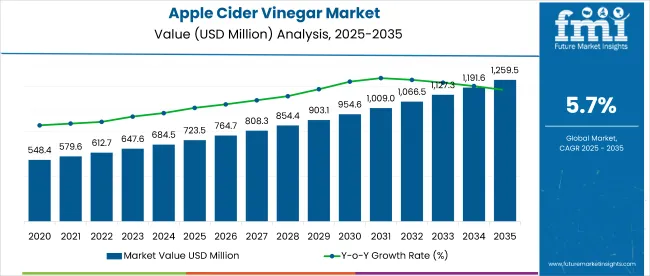

The global apple cider vinegar market is projected to grow from USD 723.5 million in 2025 to USD 1,259.5 million by 2035, registering a CAGR of 5.7%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 723.5 million |

| Industry Value (2035F) | USD 1,259.5 million |

| CAGR (2025 to 2035) | 5.7% |

The market expansion is being driven by increasing health-consciousness, rising demand for natural and organic products, and the growing use of apple cider vinegar in various food and beverage applications. Additionally, the growing adoption of apple cider vinegar in wellness products, such as skin and hair care formulations, is fueling market growth. Consumer awareness of the health benefits of apple cider vinegar, including its potential to support weight loss, regulate blood sugar, and improve digestion, is contributing to its widespread consumption.

The market holds a significant share in several related markets. Within the food and beverage market, it holds 0.5-1%, reflecting its wide use in cooking, dressings, and beverages. In the functional food ingredients market, it contributes around 1-2% as consumers seek health benefits like improved digestion and weight loss. In the health and wellness market, the share is around 0.5-1% due to its use in wellness products.

In the organic food market, the share is increasing, reaching 1-2%, driven by demand for natural ingredients. However, in the personal care and cosmetics and dietary supplements market, its share remains smaller, around 0.1-0.5%.

Government regulations impacting the market focus on food safety, quality standards, and labeling. In countries like the USA, the Food and Drug Administration (FDA) regulates the labeling and safety of apple cider vinegar, ensuring product quality and transparency for consumers.

In Europe, the European Food Safety Authority (EFSA) provides guidance on health claims related to apple cider vinegar, particularly those related to digestive health and weight management. These regulations drive the market toward better quality control and production standards, ensuring that apple cider vinegar products meet both safety and health expectations.

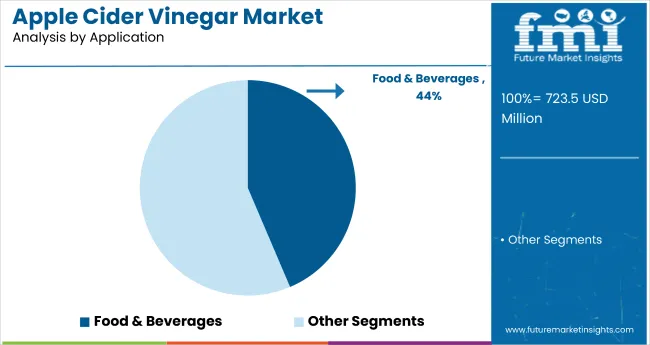

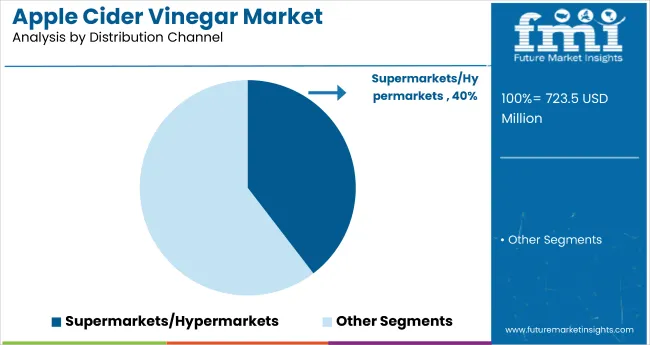

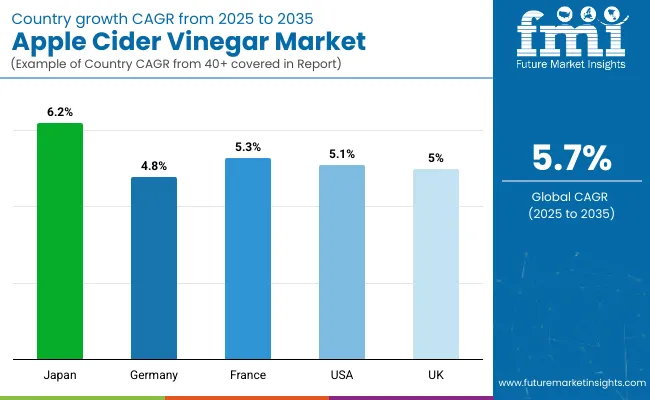

The Japan market is projected to be the fastest-growing in the market, expected to expand at a CAGR of 6.2% from 2025 to 2035. Supermarkets/hypermarkets will lead the distribution channel segment with a 39.6% share, while the food & beverage will dominate the application segment with a 43.6% share. The USA, UK, Germany, and France are also expected to grow steadily, with CAGRs of 5.1%, 5%, 5.3%, and 5.3%, respectively.

The market is segmented by application, distribution channel, and region. By application, the market is divided into food & beverages, pharmaceuticals, personal care, and household & industrial applications. In terms of distribution channel, the market is classified into supermarkets/hypermarkets, drug stores, convenience stores, specialist stores, and retail stores. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

The food & beverages are expected to dominate the application segment, holding 43.6% of the market share by 2025, driven by its extensive use in food preparations, dressings, sauces, and drinks, along with growing health trends.

Supermarkets and hypermarkets are projected to lead the distribution channel segment, accounting for 39.6% of the market share by 2025, due to their widespread reach, convenience, and availability of apple cider vinegar products.

The global apple cider vinegar market is experiencing steady growth, driven by increasing consumer demand for health-conscious, natural products. Apple cider vinegar is widely recognized for its health benefits, including weight management, digestive health, and skin care.

Recent Trends in the Apple Cider Vinegar Market

Challenges in the Apple Cider Vinegar Market

| Countries | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.2% |

| Germany | 4.8% |

| France | 5.3% |

| USA | 5.1% |

| UK | 5.0% |

Japan’s momentum is driven by the country’s high focus on health and wellness, combined with the growing preference for organic and natural products. Germany and France maintain strong demand, supported by EU regulations promoting organic food and sustainability. Meanwhile, developed economies like the USA (5.1% CAGR), UK (5.3%), and Japan (6.2%) are expected to expand at a steady pace, in line with the global growth rate.

Japan leads in the market with the highest growth, driven by its strong focus on functional food ingredients, wellness, and natural remedies. Germany and France follow closely, benefiting from EU regulations that promote organic food products and sustainability, fostering increasing demand for apple cider vinegar in health-conscious consumers.

The USA also experiences significant growth, fueled by rising demand for wellness supplements, health foods, and beverages, especially within the vegan and organic product sectors. The UK shows steady growth despite post-Brexit regulatory challenges, with increased consumer awareness of health benefits and a shift toward organic, natural food product.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The Japan apple cider vinegar revenue is growing at a CAGR of 6.2% from 2025 to 2035. The growth is driven by the country’s focus on functional food ingredients, natural remedies, and a health-conscious population. Japan's high-tech wellness culture contributes to the rising demand for apple cider vinegar in dietary supplements, beverages, and skincare.

The sales of apple cider vinegar in Germany are expected to expand at a CAGR of 4.8% during the forecast period, in line with the global average but strongly driven by EU regulations promoting organic food products. Germany’s emphasis on environmental sustainability, organic farming, and healthy food consumption is fostering the demand for apple cider vinegar.

The French apple cider vinegar market is projected to grow at a CAGR of 5.3% during the forecast period, propelled by government initiatives focused on organic food and sustainable consumption. France’s strict regulations on food safety and health standards further boost demand for apple cider vinegar, particularly in beverages, food processing, and wellness products.

The USA apple cider vinegar market is projected to grow at a CAGR of 5.1% from 2025 to 2035, in line with the global growth rate. The demand for apple cider vinegar in the USA is fueled by the growing popularity of wellness supplements, health foods, and beverages. USA consumers are increasingly drawn to organic and natural ingredients, with apple cider vinegar playing a key role in health-conscious diets.

The UK apple cider vinegar revenue is projected to grow at a CAGR of 5% from 2025 to 2035, representing steady growth in the organic food and wellness sectors. The market is driven by increased consumer awareness of health benefits and a strong shift towards organic, natural food products.

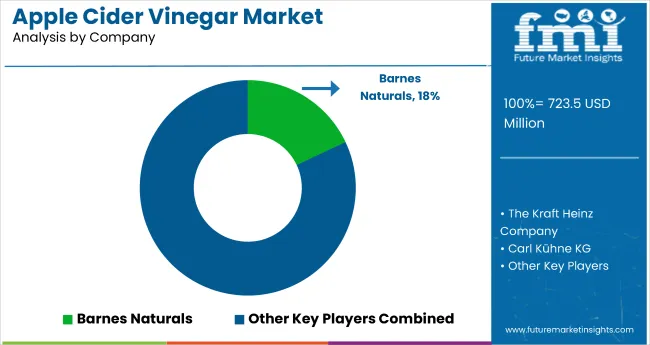

The market is moderately consolidated, with leading players like Barnes Naturals, The Kraft Heinz Company, Carl Kühne KG, Castelo Alimentos S/A, and Old Dutch Mustard Co., Inc. dominating the industry. These companies provide high-quality apple cider vinegar catering to a wide range of applications including food and beverages, wellness products, and personal care. Barnes Naturals focuses on organic, unfiltered apple cider vinegar, while The Kraft Heinz Company offers a range of flavored vinegar products.

Carl Kühne KG provides premium-quality apple cider vinegar with a focus on sustainability, and Castelo Alimentos S/A specializes in the mass production of vinegar for various food processing applications. Old Dutch Mustard Co., Inc. offers apple cider vinegar as an ingredient in sauces and condiments. Other key players such as Marukan Vinegar USA Inc., Aspall, Pepsico Inc., Molson Coors Beverage Company, and Manzana Products Co. Inc. contribute by providing a variety of apple cider vinegar products with diverse formulations for consumers.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 723.5 million |

| Projected Market Size (2035) | USD 1,259.5 million |

| CAGR (2025 to 2035) | 5.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD million for value/ volume in metric tons |

| Application Analyzed | Food & Beverages, Pharmaceuticals, Personal Care, and Household & Industrial Applications |

| Distribution Channel Analyzed | Supermarkets/Hypermarkets, Drug Stores, Convenience Stores, Specialist Stores, and Retail Stores |

| Regions Covered | North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia |

| Key Players Influencing the Market | Barnes Naturals, The Kraft Heinz Company, Carl Kühne KG, Castelo Alimentos S/A, Old Dutch Mustard Co., Inc., Marukan Vinegar USA Inc., Aspall, Pepsico Inc., Molson Coors Beverage Company, Manzana Products Co. Inc |

| Additional Attributes | Dollar sales by application type, share by distribution channel, regional demand growth, policy influence, organic product trends, competitive benchmarking |

The market is valued at USD 723.5 million in 2025.

The market is forecasted to reach USD 1,259.5 million by 2035, reflecting a CAGR of 5.7%.

The food & beverages will lead the application segment, accounting for 43.6% of the global market share in 2025.

Supermarkets/hypermarkets will dominate the distribution channel segment with a 39.6% share in 2025.

Japan is projected to grow at the fastest rate, with a CAGR of 6.2% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Apple Seed Oil Market Size and Share Forecast Outlook 2025 to 2035

Apple Accessories Market Report – Demand, Trends & Forecast 2025–2035

Cider Brewing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Cider Packaging Market Growth Trends Forecast 2025 to 2035

Cider Market Analysis by Product Type, Packaging Type, Distribution Channel and Region through 2035

Cider and Perry Market Analysis by Product Type, Trade Type, and Region through 2035

Market Share Distribution Among Cider Packaging Companies

Vinegar Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Vinegar and Vinaigrette Companies

Vinegar and Vinaigrette Market Analysis by Cava Vinegar, Honey Vinegar, Red Wine Vinegar and Others Through 2035

United Kingdom Vinegar and Vinaigrette Market Insights – Demand & Forecast 2025–2035

United States Vinegar and Vinaigrette Market Insights – Demand & Forecast 2025–2035

Market Share Breakdown of Wood Vinegar Manufacturers

Wood Vinegar Market by Pyrolysis Method, End User Application & Region and Distribution Channel

Europe Vinegar and Vinaigrette Market Outlook – Growth, Demand & Forecast 2025–2035

United Kingdom Wood Vinegar Market Insights – Growth, Trends & Forecast 2025–2035

United States Wood Vinegar Market Analysis – Trends, Growth & Forecast 2025–2035

Europe Wood Vinegar Market Analysis – Demand, Size & Forecast 2025–2035

Asia Pacific Vinegar and Vinaigrette Market Insights – Growth, Demand & Forecast 2025–2035

Asia Pacific Wood Vinegar Market Analysis – Demand, Size & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA