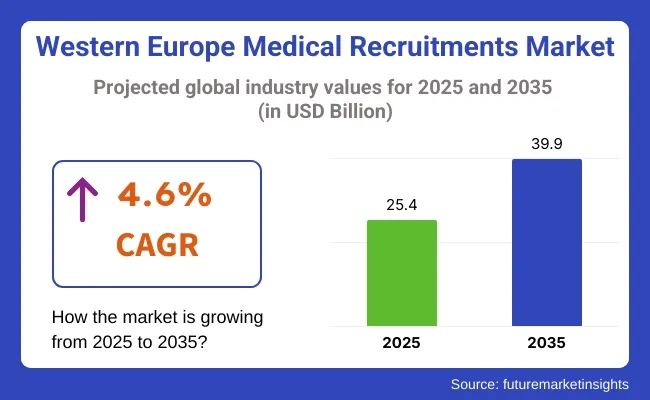

The Western Europe medical recruitment market is expected to reach approximately USD 25.4 billion in 2025 and expand to around USD 39.9 billion by 2035, reflecting a compound annual growth rate (CAGR) of 4.6% over the forecast period.

The Western Europe Medical Recruitment Market is expected to grow at a healthy rate in the forecast period of 2025 to 2035. The complex field of pharmaceuticals and biotechnology presents unique challenges, prompting companies to seek specialized talent to help them navigate regulatory obstacles while maintaining compliance.v Boosted by the increasing aging population and growth of clinical research, the recruitment demand contributes.

| Metric | Value (USD Billion) |

|---|---|

| Industry Size (2025E) | USD 25.4 Billion |

| Industry Value (2035F) | USD 39.9 Billion |

| CAGR (2025 to 2035) | 4.6% |

Managed services and digital hiring platforms will be at the forefront of providing workforce solutions. The search for healthcare professionals across all disciplines by healthcare providers will continue to be cross-border in some candidate markets, and life science companies have accessed smaller markets with qualified professionals to ensure their operations are efficient.

Pharmaceutical Industry: Constant Appeal for professionals, owing to the driving specialists behind the drug advancement

Due to persistent growth led by surging demand for novel medications, generics, and biosimilars, the pharmaceutical segment cradles the Western European medical recruitment industry. Strict regulatory demands require expertise in R&D, clinical trials, regulatory affairs, and manufacturing.

Moreover, the demand for specialized healthcare workers is driven by aging populations and the rising prevalence of chronic diseases. With the industry focus on Digital Transformation, Personalized medicine and Biologics, demand for talent is only rising.

Pharma companies are always looking for experienced people, which leads to higher recruitment. Western Europe is a leader in medical hiring within the medical sector, aided by the presence of major pharmaceutical companies and CROs.

Increasing Demand for Skilled Professionals in Regulatory Affairs, Driving the Medical Devices Segment of the Market

In Western Europe medical recruitment market, medical devises has a prominent share owing to the technological advancements along with regulatory compliance requirements. Skilled engineers, regulatory specialists and sales professionals are essential to the region’s strong manufacturing base and innovation-driven growth.

This recruitment is driven by growing need for diagnostics, imaging equipment and minimally invasive devices The growing number of older people and more surgical procedures also increase employment. EU medical device regulations (MDR) are strict, increasing the need for compliance experts to be hired.

And global companies set up R&D and production centers in Western Europe, a major driver for talent acquisition. The move to digital health and wearable tech also speeds up recruiting in this sector that is increasingly dynamic.

Growing Demand For Quick Hire Solutions To Fuel Demand In Western Europe Medical Recruitment Market Segment

Increasing use of skilled healthcare professionals in pharmaceuticals and medical devices is the key driver of the market, due to which recruitment services held the largest share in the Western Europe medical recruitment market. Businesses depend on third-party recruitment firms to urgently fill roles in R&D, regulatory affairs, clinical trials, and manufacturing.

Outsourcing recruitment is a strategic move given the complexities involved in hiring skilled professionals and changing compliance regulations. This segment is also bolstered by the increasing prevalence of contract-based work, where companies hire talent worldwide. Specialised recruitment agencies provide in-depth knowledge of specific industries, helping companies with talent shortages to streamline their hiring processes, and are thus, a crucial part of recruitment in the healthcare sector.

The private clinics and long-term care facilities segment is dominating the market due to growing demand for personalized healthcare services.

Being the dominant force in the Western Europe medical recruitment industry with an increasing number of pharmaceutical and medical device firms opting for end-to-end workforce solutions Managed services are being increasingly adopted by companies for cost-effective scalable staffing, though labor laws in Europe are strict, necessitating compliance at every step.

These services manage payroll, onboarding and workforce administration, significantly lightening the load on employers in terms of administration. Moreover, the growing demand for flexible workforce solutions such as contract-based and temporary roles, is the propelling factor behind the market growth.

Health-conscious managed services providers (MSP) also ensures that talent acquisition strategies are optimized, workforce productivity is enhanced, and no deadlines are missed, thereby making it a leading force in health care recruitment.

Economic Uncertainty and Budget Constraints Significantly Impact Workforce Expansion and Recruitment Strategies.

In the context of economic volatility and budget ceilings, the expansion of the workforce and recruitment approaches by Western European medical recruitment firms are significantly affected. Funding cuts in healthcare, changes in government policy, and an economic downturn often result in fewer hiring opportunities for pharmaceutical, biotechnology, and medical device companies.

A limited budget for competitive salaries and benefits may make it challenging for organizations to attract and retain top talent. Moreover, cost-saving initiatives may also lead to hiring freezes, a staff reduction in recruitment teams or a shift to temporary and contract workers instead of new staff hires.

In fact, smaller firms and startups in the healthcare sector are even more affected than larger corporations, as they compete with them to attract professionals. To counteract these problems, companies are adopting cost-effective recruitment through outsourcing and managed services.

Public-Private Partnerships Present a Significant Opportunity for Medical Recruitment Firms.

To help maintain a balance between the need for healthcare services and the available workforce, public-private partnerships offer an excellent opportunity for medical recruitment companies to contribute to the development of a capable workforce. Such recruiters can partner with governmental health initiatives to expedite the recruitment process in public hospitals, research institutions and national health programs.

These partnerships enable more effective workforce planning, allowing for the development and maintenance of a continuous source of skilled talent for essential jobs in pharmaceuticals, biotechnology, and medical devices. Additionally, governments could subsidize or financially incentivize recruitment agencies to address shortages in essential health service sectors.

This can be achieved by ensuring that recruitment efforts are aligned with national healthcare priorities. Efficiency can be improved, staffing outcomes can be enhanced, and the overall healthcare system can be strengthened.

Locum Tenens Growth

Huge growth in locum tenens in Western Europe is enabling healthcare systems to adapt to variations in workloads and address healthcare workforce shortages. Physicians, nurses, and allied health professionals are increasingly used in short-term placements to fill temporary voids created by vacation leaves, training intervals, or seasonal surges. Hospitals and clinics enjoy continuity of care, less pressure on permanent staff, and professionals enjoy the flexibility to pick their assignments, locations, and schedules.

Recruitment agencies have been helping with this model, forming centralised locum pools, automating scheduling, and supplying compliance support. In markets such as the UK and Germany, locum tenens forms an intrinsic part of workforce strategy in a range of specialties and areas of practice, particularly in more rural locations where the long-term recruitment of necessary staff is more difficult. As work-life balance becomes a goal for clinicians, part-time and temporary roles are likely to be in demand.

Workforce analytics is one of the most important emerging trends within the Western European medical recruitment market. Healthcare providers are increasingly using demographic data, service utilization trends, and clinician workload metrics to inform predictive analytics that can help identify staffing needs.

This information enables proactive workforce planning and decreases dependence on reactive, last-minute recruiting and enhances retention. The recruitment platforms are also embedding analytics dashboards that can track performance indicators like time-to-fill, candidate conversion rates, compliance completion, etc., which enables data-driven decision making and continuous improvement.

Market Overview: The demand for healthcare professionals has been steadily increasing over the years, driven by growing healthcare needs and an aging population. The expansion of healthcare infrastructure, with a heightened focus on patient care services, has further supported market growth. The broader expansion faced challenges such as strict regulatory requirements and ethical concerns related to international recruitment.

Future trends indicate market expansion due to advancements in recruitment technology, higher investment in healthcare services, and a focus on ethical hiring practices. The adoption of digital platforms and AI-driven recruitment solutions would ensure efficiency, while policy modifications focusing on the training and retention of domestic professionals would enable long-term workforce stability.

Market Outlook

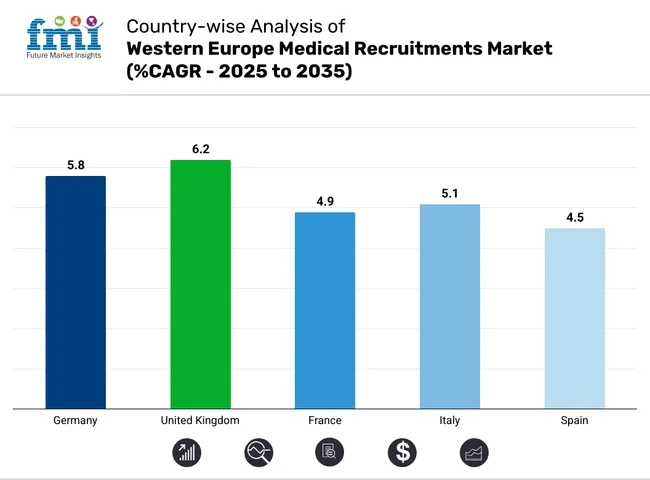

Germany is the largest and most developed medical recruitment market in Western Europe, largely due to chronic workforce shortages and a rapidly aging population. The pressure is growing on hospitals, clinics, and long-term care facilities in the country to maintain sufficient staff as demand on the healthcare system increases.

Especially acute is the need for physicians, nurses, allied health professionals with locum tenens to help fill continuing workforce gaps. Germany addresses the scarcity of healthcare workers by seeking out professionals from Eastern Europe and beyond, offering expedited immigration tracks and recognition pathways for foreign-trained medical professionals. Such consistent demand continues to support a strong medical recruitment market in the country.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 5.8% |

Market Outlook

The UK medical recruitment industry is forging ahead with remarkable resilience in spite of various obstacles, including workforce shortages due to Brexit and the complexities of regulatory requirements. The NHS remains the major employer, depending heavily on agency staffing, international recruitment, and locum professionals to fill its ever-widening gaps within the workforce.

Demand for healthcare workers intensified post-pandemic, particularly in addressing backlogs in elective procedures and expanding mental health services. The recruitment needs are further buoyed by private healthcare providers as well as care homes, strengthening the market. The UK is increasingly fast-tracking immigration routes and providing incentives to attract foreign-trained medical professionals and fill service shortages.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.2% |

Market Outlook

The medical recruitment market in France is witnessing steady growth due to a sustained shortage of physicians, especially in rural areas, and an ongoing demand for temporary or replacement doctors across all sectors of private and public healthcare establishments. The healthcare system is increasingly pursuing cross-border recruitment, primarily of nurses, general practitioners, and midwives, to fill gaps left by the onshore workforce.

Other issues where provider burnout is being addressed include methods of strategic staffing to sustain workloads and enhance healthcare service delivery. In combating the issue of a workforce shortage, France intensifies the pace of foreign credential recognition, provides incentives for medical professionals in organizationally deprived areas, and sustains interim staffing solutions for continuity of care in still-critical sectors.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| France | 4.9% |

Market Outlook

Italy has indeed well-structured and digitized healthcare. However, it lacks in workforce primarily in nursing, home healthcare, and elderly care. Therefore, as the percentage of the aging population increases, there is an accompanying rise in demand for long-term care experts.

To fill the gaps, the medical recruitment firms now focus on international hiring and sourcing skilled nurses and technicians from abroad. Telehealth staffing is now proliferating, along with flexible part-time placements, which suit the needs of changing healthcare institutions in Italy. Work-life balance and employee retention strategies are also influencing the recruitment models, particularly in private and home-based care.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Italy | 5.1% |

Market Outlook

The Spanish medical recruitment market is booming thanks to the continuous increase in healthcare needs, the rising number of elderly patients, and an ongoing shortage of trained professionals, mainly in nursing and geriatrics. The existence of temporary locum and imported professional physicians is now even more pronounced in an environment where staffing is untenable for public hospitals and private institutions.

Government initiatives are already underway to attract foreign-trained medical workers interested in coming from countries such as Latin America and EU nations to fill workforce gaps in the domestic health sector. In addition, health-care services in Spain are venturing into digital health solutions and telemedicine, which will further increase the need for IT-skilled professionals in the health sector. Private health services will continue to develop high recruitment trends.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Spain | 4.5% |

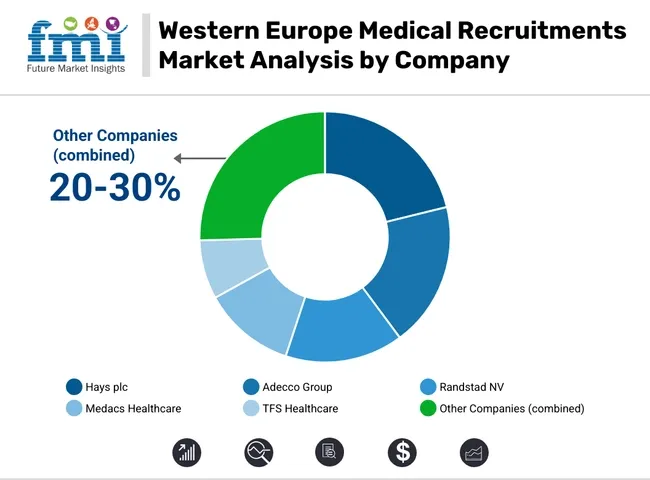

The Western Europe medical recruitment market is characterized by the presence of several clinical recruitment agencies position, which provide hiring solutions for firms in the medical device and pharmaceutical sectors. These firms are using machine learning tools, ATS and predictive analytics to make recruitment seamless. For example, expanding managed services as end-to-end solutions, such as payroll management and regulatory compliance support, is a common strategy.

Firms seek global talent to fill skill gaps and enable cross-border placements. Furthermore, collaborations with hospitals, biotech companies, and research organizations solidify market position. Through constant improvement of their services, the recruitment providers retain a competitive edge even in the dynamic healthcare environment of Western Europe.

Hays plc (20-25%)

Hays dominates the Western Europe medical recruitment market by leveraging its extensive healthcare talent networks and customized hiring solutions. Its country-specific expertise ensures precise placements across pharmaceuticals, medical devices, and healthcare sectors.

Adecco Group (18-22%)

Adecco’s strong presence in Europe enables rapid staffing for hospitals, clinics, and pharmaceutical firms. Its robust healthcare division specializes in temporary, contract, and permanent placements, ensuring workforce flexibility and efficiency.

Randstad NV (14-18%)

Randstad integrates large-scale staffing capabilities with AI-driven recruitment platforms, improving candidate-client matching. Its focus on digital transformation streamlines hiring processes, ensuring quick placements for healthcare institutions and life sciences companies.

Medacs Healthcare (10-14%)

Medacs specializes in international healthcare staffing, collaborating with public health systems and global agencies. Its expertise in placing skilled professionals across borders strengthens workforce mobility and industry compliance.

TFS Healthcare (5-9%)

TFS Healthcare, a UK-based specialist, is known for its strict compliance standards and swift placement process. It excels in supplying qualified healthcare professionals to meet urgent staffing demands.

Other Key Players (20-30% Combined)

Additional firms contributing to Western Europe’s medical recruitment landscape include:

These companies are instrumental in addressing shortages through cross-border staffing, digital hiring platforms, and training support for clinical personnel across Western Europe.

Pharmaceutical Industry, Medical Devices, Biotechnology, Nursing/Healthcare, Paramedical Staff, Scientific Research, Medical Research/Clinical Research, Pharmacies, Optometry, Regulatory and Quality, Diagnostics, Animal Health.

Health Professional, Biological and Medical Scientists, Health Information Technicians and Compounders

Recruitment Services, Managed Services, Homecare Services and Specialist Care Services

Germany, Italy, France, United Kingdom, Spain, BENELUX, Nordic Countries, Rest of Western Europe

The Western Europe Medical Recruitment industry is projected to witness CAGR of 4.6% between 2025 and 2035.

The Western Europe Medical Recruitment industry stood at USD 24.3 billion in 2024.

The Western Europe Medical Recruitment industry is anticipated to reach USD 39.9 billion by 2035 end.

Germany is expected to show a CAGR of 5.8% in the assessment period.

The key players operating in the Western Europe Medical Recruitment industry are Hays plc, Adecco Group, Randstad NV, Medacs Healthcare, TFS Healthcare, CPL Healthcare, EGV Recruiting, DRC Locums, Pulse Healthcare, Global Medics and Others.

Table 1 : Western Europe Market Analysis 2017 to 2022 and Forecast 2023 to 2033, by Vertical

Table 2 : Western Europe Market Analysis 2017 to 2022 and Forecast 2023 to 2033by Candidature

Table 3 : Western Europe Market Analysis 2017 to 2022 and Forecast 2023 to 2033, by Service

Table 4 : Western Europe Market Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 5 : United kingdom Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Vertical

Table 6 : United kingdom Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Candidature

Table 7 : United kingdom Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Service

Table 8 : Germany Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Vertical

Table 9 : Germany Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Candidature

Table 10 : Germany Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Service

Table 11 : France Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Vertical

Table 12 : France Market Analysis 2017 to 2022 aand Forecast 2023 to 2033by Candidature

Table 13 : France Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Service

Table 14 : BENELUX Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Vertical

Table 15 : BENELUX Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Candidature

Table 16 : BENELUX Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Service

Table 17 : Sweden Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Vertical

Table 18 : Sweden Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Candidature

Table 19 : Sweden Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Service

Table 20 : Norway Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Vertical

Table 21 : Norway Market Analysis 2017 to 2022 and Forecast 2023 to 2033by Candidature

Table 22 : Norway Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Service

Table 23 : Denmark Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Vertical

Table 24 : Denmark Market Analysis 2017 to 2022 and Forecast 2023 to 2033by Candidature

Table 25 : Denmark Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Service

Figure 1 : Western Europe Market Value (US$ Million) Analysis, 2017 to 2022

Figure 2 : Western Europe Market Forecast & Y-o-Y Growth, 2023 to 2033

Figure 3 : Western Europe Market Absolute $ Opportunity (US$ Million) Analysis, 2022 to 2033

Figure 4: Western Europe Market Value Share (%) Analysis 2023 and 2033, by Vertical

Figure 5: Western Europe Market Y-o-Y Growth (%) Analysis 2022-2033, by Vertical

Figure 6: Western Europe Market Attractiveness Analysis 2023 to 2033, by Vertical

Figure 7: Western Europe Market Value Share (%) Analysis 2023 and 2033, by Candidature

Figure 8: Western Europe Market Y-o-Y Growth (%) Analysis 2022-2033, by Candidature

Figure 9 : Western Europe Market Attractiveness Analysis 2023 to 2033, by Candidature

Figure 10: Western Europe Market Value Share (%) Analysis 2023 and 2033, by Service

Figure 11: Western Europe Market Y-o-Y Growth (%) Analysis 2022-2033, by Service

Figure 12 : Western Europe Market Attractiveness Analysis 2023 to 2033, by Service

Figure 13: Western Europe Market Value Share (%) Analysis 2023 and 2033, by Country

Figure 14: Western Europe Market Y-o-Y Growth (%) Analysis 2022-2033, by Country

Figure 15 : Western Europe Market Attractiveness Analysis 2023 to 2033, by Country

Figure 16 : United kingdom Market Value (US$ Million) Analysis, 2017 to 2022

Figure 17 : United kingdom Market Value (US$ Million) Forecast, 2023 to 2033

Figure 18 : United kingdom Market Value Share, by Vertical (2023 E)

Figure 19 : United kingdom Market Value Share, by Candidature (2023 E)

Figure 20 : United kingdom Market Value Share, by Service (2023 E)

Figure 21 : United kingdom Market Attractiveness Analysis by Vertical, 2023 to 2033

Figure 22 : United kingdom Market Attractiveness Analysis by Candidature, 2023 to 2033

Figure 23 : United kingdom Market Attractiveness Analysis by Service, 2023 to 2033

Figure 24 : Germany Market Value (US$ Million) Analysis, 2017 to 2022

Figure 25 : Germany Market Value (US$ Million) Forecast, 2023 to 2033

Figure 26 : Germany Market Value Share, by Vertical (2023 E)

Figure 27 : Germany Market Value Share, by Candidature (2023 E)

Figure 28 : Germany Market Value Share, by Service (2023 E)

Figure 29 : Germany Market Attractiveness Analysis by Vertical, 2023 to 2033

Figure 30 : Germany Market Attractiveness Analysis by Candidature, 2023 to 2033

Figure 31 : Germany Market Attractiveness Analysis by Service, 2023 to 2033

Figure 32 : France Market Value (US$ Million) Analysis, 2017 to 2022

Figure 33 : France Market Value (US$ Million) Forecast, 2023 to 2033

Figure 34 : France Market Value Share, by Vertical (2023 E)

Figure 35 : France Market Value Share, by Candidature (2023 E)

Figure 36 : France Market Value Share, by Service (2023 E)

Figure 37 : France Market Attractiveness Analysis by Vertical, 2023 to 2033

Figure 38 : France Market Attractiveness Analysis by Candidature, 2023 to 2033

Figure 39 : France Market Attractiveness Analysis by Service, 2023 to 2033

Figure 40 : BENELUX Market Value (US$ Million) Analysis, 2017 to 2022

Figure 41 : BENELUX Market Value (US$ Million) Forecast, 2023 to 2033

Figure 42 : BENELUX Market Value Share, by Vertical (2023 E)

Figure 43 : BENELUX Market Value Share, by Candidature (2023 E)

Figure 44 : BENELUX Market Value Share, by Service (2023 E)

Figure 45 : BENELUX Market Attractiveness Analysis by Vertical, 2023 to 2033

Figure 46 : BENELUX Market Attractiveness Analysis by Candidature, 2023 to 2033

Figure 47 : BENELUX Market Attractiveness Analysis by Service, 2023 to 2033

Figure 48 : Sweden Market Value (US$ Million) Analysis, 2017 to 2022

Figure 49 : Sweden Market Value (US$ Million) Forecast, 2023 to 2033

Figure 50 : Sweden Market Value Share, by Vertical (2023 E)

Figure 51 : Sweden Market Value Share, by Candidature (2023 E)

Figure 52 : Sweden Market Value Share, by Service (2023 E)

Figure 53 : Sweden Market Attractiveness Analysis by Vertical, 2023 to 2033

Figure 54 : Sweden Market Attractiveness Analysis by Candidature, 2023 to 2033

Figure 55 : Sweden Market Attractiveness Analysis by Service, 2023 to 2033

Figure 56 : Norway Market Value (US$ Million) Analysis, 2017 to 2022

Figure 57 : Norway Market Value (US$ Million) Forecast, 2023 to 2033

Figure 58 : Norway Market Value Share, by Vertical (2023 E)

Figure 59 : Norway Market Value Share, by Candidature (2023 E)

Figure 60 : Norway Market Value Share, by Service (2023 E)

Figure 61 : Norway Market Attractiveness Analysis by Vertical, 2023 to 2033

Figure 62 : Norway Market Attractiveness Analysis by Candidature, 2023 to 2033

Figure 63 : Norway Market Attractiveness Analysis by Service, 2023 to 2033

Figure 64 : Denmark Market Value (US$ Million) Analysis, 2017 to 2022

Figure 65 : Denmark Market Value (US$ Million) Forecast, 2023 to 2033

Figure 66 : Denmark Market Value Share, by Vertical (2023 E)

Figure 67 : Denmark Market Value Share, by Candidature (2023 E)

Figure 68 : Denmark Market Value Share, by Service (2023 E)

Figure 69 : Denmark Market Attractiveness Analysis by Vertical, 2023 to 2033

Figure 70 : Denmark Market Attractiveness Analysis by Candidature, 2023 to 2033

Figure 71 : Denmark Market Attractiveness Analysis by Service, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Western Blotting Processors Market Trends and Forecast 2025 to 2035

Western Blotting Market is segmented by product, application and end user from 2025 to 2035

Western Europe Automotive Performance Tuning & Engine Remapping Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Western Europe Bicycle Component Aftermarket Analysis Size and Share Forecast Outlook 2025 to 2035

Western Europe Automotive Load Floor IndustryAnalysis in Western Europe Forecast & Analysis 2025 to 2035

Western Europe Probiotic Supplement Market Analysis in – Growth & Market Trends from 2025 to 2035

Western Europe Women’s Intimate Care Market Analysis – Size, Share & Trends 2025 to 2035

Western Europe Non-Dairy Creamer Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Western Europe Last-mile Delivery Software Market – Growth & Outlook through 2035

Western Europe Inkjet Printer Market – Growth & Forecast 2025 to 2035

Western Europe HVDC Transmission System Market – Growth & Forecast 2025 to 2035

Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

Western Europe Intelligent Enterprise Data Capture Software Market - Growth & Forecast 2025-2035

Communications Platform as a Service (CPaaS) Market Growth - Trends & Forecast 2025 to 2035

Visitor Management System Industry Analysis in Western Europe - Market Outlook 2025 to 2035

Western Europe Base Station Antenna Market - Growth & Demand 2025 to 2035

Western Europe Banking-as-a-Service (BaaS) Platform Market - Growth & Demand 2025 to 2035

Western Europe Event Management Software Market Trends – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA