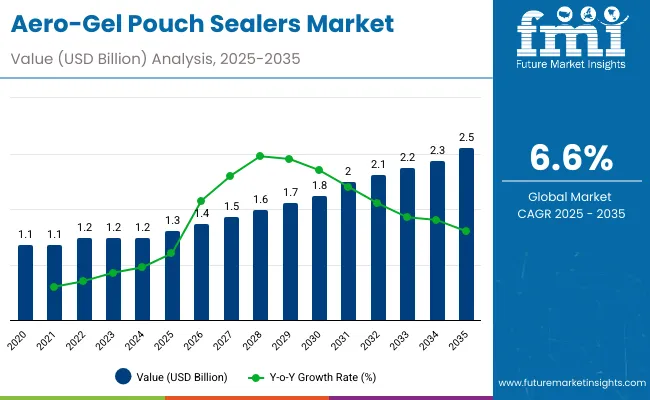

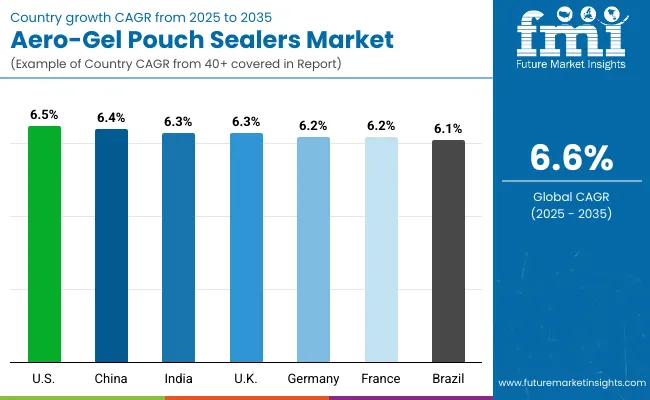

The aero-gel pouch sealers market will expand from USD 1.3 billion in 2025 to USD 2.5 billion by 2035, at a CAGR of 6.6%. Growth is supported by the rapid adoption of lightweight, thermally stable packaging for biopharmaceutical, aerospace, and electronics sectors. Ultrasonic sealers are favored for their energy efficiency and precision in sealing composite films. Aerogel composite films dominate for their insulation, flexibility, and high barrier properties, making them suitable for medical and defense-grade packaging. Asia-Pacific leads the market due to strong industrial base expansion and adoption of advanced sealing systems.

Between 2020 and 2024, rising demand for temperature-controlled and sterile packaging accelerated the use of aerogel-based films in healthcare and industrial applications. Hybrid sealing systems combining ultrasonic and heat technologies gained prominence for multilayer compatibility. By 2035, the market is forecast to reach USD 2.5 billion, driven by material innovation and automation. Asia-Pacific will emerge as the leading region, with increasing applications in pharmaceuticals and electronics. North America and Europe will remain innovation hubs focusing on medical-grade and sustainable sealing solutions.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.3 billion |

| Industry Value (2035F) | USD 2.5 billion |

| CAGR (2025 to 2035) | 6.6% |

Market growth is fuelled by increasing adoption of aerogel films for packaging that requires high insulation, moisture resistance, and mechanical stability. The pharmaceutical and healthcare sectors rely heavily on these sealers to ensure sterility and product protection during cold chain transport. Rising demand for eco-efficient sealing systems and automation upgrades is further driving industry adoption across regions.

The market is segmented by machine type, material compatibility, application, end-use industry, and region. Machine types include ultrasonic sealers, heat sealers, vacuum sealers, and hybrid sealing systems. Material compatibility spans aerogel composite films, polymer-laminated aerogel sheets, and bio-aerogel packaging films. Key applications include pharmaceutical and biologic packaging, electronics protection, thermal insulation packaging, and aerospace and industrial packaging. End-use industries cover pharmaceuticals & healthcare, electronics, aerospace & defense, and industrial goods.

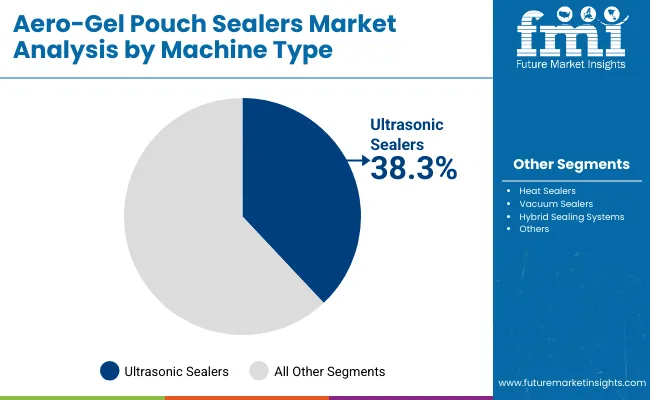

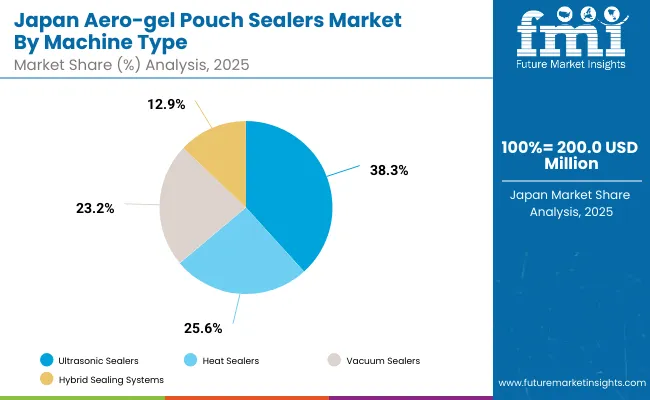

Ultrasonic sealers are projected to hold 38.3% of the market in 2025, driven by their ability to create strong, contamination-free seals for temperature-sensitive materials. The technology utilizes high-frequency vibrations rather than heat, ensuring consistent sealing for pharmaceutical, electronic, and medical applications.

Their precision and low energy consumption make them ideal for sterile production environments. Ultrasonic sealing eliminates the risk of film degradation and maintains barrier integrity in high-value pouches. As manufacturers prioritize sustainability and product safety, ultrasonic sealers remain the preferred machine type in advanced packaging systems.

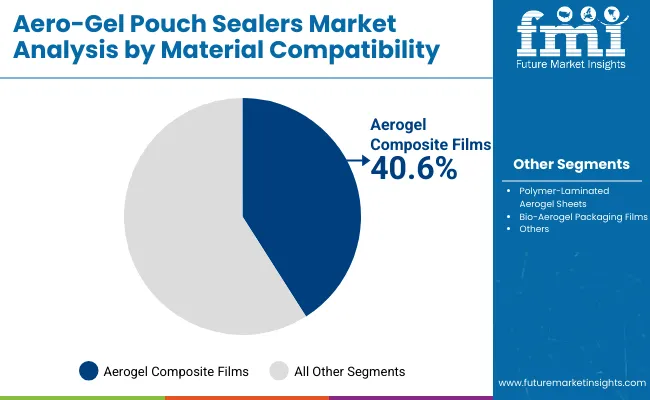

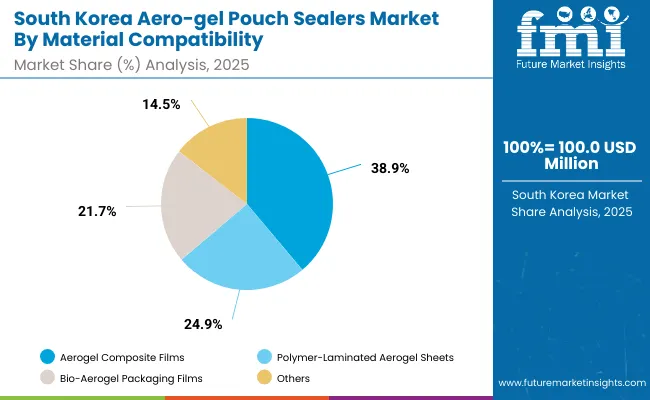

Aerogel composite films are expected to account for 40.6% of the market in 2025, supported by their unmatched insulation properties, lightweight construction, and flexibility. These films provide excellent thermal stability and moisture resistance, making them ideal for cold chain and aerospace packaging.

Their integration into pharmaceutical and medical pouches ensures consistent temperature control and product safety during transit. The balance of strength and low density enhances process efficiency. As precision packaging grows in demand, aerogel films continue to dominate as the key material type for advanced sealing applications.

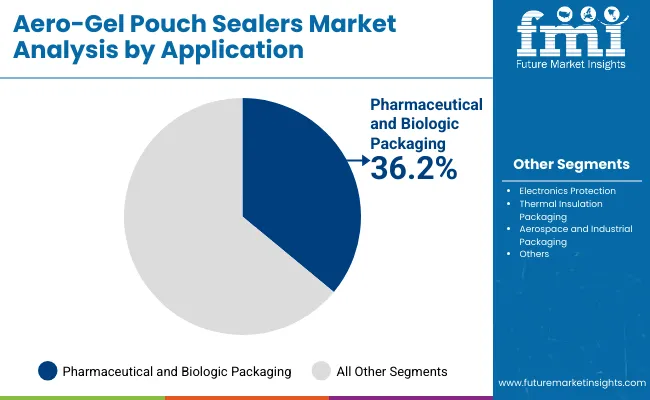

Pharmaceutical and biologic packaging is forecast to represent 36.2% of the market in 2025, reflecting the need for controlled-temperature environments in biologics, vaccines, and laboratory samples. Aerogel-based sealers ensure pouch integrity under varying storage conditions, preserving product stability and sterility.

Rising demand for biologic drugs and personalized medicine drives increased investment in high-barrier pouch systems. As healthcare logistics expand globally, aerogel-sealed packaging plays a critical role in maintaining product efficacy and compliance across cold-chain networks.

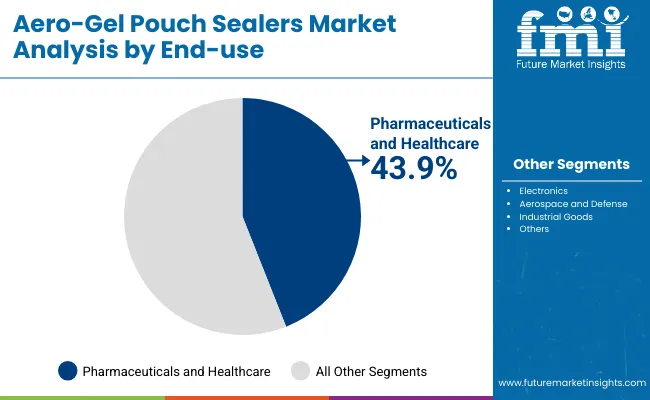

The pharmaceuticals and healthcare sector is projected to command 43.9% of the market in 2025, supported by growing requirements for sterile, thermally controlled packaging solutions. Ultrasonic sealers and aerogel films deliver safe containment for temperature-sensitive biologics and medical devices.

Ongoing regulatory focus on contamination prevention and material recyclability accelerates adoption. Investment in automated sealing systems ensures efficiency and precision across production lines. As bio-safe and insulated packaging becomes essential to healthcare logistics, this sector remains the key end-use driver.

The market is driven by increasing demand for insulated, sterile, and durable packaging solutions in pharmaceutical and electronics sectors, ensuring product safety and efficiency. However, high production costs of aerogel films and complex sealing integration limit scalability. Opportunities arise from bio-based aerogel films and smart sealing innovations for cold chain and aerospace use. Key trends include hybrid sealing systems, sustainable aerogel composites, and cleanroom-compatible automation driving advanced packaging performance.

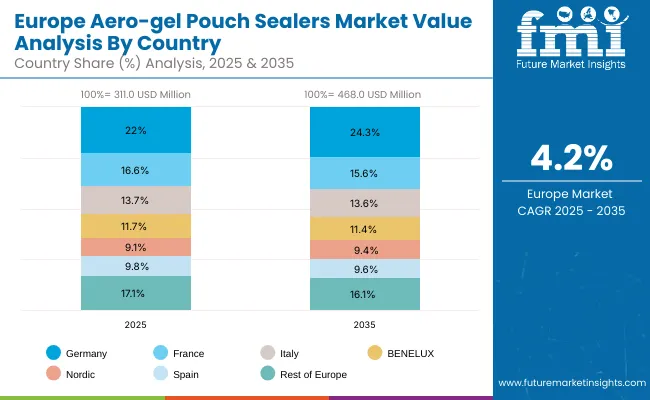

The global aero-gel pouch sealers market is expanding as industries transition toward high-barrier, temperature-resistant, and lightweight packaging solutions. Asia-Pacific dominates production with large-scale manufacturing of aerogel-based materials, supported by cost efficiency and government-led industrial expansion. North America continues to lead in innovation, emphasizing advanced sealing automation and FDA-compliant designs for biologics and pharmaceuticals. Europe focuses on sustainable aerogel laminates and energy-efficient sealing processes aligned with circular economy directives. Rising adoption in healthcare, electronics, and aerospace sectors continues to drive global demand for precision sealing systems.

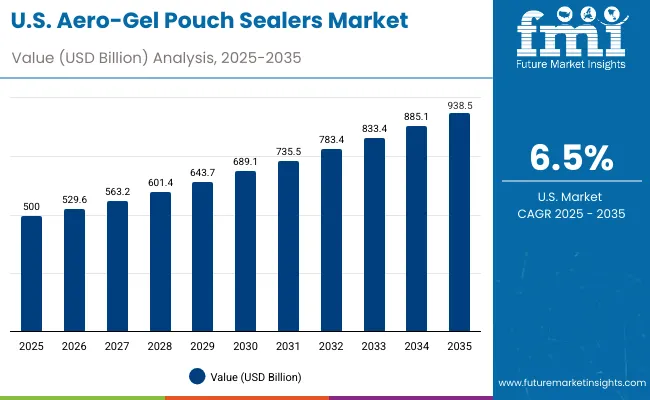

The USA will grow at 6.5% CAGR, supported by high demand for biologic, cold-chain, and precision medical packaging. Growth in healthcare logistics and advanced temperature-controlled solutions reinforces adoption. Manufacturers are prioritizing sustainability by integrating recyclable and bio-based seal films. The rise of automated seal verification systems is also enhancing quality control standards across pharmaceutical operations.

Germany will expand at 6.2% CAGR, driven by innovation in energy-efficient sealing systems and sustainable aerogel laminate production. Integration of precision sealing technologies supports compliance with EU safety and hygiene standards. Growth in pharmaceutical R&D and packaging exports continues to solidify Germany’s position in high-performance sealing equipment manufacturing.

The UK will grow at 6.3% CAGR, with increasing use of aerogel-based insulation and precision sealing in medical and aerospace packaging. Hybrid sealing technologies that combine ultrasonic and heat-seal systems are gaining traction. Expanding demand for sustainable and high-precision packaging in healthcare and research sectors drives further innovation.

China will grow at 6.4% CAGR, driven by large-scale aerogel material production and growing applications in pharmaceuticals and electronics. Domestic manufacturers are investing heavily in automation and precision sealing equipment. Technological advancements in heat-resistant, multilayer pouches continue to improve quality and competitiveness in export markets.

India will grow at 6.3% CAGR, supported by pharmaceutical export packaging expansion and improved cold-chain infrastructure. Local production of ultrasonic sealing systems is increasing accessibility for small and mid-scale manufacturers. Government programs promoting healthcare logistics modernization are accelerating market penetration.

Japan will grow at 6.8% CAGR, leading innovation in micro-insulation materials and compact automation systems. The integration of AI-based quality inspection ensures precision in sealing medical and aerospace-grade pouches. Japan’s focus on energy-efficient, high-speed production lines enhances its competitive edge in the global market.

South Korea will lead with 6.9% CAGR, driven by rapid industrial automation and export-oriented aerogel packaging manufacturing. The electronics and biologics industries are adopting hybrid sealing systems for high-precision thermal protection. Continuous R&D in aerogel insulation and sustainable sealing solutions strengthens South Korea’s regional leadership.

Japan’s aero-gel pouch sealers market, valued at USD 200.0 million in 2025, is led by ultrasonic sealers with a 38.3% share, driven by precision sealing and enhanced bonding for thermal-sensitive packaging. Heat sealers remain preferred for high-speed operations, while vacuum sealers improve insulation retention in cold-chain logistics. Hybrid sealing systems are emerging for advanced multi-layer pouch formats, supporting Japan’s growing e-commerce packaging applications.

South Korea’s aero-gel pouch sealers market, worth USD 100.0 million in 2025, is dominated by aerogel composite films, holding 38.9% share due to superior thermal resistance and lightweight strength. Polymer-laminated aerogel sheets enhance moisture barriers for electronics and medical packaging. Bio-aerogel packaging films gain attention for their compostable properties, aligning with South Korea’s green manufacturing and zero-waste production policies.

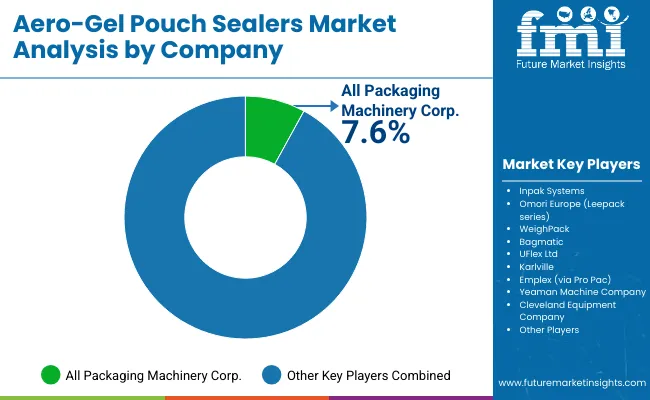

The market is moderately fragmented with key participants including All Packaging Machinery Corp., Inpak Systems, Omori Europe (Leepack series), WeighPack, Bagmatic, UFlex Ltd, Karlville, Emplex (via Pro Pac), Yeaman Machine Company, and Cleveland Equipment Company. Companies are investing in automated systems, sustainable aerogel material compatibility, and energy-efficient sealing solutions.

Key Developments

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| By Machine Type | Ultrasonic, Heat, Vacuum, Hybrid Sealing Systems |

| By Material Compatibility | Aerogel Composite Films, Polymer-Laminated Aerogel Sheets, Bio-Aerogel Packaging Films |

| By Application | Pharmaceutical & Biologic Packaging, Electronics Protection, Thermal Insulation, Aerospace & Industrial Packaging |

| By End-Use Industry | Pharmaceuticals & Healthcare, Electronics, Aerospace & Defense, Industrial Goods |

| Key Companies Profiled | All Packaging Machinery Corp., Inpak Systems, Omori Europe, WeighPack, Bagmatic, UFlex Ltd, Karlville, Emplex, Yeaman Machine Company, Cleveland Equipment Company |

| Additional Attributes | Market driven by insulation efficiency, precision automation, and sterile packaging innovation |

The Aero-Gel Pouch Sealers Market is valued at USD 1.3 billion in 2025.

By 2035, the market is projected to reach USD 2.5 billion.

The market is expected to grow at a CAGR of 6.6% from 2025 to 2035.

Ultrasonic Sealers lead the market with a 38.3% share in 2025, offering efficient and contamination-free sealing suitable for delicate composite films.

Aerogel Composite Films dominate with a 40.6% share in 2025, due to their high insulation, flexibility, and lightweight properties ideal for sterile packaging.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pouch Tapes Market Size and Share Forecast Outlook 2025 to 2035

Pouch Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pouch Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Pouch-Bowl Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pouch Filler Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Pouch Film Market Trends & Industry Growth Forecast 2024-2034

Pouch Market Insights – Growth & Trends 2024-2034

Pouch Sealing Machine Market

Pouch Dispensing Fitment Market

Arm Pouches Market Size and Share Forecast Outlook 2025 to 2035

Box Pouch Market by Pouch Type from 2025 to 2035

Competitive Breakdown of Box Pouch Providers

OPP Pouches Market Trends - Growth, Demand & Forecast 2024 to 2034

PCR Pouches Market

Doy Pouch Packaging Market

Foil Pouch Packaging Market Size and Share Forecast Outlook 2025 to 2035

Foam Pouch Market Analysis - Demand, Size & Industry Outlook 2025 to 2035

Twin Pouch Packaging Market

Peel Pouches Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA