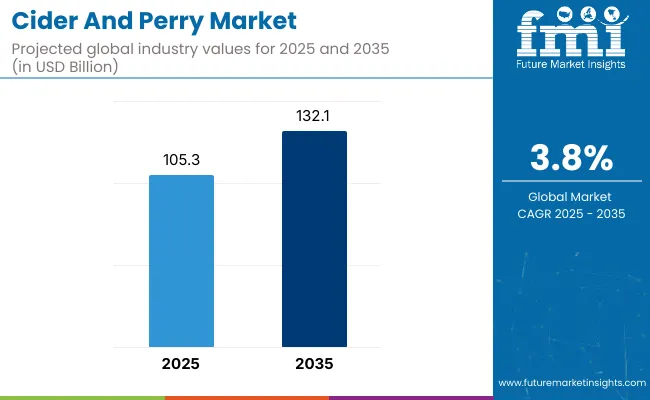

The global cider and perry market is set to observe USD 105.3 billion in 2025. The industry is projected to register 3.8% CAGR from 2025 to 2035, reaching USD 132.1 billion by 2035.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 105.3 billion |

| Industry Value (2035F) | USD 132.1 billion |

| CAGR (2025 to 2035) | 3.8% |

Consumer behaviors and premiumization with increased focus on sustainability and healthy alcoholic beverages are the main drivers behind the industry growth. These beverages are gaining popularity with a wider range of consumer groups as more and more people look for clean-label ingredients, preservative-free formulations, and natural fermentation.

Growing consumer demand for craft and small batches is also influencing the industry, driving makers to experiment-exceeding traditional aging profiles, private fruit blends, and fermentation that create complexity and dimension.

Stronger consumer interest in premium craft cider styles is one of the biggest factors driving increased sales. Consumers are moving away from mass-market offerings toward premium, oak-aged, wild-fermented products that provide big, complex flavors. Barrel-aged ciders, particularly those aged in whiskey and wine barrels, are trending.

The increasing vintage interest in specialty retail, fine dining and farm-to-bottle has also inspired brands to develop unique, small-batch releases that can stand up to discerning palates.

While the cider and perry sector has massive growth opportunities, there are barriers, too. The primary industry challenge is competition from more established alcoholic products like beer, wine, and spirits.

Beyond supply chain disruptions, seasonal fruit availabilities are less predictable, as are organic and small-batch prices, which also affect availability and prices. Regulations on alcohol taxation and labeling requirements also represent entry barriers to some markets.

As a result of the aforementioned consumer trends, the cider and perry industry is set to evolve and grow on a global scale. The industry is primarily bolstered by the surge in craft and premium cider and perry sales, as the manufacturers operate on domestic apples and pears and are majorly concerned about sustainability.

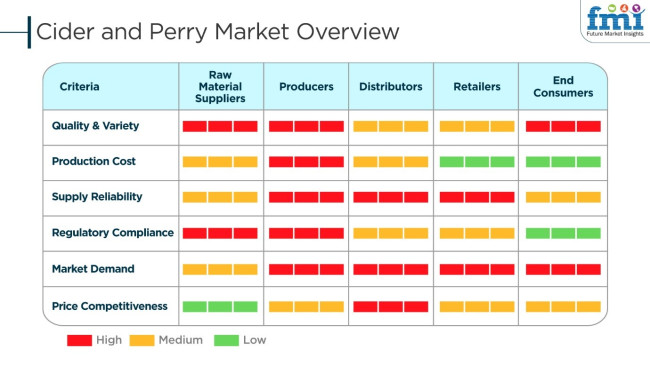

The suppliers of the raw materials focus on delivering the best quality fruits, fermentation efficiency, and sustainable practices to provide a premium product line. To upgrade their customer attractiveness, producers stress the creativity, the use of exclusively natural resources, and the diligence they show in honoring alcohol laws.

Dispersers and retailers bear in mind the cost competitiveness, supply chain functioning, and the method of advertisement to meet the requirement across supermarkets, online stores, and special liquor shops. With their demand now for a wider range of truly made products, along with perceptions of health benefits against traditional alcoholic beverages, consumers are now the main drivers of the gluten-free, sugar-free, and craft cider varieties.

The table below presents a comparative assessment of the variation in Compound Annual Growth Rate (CAGR) over six-month intervals for the base year (2024) and the current year (2025) in the global cider and perry market.

This analysis highlights key shifts in industry performance and indicates revenue realization patterns, providing stakeholders with a clearer view of the industry growth trajectory over the year. The first half of the year, or H1, spans from January to June, while the second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 2.8% (2024 to 2034) |

| H2 2024 | 3.0% (2024 to 2034) |

| H1 2025 | 3.1% (2025 to 2035) |

| H2 2025 | 3.3% (2025 to 2035) |

In the first half (H1) of 2024, the global cider and perry market is projected to grow at a CAGR of 2.8%, followed by an increase to 3.0% in the second half (H2) of the same year. Moving into 2025, the CAGR is expected to rise to 3.1% in H1 and further to 3.3% in H2.

These variations suggest a consistent upward trend, driven by factors such as the premiumization of craft cider and perry products, the rising popularity of botanical-infused and low-alcohol variants, and increased investment in sustainable practices across key global markets.

Rising Popularity of On-Tap Cider in Premium Drinking Venues

The demand for draught cider has been steadily increasing in bars, gastropubs, and craft beverage venues, driven by the consumer preference for fresh, locally sourced, and high-quality alcoholic beverages. Unlike bottled alternatives, draught cider offers a fresher taste, smoother carbonation, and a more immersive drinking experience, making it a staple in high-end hospitality and experiential drinking settings.

With millennials and Gen Z gravitating toward authentic and craft-driven beverages, draught cider producers are innovating with small-batch, unfiltered, and fruit-forward variants. Additionally, companies are experimenting with cider taps, showcasing seasonal and limited-edition flavors, further strengthening consumer engagement and repeat purchases.

This trend is particularly strong in urban markets across Europe and North America, where premiumization in the alcoholic beverage industry is driving on-tap cider adoption. Moving forward, brands that prioritize exclusive draught collaborations and invest in on-premise partnerships will maintain a competitive edge in the evolving cider landscape.

Expanding Consumer Shift Toward Packaged Cider for At-Home Consumption

The rise of packaged cider reflects a broader shift toward convenience, accessibility, and diversified flavor offerings. Unlike draught cider, canned and bottled formats cater to at-home consumption, social gatherings, and outdoor activities, making them a high-growth segment within the global beverage industry.

The demand for single-serve and multi-pack cider options has grown significantly, particularly with retailers expanding their premium craft cider selections in response to evolving consumer habits.

In recent years, the industry has witnessed a strong preference for sustainable and lightweight packaging, leading to a surge in recyclable aluminum cans over glass bottles. This shift aligns with eco-conscious drinking trends, as low-carbon production and refillable packaging formats gain traction.

Furthermore, brands are leveraging direct-to-consumer (DTC) platforms to offer subscription-based cider deliveries, allowing for personalized experiences and increased brand loyalty. As packaged cider continues to evolve, flavor innovation, sustainable packaging, and strategic retail expansion will drive long-term industry penetration.

Keg Cider as a Strategic Growth Lever in High-Volume Venues

The keg cider segment is emerging as a critical category for large-scale events, festivals, and hospitality-driven drinking spaces, where high-volume sales and operational efficiency are key priorities. Unlike draught systems that require dedicated infrastructure, keg cider offers flexible dispensing solutions, making it an attractive option for catering, pop-up bars, and live entertainment venues.

With cider brands targeting premium distribution in sporting events, music festivals, and food pairings, the demand for kegged cider is expanding beyond traditional bar settings. Additionally, brands that offer customizable keg sizes, nitrogen-infused variants, and carbon-neutral delivery systems are gaining traction in the on-premise beverage industry.

As the experiential drinking culture grows, keg cider will play a pivotal role in the expansion of high-volume cider consumption across global markets, particularly in tourism-heavy and nightlife-centric regions.

Between 2020 and 2024, the global cider and perry market saw a shift in consumption patterns, premiumization trends, and increased demand for craft and natural variants. Comparing with the previous decades, the industry saw an increasing demand for artisanal, small-batch, and fruit-driven ciders, especially in Europe and North America.

One of the major drivers of industry trends during this time was the increasing health-conscious movement, which saw high-sugar, artificially flavored ciders get less popular, and organic, dry, and natural fermentations grew in popularity. Also, low-ABV and session ciders were among the leading growth segments, reflecting the global moderation trend in which consumers are cutting down on alcohol consumption but not on alternative taste to beer and wine.

Eco-driven cider production, where brands take up carbon-neutral fermentation, regenerative orchard farming, and biodegradable packaging solutions was a way to attract customers. Functional cider products, blending adaptogens, botanicals, and fruit extracts with immunity benefits, are taking the category into the better-for-you alcoholic drinks aisle.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Growth in consumer demand for craft and artisan ciders and perry | Higher demand for low-alcohol and health-qualified cider beverages |

| Dominant position of traditional apple and pear fruit-based ciders | Development of flavor innovation, including exotic fruits, botanicals, and hybrid styles |

| North America and Europe as primary markets with strong cider heritage | Strong industry growth for Asia-Pacific and Latin America regions through increasing trends of alcohol diversification |

| Seasonal peak demand, primarily summer months | Year-round demand through diversification and premiumization initiatives |

| Reliance on conventional production methods | Sustainable practice adoption, for example, organic fruit supply and green packaging |

| Challenges in raw material supply owing to climate uncertainty | Intensified orchard management and investment in climacteric fruit varieties |

| Compliance with alcohol taxation and labeling regulations | Increased health and sustainability regulations affecting product development and marketing |

The cider and perry industry is being presented with many risks, such as raw materials, regulatory challenges, changing consumer preferences, disruption of the supply chain, and industry competition.

It is the availability of raw materials that takes the central stage as cider is produced from apples and perry from pears. Regulatory challenges differ from one area to another and affect aspects such as alcohol content, labeling requirements, and taxation policies.

Modifications in the laws governing the taxation of alcohol can have an effect on prices and profits especially in the areas where there is strict alcohol control, for instance, the USA industry, European industry, and some of the emerging markets.

Shifting consumer preferences are also seen as risks. Although low-alcohol and flavored ciders are in demand, traditional cider and perry may cease to move if the manufacturers do not introduce and adopt a new product. Supply chain disruption, such as transportation delays, labor shortages, and packaging material costs, can influence product production and distribution.

The consideration of glass bottles, aluminum cans, and the use of sustainable packaging are some of the factors that affect the product pricing.

Unlike their bottled or canned counterparts, keg formats are fresher, unfiltered, and more experimental, meaning they are very much in demand among craft bars, gastropubs, and dedicated cider taps. Keg-only releases are being used by brands to promote specialty blends, small-batch fermentations, and seasonal offerings that do not end up in mass distribution.

This model is taking off in Europe and North America, where high-end cider bars and mixology-driven establishments look for barrel-aged outliers, wild-fermented ciders, and trend-setting palate sizzlers.

For decades, traditional off-trade channels have focused entirely on branded cider, but innovative retailers like Tesco (UK), Carrefour (France), and Whole Foods Market (USA) are focusing on exclusive craft cider collections based on locally sourced apples alongside organic ingredients and sustainable packaging.

These affordable yet high-quality alternatives are putting artisanal cider consumption on the map, especially in Europe, North America, and Australia.

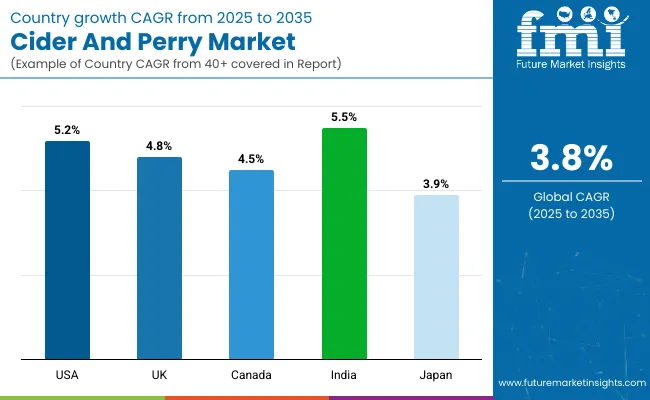

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.2% |

| UK | 4.8% |

| Canada | 4.5% |

| India | 5.5% |

| Japan | 3.9% |

The USA cider industry is growing with hybrid fermentation methods that encourage complexity and sensory profile. In contrast to conventional cider production relying on commercial yeasts or wild yeast, cider producers use blended-fermentation methods. These involve wine yeasts, champagne yeasts, and spontaneous fermentation, which yield more structured and complex ciders. Their use attracts wine and craft beer drinkers looking for ciders with complex flavor, tannic complexity, and aging potential.

FMI is of the opinion that the USA industry is slated to grow at 5.2% CAGR during the study period.

Growth Factors in the USA

| Key Drivers | Detail |

|---|---|

| Hybrid Fermentation Methods | Mixed fermentation methods produce full-bodied cider flavor. |

| Premium Industry Appeal | Luxury ciders become prominent in upscale restaurants and specialty stores. |

| Shift in Consumer Preference | Wine and craft beer consumers find sophisticated cider profiles. |

| Growing Millennial Demand | Millennial consumers seek innovative and naturally fermented ciders. |

Canada is the globe's largest producer of ice cider, with frozen-temperature fermentation methods delivering optimal aromatic complexity and natural sweetness. Unlike other ciders, cryo-concentration is a built-in process for making ice cider because apples naturally freeze before being pressed. The final product is concentrated juice that ferments into dessert-style cider with a refined balance of acidity and sweetness.

FMI is of the opinion that the Canadian industry is slated to grow at 4.5% CAGR during the study period.

Growth Factors in Canada

| Key Drivers | Detail |

|---|---|

| Ice Cider Innovation | Cryo-concentration introduces sweetness and depth. |

| Premium Industry Growth | Upscale consumers want dessert-like cider products. |

| Barrel Aging & Sparkling Techniques | Sophisticated aging and fermentation techniques enhance cider quality. |

| High Export Demand | Canadian ice cider is globally acclaimed. |

The UK cider industry is changing, with terroir single-orchard ciders becoming more fashionable. The trend differs from mass-market ciders produced using apple concentrates from anywhere, emphasizing apples, natural fermentation, and vintage, similar to fine wine.

With heritage-style drinks and authenticity becoming fashionable, cider houses use ancient orchards to produce terroir-focused expressions. Ciders emphasize local apple varieties and the contribution of soil to the fermentation process.

FMI is of the opinion that the UK industry is slated to grow at 4.8% CAGR during the study period.

Growth Factors in the UK

| Key Drivers | Detail |

|---|---|

| Single-Orchard Terroir Ciders | Estate-raised apples provide quality and flavor depth. |

| Heritage and Authenticity Appeal | Hand cider-making processes appeal to premium consumers. |

| Premium Industry Positioning | Luxury brand positioning puts cider on par with fine wine and craft spirits. |

| Growth Export Opportunities | Global demand for high-end British ciders. |

India's cider industry is growing with growing demand for new and heritage cider flavors. Although cider is still a niche drink in the overall alcoholic drinks industry, urbanization and shifts in food trends are encouraging growth. Premium fruit-based alcoholic drinks like craft ciders produced using local apples win over young, health-conscious customers looking for low alcohol content drinks compared to spirits and beer.

FMI is of the opinion that the Indian industry is slated to grow at 5.5% CAGR during the study period.

Growth Factors in India

| Key Drivers | Detail |

|---|---|

| Growing Demand for Craft Ciders | People demand good, fruit-based drinks. |

| Rising Cider Markets | Himachal Pradesh and Uttarakhand are leading producers of apple cider. |

| Investment in Complex Fermentation | Higher quality comes from using modern fermentation technologies. |

| Urbanization & Shifting Choices | Urban dwellers experiment with cider as a low-calorie option to beer. |

Barrel ciders and cider sparkling are highly appealing to sophisticated consumers looking for new patterns in consumption. Japan depends on imported cider for most of its business, with premium lines coming from the UK, France, and Canada.

Cider cocktail trend building and increased exposure in high-end restaurants create additional momentum for cider's growing presence in Japan's high-end liquor market. FMI is of the opinion that the Japanese industry is slated to grow at 3.9% CAGR during the study period.

Growth Factors in Japan

| Key Drivers | Detail |

|---|---|

| Specialty Cider Demand | Fizzy and barrel-aged ones get fashionable. |

| Craft Cider Revolution | Local industries experiment with fermentation methods. |

| Cider Cocktails | Fine cocktail professionals utilize cider. |

| Fine-Dining Industry | Industry growth: cider is more fashionable on the menus of upscale restaurants. |

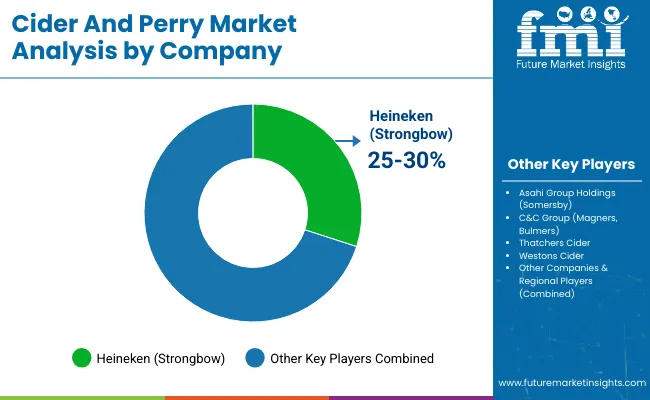

Big industry names such as Heineken (Strongbow), Asahi Group Holdings (Somersby), C&C Group (Magners), Thatchers Cider, and Westons Cider dominate the industry because of their extensive production capacity and far-reaching distribution networks. With strategic acquisitions, these brands are emphasizing flavor diversity, premium craft offerings, and sustainability-led initiatives in their championing offerings.

Contrarily, several other regional cider makers and startups have started gaining traction through their artisanal production methods, local ingredients, and organic certifications. Companies have also invested in regenerative agriculture and eco-friendly packaging and then entered into digital marketing strategies to enhance consumer engagement.

Thus, companies with a successful combination of innovation, sustainability, and industry expansion will gain a competitive edge in the changing cider and perry space.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| Heineken (Strongbow) | 25-30% |

| Asahi Group Holdings (Somersby) | 15-20% |

| C&C Group (Magners, Bulmers) | 10-15% |

| Thatchers Cider | 5-10% |

| Westons Cider | 5-10% |

| Other Brands | 15-25% |

| Company Name | Key Offerings/Activities |

|---|---|

| Heineken (Strongbow) | Industry leader with global presence, innovative flavors, and sustainability-driven cider production. |

| Asahi Group Holdings (Somersby) | Expanding premium cider portfolio with fruity and low-alcohol offerings backed by strong branding. |

| C&C Group (Magners, Bulmers) | Focuses on traditional cider-making, leveraging heritage and natural ingredients for authenticity. |

| Thatchers Cider | Family-owned brand emphasizing craft production, orchard sustainability, and limited-edition releases. |

| Westons Cider | Specializes in organic and traditional ciders, catering to the growing demand for artisanal and premium options. |

Key Company Insights

Heineken (Strongbow) (25-30%)

The company has a dominant position in the global industry, and there are constant innovations in new and exciting flavors. The company has also focused on sustainability.

Asahi Group Holdings (Somersby) (15-20%)

Asahi is selling cider in international markets at a faster pace with apple-flavored ciders and session-able cider philosophies.

C&C Group (Magners, Bulmers) (10-15%)

The company links its brand esteem with classic cider production through traditional methods to secure a loyal consumer base.

Thatchers Cider (5-10%)

Thatchers, on the other hand, focuses on craft cider making as its strategic niche, sustaining the high-quality orientation within its product in terms of the Orchard Origin.

Westons Cider (5-10%)

Focus on producing a premium product, Westons has placed it under organic, posing as a channel for having young eco- and art-consumers.

Other Key Players (15-25% Combined)

By product type, the industry is segmented into draught, packaged, and keg.

By trade, the industry is segmented into off-trade and on trade.

The industry is segmented by region into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

The industry is estimated to reach USD 105.3 billion in 2025.

The industry is projected to reach a size of USD 132.1 billion by 2035.

Key companies include Heineken (Strongbow), Asahi Group Holdings (Somersby), C&C Group (Magners, Bulmers), Thatchers Cider, Westons Cider, Angry Orchard, Aspall, Rekorderlig, and Kopparberg.

India, poised to witness 5.5% CAGR during the study period, is slated to witness fastest growth.

Off-trade channels are being widely preferred.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cider Brewing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Cider Packaging Market Growth Trends Forecast 2025 to 2035

Cider Market Analysis by Product Type, Packaging Type, Distribution Channel and Region through 2035

Market Share Distribution Among Cider Packaging Companies

Apple Cider Vinegar Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Candle Filter Cartridges Market Size and Share Forecast Outlook 2025 to 2035

Handheld Electrostatic Meter Market Size and Share Forecast Outlook 2025 to 2035

Hand Towel Automatic Folding Machine Market Size and Share Forecast Outlook 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA