The Tartrazine market on a global scale is very diversified, comprised of its competitive presence such as multinational manufacturers, regional producers, niche chemical firms, and private-label suppliers. The market is mostly dominated by multinational corporations like Sensient Technologies, Dynemic Products Ltd., and Neelikon, with a combined dominance of around 65% of the market share.

The companies attributed their success to their strong supply systems, the efficiency of the overall production and distribution model, and the ability of multiple sectors. Regional companies generally in the Asia-Pacific region and Latin America hold a market share of 20%, through the use of cheaper manufacturing technologies and by serving the local market in the food, pharmaceuticals, and cosmetics sectors.

Very few smaller players or boutique firms focusing on the green solution-specific, like the organic or the low-cool variant of tartrazine, hold about 10% of the market. The other 5% is by private-label suppliers or contract manufacturers who are offering cheap substitutes for the domestic markets or to those who are not directly regulated. The level of competitiveness is yet to be termed as moderate as the regulations somewhat affect, the very same rules are in practice.

Global Market Share by Key Players

| Global Market Share, 2025 | Industry Share % |

|---|---|

| Top 3: Sensient Colors LLC, Dynemic Products Ltd., Neelikon Food Dyes & Chemicals Ltd. | 45% |

| Rest of Top 5: Cathay Industries, Sunfoodtech | 20% |

| Next 5 of Top 10: GFS Chemicals Inc., Sigma-Aldrich Co. LLC, Shanghai Dyestuffs Research Institute Co., Ltd., TNC Chemicals Philippines Inc., Denim Colourchem | 20% |

| Emerging & Regional Brands: Koel Colours, Emco Dyestuff Pvt. Ltd., Matrix Pharma Chem, Town End Leeds PLC, Sky and Skylark Industrial Products | 15% |

The Tartrazine market is segmented into Powder and granules. Powdered Tartrazine is in the first place with about 70% market share thanks to its solubility, ease of formulation, and compatibility with wide food and pharmaceutical applications. It is the talked-about choice for industrial production due to its cost-performance ratio and the fact that it can be stored for a long time.

Granule format is in the second place, with an approximate 30% share is limited to specific confectionery and dry mixes, which demand controlled dissolution of their ingredients; the dissolution is to be made by the granule. Alert to the data, only a minor industrial usage exists at that point.

Tartrazine is mostly used in the beverages and candy/confectionery sectors. The candy/confectionery segment is the top combo, with 25% of global turnover driven by rich colors in gummies, sweets, and jellies. The big soft drinks stand is near the top with 20%, powdered mix drinks are fashionable with Tartrazine for the answer of the sight needing it.

Other notable segments are Bakery (15%), Dairy (10%), Snacks & Cereals (8%), Sauces, Soups & Dressings (7%), Fruit Preparations (5%), Meat, Poultry, Fish & Eggs (3%), Potatoes, Pasta & Rice (2%), Pet Food (3%), and others (2%).

Tartrazine producers are having exceptionally good years thanks to innovation, sustainability, and their strong standing towards regulatory dynamics. The leaders have reshaped the foundation of their production by rethinking the sources to place them all over the map and enlarge their product range.

Beyond refocusing on sustainability and profitability, this shift in paradigm in the Tartrazine sector is also about making sure that they operate both in performance and compliance. Look more in-depth at some instances of the principal actors that are forming the industry's future.

Sensient Colors LLC

Sensient stands as the company that has made the largest rush into clean-label and compliance-based color innovations. The trust that Food & pharmaceutical industries place on Sensient is mainly because their synthetic color lines are globally certified, thus the company is effective in the North American and European regions.

Dynemic Products Ltd.

Dynemic is at the forefront in the Asia-Pacific market; the company expands its production capacity while meeting the global needs. The aggressive expansion and low-price game play made them the go to supplier for big buyers and contract manufacturers.

Neelikon Food Dyes & Chemicals Ltd.

Neelikon set itself apart by offering a Tartrazine product that has low impurity levels and is tailored for particular industries like pharmaceuticals and cosmetics. The enterprise, guided by R&D, has entered ultra-high segments and countries with stringent regulations.

Cathay Industries

Cathay is making strategic advancements through vertical integration and backtracking to sourcing raw materials. Their eco-production technology has cut costs while also affirming their position as a central player in Europe and the Middle East.

Sunfoodtech

Food safety has been at the core of Sunfoodtech from the start. Their ISO-certified factories have gained them a foothold in the processed food and beverage segments. The regional supply chain has been optimized and this has improved service efficiency for the medium-sized manufacturers.

Koel Colours Pvt. Ltd.

Koel Colors is getting into the business as a niche player with offers for the specialty pet food and wellness market. They have come up with the innovation of customizable Tartrazine blends that give customers flexibility to comply with the different global markets.

Clean Label & Regulatory Compliance Driving Reformulation

The stringent global food safety regulations are coercive forces behind the manufacturers' development of Tartrazine with low impurities and heavy metal content. Clean-label movements are compelling reformulations anyway; in the EU and North America, they are reshaping the product development pipelines and compliance strategies.

Rise of Custom Blends for Niche Applications

A shortage of green solutions in pharmaceuticals, pet food, and cosmetics is prompting producers to offer application-specific Tartrazine blends. This flexibility is vital to keep up with the changing consumer needs and access to new revenue streams besides traditional food and drink sectors.

The Birth of Sustainable Manufacturing Practices

Building green factories has gained massive popularity, with source manufacturers and companies investing in environmentally sustainable processes, reducing waste, and conserving energy. Green chemistry emerges as a driving force, particularly in Asia and Europe.

Digital Sales & B2B E-Commerce on the Rise

B2B application platforms, among other things, are being utilized to optimize supply chains and provide access to the smaller and midsized manufacturers. The rise of online purchasing, along with the tech support, has transferred the Tartrazine trade to a digital environment.

Asia-Pacific Continues to be the Growth Hub

Owing to the increase in processed food consumption and the expansion of pharmaceutical manufacturing, Asia-Pacific remains the fastest-growing Tartrazine market. The strong local producers, along with the industrialization and regulatory easing, have shifted forward as the primary route of penetration to India, China, and Vietnam.

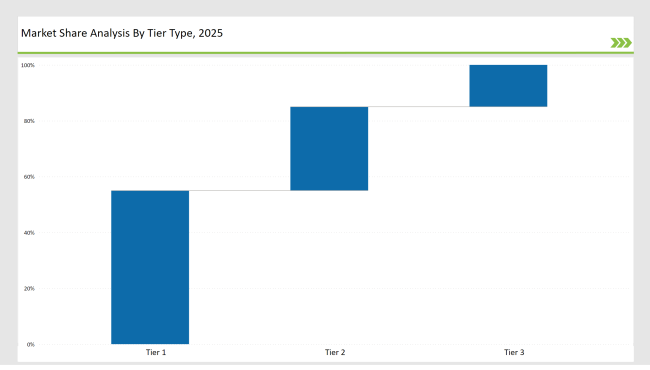

| By Tier Type | Tier 1 |

|---|---|

| Market Share % | 55% |

| Example of Key Players | Sensient Colors LLC, Dynemic Products Ltd., Neelikon Food Dyes & Chemicals Ltd. |

| By Tier Type | Tier 2 |

|---|---|

| Market Share % | 30% |

| Example of Key Players | Cathay Industries, Sunfoodtech, GFS Chemicals Inc. |

| By Tier Type | Tier 3 |

|---|---|

| Market Share % | 15% |

| Example of Key Players | Koel Colours Pvt. Ltd., Emco Dyestuff Pvt. Ltd., Matrix Pharma Chem, Town End Leeds PLC |

| Brand | Key Focus |

|---|---|

| Sensient Colors LLC | Introduced a low-metal, pharmaceutical-grade Tartrazine line for regulatory-heavy markets. |

| Dynemic Products Ltd. | Expanded manufacturing capacity in Gujarat, India, to meet rising global demand. |

| Neelikon | Developed ultra-pure Tartrazine variants tailored for cosmetic and personal care applications. |

| Cathay Industries | Invested in backward integration for dye intermediates to ensure sustainable sourcing. |

| Sunfoodtech | Achieved ISO 22000 certification and launched a new food-grade Tartrazine portfolio. |

| GFS Chemicals Inc. | Enhanced traceability and purity control for Tartrazine used in medical diagnostics. |

| Koel Colours Pvt. Ltd. | Focused on customizable color blends for niche applications like pet food and wellness. |

| Matrix Pharma Chem | Entered strategic partnerships for distribution expansion in Southeast Asia. |

| Emco Dyestuff Pvt. Ltd. | Upgraded R&D infrastructure to develop cleaner and more stable Tartrazine formulations. |

| Town End Leeds PLC | Diversified product range to include both synthetic and nature-identical food dyes. |

Regulations should be followed in all regions.

Brands need to simplify the process by making sure that there is no conflict between their formulations and the global safety regulations, which go through changes, specifically in the EU and North America. Spreading out in product ranges such as low-residue and medical verified options will not only facilitate the branding exercise but will also enhance the brand's life in the market.

Capitalize on Clean Label and Transparency Trends

Taking into consideration that people nowadays are more sensitive to synthetic additives, companies should be clear in their labelling, adopt traceable sourcing, and supply "clean-label" alternatives. Open information and advertising on safe usage can help the food and drink segments keep the consumers' trust.

Customize Offerings for Regional Applications

By focusing on region-specific application development i.e., bright colors for Asia's confections or colored cosmetic applications in Europe Tailored product portfolios increase relevance and penetration in diverse markets.

Leverage E-Commerce and B2B Digital Marketplaces

Broaden digital presence delivery across B2B e-commerce platforms and direct supplier portals. Improving order processing and providing real-time technical support will help you attract SMEs and niche buyers who seek faster and more efficient sourcing.

Adopt sustainability as a key differentiator

Go for eco-friendly manufacturing processes and sustainable packaging. By putting green practices at the forefront of branding and operations, the company will have a stronger impact both in Europe and other premium global markets that are searching for responsible sourcing and transparency in production processes.

The global Tartrazine market is forecasted on innovation and adaptation to changes in regulations in the technology space and other customer perspectives. With the demand for clean labels increasing, manufacturers will be steering towards low-residue and allergen-free formulations achieved through better purification and compliance technologies.

Digital transformation will be the backbone, with B2B e-commerce platforms offering a simple and efficient procurement process for SMEs and enable the creation of more efficient global supply chains. Local customization will go through a second wave, and the firms that integrate cultural preferences and local regulations into color feeders will prosper.

Sustainability will become the norm, with the adoption of eco-friendly production methods, biodegradable packaging, and reduced carbon footprints setting the competitive standard. In underdeveloped markets, the D2B model and localized distribution will take the business to the next level, however, the grown-up markets will be on transparency, traceability, and product differentiation.

As per Form, the industry has been categorized into Powder and Granule.

As per Application, the industry has been categorized into Beverage, Bakery, Snacks, and Cereals, Candy/ Confectionery, Dairy, Fruit Preparations/ Fillings, Meat, Poultry, Fish, and Eggs, Potatoes, Pasta, and Rice, Sauces, Soups, and Dressings, Seasonings, Pet Food and Others.

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

Sensient Colors LLC, Dynemic Products Ltd., and Neelikon lead the market, collectively holding around 45% of the global share.

Regional and emerging brands account for approximately 15% of the global Tartrazine market in 2025.

Startups and niche players have limited presence in this sector, contributing less than 5% to the overall market.

Private labels have minimal impact, holding an estimated 2-3% of the global Tartrazine market share.

The market is moderately concentrated, with the top five players controlling around 65% of total industry revenue.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tartrazine Market Analysis by Beverage, Dairy, Candy/ Confectionery, Fruit Preparations/ Fillings, Sauces, Soups, and Dressings, Seasonings, Pet Food Through 2035

United Kingdom Tartrazine Market Outlook – Growth, Trends & Forecast 2025–2035

United States Tartrazine Market Report – Trends, Growth & Forecast 2025–2035

Europe Tartrazine Market Trends – Demand, Size & Forecast 2025–2035

Competitive Overview of Pet Market Share & Industry Trends

Competitive Landscape of Hob Market Share

Leading Providers & Market Share in Kegs

Market Share Distribution Among Hops Manufacturers

Market Share Distribution Among Bran Manufacturers

Asia Pacific Tartrazine Market Analysis – Trends, Demand & Forecast 2025–2035

Leading Providers & Market Share in the Straw Industry

Assessing Okara Market Share & Industry Trends

Analyzing Market Share & Industry Trends of Chitin Providers

Examining Shrimp Market Share Trends & Industry Leaders

Analyzing Pulses Market Share & Industry Trends

Competitive Overview of Labels Companies

Market Share Insights of Leading Mezcal Manufacturers

Market Share Breakdown of the IV Bag Market

Global MDO-PE Market Share Analysis – Trends, Growth & Forecast 2025–2035

Market Share Distribution Among Lactase Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA