud segment to command 66.5% share in the automotive quantum computing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Automotive Actuator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Manifold Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA