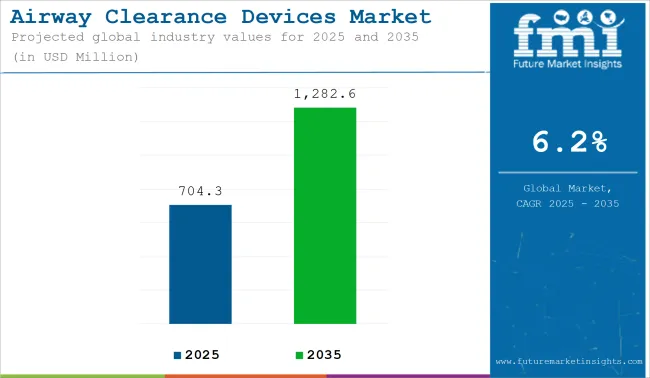

The market for Airway Clearance Devices is expected to reach approximately USD 704.3 million in 2025 and expand to around USD 1,282.6 million by 2035, reflecting a compound annual growth rate (CAGR) of 6.2% over the forecast period.

Rapid development of airway clearance devices, prompted by the growing clinical need towards pulmonary hygiene and non-invasive respiratory therapy for chronic pulmonary diseases, is the current focus of the global Airway Clearance Devices Market. Now, with diseases such as chronic obstructive pulmonary disease (COPD), cystic fibrosis, and bronchiectasis receiving growing clinical focus, the need for high-tech, patient-oriented airway clearance solutions is increasing.

Disruptive technologies including smart monitoring, portability, and condition-specific device customization are changing the nature of the competition. The product development, distribution strategy and use compliance metrics across care settings are getting reconfigured by the increasing focus of market participants towards differentiation in terms of better usability, interoperability with digital health ecosystem, and outcomes-based designs.

Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 704.3 million |

| Industry Value (2035F) | USD 1,282.6 million |

| CAGR (2025 to 2035) | 6.2% |

The Airway Clearance Devices Market has been going through an accelerated transformation from the year 2020 to 2024, during which the macro catalysts were mainly because of the global pandemic which made the world realize the impact of respiratory health. In the early stage of 2020, the pressing need for efficient respiratory management tools resulted in a sudden surge in the use of airway clearance devices, especially homecare devices that started in 2020, as hospitals shifted their focus to acute care capacity.

During this time, direct-to-patient sales saw a significant increase as manufacturers optimized e-commerce channels and improved virtual demo capabilities. And as the market matured post-2021, there became a growing preference for compact, portable systems for self-use, as a result of the increase in long-term respiratory rehabilitation and changing care models.

This gave rise to device manufacturers who responded by improving the ergonomics of their designs, as well as adding the relevant digital interfaces which would enable real-time data feedback and therapy optimization. 2022 to 2024 saw the emergence of product bundles, featuring airway clearance devices alongside digital monitoring applications or therapeutic applications to monitor compliance and build competitive differentiation.

Operational Fragmentation and Integration Gaps Hindering Scalability of Airway Clearance Devices Solutions

The Airway Clearance Devices Market continues to face scalability limitations due to non-uniform clinical adoption pathways and fragmented care delivery models. Devices often require condition-specific calibration and trained supervision for optimal use, leading to inconsistencies across hospitals, rehab centers, and homecare setups.

Moreover, variability in reimbursement structures and lack of unified therapeutic outcome metrics complicate cross-border deployment and hinder the creation of universal guidelines. In emerging regions, inconsistent access to follow-up respiratory care and limited training on device protocols reduce long-term adherence, diluting the therapeutic value of device use.

Additionally, market penetration is challenged by competition from pharmaceutical-based mucolytics and mechanical physiotherapy practices that offer lower upfront costs in resource-constrained settings.

A lack of centralized standards, fragmented procurement policies, and operational dependencies continue to challenge the seamless expansion and standardization of airway clearance devices across global healthcare ecosystems, particularly in decentralized or dual-sector (public/private) systems.

Technology-Driven Personalization, Home-Based Therapy Models, and Outcome-Linked Ecosystem Integration Fueling Market Evolution

As the Airway Clearance Devices Market matures, it is being reshaped by the convergence of technology, digital health platforms, and the evolution of patient-centric care models. Wearable airway clearance solutions that are incorporated with real-time respiratory feedback and mobile app-based usage tracking are facilitating personalized therapy plans with long-term adherence gains.

This could lead to novel clinical applications for post-operative recovery, neuromuscular disorder management, and pediatric respiratory therapy. Cloud-based dashboards for remote therapy management now enable providers to deliver care in rural and home environments without sacrificing clinical visibility.

As the demand for preventive and noninvasive respiratory support has soared, bundled service models - which link device leasing with software analytics and virtual care - are opening recurrences in revenue streams. Public-private partnerships have been critical, too, in scaling up deployment in school-based asthma programs, community respiratory screening and eldercare facilities.

Together, these bandwidth-building and smarter-data-embedding innovations are broadening the market potential in high-acuity environments with well-defined protocols and demand, as well as in low-resource locales where both the need and the opportunity for interventions is well documented.

As the healthcare landscape re-evaluated priorities in respiratory care to be more accessible and outcome driven, the Airway Clearance Devices Market saw a major paradigm shift over this period. The first happened because hospital capacity was affected where they saw an increased demand in non-invasive airway clearance tools for home management of chronic pulmonary conditions and post acute-respiratory episodes.

This change pressured market players to expedite innovation for portable, user-configurable devices with reduced reliance on an operator trained on a laboratory system.

A pivot followed, one toward devices that offered real-time feedback, usage tracking and logging of digital therapy-features that created a new baseline for product competitiveness as care delivery models began to extend into settings beyond the clinical environment. Institutional procurement stakeholders began tapping integration-ready systems capable of syncing with electronic health records and supporting decentralized respiratory therapy efforts.

By contrast, in cost-conscious markets, penetration strategies targeted long-lasting, battery-powered solutions capable of operating in low-infrastructure settings. This led to a dual-speed approach-high-income geographies embraced advanced connectivity and data-driven adherence optimization, while emerging economies focused on mass-scale deployment of simplified, maintenance-light models.

The latter part of the period witnessed increased convergence between device manufacturers and digital health solution providers in the market. Standalone airway clearance devices started to evolve into parts of integrated respiratory treatment ecosystems which encompassed bundled therapeutic pathways such as those for neuromuscular recovery, pediatric pulmonary management and transitional post-ICU rehabilitation. Interest in service-based models also started to emerge, highlighting a broader transformation toward recurring revenue plain and ongoing patient engagement across care continuums.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Approved as Class II medical devices; compliance centered on efficacy and safety |

| Technological Advancements | Basic mechanical and pneumatic oscillation; limited user interface features |

| Consumer Demand | Primarily driven by chronic disease patients and pulmonary clinics |

| Market Growth Drivers | Aging population, COPD burden, rise in non-invasive respiratory therapy |

| Sustainability | Disposable components with short product lifecycle |

| Supply Chain Dynamics | Hospital and DME (durable medical equipment) supplier channels |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Revised standards for digital connectivity, patient data integration, and remote updates |

| Technological Advancements | AI-driven treatment tracking, app-enabled settings, cloud-based respiratory analytics |

| Consumer Demand | Expanded use in post-COVID care, pediatric pulmonology, and home respiratory therapy |

| Market Growth Drivers | Telehealth expansion, digital monitoring, demand for home-based pulmonary care |

| Sustainability | Rechargeable devices, recyclable filters, modular systems with replaceable parts |

| Supply Chain Dynamics | Direct-to-patient models, telehealth-linked fulfillment, subscription-based platforms |

Market Outlook

Due to early adoption of integrated respiratory care models, the United States leads the global Airway Clearance Devices Market. The country’s emphasis on home-based therapy, particularly for COPD and neuromuscular conditions, has encouraged the expansion of digital respiratory devices with adherence tracking.

Insurance coverage for device-assisted airway management, combined with increasing hospital discharge to homecare transitions, has made the USA a highly mature and innovation-driven market. Integration of airway clearance devices with EMRs, telehealth platforms, and remote patient monitoring systems further supports their inclusion in standardized clinical workflows.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.2% |

Market Outlook

India’s Airway Clearance Devices Market is expanding rapidly due to growing investments in decentralized respiratory care and an increasing burden of post-infectious pulmonary complications. Public hospitals and government health missions are integrating non-invasive airway clearance into community-level rehabilitation services, especially for patients recovering from TB and viral respiratory illnesses.

Local manufacturing and cost-effective innovations are allowing greater penetration into rural and semi-urban areas, while private clinics are adopting compact, affordable devices for high-volume outpatient therapy.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 8.9% |

Market Outlook

Germany is a leading European market for airway clearance devices due to its structured rehabilitation ecosystem and early adoption of evidence-based respiratory therapy guidelines. High awareness among pulmonologists and strong insurance reimbursement systems have supported steady clinical integration.

Innovation hubs across the country are collaborating with medical device companies to develop programmable, AI-assisted airway clearance devices. The shift from inpatient to home-based therapy also aligns well with Germany’s health policy focus on chronic disease self-management.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.8% |

Market Outlook

China’s Airway Clearance Devices Market is growing at a high pace, driven by its aging population, increased diagnosis of respiratory conditions, and a shift toward chronic care infrastructure. Urban tertiary hospitals are investing in technologically advanced devices, while rural health programs are adopting simplified versions for large-scale use.

The government’s promotion of local innovation and digital health platforms has created fertile ground for scalable, telemonitored airway clearance solutions across both urban and rural settings.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 8.2% |

Market Outlook

Brazil’s Airway Clearance Devices Market is gaining momentum, supported by the expansion of pulmonary care services within its public healthcare network and a high prevalence of respiratory illnesses, especially in urban centers. Partnerships with rehabilitation centers and physiotherapy clinics are fueling demand for oscillatory devices and vest-based systems.

Public procurement is increasingly considering portable solutions that can be deployed in remote and underserved regions, while private hospitals are prioritizing advanced, feature-rich models for post-ICU recovery.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 4.0% |

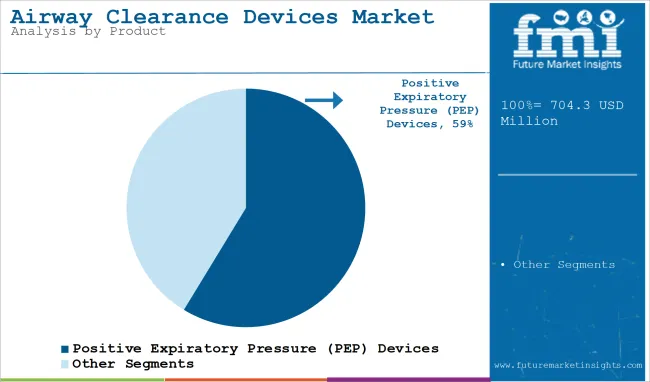

Positive Expiratory Pressure Leading Market Share Backed by Versatile Therapeutic Integration

The airway clearance device system market is dominated by the positive expiratory pressure (PEP) devices segment which is widely used across multiple respiratory indications including chronic bronchitis, cystic fibrosis and COPD among others. These devices provide resistance with exhalation helps stabilize the airways and shift secretions.

They have become increasingly used due to their streamlined design, as well as the fact that they are easy to use, and can be used in both clinical and homecare environments. PEP or positive expiratory pressure devices are more commonly preferred for physical therapy in rehabilitation settings as they are compatible with nebulization therapy to make them an integral part of combination therapy plans. In addition, these systems require little training, and offer customization for pediatric, adult, and geriatric populations.

Their low operational complexity renders them suitable for decentralized care, such as telemedicine-supported pulmonary therapy. Because of the increasing demand for simple and outcome-oriented respiratory treatment, PEP devices remained first in its domain with a continuous acceptance by the clinic and great compliance by the therapy patients over the long term.

High-Frequency Chest Wall Oscillation Emerging as Advanced Solution for Chronic Airway Management

High-frequency chest wall oscillation (HFCWO) devices, in particular, are experiencing quick growth rate in the segment as these helps in more effective mobilization of the deep lung secretions, especially in patients suffering from neuromuscular disorders or advanced cystic fibrosis. These systems use external vibrations transmitted through an inflatable vest to allow mucus clearance from the bronchial tree without the use of invasive techniques or active patient effort.

The effectiveness of these devices in challenging and high-acuity situations particularly such patients in need of airway clearance above and beyond traditional practices has paved the way for increased utilization in hospital pulmonary units, as well as pulmonary rehab sites. New generation of innovations have focused on number of wearable vests to be used as adhesive patches that can be programmed to enhance patient comfort and adherence.

With demand for effective, non-pharmaceutical, home-usable solutions for patients with chronic respiratory conditions, HFCWO systems are being considered critical to long-term care plans. Their use is also increasing in pediatric and geriatric patients because of their reduced strain and velocity treatment efforts.

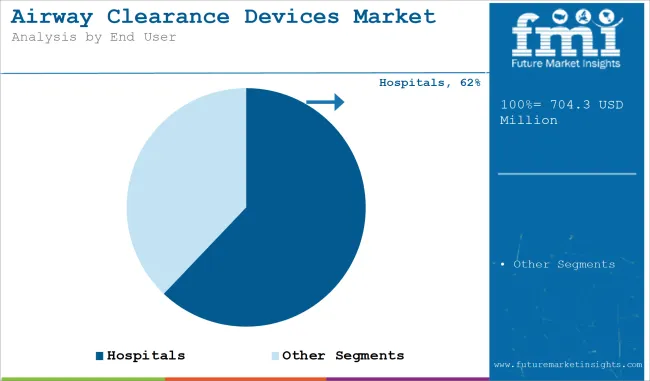

Hospitals Leading End-User Segment with Infrastructure-Driven Procedural Volume

Airway Clearance Devices Market is controlled by the hospitals end-user segment on account of sophisticated diagnostic infrastructure, presence of multidisciplinary care environments, and presence of trained professionals. These centres are necessary for the performance of tuberculin, lepromin and fungal antigen testing under the umbrella of broader infectious disease control and immunology protocols.

All they require is access to follow-up care, radiological backup and validation with the lab, which can enable hospitals to utilize skin tests in conjunction with confirmatory tests to attain high diagnostic accuracy and enhance patient prognosis. Centralized procurement and digitization with hospital EMR systems also enable large-scale screening programs.

Further, hospitals tend to have a high-risk patient population - such as recipients of transplants, cancer patients and those with chronic immunodeficiency - and thus are likely locations for skin fungal and parasitic testing. Even with low revenue per test owing to a large volume of inpatient and outpatient visits, the hospital segment still maintains the highest number of airway clearance devices procedures across any architecture in the world, leading to a good amount of technological dominance in this segment of the market.

Ambulatory Surgical Centers Emerging Due to Short-Stay Recovery Protocols and Device Mobility

The increasing inclusion of airway clearance as a part of short-term post-operative recovery protocols has led to ASCs emerging as high-growth end-user segment within the respiratory therapy device industry. As more and more procedures are done on an outpatient basis, and procedures are more minimally invasive, the prevention of pulmonary complications, like atelectasis or mucus retention, is becoming part and parcel of discharge protocols. Airway clearance devices, particularly portable ones such as PEP and flutter systems, are ideally suited for ASC settings where operational efficiency and quick patient turnover are paramount considerations.

These centers are now transitioning towards small and user-friendly devices that do not involve extensive training and can be rapidly operable in the pre-discharge respiratory sessions. Smart, patient-guided devices with automated settings are also increasingly available, enabling ASCs to deploy airway clearance protocols without dedicated respiratory therapists. With many centers diversifying into post-acute care and recovery monitoring, airway clearance devices will play a much larger role within ASC settings over the next several years.

Airway Clearance Devices Market is booming and is set to grow in the coming years. Innovation of devices technology, increasing aging population and trend toward home care are other significant factors contributing to market growth. North America presently holds the largest market share owing to its sophisticated healthcare systems and awareness levels; the Asia-Pacific region is expected to be the fastest-growing region in the market due to increased healthcare spending and an expanding patient population

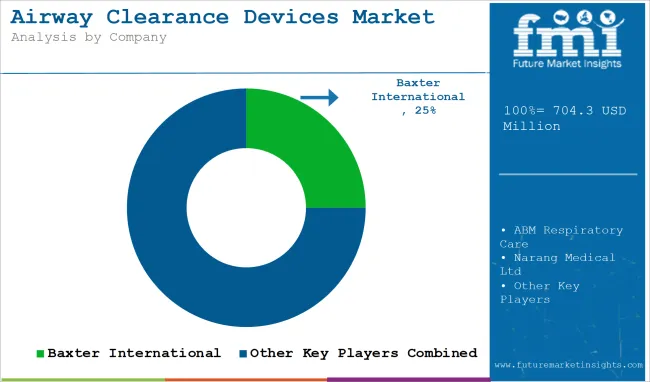

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Baxter International (Hill-Rom Holdings) | 20-25% |

| Koninklijke Philips N.V. | 15-20% |

| Electromed, Inc. | 10-15% |

| Monaghan Medical Corporation | 8-12% |

| General Physiotherapy, Inc. | 5-10% |

| Others | 15-20% |

| Company Name | Key Offerings/Activities |

|---|---|

| Baxter International (Hill-Rom Holdings) | The Vest® Airway Clearance System (a high-frequency chest wall oscillation (HFCWO) device) manufactured by Baxter International (Hill-Rom Holdings) to help patients with mucus mobilization and clearance. |

| Koninklijke Philips N.V. | Royal Philips (Philips) Offers a comprehensive portfolio of airway clearance devices, including the CoughAssist E70 - the first non-invasive therapy for patients with impaired cough effectiveness. |

| Electromed, Inc. | Electromed, Inc. Creates and sells SmartVest ® Airway Clearance System (HFCWO device) to improve patient compliance with user-friendly features. |

| Monaghan Medical Corporation | Monaghan Medical Corporation offers Positive Expiratory Pressure (PEP) devices such as Aerobika ® Oscillating PEP, which are intended to see improvements in airway clearance and lung function. |

| General Physiotherapy, Inc. | G5® line of percussors and vibrators used in chest physiotherapy to assist in mucus clearance in different patient populations. |

Key Company Insights

Other Key Players Other companies supporting the Airway Clearance Devices Market include:

Positive Expiratory Pressure, Intrapulmonary Percussive Ventilation, Oral High-Frequency Oscillation, High-Frequency Chest Wall Oscillation, Flutter and Incentive Spirometry

Hospitals, Clinics, and Ambulatory Surgical Centers

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The overall market size for Airway Clearance Devices Market was USD 704.3 million in 2025.

The Airway Clearance Devices Market is expected to reach USD 1,282.6 million in 2035.

Surge in neuromuscular disease diagnoses is driving sustained demand for non-effort-dependent airway clearance solutions in long-term care facilities.

The top key players that drives the development of Airway Clearance Devices Market are Baxter International (Hill-Rom Holdings), Koninklijke Philips N.V., Electromed, Inc., Monaghan Medical Corporation and General Physiotherapy, Inc.

Positive expiratory pressure is expected to command significant share over the assessment period.

Table 01: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 02: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 03: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 04: Global Market Volume (Units) Forecast by Type, 2018 to 2033

Table 05: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 06: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 07: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 08: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 09: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by End User, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by End User, 2018 to 2033

Figure 01: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 02: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 03: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 04: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 05: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 06: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 07: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 08: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 09: Global Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 16: Global Market Attractiveness by Type, 2023 to 2033

Figure 17: Global Market Attractiveness by End User, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 34: North America Market Attractiveness by Type, 2023 to 2033

Figure 35: North America Market Attractiveness by End User, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Airway Management Devices Market Growth – Demand & Industry Forecast 2025 to 2035

Mucus Clearance Devices Market Size and Share Forecast Outlook 2025 to 2035

Positive Airway Pressure Devices Market Size and Share Forecast Outlook 2025 to 2035

China Continuous Positive Airway Pressure Devices Market Outlook – Share, Growth & Forecast 2025-2035

Airway Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

Airway Catheters Market Analysis - Growth & Industry Insights 2025 to 2035

Fairway Mowers Market

Low Clearance Loaders Market Size and Share Forecast Outlook 2025 to 2035

FBAR Devices Market

Snare devices Market

C-Arms Devices Market Size and Share Forecast Outlook 2025 to 2035

Timing Devices Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Spinal Devices Market Size and Share Forecast Outlook 2025 to 2035

Hearing Devices 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Network Devices Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Secondary Packaging Market Analysis by Material and Application Through 2035

Hearable Devices Market Size and Share Forecast Outlook 2025 to 2035

Lab Chip Devices Market Size and Share Forecast Outlook 2025 to 2035

Orthotic Devices, Casts and Splints Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA