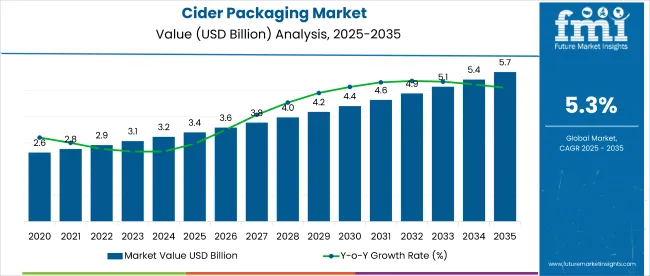

The global cider packaging market is projected to grow from USD 3.4 billion in 2025 to USD 5.7 billion by 2035, expanding at a CAGR of 5.3% during the forecast period. This rise is shaped by increasing demand for premium branding, lightweight formats, and omnichannel-ready packaging formats. While sustainability and recyclability remain hygiene factors, differentiation is being driven through digital packaging layers and hybrid retail models.

| Attributes | Value |

|---|---|

| Industry Size (2025) | USD 3.4 billion |

| Projected Industry Size (2035) | USD 5.7 billion |

| CAGR (2025 to 2035) | 5.3% |

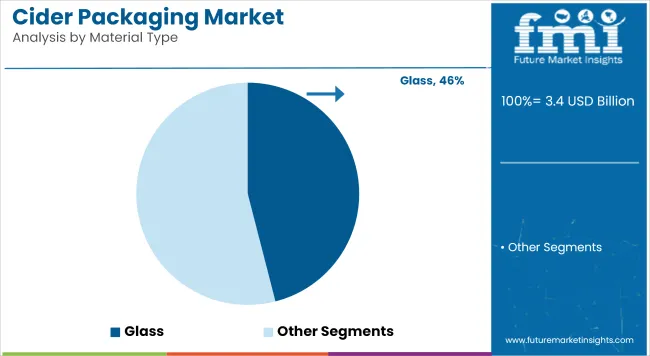

In 2025, the cider packaging segment accounted for approximately 3.1% of the total global alcoholic beverage packaging market, valued at USD 108.7 billion. Rising demand for premium cider variants and artisanal branding is pushing packaging suppliers toward glass-dominant, high-clarity formats-reflected in glass holding 46% share in 2025.

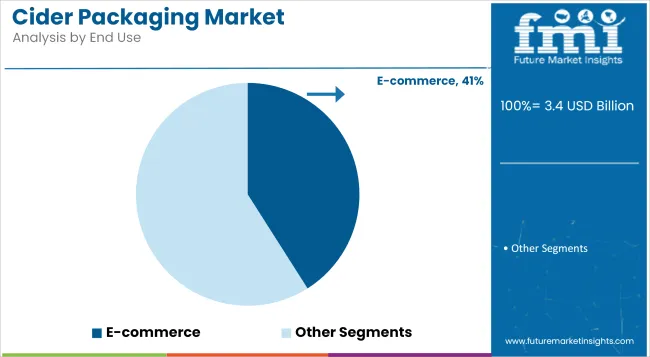

However, unit cost pressures remain a restraint, especially as raw material volatility and energy tariffs inflate input prices by 6-8% in key EU states. Notably, brands are responding by investing in lighter-weight bottle designs and digital packaging integrations such as QR-based authenticity or AR overlays. This hybridization trend is gaining traction across both online and offline channels, with e-commerce packaging alone contributing 41% of end-use share.

The cider packaging market is segmented into material type; packaging type; end use; and region. By material type, the market is categorized into glass; plastic; and metal. By packaging type, it includes bottles; cans; and stand-up pouches.

By end use, the segmentation covers veterinary pharmacies; e-commerce; veterinary clinics; and veterinary hospitals. Regionally, the market analysis spans North America; Latin America; Western Europe; Eastern Europe; East Asia; South Asia & Pacific; and the Middle East & Africa.

Glass is set to dominate the cider packaging market in 2025 with a 46% share, driven by its premium perception and compatibility with both carbonated and still cider variants. Key factors driving growth include high consumer preference for transparency and product visibility in alcoholic beverages and brand positioning strategies tied to heritage and craft value, where glass remains the default format. However, a less visible disruptor is lightweight glass bottle innovation-reducing average unit weight by 12-18%-which is helping producers manage logistics costs while preserving brand cues.

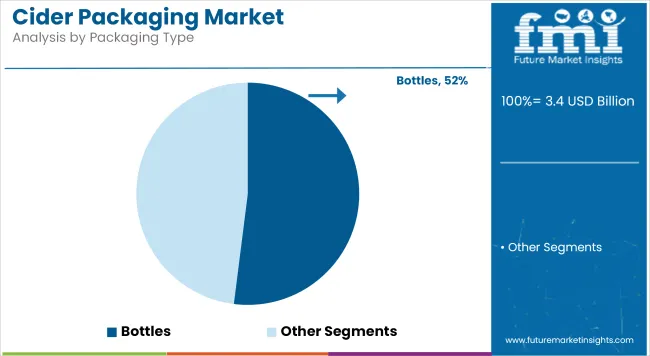

Bottles will account for the largest share of cider packaging in 2025, estimated at 52%, reflecting their entrenched use across both on-premise and off-premise channels. Two structural drivers underpin this:

A subtler shift is emerging in the form of refillable and returnable bottle programs, which-despite covering only 11% of bottle volume-have grown at 2.3x the pace of single-use formats in Northern and Western Europe.

E-commerce will dominate cider packaging end use in 2025, holding a 41% share, as digital retailing reshapes distribution for both mainstream and craft cider brands. A quieter but influential disruptor is subscription-based cider services, which now account for 6.5% of all e-commerce cider shipments-triggering demand for modular, branded outer packs that support unboxing engagement.

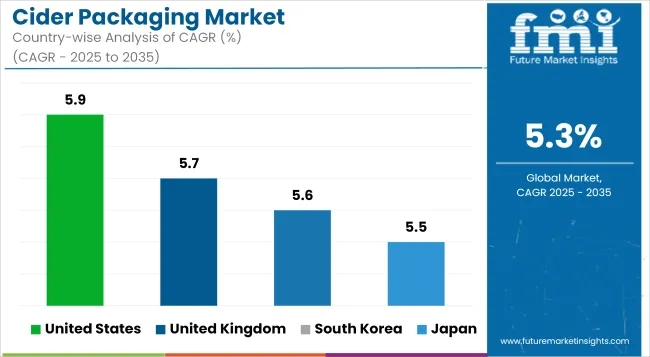

Across leading cider-consuming nations, packaging preferences are being reshaped by a mix of retail format shifts, regulatory nudges, and consumer engagement strategies. In mature markets such as the United States and United Kingdom, premiumization is pushing glass packaging formats with customized branding.

Meanwhile, South Korea and Japan are seeing faster uptake of compact, portable formats aligned with convenience retail. France and Germany continue to emphasize recyclability and local sourcing, driving demand for refillable glass and mono-material secondary packaging. Each country’s cider packaging trajectory is increasingly tied not just to volume, but to format differentiation and fulfillment compatibility across channels.

Growing at 5.7% CAGR, the UK cider packaging market remains highly glass-centric due to strong off-trade consumption and legacy branding cues. The Plastic Packaging Tax continues to shift usage from single-use PET toward recycled content alternatives. While refillable systems remain under trial, retailers report higher demand for shelf-ready packs compatible with local logistics..

South Korea is expected to grow at 5.6% CAGR, with portable and lightweight cider formats driving volume growth in the urban convenience channel. PET and aluminum cans are favored over glass due to ease of disposal and transit.

However, unit economics remain tight, as multi-pack formats raise packaging costs by 12-15%. Regulations mandating front-of-pack recyclability grades are influencing label and material choice. In a 2025 consumer study, 59% preferred resealable cider containers for on-the-go use.

The Japanese cider packaging market, advancing at 5.5% CAGR, is being driven by minimalist can designs and convenience store penetration. Glass is largely reserved for premium gift sets and seasonal SKUs. Regulatory push via the Containers and Packaging Recycling Law continues to tighten recyclability thresholds, nudging producers toward mono-material designs. Meanwhile, 63% of Japanese consumers surveyed in 2025 preferred compact, easy-to-carry cider formats.

Growing at a 5.4% CAGR, France’s cider packaging remains tied to traditional 750ml glass bottles, especially in artisanal segments. However, logistics inflation and rising glass costs (+6.2% YoY) are triggering a slow shift toward lighter and recyclable options. Compliance with the AGEC law is driving a transition to mono-material outer packaging. A 2025 national survey found 58% of French consumers believe packaging format communicates the cider’s authenticity and quality.

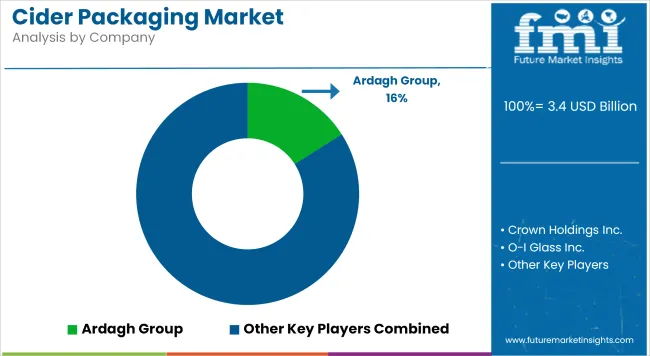

The players in the cider packaging market are focusing on format innovation and regional material sourcing to meet evolving sustainability mandates and consumer preferences. Ardagh Group, which leads with a 16% share, has expanded lightweight glass bottle production across the EU to lower transport costs and reduce emissions. Similarly, Crown Holdings Inc. is optimizing can formats tailored for portable cider SKUs in Asia-Pacific. O-I Glass Inc. has launched returnable cider bottle lines in France and Germany to align with local circular economy policies.

Ball Corporation and WestRock Company are prioritizing e-commerce-ready packaging, including crush-resistant designs and modular inserts, to tap into the 41% e-commerce end-use share. Berlin Packaging and Smurfit Kappa are strengthening private-label cider support via customized secondary packaging. Meanwhile, companies like PakTech and GPA Global are investing in molded fiber handles and compostable components, driven by shifts in Western Europe and the USA

Over the next five years, suppliers with mono-material capabilities and in-region logistics will likely gain an edge as regulations tighten and cost sensitivity rises across retail and online fulfillment. Late movers relying on conventional, mixed-material packaging risk exclusion from premium cider segments in North America and Europe.

| Attribute | Details |

|---|---|

| Market Name | Cider Packaging Market |

| Base Year | 2024 |

| Forecast Period | 2025 to 2035 |

| Market Size 2025 | USD 3.4 Billion |

| Market Size 2035 | USD 5.7 Billion |

| CAGR (2025 to 2035) | 5.3% |

| Historical Data | 2020 to 2024 |

| Forecast Units | USD Billion (Revenue) |

| Segments Covered | Material Type; Packaging Type; End Use; Region |

| By Material Type | Glass, Plastic, Metal |

| By Packaging Type | Bottles, Cans, Stand-up Pouches |

| By End Use | Veterinary Pharmacies, E-commerce, Veterinary Clinics, Veterinary Hospitals |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | 30+ (including US, UK, France, Japan, South Korea) |

| Key Companies Profiled | Ardagh Group, Crown Holdings Inc., O-I Glass Inc., Ball Corporation, WestRock Company, Berlin Packaging, Smurfit Kappa Group, PakTech, Orora Packaging, GPA Global |

The cider packaging market is projected to be valued at USD 3.4 billion in 2025.

By 2035, the cider packaging market is expected to reach USD 5.7 billion.

The market is expected to grow at a CAGR of 5.3% during the forecast period.

Glass holds the leading share at 46% in 2025.

Bottles dominate, accounting for 52% of the market in 2025.

E-commerce is the leading end-use segment, with a 41% share in 2025.

The United States is the most lucrative, with a projected CAGR of 5.9% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Distribution Among Cider Packaging Companies

Cider Brewing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Cider Market Analysis by Product Type, Packaging Type, Distribution Channel and Region through 2035

Cider and Perry Market Analysis by Product Type, Trade Type, and Region through 2035

Apple Cider Vinegar Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA