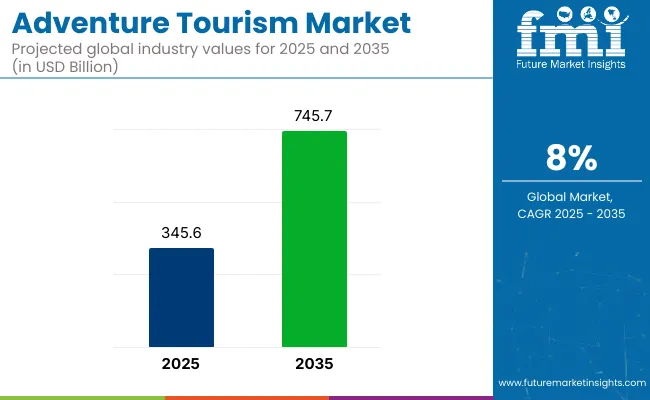

The global adventure tourism market is valued at USD 345.6 billion in 2025 and is poised to reach USD 745.7 billion by 2035, expanding at a CAGR of 8.0% over the forecast period. The market is experiencing rapid expansion as travelers increasingly seek immersive, adrenaline-driven, and experience-rich journeys that go beyond traditional sightseeing.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 345.6 billion |

| Industry Value (2035F) | USD 745.7 billion |

| CAGR (2025 to 2035) | 8% |

Activities such as trekking, scuba diving, mountaineering, paragliding, wildlife safaris, and cultural expeditions are attracting a diverse demographic of adventure seekers. The rising influence of social media, the growth of millennial and Gen Z travelers, and the shift toward wellness, exploration, and authenticity are all contributing to the strong momentum in this segment.

Operators are innovating to cater to both soft and hard adventure categories, offering curated packages that blend thrill with comfort, sustainability, and local culture. Growth in eco-tourism, volunteerism, and experiential travel is reshaping product offerings, while digital platforms and mobile apps are enhancing trip planning, safety monitoring, and destination discovery.

Adventure tourism providers are also increasingly adopting safety certifications, sustainable practices, and local partnerships to improve customer trust and environmental accountability. Destinations across Southeast Asia, Latin America, and Eastern Europe are emerging as adventure tourism hotspots due to their diverse landscapes, affordable experiences, and government support for tourism infrastructure. The rising per capita income is further boosting spending on adventure tourism.

Policy frameworks and international collaborations are fostering responsible adventure tourism through training, investment incentives, and community-based tourism programs. Governments in regions like the Himalayas, the Andes, and Sub-Saharan Africa are promoting adventure travel as a tool for rural economic development and environmental conservation.

With increasing consumer appetite for high-engagement, low-impact travel and continued innovation by tour operators, the adventure tourism market is expected to grow steadily. It is positioned as a key pillar in the global tourism industry, driven by the pursuit of transformation, self-discovery, and meaningful travel experiences.

The market is segmented based on activity type, tour type, booking mode, tourist type, age group, and region. By activity type, the market is divided into soft and hard adventure activities. In terms of tour type, it includes group, family, couples, and solo travelers.

Based on booking mode, the market is categorized into direct, travel agents, and marketplace booking. By tourist type, it is segmented into domestic and international travelers. In terms of age group, the market includes 28 and under, 29 to 40, 41 to 50, 51 to 60, 61 to 70, and 71 and above. Regionally, the market is classified into North America, Latin America, Western Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

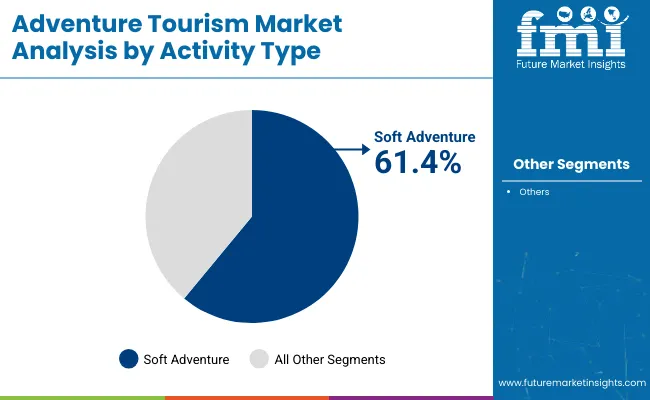

The soft adventure segment is projected to lead the adventure tourism market by activity type, commanding a 61.4% market share in 2025. Soft adventure activities such as hiking, snorkeling, kayaking, wildlife safaris, and cultural expeditions attract a broader audience due to their lower risk level and minimal physical intensity.

These activities are highly popular among families, solo travelers, and older age groups seeking enriching experiences without extreme physical exertion. Soft adventure travel also aligns well with wellness, eco-tourism, and experiential trends, which are gaining global traction post-COVID.

Tour operators such as G Adventures, Intrepid Travel, and REI Adventures have increasingly expanded their soft adventure offerings, bundling nature-based and cultural immersion trips with personalized itineraries and sustainable practices. This category benefits from easier accessibility, lower insurance costs, and inclusive options for multi-generational groups.

It is especially favored in regions like Southeast Asia, Europe, and South America, where rich biodiversity and cultural heritage attract both domestic and international visitors. With the growing focus on mental wellness, slow travel, and low-impact exploration, the soft adventure segment continues to dominate the market landscape and is expected to remain the entry point for millions of new adventure tourists each year.

| Activity Type Segment | Market Share (2025) |

|---|---|

| Soft Adventure | 61.4% |

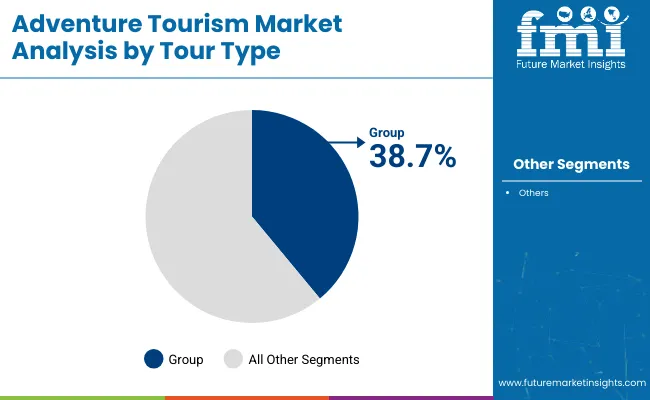

The group segment is projected to lead the adventure tourism market by tour type, accounting for a 38.7% share in 2025. Group tours are especially popular among budget-conscious travelers, educational institutions, corporate retreat organizers, and adventure clubs that prioritize safety, logistical ease, and shared experiences. These tours offer structured itineraries, expert guidance, and often lower per-person costs, making them attractive for first-time adventurers and those exploring offbeat or high-risk destinations.

Companies like Exodus Travels, G Adventures, and National Geographic Expeditions specialize in small-group adventures across trekking, cultural discovery, and nature-based tourism, offering pre-planned packages that reduce the burden on individual planning. Group tours also enhance access to remote destinations where infrastructure may be limited, ensuring safety through trained guides and local partnerships. This segment performs particularly well in regions like the Himalayas, Patagonia, the Alps, and the Serengeti.

Furthermore, the rise of themed group tours such as women-only adventures, photography expeditions, and wellness-focused journeys has expanded its demographic reach. While family and solo travel segments are gaining traction, group tours continue to represent the backbone of organized adventure tourism, especially among younger and middle-aged travelers seeking community, safety, and structured exploration.

| Tour Type Segment | Market Share (2025) |

|---|---|

| Group | 38.7% |

Marketplace booking is projected to register the fastest growth in the adventure tourism market, expanding at a CAGR of 13.4% from 2025 to 2035. Online travel marketplaces such as GetYourGuide, Viator, Klook, and TourRadar have transformed how travelers discover, compare, and book adventure experiences. These platforms consolidate global operators, offering transparent pricing, peer reviews, secure payment, and last-minute booking flexibility features increasingly demanded by tech-savvy tourists.

As mobile usage and internet penetration rise, especially in Asia-Pacific and Latin America, adventure seekers are relying more on digital ecosystems to build custom itineraries and book excursions on the go. Marketplace models also benefit operators by reducing marketing costs and streamlining distribution. Through AI-enabled recommendations, real-time availability, and multilingual support, these platforms are redefining convenience and personalization in adventure bookings.

The shift from offline travel agents and direct website bookings to marketplaces is particularly strong among millennials and Gen Z travelers who prioritize flexibility and peer validation. With growing consumer trust in digital intermediaries and expanding inventory of niche experiences such as glacier hiking, hot-air ballooning, and eco-volunteering marketplace bookings are positioned to lead the digital evolution of the adventure tourism value chain.

| Booking Mode Segment | CAGR (2025-2035) |

|---|---|

| Marketplace Booking | 13.4% |

International travelers are expected to experience the fastest growth in the adventure tourism market, expanding at a CAGR of 12.6% from 2025 to 2035. Rising global affluence, better air connectivity, and visa liberalization in adventure hotspots like Southeast Asia, South America, and Africa are driving long-haul adventure travel. As travelers seek immersive, bucket-list experiences, international adventure trips such as trekking in Nepal, wildlife safaris in Kenya, or scuba diving in the Maldives are gaining widespread appeal.

Organizations like the UNWTO and Adventure Travel Trade Association are promoting sustainable cross-border travel that emphasizes low-impact tourism and community engagement. Tour operators and DMCs are developing culturally sensitive itineraries that include homestays, eco-resorts, and guided excursions led by local experts. Furthermore, post-pandemic “revenge travel” has led to a surge in international bookings for experiential getaways, especially among affluent Gen X and millennial travelers.

Social media exposure and influencer-driven content are accelerating this trend, encouraging travelers to go beyond traditional sightseeing and embrace remote, rugged, or eco-conscious destinations. With government-backed tourism campaigns and growing adventure infrastructure globally, international travel is set to outpace domestic travel in terms of high-value tourism spending.

| Tourist Type Segment | CAGR (2025-2035) |

|---|---|

| International Travelers | 12.6% |

The 29 to 40 age group is projected to grow at the fastest rate in the adventure tourism market, registering a CAGR of 11.8% from 2025 to 2035. This demographic represents a sweet spot between financial stability, physical fitness, and lifestyle flexibility, making them key drivers of high-adrenaline and experiential travel. Typically comprising dual-income professionals and young families, this group values immersive, Instagram-worthy, and wellness-centered travel that aligns with their social and environmental ideals.

Adventure activities such as paragliding, surfing, scuba diving, and jungle trekking are gaining popularity among this cohort, especially in regions like New Zealand, Costa Rica, Iceland, and Vietnam. Tech-driven planning, flexible remote work schedules, and rising disposable income empower them to seek longer, more meaningful travel experiences.

Tour operators are tailoring curated packages blending cultural immersion, sustainable lodging, and health-focused cuisine specifically to appeal to this age group. Moreover, their affinity for digital bookings, sustainability certifications, and peer-reviewed travel content positions them as the most engaged segment online.

As this generation transitions into family travelers, demand for family-friendly adventure itineraries is also projected to rise. The combination of digital fluency, adventurous mindset, and eco-awareness makes this age group the core of future market growth.

| Age Group Segment | CAGR (2025 to 2035) |

|---|---|

| 29 to 40 | 11.8% |

Growing Awareness of Health and Wellness

It has been observed that travelers are increasingly seeking experiences that offer physical challenges, mental stimulation, and personal growth. The demand for adventure tourism has risen due to the focus on physical health, outdoor activities, and a more connected lifestyle with nature. Many operators have responded to these needs by offering unique and active travel experiences that range from trekking and mountaineering to extreme sports such as paragliding and scuba diving.

Government Support for Eco-Friendly Travel

Governments around the world have added to the development of adventure tourism through policies that place a premium on sustainability and protection of natural resources. For example, tourism revenues are increasingly being directed toward the conservation of national parks and the protection of endangered species.

These measures have encouraged responsible tourism, and initiatives are often designed to boost both environmental sustainability and local economic growth. The establishment of eco-certifications and national green standards further supports this.

Social Media Influence

Social media has greatly impacted the growth of adventure tourism through its role in the visual platforms such as Instagram, Facebook, and YouTube. The social media sites have made it easier for travelers to share their experiences with a wider audience, thereby creating a desire for unique outdoor and adventure experiences. Through showcasing the beauty of remote and exotic locations, social media has driven increased awareness and interest in lesser-known destinations that cater to adventure seekers.

Technological Advancements in the Travel Industry

New technologies are transforming adventure tourism. Augmented reality and virtual reality tools have been developed to provide immersion experiences that will allow travelers to explore locations before embarking on their adventures. Mobile applications for personalized itineraries, packages, and real-time updates are further enhancing the experience of customers. Innovations in electric vehicles and environmentally friendly transportation modes are reducing carbon footprints related to adventure tourism.

Emergence of Wellness Adventure Tourism

Increasingly, tourists are seeking physical challenges as well as wellness during their adventure experiences. This is why wellness tourism has become an offshoot of adventure tourism; it is the integration of fitness-related activities, including hiking, yoga retreats, and holistic nature-based experiences.

Adoption of Sustainable Practices by Operators

The demand for responsible travel has prompted tour operators to introduce sustainability into their offerings. This includes using eco-friendly accommodations, reducing waste, and other activities that involve the conservation of wildlife. There is a trend in adventure tourism businesses incorporating standards for eco-certification into their operations to attract environmentally conscious travelers.

Digital and Virtual Adventure Experiences

The ability to experience adventures remotely is gaining popularity, particularly as technological advancements in VR and AR allow tourists to explore far-flung destinations from their homes. This trend is beneficial for those who cannot travel physically, enabling them to explore destinations while reducing environmental impacts.

The USA Remains a Major Destination for Domestic and International Adventure Tourists

In the United States, the adventure tourism sector is forecast to reach over USD 60.7 billion by 2035, growing at a CAGR of 4.9% from 2025 to 2035. The USA is home to a wide range of outdoor attractions, including national parks, mountains, and coastal regions, which continue to attract millions of adventure travelers.

Both domestic and international travelers are drawn to destinations such as the Grand Canyon, Yosemite National Park, and the Appalachian Trail, where outdoor activities like hiking, rock climbing, and rafting are popular.

Germany market is experiencing steady growth in the adventure tourism industry, as it has varied landscapes and diverse outdoor activities. The market value is expected to reach USD 18.4 billion by 2035, with a CAGR of 5.1% from 2025 to 2035. The Bavarian Alps attract tourists for hiking, skiing, and mountain biking, while the Black Forest region attracts tourists for trekking and nature walks.

The Rhine Valley is a destination for river cruises and cycling tours, while the Harz Mountains are explored for rock climbing and Adventure Tourism. Given the emphasis on sustainable tourism, Germany's adventure tourism sector will surely flourish.

The adventure tourism industry in Japan is growing rapidly because of its diversified natural landscapes and a variety of outdoor activities. This is projected to be valued at USD 14.2 billion by 2035 and will have a CAGR of 7% during the 2025 to 2035 period.

For skiing, snowboarding, and hiking the Japanese Alps are visited, and for eco-tours and marine sports, the Ogasawara Islands. Mount Fuji is still a favorite destination for climbing enthusiasts, while wildlife safaris and hot spring experiences are enjoyed in the northern regions. As more and more people become aware of sustainable tourism, Japan's adventure tourism sector is likely to grow further.

Adventure tourism in the UK is expanding as travelers increasingly seek outdoor experiences. The country’s wide range of hiking, cycling, and coastal activities, along with its rich cultural and historical landmarks, make it a prime destination for adventure tourists. The UK’s market is expected to grow at a CAGR of 5.6% during 2025 to 2035.

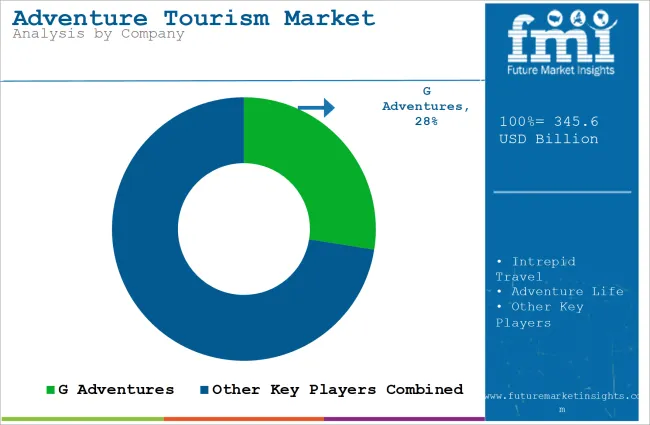

The competitive landscape is shaped by both large multinational organizations and small, niche players that specialize in customized adventure travel experiences. Key players in the adventure tourism industry include TUI Group, Expedia Group, Thomas Cook, G Adventures, Intrepid Travel, Adventure Life, and Exodus Travels.

Recent Developments in the Adventure Tourism Market Analysis

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Million/Billion for Value |

| Key Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; MEA |

| Key Segments Covered | Activity Type, Tourist Type, Booking Mode, Age Group |

| Key Companies Profiled | TUI Group; Expedia Group; Thomas Cook; G Adventures; Intrepid Travel; Adventure Life; Exodus Travels; Adventure Life; Wild Frontiers; Backroads; TrekAmerica; Gonglo Outdoors; Austin Adventures, Inc.; Butterfield & Robinson Inc.; Geographic Expeditions Inc.; Mountain Travel Sobek; Discovery Nomads; Row Adventures; Cox & Kings Ltd. |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Group, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Booking Mode, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Group, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Booking Mode, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Group, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Booking Mode, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 18: Western Europe Market Value (US$ Million) Forecast by Group, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Booking Mode, 2018 to 2033

Table 20: Western Europe Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 21: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 23: Eastern Europe Market Value (US$ Million) Forecast by Group, 2018 to 2033

Table 24: Eastern Europe Market Value (US$ Million) Forecast by Booking Mode, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 26: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 27: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: South Asia and Pacific Market Value (US$ Million) Forecast by Group, 2018 to 2033

Table 29: South Asia and Pacific Market Value (US$ Million) Forecast by Booking Mode, 2018 to 2033

Table 30: South Asia and Pacific Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 31: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Group, 2018 to 2033

Table 34: East Asia Market Value (US$ Million) Forecast by Booking Mode, 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 36: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 38: Middle East and Africa Market Value (US$ Million) Forecast by Group, 2018 to 2033

Table 39: Middle East and Africa Market Value (US$ Million) Forecast by Booking Mode, 2018 to 2033

Table 40: Middle East and Africa Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Group, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Booking Mode, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Group, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Group, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Group, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Booking Mode, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Booking Mode, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Booking Mode, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 21: Global Market Attractiveness by Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Group, 2023 to 2033

Figure 23: Global Market Attractiveness by Booking Mode, 2023 to 2033

Figure 24: Global Market Attractiveness by Age Group, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Group, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Booking Mode, 2023 to 2033

Figure 29: North America Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 30: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Group, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Group, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Group, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Booking Mode, 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Booking Mode, 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Booking Mode, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 46: North America Market Attractiveness by Type, 2023 to 2033

Figure 47: North America Market Attractiveness by Group, 2023 to 2033

Figure 48: North America Market Attractiveness by Booking Mode, 2023 to 2033

Figure 49: North America Market Attractiveness by Age Group, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Group, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) by Booking Mode, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 55: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis by Group, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Group, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Group, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Booking Mode, 2018 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Booking Mode, 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Booking Mode, 2023 to 2033

Figure 68: Latin America Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Group, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Booking Mode, 2023 to 2033

Figure 74: Latin America Market Attractiveness by Age Group, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) by Group, 2023 to 2033

Figure 78: Western Europe Market Value (US$ Million) by Booking Mode, 2023 to 2033

Figure 79: Western Europe Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 80: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 82: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 85: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 86: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 87: Western Europe Market Value (US$ Million) Analysis by Group, 2018 to 2033

Figure 88: Western Europe Market Value Share (%) and BPS Analysis by Group, 2023 to 2033

Figure 89: Western Europe Market Y-o-Y Growth (%) Projections by Group, 2023 to 2033

Figure 90: Western Europe Market Value (US$ Million) Analysis by Booking Mode, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Booking Mode, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Booking Mode, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 94: Western Europe Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 95: Western Europe Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 97: Western Europe Market Attractiveness by Group, 2023 to 2033

Figure 98: Western Europe Market Attractiveness by Booking Mode, 2023 to 2033

Figure 99: Western Europe Market Attractiveness by Age Group, 2023 to 2033

Figure 100: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 102: Eastern Europe Market Value (US$ Million) by Group, 2023 to 2033

Figure 103: Eastern Europe Market Value (US$ Million) by Booking Mode, 2023 to 2033

Figure 104: Eastern Europe Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 106: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 110: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 111: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 112: Eastern Europe Market Value (US$ Million) Analysis by Group, 2018 to 2033

Figure 113: Eastern Europe Market Value Share (%) and BPS Analysis by Group, 2023 to 2033

Figure 114: Eastern Europe Market Y-o-Y Growth (%) Projections by Group, 2023 to 2033

Figure 115: Eastern Europe Market Value (US$ Million) Analysis by Booking Mode, 2018 to 2033

Figure 116: Eastern Europe Market Value Share (%) and BPS Analysis by Booking Mode, 2023 to 2033

Figure 117: Eastern Europe Market Y-o-Y Growth (%) Projections by Booking Mode, 2023 to 2033

Figure 118: Eastern Europe Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 119: Eastern Europe Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 120: Eastern Europe Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 121: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 122: Eastern Europe Market Attractiveness by Group, 2023 to 2033

Figure 123: Eastern Europe Market Attractiveness by Booking Mode, 2023 to 2033

Figure 124: Eastern Europe Market Attractiveness by Age Group, 2023 to 2033

Figure 125: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 126: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 127: South Asia and Pacific Market Value (US$ Million) by Group, 2023 to 2033

Figure 128: South Asia and Pacific Market Value (US$ Million) by Booking Mode, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 130: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 131: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 132: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Group, 2018 to 2033

Figure 138: South Asia and Pacific Market Value Share (%) and BPS Analysis by Group, 2023 to 2033

Figure 139: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Group, 2023 to 2033

Figure 140: South Asia and Pacific Market Value (US$ Million) Analysis by Booking Mode, 2018 to 2033

Figure 141: South Asia and Pacific Market Value Share (%) and BPS Analysis by Booking Mode, 2023 to 2033

Figure 142: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Booking Mode, 2023 to 2033

Figure 143: South Asia and Pacific Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 144: South Asia and Pacific Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 145: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 146: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 147: South Asia and Pacific Market Attractiveness by Group, 2023 to 2033

Figure 148: South Asia and Pacific Market Attractiveness by Booking Mode, 2023 to 2033

Figure 149: South Asia and Pacific Market Attractiveness by Age Group, 2023 to 2033

Figure 150: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 152: East Asia Market Value (US$ Million) by Group, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) by Booking Mode, 2023 to 2033

Figure 154: East Asia Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 155: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 158: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 159: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 160: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 161: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 162: East Asia Market Value (US$ Million) Analysis by Group, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Group, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Group, 2023 to 2033

Figure 165: East Asia Market Value (US$ Million) Analysis by Booking Mode, 2018 to 2033

Figure 166: East Asia Market Value Share (%) and BPS Analysis by Booking Mode, 2023 to 2033

Figure 167: East Asia Market Y-o-Y Growth (%) Projections by Booking Mode, 2023 to 2033

Figure 168: East Asia Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 169: East Asia Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 170: East Asia Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 171: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 172: East Asia Market Attractiveness by Group, 2023 to 2033

Figure 173: East Asia Market Attractiveness by Booking Mode, 2023 to 2033

Figure 174: East Asia Market Attractiveness by Age Group, 2023 to 2033

Figure 175: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) by Group, 2023 to 2033

Figure 178: Middle East and Africa Market Value (US$ Million) by Booking Mode, 2023 to 2033

Figure 179: Middle East and Africa Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 180: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 182: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 183: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 184: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 185: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 186: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 187: Middle East and Africa Market Value (US$ Million) Analysis by Group, 2018 to 2033

Figure 188: Middle East and Africa Market Value Share (%) and BPS Analysis by Group, 2023 to 2033

Figure 189: Middle East and Africa Market Y-o-Y Growth (%) Projections by Group, 2023 to 2033

Figure 190: Middle East and Africa Market Value (US$ Million) Analysis by Booking Mode, 2018 to 2033

Figure 191: Middle East and Africa Market Value Share (%) and BPS Analysis by Booking Mode, 2023 to 2033

Figure 192: Middle East and Africa Market Y-o-Y Growth (%) Projections by Booking Mode, 2023 to 2033

Figure 193: Middle East and Africa Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 194: Middle East and Africa Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 195: Middle East and Africa Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 196: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 197: Middle East and Africa Market Attractiveness by Group, 2023 to 2033

Figure 198: Middle East and Africa Market Attractiveness by Booking Mode, 2023 to 2033

Figure 199: Middle East and Africa Market Attractiveness by Age Group, 2023 to 2033

Figure 200: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

The global adventure tourism market is projected to reach USD 745.7 billion by 2035, growing from USD 345.6 billion in 2025, with a CAGR of 8.0% during the forecast period.

The soft adventure segment dominates the market by activity type, accounting for 61.4% share in 2025, driven by strong demand for hiking, kayaking, wildlife safaris, and immersive cultural experiences.

Group tours lead the market with a 38.7% share in 2025, benefiting from safety, affordability, and curated itineraries offered by tour operators such as Exodus Travels and G Adventures.

Marketplace bookings are expected to register the fastest growth, expanding at a CAGR of 13.4% from 2025 to 2035, as platforms like Viator and GetYourGuide transform digital adventure trip planning.

International travelers are projected to grow at the highest rate, with a CAGR of 12.6% from 2025 to 2035, fueled by rising global connectivity, visa reforms, and growing demand for cross-border experiential travel.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.