The Third-Party Risk Management market is experiencing steady growth driven by the rising complexity of global supply chains, increasing data privacy regulations, and the growing emphasis on cybersecurity and compliance management. The future outlook for this market is influenced by the rapid digital transformation of enterprises and the heightened need to assess, monitor, and mitigate risks associated with third-party vendors.

Organizations are increasingly adopting risk management solutions to gain real-time visibility into vendor activities and ensure compliance with evolving regulatory frameworks. The growing incidents of data breaches, operational disruptions, and financial losses due to third-party vulnerabilities have further amplified the demand for proactive risk assessment platforms

| Metric | Value |

|---|---|

| Third-Party Risk Management Market Estimated Value in (2025 E) | USD 8.2 billion |

| Third-Party Risk Management Market Forecast Value in (2035 F) | USD 27.4 billion |

| Forecast CAGR (2025 to 2035) | 12.9% |

Additionally, the integration of artificial intelligence and automation in third-party risk management tools is enhancing efficiency and predictive analytics capabilities As organizations continue to expand their global vendor networks, the adoption of advanced and scalable risk management frameworks is expected to remain critical for operational resilience and compliance assurance.

The market is segmented by Component, Deployment Type, Organization Size, and Vertical and region. By Component, the market is divided into Solution and Services. In terms of Deployment Type, the market is classified into Cloud Based and On Premises. Based on Organization Size, the market is segmented into Large Enterprises and SMEs. By Vertical, the market is divided into BFSI, IT And Telecom, Healthcare And Life Sciences, Government And Defense, Retail And Consumer Goods, Manufacturing, and Energy And Utilities. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

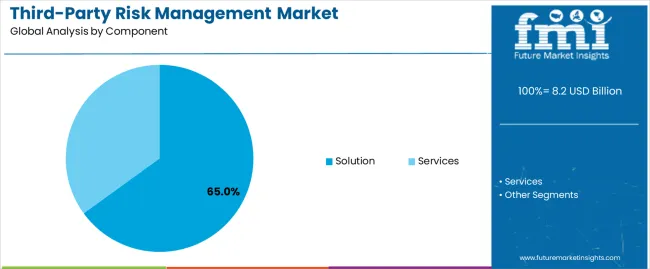

The solution segment is projected to hold 65.00% of the Third-Party Risk Management market revenue share in 2025, making it the leading component category. This dominance has been driven by the increasing demand for comprehensive software platforms that enable automated risk identification, vendor performance tracking, and compliance reporting.

The growing complexity of third-party ecosystems has LED organizations to prioritize integrated solutions that centralize data and streamline assessment processes. The segment’s growth has been further supported by the rising need for real-time monitoring and analytics capabilities to detect and mitigate potential vendor-related threats.

Additionally, the ability of solution platforms to integrate with enterprise systems such as governance, risk, and compliance tools has enhanced their adoption among large corporations Continuous innovation in software design, including AI-enabled risk scoring and workflow automation, has also strengthened the solution segment’s position as a key driver of operational efficiency and regulatory adherence in the overall market.

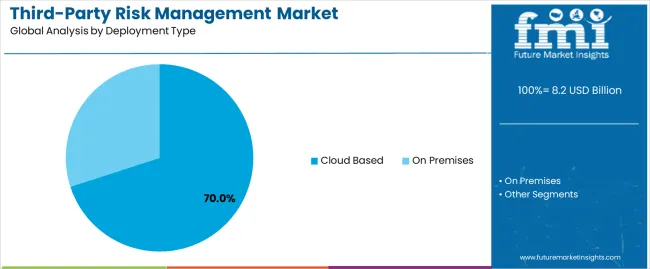

The cloud based deployment type is expected to account for 70.00% of the Third-Party Risk Management market revenue share in 2025, making it the most preferred deployment model. This growth is being influenced by the increasing shift of enterprises toward scalable, flexible, and cost-efficient cloud infrastructures that support remote access and continuous updates.

The adoption of cloud based platforms enables faster deployment and seamless integration across organizational networks, enhancing the agility of risk management processes. The segment’s dominance is also driven by the growing adoption of Software-as-a-Service models that allow organizations to efficiently manage vendor risks without large upfront investments.

Moreover, enhanced data encryption, secure APIs, and compliance certifications have increased confidence in cloud environments for critical risk management operations As digital ecosystems expand globally, the cloud based model continues to provide the scalability and interoperability required to support real-time vendor risk monitoring, making it the preferred choice among enterprises and regulatory bodies alike.

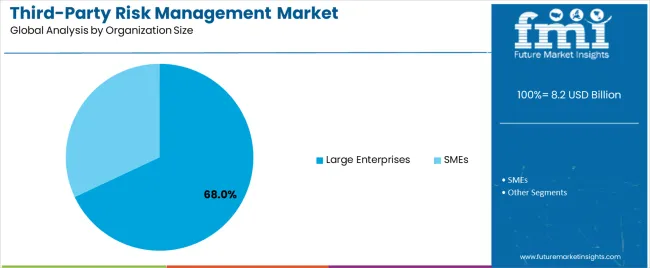

The large enterprises segment is anticipated to hold 68.00% of the Third-Party Risk Management market revenue share in 2025, positioning it as the leading organization size category. This dominance is being driven by the extensive vendor networks and complex supply chain operations managed by large corporations, which require continuous monitoring of third-party risks.

The growing regulatory scrutiny and the high financial impact of potential data breaches have prompted large enterprises to invest in advanced risk management solutions. Additionally, the increasing focus on digital transformation and automation has encouraged the adoption of integrated platforms that provide end-to-end visibility and risk intelligence.

The segment’s growth is further supported by the strong financial capability of large organizations to deploy comprehensive governance frameworks and compliance technologies Furthermore, the strategic emphasis on maintaining business continuity, data protection, and operational transparency is reinforcing the reliance of large enterprises on software-defined third-party risk management systems to safeguard organizational reputation and ensure long-term resilience.

The below table presents the expected CAGR for the global Third Party Risk Management market over several semi-annual periods spanning from 2025 to 2035. This assessment outlines changes in the Third Party Risk Management industry and identify revenue trends, offering key decision makers an understanding about market performance throughout the year.

H1 represents first half of the year from January to June, H2 spans from July to December, which is the second half. In the first half (H1) of the year from 2025 to 2035, the business is predicted to surge at a CAGR of 12.6%, followed by a slightly higher growth rate of 13.3% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 12.6% (2025 to 2035) |

| H2 | 13.3% (2025 to 2035) |

| H1 | 12.5% (2025 to 2035) |

| H2 | 13.5% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 12.5% in the first half and remain higher at 13.5% in the second half. In the first half (H1) the market witnessed a decrease of 10 BPS while in the second half (H2), the market witnessed an increase of 20 BPS.

Increasing regulatory requirements boosting the adoption of financial control management components to ensure compliance and mitigate financial risks

The regulations are designed for ensuring that the organizations are maintaining robust financial controls particularly when engaging with third-party vendors. The rising adoption of financial control management components within TPRM solutions is rolling out.

The component plays a key vital role for ensuring compliance with regulations such as USA Sarbanes-Oxley Act, Europe General Data Protection Regulation and other region-specific mandates.

In 2025, USA Securities and Exchange Commission launched a new rule to enhance third-party financial transactions and this will affect 5,000 publicly traded companies and fueling the adoption of financial control management solutions.

The shift towards outsourcing Third-Party risk management activities is leading to increased adoption of managed services components

The organizations will face the complexities for managing third-party risks there is a shift towards outsourcing the activities to specialized managed services providers. The managed services components offer continuous risk assessment, vendor compliance monitoring and regulatory reporting and makes them attractive to vendors to streamline their risk management processes.

According to new update USA Department of Defense launched new cybersecurity maturity model certification requirement and it around 300,000 contractors. Many vendors will outsource third-party risk management activities to managed services providers for complying with stricter cybersecurity standards.

Growing adoption of global compliance standards creates opportunities for compliance management components to cater to multinational enterprises

The enterprises help to operate across multiple jurisdictions and they face pressure to comply with a wide range of international regulations such as the Europe General Data Protection Regulation, USA Foreign Corrupt Practices Act and the Anti-Money Laundering directives globally.

The standards require comprehensive compliance management solutions for ensuring third-party vendors adhering to all relevant legal and regulatory requirements. According to European Commission plans to constrict GDPR enforcement for non-compliance at 4% of global revenue.

This is anticipated to lead 30% increase in the adoption of compliance management components by multinational enterprises over the next two years to avoid the penalties.

Managing third-party risk involves sharing sensitive data, raising concerns about data privacy and security

The organizations are engaging with third-party service providers and they typically need to exchange data related to financial transactions, personal information and operational details. The data sharing is very crucial for assessing the risk associated with these vendors but it also exposes sensitive information to potential breaches.

The key concern is that third-party vendors not have the same data protection standards as the hiring organization and which will raise the risk of data breaches or cyberattacks. Even with strong risk management systems the vulnerabilities will occur if the vendor’s security is weak.

The global third-party risk management market is experienced growth. The sales during this period were driven by the increasing regulatory pressures and the rising need for comprehensive risk management solutions. The market grows at 9.7% with the sales reaching by end of 2025 6,400.0 Million.

The growth was largely propelled by various concerns about data breaches and compliance requirements across different industries and it is prompting organizations to invest in advanced solutions.

Looking forward from the period 2025 to 2035 the demand for solutions is anticipated to continue and it is driven by evolving regulations, rising cybersecurity threats and the increasing complexity of third-party relationships. The market is poised at a CAGR 12.9% from the period 2025 to 2035 and with sales projected by end of 2035 24,311.6 Million.

The various factors contributing to this growth such as the expansion of global regulatory frameworks, advancements in technology and the growing emphasis on data protection and risk mitigation. Organizations are increasingly seeking for integrated solutions to address the challenges and to ensure robust third-party management strategies.

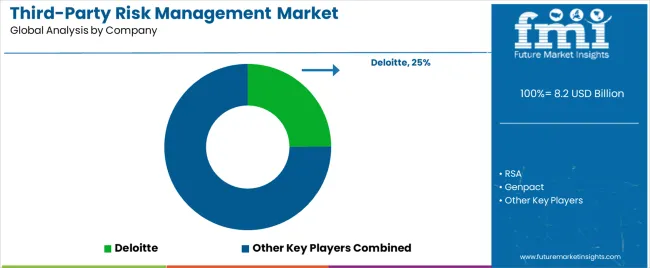

Tier 1 vendors are the major players with significant market share and global reach. Vendors such as IBM, Deloitte and SailPoint dominating this tier and cater around 45% to 50% of the market. They are focused on large-scale operations and comprehensive solutions to make the preferred choice for large enterprises.

Tier 2 includes well-established vendors with a substantial presence but less market share compared to Tier 1. Vendors such as Archer, MetricStream and RiskWatch are prominent in this category holds around 10% to 15% of the market.

Tier 2 vendors offer specialized solutions and cater to mid-sized enterprises with more focused on risk management tools.

Tier 3 vendors consist of niche players and emerging companies that help to provide targeted or innovative solutions. Vendors such as Zylo, ProcessUnity and Prevalent fall into this category and they are capturing 30% to 35% of the market. Tier 3 vendors preferred to smaller organizations or those looking for specialized functionalities.

The section highlights the CAGRs of countries experiencing growth in the Third Party Risk Management market, along with the latest advancements contributing to overall market development. Based on current estimates, India, China and Germany are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 15.9% |

| China | 14.3% |

| Germany | 8.3% |

| Japan | 13.1% |

| United States | 10.4% |

As the sectors is increasing the complexity and scale of operations and it is crucial for vendors for managing risks associated with third party vendors. Also, the need to ensure supply chain steadiness to maintain compliance with evolving regulations and protect against potential disruptions caused by vendor failures. According to government of China focused on stringent environmental regulations and it help for reducing carbon emissions by 15% by the end of 2025 and it will affect 40,000 manufacturing firms.

The policy is anticipated to propel 25% increase in the adoption of third-party risk management solutions in manufacturing sector in the next three years with the significant growth also anticipated in the energy and utilities sector.

China is anticipated to see substantial growth at a CAGR 14.3% from 2025 to 2035 in the third-party risk management market.

As the sectors are relying on third-party vendors for different operations from IT services to customer support and help for ensuring compliance with stringent regulations becomes very essential to mitigate risks such as data breaches, fraud and operational disruptions.

The Reserve Bank of India announced new guidelines requiring 1,200 financial institutions for enhancing vendor risk management and it is focusing on cybersecurity and data protection. The Telecom Regulatory Authority of India constricted data privacy and network security regulations is propelling the demand for solutions in both the sector such as BFSI and IT & Telecom.

India's Third-Party Risk Management market is anticipated to expand from 8.2 Million in 2025 to 2,649.96 Million by 2035 poised at a CAGR 15.9% during this period.

The government contracts are focused on expansion in areas such as cybersecurity, infrastructure and defense technology and also there is a growing need for monitoring third-party vendors to ensure that to meet federal regulations and security standards. In 2025, Department of Defense USA is focused on defense budget by 5% and USD 50 billion allocated for cybersecurity and defense infrastructure contracts.

The change will affect 10,000 contractors and need to adopt advanced solutions to meet new cybersecurity standards under the cybersecurity maturity model certification. USA is anticipated to see substantial growth up to 10.4% in the Third-Party Risk Management market significantly holds dominant share of 74.2% in 2025.

The section provides detailed insights into key segments of the Third-Party Risk Management market. The enterprise size category includes small & medium enterprise and large enterprise.

Deployment Type category such as cloud based and On-Premise. Among these, small & medium enterprise size is growing quickly. The cloud-based hold largest market shares in Third-Party Risk Management.

| Enterprise Size | Small & Medium size |

|---|---|

| CAGR (2025 to 2035) | 14.2% |

As the small & medium enterprise size use more in third-party vendors for different services and also they face higher risks in compliance, data security and operations. To tackle these issues many SMEs are focused on adopting third-party risk management solutions to handle and reduce these risks effectively. In 2025, USA Small Business Administration is offering USD 1 billion to help 15,000 SMEs for implementing advanced risk management systems.

This funding helps to support SMEs in adopting third-party risk management solutions to improve their compliance and data security. SMEs is anticipated to see substantial growth at a CAGR 14.2% from 2025 to 2035 in the Third-Party Risk Management market.

| Deployment Type | Cloud Based |

|---|---|

| Value Share | 54.9% |

The cloud-based solutions are focused on scalability, flexibility and cost efficiency and it allows organizations to easily manage and monitor third-party risks without investing in physical infrastructure.

The solutions enable businesses for integration of various risk management tools for seamless access data from anywhere and help in today’s remote and hybrid work environments.

The USA Department of Commerce invested USD 8.2 million to help 8,000 companies switch to cloud-based technologies. The funding will boost business ability for managing risks and comply with regulations. Cloud Based are projected to dominate the Third-Party Risk Management market, capturing a substantial share of 54.9% in 2025.

The competition in the third-party risk management market is intensifying as companies focused for enhancing solutions to meet evolving industry needs. Key vendors are investing in advanced technologies to improve risk assessment and compliance management.

The market is also witnessing an increase in strategic partnerships and product innovations which help to offer more comprehensive and automated tools.

Industry Update

In terms of Third Party Risk Management, the segment is divided into solution and services.

In terms of deployment type, the segment is segregated into cloud based and on-premises.

In terms of organization size, the segment is segregated into large enterprises and SMEs.

In terms of vertical, the segment is segregated into BFSI, IT and Telecom, healthcare and life sciences, government and defense, retail and consumer goods, manufacturing and energy and utilities.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East & Africa.

The global third-party risk management market is estimated to be valued at USD 8.2 billion in 2025.

The market size for the third-party risk management market is projected to reach USD 27.4 billion by 2035.

The third-party risk management market is expected to grow at a 12.9% CAGR between 2025 and 2035.

The key product types in third-party risk management market are solution and services.

In terms of deployment type, cloud based segment to command 70.0% share in the third-party risk management market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Risk Management Market Size and Share Forecast Outlook 2025 to 2035

Insider Risk Management Market Size and Share Forecast Outlook 2025 to 2035

Finance and Risk Management Consulting Services Market Size and Share Forecast Outlook 2025 to 2035

AI-Driven Treasury & Risk Management – Future-Proofing Finance

Financial Services Operational Risk Management Solution Market

Risk-based Authentication (RBA) Market

Frisket Masking Film Market

Tax Management Market Size and Share Forecast Outlook 2025 to 2035

Key Management as a Service Market

Cash Management Supplies Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

SBOM Management and Software Supply Chain Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Case Management Software (CMS) Market Size and Share Forecast Outlook 2025 to 2035

Farm Management Software Market Size and Share Forecast Outlook 2025 to 2035

Lead Management Market Size and Share Forecast Outlook 2025 to 2035

Pain Management Devices Market Growth - Trends & Forecast 2025 to 2035

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Cash Management Services Market – Trends & Forecast 2025 to 2035

CAPA Management (Corrective Action / Preventive Action) Market

Exam Management Software Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA