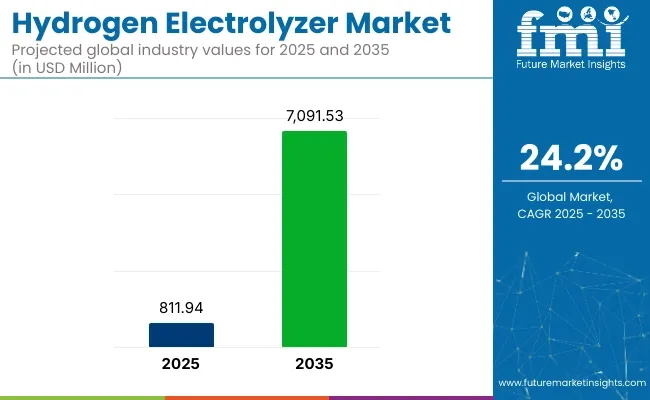

The global hydrogen electrolyzer market is valued at USD 811.94 million in 2025 and is poised to register USD 7,091.53 million by 2035, which shows a CAGR of 24.2% during the forecast period. This rapid growth is being fueled by the global push toward decarbonization, clean energy generation, and the development of green hydrogen infrastructure.

Hydrogen electrolyzers, which use electricity to split water into hydrogen and oxygen, are central to producing green hydrogen when powered by renewable sources such as solar and wind. Governments and industries are increasingly adopting electrolyzers to decouple energy systems from fossil fuels and support carbon neutrality goals across power, transportation, and industrial sectors.

Furthermore, technological advancements and falling renewable electricity costs are accelerating large-scale deployment of electrolyzers. Alkaline, PEM (proton exchange membrane), and solid oxide electrolyzer technologies are evolving to provide higher efficiencies, modular scalability, and longer operational life.

Leading manufacturers are scaling up gigawatt-level projects, supported by strategic collaborations with energy firms, utilities, and governments. Key use cases include ammonia production, steelmaking, fuel cell vehicles, and grid energy storage. The integration of electrolyzers into hybrid renewable systems is also enabling decentralized hydrogen production in off-grid or remote locations, helping improve energy access while lowering carbon footprints.

In addition, policy incentives, infrastructure investments, and national hydrogen strategies are creating a supportive regulatory environment for the electrolyzer market. The European Union Hydrogen Strategy, the USA Department of Energy Hydrogen Shot initiative, and Asia Pacific countries' net zero commitments are mobilizing funding, research, and pilot projects.

Carbon pricing, emissions regulations, and clean energy mandates are further pushing industries to transition toward hydrogen-based solutions. As global efforts to build hydrogen economies intensify, the electrolyzer market is expected to experience exponential growth, supported by innovation, supply chain expansion, and strong political will to achieve climate and energy resilience targets.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 811.94 million |

| Industry Value (2035F) | USD 7,091.53 million |

| CAGR (2025 to 2035) | 24.2% |

The market is segmented based on product type, capacity, outlet pressure, end use, and region. By product type, the market is divided into proton exchange membrane (PEM) electrolyzers, alkaline electrolyzers, and solid oxide electrolyzers. In terms of capacity, it is segmented into low (≤150 kW), medium (150 kW - 1 MW), and high (>1 MW).

The medium segment includes 150-400 kW, 400-750 kW, and 750 kW-1 MW, while the high segment is further categorized into 1-10 MW, 10-20 MW, and above 20 MW. Based on outlet pressure, the market is segmented into low (≤10 bar), medium (10-40 bar), and high (>40 bar).

By end use, the market includes ammonia, methanol, refining/hydrocarbon, electronics, energy, power to gas, transport, pharma & biotech, food & beverages, and others (including metal processing, steel manufacturing, glass production, and water treatment facilities). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

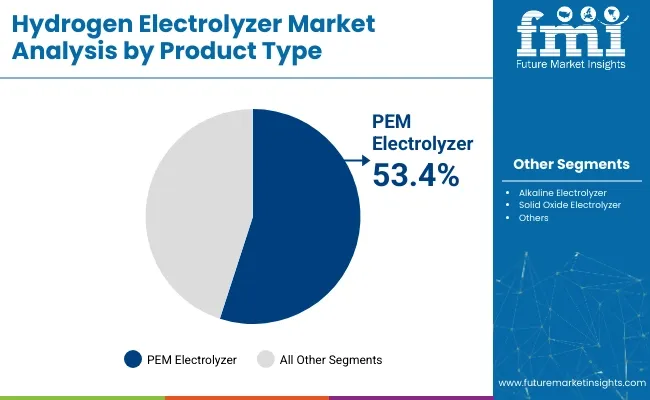

The proton exchange membrane (PEM) electrolyzer segment is expected to dominate the hydrogen electrolyzer market, accounting for a 53.4% market share in 2025. These electrolyzers are widely valued for their high efficiency, compact footprint, and ability to operate under dynamic conditions.

Unlike alkaline or solid oxide electrolyzers, PEM systems offer rapid start-up times and are highly compatible with intermittent renewable energy sources such as solar and wind. Their adaptability makes them ideal for energy storage, grid balancing, and decentralized hydrogen production.

The segment’s growth is driven by rising investments in green hydrogen projects and increasing adoption of renewable-powered electrolysis technologies in Europe and Asia. Companies like Siemens Energy, ITM Power, and Cummins are expanding their PEM electrolyzer portfolios to meet global decarbonization targets.

Although alkaline electrolyzers maintain cost advantages for large-scale hydrogen plants, PEM technologies are preferred in mobility, distributed energy, and industrial applications demanding flexibility and fast response. Solid oxide electrolyzers, while promising high efficiency at elevated temperatures, are still in earlier stages of commercialization.

The sodium oxide electrolyzer segment occupies 335 share. Overall, the growing need for clean hydrogen, combined with favorable technical attributes, is expected to keep PEM electrolyzers at the forefront of product innovation and market expansion.

| Product Type | Share (2025) |

|---|---|

| PEM Electrolyzer | 53.4% |

| Sodium Oxide Electrolyzer | 33% |

The low outlet pressure segment is projected to maintain its dominance in the hydrogen electrolyzer market, capturing a 62.8% share in 2025. Electrolyzers with outlet pressures ≤10 bar are widely favored due to their operational simplicity, cost efficiency, and broad applicability across industrial and energy sectors.

These systems are extensively used in hydrogen refueling stations, chemical manufacturing, power-to-gas applications, and localized hydrogen production for small-scale energy storage. The expansion of hydrogen mobility infrastructure globally particularly in Europe and South Korea is fueling the need for on-site electrolyzers with low-pressure output.

These units are easier to integrate with compression and storage systems, especially for fuel cell electric vehicles (FCEVs). Additionally, low-pressure systems are more energy-efficient, reducing the need for post-electrolysis compression, which contributes to overall operational savings.

Companies such as Nel ASA, Plug Power, and Giner ELX continue to develop scalable and modular electrolyzer solutions optimized for low-pressure operation. Meanwhile, medium- and high-pressure systems cater to niche applications such as pipeline injection or advanced industrial synthesis.

Despite this, the low-pressure segment’s versatility and growing use in green hydrogen hubs ensure its continued market leadership in the coming years. The medium pressure segment accounts for 30% share.

| Outlet Pressure | Share (2025) |

|---|---|

| Low Pressure (≤10 bar) | 62.8% |

| Medium Pressure (10 bar - 40 bar) | 30% |

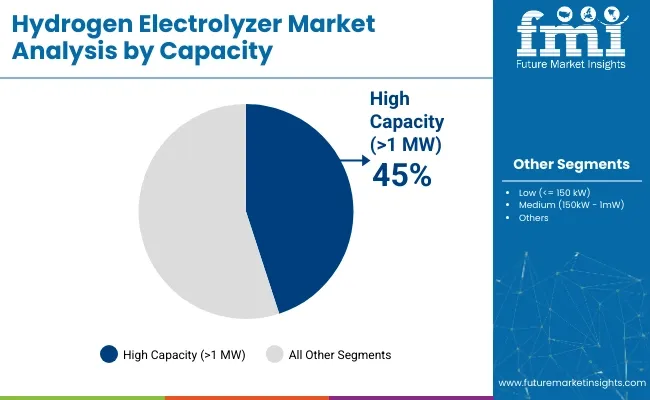

The high-capacity electrolyzer segment defined as systems above 1 MW is forecasted to grow at a CAGR of 7.1% from 2025 to 2035. This segment registers 45% share. This growth is driven by accelerating deployment of large-scale green hydrogen projects across industrial zones, refineries, and power-to-gas facilities.

High-capacity systems are crucial for meeting the hydrogen demands of decarbonizing hard-to-abate sectors such as steel manufacturing, ammonia production, and petrochemicals. Electrolyzers in the 1-10 MW and 10-20 MW ranges are increasingly being installed in centralized hydrogen hubs and renewable-powered electrolysis plants.

Projects like the NEOM Green Hydrogen Project and HyDeal Ambition in Europe exemplify this growing trend. These megawatt-scale systems enable economies of scale, improving the levelized cost of hydrogen (LCOH) and accelerating commercial viability.

Leading players such as Thyssenkrupp, Siemens Energy, and John Cockerill are developing gigawatt-scale manufacturing capacities to meet the anticipated demand surge. In addition to industrial use, high-capacity electrolyzers are also integrated with wind and solar farms to convert surplus electricity into storable hydrogen.

While low- and medium-capacity systems cater to distributed energy and mobility, the high-capacity segment is set to play a pivotal role in achieving global decarbonization targets. The medium segment captures 34% share.

| Capacity | Share (2025) |

|---|---|

| High Capacity (>1 MW) | 45% |

| Medium (150kW - 1mW) | 34% |

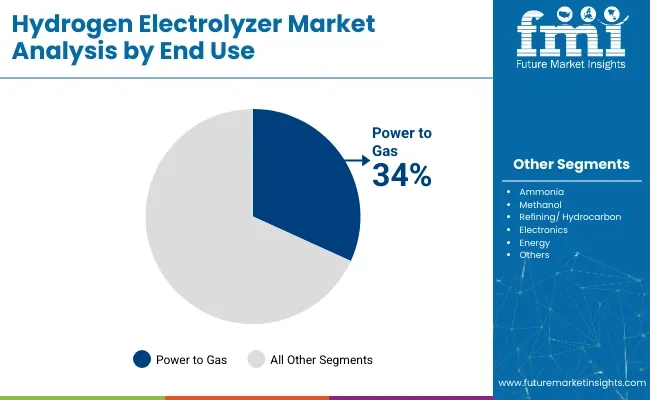

The power to gas segment is projected to grow at a CAGR of 8.2% from 2025 to 2035, emerging as the fastest-expanding end use in the hydrogen electrolyzer market. This segment accounts for 34% share. This technology enables the conversion of surplus renewable electricity into hydrogen via electrolysis, which can then be injected into natural gas grids, stored in underground caverns, or used in synthetic methane production.

The power to gas concept plays a vital role in stabilizing renewable-heavy energy grids, enabling long-duration energy storage, and decarbonizing the natural gas infrastructure. Europe remains the leading hub for power to gas projects, with Germany, the Netherlands, and Denmark investing in pilot and full-scale facilities.

Government support for grid-scale hydrogen storage and decarbonized gas infrastructure is expected to further accelerate growth. Additionally, countries like Japan and South Korea are exploring power to gas integration with offshore wind farms to address energy security and reduce emissions. Electrolyzer manufacturers are tailoring their offerings with scalable modules and grid-responsive designs to serve this growing need.

While traditional segments like ammonia and refining maintain steady demand, the power to gas sector is gaining strategic importance in energy transition plans globally, positioning it as a top investment area during the forecast period. The energy segment accounts for 22% share.

| End Use | Share (2025) |

|---|---|

| Power to Gas | 34% |

| Energy | 22% |

The hydrogen electrolyzer market grew at a 20.3% CAGR between 2020 and 2024. The global market is anticipated to grow at a moderate CAGR of 24.2% over the forecast period 2025 to 2035. The market experienced initial growth driven by increasing awareness of hydrogen as a clean energy carrier and early government initiatives to support hydrogen technology development during the historical period.

Significant advancements in electrolyzer technology, including improvements in efficiency, scalability, and cost effectiveness, also occurred during this period. These advancements contributed to the expansion of the market by making electrolyzers more competitive with traditional hydrogen production methods.

The demand for green hydrogen produced from electrolyzers is expected to surge during the forecast period. Key sectors such as transportation, industry, and power generation are likely to drive significant demand growth for electrolyzer technology.

Electrolyzer manufacturers are anticipated to scale up production facilities to meet growing demand and achieve economies of scale. Investments in manufacturing capacity expansion and supply chain optimization are expected to drive down costs and increase the affordability of electrolyzer systems.

The market is anticipated to witness the emergence of new applications and use cases for hydrogen across various sectors. Innovations in hydrogen storage, transportation, and utilization technologies are expected to open up opportunities for electrolyzer manufacturers to explore new markets and partnerships.

There is a growing global interest in green hydrogen production as part of efforts to decarbonize various sectors such as transportation, industry, and power generation. Electrolyzers play a crucial role in producing green hydrogen through electrolysis of water using renewable energy sources like wind and solar power.

The upfront capital costs associated with installing electrolyzer systems can be substantial, particularly for larger scale installations. High initial investment requirements may deter potential buyers, especially in sectors where cost competitiveness is critical.

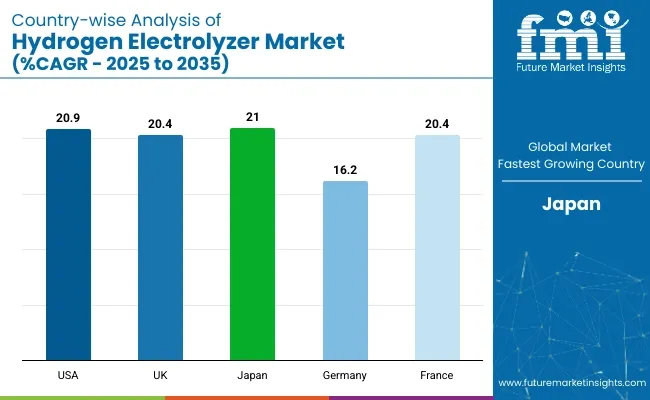

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| USA | 20.9% |

| UK | 20.4% |

| Japan | 21.0% |

| Germany | 16.2% |

| France | 20.4% |

The USA hydrogen electrolyzer market is estimated to grow at a 20.9% CAGR during the study period. This growth is driven by significant federal investments and supportive policies aimed at decarbonizing the economy. The Inflation Reduction Act of 2022 introduced substantial tax credits for clean hydrogen production, stimulating interest in electrolyzers.

Additionally, the Department of Energy's Hydrogen Shot initiative aims to reduce the cost of clean hydrogen by 80% within a decade, further encouraging investment and innovation in the sector. The establishment of hydrogen refueling stations and industrial hydrogen production facilities is expanding the infrastructure needed for widespread adoption. These developments are creating opportunities for electrolyzer manufacturers to supply equipment for hydrogen production and distribution.

The UK hydrogen electrolyzer market is estimated to grow at a 20.4% CAGR during the study period. This growth is driven by the government's ambitious targets to reduce greenhouse gas emissions and promote clean energy. The UK has set a goal to produce 10GW of green hydrogen by 2030, utilizing renewable electricity for electrolysis.

However, challenges remain, including the need for increased efforts and reforms to facilitate wider industrial adoption. Despite these challenges, the commitment to decarbonization and the development of hydrogen infrastructure are propelling the market forward. The expansion of electrolyzer capacity is essential to meet the growing demand for green hydrogen in various sectors.

The Japanese hydrogen electrolyzer market is estimated to grow at a 21% CAGR during the study period. This growth is driven by substantial government funding and support for hydrogen technology development. In 2019, the Japanese government allocated approximately USD 748 million for hydrogen-related projects to support a clean economy.

Additionally, private financial institutions are providing support through initiatives like NEXI's "Loan Insurance for Green Innovation," which offers increased commercial risk coverage for hydrogen-related projects. The installation of large-scale hydrogen electrolyzer plants, such as the 10MW facility in Fukushima, is further driving market growth.

The German hydrogen electrolyzer market is estimated to grow at a 16.2% CAGR during the study period. This growth is driven by the country's commitment to reducing carbon emissions and transitioning to cleaner energy sources.

Germany aims to achieve 10 GW of hydrogen electrolyzer capacity by 2030, aligning with the European Commission's goal of expanding EU electrolyzer capacity to at least 40 GW by the same year. The government is investing heavily in hydrogen infrastructure, with projects like the 100 MW Refhyne initiative at Shell's Rheinland refinery. These efforts are supported by substantial financial commitments, including subsidies for the steel industry to adopt hydrogen technology.

The French hydrogen electrolyzer market is estimated to grow at a 20.4% CAGR during the study period. This growth is driven by the government's National Hydrogen Strategy, which includes significant investments in low-carbon hydrogen technologies. In 2024, the French government announced substantial funding for large-scale electrolyzer projects, aiming to produce 6.5 gigawatts of renewable hydrogen by 2030.

Private companies like EDF and Engie are partnering with global leaders to develop and scale up hydrogen production facilities. These collaborations focus on advancing electrolyzer technology, improving efficiency, and reducing costs to make green hydrogen more competitive with traditional fuels.

The competitive landscape of the hydrogen electrolyzer market is characterized by a mix of established players, emerging companies, and technological innovators vying for market share and leadership positions.

The competition within the electrolyzer market intensifies, as the demand for clean hydrogen continues to rise globally, driven by decarbonization efforts and the transition to renewable energy sources.

Company Portfolio

| Attribute | Details |

|---|---|

| Current Total Market Size (2025) | USD 811.94 million |

| Projected Market Size (2035) | USD 7,091.53 million |

| CAGR (2025 to 2035) | 24.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD million for value |

| By Product Type | Proton Exchange Membrane (PEM) Electrolyzer, Alkaline Electrolyzer, Solid Oxide Electrolyzer |

| By Capacity | Low (≤150 kW), Medium (150-400 kW, 400-750 kW, 750 kW-1 MW), High (1-10 MW, 10-20 MW, Above 20 MW) |

| By Outlet Pressure | Low (≤10 Bar), Medium (10-40 Bar), High (>40 Bar) |

| By End Use | Ammonia, Methanol, Refining/Hydrocarbon, Electronics, Energy, Power to Gas, Transport, Pharma & Biotech, Food & Beverages, Others (e.g., steel, glass, water treatment) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East and Africa |

| Countries Covered | United States, United Kingdom, China, Japan, Korea |

| Key Players | Siemens AG, McPhy Energy, ITM Power Plc, Tianjin Mainland Hydrogen Equipment Co. Ltd, Gaztransport & Technigaz, Giner Inc., GreenHydrogen Systems, iGas Energy GmbH, Beijing CEI Technology Co., Ltd., Air Liquide |

| Additional Attributes | Country-wise CAGR (2025-2035), product and capacity share, policy-driven market shifts, green hydrogen initiatives, and renewable integration strategies |

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Capacity, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by Capacity, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by Outlet Pressure, 2019 to 2034

Table 8: Global Market Volume (Units) Forecast by Outlet Pressure, 2019 to 2034

Table 9: Global Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 10: Global Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 14: North America Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by Capacity, 2019 to 2034

Table 16: North America Market Volume (Units) Forecast by Capacity, 2019 to 2034

Table 17: North America Market Value (US$ Million) Forecast by Outlet Pressure, 2019 to 2034

Table 18: North America Market Volume (Units) Forecast by Outlet Pressure, 2019 to 2034

Table 19: North America Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 20: North America Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 22: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 24: Latin America Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 25: Latin America Market Value (US$ Million) Forecast by Capacity, 2019 to 2034

Table 26: Latin America Market Volume (Units) Forecast by Capacity, 2019 to 2034

Table 27: Latin America Market Value (US$ Million) Forecast by Outlet Pressure, 2019 to 2034

Table 28: Latin America Market Volume (Units) Forecast by Outlet Pressure, 2019 to 2034

Table 29: Latin America Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 30: Latin America Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 33: Western Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 34: Western Europe Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 35: Western Europe Market Value (US$ Million) Forecast by Capacity, 2019 to 2034

Table 36: Western Europe Market Volume (Units) Forecast by Capacity, 2019 to 2034

Table 37: Western Europe Market Value (US$ Million) Forecast by Outlet Pressure, 2019 to 2034

Table 38: Western Europe Market Volume (Units) Forecast by Outlet Pressure, 2019 to 2034

Table 39: Western Europe Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 40: Western Europe Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 44: Eastern Europe Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Capacity, 2019 to 2034

Table 46: Eastern Europe Market Volume (Units) Forecast by Capacity, 2019 to 2034

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Outlet Pressure, 2019 to 2034

Table 48: Eastern Europe Market Volume (Units) Forecast by Outlet Pressure, 2019 to 2034

Table 49: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 50: Eastern Europe Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Capacity, 2019 to 2034

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Capacity, 2019 to 2034

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Outlet Pressure, 2019 to 2034

Table 58: South Asia and Pacific Market Volume (Units) Forecast by Outlet Pressure, 2019 to 2034

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 60: South Asia and Pacific Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 62: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 63: East Asia Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 64: East Asia Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 65: East Asia Market Value (US$ Million) Forecast by Capacity, 2019 to 2034

Table 66: East Asia Market Volume (Units) Forecast by Capacity, 2019 to 2034

Table 67: East Asia Market Value (US$ Million) Forecast by Outlet Pressure, 2019 to 2034

Table 68: East Asia Market Volume (Units) Forecast by Outlet Pressure, 2019 to 2034

Table 69: East Asia Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 70: East Asia Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 74: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Capacity, 2019 to 2034

Table 76: Middle East and Africa Market Volume (Units) Forecast by Capacity, 2019 to 2034

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Outlet Pressure, 2019 to 2034

Table 78: Middle East and Africa Market Volume (Units) Forecast by Outlet Pressure, 2019 to 2034

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 80: Middle East and Africa Market Volume (Units) Forecast by End Use, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Capacity, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Outlet Pressure, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by End Use, 2024 to 2034

Figure 5: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 7: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 11: Global Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 14: Global Market Value (US$ Million) Analysis by Capacity, 2019 to 2034

Figure 15: Global Market Volume (Units) Analysis by Capacity, 2019 to 2034

Figure 16: Global Market Value Share (%) and BPS Analysis by Capacity, 2024 to 2034

Figure 17: Global Market Y-o-Y Growth (%) Projections by Capacity, 2024 to 2034

Figure 18: Global Market Value (US$ Million) Analysis by Outlet Pressure, 2019 to 2034

Figure 19: Global Market Volume (Units) Analysis by Outlet Pressure, 2019 to 2034

Figure 20: Global Market Value Share (%) and BPS Analysis by Outlet Pressure, 2024 to 2034

Figure 21: Global Market Y-o-Y Growth (%) Projections by Outlet Pressure, 2024 to 2034

Figure 22: Global Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 23: Global Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 24: Global Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 25: Global Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 26: Global Market Attractiveness by Product Type, 2024 to 2034

Figure 27: Global Market Attractiveness by Capacity, 2024 to 2034

Figure 28: Global Market Attractiveness by Outlet Pressure, 2024 to 2034

Figure 29: Global Market Attractiveness by End Use, 2024 to 2034

Figure 30: Global Market Attractiveness by Region, 2024 to 2034

Figure 31: North America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 32: North America Market Value (US$ Million) by Capacity, 2024 to 2034

Figure 33: North America Market Value (US$ Million) by Outlet Pressure, 2024 to 2034

Figure 34: North America Market Value (US$ Million) by End Use, 2024 to 2034

Figure 35: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 37: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 41: North America Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 44: North America Market Value (US$ Million) Analysis by Capacity, 2019 to 2034

Figure 45: North America Market Volume (Units) Analysis by Capacity, 2019 to 2034

Figure 46: North America Market Value Share (%) and BPS Analysis by Capacity, 2024 to 2034

Figure 47: North America Market Y-o-Y Growth (%) Projections by Capacity, 2024 to 2034

Figure 48: North America Market Value (US$ Million) Analysis by Outlet Pressure, 2019 to 2034

Figure 49: North America Market Volume (Units) Analysis by Outlet Pressure, 2019 to 2034

Figure 50: North America Market Value Share (%) and BPS Analysis by Outlet Pressure, 2024 to 2034

Figure 51: North America Market Y-o-Y Growth (%) Projections by Outlet Pressure, 2024 to 2034

Figure 52: North America Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 53: North America Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 54: North America Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 55: North America Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 56: North America Market Attractiveness by Product Type, 2024 to 2034

Figure 57: North America Market Attractiveness by Capacity, 2024 to 2034

Figure 58: North America Market Attractiveness by Outlet Pressure, 2024 to 2034

Figure 59: North America Market Attractiveness by End Use, 2024 to 2034

Figure 60: North America Market Attractiveness by Country, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 62: Latin America Market Value (US$ Million) by Capacity, 2024 to 2034

Figure 63: Latin America Market Value (US$ Million) by Outlet Pressure, 2024 to 2034

Figure 64: Latin America Market Value (US$ Million) by End Use, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 71: Latin America Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 74: Latin America Market Value (US$ Million) Analysis by Capacity, 2019 to 2034

Figure 75: Latin America Market Volume (Units) Analysis by Capacity, 2019 to 2034

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Capacity, 2024 to 2034

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Capacity, 2024 to 2034

Figure 78: Latin America Market Value (US$ Million) Analysis by Outlet Pressure, 2019 to 2034

Figure 79: Latin America Market Volume (Units) Analysis by Outlet Pressure, 2019 to 2034

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Outlet Pressure, 2024 to 2034

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Outlet Pressure, 2024 to 2034

Figure 82: Latin America Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 83: Latin America Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 84: Latin America Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 86: Latin America Market Attractiveness by Product Type, 2024 to 2034

Figure 87: Latin America Market Attractiveness by Capacity, 2024 to 2034

Figure 88: Latin America Market Attractiveness by Outlet Pressure, 2024 to 2034

Figure 89: Latin America Market Attractiveness by End Use, 2024 to 2034

Figure 90: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 91: Western Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 92: Western Europe Market Value (US$ Million) by Capacity, 2024 to 2034

Figure 93: Western Europe Market Value (US$ Million) by Outlet Pressure, 2024 to 2034

Figure 94: Western Europe Market Value (US$ Million) by End Use, 2024 to 2034

Figure 95: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 100: Western Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 101: Western Europe Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 104: Western Europe Market Value (US$ Million) Analysis by Capacity, 2019 to 2034

Figure 105: Western Europe Market Volume (Units) Analysis by Capacity, 2019 to 2034

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Capacity, 2024 to 2034

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Capacity, 2024 to 2034

Figure 108: Western Europe Market Value (US$ Million) Analysis by Outlet Pressure, 2019 to 2034

Figure 109: Western Europe Market Volume (Units) Analysis by Outlet Pressure, 2019 to 2034

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Outlet Pressure, 2024 to 2034

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Outlet Pressure, 2024 to 2034

Figure 112: Western Europe Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 113: Western Europe Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 116: Western Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 117: Western Europe Market Attractiveness by Capacity, 2024 to 2034

Figure 118: Western Europe Market Attractiveness by Outlet Pressure, 2024 to 2034

Figure 119: Western Europe Market Attractiveness by End Use, 2024 to 2034

Figure 120: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: Eastern Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 122: Eastern Europe Market Value (US$ Million) by Capacity, 2024 to 2034

Figure 123: Eastern Europe Market Value (US$ Million) by Outlet Pressure, 2024 to 2034

Figure 124: Eastern Europe Market Value (US$ Million) by End Use, 2024 to 2034

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 131: Eastern Europe Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Capacity, 2019 to 2034

Figure 135: Eastern Europe Market Volume (Units) Analysis by Capacity, 2019 to 2034

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Capacity, 2024 to 2034

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Capacity, 2024 to 2034

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Outlet Pressure, 2019 to 2034

Figure 139: Eastern Europe Market Volume (Units) Analysis by Outlet Pressure, 2019 to 2034

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Outlet Pressure, 2024 to 2034

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Outlet Pressure, 2024 to 2034

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 143: Eastern Europe Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 146: Eastern Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 147: Eastern Europe Market Attractiveness by Capacity, 2024 to 2034

Figure 148: Eastern Europe Market Attractiveness by Outlet Pressure, 2024 to 2034

Figure 149: Eastern Europe Market Attractiveness by End Use, 2024 to 2034

Figure 150: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 151: South Asia and Pacific Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 152: South Asia and Pacific Market Value (US$ Million) by Capacity, 2024 to 2034

Figure 153: South Asia and Pacific Market Value (US$ Million) by Outlet Pressure, 2024 to 2034

Figure 154: South Asia and Pacific Market Value (US$ Million) by End Use, 2024 to 2034

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Capacity, 2019 to 2034

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Capacity, 2019 to 2034

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Capacity, 2024 to 2034

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Capacity, 2024 to 2034

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Outlet Pressure, 2019 to 2034

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by Outlet Pressure, 2019 to 2034

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Outlet Pressure, 2024 to 2034

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Outlet Pressure, 2024 to 2034

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 176: South Asia and Pacific Market Attractiveness by Product Type, 2024 to 2034

Figure 177: South Asia and Pacific Market Attractiveness by Capacity, 2024 to 2034

Figure 178: South Asia and Pacific Market Attractiveness by Outlet Pressure, 2024 to 2034

Figure 179: South Asia and Pacific Market Attractiveness by End Use, 2024 to 2034

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 181: East Asia Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 182: East Asia Market Value (US$ Million) by Capacity, 2024 to 2034

Figure 183: East Asia Market Value (US$ Million) by Outlet Pressure, 2024 to 2034

Figure 184: East Asia Market Value (US$ Million) by End Use, 2024 to 2034

Figure 185: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 190: East Asia Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 191: East Asia Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 194: East Asia Market Value (US$ Million) Analysis by Capacity, 2019 to 2034

Figure 195: East Asia Market Volume (Units) Analysis by Capacity, 2019 to 2034

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Capacity, 2024 to 2034

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Capacity, 2024 to 2034

Figure 198: East Asia Market Value (US$ Million) Analysis by Outlet Pressure, 2019 to 2034

Figure 199: East Asia Market Volume (Units) Analysis by Outlet Pressure, 2019 to 2034

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Outlet Pressure, 2024 to 2034

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Outlet Pressure, 2024 to 2034

Figure 202: East Asia Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 203: East Asia Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 204: East Asia Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 206: East Asia Market Attractiveness by Product Type, 2024 to 2034

Figure 207: East Asia Market Attractiveness by Capacity, 2024 to 2034

Figure 208: East Asia Market Attractiveness by Outlet Pressure, 2024 to 2034

Figure 209: East Asia Market Attractiveness by End Use, 2024 to 2034

Figure 210: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 211: Middle East and Africa Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 212: Middle East and Africa Market Value (US$ Million) by Capacity, 2024 to 2034

Figure 213: Middle East and Africa Market Value (US$ Million) by Outlet Pressure, 2024 to 2034

Figure 214: Middle East and Africa Market Value (US$ Million) by End Use, 2024 to 2034

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Capacity, 2019 to 2034

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Capacity, 2019 to 2034

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Capacity, 2024 to 2034

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Capacity, 2024 to 2034

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Outlet Pressure, 2019 to 2034

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Outlet Pressure, 2019 to 2034

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Outlet Pressure, 2024 to 2034

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Outlet Pressure, 2024 to 2034

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 233: Middle East and Africa Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 236: Middle East and Africa Market Attractiveness by Product Type, 2024 to 2034

Figure 237: Middle East and Africa Market Attractiveness by Capacity, 2024 to 2034

Figure 238: Middle East and Africa Market Attractiveness by Outlet Pressure, 2024 to 2034

Figure 239: Middle East and Africa Market Attractiveness by End Use, 2024 to 2034

Figure 240: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

The global hydrogen electrolyzer market is expected to grow from USD 811.94 million in 2025 to over USD 7,091.53 million by 2035, advancing at a CAGR of 24.2% over the forecast period.

Proton exchange membrane (PEM) electrolyzers are projected to lead the market with a 53.4% share in 2025 due to their efficiency, fast response times, and compatibility with variable renewable energy sources.

Low pressure (≤10 bar) electrolyzers are set to maintain market dominance with a 62.8% share in 2025, supported by their operational simplicity and integration with small- to medium-scale hydrogen applications.

High-capacity electrolyzers (>1 MW) are forecasted to expand at a CAGR of 7.1% from 2025 to 2035, driven by their deployment in large-scale green hydrogen projects across industries and utilities.

Major companies include Siemens AG, McPhy Energy, ITM Power Plc, Giner Inc., Air Liquide, Tianjin Mainland Hydrogen, GreenHydrogen Systems, iGas Energy GmbH, and Beijing CEI Technology.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA