The vinegar and vinaigrette market features four competitive segments that include multinational companies, regional brands, niche startups, and private labels for the year 2025. Large corporations, including Mizkan Holdings and Kraft Heinz, together with Nestlé, govern approximately 55% of the vinegar and vinaigrette market.

These major market players create innovative gourmet vinaigrettes alongside their large range of top vinegars because they service both household as well as foodservice retailer markets. The regional identity and local ingredient selection of Borges in Europe and Marukan in Asia give these brands about 25% market penetration.

Start-ups, together with small-batch producers who focus on organic and unprocessed vinegar infusions, represent around 15% of the vinegar market through their products at American Vinegar Works and Acid League because they satisfy health-oriented premium consumers.

Costco Kirkland and Aldi Simply Nature operate private label brands, which account for 5% of sales under their retail-exclusive products intended for budget-conscious consumers. Competitive relations between vinegars transform through technological advancements, together with growing customer demand for naked ingredients and location-specific preferences.

Global Market Share by Key Players

| Global Market Share, 2025 | Industry Share % |

|---|---|

| Top 3 (Mizkan Group, The Kraft Heinz Company, Marukan Vinegar Inc.) | 55% |

| Rest of Top 5 (Mizkan Group, The Kraft Heinz Company, Marukan Vinegar Inc.) | 20% |

| Next 5 of Top 10 (Fleischmann’s Vinegar Company, Burg Groep B.V., Charbonneaux -Brabant, Australian Vinegar, Eden Foods) | 15% |

| Emerging & Regional Brands (Annie’s Homegrown , Galletti S.p.A., Shanxi Shuita Vinegar Co. Ltd., Borges Branded Foods, CASTLE FOOD) | 10% |

The vinegar and vinaigrette market predominantly features Apple Cider Vinegar and Emulsified Vinaigrette, two standout segments. The main reason Apple Cider Vinegar is loved by consumers is that it is associated with benefits like improving the digestive system and managing weight. Making it the number one type of apple cider vinegar, with its percentage of 24% of the total vinegar market share.

People are also using it in food supplements and beverages that claim to detox their bodies, so the demography of health-conscious living people is the main consumer of the product. Organically sourced brands that offer raw and unfiltered apple cider vinegar are experiencing a significant boost in sales. Apart from that, the production of flavored and infused variants for culinary use has also increased.

Emulsified Vinaigrette, with its 65% share, is the most preferred vinaigrette type based on the market composition. Its smoothness and the fact that it can be easily mixed make it the most favored combination. These vinaigrettes are made by mixing oils and acids to create a stable solution, often using herbs, spices, or dairy products for enhancement.

Their use in ready-to-eat salads, deli foods, and gourmet meal kits that are packed makes them highly demanded in both retail and foodservice sectors, especially in urban markets.

The year 2024 witnessed a complete overhaul for the global vinegar and vinaigrette market, with the trendsetters leading the way through their exceptional growth powered by the forces of innovation, clean-label formulations, and the exploration of regional flavors.

The hospitality, health consciousness, and upping of the premium quality have become the pillars of my refashioned industry. The leaders in this industry have branched out their product lines and have thrown out some new ideas that have had a lasting effect on consumer behavior. So let’s see who the companies were that were the major players in 2024 in the vinegar and vinaigrette case:

Mizkan Holdings

Mizkan a world leader, promotes organic heritage and traditional vinegars, investing with huge numbers in traceability and sustainable sourcing. Their new organic balsamic and infused vinegars gained traction in premium retail chains across Europe and North America.

The Kraft Heinz Company

Kraft Heinz enriched its repertoire not only with salad dressings such as plant-based and keto-friendly but also got the benefits from its well-structured distribution network. The corporation also introduced the idea of AI-driven flavour innovation for unique dressings in some specified markets.

Marukan Vinegar Inc.

Marukan strongly holds onto rice vinegar and concentrates on products that are both non-GMO and free of preservatives. The e-commerce platforms that they opened and the Asian-fusion vinaigrettes they sold allowed them to push into the young, health-oriented market.

Carl Kühne KG

Kühne which is a company based in Germany has put forward resources to invest in innovation for new probio vinaigrette products. Their regional expansion into Central Europe and collaboration with vegan chefs helped position the brand as a wellness-forward choice.

De Nigris

The Italian vinegar company has added worldwide growth to its portfolio while embracing its historical legacy through artisanal manufacturing. They launched aged balsamic lines with traceable PDO certification, targeting gourmet consumers through specialty retailers.

Fleischmann’s Vinegar Company

Until now, Fleischmann was only known for supplying industrial vinegar but now they have segmented by diversifying into retail with multipurpose apple cider vinegar, targeting the household wellness trend and DIY beauty markets.

Acid League

The prominent startup Acid League experimented with various vinegars and vinaigrettes infused with botanicals and adaptogens. Their limited-edition launches and clean branding appealed to Gen Z and premium buyers.

Health-Centric Formulations Drive Growth

The top-selling trends in vinegar right now are mainly apple, honey, and rice types, as a result of the on-demand functional ingredients. The consumer is looking for products that are more probiotic, detoxifying, and clear-label, which strengthens the company’s route to launch some products that are raw, organic, and non-GMO.

Global Fusion and Regional Flavors

The focus on regionalism is evident with the limited editions of Mediterranean herb blends and the recently added Asian-inspired sesame-soy infusions gaining popularity. This trend pertains to the local brands and their offerings and serves as a means of engaging with different culinary traditions.

E-Commerce and Direct-to-Consumer Channels Thrive

The internet is the new gateway to product availability, particularly for products that are artfully made and have health benefits. Especially in the urban areas, subscription boxes and curated bundles have triggered repeat customers, particularly among the younger and/or tech-savvy ones.

Collaborations with Culinary and Health Experts

Partnerships with chefs, nutritionists, and wellness influencers are being made to co-create vinaigrette recipes and vinegar-accented health regimens. These associations boost the brand’s credibility, while the consumer lifestyle is the main target.

Sustainable and Ethical Sourcing Gains Prominence

Growing eco-friendly packaging and ethically sourced raw materials are making a statement in this sector. The businesses that are adopting transparent supply chains and sustainable farming methods are getting stronger customer relations and long-term progress in the market.

Clean-Label and Minimal-Ingredient Lists Thriving

More and more shoppers like the goods that are not composed of numerous unknown ingredients. This trend brought to life a wave of minimalistic vinaigrettes and single-origin vinegars that resonate with the clean eating movement.

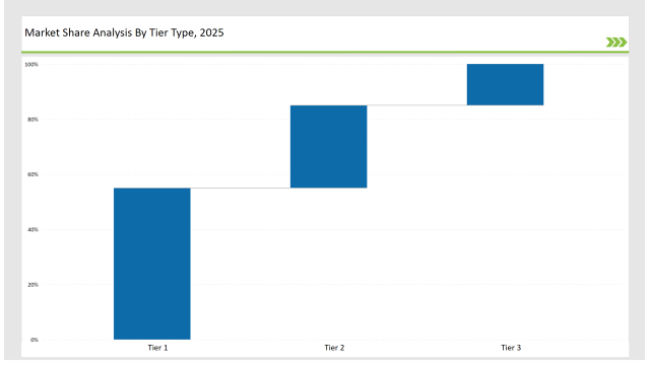

| By Tier Type | Tier 1 |

|---|---|

| Market Share % | 55% |

| Example of Key Players | Mizkan Holdings, The Kraft Heinz Company, Marukan Vinegar Inc. |

| By Tier Type | Tier 2 |

|---|---|

| Market Share % | 30% |

| Example of Key Players | Carl Kühne KG, De Nigris, Fleischmann’s Vinegar Company |

| By Tier Type | Tier 3 |

|---|---|

| Market Share % | 15% |

| Example of Key Players | Acid League, Borges Branded Foods, Annie’s Homegrown, Eden Foods |

| Brand | Key Focus |

|---|---|

| Mizkan Holdings | Introduced carbon-neutral packaging and expanded its premium infused vinegar line globally. |

| The Kraft Heinz Company | Launched a new range of keto -friendly vinaigrettes and invested in AI-driven flavor customization. |

| Marukan Vinegar Inc. | Expanded its presence in e-commerce and introduced non-GMO, preservative-free rice vinegar variants. |

| Carl Kühne KG | Partnered with nutritionists to develop probiotic-rich vinaigrettes targeting the wellness segment. |

| De Nigris | Launched a certified organic aged balsamic line and increased global distribution through gourmet retail. |

| Fleischmann’s Vinegar | Entered the retail market with household-use apple cider vinegar emphasizing natural cleaning benefits. |

| Acid League | Released limited-edition botanical-infused vinegars and expanded its D2C subscription offerings. |

| Borges Branded Foods | Focused on Mediterranean flavor profiles and introduced sustainable sourcing certification on labels. |

| Annie’s Homegrown | Expanded organic vinaigrette range targeting kids’ meals and clean-label convenience options. |

| Eden Foods | Launched small-batch, raw vinegars and highlighted their traceable farm-to-bottle supply chain. |

Prioritize Clean Label and Functional Health Benefits

Building community with gut health or detox, or anti-inflammatory vinegar and vinaigrette is paramount. Products should examine the organic, raw, and unfiltered stance that is of concern to the worldwide consumers' welfare.

Involve Regional Taste Innovations

Meter out the taste of the people. For instance, in Asia, you could have a tamarind-spiced vinaigrette, or in Europe, it might be truffle balsamic. This will not only add to the regional character but also add to the brand’s authenticity and, therefore, consumer loyalty.

Strengthen E-commerce and D2C Infrastructure

Building your brand could be done by going D2C and digital. Playing with regional e-commerce leaders will enable the capture of premium, urban, and health-conscious consumer bases, especially in the Asia-Pacific and North America.

Implement Sustainable and Ethical Production Models

Use recyclable packaging, support fair trade sourcing, and highlight traceable supply chains. These are especially important in Europe and North America, where premium and eco-conscious consumption is on the rise.

Experiment with Seasonal Limited Editions and Blended Variants

Try introducing small, seasonal vinaigrettes or vinegars that are mixed with different flavors to create a buzz. Limited editions, which contain specific herbs or exotic fruit pairings, can help brands to make their mark and grow engagement through exclusivity.

The global vinegar and vinaigrette market will continue to grow with the introduction of innovations, personalization, and sustainability. Direct-to-consumer (D2C) channels are set to witness a significant upturn as brands increasingly form deeper relationships with consumers through the delivery of tailored product experiences, subscription models, and the sharing of wellness-based stories.

The foodservice collaborations will be crucial in the expansion of premium products, as customers will get to taste the artisanal or health-oriented products in real-time dining situations, which ultimately will lead to retail purchases. The technological breakthroughs in smart packaging, clean-label processing, and fermentation science will be the major drivers of new product developments, functional vinegars in particular.

Localized flavor development will happen across Asia-Pacific and Latin America, while global firms will increase their eco-conscious lines and meet sustainability targets. On-the-go formats such as sachets and single-serve vinaigrette will continue driving the trend of snacking and healthy meals. By the combination of these strategies, brand loyalty will become easier, reach will be broader, and value creation will be more efficient in shifting terrains where the culinary and wellness spectrum will reside.

The industry has been categorized into Balsamic Vinegar, Apple Cider Vinegar, White Wine Vinegar, Rice Vinegar, Sherry Vinegar, Garlic Vinegar, Cava Vinegar, Honey Vinegar, Red Wine Vinegar, Malt Vinegar, and Others.

This segment is further categorized into Emulsified and Biphasic.

The market is segmented based on end-use into Pharmaceuticals, Food & Beverage, Dietary Supplements, and Cosmetics.

The industry is divided into Pharmacies/Drugstores, Health & Beauty Stores, Hypermarket/Supermarket, Direct Selling, and Online.

The market is analyzed across North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic countries, Russia and Belarus, and the Middle East & Africa.

Mizkan Holdings, Kraft Heinz, and Marukan lead the market, collectively accounting for over 50% of global share.

Regional and emerging brands represent around 20% of the market, driven by local flavor preferences and artisanal production.

Startups and artisanal players hold approximately 10-12% of the global market, targeting niche, health-conscious, and premium segments.

Private labels account for about 8% of the market, primarily offering budget-friendly options through retail chains.

The market remains moderately consolidated, with the top 5 companies controlling over 70% of global share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vinegar Market Size and Share Forecast Outlook 2025 to 2035

Vinegar and Vinaigrette Market Analysis by Cava Vinegar, Honey Vinegar, Red Wine Vinegar and Others Through 2035

United Kingdom Vinegar and Vinaigrette Market Insights – Demand & Forecast 2025–2035

United States Vinegar and Vinaigrette Market Insights – Demand & Forecast 2025–2035

Wood Vinegar Market by Pyrolysis Method, End User Application & Region and Distribution Channel

Market Share Breakdown of Wood Vinegar Manufacturers

Europe Vinegar and Vinaigrette Market Outlook – Growth, Demand & Forecast 2025–2035

United Kingdom Wood Vinegar Market Insights – Growth, Trends & Forecast 2025–2035

United States Wood Vinegar Market Analysis – Trends, Growth & Forecast 2025–2035

Apple Cider Vinegar Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Europe Wood Vinegar Market Analysis – Demand, Size & Forecast 2025–2035

Asia Pacific Vinegar and Vinaigrette Market Insights – Growth, Demand & Forecast 2025–2035

Asia Pacific Wood Vinegar Market Analysis – Demand, Size & Forecast 2025–2035

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Candle Filter Cartridges Market Size and Share Forecast Outlook 2025 to 2035

Handheld Electrostatic Meter Market Size and Share Forecast Outlook 2025 to 2035

Hand Towel Automatic Folding Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA